Beta ≠ Risk... in charts!

Plus: Peloton is less terrible but the Jobs Report is

"The obvious rarely happens, the unexpected constantly occurs"

- Bill Gross

“Sometimes that light at the end of the tunnel is a train”

- Charles Barkley

Hey Readers!

Trade wars, DeepSeek and a rampaging DOGE. I’ll spare you and say that none of that I will be talking about this week - just good ole stocks!

Have a good weekend,

- Ryan

Street Stories

Beta ≠ Risk

If you’ve ever taken an investing course in school or found yourself fumbling through some esoteric finance tomb, you’d likely have been programmed to believe that Beta - a metric that measures the volatility of a stock or fund relative to the overall stock market - means risk.

High Beta = High Risk.

But is that really the case?

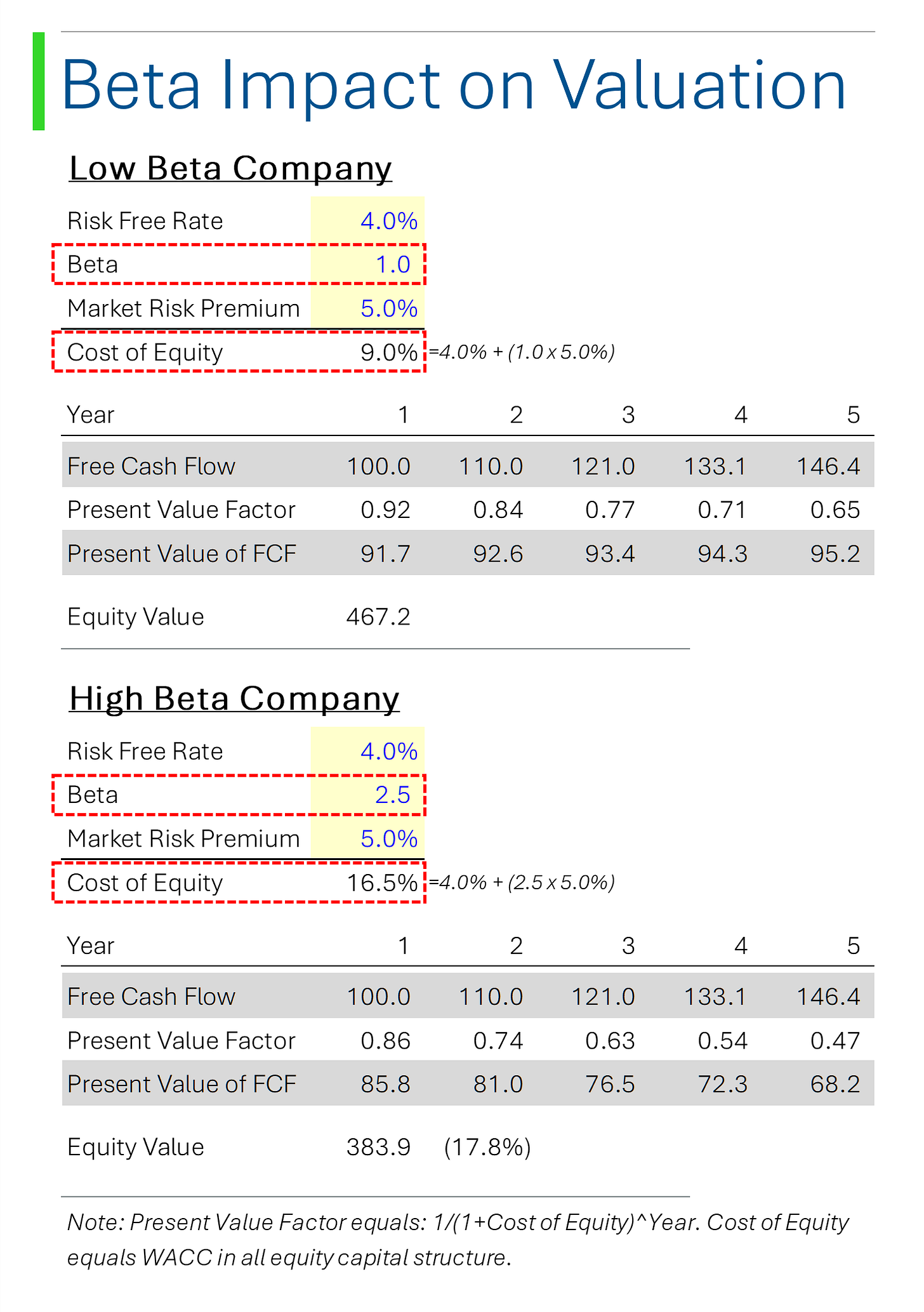

Other than its use in financial hedging (where β represents the ratio of the market needed to hedge out the systematic risk associated with a security), β is most commonly found in Discounted Cashflow Models (DCFs) where it’s place within the Weighted Average Cost of Capital (WACC) directly impacts the discount rate at which to evaluate the future cash flows of a security.

In essence, a higher β means a higher discount rate, which means a lower present value of future cash flows.

Before going any further, it might be helpful to explain what exactly β is. In nerd terms, it’s the covariance of a security with respect to the market divided by the variance of the market.

In practical terms, it’s what you get when you plot the returns of the security relative to the returns of the market. For example, Apple’s daily share performance over the last 12 months is plotted below relative to the performance of the S&P 500. The slope of this line (0.89) is Apple’s β.

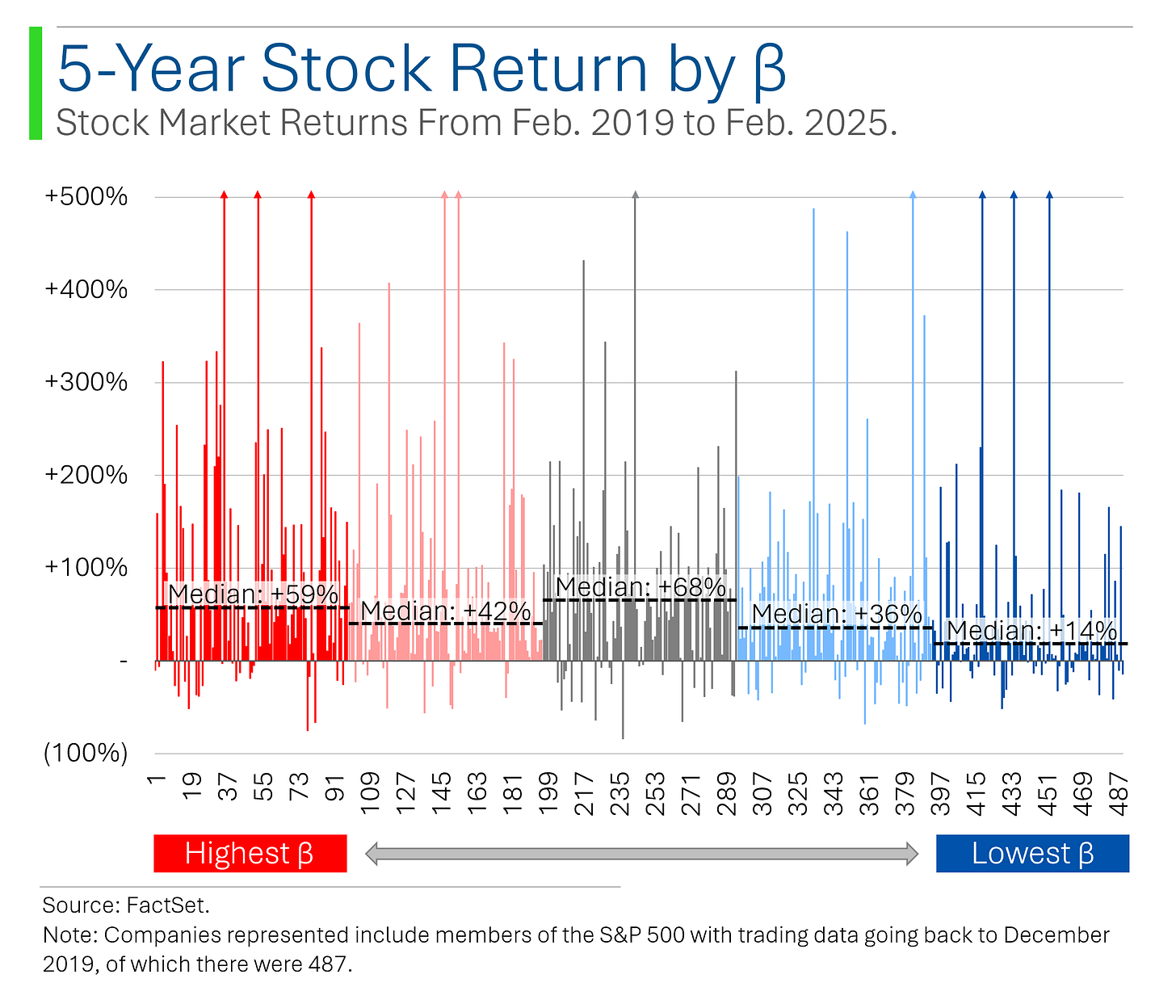

Anyway, to see if there’s any truth to classifying high β stocks as risky, I’ve lumped the companies in the S&P 500 into buckets. I calculated the 3-Month β of each company as at December 31st, 2019 and compared the returns of these stocks over the next five years (until December 31st, 2024).

The below illustrates the ranges of β within each bucket.

As you can see below, the highest β stocks have actually performed quite well, with a median return of +59% over the last 5 years vs. only +14% for the lowest bucket.

Surprisingly, the best performing bucket was actually the middle group (β between 0.9 and 1.1), with a median return of +68%.

Now, ‘Risk’ can be looked at in a number of different ways. In my opinion, real risk is the threat of a permanent loss of capital. Not volatility. And not β.

So sure, maybe high and medium β stocks have higher expected returns, but they wouldn’t be expected to have the same downside protection. Right? RIGHT?!

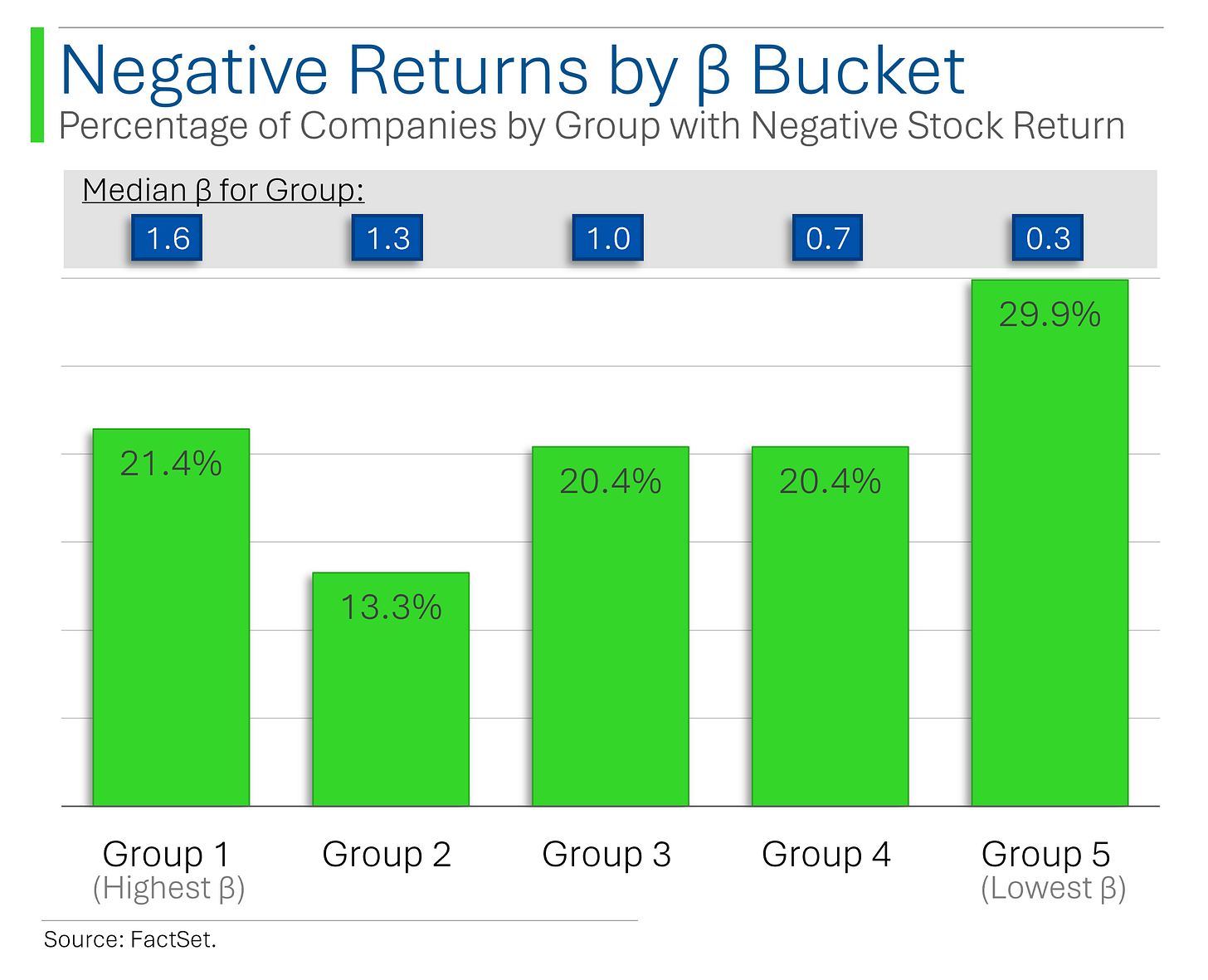

Well, here convention would be wrong again. As you can see below, 30% of companies in the lowest β bucket actually had negative returns over the last 5 years.

The ‘least risky’ group was actually the modestly high β bucket (Group 2) with only 13% of stocks ending the period in the red.

Diving in a bit further really puts the idea of using β as a proxy for risk on its head:

The ‘modestly high β’ bucket (Group 2) has had the best downside protection;

The ‘highest β’ bucket (Group 1) crushed the ‘lowest β’ bucket (Group 5) on returns (67% of stocks returned >25% vs. 38%) and downside risk (21% negative return vs. 30%);

The best group of all was arguably the ‘middle β’ bucket (Group 3), with the highest median return (+68%); the second lowest probability of a negative return (20%); and the greatest likelihood that a stock was up >50% (59%).

Probably the best quote about investing comes from Benjamin Graham when he wrote:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Over the long-term, the change in the value of a company’s shares will generally reflect the change in their profitability and future growth prospects. Companies with lower growth; opaque future prospects; and higher operating risk should trade at a discount to their peers with higher growth; clear and defensible market positions; and sound operations.

Some of this may well be captured in the day-to-day performance of the shares but share price volatility - much less β - is by no means a true measure of the underlying fundamentals of a business.

If it were, then Nike and Disney (βs of 0.7 and 0.6 in 2019) probably wouldn’t be down 25% and 23% respectively over the last five years. While Amazon and Adobe (current βs of 1.6 and 1.5) wouldn’t have seen their revenue grow like clockwork.

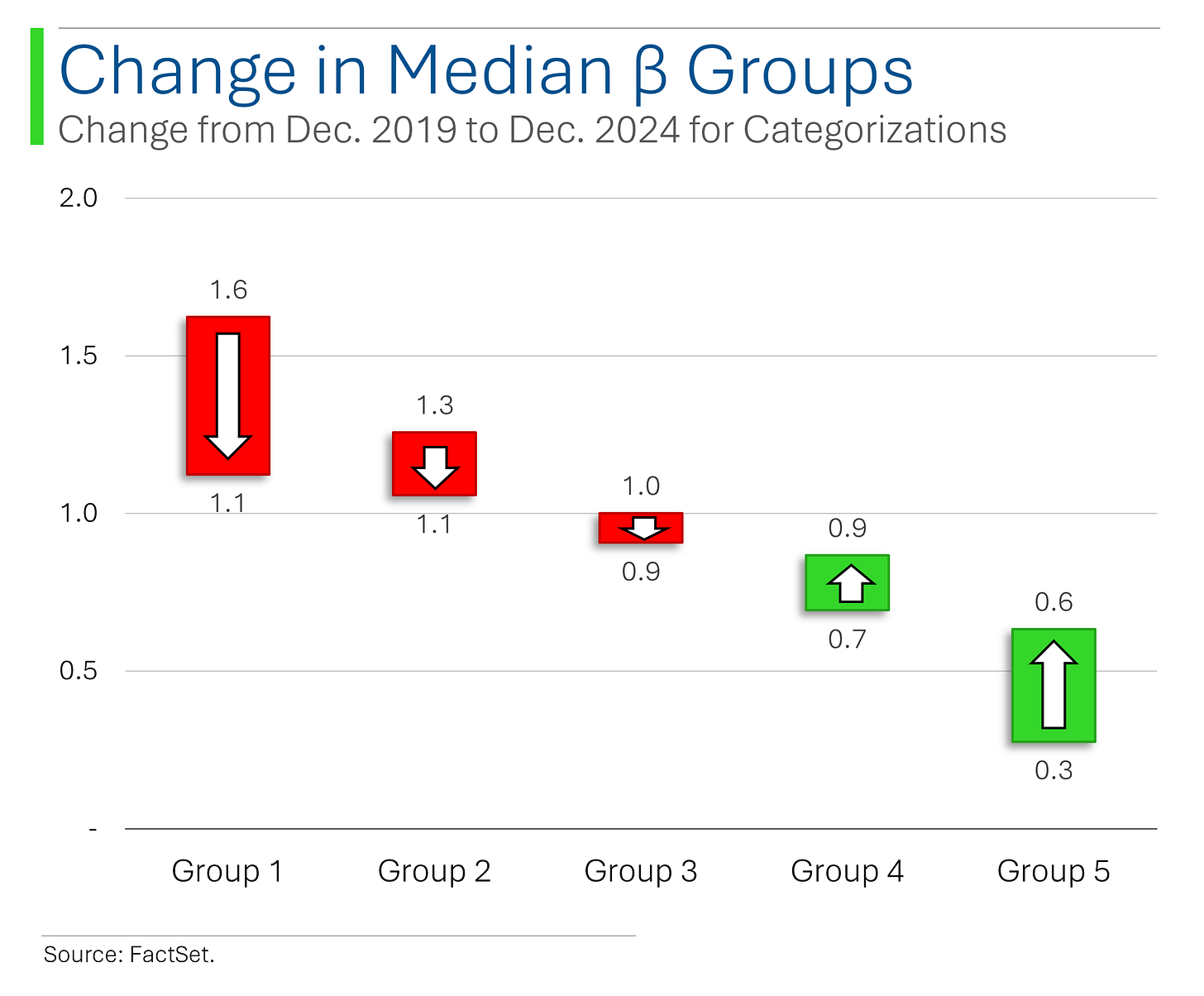

And since I couldn’t shoehorn this anywhere above, I also found it interesting that βs seem to normalize over time.

Peloton Shares… Go Up?

Peloton is one of my favorite stories. Along with Zoom, they were the poster child of the Pandemic’s ‘Everything Bubble’ when optimized, digitized and ‘fun’ fitness looked like the next big thing.

At their peak, the company held a staggering market cap of $43 billion. For context, Ford is only worth $36 billion.

Obviously Peloton is no longer worth $43 billion any more.

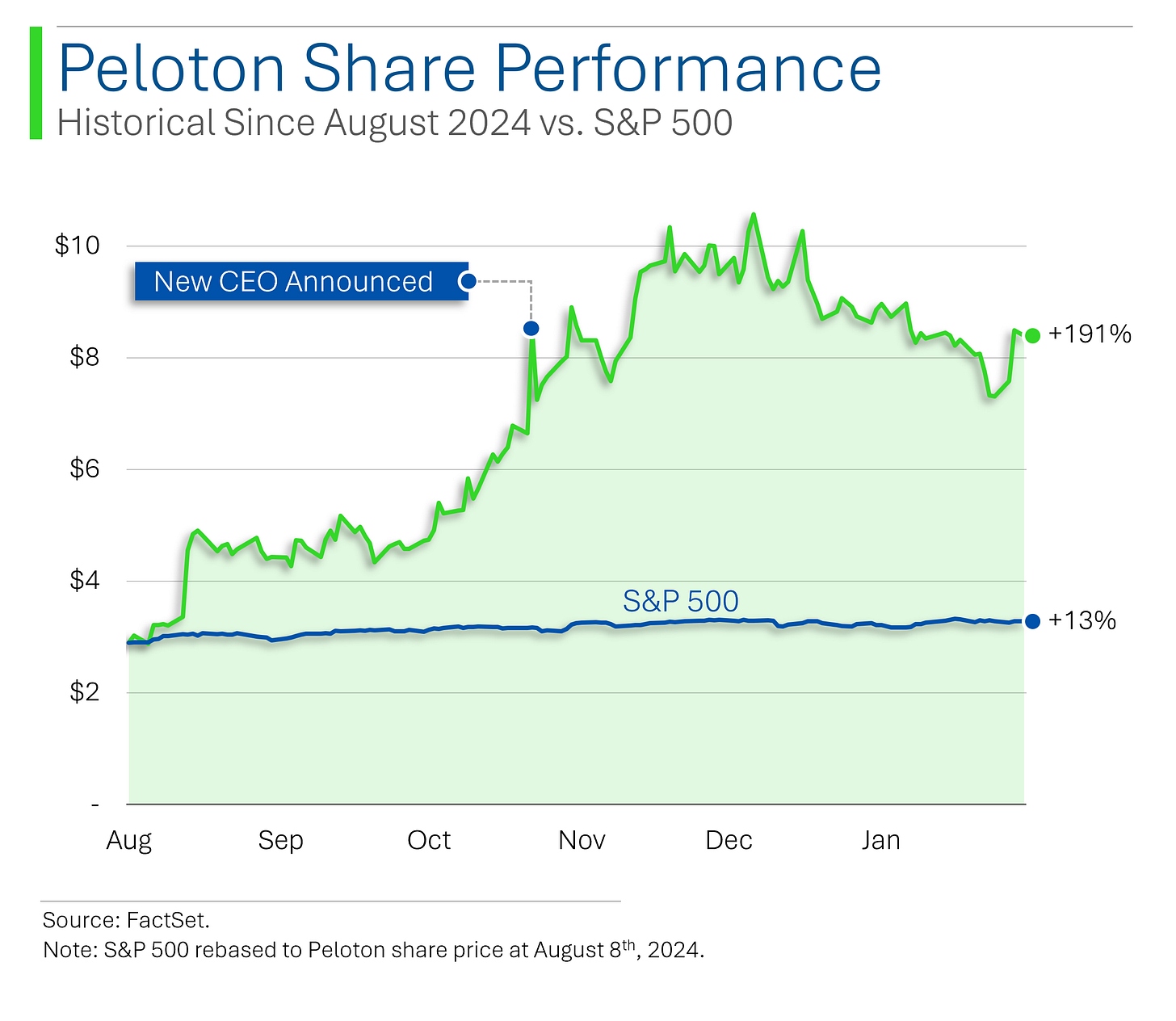

After their astonishing decline of around 97%, by August 2024 from their 2021 peak, most of us thought the company was dead in the water. Then it did something else astonishing: It started going up.

A lot up.

Since early August, Peloton is up an incredible 191%. Again with the context, Nvidia is only up 18% since then.

The triggers for this resurgence haven’t been anything too transformative: The company inked a decent distribution deal with Costco in October, and a week later announced a new CEO (Peter Stern, a former Apple executive and co-founder of Apple Fitness+).

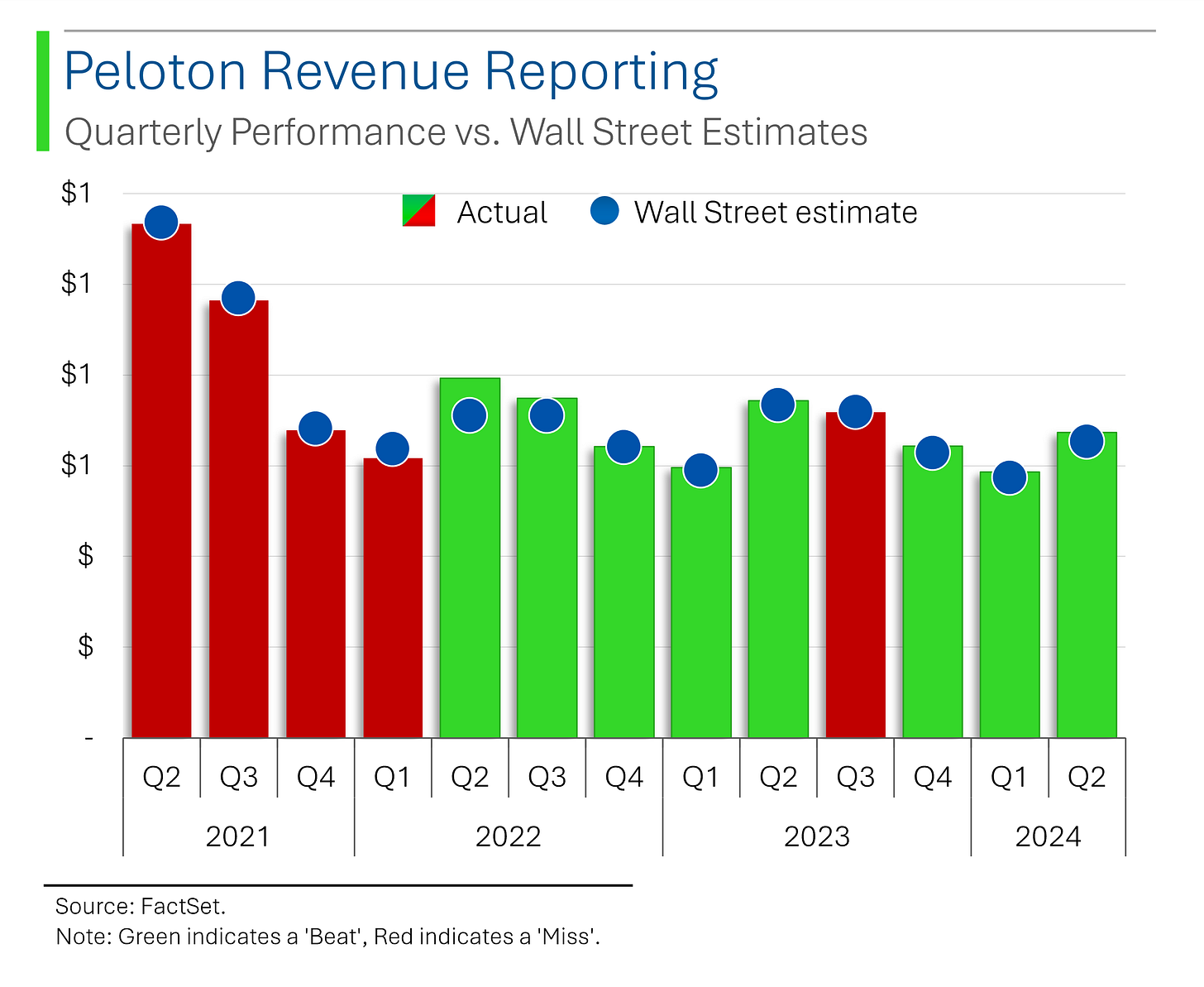

Shares also popped earlier this week after the company announced its Q2, with a monster beat on EBITDA getting the Street excited - while a modest beat on Revenue and a slight miss on EPS were mostly neglected.

Part of the excitement for Peloton is the pivot towards Subscription revenue, which has proved rather sticky and continues to see steady growth outside of stationary bikes.

In 2021, Connected Devices ( sales of bikes, treadmills, etc.) represented 78% of revenue. For 2025, that is expected to represent only 30%.

If investors have gathered renewed excitement for the company, Wall Street has been a bit more reticent, with only 18% of analysts calling the shares a ‘buy’.

While 77% of the Street is fence sitting at ‘hold’ - likely some PTSD from the fact that 85% of them had a ‘buy’ on the stock as it began plummeting in 2021.

Non-Farm Payrolls

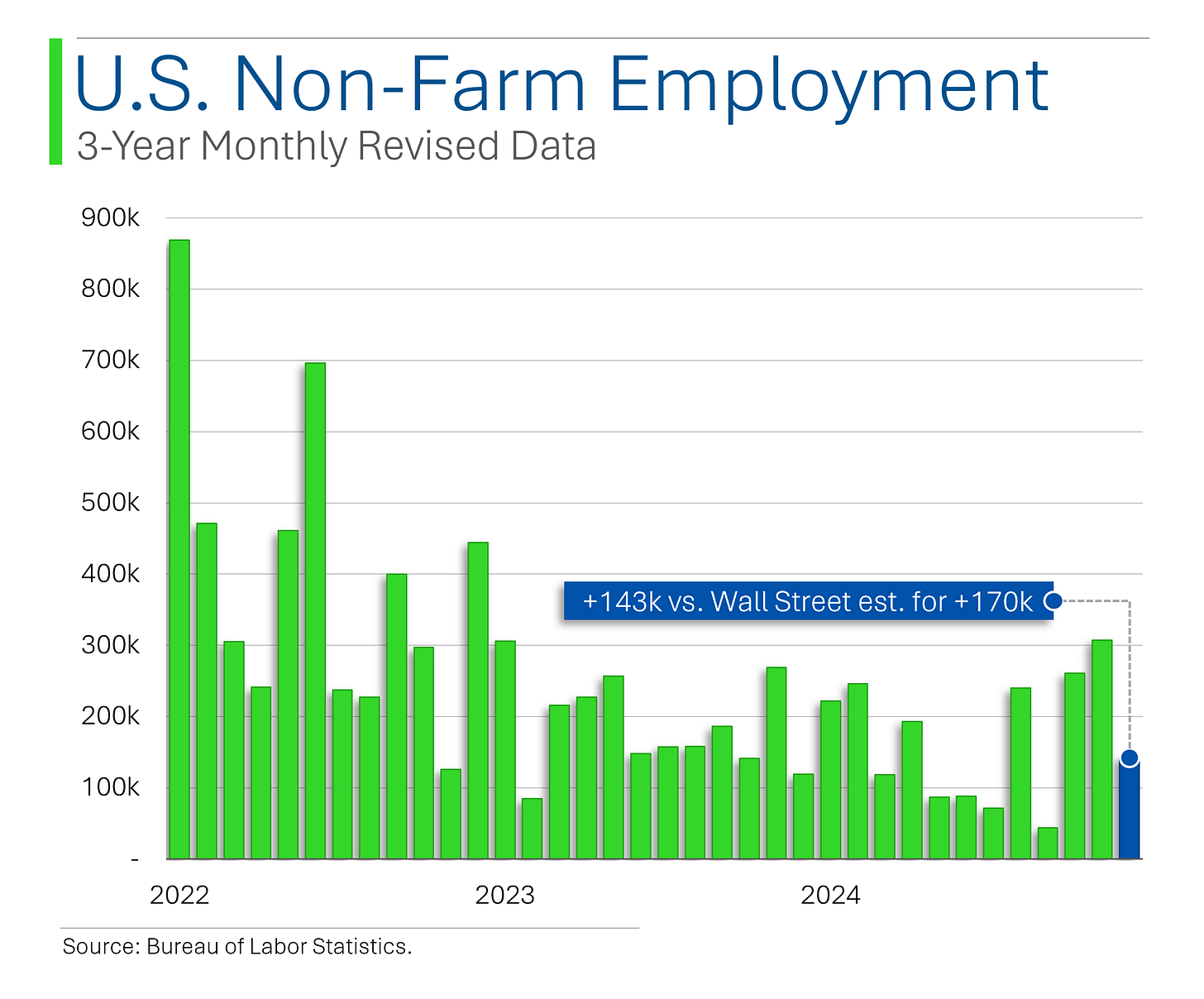

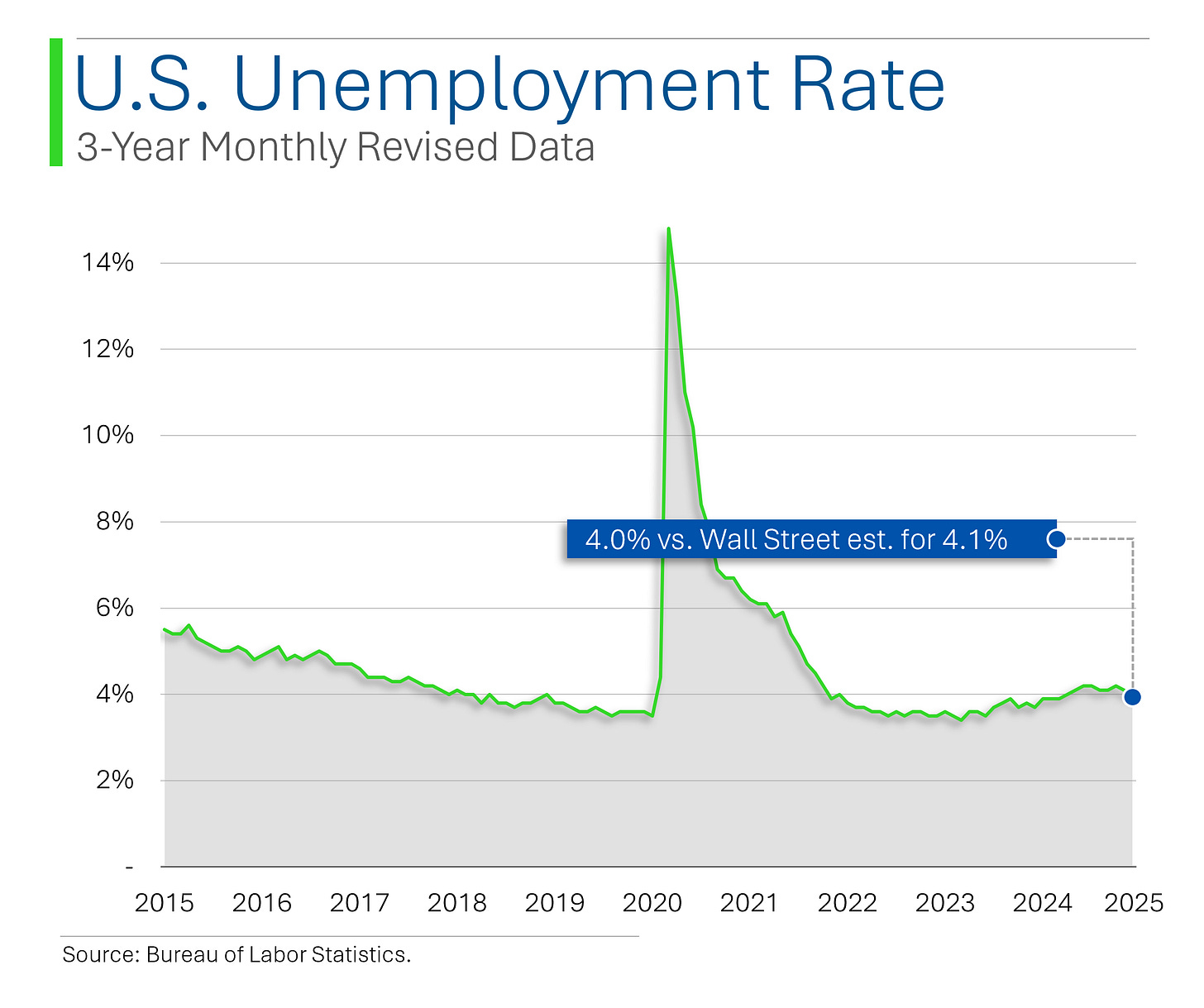

U.S. job growth in January underwhelmed at 143k (vs. 170K expected), but the unemployment rate somehow managed to drop to 4.0%, thanks in part to statistical adjustments that make direct comparisons… bemusing.

Meanwhile, wage growth refused to cooperate with the Fed’s easing hopes, jumping +0.5% m/m and +4.1% y/y, proving once again that inflation’s ghost isn’t quite ready to be exorcised. Healthcare, retail, and government led hiring, while mining and oil & gas took a nap.

The Fed, ever the cautious referee, will likely sit tight on rates, as this report is neither cold enough to scream recession nor hot enough to reignite the inflation panic. Markets reacted with a classic “bad news is good news” wobble, as investors recalibrated their rate cut fantasies toward June - because hope, much like inflation, is stubborn.

Joke Of The Day

Two investment bankers meet at a busy chicken market:

A: If I can guess how many chickens you have in that bag, can I have one?

B: You can have both

A: Three

Macro Update

Consumer Sentiment [Friday]

University of Michigan Consumer sentiment fell to 67.8 (vs. 72.0 expected, 71.1 prior), marking the second straight decline and the lowest reading since July, with declines across demographics.

Year-ahead inflation expectations jumped to 4.3% (from 3.3%), the second consecutive increase, while long-run expectations ticked up to 3.3% (from 3.2%), signaling renewed inflation concerns.

Markets reacted negatively, as fears of persistent inflation and potential tariff impacts raised doubts about the Fed's willingness to proceed with rate cuts.

ISM Services [Wednesday]

ISM Services Index missed at 52.8 (vs. 54.0 expected, 54.0 prior), with new orders falling to 51.3 (from 54.4), though employment improved for the fourth consecutive month to 52.3 (from 51.3).

ISM Manufacturing [Monday]

ISM Manufacturing Index rose to 50.9 (vs. 49.6 expected), marking the first expansion after 26 straight months of contraction, with new orders improving to 55.1 (from 52.1).

Employment rebounded to 50.3 (from 45.4), while inflation pressures persisted as the Prices Index increased to 54.9 (from 52.5).

Trivia

Today’s trivia is on Warren Buffett’s Berkshire Hathaway.

Before Warren bought in, Berkshire Hathaway was initially a company in which industry?

A) Insurance

B) Textile manufacturing

C) Railroad transportation

D) Food and beverageBuffett has remained steadfast about not doing a stock split for Berkshire’s Class A shares. Currently one share costs:

A) $2,962

B) ~$109k

C) ~$297k

D) ~$712kWhat major financial move did Berkshire Hathaway make during the 2008 financial crisis?

A) Sold all stock investments

B) Invested $5 billion in Goldman Sachs

C) Filed for bankruptcy protection

D) Bought distressed real estateBerkshire Hathaway holds a significant stake in which beverage company?

A) PepsiCo

B) Coca-Cola

C) Dr. Pepper

D) Monster Beverage

(answers at bottom)

This Week In History

Battle of Stalingrad Ends (February 2, 1943)

The Soviet Red Army defeated Nazi Germany in one of WWII’s bloodiest battles. This marked a major turning point in the war, shifting momentum in favor of the Allies.

Nelson Mandela Released from Prison Announced (February 2, 1990)

South African President F.W. de Klerk declared that Mandela, imprisoned for 27 years, would soon be released, signaling the beginning of the end of apartheid.

First Paper Money Issued in America (February 3, 1690)

Massachusetts became the first colony to issue paper currency, setting a precedent for modern banking and monetary systems.

Market Update

Market Movers

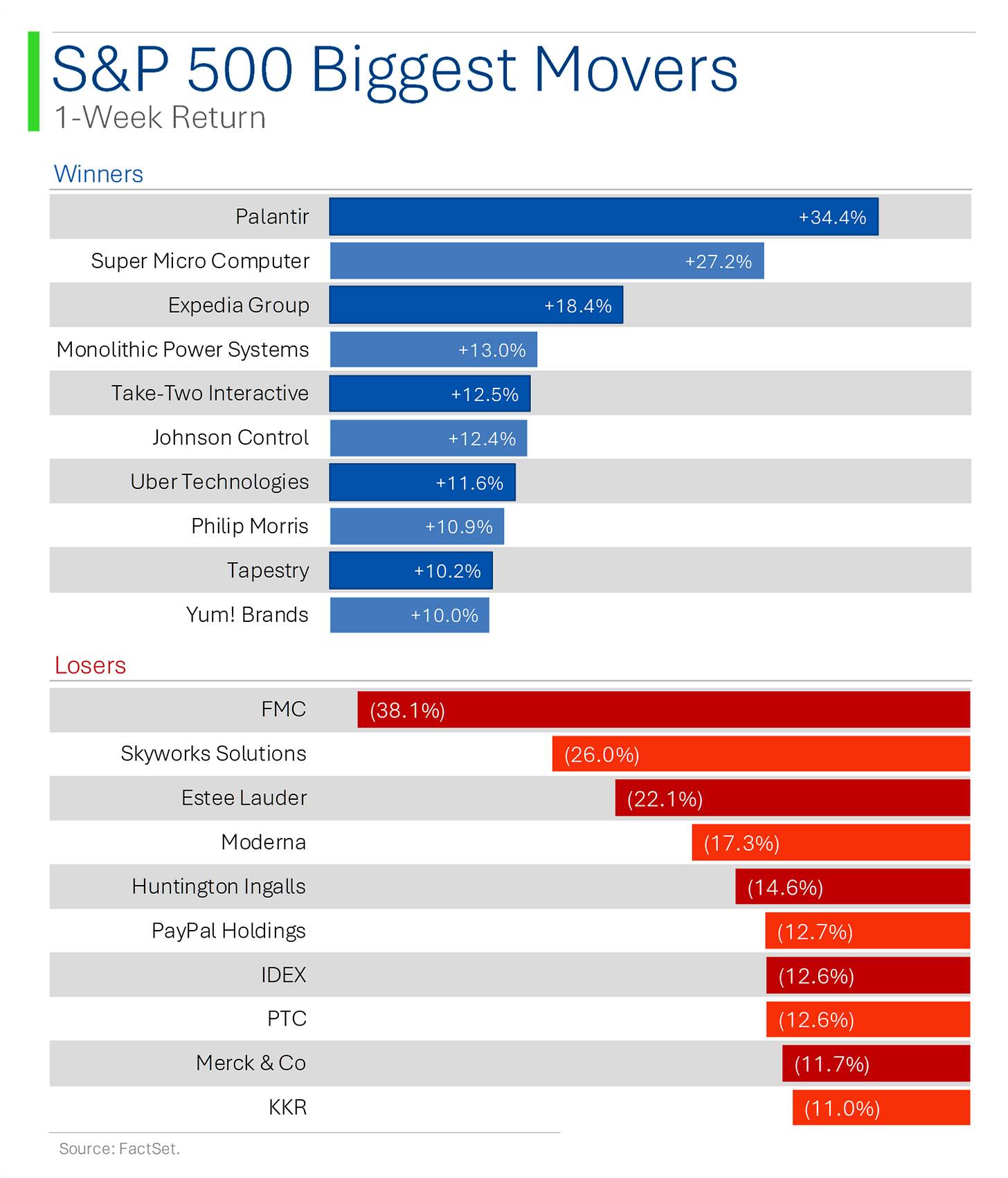

Friday:

Pinterest (PINS) [+19.1%] Q4 earnings and revenue beat thanks to AI-driven improvements, strong user growth, and accelerating ad impressions.

Cloudflare (NET) [+17.8%] Q4 earnings, revenue, and operating margins exceeded expectations, with strong enterprise demand, though Q1 revenue guidance came in a bit light.

Expedia Group (EXPE) [+17.3%] Q4 numbers impressed across the board, with a dividend reinstatement and optimism around Spring travel demand driving multiple analyst upgrades.

Uber Technologies (UBER) [+6.6%] Bill Ackman’s Pershing Square disclosed a 33.3M share stake in the company, fueling a stock jump.

Nike (NKE) [-4.3%] Citi downgraded the stock to neutral, citing ongoing margin pressures and the need for increased investment in demand creation.

Amazon (AMZN) [-4.1%] Q4 operating income beat expectations, but Q1 guidance underwhelmed due to FX and leap-year headwinds, though AI momentum remained strong.

Thursday:

Fannie Mae (FNMA) [+14.6%] Shares surged after reports that the new HUD Secretary intends to prioritize privatizing the GSEs.

Peloton Interactive (PTON) [+12.0%] Q2 EBITDA crushed expectations on cost savings, prompting upward revisions to FY guidance and an improved subscription outlook.

Ralph Lauren (RL) [+9.7%] Q3 earnings and revenue beat estimates across all regions, with upbeat FY25 guidance on revenue growth and margin expansion.

Roblox (RBLX) [-11.1%] Q4 bookings and DAUs came in light against high expectations, with cautious FY25 guidance adding to the downside.

Bausch + Lomb (BLCO) [-9.5%] Stock fell after the company rejected a private equity buyout offer, deciding not to move forward with a deal.

Honeywell International (HON) [-5.6%] Q4 EPS and revenue were solid, but soft FY25 guidance and plans to split into three companies pressured shares.

Wednesday:

Mattel (MAT) [+15.3%] Q4 profit and margins exceeded expectations, with strong demand for Hot Wheels and a promising product pipeline lifting FY25 guidance.

Super Micro Computer (SMCI) [+8.0%] Announced full production availability of Nvidia’s Blackwell Rack-Scale Solutions, further fueling AI-related optimism.

Nvidia (NVDA) [+5.4%] Stock climbed after Google revealed a $75B capex plan for AI infrastructure, with Nvidia's Blackwell chips gaining their first customer.

Advanced Micro Devices (AMD) [-6.3%] Q4 beat expectations, but disappointing data center results and guidance led to a pullback despite optimism about AI product transitions.

Tuesday:

Palantir Technologies (PLTR) [+24.0%] Q4 crushed expectations with strong growth in government and commercial revenue, driving bullish sentiment on long-term momentum.

Spotify Technology (SPOT) [+13.2%] Q4 operating income, revenue, and user growth all topped estimates, with record Q4 net adds boosting investor confidence.

Grab Holdings (GRAB) [+12.6%] Bloomberg reported the company is in merger talks with GoTo, fueling speculation of a major deal.

Super Micro Computer (SMCI) [+8.6%] Stock climbed as investors anticipated a key FY25 business update, following past patterns of pre-announcement guidance.

Estée Lauder (EL) [-16.1%] Q2 results beat estimates, but weak retail sales in Asia and North America, plus sluggish product innovation, led to a disappointing outlook.

PayPal (PYPL) [-13.2%] Q4 EPS and revenue topped estimates, but slowing Braintree growth and shrinking margins offset optimism about a $15B share buyback plan.

Merck (MRK) [-9.1%] Q4 revenue and Keytruda sales were solid, but lower Gardasil demand in China and soft FY25 guidance hurt investor sentiment.

Monday:

IDEXX Laboratories (IDXX) [+11.1%] Q4 EPS and revenue beat, driven by strong diagnostic sales, though FY25 revenue guidance was slightly below expectations.

Tempur Sealy (TPX) [+6.0%] Stock rose after a judge denied the FTC’s attempt to block its acquisition of Mattress Firm, clearing a major hurdle.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) Berkshire Hathaway was originally in textile manufacturing.

D) One Class A shares costs ~$712k.

B) During the GFC invested $5 billion in Goldman Sachs.

B) BH is a big investor in Coca-Cola.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

I love your take on beta is not risk and the detailed analysis. That is why US big tech can act as hedges when they have the earnings, profitability, and margin growth to support their performances!

Great read on Beta. Many investors get lulled into the low vol, weak returns trap and avoid great companies.