Meme Stock Recap...in Charts!

Plus: Yield Curve is 'normal' and TSMC keeps AI dreams alive

"Only when the tide goes out do you discover who's been swimming naked."

- Warren Buffett

“I’m a fancy boy.”

- Jerry Seinfeld

Street Stories

Meme Stock Update

After three years in the shadows, in May 2024 Keith Gill (AKA Roaring Kitty AKA DeepF***ingValue) reemerged. The leader of the 2021 GameStonk short-squeeze was back. And so were Meme Stocks.

As the message boards of Reddit lit up with 🚀’s and 💎👐’s, shares of the usual suspects exploded. It was a fun time and I actively tracked what Kitty was up to.

However, much of that euphoria faded by the end of the year. In the end only a handful of the core-Meme Stocks ended up outperforming the market. Shockingly, mega-fraud Carvana was one of them.

As to whether or not these companies warrant the hype is outside of the scope of this newsletter (ok, BlackBerry doesn’t). It’s a mixed bag as far as how well they have performed over the last half decade, with many showing signs of being classic value traps (*cough* BlackBerry).

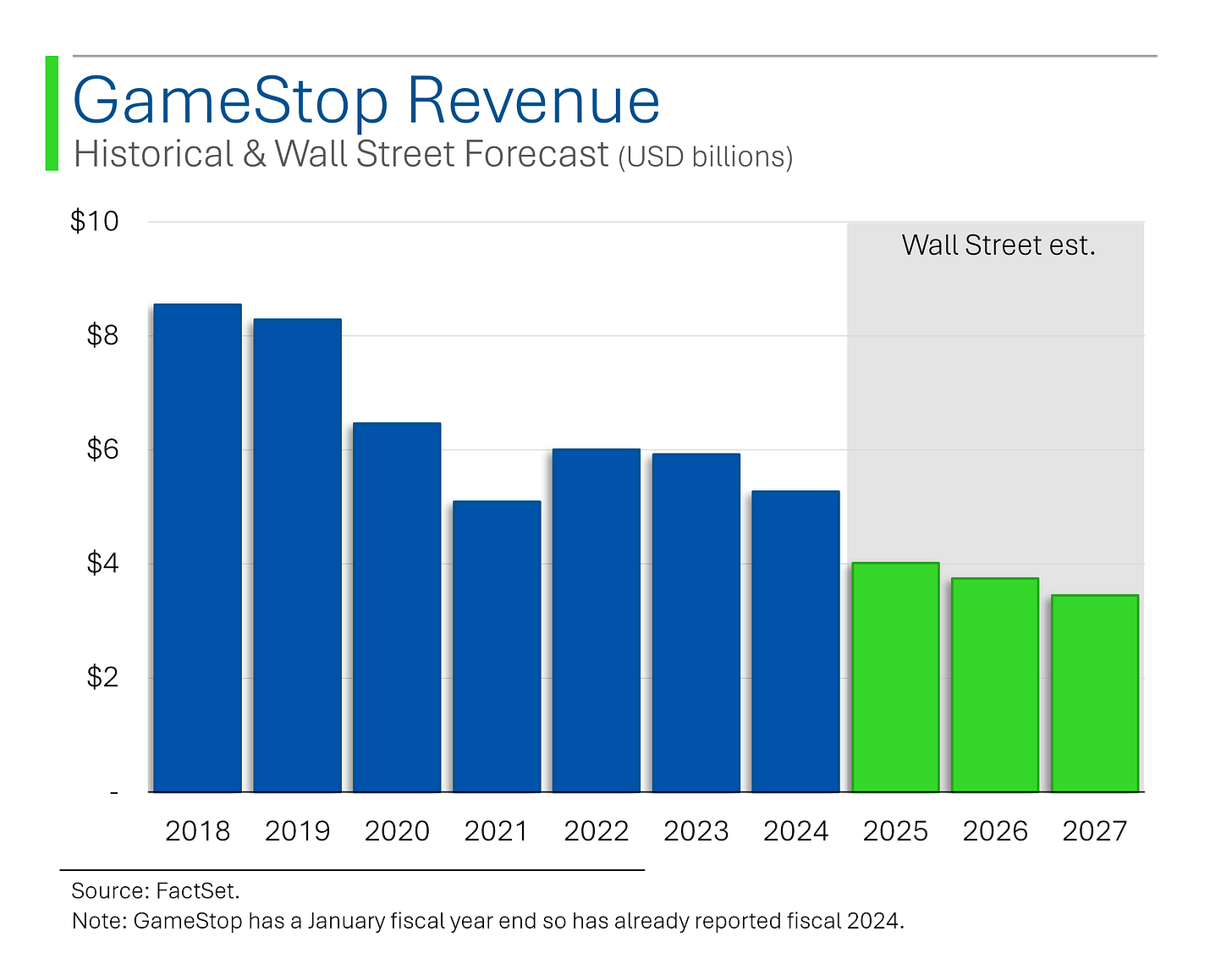

As for GameStop, they have yet to fully right the ship and revenues have continued to decline.

However, much of that has to do with the culling of unprofitable locations and the company was able to barely return to profitability in fiscal 2024.

Wall Street’s outlook has remained quite muted but they’ve got this one wrong a few times now so 🤷♂️.

What is pretty clear at this point, is that GameStop isn’t going bankrupt any time soon - despite what the haters say.

The company was close to posting flat operating cashflow over the last four quarters (only -$27 million) and, after raising ~$3.5 billion from share sales last year, they have bought themselves plenty of runway to figure things out.

That said, with a $14.7 billion valuation - bigger than Domino’s Pizza - it’s hard to get excited about any upside at this steep valuation.

For context, if they were in the S&P 500 they’d be ranked #431 by size but with net income barely a fraction of their neighbors.

Moreover, folks still betting on another MOASS, or ‘Mother of All Short Squeezes’, will be left disappointed.

That was possible in 2021 because in excess of 100% of the free floating shares were sold short by hedgefunds and other bears. As of now, that figure sits at 8% - not much off the S&P 500 average.

It seems the hedgies have learned their lesson on this one.

As for the #2 Meme Stock, theatre operator AMC Entertainment, the picture is arguably much, much worse. While revenues have clawed back in the post-Covid world, the outlook is underwhelming.

While peers like Cinemark and Cineplex seemed to have righted the profitability boat reasonably well, AMC has continued to be a shipwreck.

For all his bluster and gimmicks, CEO Adam Aron has continuously proven he has no idea what he’s doing - let alone how to make the company consistently profitable.

If investing in an unprofitable company isn’t enough to make you have second thoughts, the fact that your shares have been diluted by 97% since 2020 surely must.

Hard to make the case that the CEO has earned his $6.5 million pay package in 2023. The only solace I take is that much of that was in AMC stock.

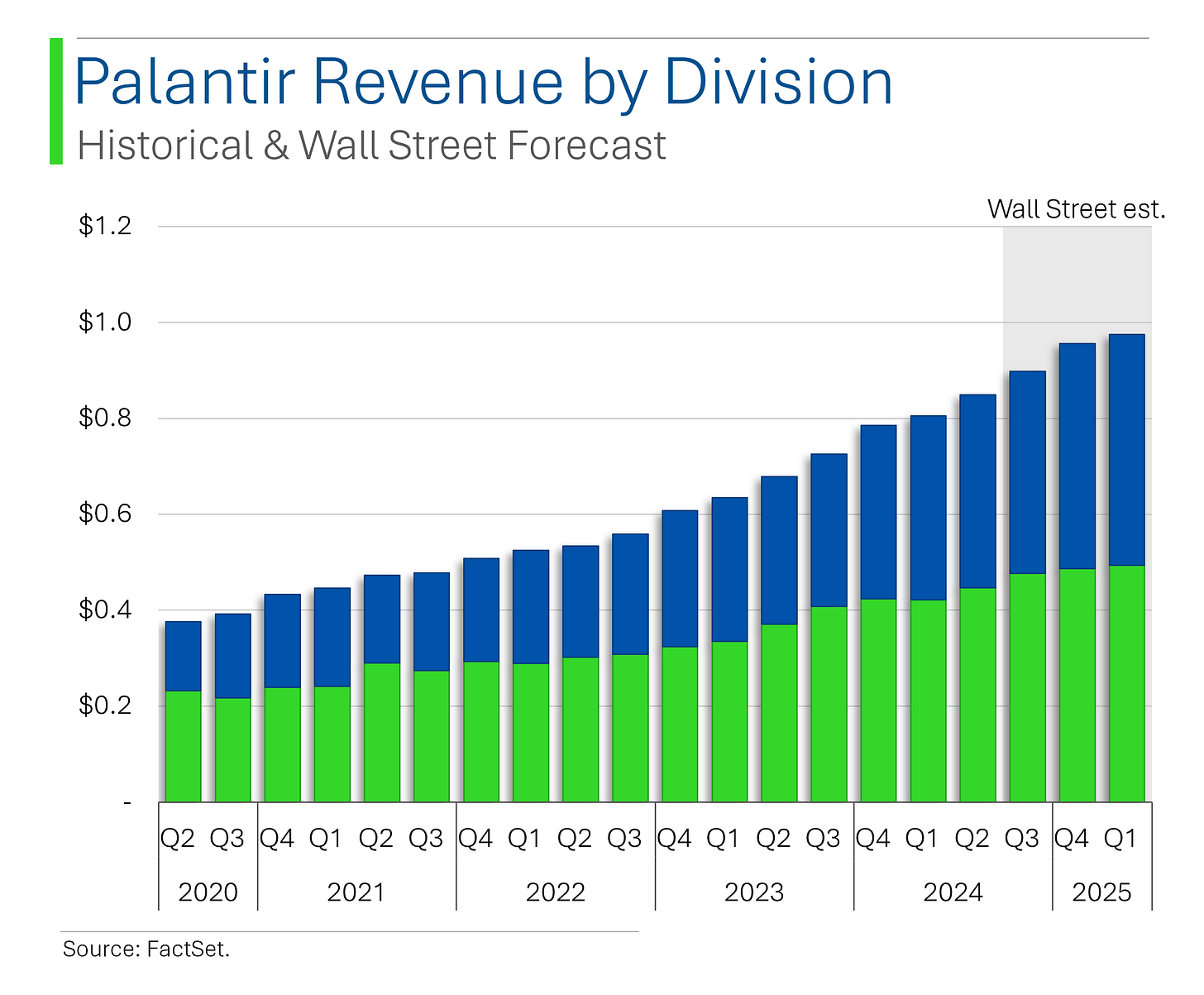

Lastly, I wanted to bring up Palantir. Palantir Technologies provides advanced data analytics software and platforms to help organizations integrate, analyze, and gain insights from complex datasets, primarily serving governments, enterprises, and institutions.

Big brain stuff, but I suspect a lot of the meme frenzy had to do with people thinking founder Peter Theil was edgy.

Anyway, I’d like to formally declare that Palantir is no longer a Meme Stock - just a regular ole Tech company with a lofty valuation.

Having officially been added to the S&P 500 - a rarity for a Meme Stock - and posting a market cap that places it 61st on the list, I think it’s fair to say they’ve shed their meme status.

So, while I do love when Meme Stocks work up into a frenzy, it seems that those times are often too short lived.

Maybe that has do to the limited capital retail investors are able to deploy. Or maybe it has to do with short attention spans.

If you’re curious as to whether GameStop is actually a viable company, I did a two-part deep-dive back in July. Check it out!

🔬GameStop Pt. II: Is It Worth Anything? (A Step-By-Step Valuation)

"Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity"

The Term Premium

The US term premium has gone from record lows to brushing up against the 10 year high.

For those a little fuzzy on this, the term premium is the additional return investors demand for holding a long-term bond instead of a series of short-term bonds, to compensate for risks like interest rate fluctuations and uncertainty over time. It reflects factors beyond expected future short-term rates, such as market volatility, inflation expectations, and investor sentiment.

Basically, investors are demanding to be compensated for holding longer term bonds. It’s why in a ‘normal’ yield curve, the back end (longer term bonds) has higher yields than the short-term.

Investors can see signs of this in the current state of the yield curve. Compared with two years ago, short-term rates have declined (mostly due to reduced inflation expectations) while the longer-term rates have increased.

So while things look a bit more ‘normal’ than they have been for some time, a rising term premium can drive up borrowing costs for governments, businesses, and consumers.

This shift is crucial for investors as it reflects changing risk sentiment and inflation expectations, potentially impacting bond prices, equity valuations, and overall portfolio strategies.

AI Keeps the Chips Falling in TSMC’s Favor

In the latest sign that the AI boom has yet to slow down, the world’s largest chip maker, TSMC, reported a record quarter.

Fourth-quarter 2024 revenue of T$868.42 billion ($26.36 billion), exceeding market expectations and reflecting 34.4% year-on-year growth, driven by strong demand for AI-related chips.

The company’s revenue for December alone surged 57.8% year-on-year, benefiting from its key customers like Apple and Nvidia despite weaker demand for consumer electronics.

Other Taiwanese firms, like Foxconn, also posted record revenues in the fourth quarter, underscoring the AI boom's impact on the tech sector.

Joke Of The Day

I used to be a doctor but then I lost patients.

Macro Update

Non-Farm Payroll [Friday]

December nonfarm payrolls grew by 256K, surpassing the 150K-160K consensus, with unemployment ticking down to 4.1% and Average Hourly Earnings (AHE) increasing 0.3% m/m (3.9% annualized).

Analysts see the data reinforcing expectations of a Fed hold at January’s meeting, with the first rate cut now pushed out to October.

Consumer Sentiment [Friday]

University of Michigan Consumer Sentiment for January prelim came in at 73.2, near consensus, while inflation expectations jumped to 3.3% y/y (highest since May-24).

Long-run inflation expectations also rose to 3.3%, marking the highest level since 2008, as the Current Economic Conditions Index rose but Consumer Expectations fell.

ADP Private Payrolls [Wednesday]

ADP private payrolls missed estimates, reporting 122K job gains (vs 135K consensus) in December.

Job-stayers' pay growth slowed to 4.6% y/y, the lowest since Jul-21, while job-changers' pay growth slightly eased to 7.1%. Initial jobless claims beat consensus at 201K, with a four-week moving average at 213K, signaling continued labor market resilience.

Job Openings & Labor Turnover Survey [Tuesday]

November JOLTS job openings hit 8.098M, beating the 7.7M consensus, with the openings rate rising to 4.8%, while the quit rate dropped to a three-year low of 1.9%.

ISM Services [Tuesday]

The December ISM Services Index rose to 54.1 (vs 53.0 consensus), led by higher business activity (58.2) and new orders (54.2), though employment growth slowed (51.4).

Prices Paid surged to a 22-month high (64.4), as 15 of 18 service industries reported higher costs, reflecting persistent inflation pressures.

Trivia

Today’s trivia is on Meme Stocks (obviousy).

What was the main subreddit that fueled the 2021 meme stock craze?

A) r/Investing

B) r/WallStreetBets

C) r/StockMarket

D) r/FinanceWhat hedge fund reportedly lost billions during the GameStop short squeeze?

A) Citadel

B) Melvin Capital

C) Point72

D) Renaissance TechnologiesWhat action by Robinhood caused outrage during the GameStop squeeze?

A) Selling customers' shares without permission

B) Halting all trades on meme stocks

C) Restricting buying of meme stocks

D) Delisting GameStop from the platformWhat was AMC Entertainment’s market cap at its peak during the meme stock craze?

A) $5 billion

B) $10 billion

C) $30 billion

D) $50 billion

(answers at bottom)

This Week In History

First Use of Poison Gas in Warfare - January 9, 1915

German forces tested poison gas on the Eastern Front during WWI, marking the start of chemical warfare's devastating role in modern conflict.

Bitcoin’s First Significant Price Surge - January 9, 2009

Bitcoin crossed $1 for the first time since its creation, signaling the cryptocurrency’s potential as a disruptive financial innovation.

Lehman Brothers Bankruptcy Filing Begins - January 7, 2008

Initial legal processes revealed the systemic issues that would lead to one of the largest bankruptcies in history, igniting the global financial crisis.

Market Update

Market Movers

Friday:

Walgreens Boots Alliance (WBA) [+27.5%]: Q1 results beat expectations with revenue up 7.5% y/y as U.S. Healthcare growth offset weaker retail pharmacy sales.

Constellation Energy (CEG) [+25.2%]: Confirmed a $26.6B acquisition of Calpine and raised FY adjusted EPS guidance above expectations.

Warner Bros. Discovery (WBD) [-3.6%]: Scrapped the planned Venu Sports JV with DIS and FOXA.

Advanced Micro Devices (AMD) [-4.8%]: Downgraded by Goldman Sachs due to industry challenges and cyclical headwinds in Embedded.

Wednesday:

eBay (EBAY) [+9.9%]: Struck a deal to list items on Facebook Marketplace in the U.S., Germany, and France.

Instacart (CART) [+4.5%]: Partnered with ULTA for nationwide same-day delivery.

Lyft (LYFT) [-6.7%]: Lost Delta's loyalty program rideshare partnership to Uber.

Tuesday:

Getty Images Holdings (GETY) [+24.1%]: Announced a merger with Shutterstock valued at $3.7B, with options for stock or cash payouts for shareholders.

Carvana (CVNA) [+5%]: Upgraded by RBC on valuation and sustainable GPU levels despite market pullback.

Tesla (TSLA) [-4%]: Downgraded by BofA citing execution risks and valuation concerns around long-term growth bets.

Monday:

fuboTV (FUBO) [+249.3%]: Surged after a deal with Hulu + Live, settlement on Venu Sports litigation, and securing a $220M payment.

United States Steel (X) [+8.2%]: Rose after suing the Biden administration over a blocked buyout and related media coverage.

Palantir Technologies (PLTR) [-5%]: Dropped after Morgan Stanley initiated coverage with an underweight rating due to concerns about growth sources.

Uber Technologies (UBER) [+2.7%]: Announced a $1.5B accelerated share repurchase program.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) r/WallStreetBets kicked off the Meme Stock craze in 2021.

B) Melvin Capital blew up based on their GameStop shorts.

C) Robinhood triggered outrage by restricting buying of meme stocks.

C) AMC hit the ridiculous valuation of $30 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.