Mega Market Update: The State of the Financial World in 25 Charts

"Time is your friend; impulse is your enemy."

- John Bogle

“Only the meek get pinched. The bold survive.”

- Ferris Bueller

Street Stories

Usually I try to have a cohesive thought that shapes my weekly write-up. Some sort of theme or concept. But given how unprecedented things are right now, I decided to take more of a ‘kitchen sink’ approach, and basically just lay out the charts and data that I feel add the most information to what’s currently taking place.

Get ready for context overload!

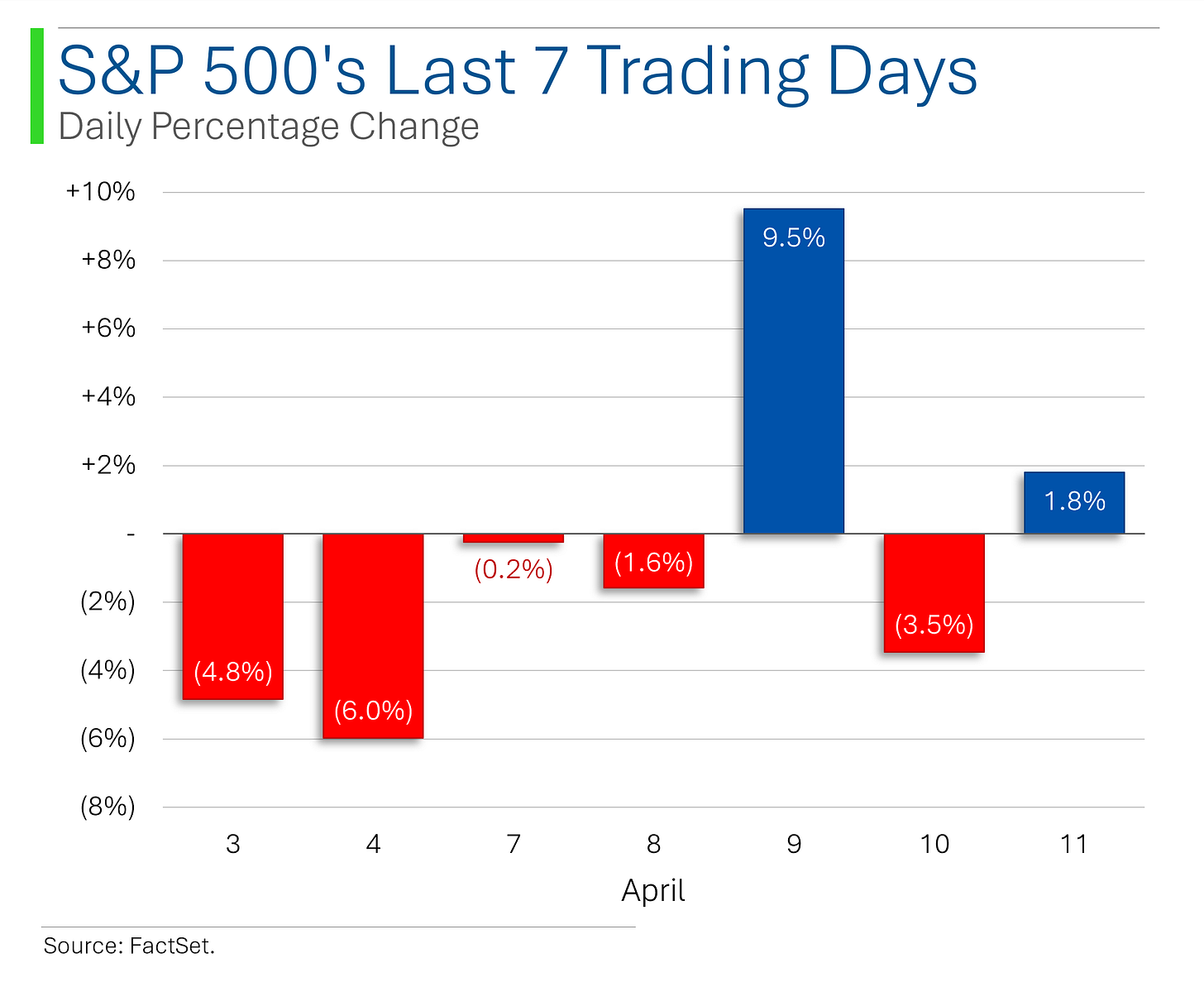

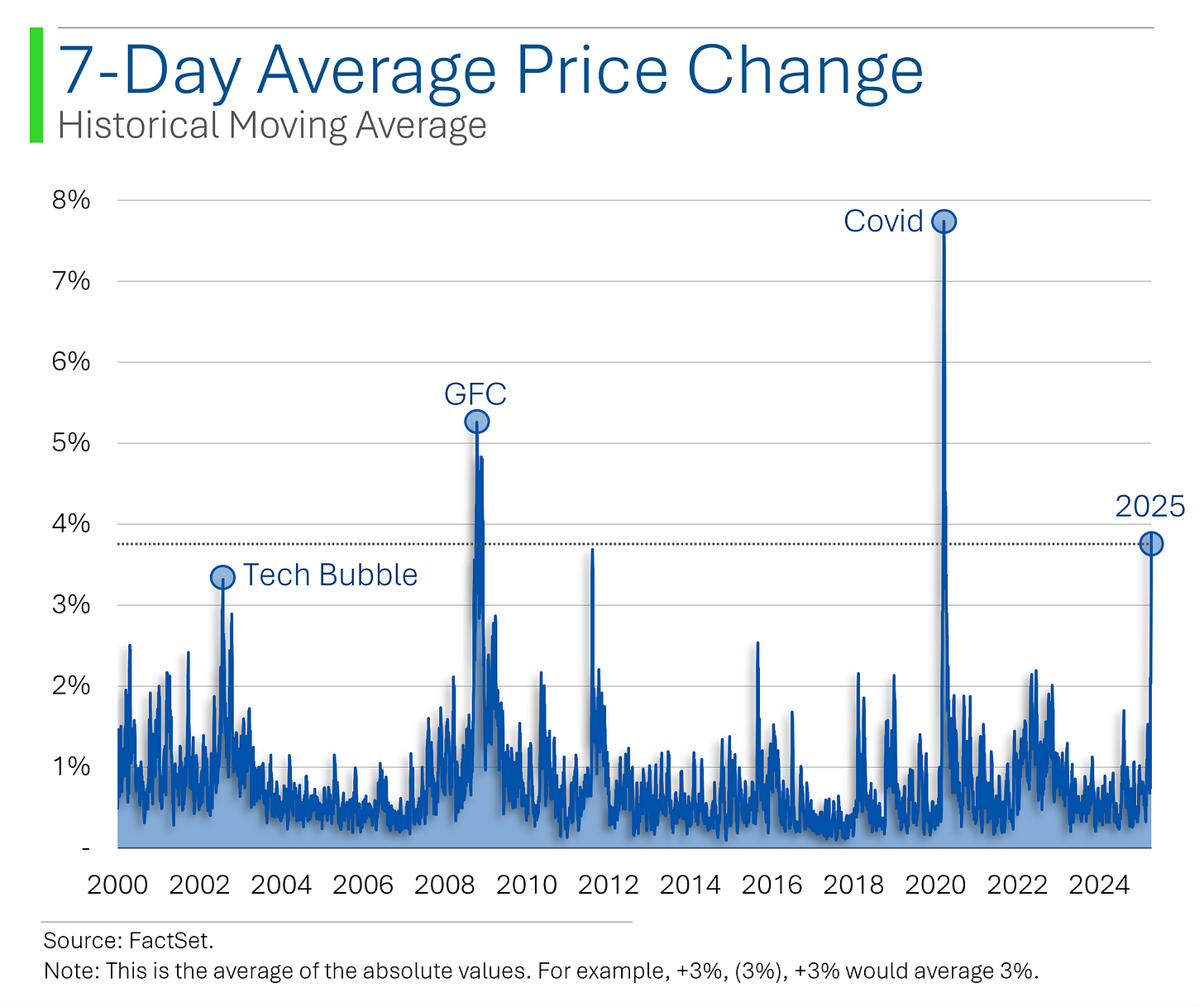

To start, the last seven trading days have seen a near record amount of volatility. Over this period, we’ve seen average price movements for the S&P 500 of 3.9% - which is a lot.

The average since 1978 is 0.7%.

To put that into historical context, that level of volatility was only surpassed by the initial Covid market crash and the heights of the Great Financial Crisis.

Yup, the Tech Bubble popping was more orderly for markets.

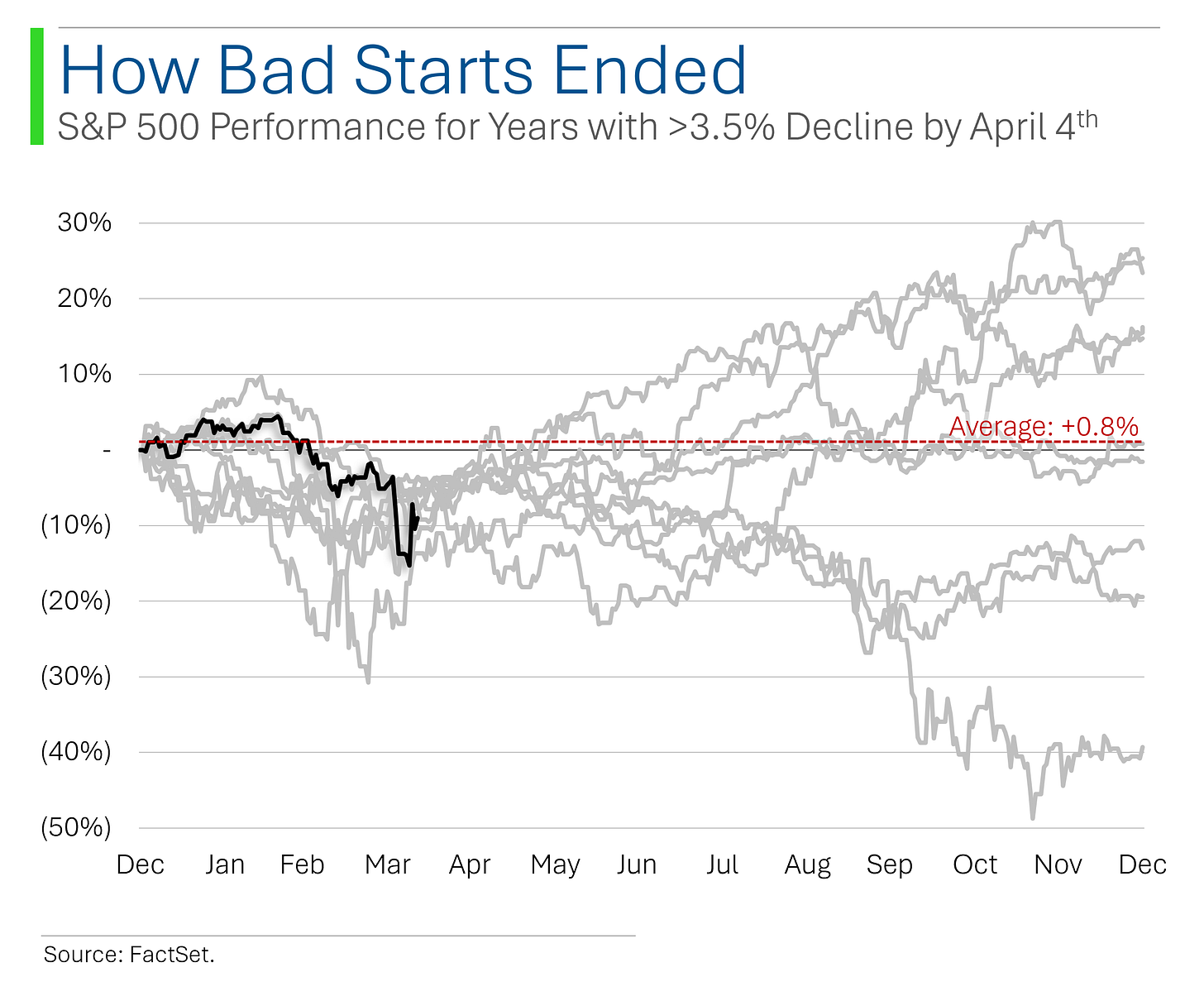

2025 is also in some ugly company for the worst starts for the S&P 500. The year to April 11th falls just behind 2008 (ie: inclusive of the Bear Stearns collapse) for the fourth worst start to the year. Truly icky stuff.

The silver lining is that most of these years ended up positive by year end - save for 1980, 2001, 2008 and 2009.

On Wednesday when President Trump called a pause to the flurry of international tariffs, the market saw one of it’s biggest one-day gains in history.

What’s interesting is that of all the biggest one-day pops the market has ever seen, pretty much all have come as relief rallies during the biggest market collapses.

Just looking at the above, one could be forgiven for thinking the Great Financial Crisis was a peachy time to be an investor.

On the sector front, the big winners of 2024 - Consumer Discretionary, Tech and Communication Services - are currently the worst performing on 2025.

And not surprisingly, the three best sectors this year have been the defensives: Health Care (-0.5%), Utilities (+0.8%) and Consumer Staples (+3.7%).

As it stands, 71% of the S&P is negative for the year with the average company down 8.5%.

(Note: That the S&P 500 is down 8.8% as more of the larger *cough* tech companies *cough* are feeling it the largest this year)

Interestingly, even though Canadians are arguably the ones taking it on the chin the hardest, so far in 2025 the TSX is holding it better than the S&P 500: 67% of companies are negative vs. 71% for the S&P and the average company is down 6.4% vs. 8.5%.

It’s a small win but go Canada!

In fact, of the main targets for Trump ire - Mexico, Canada, Europe and China - all of their main indices have outperformed the S&P since President Trump’s election.

Another fun one is Warren Buffett’s Berkshire Hathaway: Uncle Warren was catching some flak at the end of last year for being bearish on the market and - for probably the first time ever - holding more cash than he did in stocks.

While that conservative positioning led to the Oracle of Omaha being once again touted as an outdated luddite, 2025 has proven once again that he still may know what he’s talking about.

2025 has also seen a few shakeups at the top of the pile for who will reign as the world’s largest company. Nvidia retook the title early in the year from Apple, but that was short lived amidst general displeasure with chip stocks.

China tariffs hit Apple hard - since apparently President Trump’s ‘we should make iPhones in America’ didn’t hit too well with investors and Microsoft swooped in to take the lead.

America’s pausing of most tariffs (and hints at green shoots for Apple) on Wednesday saw Apple retake the top spot - adding a bewildering $397 billion in market cap to boot.

Something I’ve harped about for the last six months has been how expensive the market is - hitting levels only seen during the Covid blip and the heights of DotCom insanity.

While things have definitely contracted, the S&P 500’s forward P/E multiple is still not exactly in ‘screaming buy’ territory.

For context, when the rubble settled after the Great Financial Crisis settled, the S&P 500 traded at a P/E of 9.5x - a touch under half of today’s ‘on sale’ 19.1x.

While the S&P may not be back to ‘normal levels’, the Tech sector has definitely seen some moderation - taking the market pull-back square on the jaw.

In July 2024, the gilded Tech sector peaked at a P/E premium to the S&P 500 of 9.8x (31.3x for Tech and 21.6x for the S&P). This has since shrunk to a more modest 4.0x.

While Tech may have been hit hardest, every sector in the S&P 500 has seen their one year forward P/E multiples compress, save for defensive Consumer Staples and… Materials (?) Didn’t see that one coming did ya!

[Note: P/Es go up when earnings estimates get cut]

An interesting nuance of Wall Street is their hesitance to get particularly negative on stocks. Piss off the company with a sell report, and you just lost your bank’s allocation on the next debt deal or management cancels you hosting of their next investor roadshow. Bonus deleted.

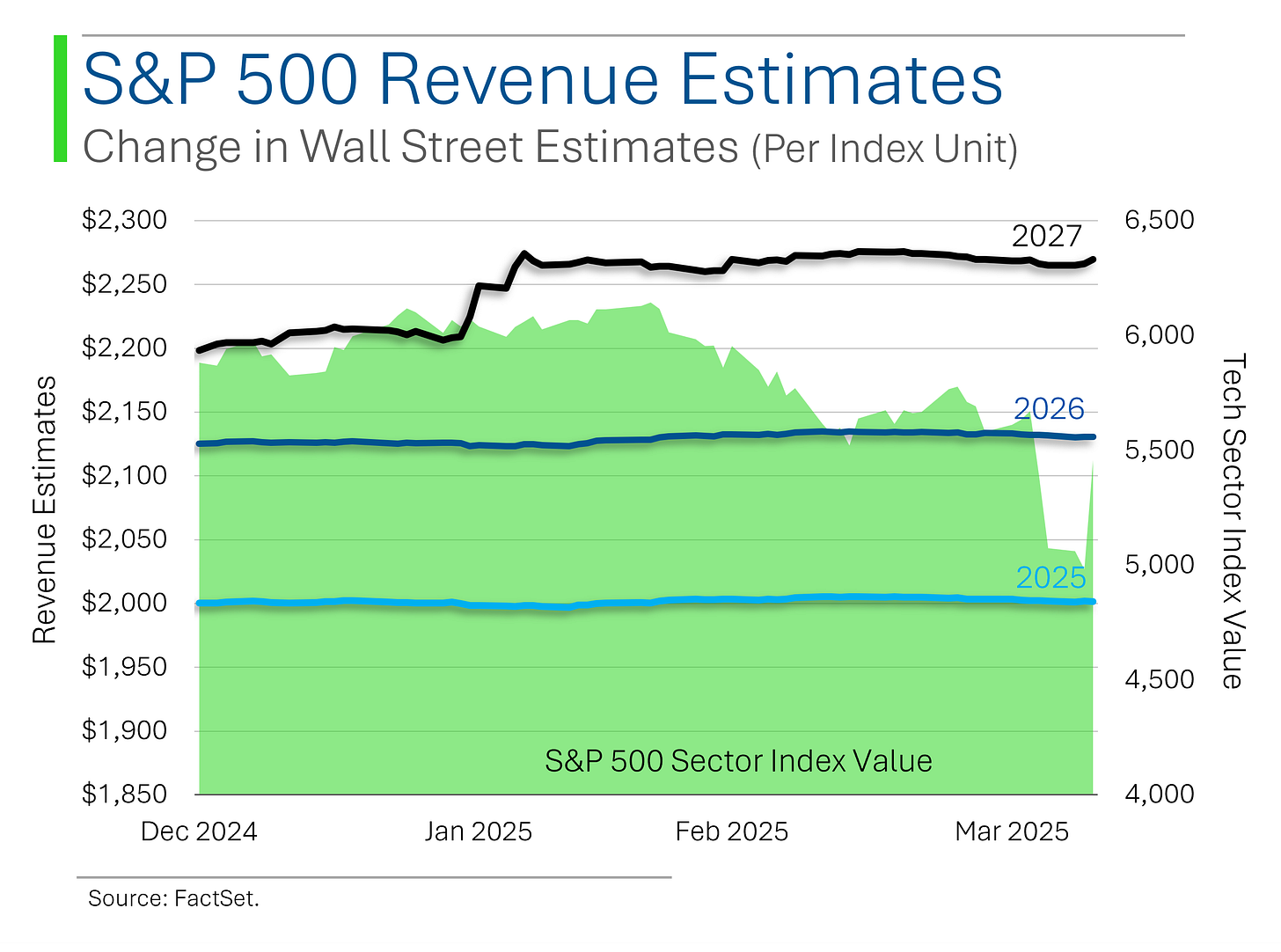

Still, the stubbornness of analyst to trim estimates this year is a bit surprising. As you can see above, the aggregate 2025 and 2026 estimates for companies in the S&P 500 hasn’t budged this year.

That’s not saying nothing has happened. In fact, 72% of companies have seen an increase to their 12-month forward EPS estimates increase since the start of the year.

[Note: If a company has positive growth, the 12-month forward EPS will always increase overtime without estimate changes due to the a greater proportion of outyear estimates in the aggregated figure.]

One company that has seen their forecast get taken to the woodshed is Tesla. Estimates for their fiscal 2025 earnings per share now sit at $2.67 - a full 28% down from this time last year at $3.69.

Fun Fact: In April 2022, that figure sat at $6.88. 🫠

The market’s favorite ‘fear gauge’ - the VIX - hasn’t sat idly by either. The pop this week took the CBOE’s Volatility Index into the stratosphere, only topped this millennium by the worst weeks in the GFC and pandemic.

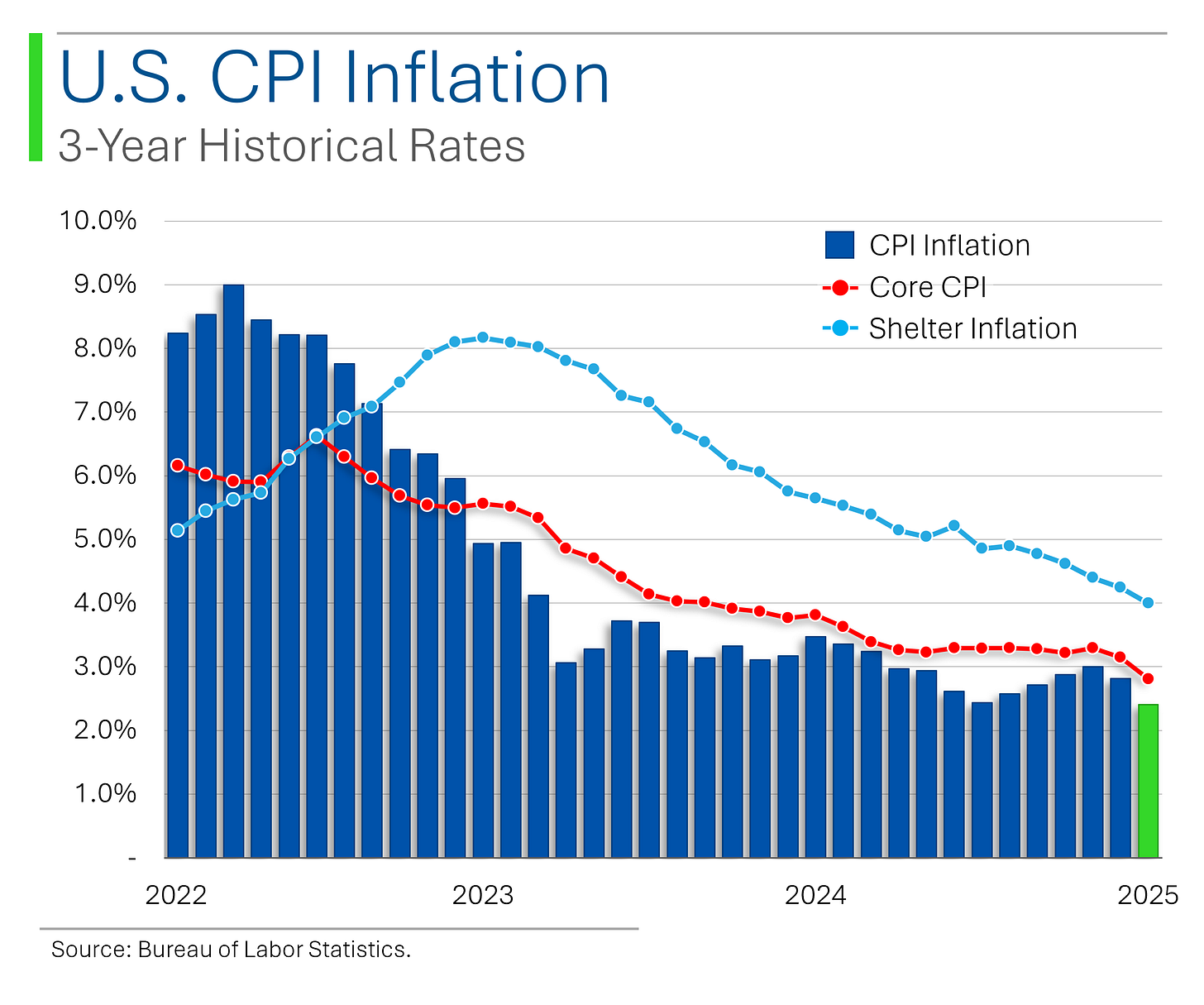

Another adage of mine this past year has been ‘well, at least inflation is down’.

Sure that’s nice and all, as the Consumer Price Index for March came in at 2.4% - it’s lowest level since you were wearing facemasks and busy trying to ‘flatten the curve’ - but significant drops like that can be troubling as well.

At its core, inflation is driven by people buying goods and services. If they aren’t buying, inflation may go down but there’s broader - often less positive - implications for economic health.

Fingers crossed for the US consumer.

Consumer Sentiment - released Friday - didn’t help alleviate fears either, as a massive miss seems to portend a worrying outlook for the average American.

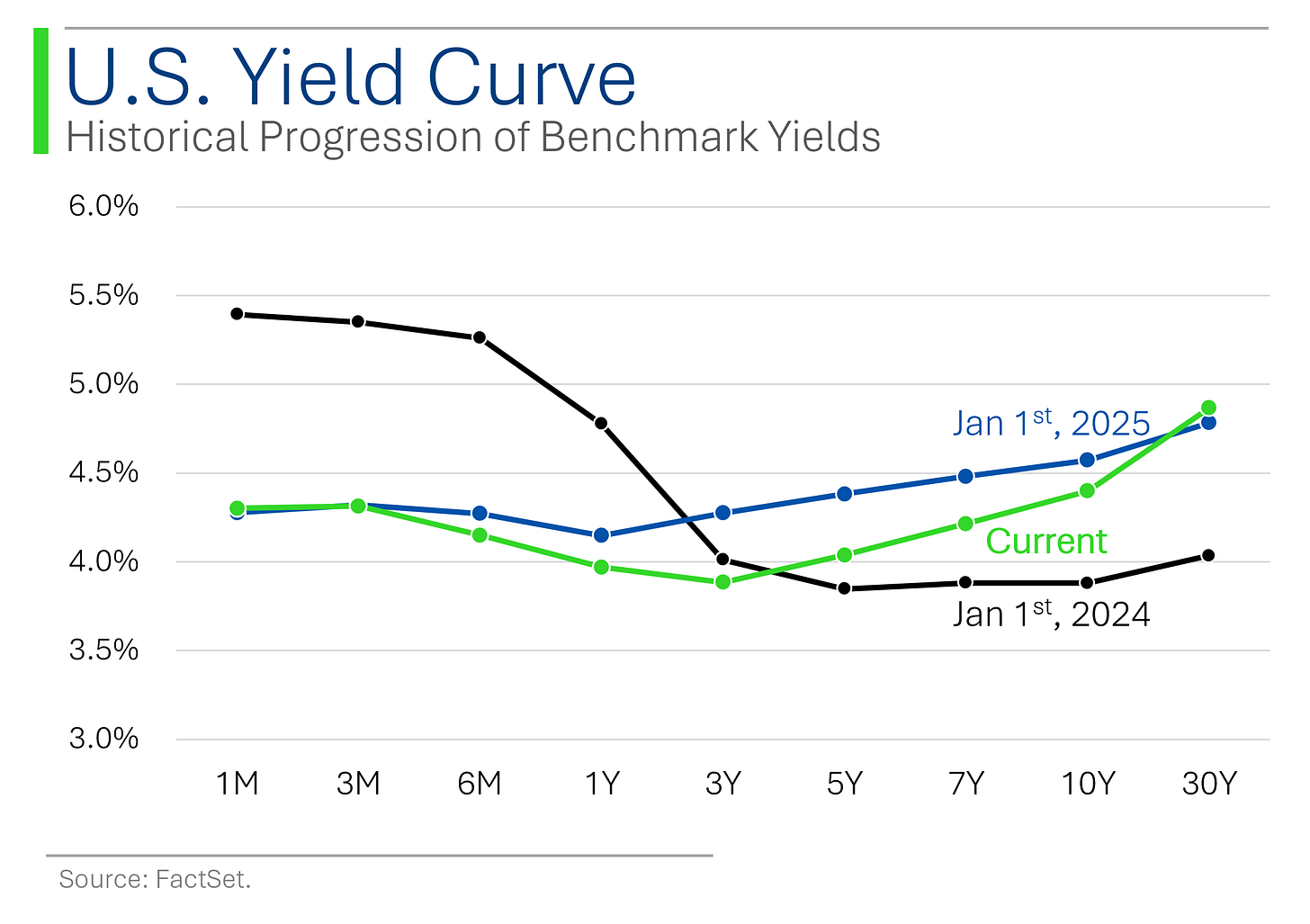

One of the biggest whipsaws we’ve seen this year is the spike in expectations for rate cuts this year.

At the time of President Trump’s election, the interest rate swaps market was pricing in a 41% chance of three or more rate cuts over the course of 2025.

To oversimplify, tariff rhetoric posed inflationary fears so expectations for +3 cuts dropped to around 23% by New Years (the Fed doesn’t usually cut rates in the face of increased inflation.

Since then, however, the concern has moved from ‘inflation from tariffs’ to ‘recession from tariffs’ and the Fed tends to cut rates during period of economic decline.

Right now, the odds of three of more rate cuts in 2025 sits at 81%. ⛷️

The bond market hasn’t ignored this, and as a result we’ve seen yields for most of the curve drop significantly since the start of the year based on the idea that rates will be lower and for longer.

I write StreetSmarts to share a bit of information and maybe the odd insight or terrible meme. It’s fun and I love it. But this is certainly one of the more unique times in my investing journey and, if I’m being honest, I’m not too optimistic at the moment.

Hopefully something above was helpful as you try to figure out how to navigate the situation and I definitely don’t want to tell anyone what they should or shouldn’t be doing (see disclaimer at bottom). I also know that a lot of folks are worried about their savings and financial future right now.

There are a million quotes or adages that take both sides of what people should be doing; from JP Morgan’s ‘I made a fortune selling too early’ to Kenny Fisher’s ‘Time in the market beats timing the market’.

The nice thing about investing is you can choose your own adventure, and - with a little bit of digging - can figure out a spot in the middle where your risk tolerance intersects your ability to sleep at night.

As Arthur Dane said to Ned Stark in season 6 episode 3 of Game of Thrones: “I wish you good fortune in the wars to come”.

Joke Of The Day

So apparently RSVP'ing back to a wedding invite 'maybe next time' isn't the correct response…

Claustrophobic people are better at thinking out of the box.

Trivia

Obvvvviously today’s trivia is based on the great stock market crashes throughout history.

What nickname was given to the day the stock market crashed in 1929?

A) Black Friday

B) Black Tuesday

C) Black Monday

D) Red ThursdayWhat percentage did the Dow Jones Industrial Average fall on Black Monday in 1987?

A) 12.7%

B) 16.0%

C) 22.6%

D) 25.3%Which famous investor said "Be fearful when others are greedy, and greedy when others are fearful"?

A) Benjamin Graham

B) Peter Lynch

C) Warren Buffett

D) Charlie MungerWhich Wall Street investment bank famously collapsed in 2008, marking a turning point in the crisis?

A) Morgan Stanley

B) Bear Stearns

C) Lehman Brothers

D) Merrill LynchWhich economic theory inspired FDR’s New Deal programs during the Great Depression?

A) Monetarism

B) Keynesian Economics

C) Supply-side Economics

D) Austrian SchoolDuring the Great Depression, what percentage of Americans were unemployed at the peak?

A) 14%

B) 19%

C) 25%

D) 30%What infamous hedge fund collapsed in 1998, requiring a $3.6 billion bailout?

A) Renaissance Technologies

B) Long-Term Capital Management

C) Tiger Global

D) Bridgewater Associates

(answers at bottom)

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) The start of the great Depression is generally considered to be Black Tuesday.

C) The Dow fell 22.6% on Black Monday.

C) Warren Buffett said the whole ‘be fearful’ thing.

C) Lehman Brothers collapsed… right when I was doing full-time recruiting for investment banking. Thannnnks.

B) Keynesian Economics inspired FDR and other fiscal policy acolytes.

C) Unemployment peaked at ~25% during the Great Depression.

B) Long-Term Capital Management. Fun-Fact: There’s a conspiracy theory that because Bear Stearns and Lehman Brothers didn’t contribute to the bail-out (Lehman later did), that that’s why Wall Street didn’t come to their aid when they failed. Treasury Secretary Hank Paulson was COO (and later CEO) of Goldman Sachs at the time.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.