How Defensive Are Staples?

Plus: The Un-inverting of the Yield Curve

"It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong"

- David Einhorn

“If you're going through hell, keep going”

- Winston Churchill

Hey Readers!

Bit of a shorter one today (no Macro Update or Market Movers) since last week’s was a monster!

If you missed it, I did a big primer on the current state of the financial world - check it out!

Have a good weekend,

- Ryan

Street Stories

How Defensive Are Staples?

The Consumer Staples sector of the S&P 500 hasn’t been a bad place to put your money over the last few years.

It just hasn’t been a particularly good place.

Since the start of 2020, the index has underperformed the more trendy sectors like Tech, Communication Services and Consumer Discretionary - in part because that’s where the Mag7 are located.

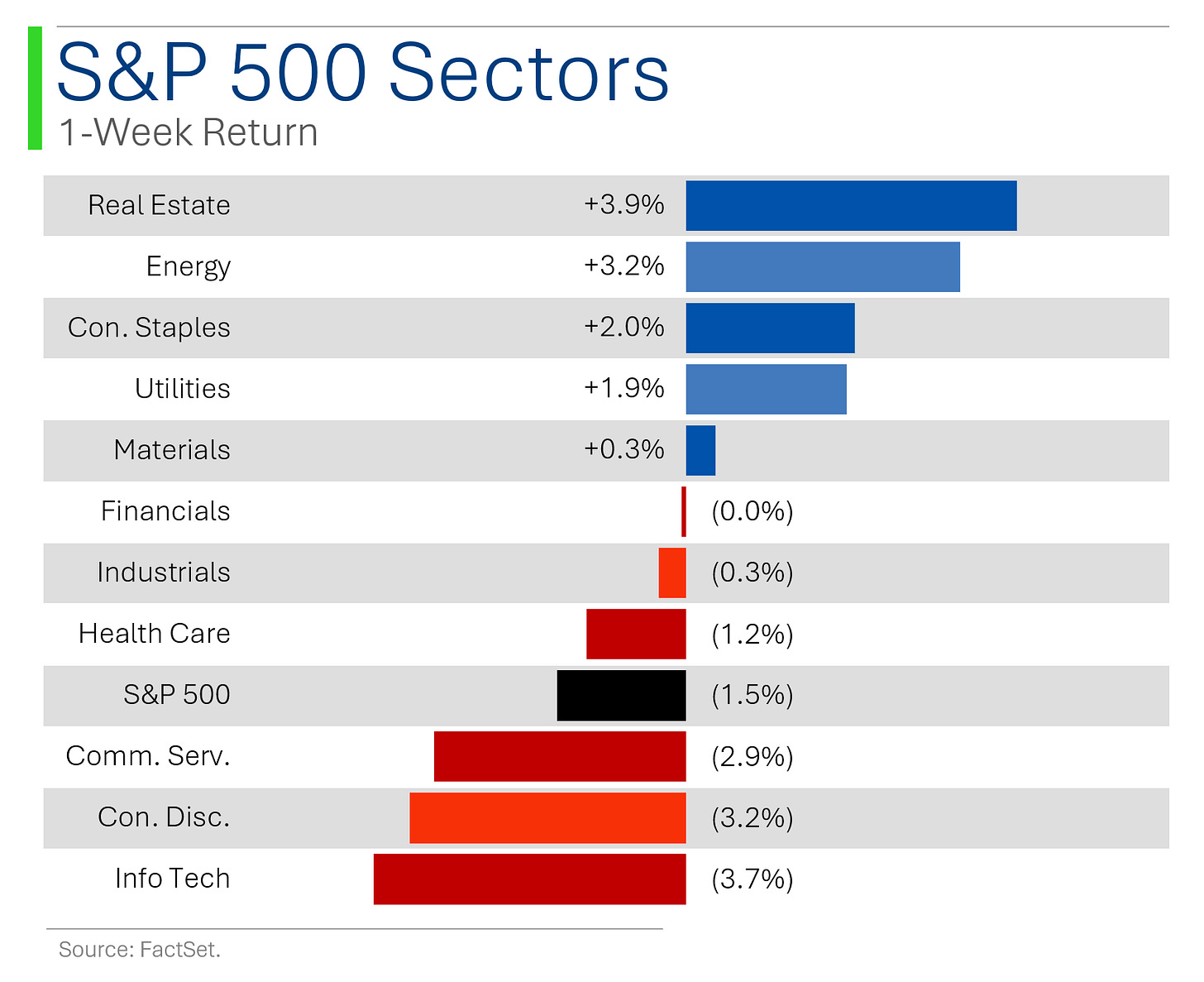

However, so far in 2025, Staples is the best performing sector; up 5.8% while the S&P 500 is down 10.2%.

Fan favorites Discretionary, InfoTech and Comm. Services are also getting smoked - down a respective 19.7%, 18.4% and 11.7%.

The Staples sector is clearly showing that once again, it’s a defensive bulwark against a correcting market. The question is whether or not those companies - not their shares - are actually well insulated from the whims of consumer demand.

The results are actually pretty astounding!

As you can see, earnings per share has steadily marched upwards even through the worst parts of the last three recessions. All while Discretionary and the S&P 500 more broadly all took it square on the chin.

While the Consumer Discretionary sector has bounced around all willy-nilly, Staples has only had two down years for EPS growth since 2000: -0.1% in 2001 and -1.7% in 2015.

Something that you might find interesting is that sleepy old Staples has actually grown revenue faster than its more exciting Discretionary peer.

A good chunk of this has to do with M&A activity and consolidation within the industry but it is pretty wild that the sector has grown revenue per share by nearly 500% since 1999 while the overall S&P 500 has only managed around 200%.

Looking at the big fish within the sector only adds to the feeling of persistent, steady growth. As you can see, both Walmart and Costco have each only seen revenue contract once in the last 25 years. Pretty darn impressive.

Compared to Discretionary names, like Ford, Staples looks downright zen.

It may only happen every decade or so but going heavy into Staples at the right time really makes you look like a hero. 😏

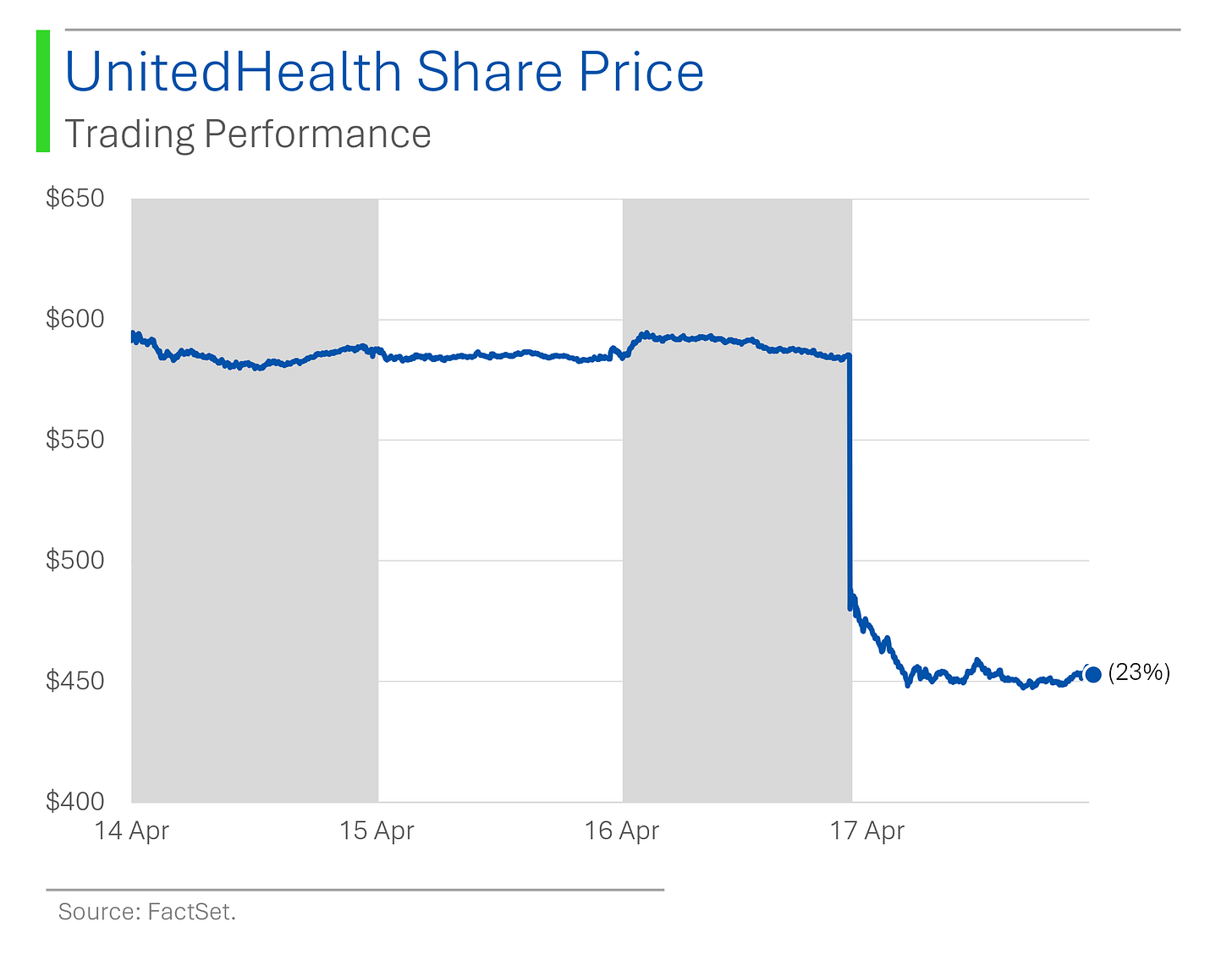

UnitedHealth Reports A Dud

A truism for the stock market over the last decade has been that UnitedHealth beats on every quarter. EVERY. QUARTER.

Until now.

On Thursday, the health insurance giant popped out Q1 2025 EPS of $7.20 vs. Wall Street estimates for $7.30, as well as tiny miss on Revs ($110B vs. $112B expected), driven mostly by poorly adapting to rule changes relating to Medicaid billing practices - which UnitedHealth is being investigated by the DOJ for since February. They also chopped their 2025 EPS guidance.

Probably not the end of the world but geez, the market cut them no slack - dragging down the broader health care sector with it.

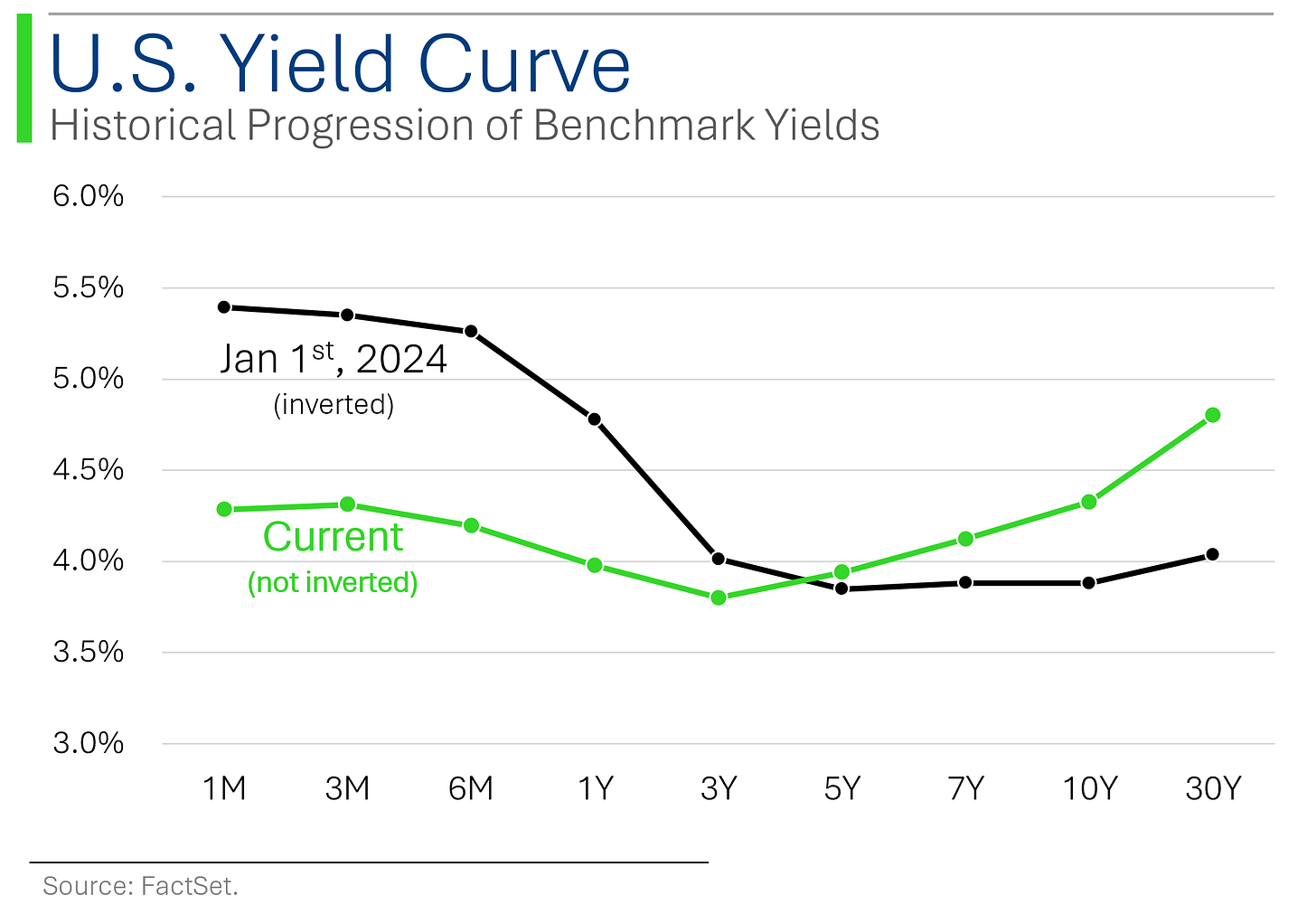

The Un-inverting of the Yield Curve

Inverted yield curves get a lot of attention from the financial community - and for good reason.

To oversimplify, when faced with growing inflation, central banks raise short-term interest rates to cool the economy.

This often is accompanied by a decrease in the longer-term rates as investors reason that future economic growth will be suppressed, and that the central bank will be forced to lower rates in the future to stimulate growth.

The result is usually a tilting of the yield curve from upward sloping, to downward sloping (ie: inverted).

Market participants also view the inverting of the yield curve as presaging a recession. Which, of course, isn’t typically good for the stock market.

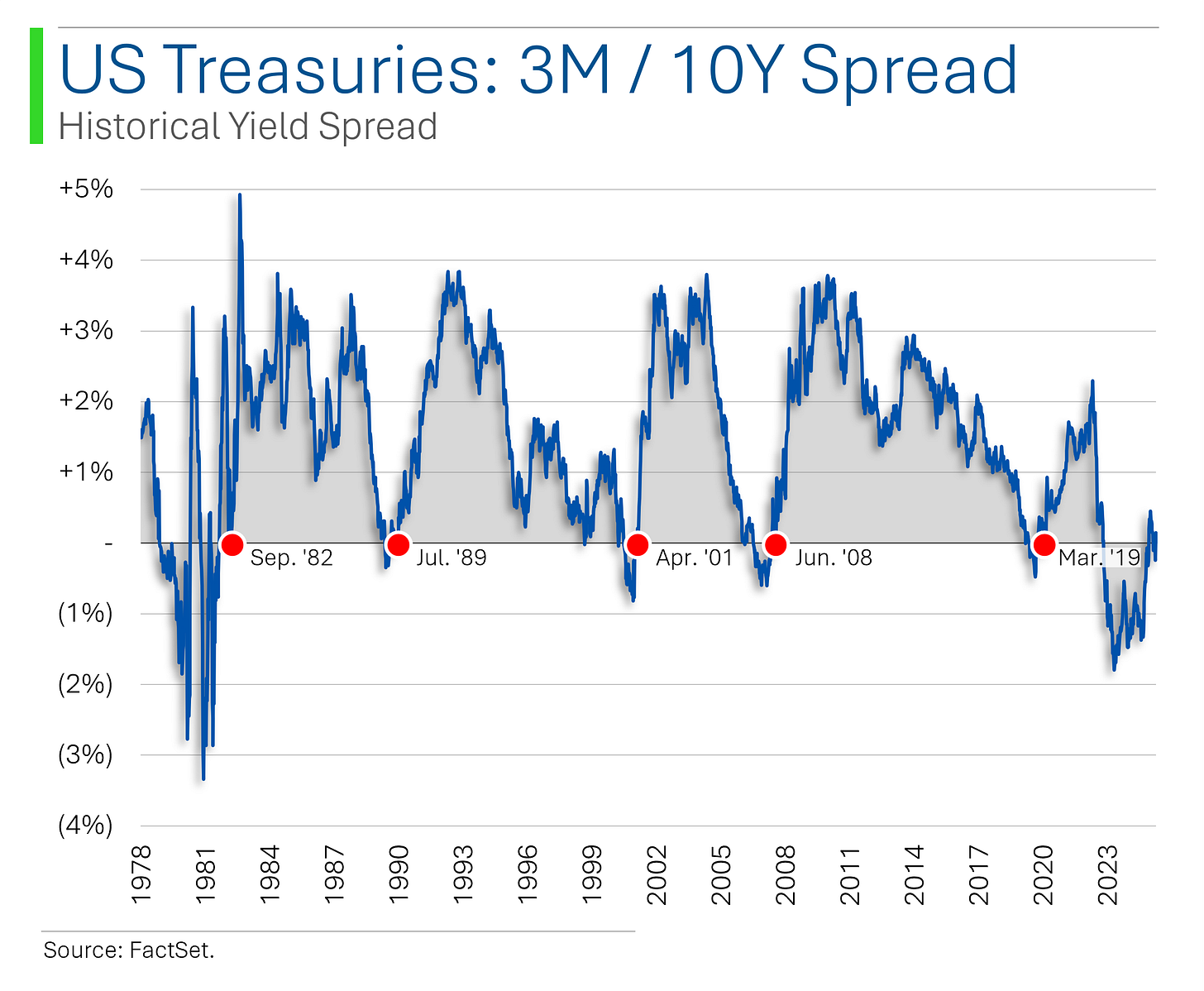

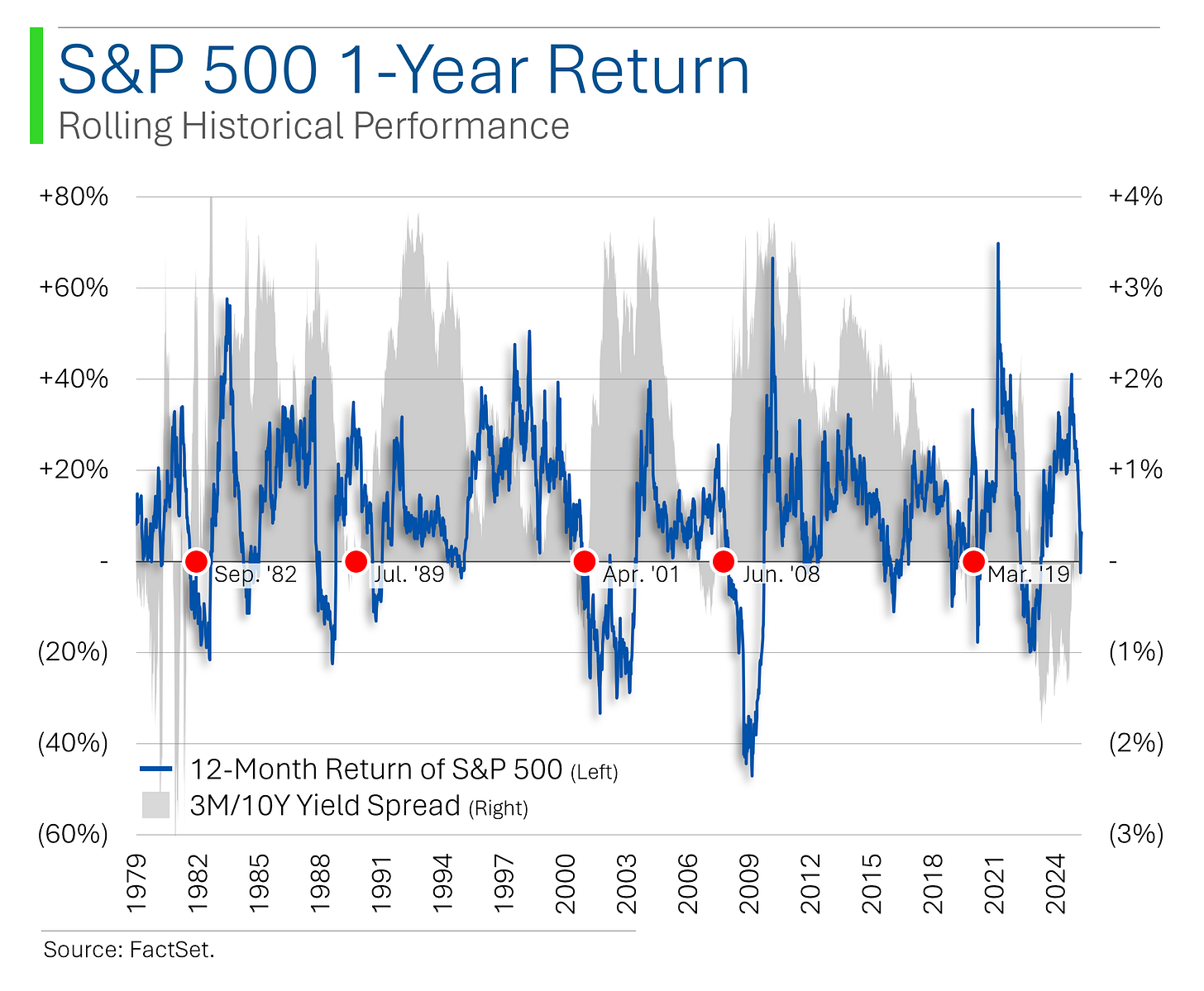

While the process of inverting does generally indicate a cooling of economic growth, the point at which the curve un-inverts is also a useful data point.

Essentially, short-term rates are on their way down due to some combination of the central bank wanting to stimulate the economy (because growth is slowing) or because inflation is now at a reasonable level (typically because growth has slowed).

The spread between the US 3-Month T-Bill and the 10-Year Note has hovered around zero since December, after a record 25 months being inverted.

As you can see above, when the yield curve univerts the stock market doesn’t typically do so hot.

Joke Of The Day

All I ask is a chance to prove money can’t buy happiness.

Early to bed, early to rise… makes people suspicious.

Trivia

Today’s trivia is on Consumer Staples.

Which legendary investor called Procter & Gamble stock “the kind of company you want to marry, not date”?

A) Carl Icahn

B) Peter Lynch

C) Warren Buffett

D) Ray DalioWhich company introduced the first toothpaste in a collapsible tube in 1896?

A) Colgate

B) Unilever

C) Church & Dwight

D) Johnson & JohnsonWhat year was Walmart founded?

A) 1949

B) 1959

C) 1969

D) 1979Which of these companies is headquartered in Switzerland but has a major footprint in U.S. staples?

A) Kraft Heinz

B) PepsiCo

C) Nestlé

D) MondelezWhich of these companies famously uses a “Dividend King” strategy with over 50 consecutive years of dividend increases?

A) Coca-Cola

B) Procter & Gamble

C) Colgate-Palmolive

D) PepsiCoWhat Percent of the S&P 500 does Consumer Staples represent?

A) 15.2%

B) 2.4%

C) 6.1%

D) 21.3%

(answers at bottom)

This Week In History

April 14, 1865 – Abraham Lincoln Assassinated

President Lincoln was shot by John Wilkes Booth just days after the Civil War effectively ended. His death shocked the U.S. and derailed Reconstruction efforts.

April 15, 1912 – RMS Titanic Sinks

Though not a war event directly, the Titanic’s sinking had massive implications for naval regulations and maritime safety worldwide.

April 14, 2000 – Peak of the Dot-Com Bubble (NASDAQ)

NASDAQ hit its all-time high of 5,048.62, marking the peak before the brutal crash. It took 15 years to fully recover.

Market Update

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

C) Warren Buffett said this about P&G.

A) Colgate launched the squishable tooth paste tube.

C) Walmart was founded in 1969.

C) Nestlé is Swiss.

B) Procter & Gamble has raised dividends for 50 straight years.

C) Consumer Staples represents 6.1% of the S&P 500.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great analysis on stables!