🔬GameStop Pt. II: Is It Worth Anything? (A Step-By-Step Valuation)

Plus: The Fed signals rate cuts may (finally) be coming; and much more!

"Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity"

- Carl Icahn

“Life is like a dogsled race. If you ain't the lead dog, the scenery never changes”

- Lewis Grizzard

Decent day for the big US markets with the S&P 500 +0.3% and Nasdaq +0.4%. Biggest news is the ongoing small-cap rally that saw the Russell 2000 finish +1.8%.

6 of 11 sectors closed higher with Energy (+1.6%) and Financials (+1.4%) at the top. Utilities got smoked (-2.4%) to come in at the bottom.

Notable companies:

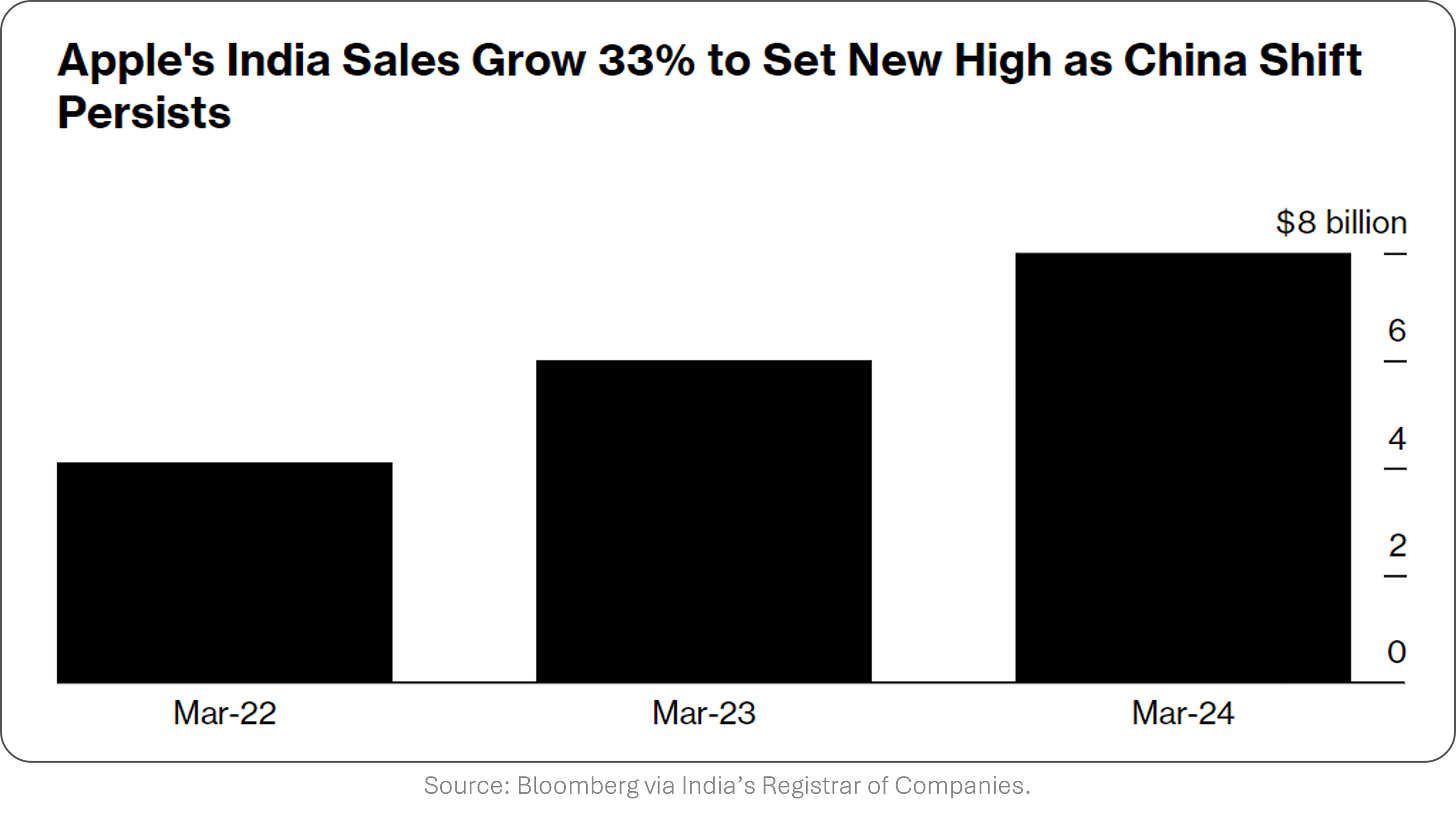

Apple (AAPL) [+1.7%]: Upgraded to buy from hold at Loop Capital; Goldman Sachs raised price target to $273 from $216; Bloomberg noted India revenue rose 33% to nearly $8B.

Zeta Global Holdings (ZETA) [+8.4%]: Initiated at buy at Truist; disruptive potential in marketing-tech; noted competitive moat, profitable growth, and large-customer traction.

Goldman Sachs (GS) [+2.6%]: Q2 earnings and revenue beat; FICC bright spot; analysts less concerned on expense miss and light advisory revenues due to timing; larger-than-expected buyback positive.

More below in ‘Market Movers’.

Street Stories

GameStop Pt. II: The Valuation

This is part two of two in my series on GameStop. Yesterday covered the history and the operations, while today goes through the stock and the valuation.

In yesterday’s note I focused on how GameStop is in the midst of right-sizing the business for the future but that the pivot to online hasn’t yet taken shape.

While still mid-transition, the company is approaching steady positive cashflow and - with the billions raised from share sales - is at little risk of bankruptcy over the medium term. Despite what the financial media may portray.

This, however, then leads to the question ‘well, what the hell are the shares actually worth?’

At its current market capitalization of $11.4 billion, if GameStop were a member of the S&P 500 it would be in around the 458th spot. What stands out, however, is the massive gap in net income to their peers of a similar size. In fact, their peak net income in 2011 of $408 million doesn’t even hold up that well. Yeesh.

As the company is in a bit of limbo at the moment, just looking at current trading multiples (P/E, EV/EBITDA) isn’t too helpful. To rectify this, I built a small model to forecast the range at which revenue may progress in the future should the business successfully turn itself around.

Doing this, I get to a 2033 revenue estimate range of between $3.9 billion to $11.1 billion. The high-side of this involves growing revenues at +15% a year from 2028 onward - which is likely a bit punchy.

For the next step, I plug in some estimates for GameStop’s net income margin, which since 2011 has ranged from +4.3% (2016) to -5.5% (2022).

The 2033 estimates range is based on a high figure that uses a +5.0% margin attached to the high revenue estimate above ($11.1 billion) which implies $556 million in net income. The low estimate applies a 2.5% margin to the low revenue estimate ($3.9 billion).

The result is a 2033 net income range of $98 to $556 million - which would be a record for GameStop historically.

Next we need to figure out what P/E multiple would be appropriate to apply here.

Currently, their peers in the electronics and entertainment retail space average a forward P/E of 12.1x.

Moreover, since GameStop’s IPO following its spin-out from Barnes & Noble, the company has traded at P/E’s ranging from 32x to 2x forward earnings. Pretty damn broad.

(Note that I exclude the post-June 2020 period when net income approached zero and made the multiple go stupid)

Putting it all together, the below gives a range of valuations possible in the year 2032 based on different forward P/E multiples applied to the high and low net income estimates ($98 to $556 million).

For example, the high 2033 net income estimate of $556 million applied to the high P/E of 30.0x yields an equity value of $16.7 billion.

Obviously the estimates required to get to this high figure are pretty punchy (aggressive growth estimates; record net income margin; and an outsized P/E multiple) but they illustrate that - under the right circumstances - GameStop could end up being a decent investment. Huh…

The last thing I want to get across is that the above only makes sense if GameStop doesn’t continue to dilute its shareholders by issuing more equity. Since the 2024 rally kicked off, the number of shares has increased by a comical 39%.

However, with a few billion in the bank now, this likely won’t be an issue…but seven years is a long time, so 🤷♂️

To wrap this up, I’d be hard pressed to call GameStop the buy of the century, but if they can manage to pull off this turnaround then there is a shot that this could end well for everyone. Sure, maybe it’s not the most likely outcome, but it has defied the odds in the past and the fan support doesn’t seem to be waning.

It’s such a wonderful story and deserves a happy ending so fingers crossed.

Power to the players 💎✋🤚💎🚀

J-Pow’s Inflation Deflation

Federal Reserve Chair Jerome Powell expressed increased confidence that inflation is heading towards the Fed’s 2% goal, suggesting potential near-term interest-rate cuts while noting balanced risks to both inflation and the labor market. Despite holding borrowing costs high for over a year, the Fed is now considering rate cuts as unemployment rises and inflation shows signs of cooling.

Joke Of The Day

My boss told me to stop acting like a flamingo, so I had to put my foot down.

My boss is very easygoing. He told me not to think of him as the boss, rather, think of him as a friend who is never wrong.

Hot Headlines

Bloomberg / Apple’s pivot away from China to India sees sales jump nearly 50% in two years. India sales in the year to March hit $8.0 billion up from $4.1 billion in 2022.

Politico / How Biden could get dropped at the Democratic Convention (August 19-22). If another challenger arises then this would be a contested convention but the mechanism behind it are actually robust enough to deal with this efficiently.

Axios / Despite technology gains and modern logistics networks, US stamps are approaching their highest cost ever on an inflation-adjusted basis. USPS still projected a net loss of $6.5 billion for its fiscal year. This makes… no sense.

AP / Elon confirms delay to Tesla’s August robotaxi unveiling event in order to make design changes. Tesla? Delay? No, I’m shocked.

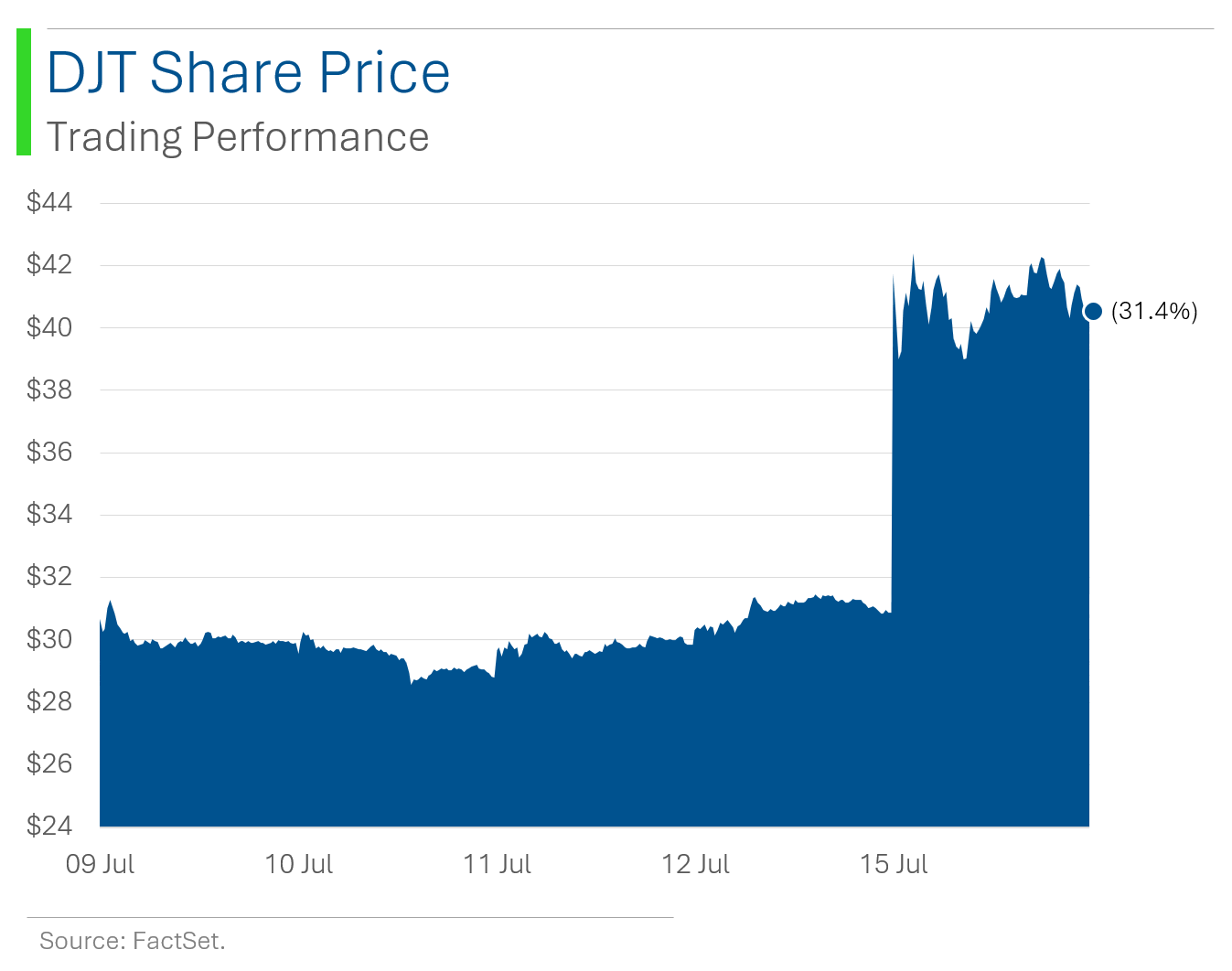

Bloomberg / Safe haven assets and ‘Trump trades’ pop following assassination attempt. Shares of Truth Social parent Trump Media & Technology Group jumped 31% on Monday.

The Telegraph / The Paris Olympics is looking like a financial disaster. At 44 million tourists a year, Paris is the most visited city in the world but the games are keeping tourists away from the city during the €7.5bn games. Hotel occupancy is forecast at 81.4%, well below summer 2023 levels, and major French companies are forecasting losses, such as the €180 million hit Air France is predicting in the quarter.

Trivia

Today’s trivia is on technology innovation.

Who launched the first modern credit card?

A. Visa

B. Diners Club

C. American Express

D. MasterCardWhich company created the first handheld mobile phone?

A. Nokia

B. Samsung

C. Motorola

D. AppleWho developed the first successful color television?

A. Sony

B. RCA

C. Philips

D. Samsung

(answers at bottom)

Market Movers

Winners!

Zeta Global Holdings (ZETA) [+8.4%]: Initiated at buy at Truist; disruptive potential in marketing-tech; noted competitive moat, profitable growth, and large-customer traction.

Goldman Sachs (GS) [+2.6%]: Q2 earnings and revenue beat; FICC bright spot; analysts less concerned on expense miss and light advisory revenues due to timing; larger-than-expected buyback positive.

TD SYNNEX (SNX) [+2.3%]: Upgraded to outperform from sector perform at RBC; noted Hyve customer ramp, Strategic Technologies momentum, AI-powered PC demand to boost billings growth.

Carrier Global (CARR) [+2.1%]: Upgraded to outperform from neutral at Baird; potential asset sales, aggressive capital deployment, resurgence in U.S. residential market.

Apple (AAPL) [+1.7%]: Upgraded to buy from hold at Loop Capital; Goldman Sachs raised price target to $273 from $216; IDC reported iPhone shipments +1.5% y/y in Q2; Bloomberg noted India revenue rose 33% to nearly $8B.

Losers!

SolarEdge Technologies (SEDG) [-15.4%]: Announced ~400 employee reduction; cited market downturn and excessive inventory.

Macy's (M) [-11.7%]: Terminated acquisition talks with Arkhouse and Brigade; talks failed to produce actionable proposal with financing certainty or compelling value.

STAAR Surgical (STAA) [-4.0%]: Downgraded to underweight from equal weight at Morgan Stanley; concerns over Chinese market and company's growth prospects.

Caesars Entertainment (CZR) [-2.0%]: Downgraded to negative from neutral at Susquehanna; argued company 'over-yielded' properties, resulting in competitively inferior assets.

Veeco (VECO) [-1.0%]: Downgraded to neutral from buy at Citi; valuation concerns after outperformance to S&P 500 YTD; balanced risk and reward following wafer fab equipment sensitivity analysis.

Market Update

Trivia Answers

B. Diners Club was the first credit card when it launched in 1950.

C. Motorola with the 4.4lb Motorola DynaTAC 8000X in 1973.

B. RCA had the first color TV back in 1953.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.