🔬 Explainer: What About The Crypto Companies?

Plus: I explain why Boeing is terrible in one graph; Home Price are up (as always); Consumer Confidence slips; and much more

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble"

- Warren Buffett

“Cheese. It’s milk that you chew”

- Chandler Bing, Friends

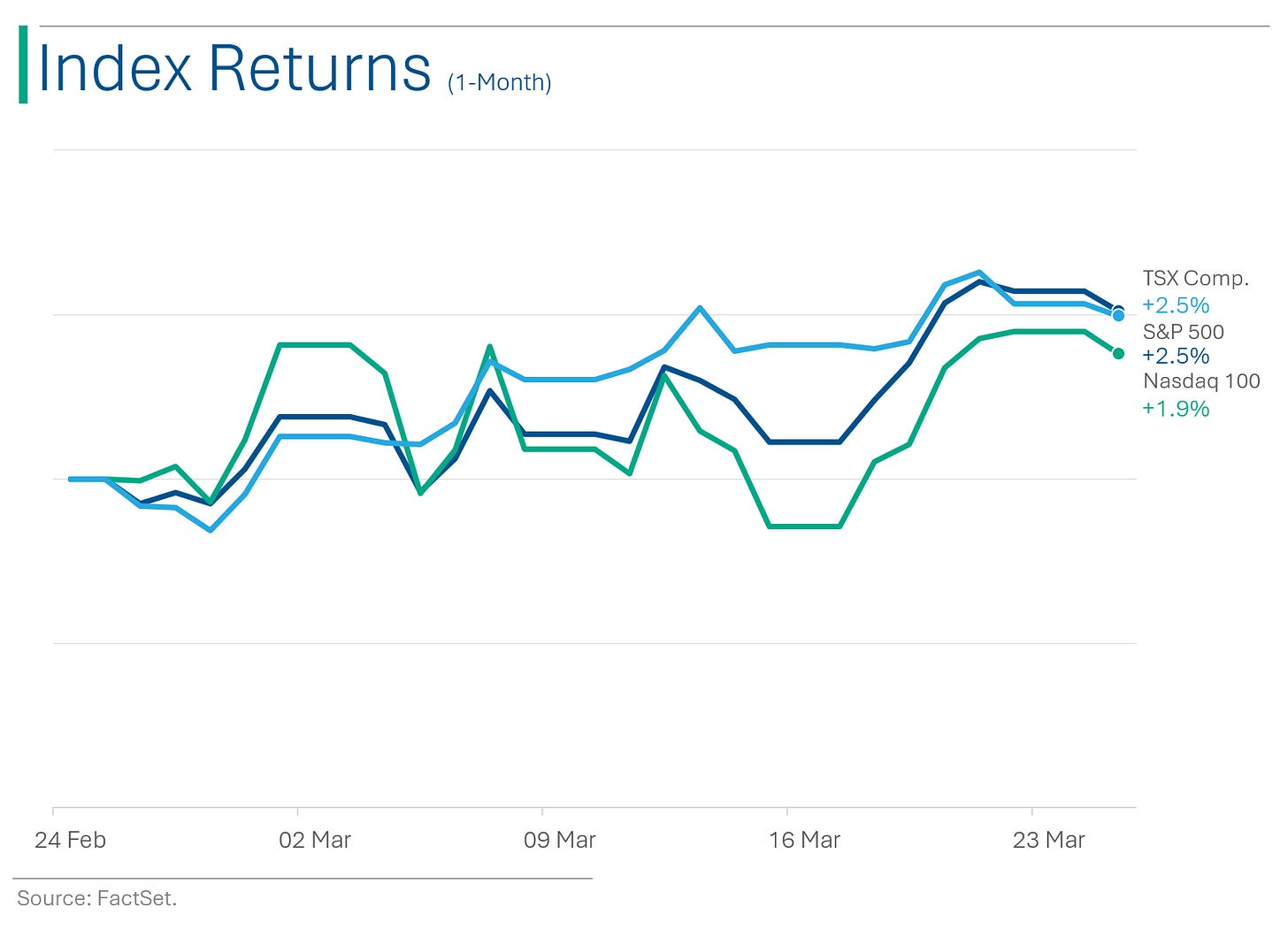

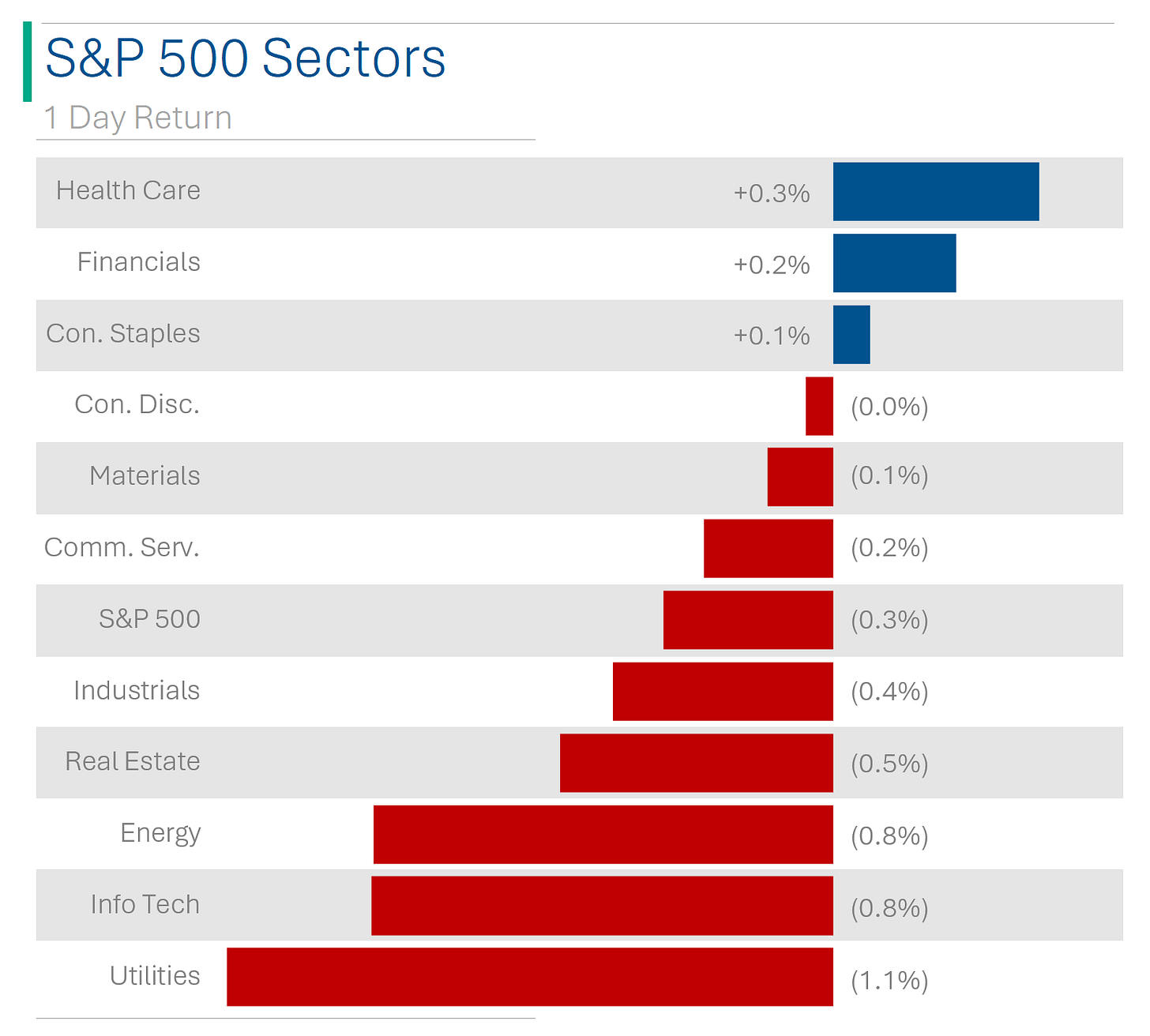

Back to back soft days for the big US markets (S&P 500 -0.3%, Nasdaq -0.4%).

3 of 11 sectors closed higher led by Healthcare (+0.3%) and Financials (+0.2%). Utilities (-1.1%) (always garbage) and Tech (-0.8%) were at the bottom.

Retail lovechild GameStop reported after the close and is down 18.5% in after-hours trading with misses on Revenue ($1.8b vs. Wall Street estimate for $2.1b) and EPS ($0.22 vs. Street at $0.30).

Krispy Kreme (+37.4%) popped on partnership deal with McDonald’s.

Truth Social parent company Trump Media & Technology Group (+16.1%) had a big (some might say Yuge) first day of trading following the SPAC merger.

Street Stories

Crypto Company Returns

If you’re like me, you sorta follow what’s going on in Cryptoland but don’t really do much else in the space. So after the meteoric rise in Bitcoin over the last year I thought I’d take a few hash cycles to check out the companies that exist in the crypto space. Hold on to your mining rigs, cuz here we go.

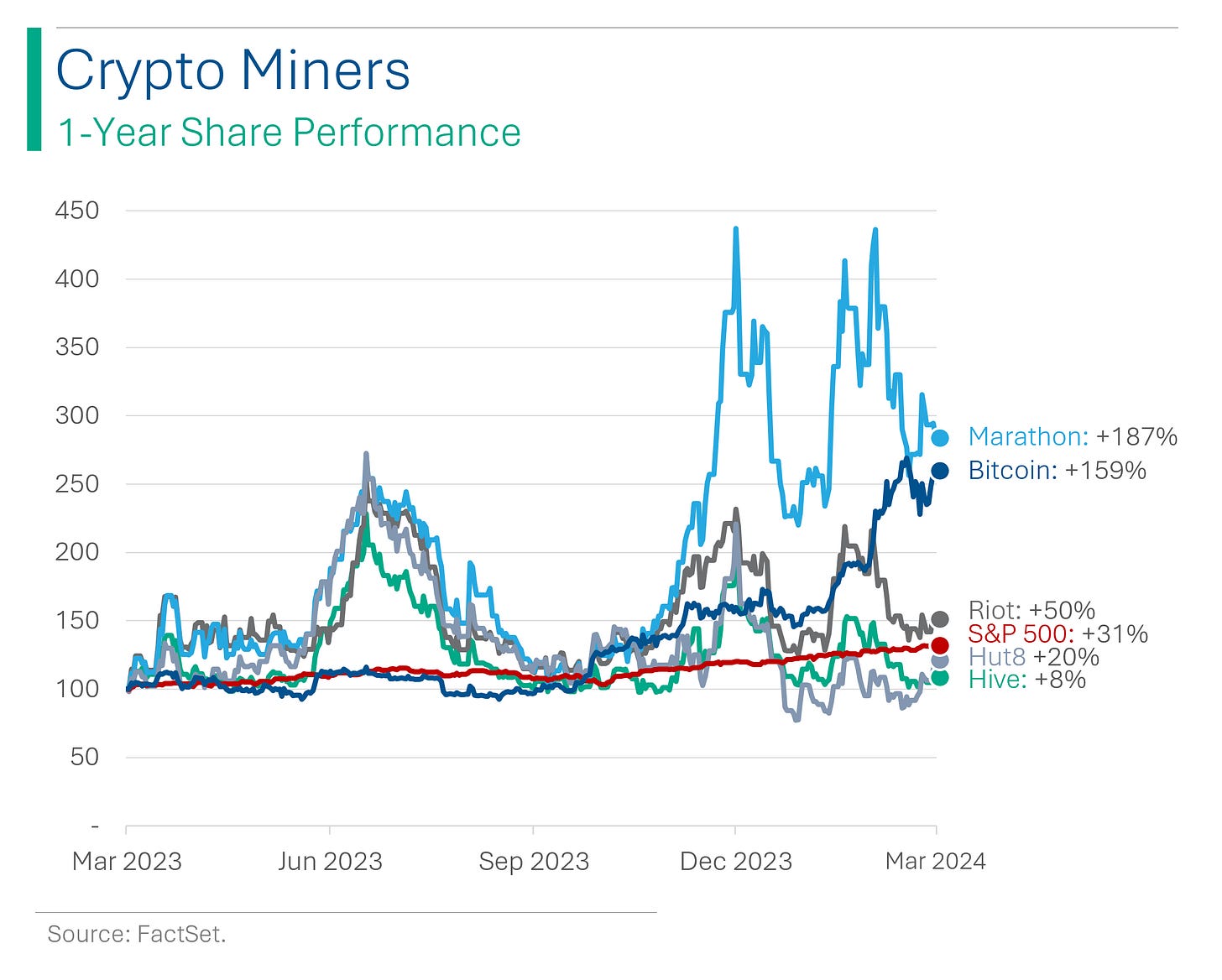

First up is the crypto miners. These were some of the first companies in the space to go public and generally were considered to be the most direct way to get access to the crypto market without buying crypto. In fact, I actually met with Hive and Hut 8 during their IPO roadshows back in 2017*. I didn’t invest.

*Interestingly a lot of crypto companies initially listed here in Canada. Ostensibly because of it’s similarity to traditional mining, of which Canada is considered a world leader with a sound regulatory system, but mostly because of loose filing restrictions on our venture stock exchange (also a favorite of sketchy junior mining companies).

Anyway, as you can see, other than Marathon - which had negative $615m in 2022 EBITDA and was probably on life support - all of them significantly underperformed Bitcoin in over the last year.

The twist to the miners is that they almost exclusively bank their mined crypto so that they can in a way be looked at as proxies for the underliers. Without getting too into the weeds on this, their underperformance in 2024 can in part be attributed to the fact that, with the SEC approving Bitcoin ETFs, professional money managers don’t need to rely on them in order to get exposure to the underlying crypto. Sucks for them.

What has really shined over the last year are the ‘other’ players in the crypto space. These are pretty varied in what they do. For example, Canaan is a Chinese company that makes mining rigs - and is the only big player to be outperformed by Bitcoin and the S&P 500 (loser!) While Galaxy and Greyscale, mostly investment funds and some associated crypto infrastructure, did very well. Coinbase - the leading crypto exchange now that FTX and Binance blew up - did very, very well.

Microstrategy is actually pretty hilarious if you haven’t heard of them. They are a software analytics company (literally nothing to do with Bitcoin) but have aggressively banked all their cash into Bitcoin and as a result have been looked at as another Bitcoin proxy. They even went as far as issuing $800 million in convertible bonds two weeks ago just to buy Bitcoin. I have no idea how that is legal in a first world country.

What also stands out beyond share performance, is that the the size distribution of the ‘crypto’ companies is also skewed away from the miners.

Anyway, that’s probably enough crypto for today. Tomorrow I’ll do a small follow-up looking at the profitability of these companies to see how much is hype and how much is actually sound fiduciary management of shareholder value. Either way, I’m probably in the wrong business. 🚀😅

Why Boeing Is A Terrible Company

Yesterday I made fun of Boeing (again) in Boeing Loses Another CEO, but I thought it would be helpful to try and explain what exactly has gone wrong at the company to turn them from a world-class engineering firm into a husk of MBA-induced malfeasance. Since a picture says a thousand words, here it is…

Boeing became a world-leader by investing in technology and developing the best aircraft in the world. Along the way, and particularly under CEO Phil Condit, the company changed to adopt a sort of ‘General Electric’ style, focusing only on immediate shareholder returns. That’s why the problem child 737, initially designed in 1964, never got a modern replacement. Cuz that costs money.

In 1980, dividends and share buybacks only represented 20% of what Boeing spent on capital expenditures, such as R&D and manufacturing improvement. When Lion Air Flight 610 nosedived into the Java Sea in 2018 - due to a software program designed to compensate for the poor flight characteristics of the 737’s outdated, Frankenstein airframe - the company spent 782% of Capex on dividends and buybacks. I’m a capitalist, but this was just pure greed and hubris. And combined with the Ethiopian Air crash, 346 people lost their lives because of it.

Consumer Confidence

March Consumer Confidence came in at 104.7 vs. Wall Street’s consensus estimate for 107.0, and essentially unchanged from February's 104.8. The expectations component fell to 73.8 from February's 76.3.

Nothing really significant imo.

House Prices

S&P’s Case-Shiller 20 City Home Price Index ticked up 0.1% in January to an annualized level of +6.6%, roughly inline with analyst expectations.

Not great but looks like it’s starting to roll over. Very slowly.

Joke Of The Day

When in doubt, mumble.

Hot Headlines

Tech Crunch / Adobe unveils over 20 new generative AI products available to developers. The company’s AI-powered features from its Creative Cloud tools like Photoshop available are designed to help enterprise developers to speed up content creation. Can they write my note for me? Plzzz

The Verge / Related to the above, Canva has acquired Affinity to position itself as competitor to Adobe in the digital design industry. The Affinity Designer, Photo, and Publisher are similar (albeit lower tier) offerings to Adobe’s Illustrator, Photoshop and InDesign software offerings.

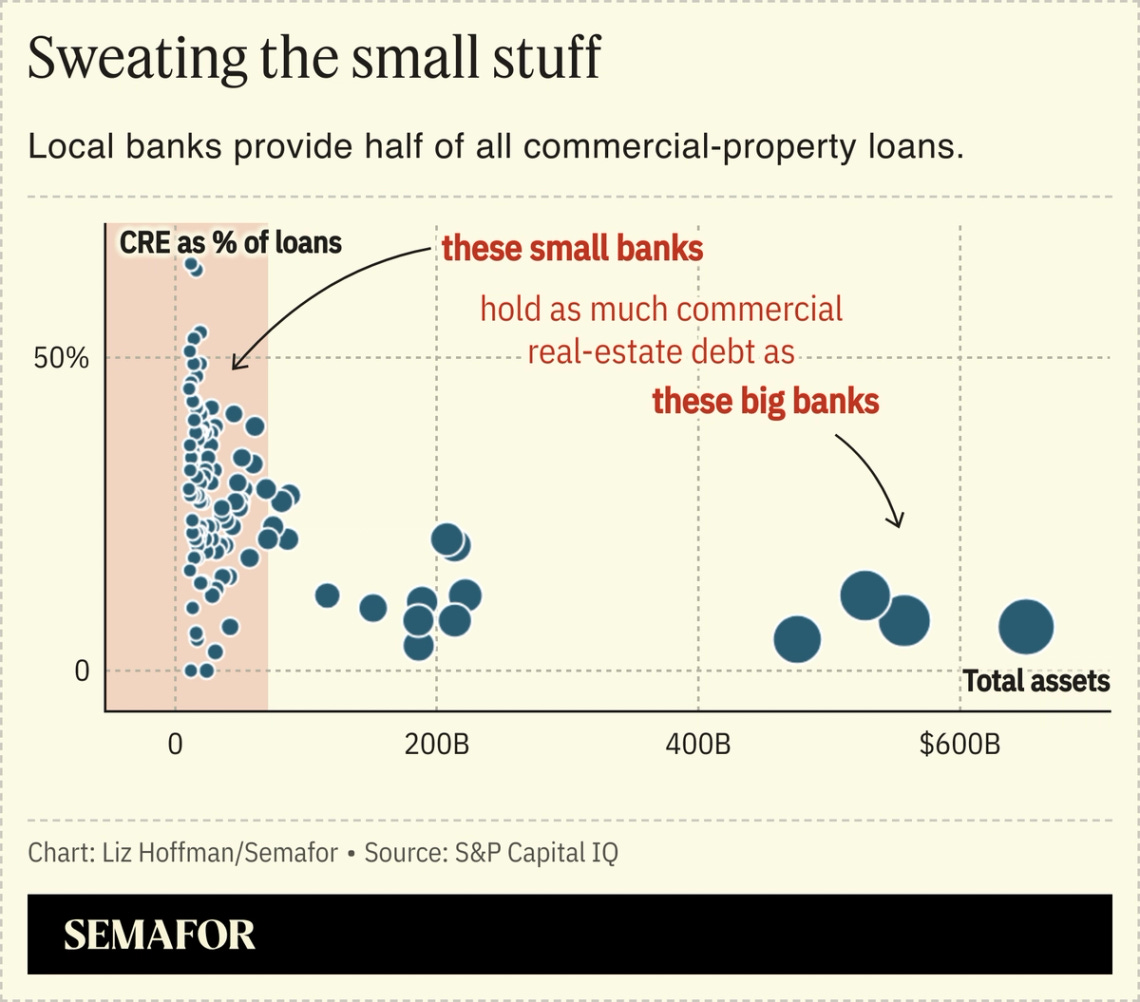

Semafor / Why do small banks fail? Well, lately it’s because they’re the one’s with all the Commercial Real Estate (CRE).

Reuters / Visa, Mastercard reach $30 billion settlement over credit card fees. If approved, this will represent one of the largest antitrust lawsuits in US history. Merchants have long accused Visa and Mastercard of charging inflated swipe fees, or interchange fees, when shoppers used credit or debit cards.

CNBC / Cocoa prices hit $10,000 per metric ton for the first time ever. I talked about this in February at $6k and yesterday and $9k. I think I’m jinxing it so imma shut up now…

CNBC / Adam Neumann reportedly has offered $500 million by back (bankrupt) WeWork. Tryna be the first guy to bankrupt a company twice!

Trivia

Today’s trivia is on Charlie Munger.

Charlie Munger got his law degree from Harvard. What was interesting about the way he got his degree?

A) He failed most of his tests and only passed because he was likeable.

B) He never completed an undergraduate degree.

C) He is highly dyslexic and couldn’t read the text books.

D) He never went to class.Charlie coined a term that he uses to describe the phenomenon wherein different biases layer and interlock with one another that ultimately can distort people’s perception of events and things, such as the stock market. This was called what?

A) Layered Biases Effect

B) Lollapalooza Effect

C) Three Stooges Effect

D) Sticky Perceptions

What famous book is based on the writings and speeches given by Charlie Munger?

A) Munger on Munger

B) Tap Dancing To Work

C) Snowball

D) Poor Charlie’s Almanack

(answers at bottom)

Market Movers

Winners!

Krispy Kreme (DNUT) [+39.4%]: Expanded partnership with McDonald’s; expects nationwide availability by end of 2026, starting phased rollout this year. Shareholders are lovin’ it. No? Sorry.

Viking Therapeutics (VKTX) [+16.8%]: Positive phase 1 trial data for VK2735, showing dose-dependent weight loss; plans for further dose escalation and Phase 2 trial initiation.

Trump Media & Technology Group (DJT) [+16.1%]: Began trading today after merger approval with Digital World Acquisition Corp. SPAC on Friday.

McCormick & Co. (MKC) [+10.5%]: FQ1 EPS and revenue beat; reaffirmed FY24 growth guidance. Analysts highlight strong organic sales and margin growth.

Seagate Technology (STX) [+7.4%]: Upgraded to overweight by Morgan Stanley; noted market recovery and anticipated demand from Generative AI.

Losers!

United Parcel Service (UPS) [-8.2%]: Reiterated 2024 and set ambitious 2026 targets above consensus. Despite revenue and operating profit forecasts 10% and 20% higher, respectively, some view the guidance as too aggressive amid concerns over parcel capacity oversupply.

Canada Goose (GOOS) [-6.8%]: Announced a 17% cut in its global corporate workforce, with organizational structure changes in management.

CONSOL Energy (CEIX) [-6.8%]: Fell after a bridge collapse in Baltimore, potentially impacting the company's export terminal's access to shipping routes.

International Paper (IP) [-6.5%]: DS Smith confirmed talks about a potential acquisition by IP for over $6.3B in stock, following Mondi's earlier agreement to purchase DS Smith for approximately $6.5B in an all-stock deal.

Market Update

Trivia Answers

B) While he’d been to two universities prior to Harvard, he had never completed an undergraduate degree.

B) Lollapalooza Effect.

D) Poor Charlie’s Almanack.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

The Boeing documentary on Netflix is great! It will make you instantly hate the company even more. This is one of those companies I am staying far, faaaar away from at any time.

Ethiopian Air was pilot error after the initial Max disaster adjust.