🔬Why the Stock Market Sucks Right Now, Plus Disney Drama, and Much More

"You can't predict. You can prepare"

- Howard Marks

“Cocaine is God’s way of saying you’re making too much money”

- Robin Williams

The big US markets are batting 1000 for down days so far in 2024 with S&P 500 -0.80% and Nasdaq -1.18%.

3 of 11 sectors closed in the win-column with Energy (+1.5%) stocks leading the way after crude oil closed up +3.3% - mostly due to protests in Libya that caused a 300k barrel per day shutdown. Cyclicals got smoked again (Real Estate -2.5%, Consumer Discretionary -1.9%, Industrials -1.5%).

November JOLTS job openings were in-line (8.79m vs. 8.76m estimate). December ISM Manufacturing Index was also in-line (47.4 vs. 47.2 estimate), and up from last month’s 46.7.

Street Stories

MARKET UPDATE

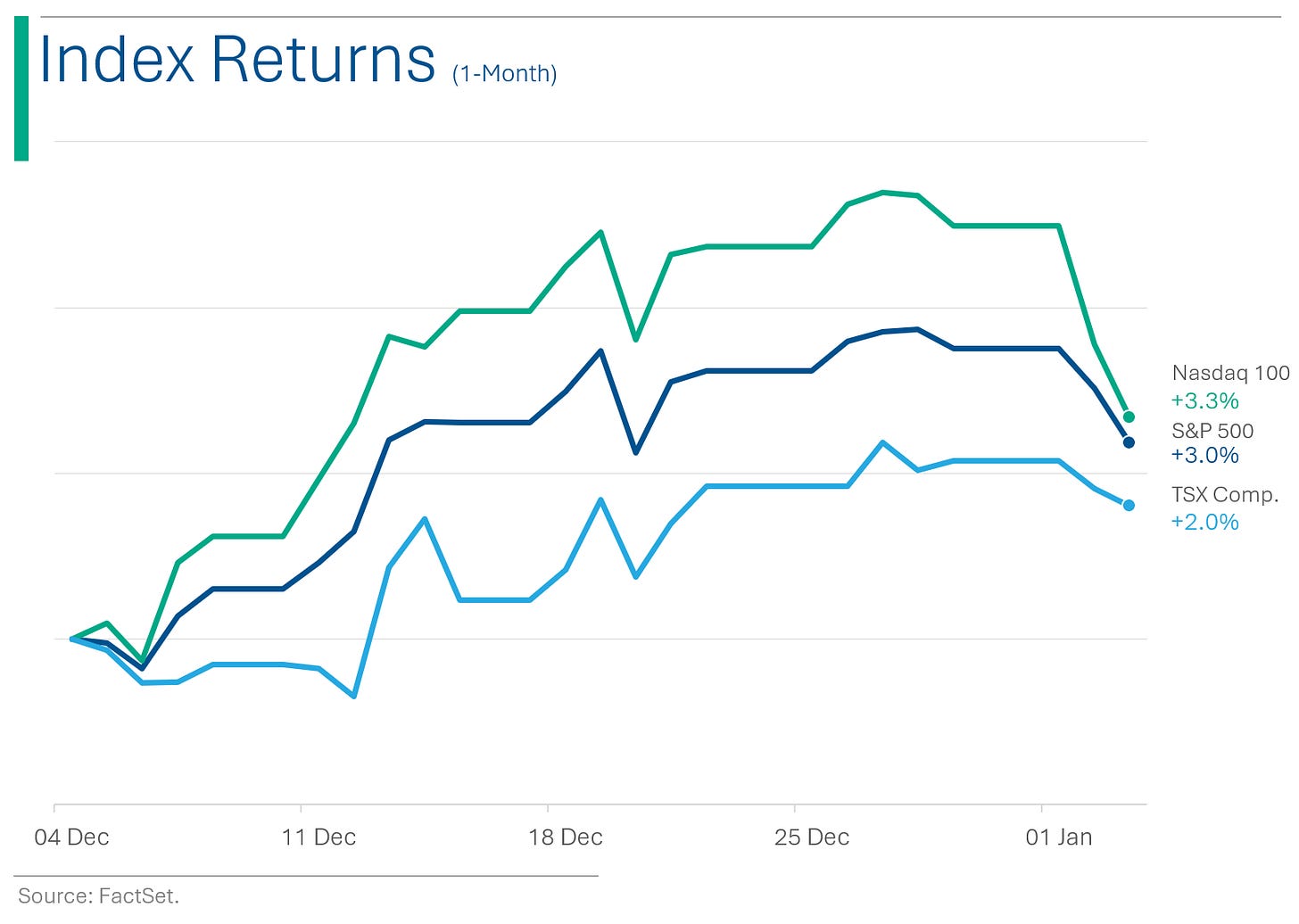

With the year just starting out, I thought it would be helpful to take stock of where things are in the market. To start, we are coming off of a pretty big year with the S&P 500 gaining 24.2% in 2023 (excluding dividends of around 1.5%). In the last 20 years, we’ve had five years with a return above 20% and this was our third in the last five. Are we overheating a bit? Perhaps.

And the market’s valuation doesn’t do much to counter that argument: If you exclude the wonky P/E multiple during the COVID pandemic (read as: the denominator was temporarily depressed), we are roughly at the same valuation peak as July 2023 (19.8x) which stands as the highest that valuations have been since the DotCom bubble.

So, we’re coming off of several years of massive price appreciation (ex. 2022) and valuations are at multi-decade highs. Super. One saving grace is that Wall Street analysts are still pretty Bullish on corporations’ ability to grow Sales and Earnings Per Share.

Currently Wall Street sees aggregate Sales growth in-line with historical levels in the mid-single digit range for the next three years, and EPS coming in at low double digits. That’s nothing to shake a stick at.

Ryan’s View: Based on the above, things look pretty $%&T for stocks at the moment. That said, I’m not keen to jump into the bear cave because the market could end up hanging in there (and rallying) while I sit on the sidelines. I’m also not much of a fan of pivoting into the Value bucket just to extricate myself from high valuations. Rather, I think companies that still have interesting, catalyst-rich stories will do well. Like, AMD’s pivot to AI, or Eli Lilly’s Zepbound going tete-a-tete with Ozempic. Disney and Nike also have some nice redemption arcs (too Value?).

Anyway, I think the ‘rising tide’ of the last few years has washed away a lot of the easy money and now it’s important for stock pickers to find names that have real stories playing out that investors can believe in.

DISNEY DRAMA HITS THIRD ACT

Recall the battle taking place at Disney between CEO Bob Iger and activist hedge funds ValueAct and Nelson Peltz’s Trian over Board seats (and effectively Bob’s job). Well, it took a weird turn yesterday with Disney essentially announcing a partnership with ValueAct that will involve supporting their Board appointments against Trian and even opening up the books for ValueAct to provide some strategic insight. Disney had already placated mini-activist Blackwells so things are looking much safer for Bobby.

Here’s my deep-dive of what’s really happening behind the scenes…

Nelson Peltz is a billionaire but having a gaggle of ex-wives and a bunch of kids that are ‘actors’ is expensive. And now that daughter Nicola has married Brooklyn Beckham - who Wikipedia reports has left modelling for photography and again left that for cooking (next stop is ‘sea glass collecting’) - she is going to be get even more expensive. So that’s when ole Peltzy had a brain eruption! (It was just a minor stroke and he’s fine now.) While recuperating he thought he would take a run at a vulnerable Disney and shake down Bobby Iger to get his kids roles in the Marvel Phase 6 films (or even at Pixar since that doesn’t require actual acting). However, the way it’s shaping up, he’d probably settle for some express passes to Space Mountain.

ValueAct CEO Mason Morfit had a similar idea. See he married Jordana Brewster, and since there’s only going to be like 14 more Fast and Furious films he’s gotta start thinking ahead about her career. He thought he’d lean on Bobby for maybe a Stormtrooper role for Jordana but saw the opportunity to partner against Trian instead (see, he worked at Credit Suisse like me, so he’s super smart). Now in exchange for voting for Bob’s Board selections, he’s gunna get Jordana a role on a new STAR series. That way she’ll be out of the house more because he’s worried if she’s home too much she’ll realize he looks like a middle-aged version of the Mad Magazine mascot.

FED MINUTES - The US Federal Reserve released the Minutes from their December meeting yesterday afternoon. The tone was generally in-line with market expectations but some were caught out by some of the ‘higher for longer’ rhetoric given that the market is now (aggressively imo) pricing in six rate cuts for 2024. Despite market expectations of aggressive cuts, Fed members stressed the need for a data-dependent, cautious approach, with the possibility of maintaining or even raising rates (that’s a lie) if inflation remains high .

The Fed’s current estimates only account for around three rate cuts in 2024 (compared to the market priced in for six).

Inflation expectations have come down a tiny bit since the September meeting but most Fed participants still don’t see inflation reaching the target 2% rate by 2025.

Essentially the same as the above: The Fed has lowered their expectations for interest rates but nowhere near to what Wall Street has forecast.

GM TOPS TOYOTA AS TOP US AUTOMAKER - General Motors maintained its lead as the top-selling automaker in the U.S. in 2023, with sales up 14.1% to about 2.6 million vehicles, edging out Toyota, whose sales rose 6.6% to around 2.25 million. The U.S. auto industry experienced its best year since the pandemic, with total sales reaching around 15.5 million units, including a notable 17% share of electrified vehicles, signaling a resilient economy despite concerns over high vehicle prices and rising interest rates. (Reuters has more)

Joke Of The Day

I quit my job to start a cloning business and it's been great, I love being my own boss.

Hot Headlines

CNBC | Xerox to cut 15% of its workforce. The move will effect about 3k of their 20.5k employees. Biggest surprise is that they still had 21k people there working at Xerox. RIPxoxo

Reuters | Protests shut down Libya's Sharara oilfield. (=🛢️💵⬆️)

Bloomberg | Amazon’s Video Ad Push Expected to Generate an Extra $5 Billion in Revenue. Ads will start appearing on January 29th and subscribers can pay an extra $3 per month for ad-free. In other news, Bezos can suck an egg.

CNBC | Mortgage demand down 9.4% for final week of 2023, despite recent drop in interest rates. BECAUSE NO ONE BUYS HOUSES ON CHRISTMAS. Ok, Muslims do. And Jews. And Grinches.

Daily Mail | The Epstein List is out! The now unsealed court documents covers 170 individuals listed as Epstein associates. The f&*@ is Steven Hawking doing here?

SA | Cannabis stocks gain amid report US DEA reviewing legal status of marijuana which is classified as a Schedule 1 drug.

Trivia

This week’s trivia is on ‘first year economics’.

In economics, 'Rent Seeking' is:

A) The pursuit of profit through manipulation of the political environment

B) The act of leasing property

C) Searching for the most affordable housing

D) The study of rental market trends'Dutch Disease' refers to:

A) An economic problem stemming from the rapid development of one sector

B) The decline in manufacturing due to automation

C) The economic downturn faced by the Netherlands in the 20th century

D) A disease affecting tulip production'Crowding out' occurs when:

A) Investors withdraw from the stock market

B) Government spending reduces private sector spending

C) Corporations outsource jobs overseas

D) Technology replaces jobs

(answers at bottom)

Market Movers

Winners!

Suncor Energy (SU) [+5.7%]: Reported Q4 upstream production at 808.0 Mboe/d, surpassing FactSet estimates of 771.1 Mboe/d, with December marking their best month at over 900,000 bbls/d.

Pure Storage (PSTG) [+4.9%]: Will join the S&P MidCap 400 on January 5, replacing Patterson (PDCO).

Losers!

SoFi Technologies (SOFI) [-13.9%]: Downgraded to underperform from market perform by Keefe, Bruyette & Woods, citing overvaluation post-December's 36.5% gain and potential headwinds in 2024.

Xerox Holdings (XRX) [-12.1%]: Announced an organizational revamp and executive reshuffles, aiming for a 15% workforce reduction this quarter.

SentinelOne (S) [-8%]: Announced the acquisition of cloud tech firm PingSafe, with the deal expected to close in Q1 of FY25.

Rocket Cos. (RKT) [-6.6%]: Suffered multiple downgrades, including to underperform by Keefe Bruyette & Woods, due to valuation concerns, a weak mortgage environment, and projected volume weakness through 2024. KBW just ruining everyones day

Market Update

Trivia Answers

A) Rent Seeking is the pursuit of profit through manipulation of the political environment.

A) The ‘Dutch Disease’ refers to an economic problem stemming from the rapid development of one sector.

B) ‘Crowding Out’ occurs when Government spending reduces private sector spending.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.