🔬Fed Rate Cuts 101: A Primer for This Week’s Decision

Plus: Amazon goes back to the office; and much more!

"Time is your friend; impulse is your enemy."

- Thomas Rowe Price

"The quickest way to double your money is to fold it in half and put it in your back pocket."

- Will Rogers

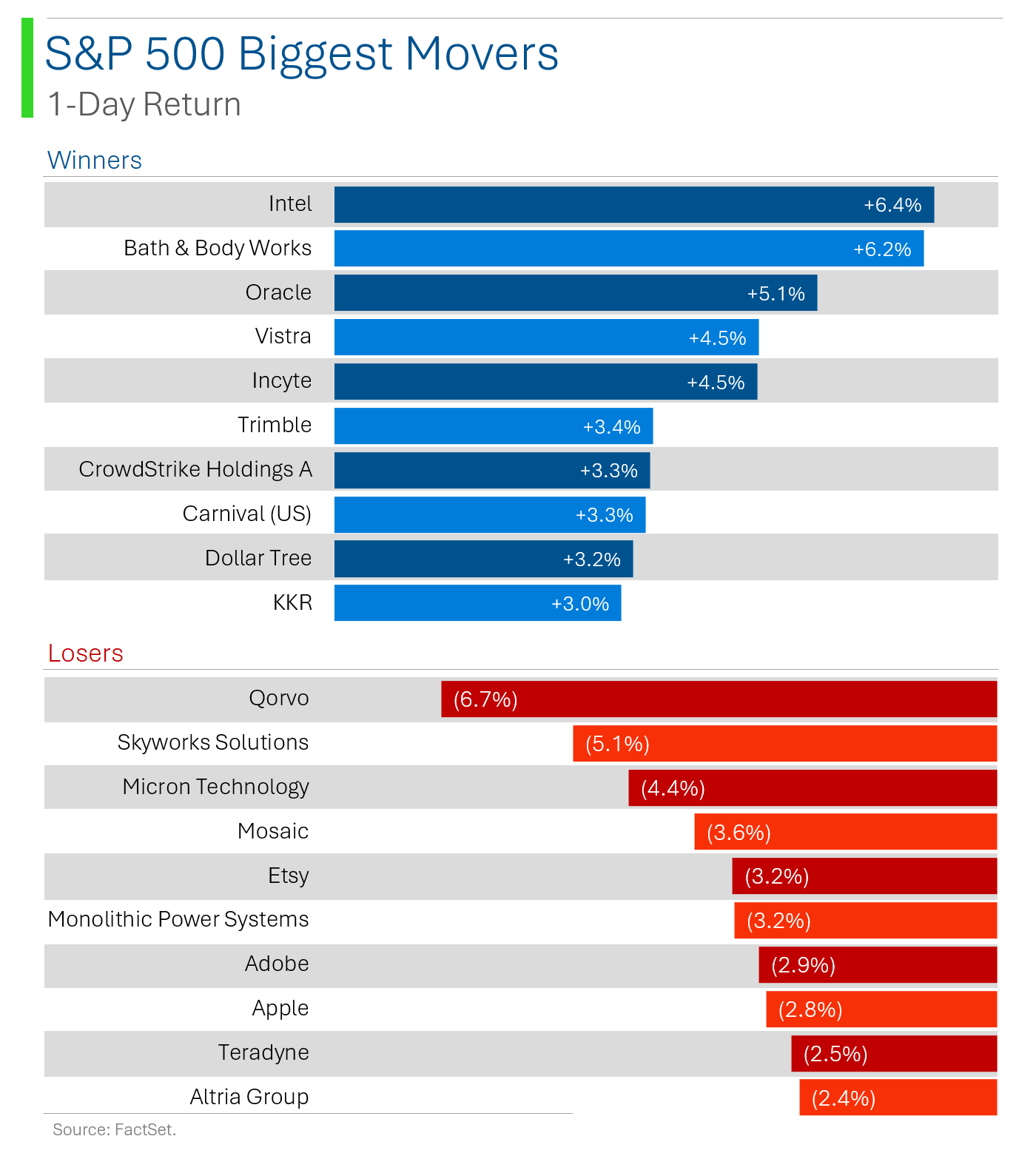

US stocks mostly rose in a quiet Monday session, with the S&P 500 nearing its July record and the equal-weight S&P 500 hitting a new high. Tech stocks, especially AAPL and NVDA, lagged, but strength in sectors like energy, banks, and building products supported the market.

Markets are awaiting the Fed's Wednesday rate-cut decision, with most expecting a 50 bp cut. Positive breadth, soft-landing optimism, and improving earnings prospects helped sentiment, though weak China data and election uncertainty weighed on the market.

The NY Fed's Empire manufacturing survey surprised by turning positive in September, driven by new orders and shipments. Analysts are watching for Tuesday’s retail sales data and the Fed’s decision on Wednesday, with further economic indicators throughout the week.

Notable companies:

Icahn Enterprises (IEP) [+14.5%]: A class action lawsuit against the company was dismissed, giving the stock a big boost.

Intel (INTC) [+6.4%]: Scored a potential $3.5B grant to produce chips for the U.S. military.

Apple (AAPL) [-2.8%]: Analyst Ming-Chi Kuo says iPhone 16 pre-orders are lagging behind the iPhone 15's, with lower demand for Pro models until new features roll out in October.

Street Stories

Fed Rate Cuts 101: A Primer for This Week’s Decision

After 14 months sitting at the 5.25%-to-5.50% target range, interest rates will finally start to come down with the Fed’s announcement on Wednesday afternoon ahead of their September press conference.

It’s worth mentioning the last time the Fed cut rates was in March 2020, as the pandemic kicked off.

The odds of a no-cut September meeting have been sitting at zero percent since July but we’ve seen a massive pivot in expectations for the number of cuts. As recently as two months ago the base case (88%) was for one cut (25bps) but now that’s pivoted with the most likely scenario being a 50bp ‘double-cut’.

Creating the conditions for the cut has mostly come from inflation data that has (slowly) started moving downward once again as well as signs that the US consumer isn’t in the greatest shape. The latter perhaps best indicated by poor jobs data over the last two months.

As a result, the market has built in some aggressive estimates for interest rate cuts with four to five 25 basis point cuts expected by year end.

A September rate cut will also mean the US will be joining it’s fellow G7 peers - save for Japan - in all having started their rate cutting cycles.

The US stood out as not only having the highest interest rates through this cycle but also keeping them there the longest.

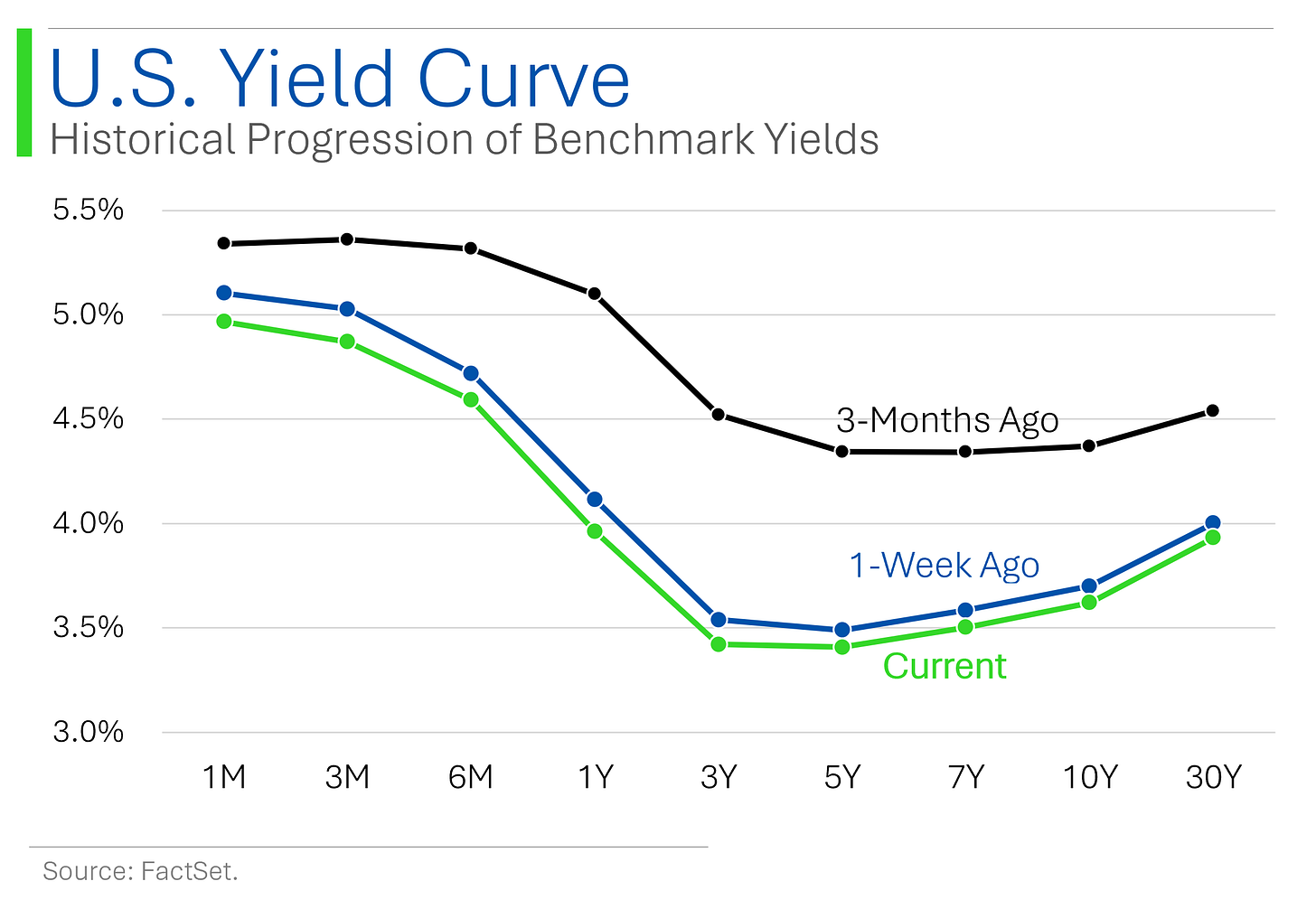

Rate Cut Fever has also served to progressively push down the U.S. yield curve.

But for the average consumer the biggest benefit will likely be the decline in mortgage rates, which have already come down quite dramatically over the last four months in anticipation of the pending cuts.

I won’t lie, I’m really excited for this to kick off - mostly so I can stop updating that ‘Rate Cut Probabilities’ chart which is a real pain in the ass. The next question, however, will be if this reignites market sentiment or if it’s the ‘sell the news’ even I fear it might be. TBD.

No Free Shipping on Remote Work

Amazon is mandating its corporate employees return to the office five days a week starting January 2025, up from the current three-day requirement.

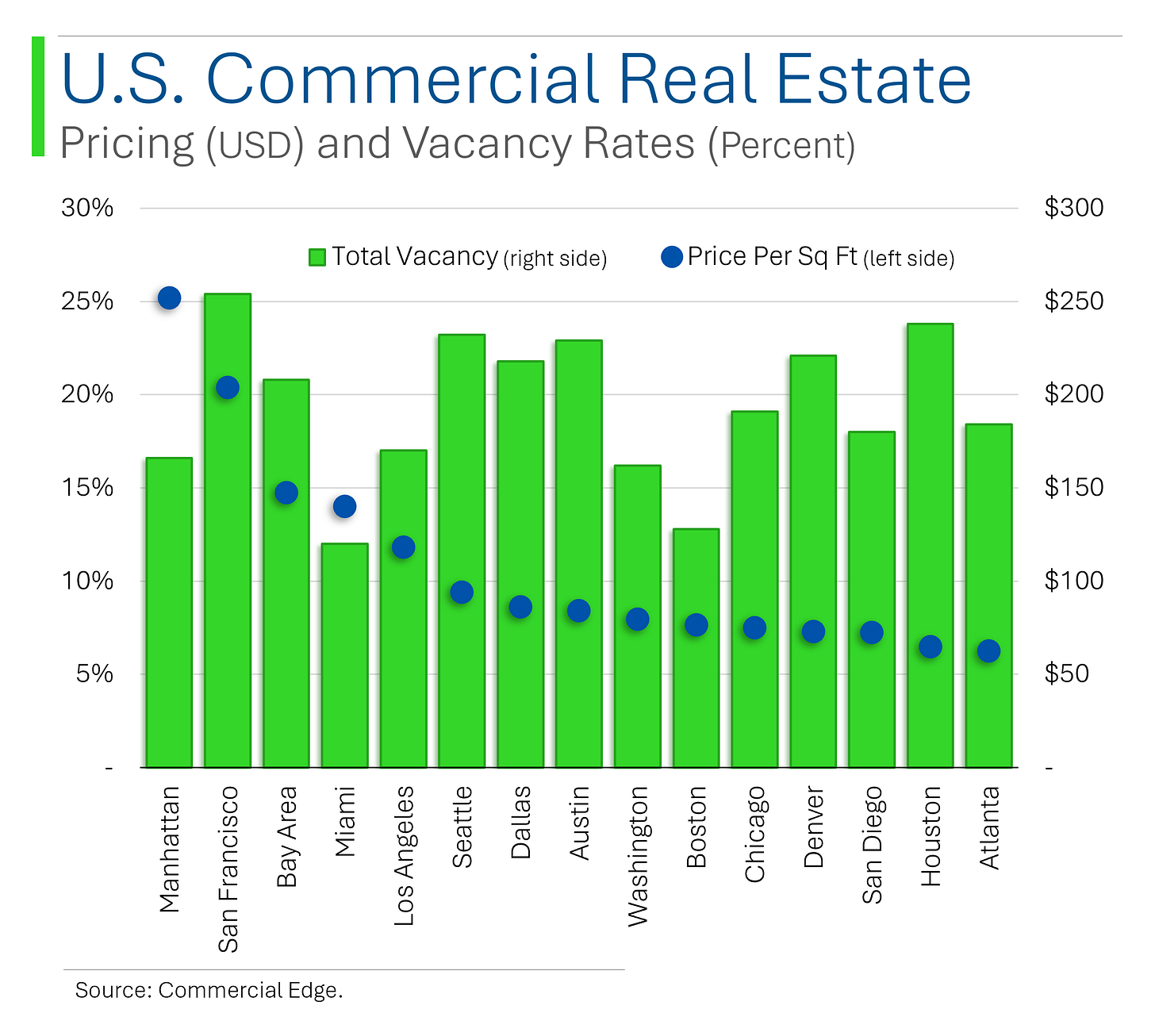

CEO Andy Jassy outlined the change in a memo, emphasizing the benefits of in-office collaboration…and the cheap leases they can assume given the abysmal disconnect between prices and vacancy rates.

Additionally, Amazon plans to reduce management layers by 15% by Q1 2025, aiming to streamline decision-making and boost productivity.

Good thing don’t have any culture problems or issues with employee satisfaction or this might be poorly received. 🙃

Joke Of The Day

Today I went to a presentation on how ships are held together. It was riveting.

Hot Headlines

Reuters / Amazon drivers join Teamsters in New York, union says. While the unionization follows similar efforts in California and Illinois it also comes as Amazon faces growing legal pressure with the National Labor Relations Board recently holding the company liable for anti-union tactics. Amazon has pledged a $660 million investment to increase compensation for its delivery service partners over the next year. I just hope they can afford it…

Reuters / Vista and Blackstone nearing $8 billion deal to buy Smartsheet. The collaboration and project management SAAS company reportedly serves 85% of Fortune 500 firms, recently beat Q2 earnings. Helluva way to kick off the LBO season after the rate cut on Wednesday…

CNBC / Charter rolls out new Spectrum pricing and internet speeds, aims to ‘be a better service operator’. Charter's Spectrum is reframing the game to focus on the customer with the rolling out of their “Life Unlimited Platform”. It includes $30/month plans, and credits for service outages. I never thought I’d live to see the day that a telco plays ball…

Bloomberg / Boeing starts hiring freeze and weighs temporary furloughs. Boeing is apparently bracing for a prolonged strike at its Seattle hub - furthermore, the plane maker is also cutting supplier spending and non-essential travel. With a credit rating that’s flirting with junk status, it’s make or break time.

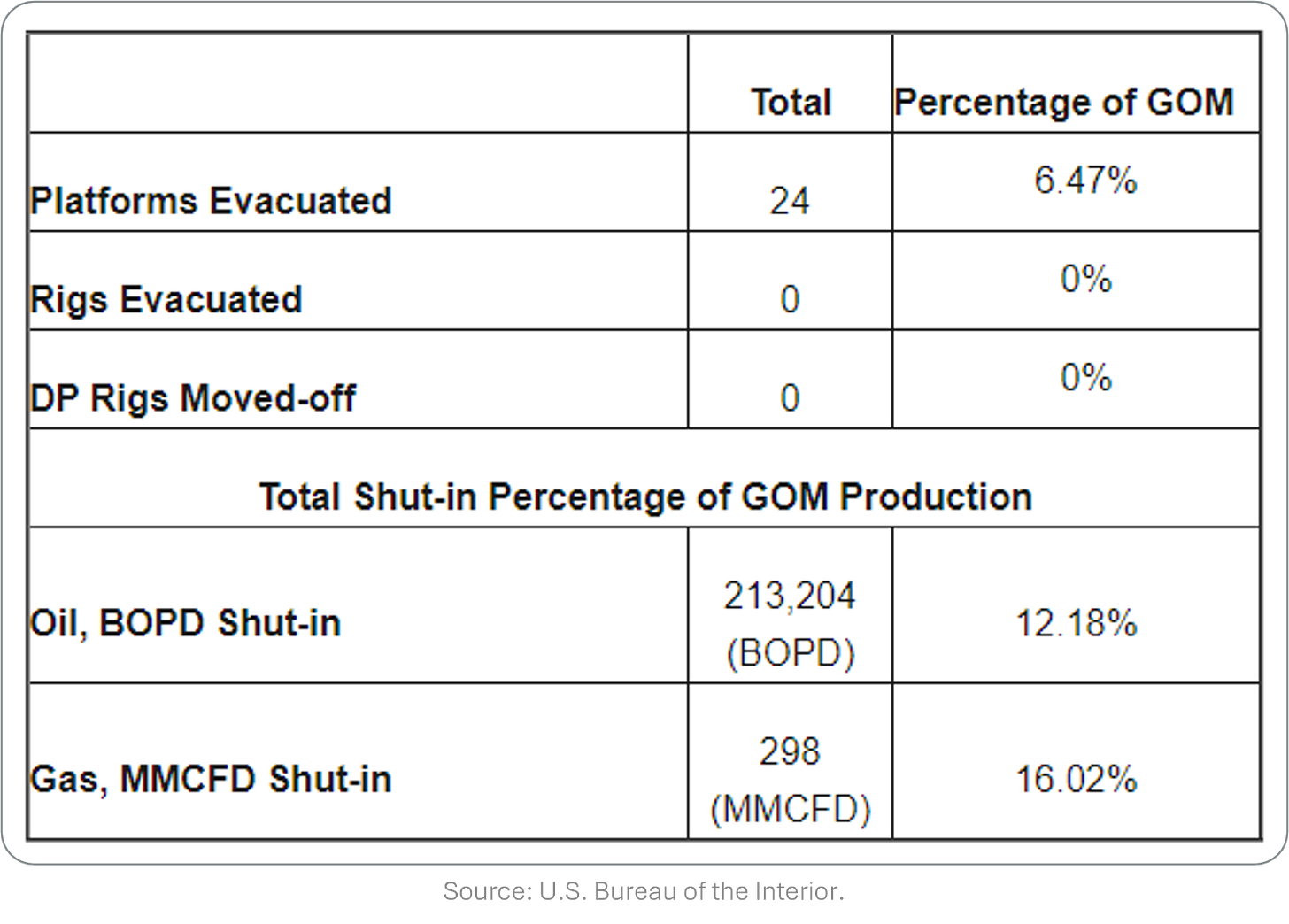

U.S. Department of the Interior / 12% of oil production at US Gulf of Mexico remain shut in after Hurricane Francine. 24 production platforms have been evacuated and while inspections are underway, this is also causing a 16% decrease in gas production. Let’s hope for another warm winter.

Trivia

Today's trivia is on Larry Ellison, the billionaire founder of Oracle!

Which programming language did Larry Ellison help develop through Oracle that became a staple for enterprise applications?

A) Python

B) Java

C) C++

D) RubyWhat major acquisition in 2009 solidified Oracle’s presence in the hardware industry?

A) Dell

B) IBM

C) Sun Microsystems

D) Hewlett-PackardIn what year did Larry Ellison step down as CEO of Oracle?

A) 2012

B) 2014

C) 2016

D) 2018What sport has Larry Ellison heavily invested in, even winning prestigious titles?

A) Formula 1

B) Sailing

C) Golf

D) Tennis

(answers at bottom)

Market Movers

Winners!

Ascendis Pharma (ASND) [+17.1%]: Positive study results for its treatment for kids with achondroplasia had analysts comparing it to BMRN's Voxzogo.

Icahn Enterprises (IEP) [+14.5%]: A class action lawsuit against the company was dismissed, giving the stock a big boost.

Bausch + Lomb (BLCO) [+14.5%]: Word is they’re working with advisors on a potential sale, according to the Financial Times.

Lattice Semiconductor (LSCC) [+12.3%]: Named Ford Tamer as its new CEO, who led Inphi for nine years.

EchoStar (SATS) [+8.9%]: Rumors are flying about a possible merger with DirecTV that could shake up the pay-TV world.

Intel (INTC) [+6.4%]: Scored a potential $3.5B grant to produce chips for the U.S. military.

Alcoa Corp. (AA) [+6.1%]: Agreed to sell its stake in a Saudi metals plant for about $1.1B, with the deal closing in the first half of 2025.

Exact Sciences (EXAS) [+6.0%]: Shared impressive data on its blood-based colorectal cancer screening, showing strong sensitivity results.

Zillow Group (ZG) [+4.8%]: Got an upgrade thanks to its revenue potential and falling mortgage rates, which could boost their core business.

CACI International (CACI) [+3.0%]: Announced it’s buying Azure Summit Technology in a cash deal expected to close by Q2 2025.

Builders FirstSource (BLDR) [+2.4%]: Got an upgrade due to optimism about housing market trends and their solid product offerings.

Losers!

BioMarin Pharmaceuticals (BMRN) [-17.7%]: Took a hit after ASND’s new study results suggested their treatment could compete with BioMarin's Voxzogo, the only FDA-approved option right now.

AeroVironment (AVAV) [-9.7%]: A protest was filed against the Army’s decision to award them a $990M contract for the Switchblade program, leading to a stop-work order.

Micron Technology (MU) [-4.4%]: Morgan Stanley cut its price target, citing concerns over DRAM pricing and also downgraded Korean competitor SK Hynix.

Mosaic (MOS) [-3.6%]: Operational issues, like electrical problems and weather challenges, are expected to hit production and shipments in their Potash and Phosphate segments for Q3.

Yelp (YELP) [-3.0%]: BofA Securities initiated them at underperform, pointing to a shrinking user base, ad spend shifts, and risks from generative AI competition.

e.l.f. Beauty (ELF) [-3.0%]: Piper Sandler lowered their price target, saying they’re less confident in a big FY25 beat after management flagged some softening trends.

Apple (AAPL) [-2.8%]: Analyst Ming-Chi Kuo says iPhone 16 pre-orders are lagging behind the iPhone 15's, with lower demand for Pro models until new features roll out in October.

Market Update

Trivia Answers

B) Java—Ellison acquired Sun Microsystems in 2009, bringing Java under Oracle’s wing.

C) Sun Microsystems—This acquisition gave Oracle control over both software and hardware.

B) 2014—Ellison transitioned to become Oracle’s CTO while retaining a prominent role.

B) Sailing—Ellison’s Oracle Team USA has won the America’s Cup multiple times.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.