Costco in 17 Charts: Everything in Bulk Except the Valuation

"The best time to buy a stock is when the company is as unpopular as a dentist at a lollipop convention."

– Peter Lynch

“The difference between playing the stock market and the horses is that one of the horses must win."

– Joey Adams

Hey Readers!

I’ve been meaning to do a write-up on Costco forever so I’m glad to have finally got around to it.

I’m hoping to do more single stock write-ups since I’ve mostly been whining about volatility doing more equity strategy stuff lately. If you have any ideas for other interesting companies to look into next, please let me know in the comments (please no meme stocks).

Have a good weekend,

- Ryan

Street Stories

The Costco Juggernaut

Since first hearing Charlie Munger gush about the company, I’ve been a fan of Costco-the-stock for years. As for Costco-the-company, I’ve been a member for a long time now but - to my eternal shame - I’ve only ever used the delivery app and never set foot in a warehouse. That is, until yesterday.

And it was glorious.

And as much as I love a good deal, or a 40lb bag of trail mix, as an investor I love great companies even more. And any way you slice it, Costco is truly one of the great corporate success stories.

What follows below is my concise summary of the financial wizardry that has made Costco one of the best investments this millennium. If you want to learn more about the company’s history and what makes it tick, I found the above podcast by Acquired to be of particular interest.

Hope you like it!

To start, Costco has been a rocket ship of a stock. Outperforming the market by 3.4x over the last 10 years. A period where the S&P 500 has enjoyed one of its greatest bull runs ever.

The true test for a quality growth company is also that it can hold up when market sentiment sours and, as you can see above, Costco is consistently an outperformer.

Part of Costco’s investor appeal is its consistent, steady growth.

Plenty of overzealous retailers experience massive boom and bust phases of expansion and contraction to their location count. Costco stands out for its disciplined approach which results in near clockwork expansion and a nearly 0% closure rate for warehouse locations.

A modest point of concern for long-term investors is that the rate of annual warehouse expansion has tapered down a bit.

Costco’s discipline in expansion has kept them from overreach that could ding its Return on Investment, but it can’t magically create new, scalable markets with the cultural receptivity to embrace their warehouse membership model.

To continue to find profitable locations for expansion, Costco is increasingly reliant on international markets to grow their business.

Since 2011, 43% of new Costco locations have come from international expansion.

However, as you can see above, the company does have plenty of large markets that don’t appear to have yet been tapped. For example, currently there are no South American locations.

Whereas most traditional supermarkets offer between 30,000 to 100,000 different items, Costco rigidly adheres to a policy of only allowing approximately 3,800 to 4,000 items per warehouse. The result is:

Increased negotiating power with suppliers (better price on bulk ordering)

Streamlined operations (faster inventory turnover; reduced labor required for stocking)

Simplified shopping experience (reduced decision fatigue; faster shopping)

Another sign of Costco’s discipline can be seen in its steady merchandise margin. For their house brand, Kirkland Signature, the company caps their mark-up at 14% over cost. For all other items this is capped at 15%.

It takes significant discipline for company management not to maximize short term profits but this non-exploitative pricing has built significant customer loyalty.

Costco’s steady, persistent growth is best seen in their annual revenue. Since going public in 1985, Costco has had only a few instances of revenue contraction; the most notable was in 2009 - while the whole world was melting down - when they saw revenue decline by a mere 1.5%.

It was then up 9.1% in 2010 and 14.1% in 2011.

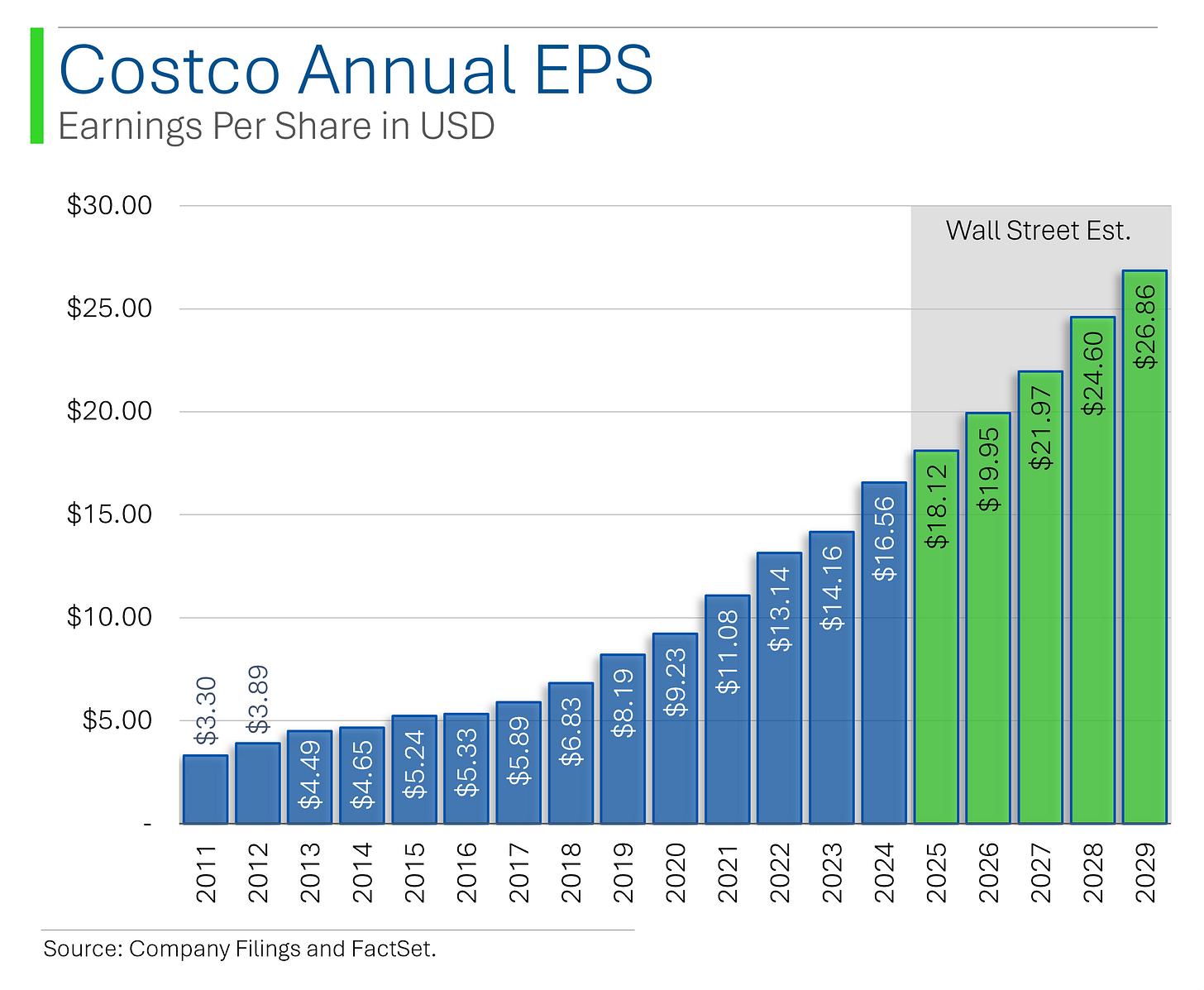

Increased operational efficiency and sourcing has also meant that EPS growth has consistently outpaced revenue growth. Since 2012, only two years (2014 and 2016) have seen EPS grow by less than revenue.

Stock buybacks have also chipped in here as well, as the company has averaged ~0.4% annual buyback yield over the last five fiscal years.

While a consistent grower, Costco isn’t immune to the impact of inflation. During the darkest times of sticky inflation in 2022/2023, Wall Street progressively trimmed revenue estimates for the company’s out years.

Interestingly, Wall Street’s numbers have remained solid during the 2025 tariff commotion - even ticking up modestly. Concerns of increased supplier costs are apparently outweighed by belief that looming economic concerns may drive more cost conscious consumers into Costco’s clutches.

The company reports their Q3 2025 on May 29th, which will likely get more scrutiny than usual due to the readthroughs to the US consumer and commentary relating to global retail supply chains.

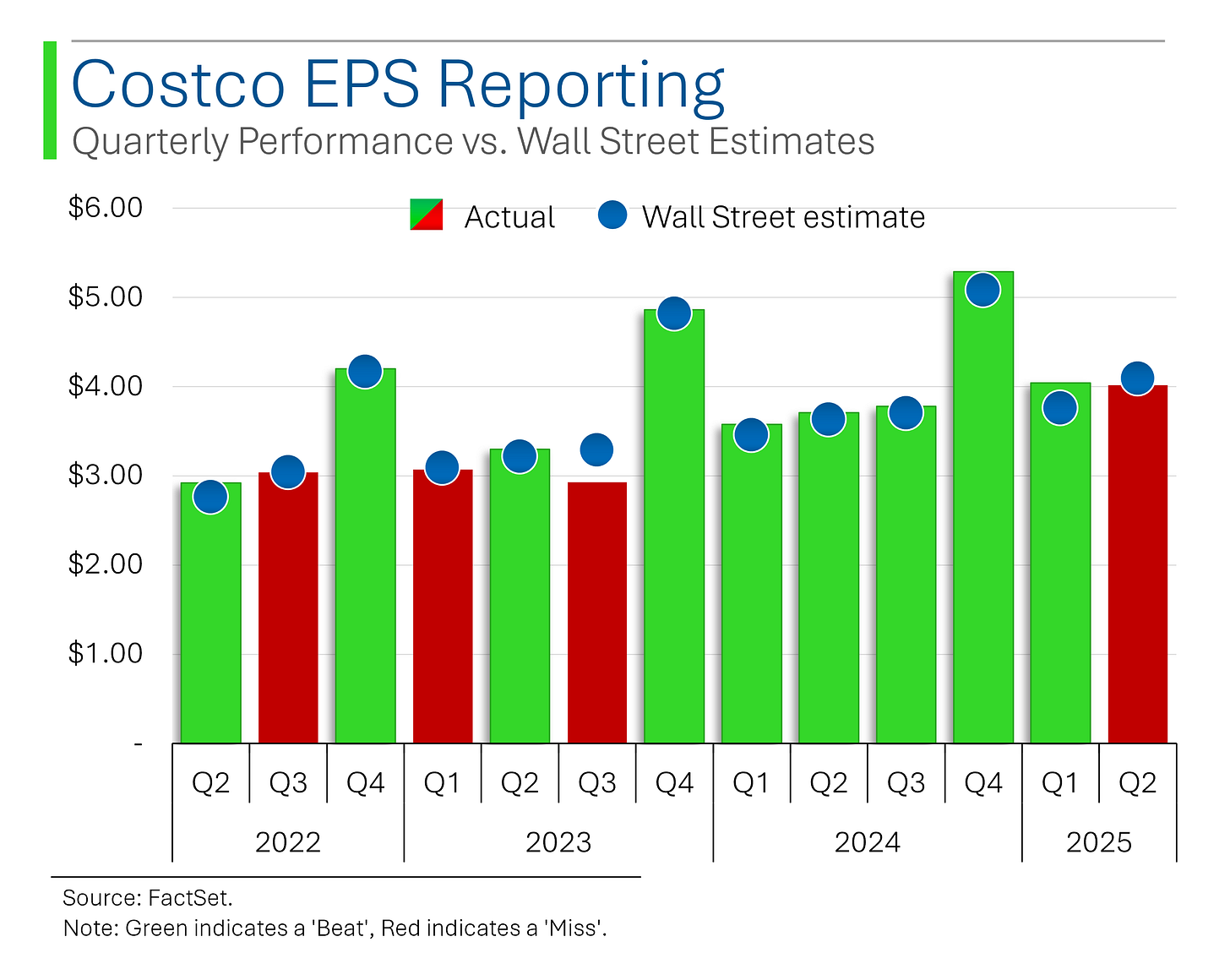

Historically, however, Costco reporting is usually a non-event. As you can see above, while the company has its fair share of misses (red) on Revenue and EPS, the gap between reported figures and Wall Street estimates are usually very tight.

Q3 2023 stands out as a rare exception, as economic concerns saw a marked decline in higher margin non-essentials (home furnishings, jewelry, electronics). That said, revenue only came up 1.6% shy of estimates so not exactly disaster.

As a big, high quality retailer, Costco would be expected to be a dividend investor’s best friend but sadly this isn’t the case as their dividend yield is a paltry 0.5%.

Their dividend track record is still pretty impressive though: Regular dividends have grown by an average of 13.2% annually since 2011 and every few years they announce a surprise special dividend to investors, with the most recent being a $15 one in 2024.

Taking into account the special dividends, the average dividend yield (calculated at year end share prices) is actually ~1.8%. Not great, but not as tragic.

A big reason their dividend yield isn’t anything to write home about has to do with their valuation: Costco trades at a forward P/E multiple of 52.4x - which is f****** massive.

For example, if Costco traded at the S&P 500’s P/E of 21.1x then that 1.8% all-in dividend yield would be 4.5%. Much more respectable.

To illustrate just how crazy that premium is, consider that Costco trades at a P/E 2.0x and 1.9x that of Apple and Nvidia respectively.

Apparently $1.50 hotdogs and 200 box packs of Kraft Dinner > iPhones and AI compute.

In all seriousness, beyond the steady, consistent growth offered by Costco, the investor base rightfully appreciates the straight-forward, transparent way management runs the company - which is something of a rarity these days.

Costco reporting is tight to GAAP accounting and extremely transparent:

No adjusted earnings games (a big issue with tech companies):

No aggressive capitalization, inventory tomfoolery or revenue pull-forwards;

No hiding share-based compensation;

Low leverage with expansion capital primarily coming from free cash flow

It’s easy to see why investor’s love Costco but buying the stock is like shopping there without a membership: expensive and no free samples.

Joke Of The Day

On a Miami to Chicago flight, there was a lively youngster who nearly drove everyone crazy. He was running up and down the aisle when the flight attendant started serving coffee. He ran smack into her, knocking a cup of coffee out of her hand and onto the floor.

As he stood by watching her clean up the mess, she glanced up at the boy and said, ‘”Look, why don’t you go and play outside?”

Trivia

Today’s trivia is on Costco (duh).

Which company did Costco merge with in 1993?

A) Price Club

B) Price Club

C) Sam's Club

D) BJ's WholesaleWhen was Costco founded?

A) 1976

B) 1983

C) 1987

D) 1991Where does the name 'Kirkland' come from?

A) CEO's hometown

B) Original supplier

C) Original Costco HQ location

D) Founder's middle nameWhat is true about Costco’s famous cafeteria hot dogs?

A) It’s seasonal

B) Price fluctuates yearly

C) It’s been $1.50 since 1985

D) It includes friesWhen did Costco first reach $1 billion in sales?

A) 1992

B) 1985

C) 1989

D) 1991Which of these is NOT sold at most Costco warehouses?

A) Caskets

B) Gold bars

C) Firearms

D) Hearing aids

(answers at bottom)

This Week In History

May 20, 1498 – Vasco da Gama reaches India

The Portuguese explorer lands in Calicut, opening direct sea trade between Europe and Asia and initiating centuries of colonial competition.

May 25, 1961 – JFK proposes the moon landing

Kennedy’s “We choose to go to the moon” speech launched the Space Race, a major new front in the Cold War. Baller.

May 20, 1927 – Charles Lindbergh takes off on transatlantic flight

His solo trip from New York to Paris made him a global icon and demonstrated aviation’s new role in geopolitics and transportation.

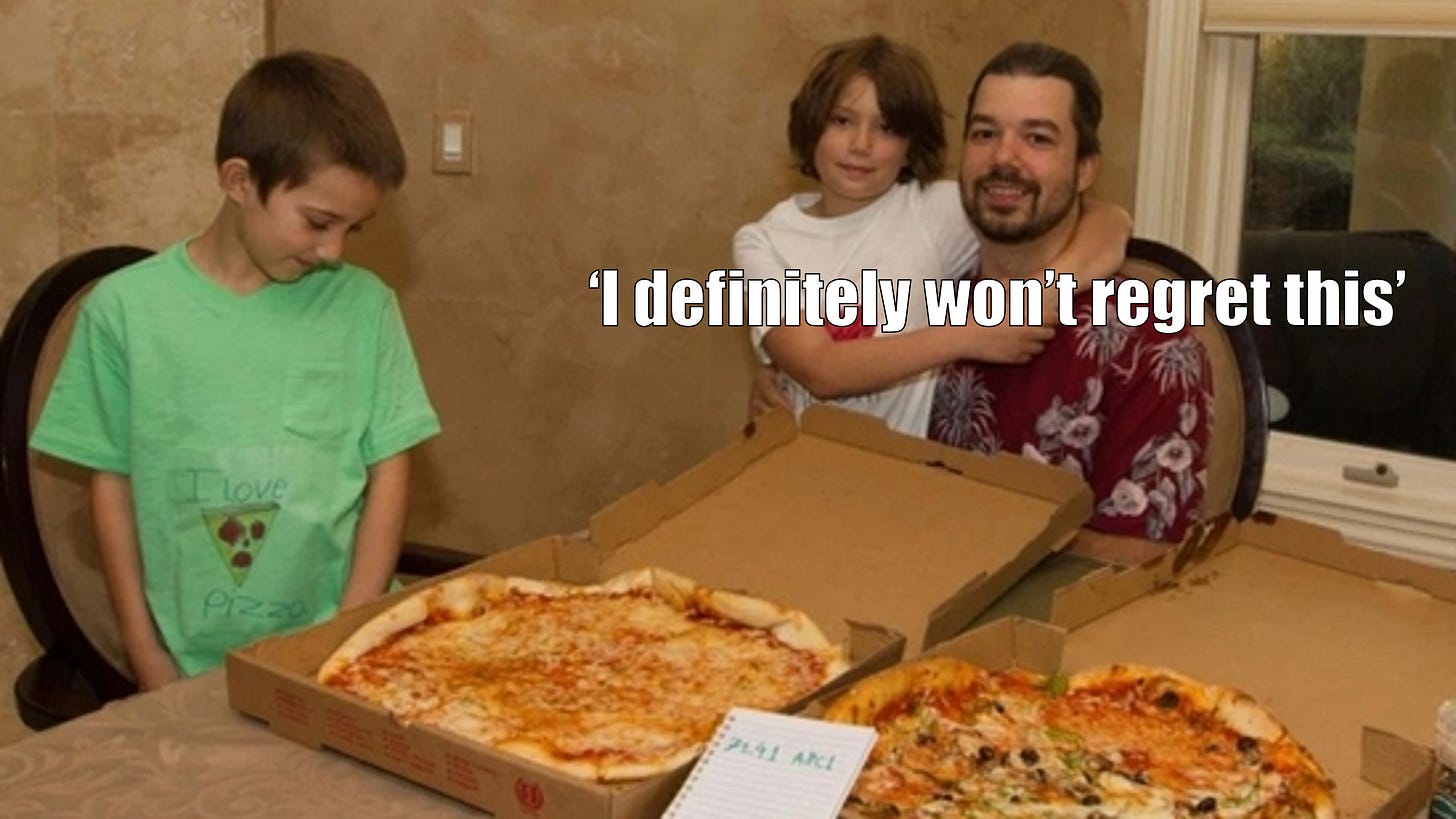

May 21, 2010 – Bitcoin's first known commercial transaction

A programmer pays 10,000 BTC for two pizzas, a landmark moment in cryptocurrency history. At the current BTC price of $108k, those pizzas cost $1,080,000,000. Gulp.

May 25, 1977 – Star Wars premieres

The movie’s release changed the business of film financing, merchandising, and marketing forever.

Market Update

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) In 1993, Costco merged with Price Club.

B) Costco was founded in 1983.

C) ‘Kirkland’ is the original Costco HQ location.

C) Costco’s hot dogs have been $1.50 since 1985.

B) Costco hit $1 billion in sales in 1985. Pretty good for a three year old company.

C) Costco doesn’t sell firearms. Not even in bulk.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Hey Ryan, how are you? I really miss your stuff! Is StreetSmarts dead, or is it just on hiatus?