🔬March Madness By The Numbers

Plus: The VIX remains comatose; Investment Managers are super bullish; Trump's Truth Social gets greenlight to start trading; and much more.

"Wide diversification is only required when investors do not understand what they are doing"

- Warren Buffett

"Never interrupt your enemy when he is making a mistake."

- Napoleon Bonaparte

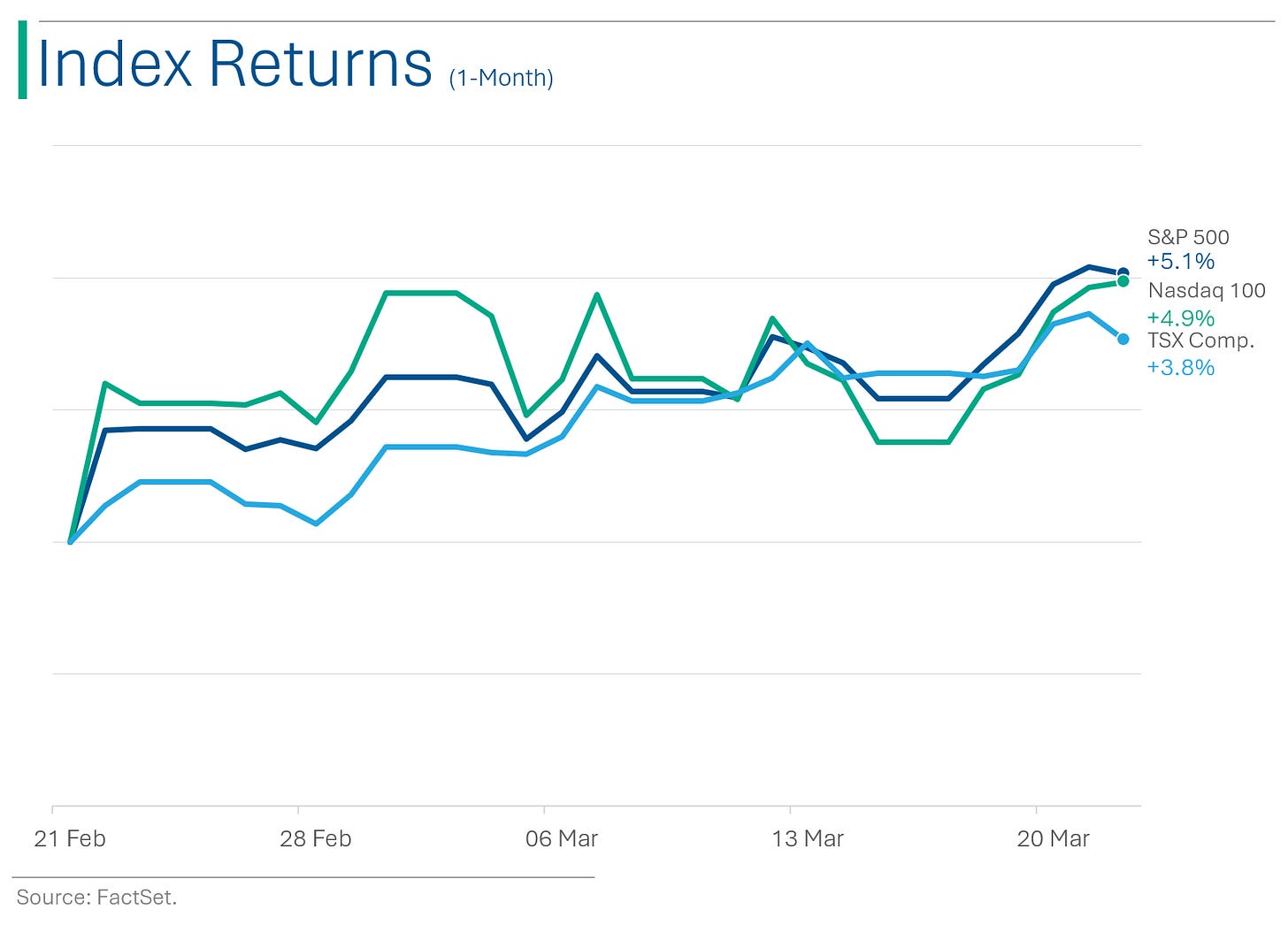

Soft Friday for the big US markets (S&P 500 -0.1%, Nasdaq +0.2%) but the week still ended up nicely in the win column with the S&P +2.3% and Nasdaq +2.9%.

10 of 11 sectors finished the week higher, led by a monster from Communication Services (+4.8%). Tech and Industrials were next best (both +2.9%). Real Estate (-0.4%) and Healthcare (+0.4%) were worst off.

WTI Crude Oil slowed its recent price momentum to finish the week down 0.5%.

FedEx (+7.4%) reported a decent quarter Friday but impressed with its guidance. While Lululemon (-15.8%) and Nike (-6.9%) both beat analyst estimates for EPS and Revs but disappointed with their revenue outlooks.

Street Stories

March Madness In Numbers

With the NCAA Division I men's basketball tournament in full swing I thought I’d take a minute to drop some stats:

The Money: The tournament contributes around 80% of the NCAA’s total revenue, primarily through TV rights. The 2022-2023 season earned the NCAA $1.28 billion with ~$900 million of that coming from March Madness.

Betting: The Super Bowl is the most bet single game but March Madness holds up well. In 2023, an estimated $15.5 billion was bet on March Madness ($16 billion on the Super Bowl).

According to American Gaming Association, a record 68 million Americans placed bets on the tournament in 2023.

The growth of legalized sports betting has contributed significantly to this and current sports betting in legal in 38 states and Washington, D.C.

Tournaments: 2024 marks the 85th tournament. The tournament took place during WWII and was only cancelled once, in 2020 as a result of the Covid pandemic.

Games: 68 teams play a total of 67 games.

- First Four (qualifier for lowest ranked 8 teams): 4 games

- First Round (‘Round of 64’): 32 games

- Second Round (‘Round of 32’): 16

- Third Round (‘Sweet 16’): 8 games

- Quarter Finals (‘Elite Eight’): 4 games

- Semi Finals (‘Final Four’): 2 games

- NCAA Championship: 1 gameBracketology: Around 1 in 4 Americans fill out a March Madness bracket.

The odds of winning are 1 in 9.2 quintillion (1 followed by 18 zeros) with a random bracket.

Warren Buffett famously offered Berkshire Hathaway employees a $1 billion prize if they could predict the outcome of all 67 games. No one’s ever won.

The closest anyone has reportedly ever got to a perfect bracket is correctly guessing the first 47 games in 2019. The closest anyone got last year was reportedly only 25 games

The Name: The tournament has colloquially called ‘March Madness’ virtually since its inception but the term was officially adopted by the NCAA in 1992.

Number 1 Seed: Since the modern bracket era in 1985, the top ranked team has won 24 of the 38 championship.

Biggest Upset: A 16th seed team has knocked out the 1st seed twice (2018: UMBC beat Virginia; 2023: Fairleigh Dickinson beat Purdue).

Who fills out brackets? People from all walks of life get in on the action, from celebrities to President’s.

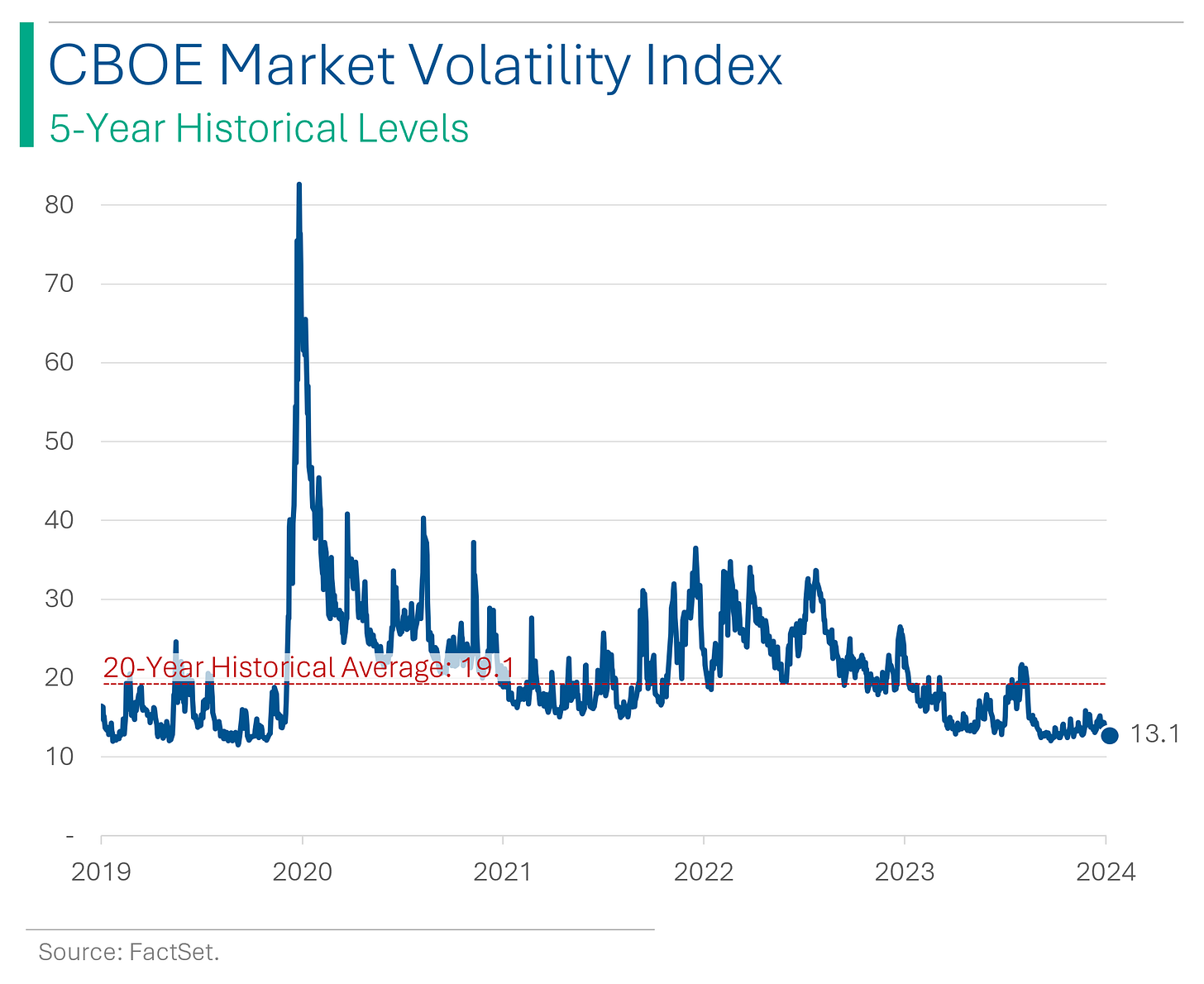

Silence Before the Storm? VIX Nap Continues

The Chicago Board Options Exchange’s Volatility Index (aka ‘The Vix’) continues to sit at near record lows. Commonly referred to as the stock market’s ‘Fear Index’, the VIX seems to imply that drastic price movements in the S&P 500 aren’t really on anyone’s radar at the moment. Whether that’s complacency or just that investors don’t have much conviction on where the hell the index is headed is beyond the scope of this course.

Explainer: Without getting super technical, the VIX is calculated using S&P 500 index options for the next 30 days. The index essentially uses the ‘implied volatility’ of options from the good ole Black-Scholes option pricing model to gauge the expected volatility (up or down) of the S&P 500.

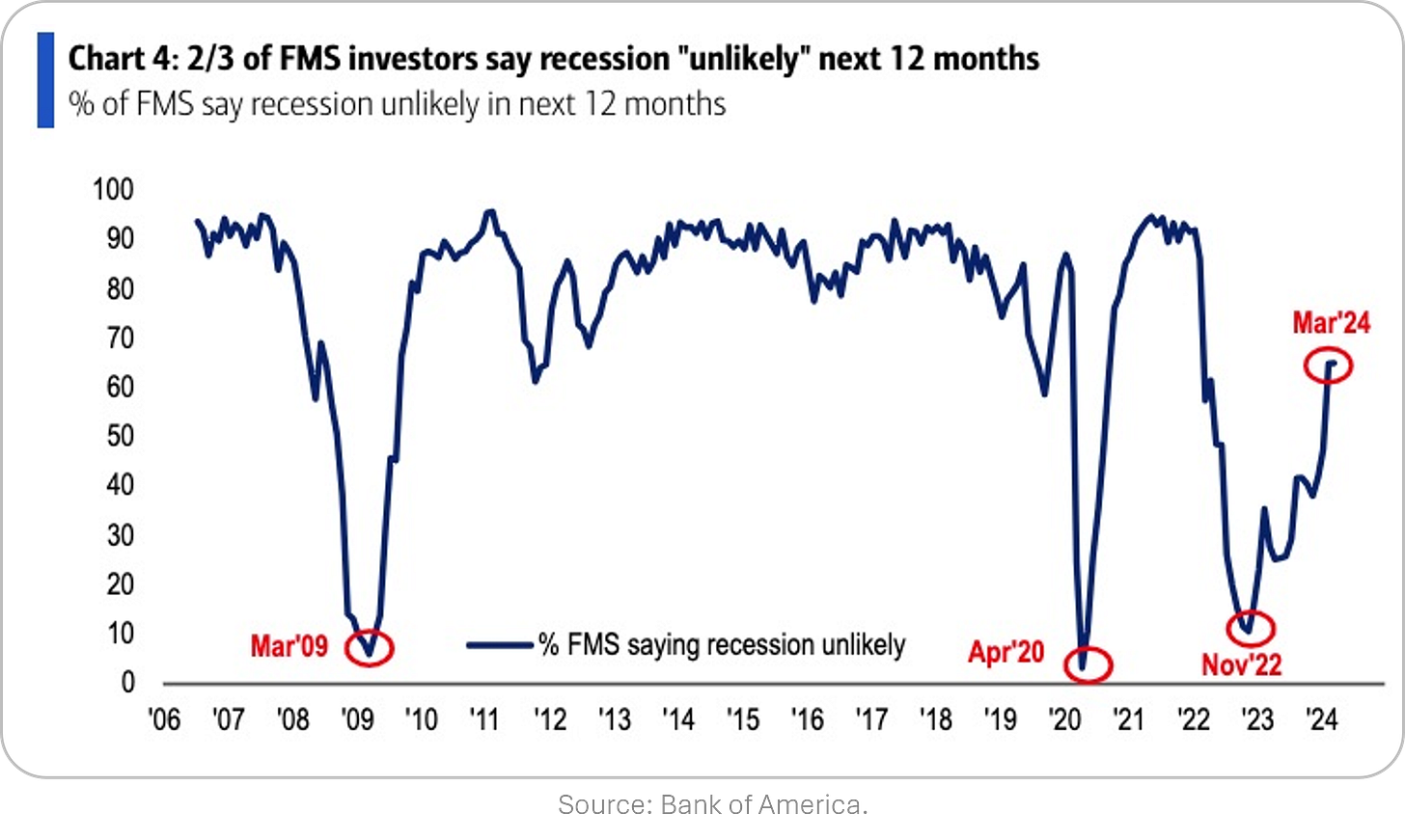

Everything Is Awesome (according to fund managers)

The latest installment of Bank of America’s Fund Manager Survey showed that professional investors think everything is just peachy. The trajectory of growth sentiment is at the highest level since the ‘everything bubble’ of 2021, and basically parabolic since bottoming out at the end of 2022.

Additionally, the narrative switch from ‘recession’ to ‘soft landing’ seems to have taken another pivot as increasingly ‘no landing’ (ie: no recession or economic slowdown) has picked up steam over the last two months.

Furthermore, expectations for global corporate profitability has ticked up and into positive territory, as the formerly bearish investors have began to reverse course.

Ryan Thoughts: It’s interesting that amidst the massive rally of 2023, investors held such a bleak outlook. Admittedly, this is a ‘global’ survey and things internationally haven’t been a groovy as in the US, but outside of a few select countries (looking at you, UK), markets did quite well last year.

Like the old stock market adage states ‘nothing changes sentiment like price’.

Trump’s Truth Social Going Public (finally)

Shareholders of Digital World Acquisition Corp. (DWAC) SPAC approved a merger with Truth Social's parent company, Trump Media & Technology Group (TMTG), marking it’s launch as a publicly traded company and significantly increasing former President Trump's net worth (his 58% stake is worth ~$3.5 billion), though he can't sell shares for six months.

The merger concludes a complex saga involving lawsuits and shareholder disputes, and following the merger, TMTG will be listed on the Nasdaq (ticker: DJT), with a potential impact on stock value depending on market demand and actions by the new board, which includes Donald Trump Jr.

Joke Of The Day

Why is money called dough? Because we all knead it.

Got an email asking me to invest in Egyptian architecture. Sounds like a pyramid scheme to me.

Hot Headlines

Fox Business / China blocks use of Intel and AMD chips in government computers. The new procurement guidance also looks to bring an end to the use of Microsoft's Windows operating system as well as foreign-made database software on Chinese government devices in favor of domestic options. No Excel in China? That makes me sad.

Yahoo / Gas tops $3.50 per gallon as oil prices rise.

CNBC / The last time a Trump company went public it didn't go well for investors. Trump’s Truth Social SPAC got shareholder approval on Friday, and will use the ticker DJT (his initials). The same ticker Trump Hotels and Casino Resorts used when it went public in 1995.

The Guardian / First it was Facebook, then Twitter. Is Reddit about to become rubbish too? Interesting look at how being a public company may force Reddit away from the things that made it a success.

Bank of Russia / Russia announced that it will keep it’s key policy interest rate at 16.00%. Move comes as inflation has started to cool but still remains high at 7.7% as of its most recent print. Oh darn.

Trivia

This week’s trivia is on random stock market facts.

The Dow Jones Industrial Average was created in 1896 and consisted of 12 companies. Which company was one of the originals?

A) General Electric

B) IBM

C) 3M

D) General MotorsWhich country is home to the world's oldest continuously operating stock exchange?

A) United Kingdom

B) Netherlands

C) France

D) ItalyWhat is the oldest stock exchange in the United States?

A) Chicago Stock Exchange

B) Philadelphia Stock Exchange

C) Boston Stock Exchange

D) NASDAQ

(answers at bottom)

Market Movers

Winners!

Worthington Steel (WS) [+10.8%]: FQ3 earnings surpassed expectations with higher ASPs, tonnage, and favorable mix boosting GM. Automotive business remains strong.

FedEx (FDX) [+7.4%]: FQ3 EPS exceeded forecasts, revenue met expectations. Benefits from reduced costs across Express, Ground, and Freight, despite Freight underperforming. FY24 EPS guidance improved; $5B share repurchase plan announced. Analysts highlight improved Express margins and cost management.

Foot Locker (FL) [+3.1%]: Rating upgraded to neutral by Citi. NKE's increased wholesale allocation and reduced digital focus cited.

Losers!

lululemon athletica (LULU) [-15.8%]: FQ3 EPS and revenue surpassed expectations, but FY25 guidance fell below consensus due to a soft quarter start, slower US traffic, and conversions, alongside rising competitive pressures and unexpected brand investment.

Nike (NKE) [-6.9%]: FQ3 revenue and EPS exceeded forecasts, though GM fell short. Q4 revenue expected below Street estimates, with 1H revenue predicted to decline slightly. Downgraded by RBC Capital Markets to sector perform due to weak guidance amid promotional shifts and competitive pressures.

AAR Corp (AIR) [-5.9%]: FQ3 earnings and revenue met expectations, with strong commercial distribution sales offset by a year-over-year decline in government sales (improving sequentially). Analysts view the report as aligned with expectations but note caution on Parts Supply; outlook on margins is more optimistic.

Tencent Music Entertainment Group (TME) [-4.0%]: President Zhenyu Xie steps down for personal reasons, effective March 31.

Market Update

Trivia Answers

A) General Electric was in the original Dow.

B) Netherlands has the oldest continuously operated stock exchange.

B) Philadelphia Stock Exchange is the oldest in the US.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Lots of great info here! Might you be open to doing a similar “March Madness” analysis for NCAA Women’s Basketball? Their leagues are really picking up steam & attention (well deserved - they’re great fun to watch) and this year, some top teams were frequently selling out their arenas, even before the tournaments started. 🙂

Another very insightful update! Oh, and I just love the trivia!