🔬What's Moving Markets, Millennials Are Boring Investors, Ford's Pot Hole, and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

“The stock market is designed to transfer money from the active to the patient.”

- Warren Buffett

“I am not going to die sober”

- Jordan Belfort, Wolf of Wall Street

Table of Contents

A.M. Allocations: Summaries of important news and investing events

What’s Been Moving The Markets?

Bond ETFs: Millennials' New BFF (Best Financial Friend)

Ford Hits a Pothole: Union Contract Drives Up Expenses

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

What’s Been Moving the Markets?

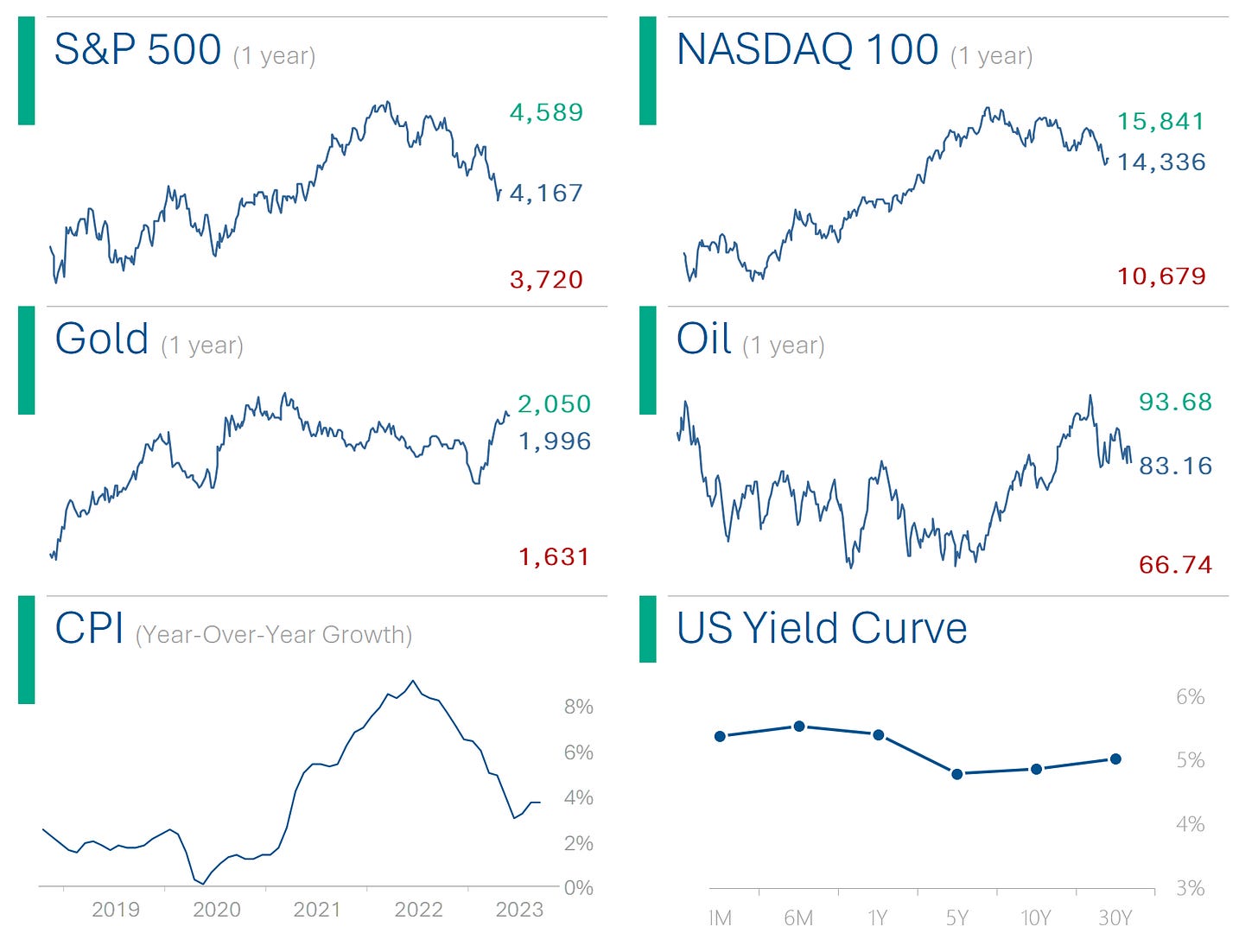

There is an over-supply of data circulating; it’s tricky to know what’s actually driving the stock market of late (even earnings season seems to be taking a back seat). So, below I lay out my (non-exhaustive) brief on some of the key themes moving the markets:

Sept 20th - At the September Fed meeting, rates were kept on hold as expected, but the outlook for the Fed highlighted higher interest rates for longer, including the likelihood of no interest rate cuts in 2024. This helped propel the yield on the US 10-Year Bond to new heights, and hurt the stock market as investors felt that high interest rates would dampen consumer activity and the economic outlook.

Oct 4th - The U.S. Energy Information Administration (EIA) reports demand for petroleum declining, including the expectation for weaker economic activity. Coupled with a softer economic outlook, this sent the oil price reeling, only to reverse after concerns of a broader conflict in the middle-east led to speculation of supply issues in the region.

Oct 7th - Hamas attacks Israel. In the immediate aftermath, defensive support for Israel by the US, and Arab and Iranian support for Hamas raised the specter of another regional conflict. This increased following Iran-backed rocket and drone attacks at US bases in the region. In the face of sticky inflation and a possible protracted Middle-East conflict, the price of Gold is up 9.4% following with its usual role as a safe haven asset.

Oct 11th - The Minutes from the Fed’s September meeting are released, which add to 'higher for longer' rhetoric. This helps ignite another rally in the 10-Year bond yield and gold price, and sinks a recently recovering S&P 500.

Bond ETFs: Millennials' New BFF (Best Financial Friend)

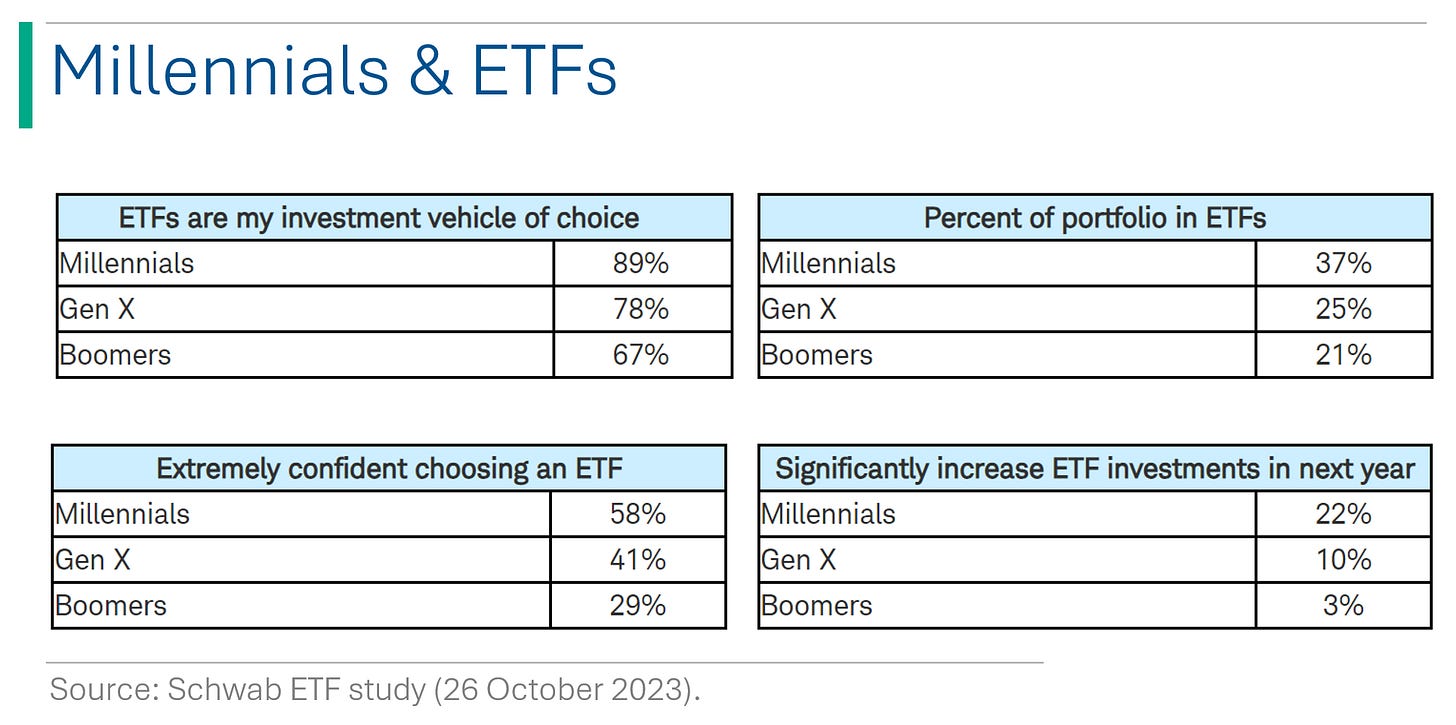

A recent study by Schwab found that Millennials are more likely to be invested in bonds compared to their Gen X and Boomer peers. In the case of the latter, they hold on average nearly 50% more of their portfolios in fixed income compared with Boomers.

The study also found that - admittedly less shocking - Millennials are also much more active in ETFs, with 89% of claiming that they are their preferred investment vehicle.

Take-Aways: The idea that Millennials are more invested in ETFs is fairly intuitive, since they are a modern, typically low-cost method of getting diversification that older generations may well be slower adopters of. However, the idea that they are more invested in bonds and other fixed income is shocking (and kinda sad for an equity guy like me).

The traditional view is that younger generations tend to (and should) focus on equities due to their long-term historically higher rate of return. This is in contrast with older generations that are looking for more retirement income (dividends and bond coupon payments) and the preservation of capital against stock market fluctuations.

There are likely some technical factors at play here - for instance, that Millennials may be more ‘active investors’ and thus keener to capitalize on the recent increases in bond yields. But that on its own isn’t likely to explain this massive shift, and - as a equities snob - I think they must be crazy.

Ford Hits a Pothole: Union Contract Drives Up Expenses

While I think most people are glad that Ford and UAW have reached a concord to end the strike, investors might not be so thrilled. Deutsche Bank research analyst Emmanuel Rosner estimates that the new contract will increase Ford’s operating costs by ~$6 billion a year by the end of the contract in 2028.

Currently, Ford’s North American operating profit (its Earnings Before Interest and Taxes, or EBIT) is $9.2 billion so the company will have its work cut out for them to build back profitability in the face of increased labor costs.

Joke Of The Day

Crisis has taken over the Japanese banking system: In the last seven days, Origami bank has folded, Sumo Bank has gone belly up and Bonsai Bank has announced plans to cut some of its branches. Yesterday, it was also announced that Karaoke Bank will go up for sale and will likely go for a song, while shares in Kamikaze Bank were suspended today after they nose-dived. While Samurai Bank is soldiering on after sharp cutbacks, 500 staff at Karate Bank got the chop and investment analysts report that there is something fishy going on at Sushi Bank, where it is feared that staff may get a raw deal.

Hot Headlines

(Barron’s) Big Money Pros Are Split on the Outlook for Stocks. But They Are Fans of Bonds - Big survey of professional money managers had a cautious/wimpy tone: only 38% are bullish about the prospects for equities in the next 12 months (38% neutral, 24% bears). While the survey highlighted a lot of near-term market fear, 95% of respondents expected equities to outperform bonds over the next 5 years. Take that Millennials! (see above)

(Reuters) Goldman Sachs no longer sees U.S. govt shutdown in 2023 - the bank sees the election of the new speaker and increasing geopolitical risks as drivers for congress to work things out - but warns of risks in 2024. Previously, the bank’s base case was for a 2-3 week shutdown.

(Reuters) Tesla falls as production cut by battery supplier Panasonic fans EV demand fears - Panasonic cut production by 60% to normalize inventories, and also slashed its profit forecasts by 15% based on a weaker view of EV production in the coming months.

(WSJ) China Manufacturing PMI Fell Into Contraction for October - the official purchasing managers index fell to 49.2 from 50.2 in September.

(CNBC) McDonald’s, Chipotle to raise menu prices in California next year as fast-food wages rise to $20 - the their conference call, Chipotle CFO said they expect to raise prices by “mid-to-high single-digit” percentage in the state. More food inflation but that doesn’t seem too bad for a livable wage.

(Barron’s) Bond King Bill Gross Is Staying Away From Regional Bank Stocks. Except for These 3 - Citizens Financial Group (CFG), Truist Financial (TFC), and KeyCorp (KEY). More importantly, he’s starting to give off serious Cryptkeeper vibes.

Trivia

The oldest and largest ETF in the world is the SPDR S&P 500 Trust ETF. What year was it created?

1978

1984

1988

1993

How big the the SPDR S&P 500 (in AUM)?

$124 billion

$382 billion

$550 billion

$3.1 trillion

State Street Global Advisors’ long list of SPDR (called ‘Spiders’) ETFs are some of the largest and most popular in the world. What does SPDR actually stand for?

Standard & Poor's Depositary Receipts

State Street Performance Driven Return

Stock Performance Derived Return

Stock Price Down, Rage!

(answers at bottom)

Market Movers

Winners

Western Digital (WDC) [+7.3%]: Beat FQ1 earnings and revenue; despite lower hard drive shipments, saw increased flash shipments; EPS guidance above expectations; plans to split HDD and Flash businesses by H2'24.

Losers

ON Semiconductor (ON) [-21.8%]: Surpassed Q3 expectations but gave weak Q4 guidance; revenue and EPS guidance significantly below estimates, noting softness in Europe and risks to auto demand.

Revvity (RVTY) [-16.1%]: Missed Q3 EPS and revenue; reduced FY23 guidance, expecting a 17% decline in organic growth; highlighted difficult market conditions.

Realty Income (O) [-5.7%]: Announced acquisition of SRC in a ~$9.3B all-stock deal, representing a ~15% premium; deal anticipated to close in Q1'24.

Market Update

Trivia Answers

1993. While Vanguard under the legendary John C. Bogle had been doing index tracking since the 1970s, those were officially mutual funds.

$382 billion (as of last close).

Standard & Poor’s Depository Receipts. So yeah, the SPDR S&P 500 ETF is technically the ‘Standard & Poor’s Dep. Receipt Standard & Poor’s 500 ETF’. Spider is way cooler.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.