🔬Ferrari Explained (Part I)

Plus: Bitcoin miners are struggling despite record prices; US Consumers are hyped; and much more.

"Monopoly is the condition of every successful business."

- Peter Thiel

"A fool with a plan can outsmart a genius with no plan."

- T. Boone Pickens

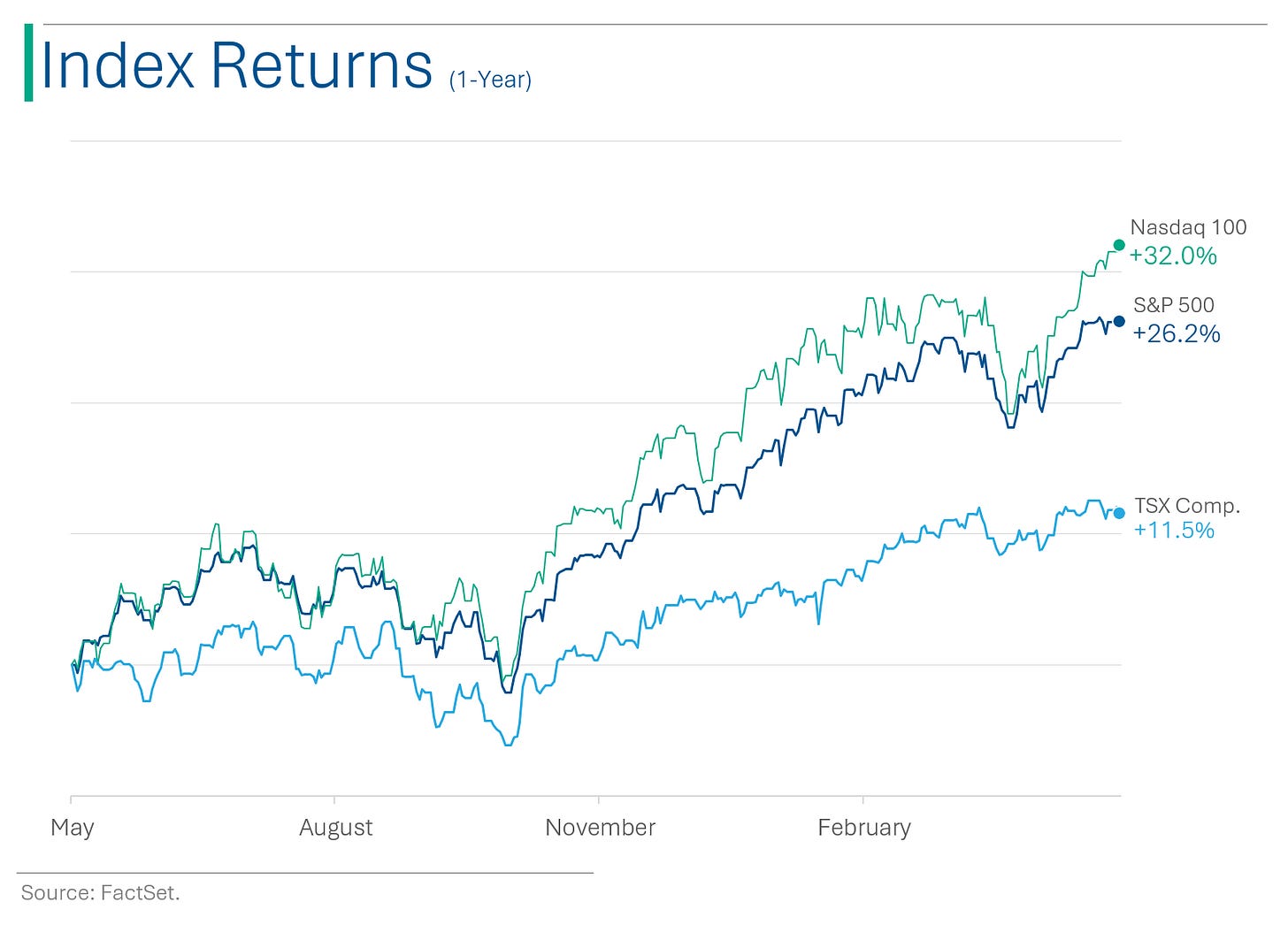

Mixed day for the big US markets, with the S&P 500 +0.02% while the Nasdaq was +0.6%.

3 of 11 sectors closed higher, led by Tech (+1.4%) and Energy (+1.1%). While Industrials (-1.3%) and Health Care (-1.2%) were worst.

The Case-Shiller home price index jumped +6.5% (YoY) in March, with momentum blamed on easing of mortgage rates and tight supply.

Crude oil was +2.7%, linked to the upcoming OPEC+ meeting.

Notable Companies:

Nvidia (NVDA) [+7.1%]: Elon Musk's AI startup xAI just raised $6B and is reportedly planning a massive investment in Nvidia chips.

DraftKings (DKNG) [-10.3%]: Illinois state senate passed a bill incorporating higher taxes for online sports-betting operators, potentially effective July 1.

iPhone shipments increase 52% in April due to significant discounting from retail partners.

Proxy advisory firm Glass Lewis recommended Tesla shareholder’s reject Musk’s (re-)proposed $56B pay package.

More below in ‘Market Movers’

Street Stories

Ferrari Explained

Another 2-parter, with today covering some of the financial highlights and tomorrow getting into some nitty gritty, like Formula 1, the divisions, etc. Andiamo e Vroom Vroom!

Ferrari isn’t just a car company.

A few weeks back I made a post about LVMH and the luxury market. Bags and wine are nice but the ultimate luxury brand is Ferrari. For example, just for the privilege of qualifying to buy one of the new $2m limited edition Ferrari Monza SP1s, one must have previously purchased a half dozen or so ‘entry level’ Ferraris.

That’s the true definition of brand power.

Sure that’s amazing and all. But why I’m writing about them in StreetSmarts is that Ferrari’s share price has increased at a pace akin to that of an old 250 GTO. Ie: A lot.

Since spinning off from Fiat and IPO’ing in October 2015, Ferrari’s shares have increased in value by +786%. The Nasdaq has been a rocket ship over that time but, like the McLarens and Red Bulls at the Monaco GP last weekend, they’ve all been left in Ferrari’s dust.

The company has been able to translate this brand power into consistent growth and profitability. As you can see below, Ferrari has been able to grow its revenues like finely tuned laps around Fiorano.

And while many automakers, such as Mercedes below, have yet to fully recover from the Covid-19 pandemic, Ferrari has shown to be the ultimate defensive driver.

One of the true tests for a luxury brand is comically high gross margins, and Ferrari is on pole here too. While peers struggle to keep one quarter of what they make on a per vehicle basis, Ferrari nets about half. Those poor, poor Germans.

Strong growth, incredible brand power, high margins and recession proof profits: If you think that’s enough to warrant a high valuation multiple, you’d be wrong. According to the markets, it’s worth a staggering, eye-watering, hallucinatory multiple.

For context, the S&P 500 is at decade-highs - excluding the Covid blip - and trades at 21x forward P/E, which still puts it at a 56% discount to Ferrari at 47x.

Just how big is a P/E of 47x? Well, Nvidia is currently trading at 38x.

The result of this hyper valuation is that despite being a relatively small fish from a financial perspective, it is still the 3rd largest automaker in the world with a valuation of $81 billion. Behind only Tesla ($575 billion) and Toyota ($331 billion).

For context, in 2023 Ferrari raked in $1.4 billion in profit on $6.5 billion in revenue, while Volkswagen made $15.4 billion in profit on $348.4 billion in revenue. Ferrari is worth $10 billion more than Volkswagen.

This is probably a good place to pull the handbrake. Tomorrow we’ll get into the some of the internal things that make Ferrari tick.

Value Investors realizing they’ll never get the chance to buy shares.

Feeling Confident But Cautious: Inflation Looms

May Consumer Confidence rose to 102.0, surpassing expectations for 95.9 and the previous month's revised 97.5, with improvements in both the Present Situations Index and Expectations Index, despite the latter remaining below recessionary levels.

Labor market perceptions also improved, although expectations for inflation increased slightly from 5.3% to 5.4%.

Bitcoin Miners: Halving the Fun, Doubling the Trouble

Bitcoin miners have faced a challenging year due to halved mining rewards, increased mining difficulty, and investor capital shifting to new bitcoin ETFs, causing significant drops in stocks like Marathon Digital and Riot Platforms.

Despite bitcoin's price surge, mining revenues have decreased, prompting miners to enhance efficiency and consider relocating to countries with cheaper energy.

Analysts are predicting consolidation and increased M&A among miners, with companies like CleanSpark acquiring smaller operations and others diversifying into AI services to boost revenue.

Riot Platforms also announced yesterday that it has acquired a 9.25% stake in miner Bitfarms and is looking at a hostile takeover; offering a proposed $950 million to take over the company after management rejected a private offer.

Joke Of The Day

A stockbroker is someone who will invest your money until it's all gone.

Hot Headlines

Reuters / Meme stock GameStop climbs after raising $933 million in share sales. Shares popped +14% on Tuesday after the struggling video game retailer announced it had cashed in on the rally earlier this month. The company is currently worth $5.8 billion.

CNBC / Fed’s Kashkari wants to see ‘many more months’ of positive inflation data before a rate cut. In another douchey move by the Minneapolis Federal Reserve President, Neel Kashkari told CNBC that potential rate increases could be on deck if inflation doesn’t start to subside.

Reuters / Weight-loss drug forecasts are hitting $150 billion as supply grows. According to drug data provider IQVIA, global spending on obesity medications totaled $24 billion last year with them forecasting $132 billion by 2028. Bank Leerink has one of the higher estimates, forecasting annual sales of $158 billion by 2032.

CNBC / 25% of US consumers used a ‘Buy Now, Pay Later loan’ in the last 12 months. 8% expect to use BNPL for necessities in the coming 12 months in part due to financial pressures such as inflation.

Bloomberg / Chevron’s $53 billion takeover of Hess inches closer as Hess shareholders vote to approve the deal. FTC and some arbitration left to sort out. before the megadeal goes through.

Yahoo Finance / FTX Co-CEO Ryan Salame, part of the 'inner circle' at the collapsed crypto exchange, sentenced to 7.5 years in prison. He pleaded guilty last year to illegally making unlawful U.S. campaign contributions and to operating an unlicensed money-transmitting business.

Reuters / UBS lifts its year-end price target for the S&P 500 to a Street high of 5,600. The target represents a premium of +5.5% to current levels.

Trivia

Today’s trivia is on Ferrari (obviously!)

When was Ferrari founded?

A) 1923

B) 1939

C) 1947

D) 1951After running into financial troubles, Ferrari turned to Fiat which acquired 50% of the company in what year? (Hint: It’s in the ‘Ford vs. Ferrari’ movie.)

A) 1969

B) 1981

C) 1958

D) 1973How many cars did Ferrari sell in 2023?

A) 6,499

B) 21,812

C) 51,337

D) 13,663Which Ferrari model was named after the founder's son?

A) Ferrari Testarossa

B) Ferrari Enzo

C) Ferrari Dino

D) Ferrari Sergio

(answers at bottom)

Market Movers

Winners!

Insmed (INSM) [+118.7%]: Announced phase 3 trial of brensocatib in non-cystic fibrosis bronchiectasis met primary endpoint, showing significant reductions in annualized pulmonary exacerbations; expects to file NDA with FDA in Q4.

Agios Pharmaceuticals (AGIO) [+23.2%]: Announced sale of rights to its 15% royalty on vorasidenib to RPRX for $905M upfront; retains 3% royalty on US annual net sales over $1B.

GameStop (GME) [+25.2%]: Completed 45M share equity offering, raising $933.4M; proceeds for general corporate purposes.

Corcept Therapeutics (CORT) [+14.9%]: Announced phase 3 trial of relacorilant for Cushing's syndrome met primary endpoint; expects to submit FDA new-drug application in Q3.

Duolingo (DUOL) [+8.8%]: Upgraded to market outperform from market perform at Citizens JMP; cited rollout of Max, optimized subscription tiers, Family Plan, and new conversational experience launch.

Nvidia (NVDA) [+7.1%]: Elon Musk's AI startup xAI raised $6B, valuing it at $24B. The Information reported plans for a massive new supercomputer which will entail a large number of Nvidia chips.

Losers!

DraftKings (DKNG) [-10.3%]: Lower after the Illinois state senate passed a bill incorporating higher taxes for online sports-betting operators, potentially effective July 1. Analysts noted rates higher than expected and raised concerns about other states following suit.

Sarepta Therapeutics (SRPT) [-8.2%]: Downgraded to sector perform from outperform at RBC due to valuation amid expectations for FDA label expansion of Elevidys. Agency language could be more cautious.

Atlantica Sustainable Infrastructure (AY) [-5.2%]: Agreed to be acquired by Energy Capital Partners and Co-Investors for $22.00/sh cash. Represents a ~6% discount to prior close but a nearly 19% premium to April 22 closing price, before market rumors of a potential transaction.

Zscaler (ZS) [-4.4%]: Downgraded to neutral from buy at Rosenblatt Securities and to equal weight from overweight at Wells Fargo. Company reports earnings on May 30.

Market Update

Trivia Answers

B) Ferrari was founded in 1939.

A) Fiat bought it’s 50% stake in 1969. They would later go on to acquire 90% of the company.

D) Ferrari sold 13,663 cars in 2023.

C) The Ferrari Dino was named after Founder Enzo’s son. ‘Testarossa’ just means ‘redhead’ - proof everything sounds better in Italian.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.