Are Dividends Lame? Plus: The World's Greatest Money Factory

"Do not save what is left after spending, but spend what is left after saving"

- Warren Buffett

“Money is the best deodorant”

- Elizabeth Taylor

Hey Readers,

November is now in the books (for the stock market at least) and it’s been one crazy month. Hope you had a good Thanksgiving and are ready to put the Christmas lights up!

Thanks for reading!

All the best,

Ryan

Street Stories

The Dividend Conundrum

One of the alleged truisms of the stock market is that dividends are for mature, low growth companies. IE: If you’re paying a divy, you probably aren’t one of the cool kids anymore.

Sure, some big name Tech companies pay nominal dividends, like Apple (0.4% dividend yield) or Alphabet (0.1%) - but that’s mostly just to get around certain fund mandates that limit investment into companies that pay a dividend.

Certainly no one is invested in Nvidia for their beefy 0.0072% dividend yield…

So, as an outside-the-box, contrarian thinker (lol jk) I thought I would dive into the world of dividends and see if it’s true that divy payers are the old, slow growth fogies of the capital markets. And more importantly: Are they actually good investments?

To start, 400 of the 500 companies in the S&P pay a dividend (80%) with the average sitting at around a 2.2% dividend yield. In case curious, this number is 20.6% of companies in the techy Nasdaq.

The highest dividend payer is Walgreen’s at 11% - but that has more to do with the shares being down >85% in the last five years rather than the company being overly generous.

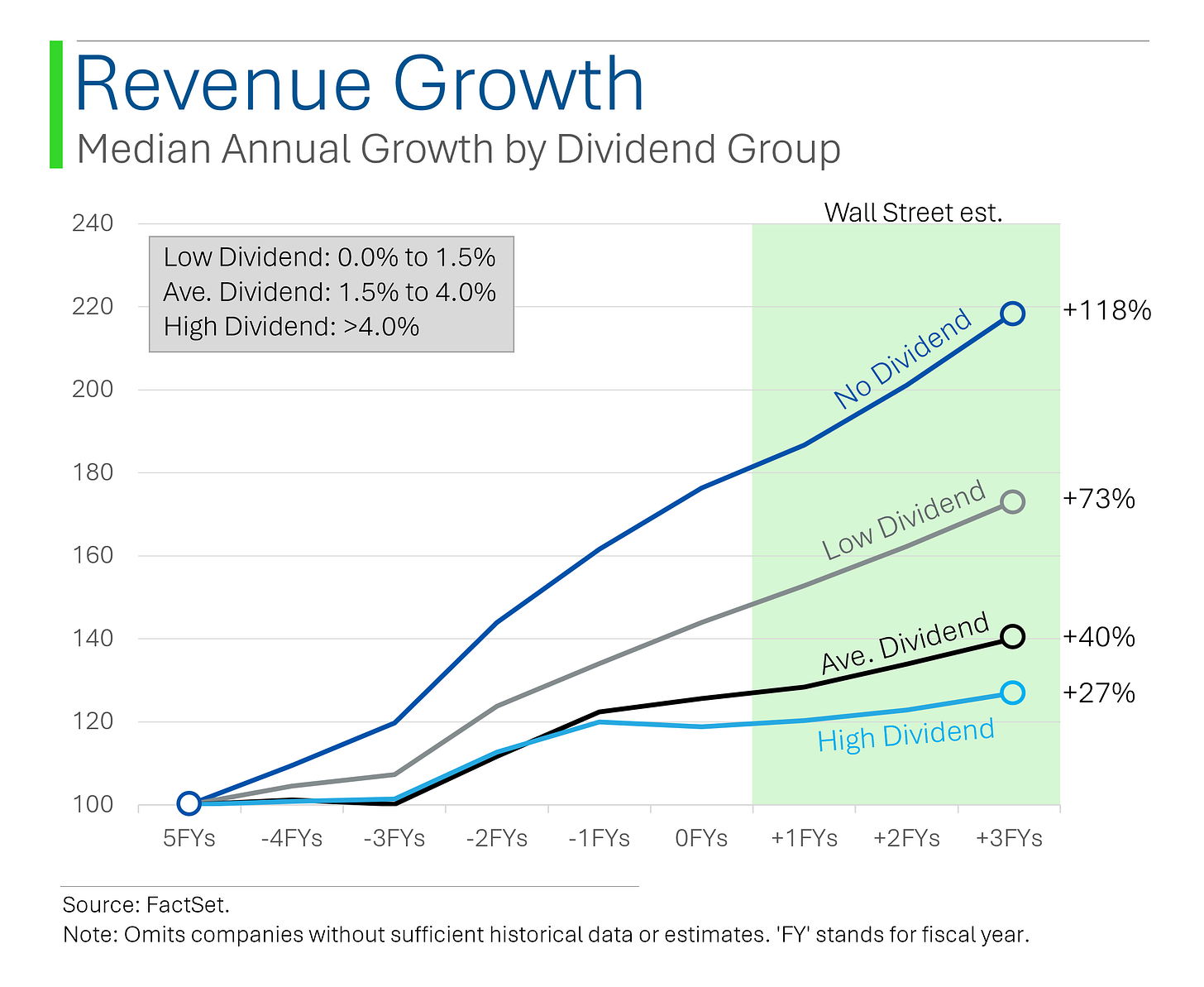

So what does the data show? Well, some market aphorisms are indeed true. If you put the companies in the S&P 500 into buckets based on their dividend yield, it’s immediately clear that, not only do dividend payers have slower growth than non-payers, in fact the bigger the dividend, the slower the growth.

Over the preceding 5 fiscal years, the ‘No Dividend’ bucket has grown revenue at a median of 12.1% per year. For the highest bucket (+4.0% dividend yield) this figure drops down to 3.6%.

Looking out, Wall Street forecasts the median ‘no-divy’ to grow Revs at 7.3%, while also seeing the ‘high divy’ group to grow at a measly 2.2%. Yucky.

The logical retort to this is of course ‘yeah, we don’t care if the company grows as long as it pays a good return’.

Sure, but as you can see below, historically that return hasn’t compared favourably to the share price appreciation experienced in ‘No Divy’ and ‘Low Divy’ stocks.

For example, the median annual return for an S&P 500 company in the ‘Low Divy’ group over the last 10 years has been 18.9% (15% share return and 3.9% dividends reinvested into shares).

Meanwhile, the median company in the ‘High Divy’ group has seen their shares actually decline over the past 10 years (0.4%).

And that trend isn’t likely to turn around either: If you use Wall Street’s median EPS growth estimates over the next three years as a proxy for share price return, and add it to the dividend yield to guess at ‘Total Return’, then the no or low dividends seem to be best positioned for the future.

I’m aware that this basically sounds like propaganda for my general ‘Growth Investing’ proclivities, and there definitely are some caveats. Namely:

It’s a stock pickers world so dealing in ‘medians’ hides the great companies out there that do pay dividends (Coca-Cola, Lockheed, JP Morgan, etc.)

For investors requiring more defensive portfolios - such as individuals close to retirement - high dividend stocks can represent a safer stock alternative, adding some of the benefits of bonds.

Dividends can often be more tax efficient; provide a steady, reasonably predictable income; and is generally less complicated than liquidating investments for income purposes.

That said, growth stocks are still much cooler ✌️

November Goes Big

Finishing the month +5.7%, November notches the biggest monthly gain of the year for the S&P 500. In fact, it’s the biggest monthly gain since last November.

As a Canadian, I’ve never been a big fan of November (that’s when things start to suck) but damn is it one hell of a month to buy stocks.

Microstrategy’s Money Printer

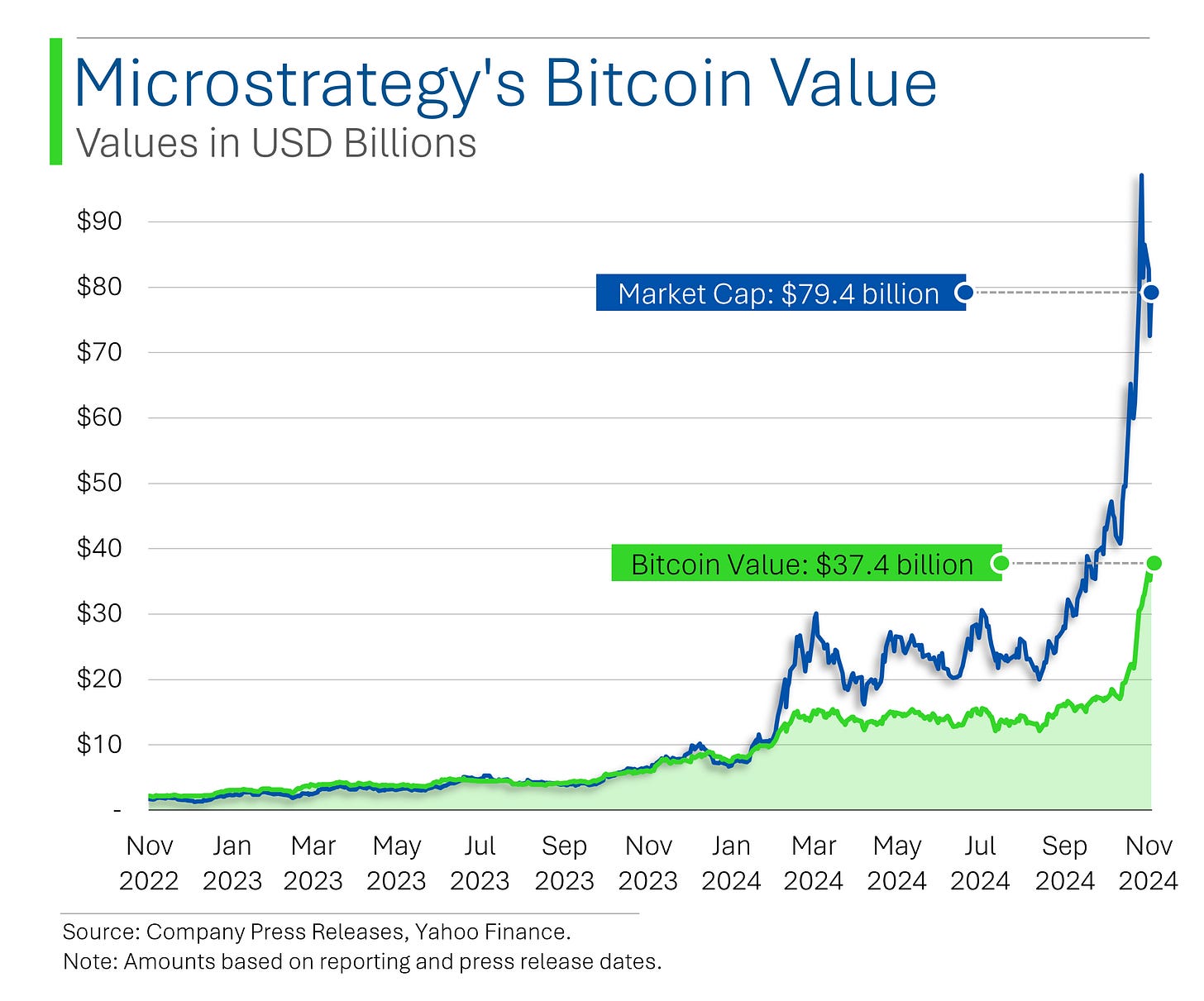

Arguably one of the weirdest things I’ve ever seen in my decade in the financial world is Microstrategy - a mediocre software company turned Bitcoin piggybank that is now worth $79 billion.

Yep, a company where 95% of the investor base doesn’t even know what the company actually does (cheesy data analytics) is bigger than FedEx, Ecolab, Northrop Grumman, Colgate-Palmolive, Marriot...

What investors do know is that they invest in Bitcoin. A lot of Bitcoin.

Without getting too into the weeds here, the company achieved notoriety - and a hilarious valuation - by essentially doing the following:

The company issues shares or convertible bonds;

They use the cash to buy Bitcoin;

The share price goes up.

Repeat.

And they’ve done it, like, a lot.

Now this is nothing new, and most of you have probably heard of them before (if you’re curious about the actual mechanics of what they do, I did a deep-dive back in April on them).

Why I bring it up is that since the post-Election crypto pop, the story has gotten even more unbelievable than I could have ever imagined, with their Bitcoin tally now sitting at a whopping 386,700 coins worth a cool $37.4 billion.

And sure that’s a big pile of Bitcoin, but what’s harder to explain is that the company’s market cap is now $42 billion higher than the value of those coins.

And no, it doesn’t have anything to do with their software business, which as you can see below is a bit of a dud, and probably only worth a billion or so.

This also isn’t the first time Microstrategy has flirted with euphoria. In fact, it wasn’t until earlier in the month that the company actually saw it’s share price top it’s former DotCom bubble peak of $313 a share.

You know, before it lost 99.86% of it’s value when the bubble popped…

Despite the recent pullback in the shares, the company still trades at a multiple of their Bitcoin value of over 2x.

Now don’t get me wrong here, I think crypto is neat. But in a world where you can just go and buy Bitcoin this literally makes as much sense as a potato trying to do quantum physics.

Michael Saylor, the company's Bitcoin-obsessed Chairman and Co-Founder, has essentially turned a bland software company into the world's most elaborate Bitcoin ETF - just without the ETF paperwork. It's like watching a magic trick where a boring enterprise software firm pulls a $40 billion Bitcoin rabbit out of a corporate hat, and Wall Street just... applauds. 🤦♂️

Joke Of The Day

A trader and an engineer meet in the Caribbean. The trader said, “I’m here because my house burned down, and everything I owned was destroyed by the fire. The insurance company paid for everything.”

“That’s quite a coincidence,” said the engineer. “I’m here because my house and all my belongings were destroyed by a flood, and my insurance company also paid for everything.”

The trader looked somewhat confused and asked “How do you start a flood?”

Macro Update

PCE Inflation [Wednesday]

October core PCE rose 0.3% m/m, at 2.8% annualized and in line with consensus. September core PCE unchanged at 0.3%.

Personal income jumped 0.6% m/m, beating expectations, while personal spending increased 0.4%, slightly above consensus.

U.S. New Home Sales [Tuesday]

October new home sales declined to 610K, representing a 17.3% month-over-month decrease and significantly below the consensus estimate of 725K.

The October sales volume marks the lowest level since November 2022, with the prior month's reading remaining unrevised at 738K. The average October sales price stood at $545,800.

U.S. Consumer Confidence [Tuesday]

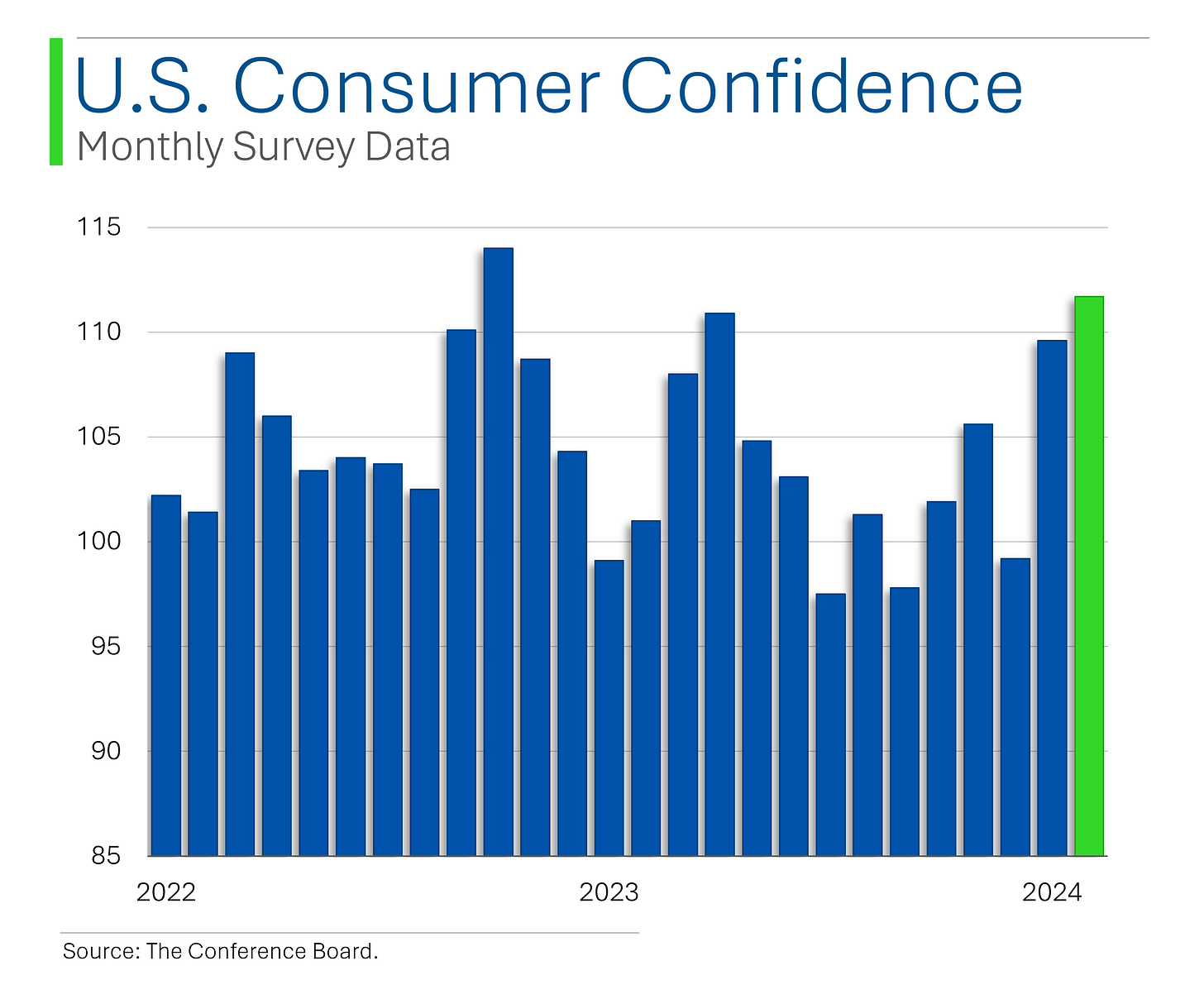

The Consumer Confidence Index registered 111.7 in November, marginally below the projected 112.7 but showing improvement from October's 109.6.

Notably, average 12-month inflation expectations decreased from 5.3% in October to 4.9% in November, marking the lowest level since March 2020.

Trivia

This week’s trivia is on Investing 101.

In finance, 'hedging' refers to:

A) Gardening activities by bankers

B) Making investments to reduce the risk of adverse price movements

C) Predicting future trends in the stock market

D) Fencing in financial risksWhich index is known as the "Fear Index"?

A) Dow Jones Industrial Average

B) S&P 500

C) Volatility Index (VIX)

D) MSCI World Bond IndexWhich of the following is a leading economic indicator?

A) Gross Domestic Product (GDP)

B) Unemployment rate

C) Stock market performance

D) Inflation rateWhat is a 'junk bond'?

A) A bond made from recycled paper

B) A bond of a company that has defaulted

C) A bond for waste management companies

D) A high-risk, high-yield bondWhat does the PEG ratio measure?

A) A company’s debt relative to its earnings

B) A stock’s price relative to its growth and earnings

C) The profitability of a company compared to its peers

D) The relationship between dividends and equityIn the context of bonds, what does the term yield curve inversion typically signal?

A) Rising inflation

B) A coming recession

C) Strong economic growth

D) Increased bond defaults

(answers at bottom)

Market Movers

Friday

Hasbro (HAS) [+2.0%] Elon Musk's "How much is Hasbro?" post on X stirred interest in the company, likely tied to Wizards of the Coast.

Wednesday

Urban Outfitters (URBN) [+18.3%] Smashed Q3 expectations on earnings, revenue, and margins, with upbeat holiday sales commentary.

Dell Technologies (DELL) [-12.3%] Q3 earnings beat, but revenue and guidance fell short due to delayed PC refresh and supply chain issues.

Tuesday

Semtech (SMTC) [+18.1%] Blew past fiscal Q3 expectations with strong growth in data center and innovative LPO products.

Eli Lilly (LLY) [+4.6%] Got a boost from Biden's proposal to expand Medicare and Medicaid coverage for anti-obesity drugs.

Monday

Bath & Body Works (BBWI) [+16.5%] Surprised with solid Q3 results, raised FY guidance, and highlighted product innovation.

Target (TGT) [+4.4%] Got back on Oppenheimer's top pick list for its attractive risk-reward balance.

Robinhood Markets (HOOD) [+3.3%] Upgraded by Morgan Stanley for its surging revenue and growing support for crypto.

Macy's (M) [-2.3%] Delayed Q3 earnings report after uncovering $100M of hidden expenses, though preliminary revenue was slightly ahead.

This Week In History

United Nations Partition Plan for Palestine (November 29, 1947): The UN General Assembly approved a plan to divide Palestine into separate Jewish and Arab states, setting the stage for the establishment of Israel. And everyone lived happily ever after.

Bank of England Founded (November 27, 1694): The Bank of England was established by royal charter, becoming the model for modern central banking.

Argentina Default (November 29, 2001): Argentina failed to pay a $132 billion debt, the largest sovereign debt default in history at the time, leading to severe economic turmoil.

General Electric Removed from Dow Jones (November 30, 2018): GE's removal after over a century highlighted its struggles and the changing face of American industry.

Market Update

Trivia Answers

B) Hedging refers to making investments to reduce the risk of adverse price movements.

C) The Volatility Index (VIX) is generally referred to as the ‘Fear Index’ as higher trading activity in options can be indicative of increased concern over the markets direction.

C) Stock market performance is generally considered a leading indicator.

D) A Junk Bond is a high-risk, high-yield bond, typically from a company with significant leverage and thus poses a higher risk of default.

B) The PEG Ratio describes a stock’s price relative to its growth and earnings.

B) An inverted yield curve often signals a coming recession.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Love all of this ... and yet I'm a dividend investor. It's worth noting that the history of the US stock market goes back more than 10 years. Growth has indeed overperformed for the last 10 years! Will it continue to do so? Maybe! Maybe I'll continue to look like an idiot. But, well, the older you get, the more you learn that things change ... that looking back 10 years and declaring that "the past" can get you in a lot of trouble.

According to

https://www.investopedia.com/these-are-the-best-performing-stocks-of-the-last-century-8680461

, the #1 stock to own over the past 100 years has been Altria, notorious for paying out almost all its income in dividends. Worth thinking about perhaps.