🔬Yield Curve Hype Explained, No One Is Saving Money, and Much More

StreetSmarts Morning Note

***Friendly reminder to please share StreetSmarts with a friend (or 20) that might enjoy it***

"In the stock market, the most important organ is the stomach. It's not the brain."

-Peter Lynch

"Only when the tide goes out do you discover who's been swimming naked."

-Warren Buffett

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Un-Yielding Yield Curve

From Stimulus Stash to Cash Crash: The American Savings Saga

Ford Accelerates to Strike Settlement: UAW's Victory Lap Ahead?

Hot Headlines: Links to some of the top financial stories of the day

Market Movers

Winners

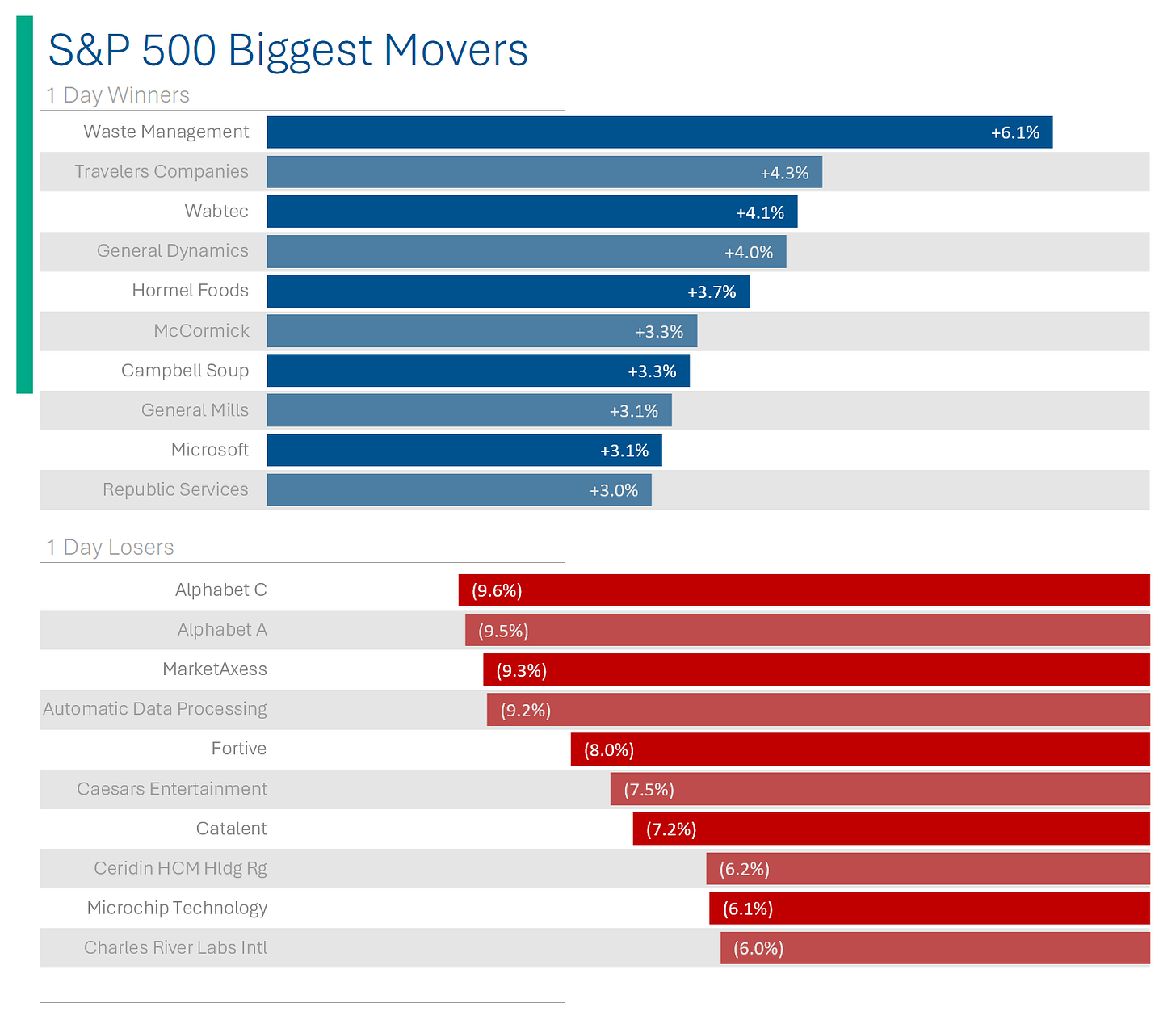

General Dynamics (GD): +4.0%. [EARNINGS] Beat on Q3 earnings and revenue with strong orders in Marine Systems and Aerospace. The company highlighted a record backlog, though some analysts expressed concerns over weaker Marine margins.

Microsoft (MSFT): +3.1%. [EARNINGS] Revenue exceeded forecasts by 4%, and EPS was 13% ahead. Key takeaways included significant growth in Azure, with analysts highlighting an added 3pts of AI services benefit, exceeding the guidance.

Ford Motor (F): +1.4%. [STRIKE DEAL] The company is close to finalizing an agreement with UAW that could conclude the strike, based on an AP report. The union has reportedly countered with a proposal for a 25% general wage increase over the new four-year contract.

Losers

Vicor (VICR): -26.6%. [EARNINGS] While Q3 earnings and revenue met expectations, backlogs saw a steep drop of 53% y/y and 20% from Q2. Investors are wary of a potential decrease in bookings and the company expressed caution regarding AI.

Alphabet (GOOGL): -9.5%. [EARNINGS] Q3 revenue and EPS exceeded projections, primarily driven by Search and YouTube. However, Cloud revenues fell short and there were slight concerns over operating income margins. The consensus is positive about robust digital ad results, especially from the retail segment, but the Cloud segment likely lost ground to Microsoft's Azure.

Teladoc Health (TDOC): -4.0%. [EARNINGS] Q3 revenue missed targets, but EBITDA exceeded due to better margins. Q4 projections varied, and adjustments were made to F23 guidance, indicating a focus shift from growth to margins.

A.M. Allocations

Un-Yielding Yield Curve

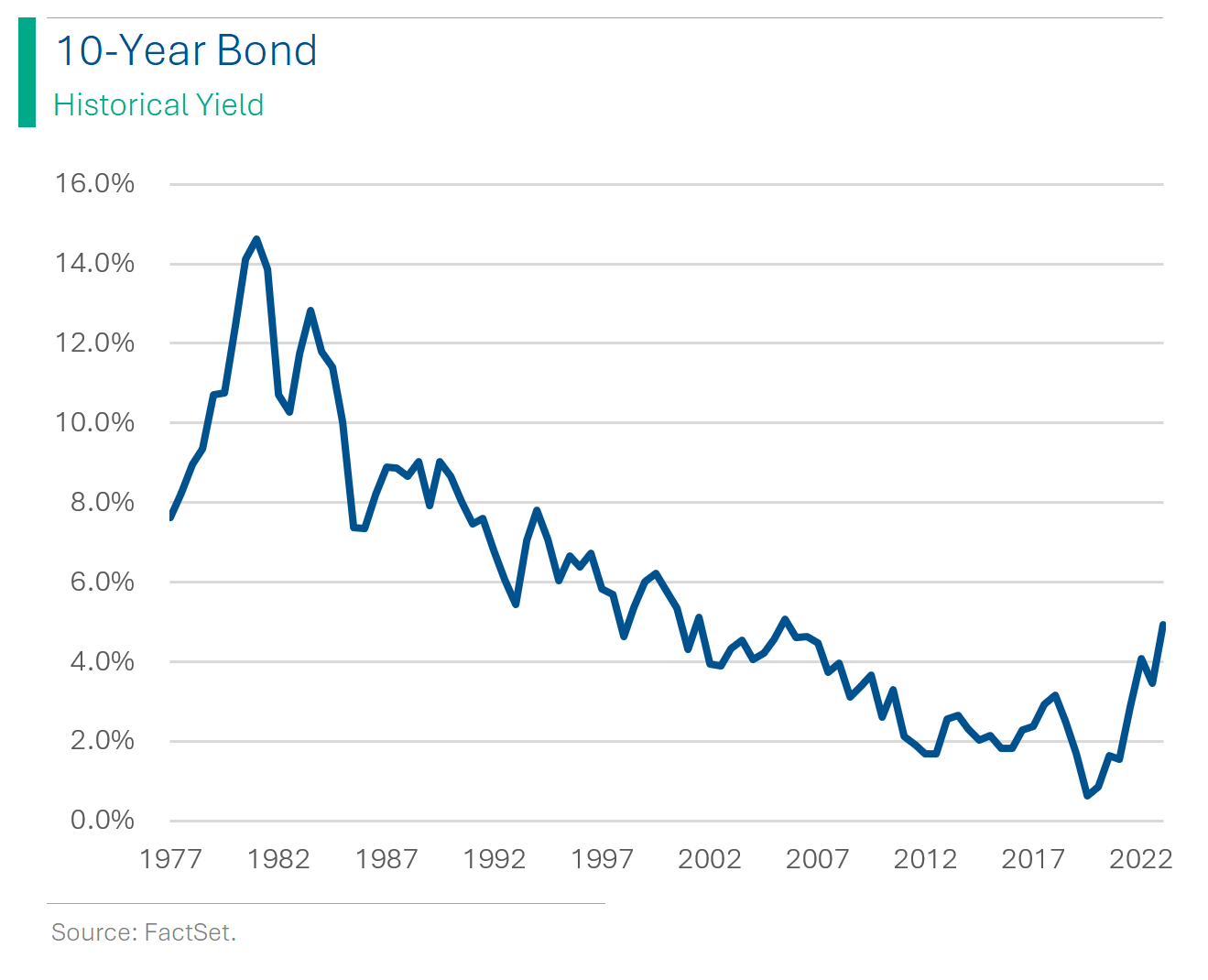

The chatter amongst news outlets about bond yields has been getting annoying - and surprisingly repetitive. It seemed like last week every financial site had to have three articles a day about ‘the 10-year bond yield hitting 5%’. Beyond the repetition, I think what got a bit lost was the necessary context into the progression of the bond sell-off, and the explanation of why it matters. So here’s my 2-min rundown of the situation and why it’s significant:

Explainer

Inverted Yield Curve: The first thing to understand is that the U.S.

hashad an inverted yield curve, meaning that short-term interest rates, like the 3-Month Treasury bill, were higher than long-term rates, like the 30-Year Bond. This came about when high inflation kicked-in after the pandemic, which caused the U.S. Federal Reserve to start raising its Federal Funds Rate to try and combat price increases. This started lifting interest rates off their former low floor, particularly in the ‘short-end,’ as this segment in part represents expectations for inflation and growth. The bump that formed in the yield curve (seen above in the ‘6-Month Ago’ curve) depicted to investors the idea that the Fed would keep interest rates high only for a few years, and then lower them again once the inflation dragon was slayed. Inverted curves aren’t generally good things - in fact, they’ve predicted every recession in the last 70 years with only one false start.

Explainer (cont’d):

Current Situation: As you can see above, over the last 3-months the ‘long-end’ of the curve has seen a significant increase in yields. The absolute levels aren’t really scary - we’ve seen much worse (see below) - but the pace of yield increase and why the sell-off in bonds (recall bonds going down increases the yield) happened, is why it is important.

Take-Aways: The big “so what?” from all of this is that investor expectations for cooling inflation and interest rates have become noticeably skeptical over the last three months. Many people - myself included - held a rosy view of the path of inflation. I believed that the Fed’s interest rates hiking activity would swiftly and effectively quell inflation, prompting them to move on to cutting interest rates back around pandemic-era levels in 2024. While the market is still pricing in the chance for some modest Fed rate cuts next year, there is a growing belief that stickier inflation - and the accompanying higher rates than we are accustomed to - are now expected to be around for quite some time. The Fed has stoked this with ‘higher for longer’ rhetoric which now appears to be the market’s ‘base case.’

From Stimulus Stash to Cash Crash: The American Savings Saga

Due to high inflation and rising interest rates, 81% of Americans did not add to their emergency savings this year, with 60% feeling behind in building a financial safety net, as per a Bankrate report.

While government stimulus funds provided a temporary boost to household savings after 2020, most of these reserves have been depleted from pandemic-era spending.

The combination of soaring inflation post-pandemic, and the Federal Reserve's significant interest rate hikes, have both tightened household budgets and increased borrowing costs.

Take-Away: Savings rates go hand-in-hand with consumer spending and household debt. Consumers are starting to pile on credit card debt, but spending has remained strong. If that starts to drop-off - which seems likely - we could start to see real cracks in the economy emerge.

Ford Accelerates to Strike Settlement: UAW's Victory Lap Ahead

The United Auto Workers (UAW) union announced a tentative four-year contract agreement with Ford, signaling a potential conclusion to the nearly 6-week-old strikes across major Detroit automakers.

This proposed deal offers significant wage hikes, with temporary workers seeing over 150% raises, and introduces a groundbreaking provision allowing the union to strike if the company plans factory closures.

In response, Ford is gearing up to restart key production facilities, particularly the massive Kentucky Truck Plant, aiming to bring 20,000 workers back into action and ensure uninterrupted vehicle deliveries to customers.

Take-Away: This likely means they are getting closer to a deal with GM and Stellantis. Although the latter seems particularly reluctant to budge any further, so negotiations could be left in neutral.

Joke Of The Day

What do cows invest in? Mootual Funds.

Why were the bankers feeling grumpy? Because they never get any credit.

Hot Headlines

(Bloomberg) Controversial Chip in Huawei Phone Produced on ASML Machine - The ‘how did Huawei do it’ saga takes another interesting turn as China's Semiconductor Manufacturing International Corp. (SMIC) reportedly utilized equipment from Europe's leading tech firm, ASML Holding NV, to create an advanced processor for the Huawei smartphone that has raised U.S. concerns. Amidst these developments, U.S. and Dutch continue developing restrictions aimed at curbing ASML sales to China, though ASML's CEO warns that increased pressure might motivate China to further develop its own competing technologies.

(Axios) Coinbase accuses SEC of overstep in latest bid to dismiss suit - The U.S.'s largest crypto exchange, is challenging the SEC's application of the Howey Test which is used to determine whether or not something is a ‘security’. Coinbase claims that not all trades on its platform involve "investment contracts" and the company further questions the doctrine, arguing against government agency actions that lack clear congressional backing.

(NBC) Rep. Mike Johnson elected 56th speaker of the House, ending weeks of GOP chaos - THANK. GOD. Forget about the government shut-down, I’m just sick of talking about government bureaucracy and horse-trading. Although it did bring out some of my more creative work.

(CNBC) Sam Bankman-Fried to testify in FTX fraud trial, attorney says - This is going to be awesome.

(CNBC) Shell will cut 200 jobs in clean energy division - Exxon and Chevron recently announced big fossil fuel acquisitions, so green energy might not be the top-priority at Big Oil. Shocker.

(Reuters) Turkey's Erdogan says Hamas is not terrorist organization, cancels trip to Israel

Trivia

Since we’ve been talking a lot about the automakers later, here’s some Big 3 trivia.

GM reported its Q3 earnings on Tuesday. How many vehicles did it sell in the quarter?

678 thousand

823 thousand

1.2 million

1.6 million

In 2021, Fiat Chrysler merged with what company that resulted in the re-branding to Stellantis?

Peugeot S.A.

Groupe Renault

Nissan

Rolls-Royce

In 1908, the average U.S. worker made around $200-$400 a year. That year, Ford garner considerable media attention by announcing that it was doubling workers pay to how much?

$5 per day

$500 a year

$850 a year

$3.50 per day

(answers at bottom)

Market Update

Trivia Answers

1.6 million.

Peugeot S.A.

$5 a day.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.