🔬Why Sector Themes Matter, I'm Sick of Bitcoin, and Much More

"Show me the incentive and I will show you the outcome"

- Charlie Munger

“If I had asked people what they wanted, they would have said faster horses.”

- Henry Ford

Bit of a bla day for the big US markets (S&P 500 -0.07%, Nasdaq -0.00%) after a generally strong week thus far.

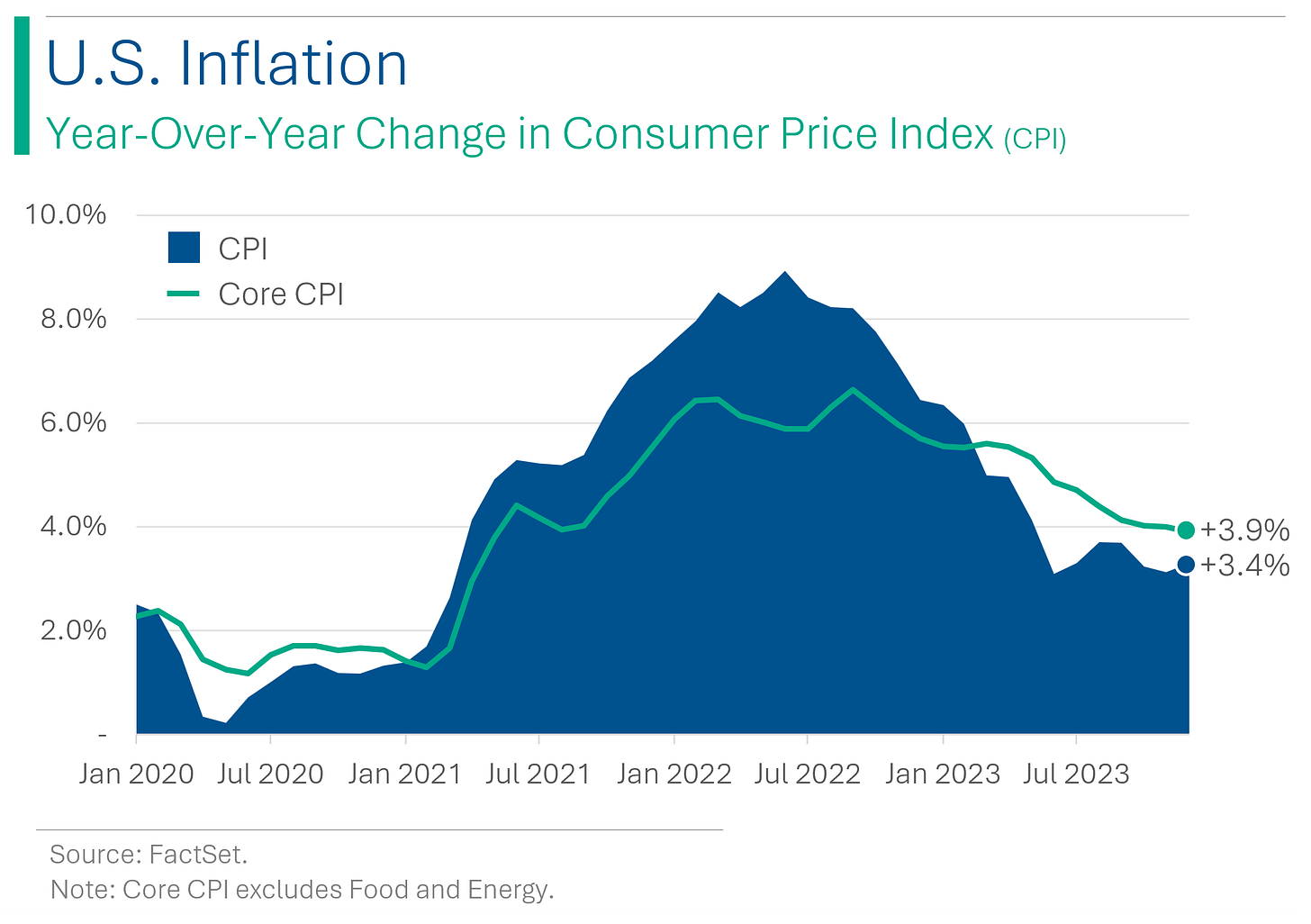

The big story of the day was inflation, as the CPI print came in a titch higher than forecast (+3.4% YoY vs. +3.2%) which gave the market a bit of pause regarding the pace of expected interest rate cuts (potentially slower now).

2 of 11 sectors closed in the green with Info Tech (+0.4%) and Energy (+0.2%) not showing anything heroic. Inflation sensitive Utilities (-2.3%) got smacked pretty hard, and led the way down.

Bitcoin ETFs started trading today (and I promise I’ll stop talking about them now).

Microsoft passed Apple to be the largest company in the world - for about 10 minutes.

Street Stories

Why Sector Themes Matter (or Why Healthcare Doesn’t Suck for Once)

So a bit of personal backstory: I was a healthcare analyst at a mutual fund before I got the bright idea to write a newsletter. And by that I mean, I got enough brain damage reading clinical trials and healthcare journals that I decided to do something else. Part of that frustration comes from the fact that Healthcare is so obscure and disparate, that most Portfolio Managers out there - who are generalists - don’t get too into the weeds, or venture too far away from the safe Blue Chip Healthcare names out there.

As a result, I often felt like it was less about picking the best stocks, and more about finding the next trend early enough. Good examples of this include the Specialty Pharma rush (Valeant and friends), the Tax Inversions (2013-2015ish), Gene Therapy (201-2018ish), COVID plays (from vaccines to supplies to testing), and now the Weight-Loss drugs (GLP-1s, GIPs, etc.) During these times, a rising tide lifts anything not made of lead or in Chapter 11, and we are seeing that now with Healthcare broadly.

A few days ago I wrote about how the big JP Morgan Healthcare Conference is on, and that this year seems particularly hyped up. Drivers for Healthcare include: 1) The urgency of large pharma to replace the large slew of drugs coming off patent through M&A; 2) A similar issue to replace COVID based product lines (from vaccines to testing equipment); 3) The hype around the weight-loss industry driven by Ozempic and Zepbound; and 4) The fact that despite being a ‘growthy’ sector, it’s relatively defensive (and defense has been working since the market is so expensive).

In my long-winded way, which I’m oft to do when I vent about my healthcare days, what I’m trying to convey is that often a stock’s sector matters a lot more than the fundamentals. Do any of the above themes really apply to Viatris (+11.4%) - Pfizer’s legacy drug spin-off that owns Viagra, Lipitor and Celebrex? Nah. How about dialysis company, DaVita (+4.9%)? Again, not really.

The generalist PM or the guy in his basement punting ETFs may not be able to tell you the difference between a GLP-1 and a GIP, or speak to the patent cliffs at Amgen or AbbVie but Healthcare is trendy right now and they are going to buy it. Or I could just be bitter that I’m underweight right now.

Cash Crunch Chronicles: Startups Navigate the 2023 Investment Maze

U.S. investors allocated $170.6 billion to startups in 2023, a 30% decrease from 2022, amid a market grappling with valuation resets and higher interest rates, with a notable focus on AI startups which drew a significant portion of the investment. Despite a modest increase in deal activity in the fourth quarter, there was a marked increase in startups raising funds at lower valuations (‘down rounds’) than previous rounds, indicating a broad valuation reset. U.S. venture capital firms themselves raised 60% less in 2023 compared to the previous year, leading to concerns about future funding availability for numerous unicorn companies and other startups in need of capital. (Axios has more details)

Bumpy Road to Recovery: Inflation's 3.4% Speed Bump

The December Consumer Price Index rose by 3.4% annually vs. a Wall Street consensus estimate of 3.2%, showing progress in efforts to reduce high inflation, but still an unwelcome miss for the market. Despite the overall inflation rate being down from 6.5% in December 2022, economists predict the Federal Reserve will maintain interest rates in the near term due to persistent core inflation. Recent trends indicate disinflation in goods, but concerns remain about inflation in housing and services, signaling ongoing challenges for the Fed in managing inflation levels. Basically, yesterday didn’t help us get to rate cuts any sooner. (CNN has more the inflation situation)

Wings of Fortune: Airbus Leads the Flock, Boeing Trails Behind

Airbus maintained its lead over Boeing for the fifth consecutive year, reporting record annual jet orders with 2,319, and confirmed an 11% increase in deliveries with 735 airplanes in 2023. In contrast, Boeing, still recovering from the 737 MAX 9 grounding and production issues, delivered fewer aircraft at 528 in 2023 and is facing renewed scrutiny over production quality, highlighting Airbus's stronger position in the current aviation market. It’s early but I think we can assume Airbus is gunna make it six years in a row. (Yahoo has more on this story)

Non-ETF Bitcoin

Today marked the first day of Bitcoin ETF trading. During which the price briefly popped up to a fresh 2-year high before trading down -0.74% for the day. Not too interesting. What was interesting (and kinda funny) was the meltdown in crypto related stocks. Guess if you can buy an ETF now, why waste your time punting the indirects, like shady miners?

Joke Of The Day

A reporter is interviewing a wealthy investor and asks what the secrets were to his success. “Well, I’ll tell you one of the best financial decisions I made was based on stock advice I got from a shoe shiner!”

“What? That’s incredible!” said the reporter.

“Ya, I figured if my shoe shiner is giving out stock tips, it’s probably right to get out of the market.

Hot Headlines

Tech Crunch | Google cuts over 1,000 jobs in its voice assistance and hardware teams. Tech layoffs picking back up again, following Amazon’s massacre yesterday. The Alphabet Union wasn’t a fan…

CNN | Iran seizes oil tanker in Gulf of Oman by force and directs it to Iranian port. In a fun twist (ok, maybe not that fun), it is literally the same ship - but renamed - that the US seized from Iran last year.

CNN | US and UK carry out strikes against Iran-backed Houthis in Yemen.

CNBC | Microsoft briefly tops Apple as most valuable public company. Still a fresh all-time high for Microsoft and closing in the $3 trillion club..

NY Post | Retailers take $100B hit over bogus returns: ‘Sent back box of bricks instead of TV’.

Trivia

This week’s trivia is on the great financial dynasties. Today’s is on the The House of Saud, the ruling royal family of Saudi Arabia.

The Saudi government own of 90% of Saudi Aramco, the world’s largest oil company. How much is that worth today?

A) $605 billion

B) $1.1 trillion

C) $1.9 trillion

D) $3.2 trillionHow many members are there approximately in the House of Saud?

A) 5,000

B) 15,000

C) 25,000

D) 35,000How many private jets are in the Saudi royal fleet?

A) 5

B) 10

C) 15

D) 20

(answers at bottom)

Market Movers

Winners!

DocuSign (DOCU) [+9.3%] saw a stock rise following reports by Reuters of potential acquisition interest from Hellman & Friedman and Bain Capital, valuing the company at around $12B. How is this a $12B company?

Netflix (NFLX) [+2.9%] experienced a boost in shares as Variety reported its ad-supported subscriptions surpassing 23M monthly active users, up from 15M+ disclosed in October.

Losers!

Hertz Global (HTZ) [-4.3%] revealed plans to reduce its EV rental fleet by one-third, approximately 20K vehicles, leading to about $245M in net depreciation expense, aiming to cut lower margin rentals and EV-related damage expense.

Warner Bros. Discovery (WBD) [-3.9%] was downgraded to Neutral from Buy at Redburn Atlantic, with concerns about linear advertising reaching a negative tipping point and underestimation of declines across the group.

Tesla (TSLA) [-2.9%] faced impact from Hertz's announcement to cut its EV rental fleet by about 20K vehicles; Tesla also implemented pay raises across its U.S. factories.

Market Update

Trivia Answers

C) The Saudi’s stake in Aramco is worth $1.9 trillion.

B) There are currently 15,000 members of the House of Saud.

B) There are 10 known private jets in the Saudi royal fleet. There are more personally held across the different family members outside of the royal house.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.