🔬 Luxury Companies Pt. I: if you have to ask what the share price is, you can’t afford it

Plus: Retail sales show that the party is still on; China's GDP comes in strong despite conflicting econ data; metals pop on Russian sanctions; and much more

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine"

- Benjamin Graham

“The road to success is dotted with many tempting parking spaces”

- Will Rogers

Terrible start to the week for the big US markets (S&P 500 -1.2% and Nasdaq -1.8%) as last week’s sell-off continues.

Just like Friday, 0 of 11 sectors closed in the green. Defensives Healthcare (-0.2%) and Consumer Staples (-0.5%) hung in the best, while Tech (-2.0%) and Real Estate (-1.8%) got smacked.

The day started off positive on optimism that the Iranian attack showed minimal success, until the Israeli war cabinet reportedly stated that they decided to retaliate ‘clearly and forcefully’. 🫠

Apple iPhone sales reportedly down 10% in Q1, according to latest IDC report.

Street Stories

Luxury Companies (Part I):

If you have to ask what the share price is, you can’t afford it

For those of you that have been reading StreetSmarts, you’ll know I’ve never once talked about fashion or luxury companies. Namely, because I don’t know s*** about fashion or luxury.

But some of these names are great companies and I thought it would be informative to briefly walk through a few of the biggest and best known names out there.

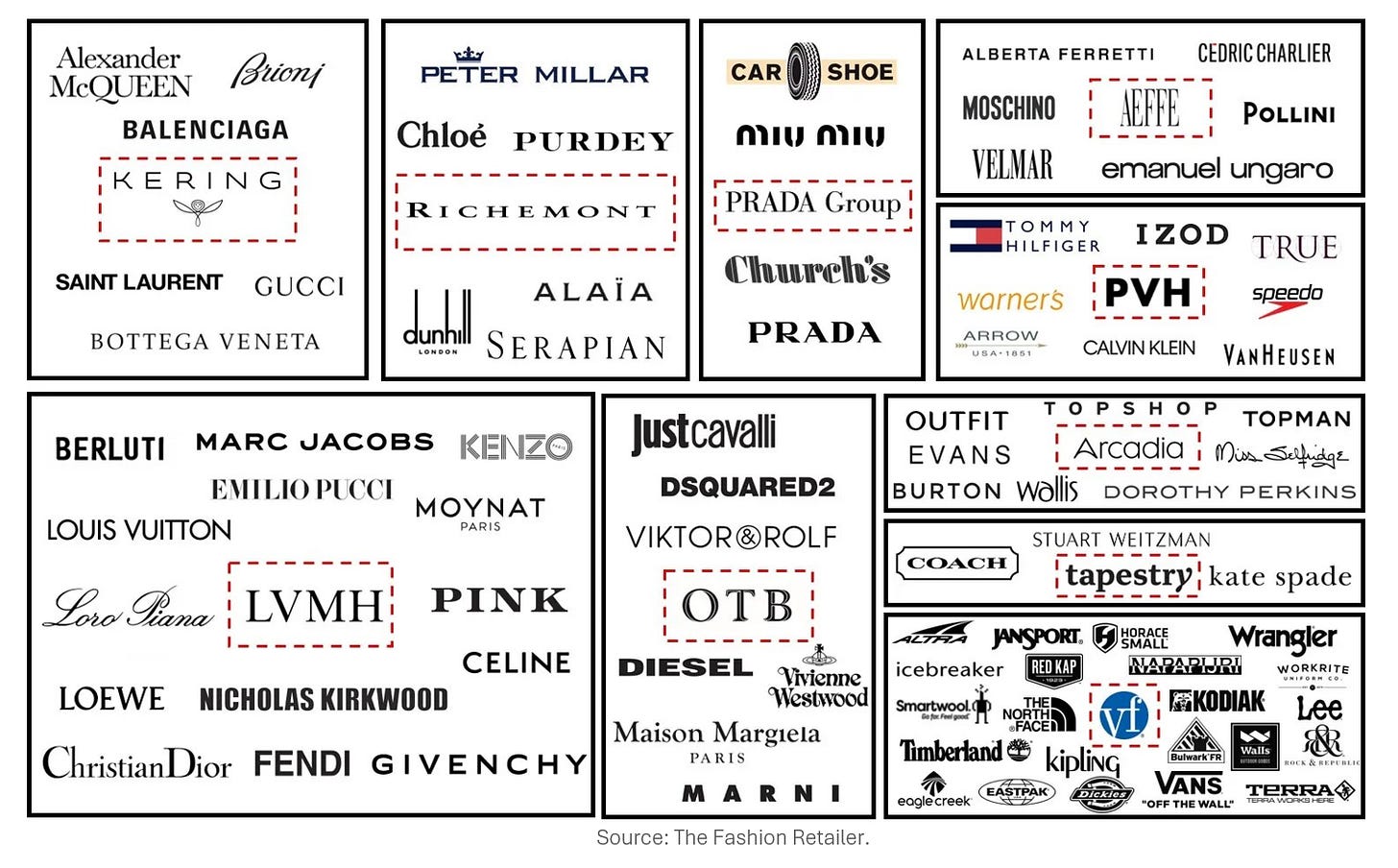

To start, the two 800lb gorillas of the luxury world are Hermès and LVMH Moët Hennessy Louis Vuitton1, which combined have a market cap of $671 billion dollars. Or, looked at another way, 24% of the French GDP ($2.8 trillion). Zut alors!

Publicly traded companies in the space represent roughly a trillion dollars of market capitalization. Interestingly, nearly all of the main luxury fashion brands you’ve heard of are owned by one of the above companies. The glaring exception is Chanel which remains private in the control of the Wertheimers (following that whole Coco Chanel thing with the Nazis…)

1. Yes, the full name actually contains a mixed up acronym of the other part of the name. So chic.

The industry has experienced strong growth and surprisingly durable sales. However, in overall category spending, the apparel and beauty businesses have only modest growth.

To summarize, the luxury industry has been a solid place to put your money. But that doesn’t fully capture the fact that within the space there have been losers, and some big, big winners. Let me explain.

Hermès and LVMH are in a different stratosphere compared to their peers.

Since going public in 1987, LVMH has outperformed the market by 7x. Not just over one year, but over 37 of them (it stopped being luck a long time ago). Hermès has done even better; returning a whopping 38x what the S&P 500 has done since its early-90s IPO. This is Nvidia level s***.

Anyway, this is probably a good place to take a break. Tomorrow I’ll dive into the incredible story of LVMH, and try and figure out how the hell they were able to do this:

Retail Sales

Data from the US Commerce Department reported a +0.7% increase in March retail sales, beating the gloomy economists’ guess of +0.3%. The win came despite rising inflation, with significant gains (excluding autos) and driven by a surge in online sales. Despite overall growth, sectors like sporting goods and clothing saw declines.

Important to note is that in the year-over-year to March, retail sales increased at an annualized figure of +4.0% which comes out well ahead of the CPI inflation print of +3.5%. Basically, spending has grown faster than inflation. 🤘

Chinese GDP

China's economy decided to show off a bit in the first quarter of 2024, growing at 5.3% year over year and beating the experts' guesses with a 1.6% growth quarter-on-quarter. However, not everything was as rosy, with export and inflation numbers not quite hitting the mark and industrial output and retail sales in March looking like they didn't get the memo about growth expectations.

Metals Bounce On New Russian Sanctions

Metals experienced significant volatility as aluminum surged by a record amount in Asian trading following news that new US and UK sanctions restrict Russian metal deliveries to the London Metal Exchange and Chicago Mercantile Exchange. The sanctions, which do not halt Russian metal sales globally or affect most direct trade between miners and manufacturers, still impact the market due to the LME's role in setting global metal prices.

While the immediate market reaction saw sharp price spikes, industry insiders suggest that these sanctions may not have as dramatic an impact as previous disruptions, with Russia nonchalantly pivoting to China as its metal buddy.

Joke Of The Day

Why was the employee fired from the calendar plant? He took a day off.

Hot Headlines

The Verge / YouTube’s ad blocker crackdown now includes third-party apps.

Vox / A look into why car insurance rates are so high. Last week’s CPI noted that the price of car insurance is up more than 22 percent over the same time last year, the largest jump since 1976.

Tech Crunch / Elon Musk plans to charge new X users to enable posting as part of an effort to reduce bots. ‘Sorry, you need to give me money so I know you’re not a bot’. Oldest trick in the book.

Yahoo Finance / Evercore strategists back dour S&P 500 view and expect weaker earnings outlook. The strategists reiterated their year-end target for the S&P 500 of 4,750, about a 6.2% discount to current levels. Contrasts with Wells Fargo last Monday, who released an updated target that sits at a 9.3% premium to current levels. Basically, research analysts are just making s*** up at this point in the cycle.

Daily Mail / Family who got their nine-year-old son a pet octopus reveal how it upended their life and destroyed their home after giving birth to 50 babies. The family spent more than $3k on food supplies and water damage repairs. Sounds like a good frenemy gift.

Trivia

Today’s trivia is on semiconductors.

When was the first integrated circuit (IC) successfully demonstrated?

A) 1948

B) 1958

C) 1964

D) 1972What year was chip giant Taiwan Semiconductor Manufacturing Company (TSMC) founded?

A) 1972

B) 2001

C) 2011

D) 1987Before silicon, what material was commonly used to make semiconductors?

A) Copper

B) Gold

C) Germanium

D) AluminumWhat year did Intel surpass a market capitalization of $100 billion?

A) 1987

B) 1996

C) 2000

D) 2006

(answers at bottom)

Market Movers

Winners!

Medical Properties Trust (MPW) [+18.8%]: Sold about 75% interest in five Utah hospitals for approximately $886M to a joint venture, securing new non-recourse financing. The deal generated about $1.1B in immediate cash to reduce debt.

Encore Wire (WIRE) [+11.6%]: To be acquired by Prysmian at $290 per share, a 12% premium to Friday's close. The acquisition is anticipated to finalize in the second half of 2024.

M&T Bank (MTB) [+4.7%]: Reported slightly better Q1 earnings with net interest income ahead of estimates, though net interest margin was below expectations. Fee income was lower than expected and provisions were higher due to some criticized commercial and industrial loans. Positive outlook on raised full-year net interest income guidance, reduced core expenses, and improvement in criticized commercial real estate.

Losers!

Neumora Therapeutics (NMRA) [-17.5%]: FDA placed a clinical hold on its phase 1 trial of NMRA-266 for schizophrenia after pre-clinical trials showed convulsions in rabbits, though no such issues in human participants. The company is collaborating with the FDA to lift the hold.

Ultragenyx Pharmaceutical (RARE) [-8.8%]: Released interim Phase 1/2 data for its treatment of Angelman syndrome with GTX-102.

Salesforce (CRM) [-7.3%]: Reuters reported that Salesforce is discussing acquiring Informatic (INFA). Initial feedback from the Street views the potential deal as strategically sound but notes risks related to execution and a return to M&A.

Logitech International (LOGI) [-6.4%]: Downgraded by Morgan Stanley to underweight from equal weight, citing expectations for lower revenue growth through FY27 than consensus estimates. The upcoming FQ4 earnings are seen as a potential trigger for a reevaluation of the stock.

Tesla (TSLA) [-5.6%]: Electrek reported Tesla plans to cut about 10% of its global workforce, roughly 14,000 employees, as stated in an internal memo from CEO Musk. This move aims at cost reduction and increased productivity following rapid growth, alongside the departure of key executive Drew Baglino.

Market Update

Trivia Answers

B) The first integrated circuit was created in 1958.

D) TSMC was founded in 1987.

C) Germanium was used before silicon. They stopped because it is horrendously expensive.

B) Intel passed $100 billion market cap in 1996.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.