🔬Where The Hell Are The IPOs?

Plus: The Dow doesn't suck (for once); way too many earnings; and much more

"The stock market is a giant distraction to the business of investing."

- John Bogle

"I thought I had mono once for an entire year. It turned out I was just really bored."

- Wayne Campbell, "Wayne's World"

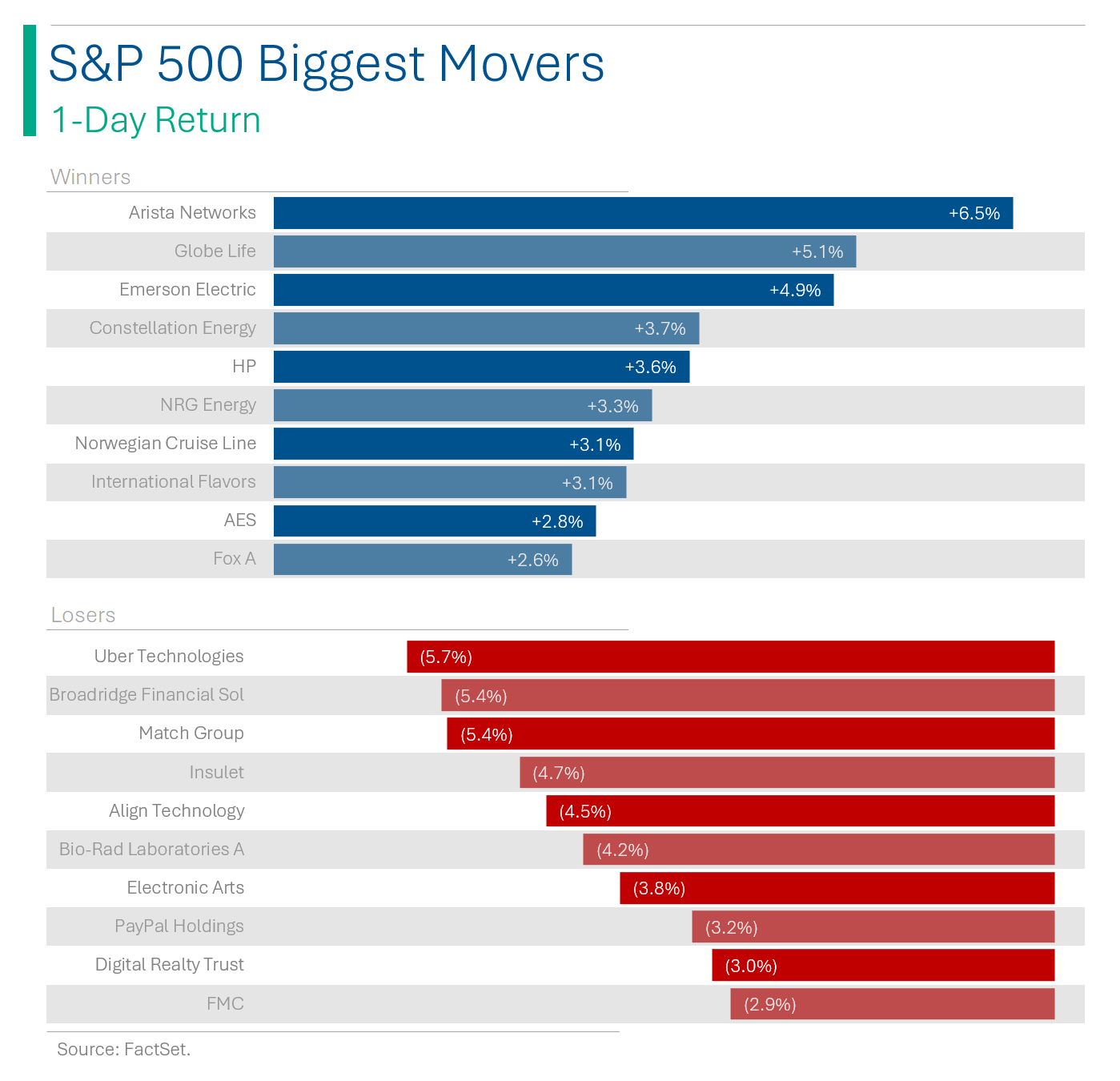

Soft day for the big US market with the S&P 500 flat and Nasdaq -0.2%. Technically the S&P was down 0.0006% but that still means the winning streak ends at four days.

4 of 11 sectors closed higher, led by Utilities (+1.0%) and tailed by Real Estate (-0.9%).

Another super busy day for earnings but luckily that will be mostly over by tomorrow.

Uber (-5.7%) got smoked on a surprise increase to its net loss that widened to $654 million from $157 million in the same quarter last year. Lyft (+7.1%) did the opposite of it’s biggest rival on a solid quarter with beats and a strong guide.

TripAdvisor (-28.7%), Shopify (-18.6%) and LegalZoom (-23.9%) also had s***** days from weak Q1 prints.

I can’t wait to stop talking about earnings…

Street Stories

Where Are The IPOs?

Something I’ve written a decent amount over the past few months is the alleged ‘opening of the IPO window’.

Basically, a decent IPO comes to market, like Birkenstock last year or Reddit this year, and the news services light up saying there’s a huge pile of IPOs en route to the market, so get excited.

My criticisms in the past have hinged on the fact that companies want to IPO in a warm, receptive market. A little bit of froth is a good thing as a hefty valuation helps to minimize dilution from new capital raised and gives a bit more cash to investors and employees that want to cash-out.

At the moment, the market seems ok. Higher for longer rates is an annoyance but stocks are generally hanging in. Sure there’s been a bit of chop, but after all, the S&P 500 is a mere 1.3% off it’s all-time high.

So where are the friggin IPOs?

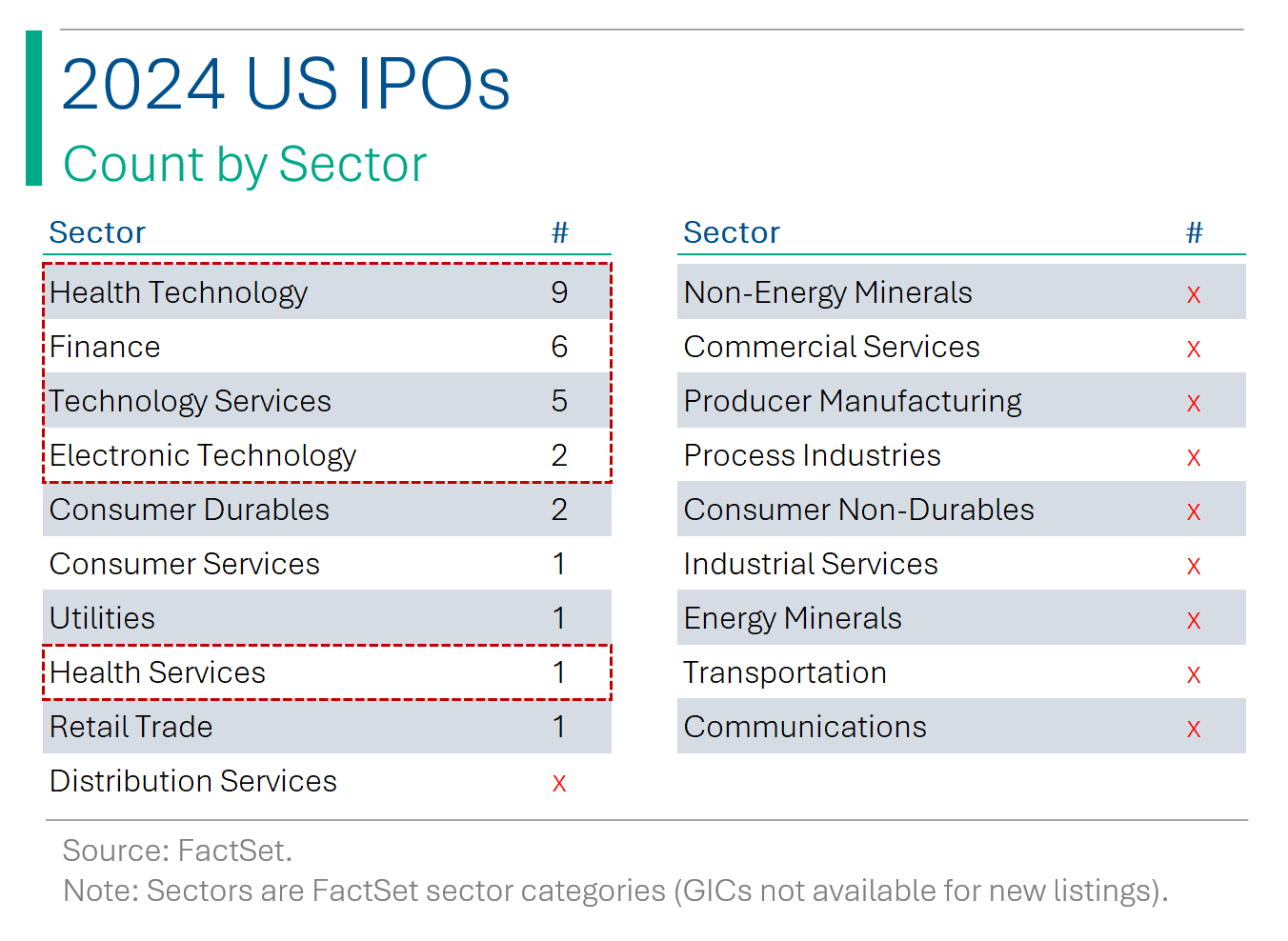

As you can see above, with 28 decent sized IPOs this year we are tracking better than 2022 and 2023 but, other than those years, we are on track for the worst pace in more than a decade.

What is also notable is that smaller IPOs (less than $1 billion in market cap) aren’t really happening (dark blue and green boxes above). In 2020 and 2021, sub-$1 billion IPOs represented 79% and 73% of IPOs, respectively. In 2024 so far, they’ve only represented 39%.

And you can’t really blame the SPAC boom in ’20/’21 for that either, since the average was 68% from 2014 to 2019.

Have we entered a new era where small-caps don’t bother coming to market anymore?

As for the larger deals with IPO market caps of greater than $5 billion, we are actually seeing some life. Run-rate we are at is predicting 14-15 IPOs this year, which holds up very well for previous years (excluding the crazy ’20/’21 party).

As for the deals that have taken place, there are some great companies there. But it is worth noting that 23 of the 28 IPOs (82%) >$200m this year have come from Tech, Healthcare and Financials.

I mean, geez, not even one sketchy junior mining company?

Lastly, beyond general market conditions being relatively positive, another important consideration for companies (or, their bankers at least) is how recent IPOs have fared in the market. If everybody else that listed of late has been scalped, you don’t want be the next one to jump in line.

Turns out, we’ve seen the opposite of this: The performance of IPOs from Q4 2023 until now has been strong, with 63% of companies trading positively with an average return of +10%.

Again, where are the f***** IPOs?

So, where are the IPOs?: Well, that’s a confluence of factors: Firstly, the IPO window has really only been open since November and it takes months at the minimum to plan an IPO (and no one wants to do that over the holidays).

Secondly, the IPO bonanza of 2020 and 2021, including the SPAC frenzy, likely pulled ahead a lot of potential deals. Many other companies rushed to raise capital during the good times in anticipation of this recession that never arrived, and are too flush with cash to bother right now.

However, this could also be part of a general trend of companies choosing to wait longer and longer to IPO. Their venture capital and private equity overlords, with more invested capital than ever, have made big pushes to grow ‘later stage’ funds. From Softbank to Kleiner-Perkins to Apollo, the big money private investors see value being generated later in a company’s life cycle. And they don’t feel like sharing.

The result: Fewer little IPOs, a greater number of mega IPOs.

The Dow…doesn’t suck?

As the world’s most vocal critic of the Dow Jones Industrial Average (see: ‘What Is The Dow & Why I Hate It’) it pains me to say it - but lately it’s been ok. Good even.

The Dow is on a six day winning streak - the Nasdaq and S&P 500 are on zero day winning streaks. And is up +2.8% over the last 12 trading days - the Nasdaq and S&P are +0.8% and +1.3%.

You might expect the geriatric Dow to hold up well in a down market but winning on the upside? Against the Nasdaq? That’s not David vs. Goliath, that’s early-90s Mike Tyson against the elderly gentlemen from Old School.

Ryan’s Reaction: I bring this up because it could show the teensiest bit of a rotation out of high-valuation, high-flyers - the domain of the Nasdaq - and into more staid, Blue Chip companies, like the ones that inhabit the Dow.

If this persists, that could mean sentiment is shifting from ‘meh’ to nope.

Joke Of The Day

How many financial advisers does it take to change a light bulb? Just one. He hires a lightbulb installer to do it and then charges you 1% of your assets each year.

Hot Headlines

Reuters / In Tesla Autopilot probe, US prosecutors focus on securities, wire fraud - basically that Elon & Co. have lied about how good Autopilot is - to shareholder and buyer detriment). The probe, which is not evidence of wrongdoing, could result in criminal charges, civil sanctions, or no action.

CBNC / Uber reports first-quarter results that beat expectations for revenue, but posts unexpected net loss… and the shares get obliterated. The company’s revenue grew 15% year over year to $10.13 billion but net loss widened to $654 million from $157 million in the same quarter last year.

Yahoo / GM to end production of Chevy Malibu as it shifts to EVs. GM has sold more than 10 million Malibus since 1964 worldwide and will end production in November.

Reuters / US eyes curbs on China's access to AI software behind apps like ChatGPT. The Biden administration set to add new safeguards to U.S. AI from China and Russia with preliminary plans to place guardrails around the most advanced AI Models, the core software of artificial intelligence systems like ChatGPT.

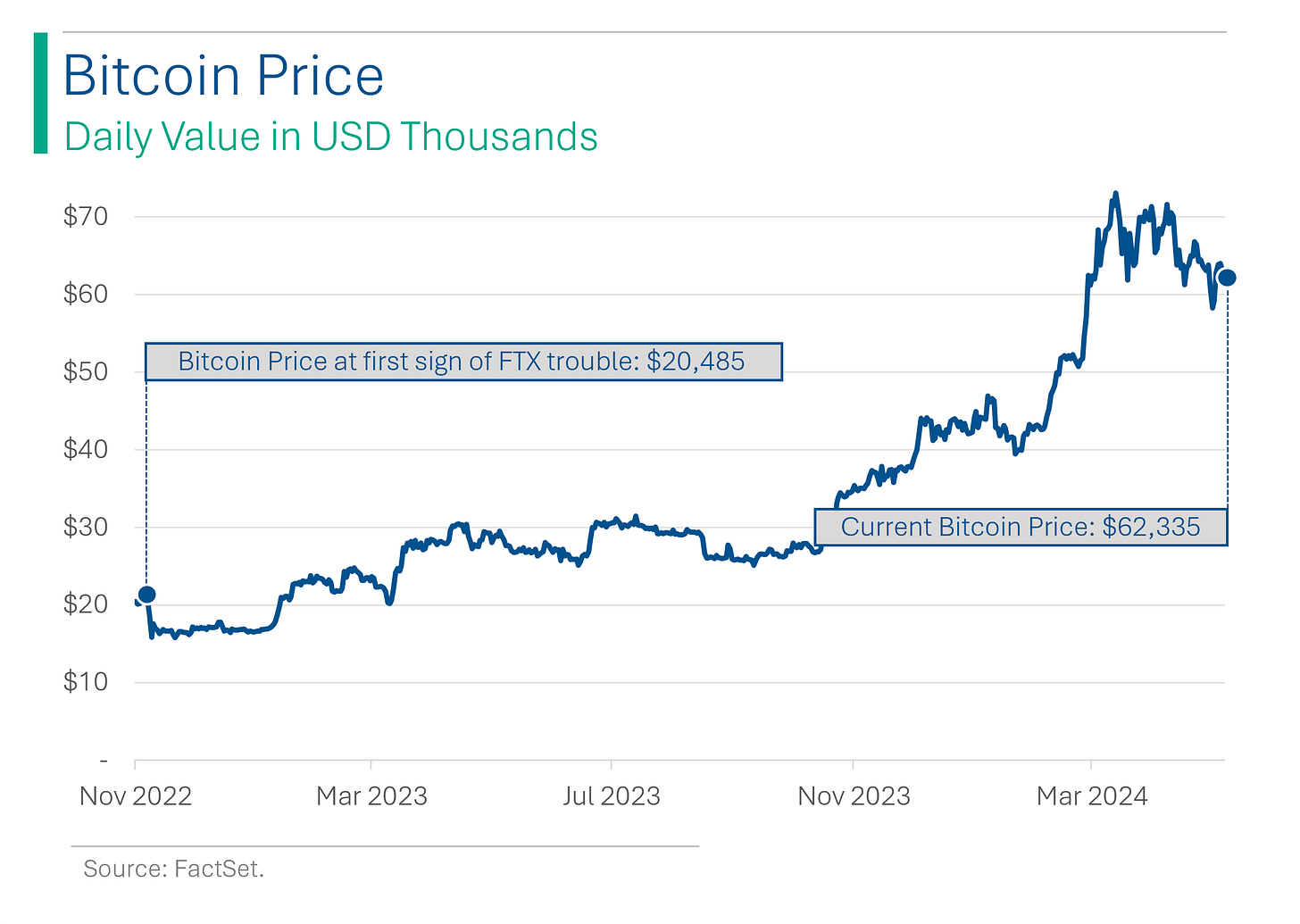

CNBC / FTX says most customers of the bankrupt crypto exchange will get all their money back. Money back, not Bitcoin back. Because importantly…

Trivia

Since they reported yesterday, today’s trivia is on Uber.

When was Uber founded?

A) 2004

B) 2009

C) 2012

D) 2015Who were the founders of Uber?

A) Larry Page and Sergey Brin

B) Travis Kalanick and Garrett Camp

C) Marc Andressen

D) Elon MuskIn what year was Uber’s co-founder/CEO forced to resign after a string of internal scandals?

A) 2015

B) 2023

C) 2008

D) 2017At Uber’s 2019, the company was valued at how much?

A) $82 billion

B) $27 billion

C) $136 billion

D) About three fiddy

(answers at bottom)

Market Movers

Winners!

Louisiana-Pacific (LPX) [+20.8%] Significant Q1 revenue and EBITDA beat; Siding sales and margins exceeded forecasts. Robust demand for Siding and OSB noted; Q2 EBITDA and FY EBITDA guidance raised, buyback increased by $250M.

Globus Medical (GMED) [+20.2%] Strong Q1 earnings with better revenue; reduced dissynergies from NuVasive merger, potential for record salesforce recruiting. FY guidance lifted; merger progress well-received despite some remaining disruption concerns.

Toast, Inc. (TOST) [+13%] Q1 EBITDA significantly above expectations, FY EBITDA guidance raised. Financial Technology and Subscription Services performed well; effective cost management and location growth noted, along with strategic execution.

Teva Pharmaceutical Industries (TEVA) [+12.8%] Q1 revenue surpassed forecasts, though EPS and margins were lighter. Strong generics growth highlighted, driven by Austedo and Ajovy; FY guidance reaffirmed.

Confluent (CFLT) [+12.8%] Q1 earnings and revenue exceeded estimates; margins better than expected. Strong customer growth and positive reception for Flink observed; Q2 guidance slightly above expectations, upgraded at Canaccord.

Lyft (LYFT) [+7.1%] Q1 earnings and revenue outperformed; bookings and active riders exceeded expectations. Take rate improved with lower driver incentives; marketplace health emphasized. Q2 guidance above consensus, on track for positive FCF by year-end.

Reddit (RDDT) [+4.1%] Q1 EPS and revenue outpaced estimates; Q2 earnings and revenue guidance above consensus. DAU up 37% y/y, WAU up 40% y/y; margins exceeded expectations. Tailwinds from Google search changes and doubled click-volume in Q1 ad business noted.

Losers!

TripAdvisor (TRIP) [-28.7%] Q1 earnings exceeded expectations, revenue matched forecasts. Decline in branded hotels revenue, Viator performed relatively well. No current potential transaction considered beneficial.

ZoomInfo Technologies (ZI) [-24.2%] Q1 EPS, operating income, and revenue surpassed expectations; FY24 EPS guidance raised, but revenue and OI forecasts reduced. Downgrades due to weak NRR and tech hiring slowdown.

LegalZoom.com (LZ) [-23.9%] Q1 EPS missed, revenue nearly met expectations; Q2 and FY24 guidance below consensus. Subscription revenue fell short, Transaction revenue exceeded; impacted by 18% y/y drop in business formations.

Shopify (SHOP) [-18.6%] Q1 earnings and revenue aligned with expectations; Subscription results strong. GMV slightly above consensus, offset by lower take rate. Anticipates GM decrease in Q2, modest Q2 revenue growth.

Twilio (TWLO) [-7.5%] Q1 EPS and revenue exceeded forecasts; Q2 revenue outlook disappointing. Strong voice and email segments; messaging struggled with lower international volumes.

Uber Technologies (UBER) [-5.7%] Q1 bookings missed expectations, Q2 bookings guidance lower. Mobility bookings down, Delivery up. Q2 EBITDA guidance midpoint positive.

Intel (INTC) [-2.2%] Expects Q2 revenue below midpoint due to new US ban on Huawei exports.

Tesla (TSLA) [-1.7%] Under Justice Department scrutiny for potentially misleading investors about self-driving capabilities.

Market Update

Trivia Answers

B) Uber was founded in 2009.

B) Travis Kalanick and Garrett Camp founded Uber.

D) Travis got tossed out in 2017.

A) Uber IPO’d at a valuation of $82 billion - then sunk 7% in its first day of trading.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.