🔬Explained: How Microstrategy Prints Money (for now)

Plus: Petroleum goes parabolic; Euro inflation may impede rush to cut rates; and much more

"In bear markets, stocks return to their rightful owners"

- J.P. Morgan

“I can’t take his money. I can’t print my own money. Why don’t I just lie down and die?”

- Homer Simpson

Another bla day for the big US markets (S&P 500 +0.1%; Nasdaq +0.3%) as we await the pivotal Fed meeting and CPI print later today.

9 of 11 sectors closed higher led by interest rate sensitive Real Estate (+1.3%) and Utilities (+0.6%). Financials were at the bottom of the pile at -0.5%.

Bitcoin finished down 2.9% while oil finally had a bad day (-1.4%) after a big rally.

Street Stories

MicroStrategy’s Money Printer

One of the most talked about things in the stock market over the past year has been the ridiculous rise of MicroStrategy and it’s Bitcoin treasury business. I think almost everyone knows the basics1 but it’s basically:

The company issues shares or convertible bonds;

They use the cash to buy Bitcoin;

Their share price keeps going up.

So, for today’s newsletter I thought I would take a few minutes to explain some of the mechanics (and market failures) that make what they are doing extremely profitable.

1. If you don’t know, I sorta intro’d it in a two-part write-up last week: Part I, Part II

To start, I’ll set the table a bit:

- Yes, Microstrategy is a tech company (they have some cheesy business analytics software business - link)

- But no, they don’t have anything (at least yet) to do with Bitcoin (the CEO just likes it, I guess).

- They have been around since 1989 and for most of their life have been a sub-$1 billion company. I say this to impress that the rise in the value of this company has little to do with the actual operations of the business.

To start, the company opened 2024 with 16.9 million shares across two share classes. If you include other dilutive securities, like stock options and the shares potentially coming from the convertible notes, then the fully diluted number is around 19.8 million.

Now the company currently has ~214k Bitcoin but to keep things simple I’m going to use the 189k they had on December 31st (they’ve done a bunch of convertible bond issuances and at-the-market equity offerings since so the share count gets muddled). Anyway, pretending it’s January 1st, at current market prices, those 189k are worth $13.1 billion.

Now, for illustrative purposes I’m just going to treat the actual software business just like a asset with the generous intrinsic value of $2.0 billion. So, a (very) simplified way to look at Microstrategy is as a composite of $13.1 billion in Bitcoin and $2.0 billion in ‘OpCo’ (the s**tty software business). This obviously ignores things like cash, debt, etc. but this is just meant as a simplified example.

Based on the above, I calculate around $762.53 in intrinsic value for each fully diluted share of Microstrategy (just the asset values above divided by the 19.8 million shares).

Now the important bit for MicroStrategy’s money printer is the spread between that intrinsic value and the actual market price of their shares, which is $1,420.95 as I write this. That means that - for some ungodly reason - Microstrategy trades at an ~86% premium to the intrinsic value of the shares.

As for how the money printer works, consider the below example:

The company issues 1.0 million in new shares at the current market price ($1,420.95). The $1.42 billion in cash is used to purchase 20,564 Bitcoin at $69,098 per coin.

The additional Bitcoin increases the value of the holdings from $13.07 billion to $14.49 billion. The value of the Core software business is unchanged.

The intrinsic value of Bitcoin per share is now $697.92: The new Bitcoin value of $14.49 billion divided by the new share count of 20.8 million. The increased value of the Bitcoin holdings (+10.9%) more than compensates for the dilution from the new shares (-4.8%).

Lastly, the intrinsic value of the Core Business declines by 4.8% from the dilution, but overall the intrinsic value of the shares increases from $762.53 to $794.24 (+4.2%). Rinse and repeat.

As long as this extensive premium continues to last, the company can continue to sell shares or issue convertible debt in an accretive manner. The risk is obviously that the value of Bitcoin declines significantly but when you consider that this was a flat growth $1.2 billion company before buying Bitcoin, and now it’s a $25 billion company with a $14.5 billion Bitcoin pile, they have definitely come out ahead here.

But that doesn’t mean it’s not stupid.

Awkward EU?

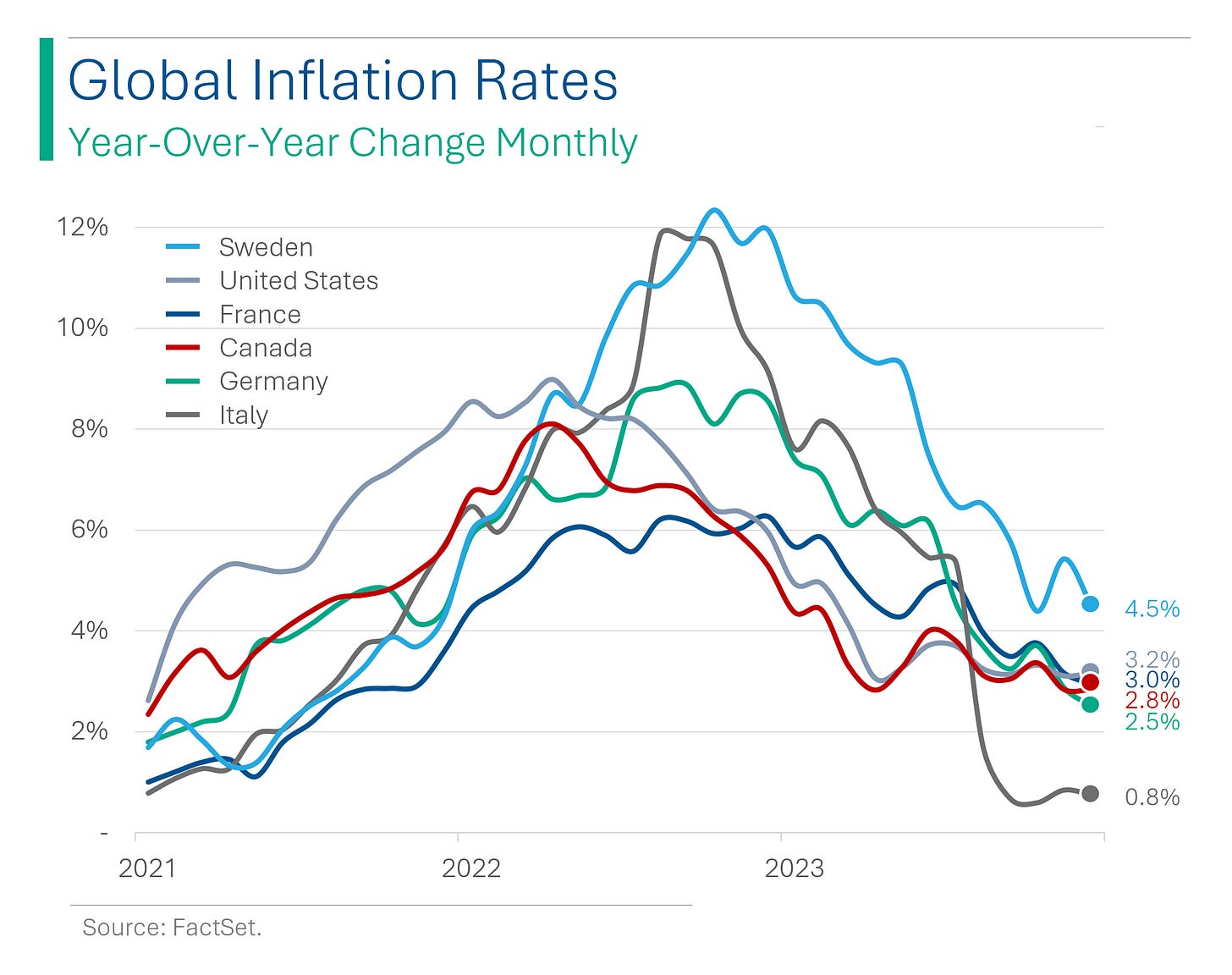

Inflation has been ticking back up in the EU in recent months. A good chunk of that is from the impact of increasing energy costs which probably aren’t cooling any time soon, so it makes me think the ECB may find itself it an awkward position. Why? Currently the ECB President is calling for four rate cuts this year.

The Euros aren’t in a much better inflation spot than the US to begin with, which currently has 2-3 priced in for the year, and they generally are more susceptible to OPEC+ f***ery with the oil price, so we could end up seeing some back peddling from the ECB.

Petroleum Parabola

Rather than slowing down, the rate of increase in the oil price seems to actually be picking up steam.

Good thing oil doesn’t cause inflation 🤫🤥

Joke Of The Day

Two hunters are out in the woods when one of them collapses. He’s not breathing and his eyes are glazed. The other guy whips out his cell phone and calls 911.

“I think my friend is dead!” he yells. “What can I do?”

The operator says, “Calm down. First, let’s make sure he’s dead.”

There’s a silence, then a shot. Back on the phone, the guy says, “Okay, now what?”

Hot Headlines

The Verge / Peloton’s fall from $50 billion fitness powerhouse.

Reuters / Google unveils Arm-based data center processor and new AI chip. Google's tensor processing units (TPUs) are one of the few viable alternatives to the advanced AI chips made by Nvidia though developers can only access them through Google's Cloud Platform and not buy them directly.

CNBC / Popular YouTube channel Dude Perfect gets investment from Highmount Capital. The group that rose to popularity for its trick shots, has secured a significant nine-figure investment, in the range of $100 million to $300 million. Here comes the brand killing MBAs…

Reuters / Moderna stock jumps on positive data for cancer vaccine in 22 person early trial. The individualized cancer vaccine was tested in combination with Merck’s Keytruda in head and neck cancer. The vaccine aims to train the immune system’s of patient’s to recognize and attack cancer cells. Fingers crossed!

Reuters / BlackBerry gains on partnership with AMD for robotics systems for industrial and healthcare industries. Shares jumped +7.6% on the news.

Trivia

Today’s trivia is on the Nasdaq.

When was the NASDAQ stock market founded?

A) 1959

B) 1965

C) 1971

D) 1980What does NASDAQ stand for?

A) National Association of Securities Dealers Automated Quotations

B) National Association of Securities Dealers Automated Quotients

C) North American Securities Dealers Automated Quotations

D) North American System for Digital Asset QuotationsNASDAQ was the first stock market to:

A) Trade online

B) Introduce electronic trading

C) Both A and B

D) None of the aboveThe NASDAQ-100 index includes:

A) The top 100 largest companies.

B) The top 100 NASDAQ-listed non-financial companies

C) The top 100 NASDAQ-listed companies excluding financial companies

D) Any 100 companies selected by NASDAQ

(answers at bottom)

Market Movers

Winners!

Amkor Technology (AMKR) [+7.7%] Buy rating by Needham highlights unique US-based semi assembly/test provider status, geopolitical resilience.

BlackBerry (BB) [+7.6%] Teams up with AMD for advanced robotic systems.

Moderna (MRNA) [+6.2%] Showcases positive mRNA-4157 cancer vaccine results for head and neck cancer with MRK.

Losers!

Tilray Brands (TLRY) [-20.7%] Fiscal Q3 misses on revenue, EBITDA; cuts FY24 EBITDA outlook, no longer expects positive FCF due to asset sale delays. WEED STOCK RALLY OFFICIALLY CANCELLED!

Harmonic (HLIT) [-14.6%] CEO Patrick Harshman to resign effective 11-Jun; narrows Q1 revenue guidance to $121M-$123M; concludes video business review, citing unfavorable market conditions for value creation.

Neogen (NEOG) [-9.3%] Q3 earnings and revenue fall short; lowers FY24 forecasts, citing $130M capex and operational challenges from food safety unit integration.

Market Update

Trivia Answers

C) Nasdaq was founded in 1971.

A) National Association of Securities Dealers Automated Quotations.

C) Nasdaq was first for online trading and electronic trading.

C) The top 100 NASDAQ-listed companies excluding financial companies makes up the Nasdaq 100.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.