🔬Why Dell is a Tech Titan (Again)

Plus: PCE inflation is a non-event (which is probably good); another example of why ARK sucks; and much more!

"The most important quality for an investor is temperament, not intellect."

- Warren Buffett

“Damn you people, go back to your shanties.”

- Shooter McGavin

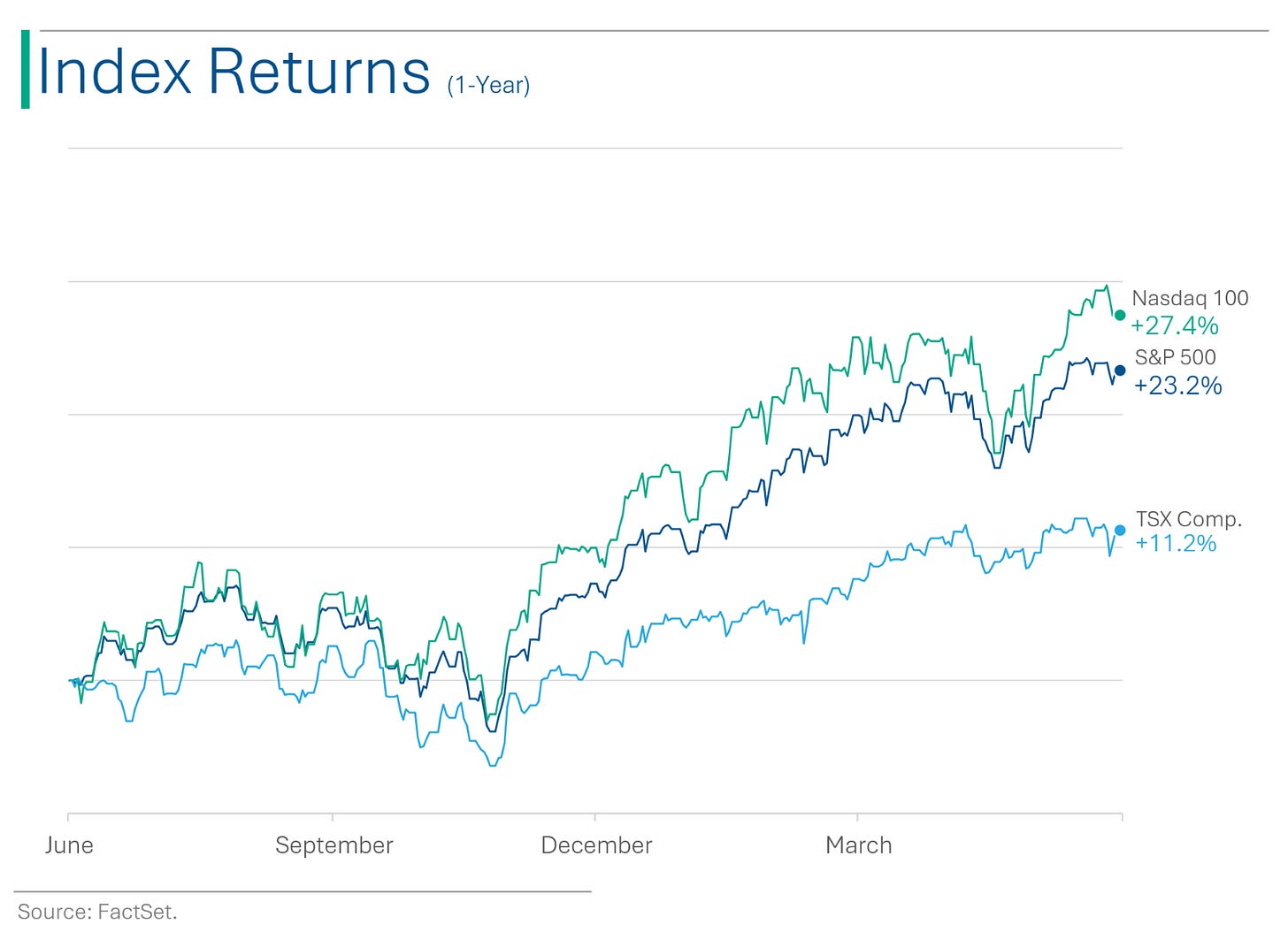

Mixed day for the big US markets with the S&P 500 +0.8% and the Nasdaq -0.1%, however, it wasn’t enough to keep the 5-week win streak going for the S&P as it finished the week down 0.5%.

10 of 11 sectors closed higher, and as you might have guessed by the above, Tech (-0.001%) was the sole weak spot as the rest of the market powered higher (S&P up/Nasdaq down usually means Tech was weak). Energy (+2.5%) and Real Estate (+1.9%) were the best on Friday.

Notable companies:

Gap (GPS) [+28.6%]: Q1 EPS, revenue, and comps all beat; raised FY25 revenue growth, operating income, GM guidance; analysts highlighted broad strength across all four brands, margin tailwinds from cost management, and better inventory dynamics.

MongoDB (MDB) [-23.9%]: Q1 revenue and EPS ahead; billings missed, guided below for Q2, and lowered FY guidance.

Dell Technologies (DELL) [-17.9%]: Q1 revenue ahead and EPS in line; raised FY25 revenue and EPS guidance by 2% and 3% respectively; positive takeaways on AI server momentum but noted a very high bar; some scrutiny over Infrastructure margin miss on Storage; expects continued margin pressures in Q2 but a ramp in profitability in 2H.

More below in ‘Market Movers’

Street Stories

Why Dell is a Tech Titan (again)

If you’re like me, you’ve kinda forgotten Dell existed. They used to dominate the PC market but that space fizzled out, and other than a hilarious spat between Michael Dell and activist douche Carl Icahn (link), they really haven’t been on my investment radar.

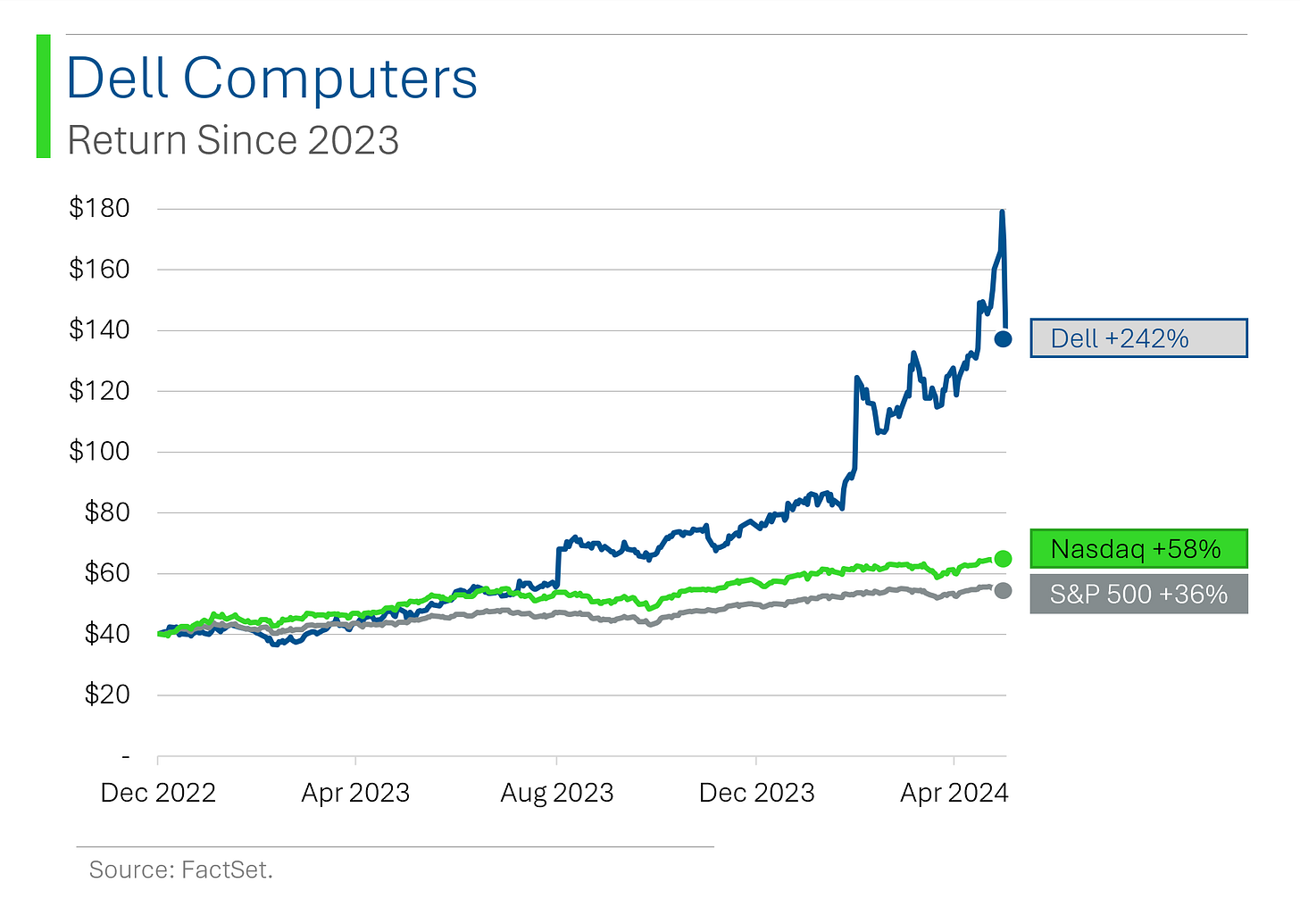

So, with the last twelve months being dominated by AI and Mag7 hype, you might be surprised to learn that Dell computers has outperformed every member of the S&P 500 Tech Sector save for Super Micro Computers.

Correct. In the last 12 months you would have been better off holding Dell shares than Nvidia. The world makes no sense sometimes.

Dell blew out a tire on Friday, after an unimpressive quarter considering the euphoria baked into their shares. They beat on EPS ($1.27 a share, compared with the average projection of $1.23) but their raised guidance implied a relatively flat AI server business for the rest of the year.

Even after the 18% drop in shares Friday, the company is still up +242% since the start of 2023. They have easily out paced the rocket ship that has been the Nasdaq by a factor of 4.2x.

See, Dell isn’t just a PC company anymore. They’ve moved into the formerly boring but now super hot server and data center business, with strong growth in the AI capabilities for commercial clients.

In their Q1 press release, COO Jeff Clarke went as far as to state that, “No company is better positioned than Dell to bring AI to the enterprise.” Sure bud…

Anyway, lots of ambitious rhetoric from the company but certainly worth taking note.

Interestingly, there haven’t exactly been buckets of revenue growth to support that share performance. For example, Nvidia has grown revenues +265% over the last three fiscal years.

For Dell, that number is -6.3%. Yeesh.

So why the excitement? Well, their AI offerings - mostly baked into the Servers & Networking division - are expected to grow massively over the next three years. So while the rest of the business may be none too sexy, if they can live up to the hype they’ve been fomenting, there could be a decent little growth story here.

Lastly, it’s important to note that Dell’s historic rally hasn’t exactly sent its valuation into the stratosphere. Since its IPO in 2018, the company has traded at a valuation closer to distressed, deep-value territory than Tech stock royalty.

Currently the company trades at a 17.0x forward P/E, which still puts it below the S&P 500’s of 20.6x. So, while the share performance has been phenomenal, it’s probably best to look at Dell as a company whose prospects went from ‘terrible’ to ‘decent’ instead of comparing them to the likes of Nvidia or Super Micro.

Fun Fact: The famous ‘Dell Dude’ Ben Curtis got fired by Dell after getting arrested for buying pot in 2003. I mean, marijuana is a Gateway drug…

GameStonk Is Back On!

GameStop shares are up +85% pre-market after Keith Gill aka Roaring Kitty aka DeepF****ingValue posted on Reddit for the first time in over four years. While he followed his old style of just posting his GameStop position, this time it was noted he held nearly $200 million dollars in GameStop options.

Link to his post (comment section is hilarious)

PCE Peekaboo

The Federal Reserve's favorite inflation gauge, the PCE price index, rose 0.3% in April, while Core PCE inflation rose a minimal 0.2%, both conveniently hitting the bullseye of Wall Street forecasts.

Despite this, the 12-month core inflation rate stayed put at 2.8%, its lowest since March 2021, but Supercore services inflation (excludes Housing, Energy and Food) barely budged, dipping to 3.4% from 3.5% in March. So, while Wall Street takes a victory lap, it's clear we still have a way to go in taming the wild beast of wage-driven inflation.

ARK’s Nvidia Play

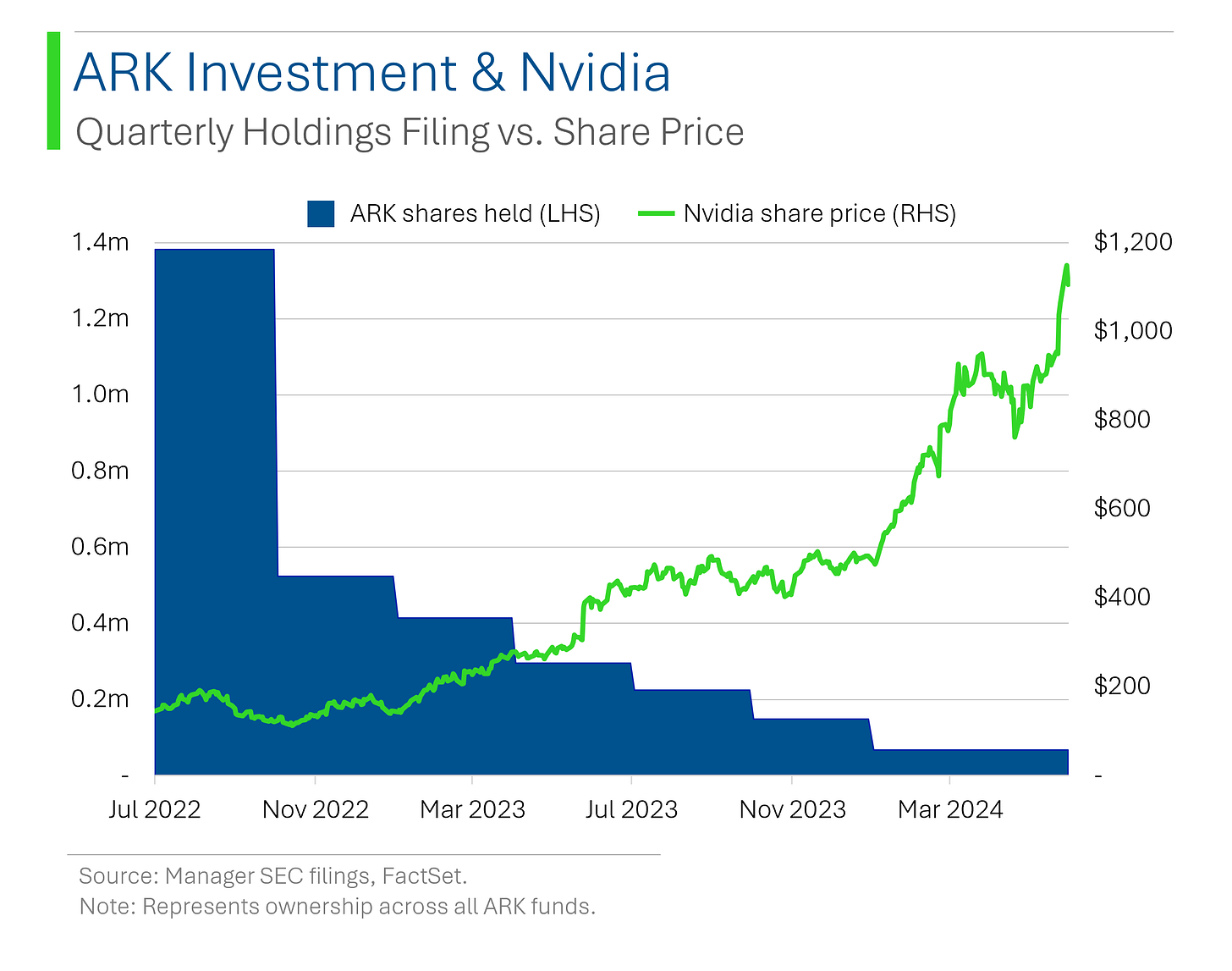

Ever feel like you wimped out and sold a stock too early? ARK Investment’s Cathie Wood would like you to know that you’re not alone.

ARK dropped the vast majority of their Nvidia shares at the lows in Q2 and Q3 2022. Meaning they missed out on the +500% rally that came next.

Joke Of The Day

The stock market took a dive today. It was so bad, Goldman Sachs had to lay off three congressmen.

Hot Headlines

WSJ / The Fed might soon have to worry about more than just inflation. With the economy showing signs of slowing, pressure to lower rates could be building, especially if we start to see a material cool down in employment.

Reuters / Boeing Starliner capsule's first crewed test flight postponed minutes before launch. Yet another 11th hour cancellation in Boeing’s attempt to compete with SpaceX, but (for once) this time not their fault as the postponement on Saturday was triggered by computers on the Atlas V rocket's launchpad that coordinate the final moments before liftoff.

WSJ / Tesla Chairwomen Robyn Denholm is leading the charge to convince shareholders to approve Musk’s $46 billion pay package. This isn’t the first time the Australian board member since 2014 has stuck her neck out for Musk. Not saying this is the hill I'd be willing to die on but 🤷♂️.

Fox Business / OPEC agrees to keep oil production cut, likely maintaining high prices through November election. The alliance said that it is extending additional voluntary cuts of 1.65 million barrels per day that that were announced in April 2023 through the end of December 2025. Punks.

Barron’s / BYD’s May deliveries show a tough trend for struggling Tesla to compete with. May results show that sales have been picking up, with battery electric vehicles growing +13%. Tesla’s last data point was an April figure down about 18% from a year earlier.

Trivia

Today’s trivia is on Dell Technologies.

In which year was Dell founded?

A. 1975

B. 1980

C. 1984

D. 1990Dell was the first company to sell PCs directly to customers via which method?

A. Retail storesB. Door-to-door sales

C. Internet

D. Phone orders

Michael Dell was how old when he started the company?

A. 19

B. 25

C. 30

D. 35

When Dell went private in 2013, it was valued at how much?

A. $83.4 billion

B. $2.4 billion

C. $57.4 billion

D. $24.4 billion

(answers at bottom)

Market Movers

Winners!

Gap (GPS) [+28.6%]: Q1 EPS, revenue, and comps all beat; raised FY25 revenue growth, operating income, GM guidance; analysts highlighted broad strength across all four brands, especially a faster-than-expected Athleta turnaround, margin tailwinds from cost management, and better inventory dynamics.

Ambarella (AMBA) [+20.6%]: Q1 earnings and revenue better; GM ahead of guidance; highlighted multiple AI inferencing wins, including a key auto win for its CV3-AD family; Q2 revenue guide above the Street driven by normalizing customer inventories and secular growth of AI inferencing portfolio.

Penn Entertainment (PENN) [+19.7%]: Shareholder Donerail Group released an open letter to the board arguing stock price is below intrinsic value; recommends company be put up for sale, estimates casino properties could fetch $5.9-6.9B (vs. company's current EV of $4.1B).

Elastic (ESTC) [+11.7%]: FQ4 earnings and revenue beat; billings and large-customer growth ahead of consensus; Elastic Cloud results strong, management notes cost-consciousness driving customers to consolidate workloads; next-Q guide largely brackets consensus, FY25 guidance midpoints above the Street.

Caesars Entertainment (CZR) [+11.7%]: Bloomberg reported Carl Icahn has acquired a sizable position in the company.

Zscaler (ZS) [+8.5%]: FQ3 earnings, revenue, and margins beat; billings well ahead of consensus despite deal scrutiny and higher-than-expected sales attrition; management highlighted continued large-customer growth; raised FY guidance; analysts broadly constructive with thoughts of conservatism in tempered FY25 guide.

VF Corp (VFC) [+7.7%]: Announced the appointment of Michelle Choe as Global Brand President of Vans; she most recently served as Chief Product Officer at Lululemon (LULU).

Losers!

MongoDB (MDB) [-23.9%]: Q1 revenue and EPS ahead; billings missed, guided below for Q2, and lowered FY guidance; flagged slower than expected start to the year for both Atlas consumption growth and new workload wins; blamed macro headwinds and internal changes.

Dell Technologies (DELL) [-17.9%]: Q1 revenue ahead and EPS in line; raised FY25 revenue and EPS guidance by 2% and 3% respectively; positive takeaways on AI server momentum but noted a very high bar; some scrutiny over ISG margin miss on storage; flagged mix shift, lower margin AI, pricing pressure in traditional; expects continued margin pressures in Q2 but a ramp in profitability in 2H.

SentinelOne (S) [-13.3%]: Q1 EPS and revenue beat but deferred revenue, billings, and ending ARR all light; cut FY25 revenue guidance, though raised GM range; analysts flagged go-to-market transition challenges adding risks to 2H despite guidance suggesting back-half improvement, weaker ARR trends than peers.

Marvell Technology (MRVL) [-10.4%]: Q1 earnings and revenue in line; Data Center a bright spot despite continued weakness in more cyclical Enterprise and Carrier segments; Q2 guidance largely brackets consensus; cautioned about GM headwinds in H2 amid substantial ramp in custom silicon programs.

Veeva Systems (VEEV) [-10.3%]: Q1 results better; Q2 billings guide missed by 3%, and company lowered FY billings and revenue guide by 1%; takeaways focused on lower services revenue expectations amid macro headwinds, and AI budget prioritization issues.

Paycom Software (PAYC) [-8.6%]: Disclosed Co-CEO Thomas resigned effective immediately for personal reasons; CEO Richison will continue to lead the company; promoted strategic advisor Randy Peck to COO role.

Market Update

Trivia Answers

C. Dell was founded in 1984 in Austin, Texas.

C. Dell was the first computer company to sell over the Internet.

A. Michael Dell founded the company at 19.

D. Dell went private at a valuation of $24.4 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

It’s interesting how Dell isn’t in the S&P 500