🔬IPO, Where Did You Go?

Plus: U.S. CPI inflation is in-line (ie: didn't ruin the party); and much more!

"Risk more than others think is safe. Dream more than others think is practical."

- Howard Schultz

“You miss 100% shots you don't take - Wayne Gretzky”

- Michael Scott

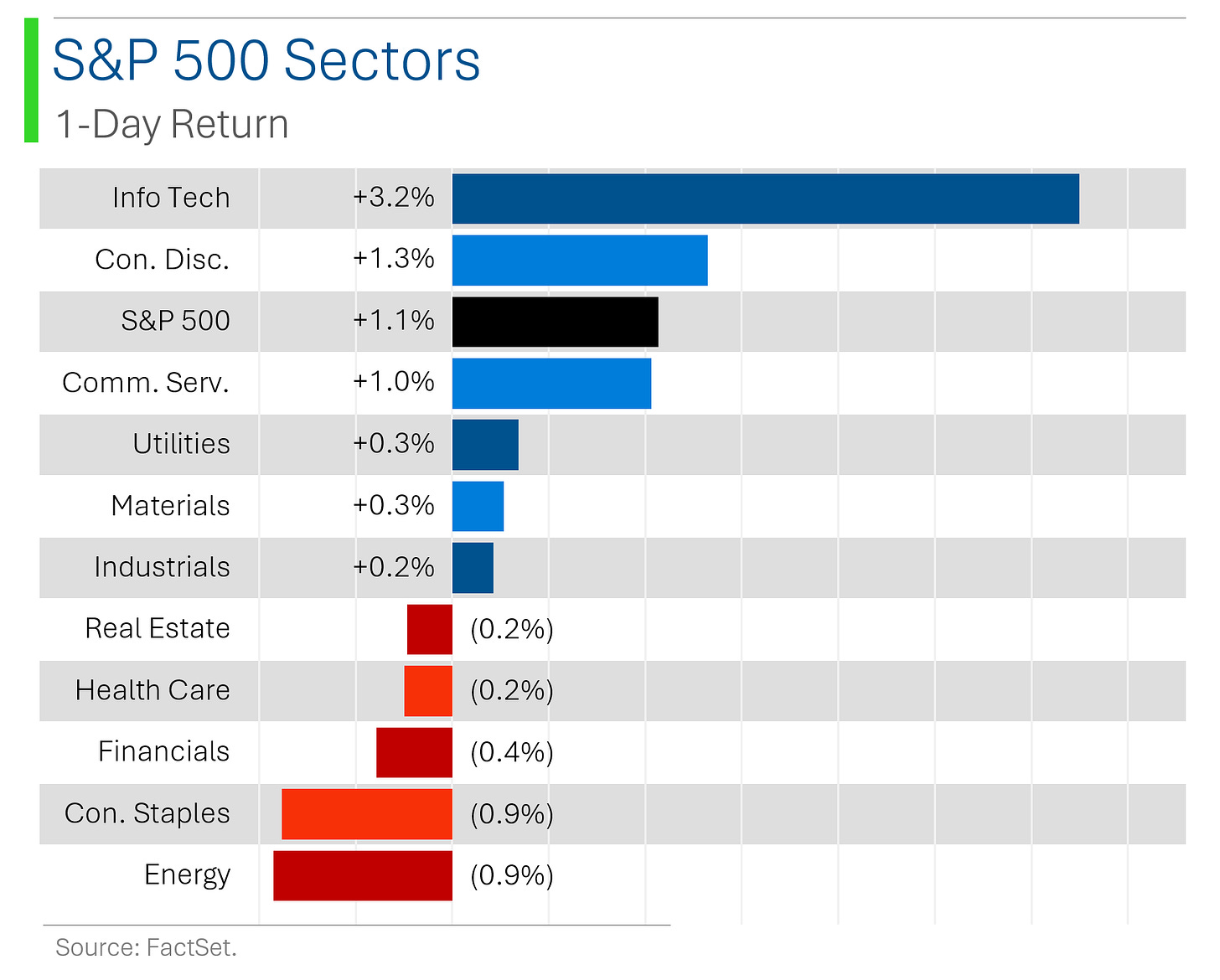

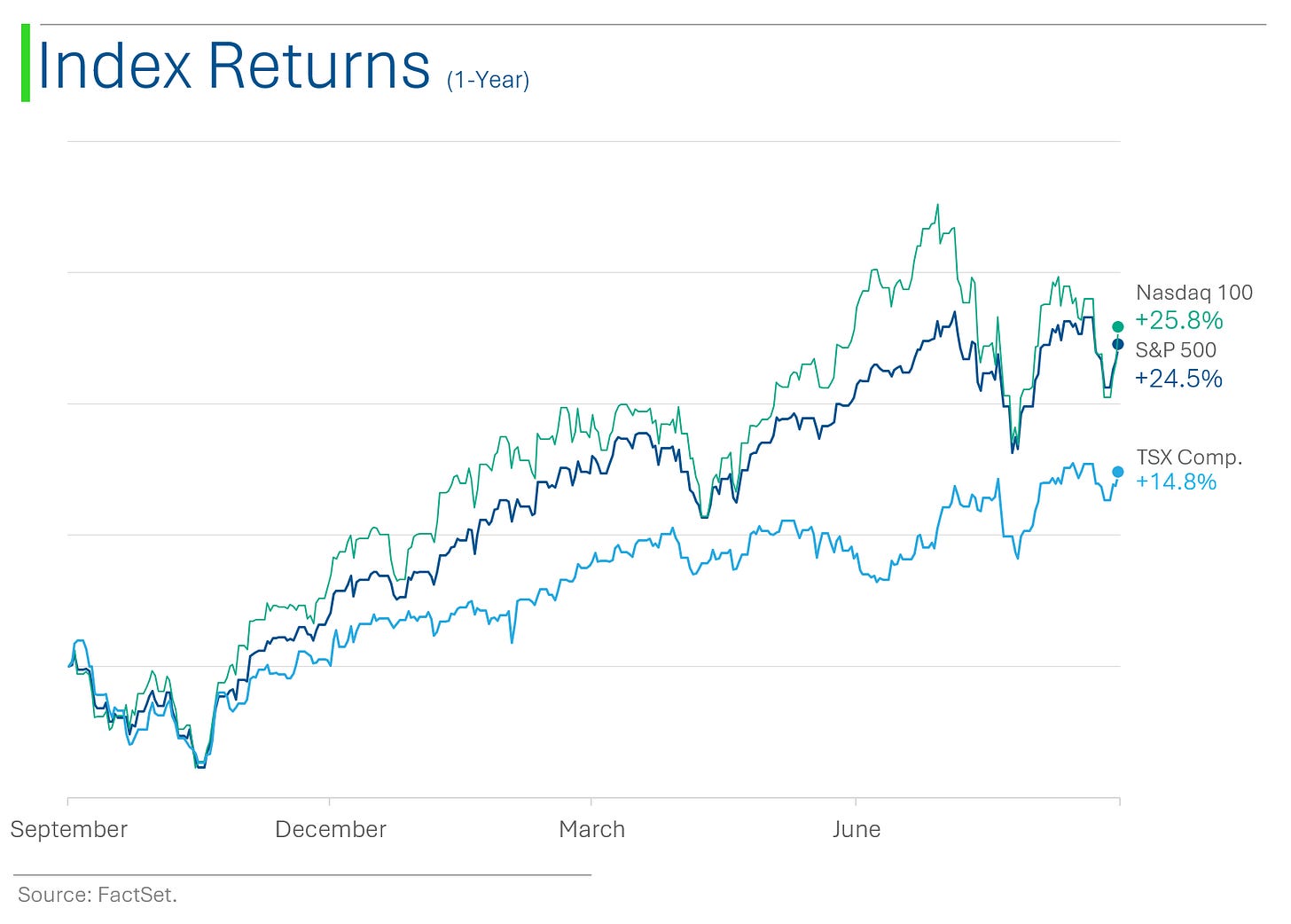

Market Movement: US equities rebounded from post-CPI weakness, with big tech, semiconductors, and growth sectors leading gains, while Treasuries weakened and the dollar inched higher.

Sector Performance: Outperformers included tech, lithium, solar, and China tech, while laggards were HPCs, food, airlines, and banks; WTI crude rose 2.4%.

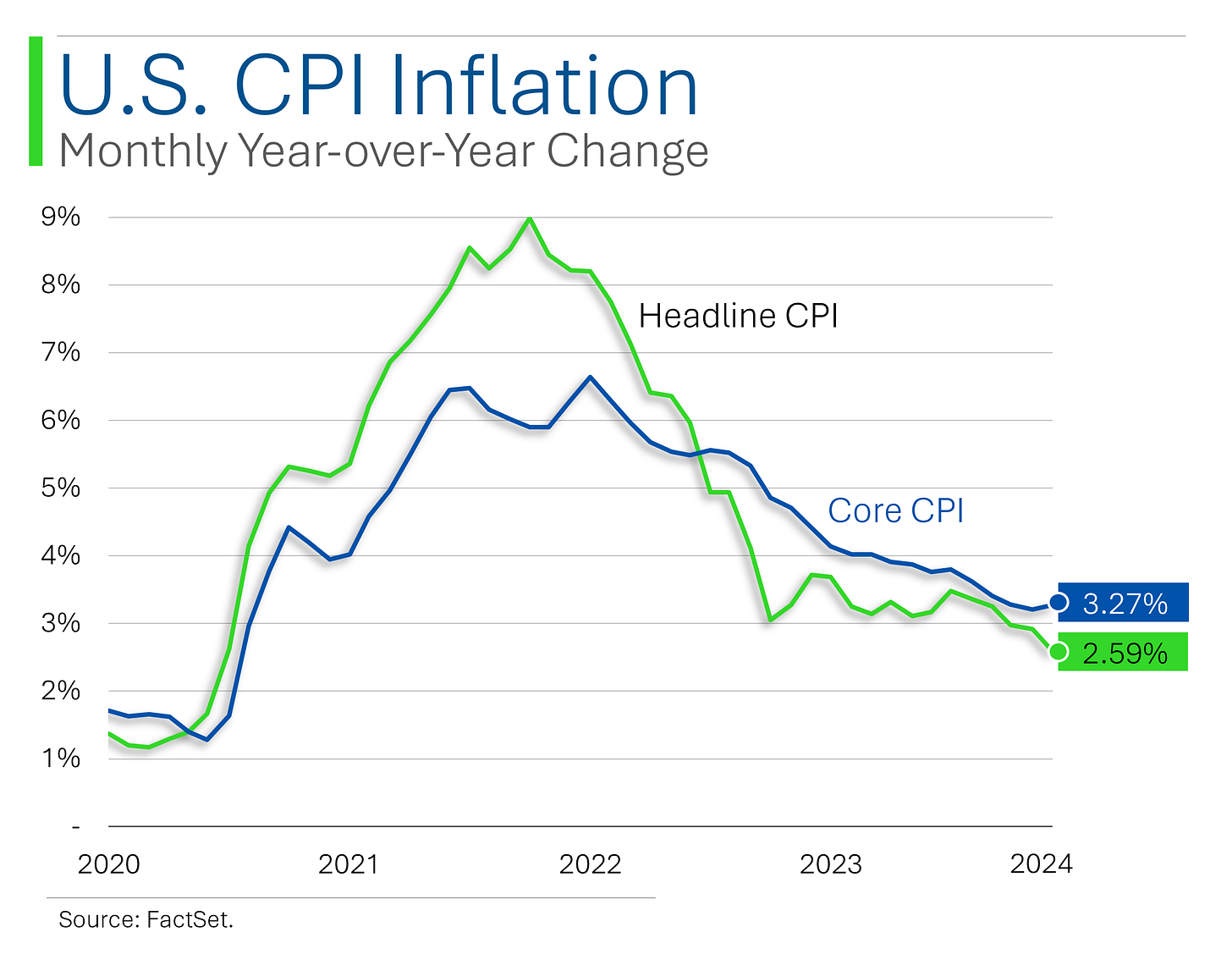

CPI Impact: August CPI was in line at 2.5% y/y, but hotter core inflation due to shelter prices; economists maintained broader disinflationary trends.

Notable companies:

Petco (WOOF) [+32.9%] New CEO shows some early progress, with Q2 comp growth and EBITDA ahead of expectations, and Q3 guidance beating the Street.

Nvidia (NVDA) [+8.0%] Goldman Sachs highlighted positive takeaways from their CEO’s presentation, with talks of data center growth, supply chain agility, and Nvidia's chips possibly heading to Saudi Arabia.

GameStop (GME) [-12.0%] Q2 earnings were better, but revenue fell short, and they amended a stock sales agreement to potentially sell 20 million more shares.

More below in ‘Market Movers’.

Street Stories

IPO, Where Did You Go?

Spare a thought for those poor investment bankers out there doing God’s work, yet finding dry hole after dry hole. It seems no one wants to go public anymore and those +3% underwriting fees are sorely missed. It’s selfish really.

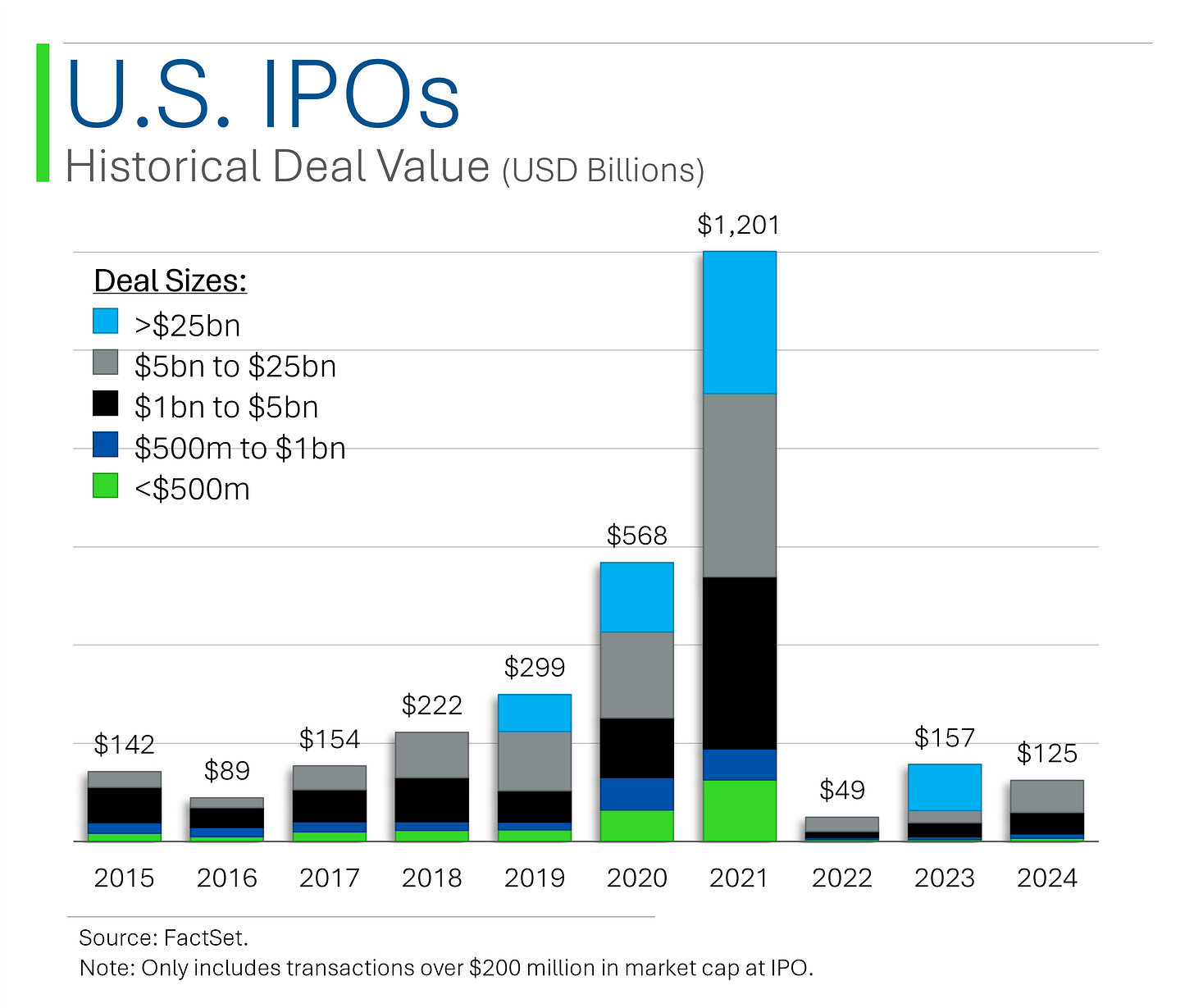

As you can see below, there has been some progress coming off of the bottom in 2022 but we are still miles away from pandemic deal flow.

What I found most interesting is that the mega IPOs - those valued at +$10 billion - have pretty much disappeared recently

For context, 2021 had 23 IPOs >$10 billion but since the start of 2022 we’ve only had a total of four.

Historically, IPOs were looked at as free money for the institutional investors lucky (read as: connected) enough to get an allocation to this month’s hot deal. However, despite the the tear the markets been on over the last 18 months, the biggest IPOs in the last 5-years have really been a mixed bag.

So, where are the IPOs?: Part of this has to do with the IPO bonanza of 2020 and 2021, including the SPAC frenzy, which pulled ahead a lot of potential deals (ie: might as well bang it out a year or two early while valuations are stupid).

Other companies rushed to raise capital during the good times in anticipation of this recession that never arrived, and are too flush with cash to bother right now, like Stripe.

However, this is also be part of a general trend of companies choosing to wait longer and longer to IPO. Their venture capital and private equity overlords, with more invested capital than ever, have made big pushes to grow ‘later stage’ funds. From Softbank to Kleiner-Perkins to Apollo, the big money private investors see value being generated later in a company’s life cycle. And they don’t feel like sharing it.

The result: Fewer little IPOs, more mega ones (eventually).

Inflation Goes on a Diet: Down to Its Slimmest Since 2021

Inflation continues its decline, with the August Consumer Price Index (CPI) rising just +2.5% compared to a year ago, marking the lowest rate since February 2021.

The drop is welcome news for consumers who faced steep price hikes during the pandemic…Given the fact that prices are up 23% since just 5 years ago.

While prices for essentials like groceries and gasoline have stabilized, housing remains a significant concern, rising 5.2% year-over-year. This sector alone accounted for over 70% of the core inflation increase.

And while lower reported CPI is great and everything, just remember that these are just the reported numbers.

Joke Of The Day

The Lord said unto John, "Come forth and receive eternal life."

But alas John came fifth, so he won the toaster.

Hot Headlines

Reuters / Nippon Steel, U.S. Steel make last-ditch effort to win US nod. Execs from the respective firms met with top U.S. officials to salvage their merger apparently in response to a recent letter that warned the acquisition could weaken the U.S. steel supply chain. Unless they plan to move the steal plants to Japan (they don’t) I’m not sure I follow.

Yahoo Finance / Bitcoin could soon hit six figures regardless of who wins U.S. election, investors say. While some expect a short-term boost if Trump wins, experts note the long-term price is more tied to macroeconomic trends like rate cuts and ETF approvals, which have been trending in the token’s direction recently. Witchcraft!

Bloomberg / OpenAI fundraising set to vault startup’s valuation to $150 billion. The AI giant is in talks to raise $6.5 billion in equity and secure a $5 billion credit line, doubling its previous valuation of $86 billion. Microsoft, Apple, and Nvidia are reportedly in discussions to invest. Apparently the infusion will be used to buy more of Nvidia’s coveted and ever elusive chips.

Bloomberg / Taylor Swift brings 283 million fans to razor-thin election. After endorsing Kamala Harris post-debate, Swift's support drove 300k visits to Vote.gov and ignited social media. Her influence, particularly among younger voters, may sway key swing states like Pennsylvania, which starts early voting soon. Last album was mid imo…

Bloomberg / Roche shares drop on concern about Ozempic competitor pill’s side effects. A small study linked Roche’s experimental pill to side effects like nausea and vomiting, with 5 out of 6 patients experiencing issues at higher doses. The findings raise doubts about Roche’s ability to catch up to competitors Novo Nordisk and Eli Lilly in the $130 billion weight-loss market, despite plans for larger trials. Sign me up Scotty.

Trivia

Today's Trivia Is On Presidential Debates!

Which year featured the first televised U.S. presidential debate, marking a historic shift in political campaigning?

A) 1948

B) 1956

C) 1960

D) 1976Who was the first sitting U.S. president to participate in a presidential debate?

A) John F. Kennedy

B) Gerald Ford

C) Lyndon B. Johnson

D) Richard NixonWhich debate format, introduced in 1992, allows undecided voters in the audience to ask questions directly to the candidates?

A) Town Hall

B) Roundtable

C) Open Forum

D) Moderator-ledWho was the first female moderator of a U.S. presidential debate?

A) Barbara Walters

B) Diane Sawyer

C) Gwen Ifill

D) Carole Simpson

(answers at bottom)

Market Movers

Winners!

Petco (WOOF) [+32.9%] New CEO shows some early progress, with Q2 comp growth and EBITDA ahead of expectations, and Q3 guidance beating the Street.

Albemarle (ALB) [+13.6%] Lithium stocks surged after Chinese battery maker CATL paused production due to overcapacity concerns.

Viking Therapeutics (VKTX) [+11.3%] JP Morgan initiated coverage at overweight, seeing potential in its upcoming GLP-1 drug data in November.

NVIDIA (NVDA) [+8.0%] Goldman Sachs highlighted positive takeaways from their CEO’s presentation, with talks of data center growth, supply chain agility, and Nvidia's chips possibly heading to Saudi Arabia.

Losers!

Rentokil Initial (RTO) [-21.0%] A weak trading update revealed challenges in the North American market, with revenue growth now expected to be just 1% in the second half after cutting guidance in July.

GameStop (GME) [-12.0%] Q2 earnings were better, but revenue fell short, and they amended a stock sales agreement to potentially sell 20 million more shares.

Designer Brands (DBI) [-11.5%] Q2 results disappointed with negative comps, big misses on revenue and EPS, and a major cut to full-year guidance, though athleisure and back-to-school are looking solid.

Market Update

Trivia Answers

C) The first televised presidential debate occurred in 1960 between John F. Kennedy and Richard Nixon.

B) Gerald Ford became the first sitting president to debate in 1976.

A) The Town Hall format, introduced in 1992, allows voters to ask questions directly.

D) Carole Simpson was the first female moderator of a U.S. presidential debate in 1992.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

You can rest easy tonight knowing that GS made $92M on the Kellanova transaction