Welcome To The New World (in Charts!)

“In the business world, the rearview mirror is always clearer than the windshield.”

- Warren Buffett

“Never make forecasts, especially about the future.”

- Samuel Goldwyn

A crazy week for markets as you can imagine. This week’s note is quite election heavy so apologies if you’re like me and suffering from late-stage election fatigue!

Lots to talk about so let’s get into it!

- Ryan

Street Stories

Winners & Losers in Trump Pt. II

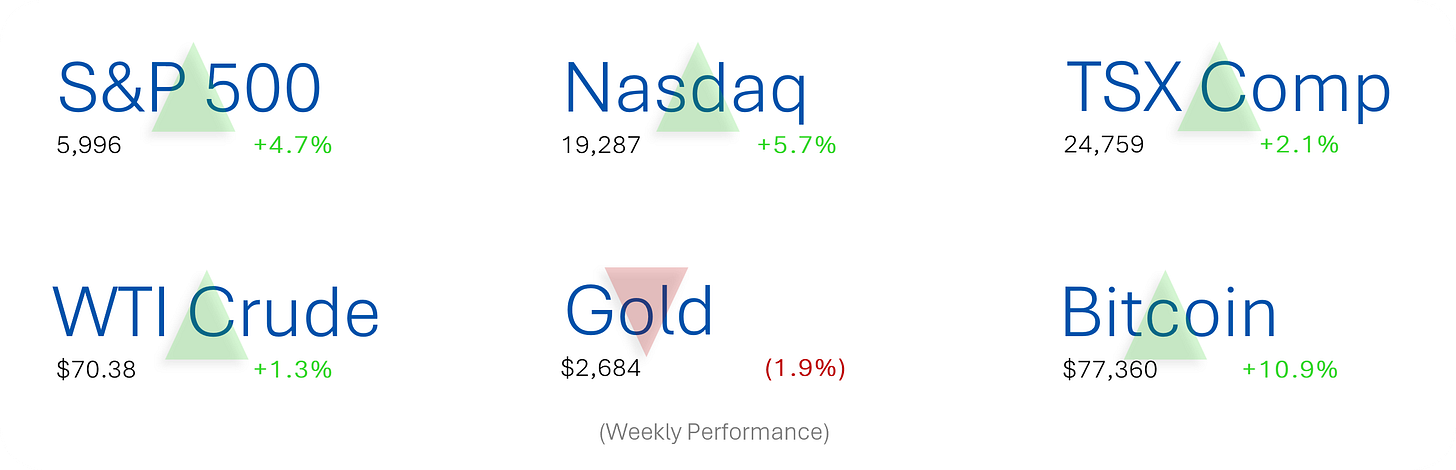

While 47.8% of American voters may disagree, Wall Street’s evaluation of the U.S. election was pretty clear. With a +2.5% on Wednesday, the S&P 500’s post-election pop was the biggest since… well, as far back as my FactSet subscription level gets me access to.

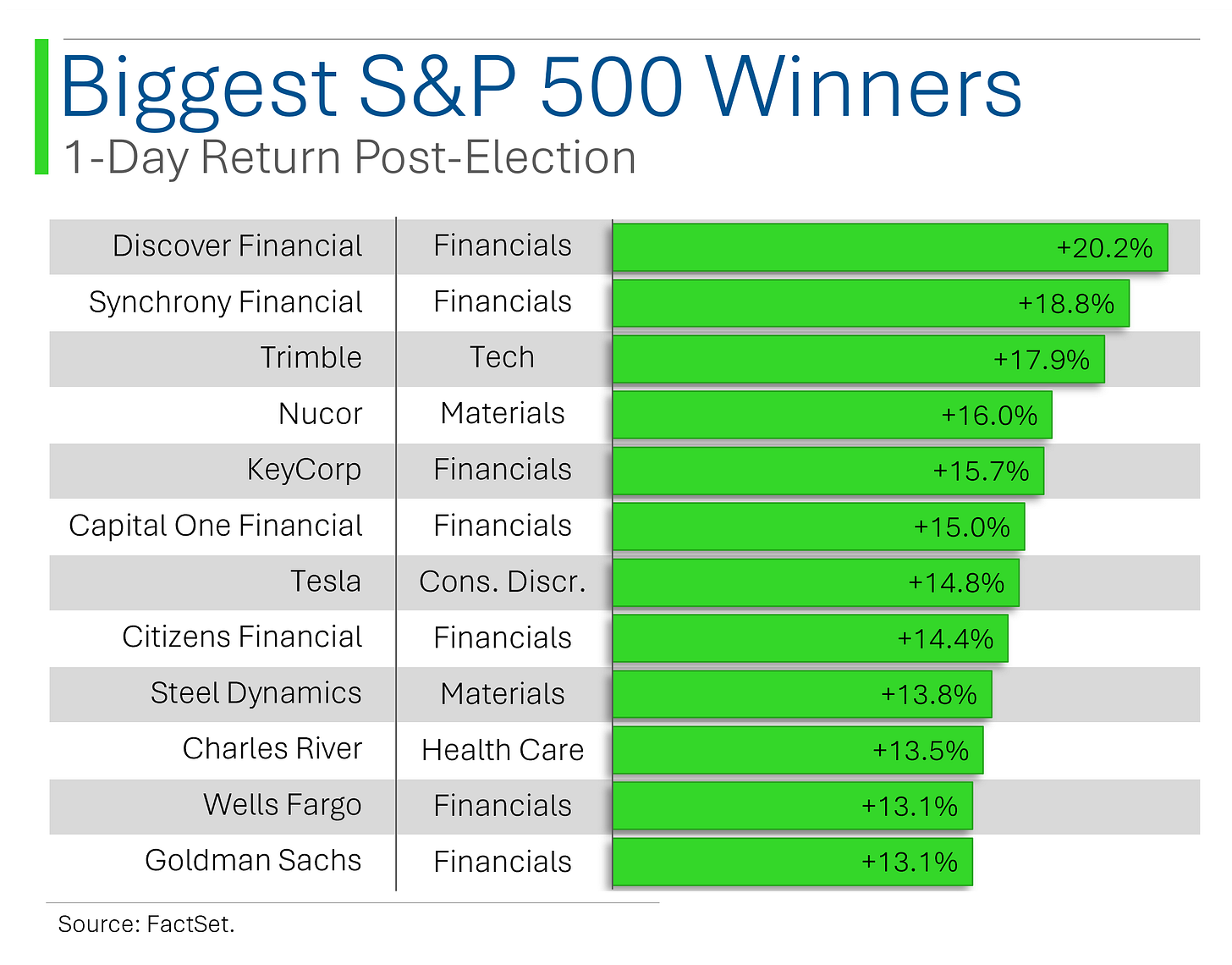

While most sectors had a big day following the election due to expectations for lower taxes, Financials were the biggest beneficiary: The sector jumped +6.2% following the election, mostly due to a more laissez faire expectations around financial regulation.

Trump’s tough tariff talk (say that 10 times fast) was also an important contributor, as protectionist rhetoric is seen as a potential boon to domestic industry. #industrials #consumerdiscretionary #blessed

Interest rate sensitive sectors had a stumble, as the corollary of said tariffs poses some concerns about increased inflation since, well, that’s literally the definition of inflation.

Not sure I have another round of interest rate peekaboo in me…

And for some, the wins weren’t mild either - mostly covered by financials (and big Q3’s by Trimble and Charles River), the S&P saw many of the beneficiaries leap into the double-digits.

Tesla’s pop is a funny one. Most media outlets sighted increased foreign tariffs as the cause for the 15% gain - but Chinese EV imports already have a 100% tariff so isn’t that just the Street valuing the Elon-Trump bromance at +$123 billion (the increase in Tesla’s market cap post-election)?

Even bigger than the impact to financials, Hodlers saw one of the biggest one-day gains for crypto assets EVER, with Bitcoin popping +8% to a fancy new all-time high and Elon’s pet, Dogecoin, up +18%.

President Trump’s made a complete 180 on crypto since he called it a ‘scam’ and ‘a disaster waiting to happen’ back in 2021.

“For too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin,” Trump said during his July keynote speech in Nashville.

There were other crypto winners across the board, with beleaguered miners finally catching a break as well as the main U.S. exchanges.

Microstrategy, the software company turned Bitcoin repository, also had a big day, up +13%.

(For a deep-dive into the one of the funnier market sagas, check out my write-up on Microstrategy)

Global stock market reaction to Trump Part Deux was decidedly mixed - and surprisingly mild.

China is expected to be the biggest loser economically from a Trump second term, but the main CSI 300 index only slipped 0.5% in the aftermath. Hong Kong’s Hang Seng and the Shanghai Composite also only dropped 2.2% and 0.1% respectively.

This was partly due to pending expectations for a stimulus bazooka from the PRC. As yet this hasn’t materialized, with Friday’s National Peoples' Congress standing committee (NPCSC) limiting action to a debt swap and other modest measures.

And as a Canuck, I can only hope that Trump forgets we exist until this tariff frenzy wears off.

Nvidia Back On Top

Everyone’s favorite GPU maker is once again the world’s largest public company (it was for about 5min back in June).

It took over the mantle on Tuesday, becoming the largest company in history to trade its shares on the public markets, with a market capitalization of $3.6 trillion.

Nvidia may have passed Apple in value, but it’s revenues are a far cry from the iPhone maker’s: $29.8 billion in for their last fiscal year versus Apple at $60.9 billion.

That said, Nvidia’s high margins (it’s good to be a monopoly) mean that Wall Street analysts are expecting the gap to be nearly eliminated by 2027.

(and the Apple estimates are too high imo)

The Stock Market Post-Election

(updated from Wednesday’s publication)

If the stock market is normally a roller coaster, during election years it becomes a roller coaster designed by someone who just discovered energy drinks. And it shows in the numbers - since 1979, election years have delivered returns that are about as impressive as a participation trophy (+5.8%), while non-election years flex with a much more robust +11.8%.

Turns out politics and profits mix about as well as oil and water!

What is pretty clear, however, is that regardless of who wins, the stock market typically continues its march higher - independent of the political party in power.

In fact, the average return for any given presidential terms since 1979 is quite impressive at +45%, with only two negative terms:

2000 to 2004: Less about politics and more to do with the market finding out that sticking ‘.com’ to your company name didn’t magically make it profitable.

2004 to 2008: A decent run right up until the Great Financial Crisis.

This of course means that President George W. Bush holds the distinction of being the only president in 45 years to have a term in office where the stock market went down - and he did it twice!

Looking more at what the immediate future may bring, it’s interesting to note that the 12 months following the election actually yields a pretty positive return: +13%.

And only twice since the 1980 election of Ronald Reagan has the market been down a year out from the election.

Although, when looked at by political party the Dems have actually faired much better here: Averaging +22% vs. the Republicans at +6%.

The period following elections has historically been jumpy, so investors should expect the markets to continue to be volatile over the coming months.

For example, since 1990 the CBOE’s Volatility Index AKA ‘The Vix’ has averaged around 23.7 in November in election years - a full 23% higher than in non-election years.

The VIX is basically the market's mood ring - and during election years, it's giving off serious 'teenage angst' vibes.

Regardless, this election cycle has me burnt out so I’m glad that it’s over!

Joke Of The Day

What do fish say when they hit a concrete wall? Dam!

A rich man is one who isn’t afraid to ask the clerk to show him something cheaper.

Macro Update

Consumer Sentiment [Friday]

Consumer Sentiment jumped to 73.0 in November (vs. 64.9 in October), marking its highest level in six months and fourth straight monthly increase, with the Index of Consumer Expectations reaching its best reading since July 2021 at 78.5.

Interest Rates [Thursday]

The Fed unanimously cut rates by 25 basis points to 4.5-4.75%, while removing language about gaining confidence in inflation's path to 2% and noting that labor market conditions have eased though unemployment remains low.

The policy statement maintained that risks to employment and inflation goals are balanced, with no changes to balance sheet policy. In the press conference, Powell emphasized data dependence for future decisions and declined to speculate on potential Trump fiscal policies.

Jobless Claims [Wednesday]

Initial jobless claims matched expectations at 221K while continuing claims rose to 1.892M, reaching their highest level since November 2021.

Q3 preliminary productivity grew 2.2% quarter-over-quarter, slightly below consensus but above Q2's revised 2.1% figure.

ISM Services [Tuesday]

The October ISM Services Index hit its highest level since July 2022, showing strength in the services sector despite slowing new orders.

Employment returned to expansion territory and inflation pressures continued to ease, as evidenced by a declining prices index.

Trivia

Today’s trivia is on everyone’s favorite crypto, Bitcoin.

When was Bitcoin created?

A) 2005

B) 2008

C) 2010

D) 2009How many Bitcoins will ever be created?

A) 21 million

B) 21 million

C) 25 million

D) No limitWhat is a 'Satoshi', in the context of Bitcoin?

A) A software bug in Bitcoin code

B) A Bitcoin mining rig

C) The smallest unit of Bitcoin

D) A type of Bitcoin walletWhat is Bitcoin’s market cap (the total value of all Bitcoin in existence)?

A) $105 billion

B) $617 billion

C) $1.2 trillion

D) $3.2 trillion

(answers at bottom)

Market Movers

Friday:

Insulet (PODD) [+9.4%]: Q3 results beat expectations thanks to strong Omnipod sales internationally and a raised FY24 outlook.

Expedia Group (EXPE) [+3.8%]: Q3 EBITDA beat with room nights and B2B growth, though revenue missed; CFO to step down, and guidance was raised.

Pinterest (PINS) [-14.0%]: Q3 revenue rose, but Q4 revenue outlook fell short, with food and beverage pressures cited.

Capri Holdings (CPRI) [-6.7%]: Global demand for luxury fashion is softening, impacting Q3 results for Michael Kors and Versace.

Thursday:

Applovin (APP) [+46.3%]: Big Q3 EBITDA beat with strong platform performance; raised guidance and expanded its buyback.

Dutch Bros (BROS) [+28.1%]: Q3 growth and upbeat guidance due to mobile order rollout and strong new store productivity.

Under Armour (UAA) [+27.2%]: Q2 beat on EPS and revenue, raising guidance but flagging softness in Asia.

Zillow Group (ZG) [+25%]: Q3 results solid, with growth in Residential and Rentals and disciplined cost management.

Lyft (LYFT) [+22.9%]: Q3 beat across metrics, with share gains against Uber and growth expected with DoorDash partnership.

Match Group (MTCH) [-17.9%]: Tinder MAUs down, causing Q3 and Q4 revenue guidance disappointments.

Klaviyo (KVYO) [-15.9%]: Strong Q3 results but lowered operating income outlook raises caution on margins for FY25.

Wednesday:

CVS Health (CVS) [+11.3%]: Q3 revenue beat, with growth in prescription volume and solid pharmacy performance.

IRobot (IRBT) [-35.2%]: Announced restructuring, impacting 16% of workforce, with CFO retirement set for December.

Super Micro Computer (SMCI) [-18.1%]: Q3 revenue missed expectations despite strong margins; Q4 guidance fell short.

Tuesday:

Palantir Technologies (PLTR) [+23.5%]: Q3 beat, raised guidance, and demand for AI tech drives strong U.S. revenue growth.

GlobalFoundries (GFS) [+14.9%]: Q3 revenue uptick driven by automotive growth and solid wafer shipments.

Ferrari (RACE) [-7.4%]: Q3 revenue slightly missed, with light shipments and no guidance raise, disappointing investors.

Monday:

Chewy, Inc. (CHWY) [+6.3%]: Set to join the S&P MidCap 400, replacing Stericycle.

Peloton Interactive (PTON) [+3.6%]: Upgraded by Bank of America, citing potential for profitability improvement.

New York Times (NYT) [-7.7%]: Q3 beat but digital subscriptions slowed; tech union strike may impact coverage.

Intel (INTC) [-2.9%]: Set to be removed from the Dow Jones Industrial Average.

Tesla (TSLA) [-2.5%]: October Shanghai deliveries fell as Chinese EV competitors reported record sales.

This Week In History

First Day of the New York Stock Exchange (November 8, 1792)

The NYSE opened for trading, laying the foundation for the U.S. stock market system, which would become a central pillar of global finance.

Lehman Brothers Files for Bankruptcy (November 9, 1987)

The oldest U.S. investment bank filed for bankruptcy due to leveraged buyouts, foreshadowing the financial turmoil that would recur in 2008.

Petrodollar Agreement Begins (November 8, 1974)

The U.S. struck a deal with Saudi Arabia to price oil in dollars, establishing the petrodollar system and reinforcing the dollar’s role in global trade.

WorldCom Fraud Revealed (November 10, 2002)

Revelations of WorldCom's accounting fraud shocked investors, leading to billions in losses and spurring the Sarbanes-Oxley Act for corporate accountability.

Fall of Berlin Wall Begins (November 9, 1989)

East Germany opened the Berlin Wall, symbolizing the Cold War’s end. This led to Germany's reunification and reshaped European political dynamics.

Market Update

Trivia Answers

D) Bitcoin was created in 2009.

B) 21 million. Currently 19 million have been minted.

C) A Satoshi is the smallest unit of Bitcoin, equal to 0.00000001 bitcoin.

C) The market cap of Bitcoin is $1.2 trillion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

The new weekly format is fantastic!