🔬Why Stocks Aren't 'Risky', the Market Thinks the Fed is Done With Rate Hikes, and Much More

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

"To make money in stocks you must have the vision to see them, the courage to buy them, and the patience to hold them"

- Mario Gabelli"Diversification is for idiots"

- Mark Cuban

Hot Headlines

FEDERAL RESERVE - Wall Street's major indices surged on optimism that the Federal Reserve may pause its interest rate hikes, supported by Chair Jerome Powell's recent comments and a wave of positive quarterly earnings reports. Investors' confidence was further bolstered by strong performances from companies like Starbucks and Qualcomm, despite a moderate increase in new unemployment claims and anticipation for the October non-farm payrolls data. (Reuters)

GEOPOLITICAL RISK - Forget the earnings seasons and the economy, global leaders in business and finance, like Jamie Dimon of JPMorgan and World Bank President Ajay Banga, express profound concern over a complex blend of geopolitical risks, including shifting power dynamics, potential conflicts, and multiple global crises, challenging the stability and future of the global economy and investment environment. (Bloomberg)

MORTGAGES - Mortgage rates slightly declined for the first time in eight weeks, with the 30-year fixed mortgage rate dropping to 7.76%, providing minimal relief against the backdrop of high home prices and tight inventory. (Yahoo)

AMAZON - The U.S. Federal Trade Commission has accused Amazon of employing a secret algorithm, 'Project Nessie,' to inflate prices and extract over $1 billion from consumers, alongside forcing sellers to use Amazon's logistics services to the detriment of competitors like Walmart. The FTC's detailed allegations, now public, also claim Amazon used messaging apps to hide information from antitrust enforcers and sought to discourage Walmart from offering discounts to its customers. (Reuters)

SPACEX - CEO Elon Musk announced that Starlink, the company's satellite internet unit, has reached cash flow breakeven, marking a pivotal financial milestone that could lead to a future public spin-off as planned. Starlink, now the world's largest satellite operator, has been instrumental in supporting communication in conflict zones like Ukraine and Gaza, and its revenues, crucial for funding SpaceX's ambitious Starship project, surged six-fold last year to $1.4 billion. (CNBC)

ECONOMY - Target CEO says consumers are increasingly cautious, even when buying groceries, and doubles down on its cautious outlook. (CNBC)

SBF TRIAL - Sam Bankman-Fried was found guilty Thursday on all seven charges against him, including fraud on FTX customers and investors, fraud on Alameda's lenders and conspiracy to commit money laundering. (NBC)

Joke Of The Day

Journalist: So how many employees are working in your company?

Business owner: Approximately half of them.

Man: Could I interest you in a microscope?

Customer: No thanks, I'd have no use for it.

Man: Here is my business card in case you ever do!

Customer: I can't read this, it's too small!

Man: Boy have I got the product for you!

A.M. Allocations

How Risky is the Stock Market?

Investing in individual stocks can be a gamble. Even staid, Blue Chip names that prided themselves for decades on stability, can invariably fall from grace (see: Sears, GE, Kodak, Blackberry, Nokia, etc.) Like that fit-as-a-fiddle, never-been-sick great uncle that one day gets a pain in his tummy and departs this world before the next full moon, time comes for all of us - ‘safe stocks’ included.

But what about the market? Something that bugs me to no end is the baseless allegation that ‘stocks are risky, bonds are safe’. With proper diversification - like say, an index ETF - the stock market isn’t just a mechanism for superior returns, it is also one of the safest places to deploy your hard earned savings. One way to gauge this is in the return of the S&P 500 - a shorthand proxy for the broader performance of the market.

Since 1980 the average 2-Year return taken from any random date has yielded a 21% return. Great. But is it ‘safe’? Well, should the index ever go to zero we’d probably have bigger problems to deal with - like hunting/gathering/zombies - but over this period, the market has been up on a two year basis about 86% of the time. And if you exclude the DotCom fall-out and the Great Financial crisis - both which were preceded by massive stock market gains - then the longest stretch of negative 2-Year returns has only been about 6 months back in 1982.

Take-Away: The next time your ‘investment advisor’ buddy tries to tell you that a 33-year-old should be in a 60/40 Equity/Bond portfolio, ask him/her how the biggest bond fund in the world has done lately and if that looks ‘safer’ to them. #stocksonly #bondsarelame.

Trivia

Britain’s ‘South Sea Bubble’ is considered the world’s first financial bubble and ponzi scheme, and is the theme of today’s trivia.

What was the primary commodity that the South Sea Company was expected to trade in after its establishment in 1711?

A. Bitcoin futures

B. Spanish treasure

C. Slaves and produce from Spanish America

D. Beaver pelts and textiles

The South Sea Company was granted a monopoly over trade with South America by the government after what war?

A. The War of Spanish Succession

B. The Wars of the Roses

C. The 30 Years War

D. The War of 1812

Who was the famous scientist that reportedly lost a fortune in the South Sea Bubble?

A. Niels Bohr

B. Sir Isaac Newton

C. Leonardo da Vinci

D. Albert Einstein

(answers at bottom)

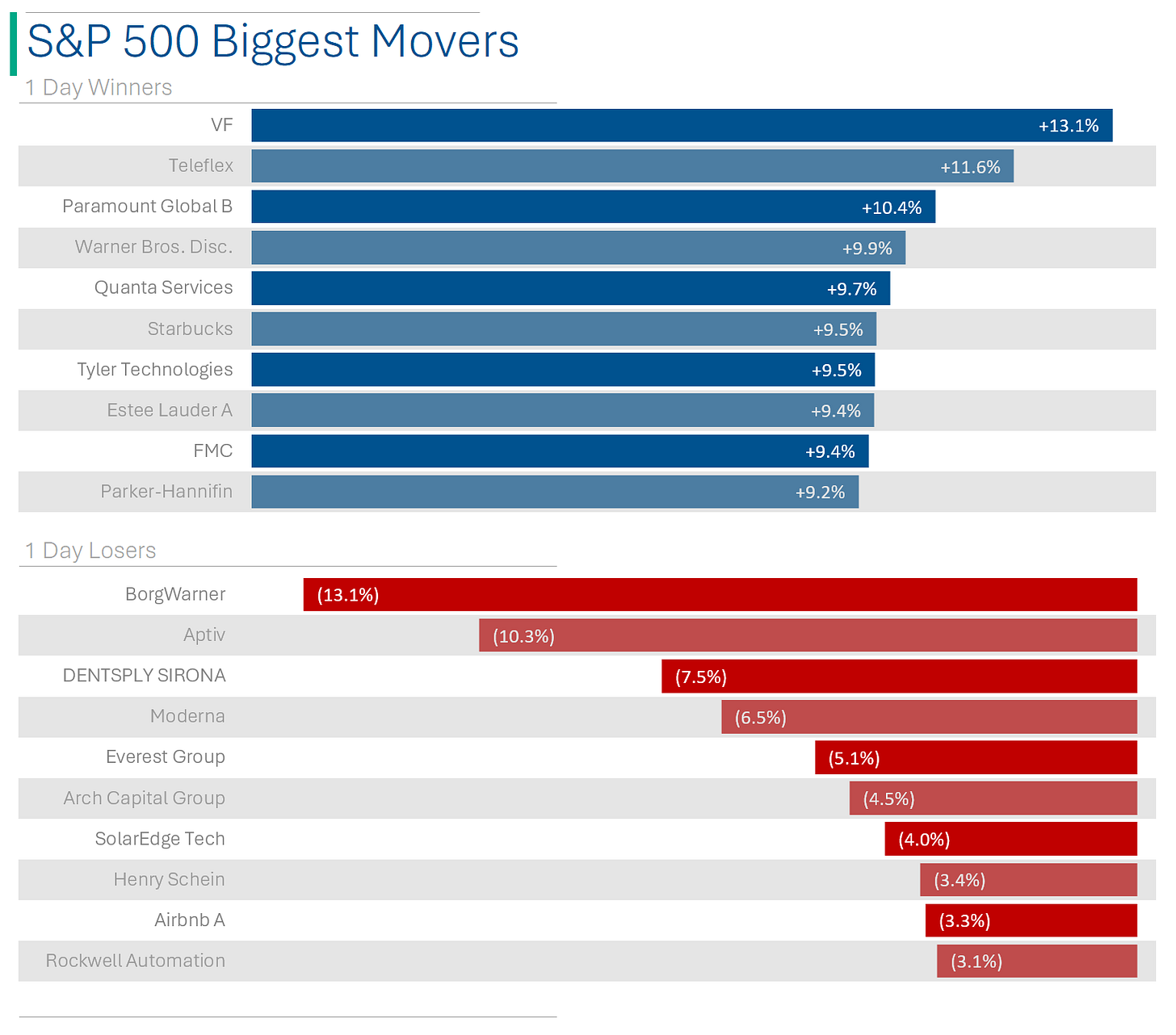

Market Movers

Winners

Roku (ROKU): [+30.7%] Q3 revenue surpasses with positive EBITDA, potential in TV ad shift, and strong content trends, aiming for positive FY24 EBITDA.

Shopify (SHOP): [+22.4%] Outperforms in Q3 with top GMV post-pandemic, higher margins post-logistics exit, and solid European performance, with positive outlook.

DoorDash (DASH): [+15.7%] Exceeds Q3 expectations with order growth and optimistic Q4 EBITDA, driven by product and market expansions.

Qualcomm (QCOM): [+5.8%] Better than expected Q3 and Q4, benefiting from iPhone and Android market, with Snapdragon AI enhancements noted.

Starbucks (SBUX): [+9.5%] FQ4 outshines with global comp gains led by the US and resilient China performance, underscored by strong rewards program growth.

Losers

Airbnb (ABNB): [-3.3%] Q3 meets expectations; Q4 outlook disappoints due to market and geopolitical instability, bookings slightly above consensus; analysts cite direct traffic and free cash flow strengths.

Moderna (MRNA): [-6.5%] Tops revenue but suffers loss from vaccine write-downs and high R&D; FY23 guidance lower than expected, projecting growth resumption by 2025.

Marriott International (MAR): [-1.6%] Q3 outperforms except for incentive fees; Q4 EBITDA and FY guidance revised down, though demand outlook remains positive.

Market Update

Trivia Answers

C. Slaves and produce from Spanish America. Not the noblest of endeavors…

A. The War of Spanish Succession. Kicking someone when they’re down goes back generations.

B. Sir Isaac Newton.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.