Mag7 Reality Check

Plus: US GDP fails to outweigh inflation.

"What the wise do in the beginning, fools do in the end"

- Warren Buffett

"How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case"

- Robert G. Allen

Hey Readers!

Not much new to report other than that I rejoice at the conclusion of Dry January. In case you missed it, I did a fun one of how to build a basic company model in 1-1.5hrs last week so be sure to check that out if you missed it (link below, including a free downloadable Excel template).

After 25 years snowboarding, I’m trying skiing today. If I don’t write something next week, you can probably guess how that went. ⛷️😧

Have a good weekend,

- Ryan

Street Stories

Mag 7 Reality Check

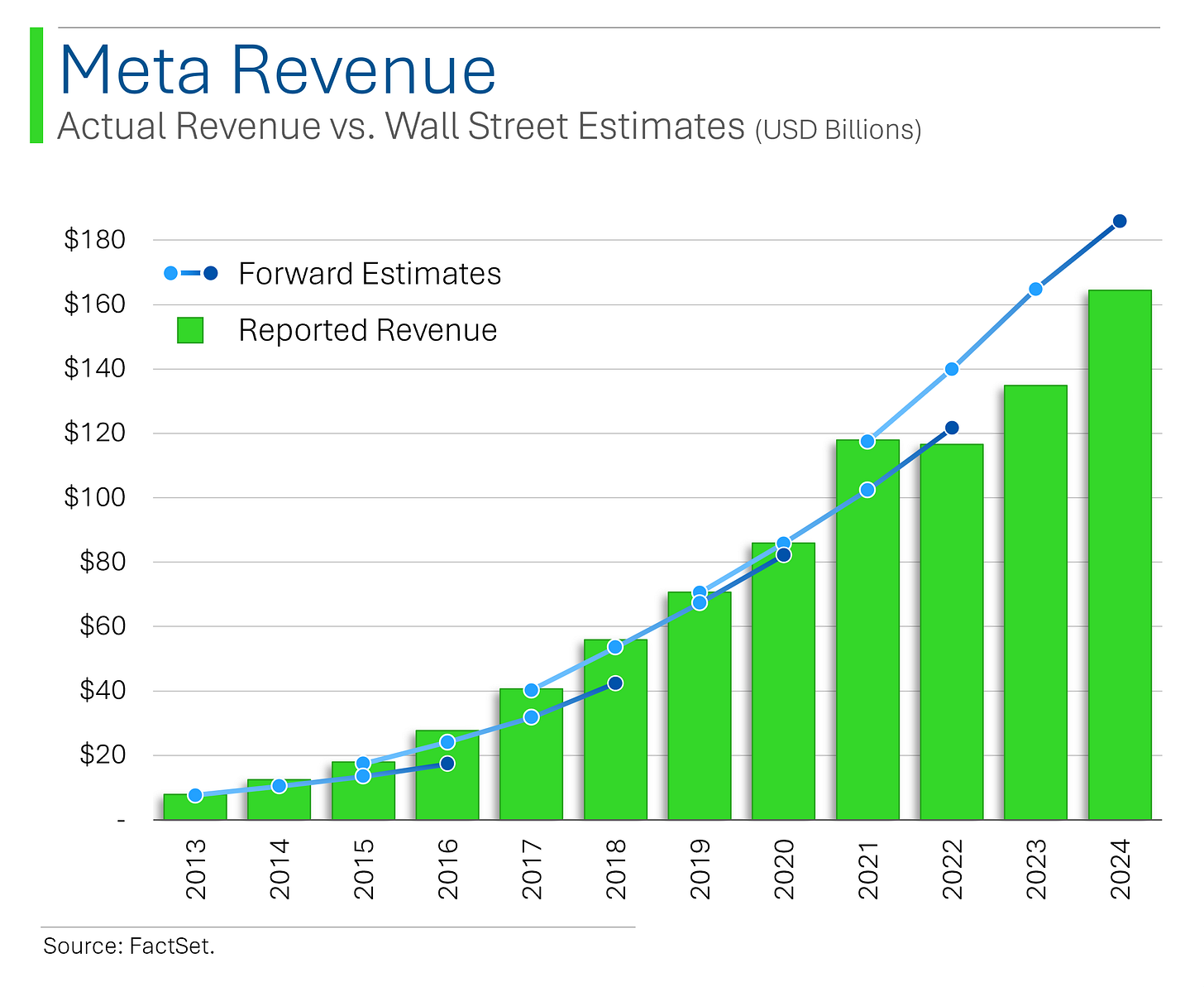

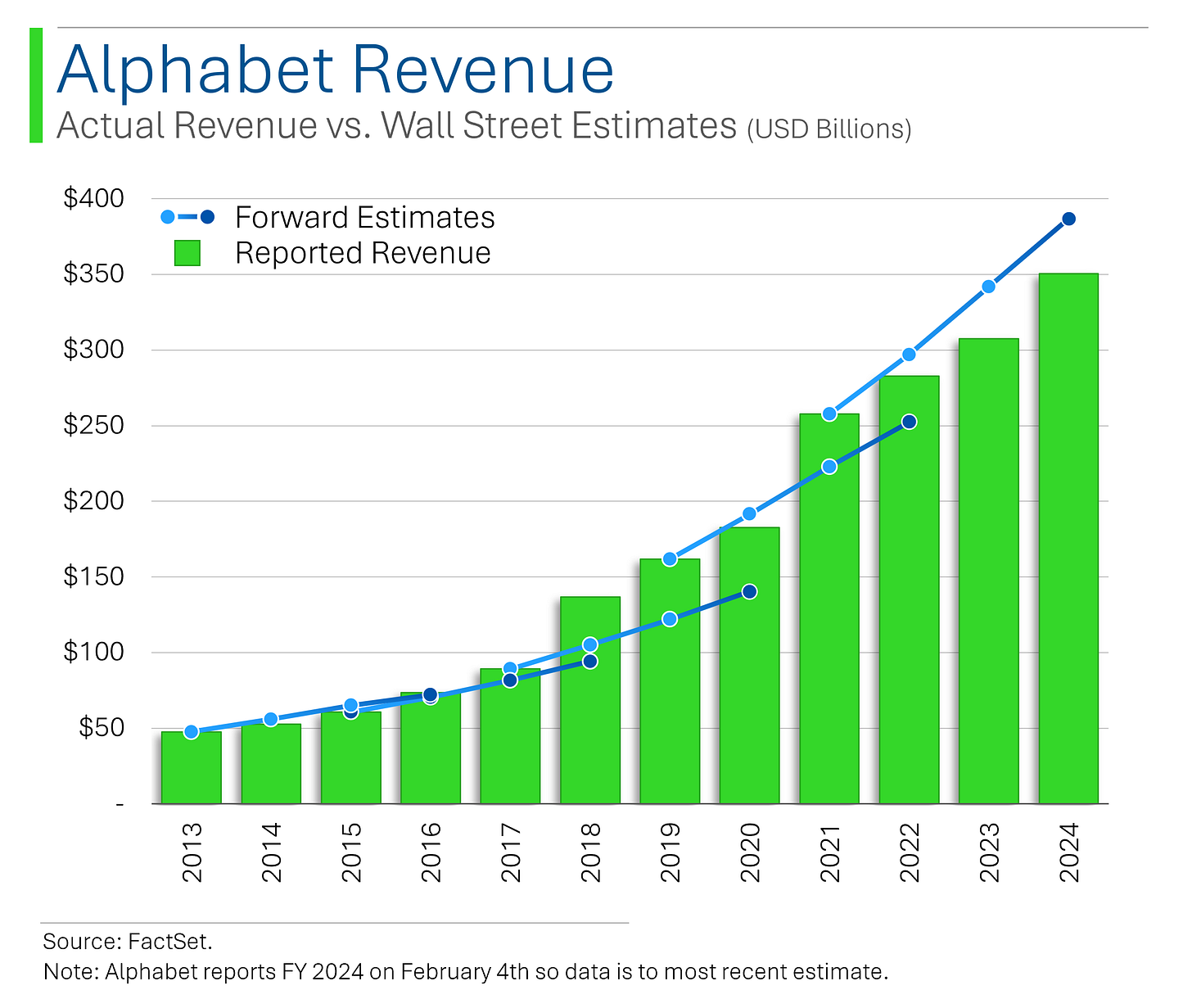

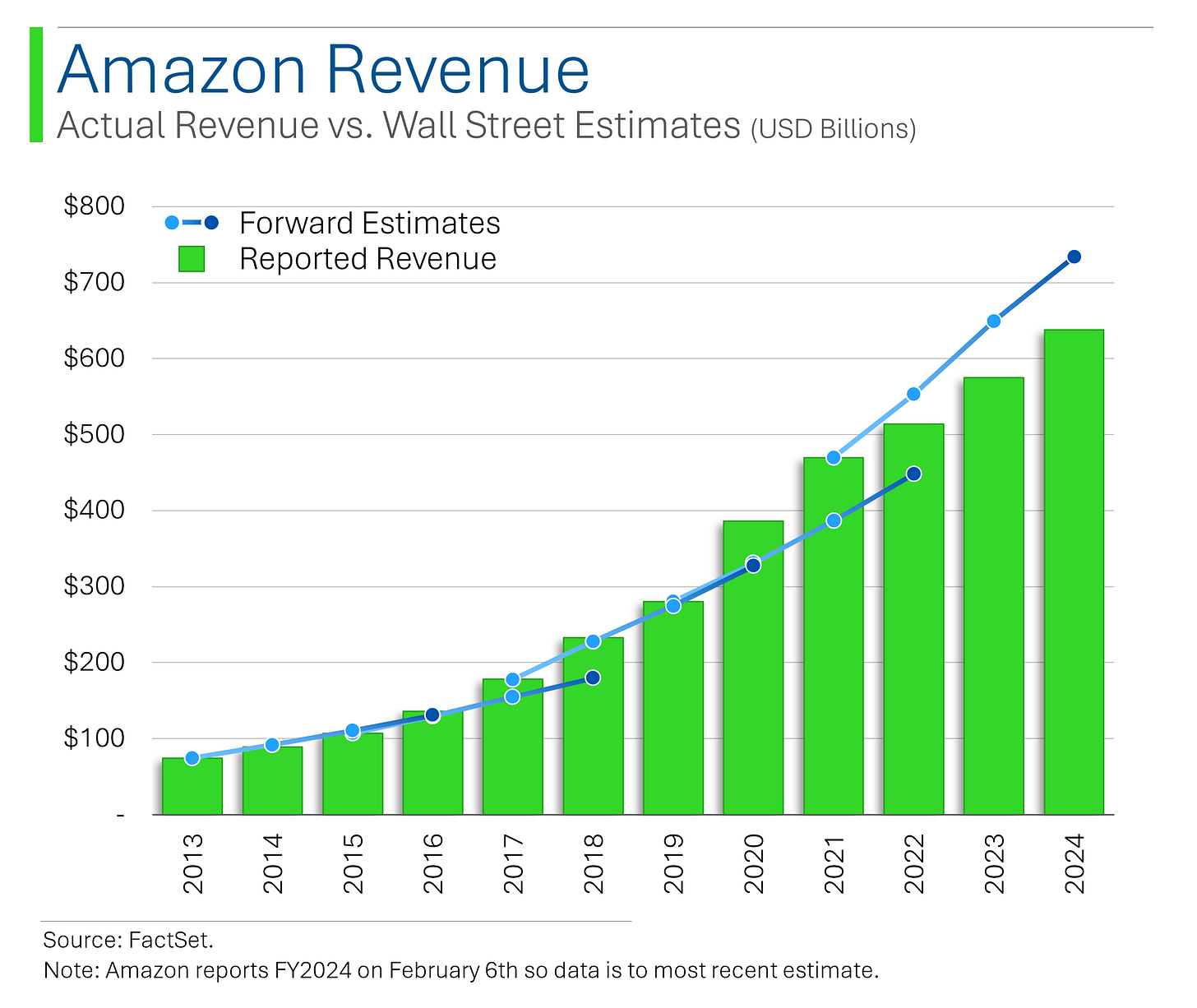

Four of the seven members of the market’s most notable collective reported this week. Meta annihilated earnings driven mostly by a +14% increase in price per ad, but for the rest it’s been a bit ‘meh’.

Tesla missed estimates by a mile but the shares jumped on more Musk hype about cheaper EVs launching mid-year and power generation/storage, while Microsoft beat but melted down as its main growth engine (Intelligent Cloud) failed to impress (only +21% YoY after all).

All-in-all, a bit 🤷♂️.

On their own, none of this is too significant but given that the market’s direction has been heavily dictated by its flagship companies, this doesn’t improve the outlook for a market already quite extended and facing some potentially turbulent times (inflation, trade wars, consumer debt, etc.).

Anyway, my initial plan for today’s note was a bit of a review of Wall Street’s accuracy at predicting future revenue and profitability. However, as I was tinkering in Excel it became pretty clear that a lot of the ‘hype’ Wall Street had a few years back for the Mag7 has actually failed to materialize.

As you can see above, Wall Street’s estimates 3 years ago for the most recent (or pending) fiscal years have all missed the mark to the downside - save for the miracle that has been Nvidia.

It’s important to remember that a stock’s performance often has less to do with actual growth than it does with expectations - what is ‘priced in’ to the shares. For example, if a company is expected to grow revenue by 3% ends up reporting revenue up 5%, the shares usually go up. If a company is expected to grow 25% and only grows by 23%, the shares usually go down.

Estimates for the Mag7’s ‘out years’ have been tapering down for while, so even though the most recent bogeys have been honed in on, compared to where they stood just a few years back, it’s pretty clear that back in 2022 things were expected to be materially better.

This obviously stands in sharp contrast to their share performances. For example, back in 2022 Wall Street expected Apple’s fiscal 2024 to be 7% higher than it turned out to be - but the shares are still up 36% since then.

If the change in a stock’s share price is partially a function of the change in expectations, it’s also quite clearly a function of euphoria as well.

Some charts that show the progression:

(sorry, that was a lot…)

U.S. Economy

Thursday data showed that the U.S. economy expanded at an annual rate of +2.3% in the fourth quarter, primarily driven by increases in consumer and government spending and a freckle below consensus for +2.4%. While decent enough, this marked a cool down from the +3.1% rate we saw in Q3.

Grade: B+

This got followed up Friday with December Personal Consumption Expenditures (PCE) price index, the Federal Reserve's preferred inflation gauge, increasing by +0.26% from the previous month. Year-over-year, Headline PCE was up +2.6% and inline with Wall Street estimates.

With inflation ticking up continuously since September and now a full 60bps above the Fed’s 2% target, it seems like those of us that saw an end to sticky inflation may have only witnesses a mirage.

Grade: B-

So, while indicators suggest that while the economy continues to grow, inflation remains an important issue - especially for the Fed which may maintain a cautious approach to interest rate adjustments to balance economic growth with inflation control.

According the the CME’s FedWatch, swaps are currently pricing 18% odds of one or more cuts at the next Fed meeting in March, well below the 69% odds in early December.

Joke Of The Day

My hotel tried to charge me ten dollars extra for air conditioning. That wasn’t cool.

Trivia

Today’s trivia is on the history of Wall Street.

What year was the Buttonwood Agreement, which laid the foundation for the New York Stock Exchange, signed?

A) 1689

B) 1792

C) 1834

D) 1901What is the origin of the name "Wall Street"?

A) It was named after a Dutch-built wall meant to defend against attacks

B) It was named after a famous banker, John Wall

C) It was an early nickname for the financial district in London

D) It was the first street paved in ManhattanWhat major event occurred on Wall Street on October 28, 1929?

A) The opening of the NYSE

B) The worst single-day stock market crash in U.S. history at the time

C) The signing of the Securities Act

D) The Dow Jones hit an all-time highIn what year was the Dow Jones Industrial Average (DJIA) first introduced?

A) 1856

B) 1896

C) 1914

D) 1933Which company was the first to reach a $2 trillion market capitalization?

A) Amazon

B) Tesla

C) Microsoft

D) Apple

(answers at bottom)

This Week In History

Battle of Stalingrad Ends (February 2, 1943)

The German 6th Army surrendered to the Soviet Union, marking a decisive turning point in World War II as Nazi Germany began its retreat from the Eastern Front.

Thomas Edison Patents the Electric Incandescent Lamp (January 27, 1880)

One of the most revolutionary inventions in history, Edison’s light bulb paved the way for widespread electric lighting.

Coca-Cola Secret Formula Stolen (January 31, 2006)

Three employees attempted to sell Coca-Cola’s secret formula to Pepsi, leading to a major corporate espionage case.

Market Update

Market Movers

Friday:

Atlassian (TEAM) [+14.9%]: Big Q2 beat with stronger-than-expected cloud growth, record $1M deals, and a solid guidance boost.

AST Spacemobile (ASTS) [+11.2%]: Scored FCC approval for testing services in the U.S.

Deckers Outdoor (DECK) [+20.5%]: Crushed Q3 thanks to strong HOKA and UGG sales, but Q4 guidance was a little soft.

Walgreens Boots Alliance (WBA) [-10.3%]: Cut its dividend to conserve cash for litigation and turnaround efforts.

Thursday:

IBM (IBM) [+13%]: Q4 EPS came in strong, FY25 guidance steady, and AI tailwinds keep optimism high.

Las Vegas Sands (LVS) [+11.1%]: Macau was weaker, but Singapore growth, a dividend hike, and strong long-term trends kept investors happy.

Tesla (TSLA) [+2.8%]: Despite an EPS miss, investors liked the cost-cutting progress, FSD hype, and new models coming in 2025.

Whirlpool (WHR) [-16.5%]: Weak earnings and soft 2025 guidance fueled worries about sluggish North American demand.

United Parcel Service (UPS) [-14.1%]: Revenue missed expectations, 2025 guidance disappointed, and Amazon volumes set to drop 50% by 2026.

ServiceNow (NOW) [-11.4%]: Q4 numbers were decent, but weak billings and revenue guidance put a damper on things.

Microsoft (MSFT) [-6.2%]: Revenue and EPS were fine, but Azure’s slowdown and soft Q3 guidance took the shine off.

Wednesday:

Starbucks (SBUX) [+8.1%]: Better-than-expected sales, a strong Q2 outlook, and leadership changes gave investors a boost.

ASML (ASML) [+4.3%]: Big Q4 order numbers and solid AI-driven demand offset lingering 2026 uncertainty.

Moderna (MRNA) [-9.4%]: Goldman Sachs downgraded the stock over concerns about future revenue streams.

Danaher (DHR) [-9.7%]: Q4 revenue was okay, but weak guidance and China headwinds weighed heavily.

Thursday:

Surgery Partners (SGRY) [+21.2%]: Bain Capital made a buyout offer at $25.75 per share, sending the stock soaring.

Royal Caribbean (RCL) [+12%]: Strong Q4 results, higher FY25 guidance, and booming demand kept momentum going.

JetBlue Airways (JBLU) [-25.7%]: Q4 was fine, but weak Q1 revenue guidance sent investors running.

Lockheed Martin (LMT) [-9.2%]: Q4 results were mixed, with weak free cash flow and cautious 2025 guidance.

General Motors (GM) [-8.9%]: Strong Q4 earnings and solid guidance weren’t enough to calm tariff concerns.

Monday:

AT&T (T) [+6.3%]: Beat Q4 estimates thanks to strong Mobility and Fiber growth, reaffirming solid FY25 guidance.

Ralph Lauren (RL) [-3.2%]: Raymond James downgraded the stock, citing valuation concerns after a big 2023 rally.

Nvidia (NVDA) [-16.9%]: AI stocks took a hit after China’s DeepSeek claimed its models rival OpenAI and Meta’s at a fraction of the cost.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) The Buttonwood Agreement was signed in 1792.

A) Wall Street is named after a defensive wall the Dutch built before New York was acquired by the British.

B) October 28, 1929 was worst single-day stock market crash in U.S. history at the time and ushered in the Great Depression.

B) The Dow-Jones was created in 1896.

D) Apple was the first company to reach a $1 trillion market cap.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.