🔬Commodities Update, Inflation Expectations Chill-Out, and Much More

"Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years"

- Warren Buffett

"In God we trust; all others bring data"

- Michael Bloomberg

The big U.S. markets had another strong day (S&P 500 +0.39%, Nasdaq +0.20%) reaching fresh highs for the year.

10 of 11 sectors closed in the green with Staples (+1.0%) and Industrials (+0.9%) leading the way. Only Communication Services (-1.0%) was out of step.

Gold continued its trip downwards (-1.0%) and Oil was flat (+0.1%). Bitcoin futures were down 9.1% (ha!) following the big rally over the last month.

The Nasdaq announced a shake-up to its Nasdaq 100 index:

Additions: DoorDash ($Dash), MongoDB ($MDB), CDW ($CDW), Coca-Cola Europacific ($CCEP), Roper ($ROP) and Splunk ($SPLK)

Removals: eBay ($EBAY), Align ($ALGN), Enphase Energy ($ENPH), JD.com ($JD), Lucid Group ($LCID), and Zoom ($ZM).

Street Stories

COMMODITY UPDATE - 2023 has made for a wild year in equities due to all of the macro factors impacting the market, including shooting wars, record inflation and interest rates, and a recession that was supposed to have happened months ago. We shouldn’t ignore the commodity markets, however, as the impact there has been just as pronounced, so I thought it would be helpful to do a brief overview of how things have shaped up this year.

Despite all the games OPEC has played this year trying to restrict production to prop up the price, oil is down on the year, having started January at $80 a barrel. With demand slowing and excess production from non-OPEC producers, all OPEC seems to have done is just diminish its own market share. Moreover, while reduced demand for Oil is a bad economic indicator, a lot of this is the result of a soft Chinese economy so it isn’t all bad news for Western nations.

Natural Gas has been pretty volatile but it’s worth noting that prices were heavily inflated in 2021 and 2022, in part due to supply issues, not least of it was all of the Russian pipeline shenanigans.

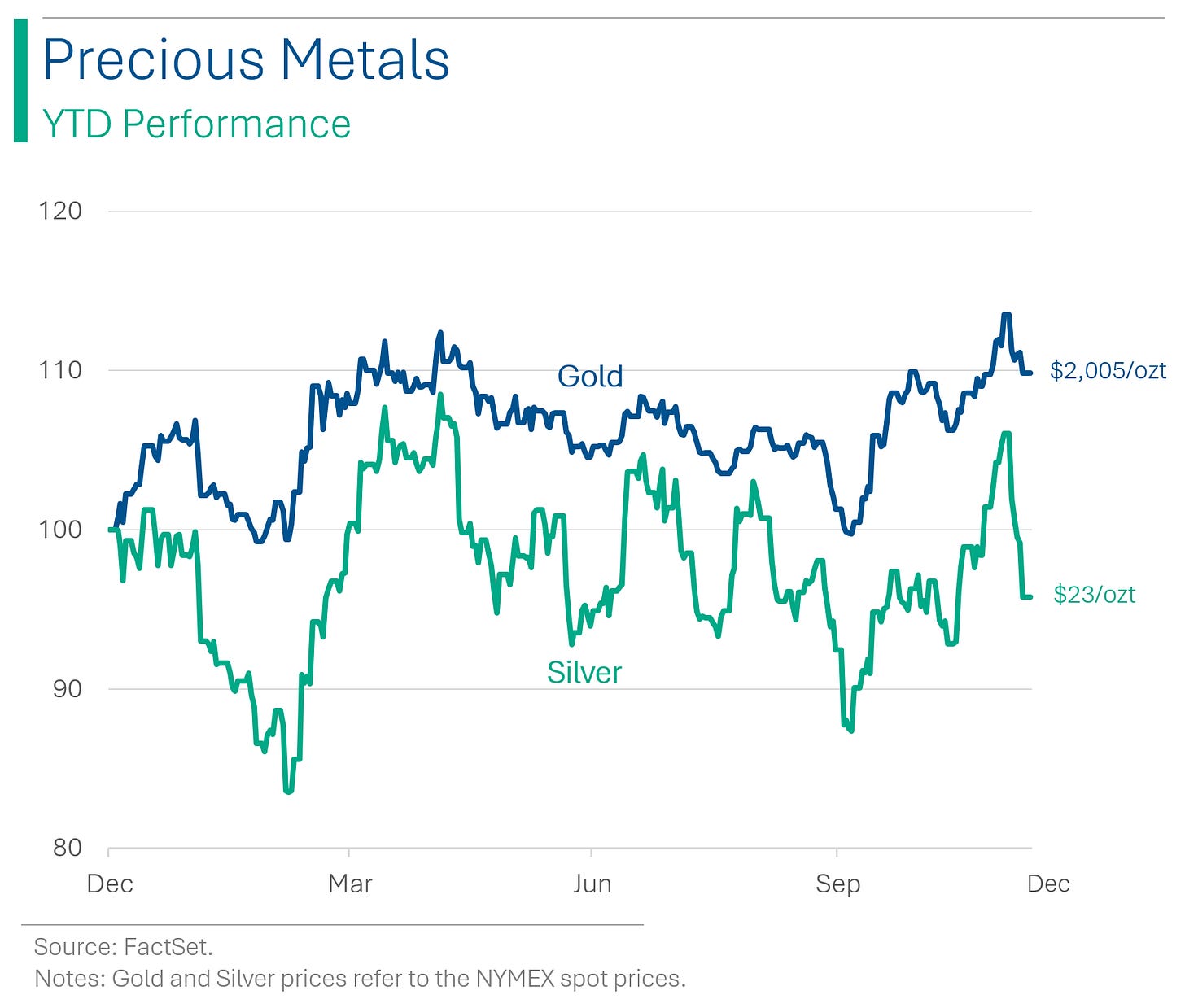

Gold is the greatest of the world’s safe-haven assets (sorry US Treasury Bonds) so during times of uncertainty it really comes into its own. Strength this year has come from some economic uncertainty but mostly driven by inflation that has at times appeared very sticky, but recently seems to be abating nicely.

Silver is a weaker version of the the above but also serves a more fundamental purpose in jewelry, so it’s soft performance this year is probably more indicative of general demand for luxury discretionary goods, which appears to be steadily weakening as budgets become tighter.

Iron Ore has had a standout year but it’s worth noting that during the pandemic prices peaked at around $220 per metric ton. Around 50% of iron is used in construction, which appear to be picking back up due to the ‘soft landing’ narrative but the supply/mining side is a bit more complicated.

Copper is also heavily tied to construction (~43%) but is more broadly linked to demand around consumer electronics (~20%), transportation (~20%) and consumer products (~10%), which have started to pick up as the economic picture began to look less murky.

Aluminum has been a bit of a weak spot but nothing critical. Its use is closely tied to transportation (~40%) which may be a bit soft at the moment. While the Western consumer remains relatively healthy, the outlook for larger durable goods isn’t perhaps as rosey.

Pork Bellies went on a wild ride this year, mostly due to speculation for inflation in things like feed. Important to note is that current prices in the $130 range are still a far cry from their 2021/2022 average in the +$200 range.

Soybeans, I think, have a similar story; now that the inflation picture seems a bit more clear, prices have become a bit more moderated, but still elevated from the $8-$10 range we saw in the five years before the pandemic.

Lumber has started to tick back up as the outlook for new housing looks more positive. New builds were stymied due to the record interest rates that homebuilders were forced to take on but as that picture transitions to a more manageable outlook, prices have ticked higher.

INDIAN STOCK RALLY - India's National Stock Exchange has surpassed Hong Kong's in market value, becoming the world's seventh largest with a capitalization of $3.989 trillion. The Nifty 50 index in India has seen a near 16% increase this year, contrasting with Hong Kong’s Hang Seng index's 18% decline. Economic optimism in India, driven by factors like increased liquidity and positive global macro trends, is high as the country approaches its 2024 general elections, with expectations of a continued Bharatiya Janata Party government. In contrast, Hong Kong faces challenges due to its ties to mainland China, with a downgraded economic outlook and expectations of moderate growth in the coming years.

BUFFETT MOVING MORE TOWARDS CASH - So far in 2023, Warren Buffett's Berkshire Hathaway sold $28.7 billion worth of stocks, with economist Steve H. Hanke interpreting this as a preparation for a potential recession due to significant contractions in the U.S. money supply. However, other investors, like David Wagner, suggest that Berkshire Hathaway's actions might be driven by increased insurance costs (he does own a lot of insurance companies) and a strategy to hold cash for potential market opportunities. Any way you slice it, Buffett moving out of the market towards cash is a sign he doesn’t think the risk/reward of stocks is particularly appealing at the moment. (Newsweek has the full story)

INFLATION EXPECTATIONS - The New York Fed’s Survey of Consumer Expectations showed a drop in expected 1-Year inflation to 3.4% - its lowest level since April 2021. Data for three and five years out was unchanged at 3.0% and 2.7% respectively. (New York Fed)

IS PLAYTIME OVER FOR TOY INDUSTRY? - Hasbro is cutting nearly 20% of its workforce, amounting to about 1,100 jobs, due to weaker-than-expected toy sales and a challenging market, adding to 800 layoffs earlier this year. The company, facing its fourth consecutive quarterly loss with a 10% drop in third-quarter sales, is implementing cost-cutting measures to save $100 million annually, including vacating its Providence office. In contrast, Mattel, buoyed by the success of the "Barbie" movie, has seen an upturn in sales, expecting a flat sales year in 2023 compared to Hasbro's struggle with bloated inventories and reduced consumer spending. (WSJ has more)

Joke Of The Day

I have a joke about trickle-down economics, but most people won’t get it.

Hot Headlines

Reuters | Weight loss from Lilly's Zepbound reversed after stopping treatment, study shows. To quote Steve Jobs, ‘It’s not a bug, it’s a feature’.

CNBC | Regulators caught Wells Fargo, other banks in probe over mortgage pricing discrimination. Black and female borrowers got fewer pricing exceptions than other customers, the Consumer Financial Protection Bureau has found. Not a good look, but this is the bank from the 2018 account fraud scandal.

EW | Senator Elizabeth Warren introduces crypto crackdown bill along with five co-sponsoring. “[W]e need new laws to crack down on crypto’s use in enabling terrorist groups, rogue nations, drug lords, ransomware gangs, and fraudsters to launder billions in stolen funds, evade sanctions, fund illegal weapons programs, and profit from devastating cyberattacks.” Dammmmn. No sugar coat.

Axios | Epic Games wins lawsuit against Google's Play Store. Stems from 2020 when Epic updated its popular Fortnite game on iOS and Android, adding options for players to buy virtual items directly from Epic, bypassing the phone-makers' (ridiculous) 30% cut on in-app purchases.

CNBC | Ford cuts planned 2024 production of electric F-150 Lightning in half. From 3,200 to 1,600.

Trivia

This week’s trivia is on major financial crises or bubbles.

The 'Panic of 1837' in the United States was partly caused by a speculative bubble in which sector?

A) Gold

B) Land

C) Industrial stocks

D) CottonIn what year did Japan's asset price bubble burst, leading to the 'Lost Decade'?

A) 1985

B) 1990

C) 1995

D) 2000Which country experienced a major banking crisis in 2008, leading to the collapse of all its major commercial banks?

A) Greece

B) Ireland

C) Iceland

D) Spain

(answers at bottom)

Market Movers

Winners!

Macy's (M) [+19.5%]: Received a takeover bid from Arkhouse Management and Brigade Capital at $21 per share, a ~21% premium, valuing the deal at $5.8B.

The Cigna Group (CI) [+16.7%]: Ended merger talks with HUM over financial disagreements; announced a $10B repurchase program and received an upgrade to buy at Jefferies.

Shake Shack (SHAK) [+9.6%]: Confirmed 4Q23 guidance with strong fundamentals; CEO Randy Garutti to retire in 2024.

Broadcom (AVGO) [+9.0%]: Reinstated as buy at Citi, optimistic about AI growth and software focus post-VMware acquisition.

Losers!

Gildan Activewear (GIL) [-10.8%]: President and CEO Glenn Chamandy stepped down; Vince Tyra appointed as new President and CEO, starting 12-Feb-24.

RingCentral (RNG) [-6.8%]: CEO Tarek Robbiati to leave the company and resign from the board on 8-Dec-23; founder Vlad Shmunis resumes full-time CEO role.

CRISPR Therapeutics (CRSP) [-6.6%]: Downgraded to underperform at TD Cowen due to overvaluation and unrealistic market expectations for Casgevy.

Market Update

Trivia Answers

B) The 'Panic of 1837' was partially driven by a asset bubble in land.

B) Japan’s asset bubble burst in 1990. The TOPIX index is still well below its all-time highs.

C) Iceland lost all of its major banks in the GFC.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.