🔬What's Behind the Market's Run?

Plus: Nvidia is down (profit taking); Trump Media is down (conspiracy); and much more!

"Show me the incentive and I will show you the outcome"

- Charlie Munger

“If I had asked people what they wanted, they would have said faster horses.”

- Henry Ford

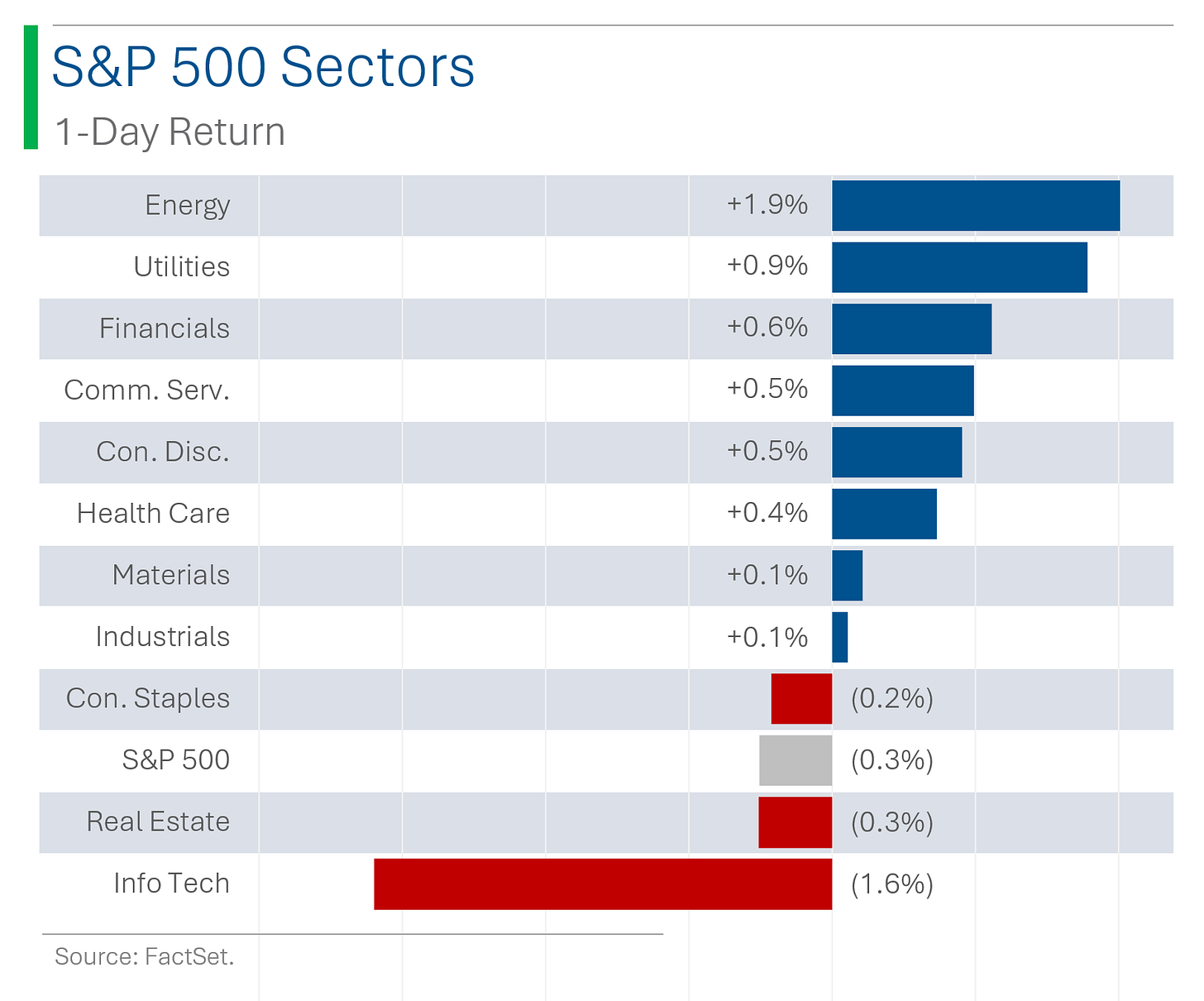

Finally a bad day for the big US markets with the S&P 500 -0.3% and Nasdaq -0.8%. This is only the second negative day in the last 12 trading sessions.

8 of 11 sectors closed higher, led by Energy (+1.9%) and Utilities (+0.9%). Tech (-1.6%) is what really pulled things negative, mostly due to Nvidia closing down 3.5%.

Jobless Claims came in in-line with market expectations (238K vs. consensus 235K).

May Housing Starts had a big miss (1.277M vs. consensus 1.390M), falling 5.5% since last month and against expectations for a +1.1% increase.

Notable companies:

Gilead Sciences (GILD) [+8.5%]: Phase 3 clinical trial of drug Lenacapavir shows complete prevention of HIV in women.

Nikola (NKLA) [-31.5%]: Disclosed 1-for-30 reverse stock split.

Brookfield Business Partners (BBU) [-6.8%]: Owns CDK Global, which shut down its systems on Wednesday following cyber incidents and is still down.

Street Stories

What's Behind the Market's Run?

Ya, obviously Nvidia. But besides that, I wanted to see what companies and sectors are pulling their weight and which are dead money or worse. Here we go!

To start, as I write this the S&P 500 is up 14.7% for the year, which makes it one of the better years on record with only half the year done.

Interestingly, only two sectors have actually managed to outpace the market this year: Tech (obviously) and its little brother Communication Services, which admittedly holds some duds (like Paramount, Fox, AT&T) but also some heavy weights like Alphabet and Meta.

And while only two sectors have been able to hold the market, everything else has been surprisingly solid as well, with the exception being Real Estate which got a bit over its skis at the end of last year in anticipation of rate cuts that never transpired.

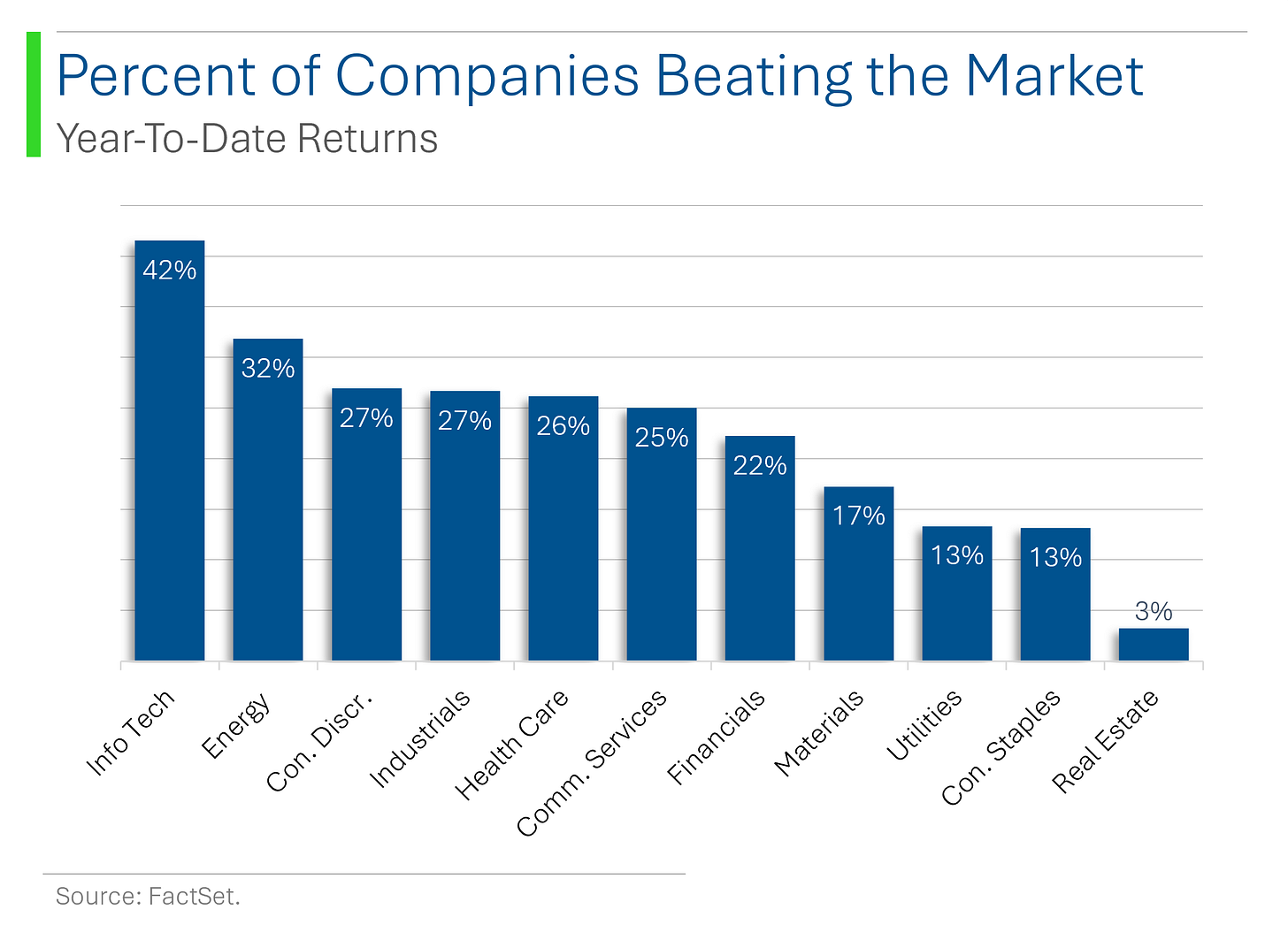

Within the sectors, most of the outperformers follow expectations: Tech has the most companies beating the S&P and Real Estate the least.

Interestingly Communication Services only has 5 companies out of the 20 on the subindex beating the market but the sector is up 24% for the year. The explanation is that the smaller companies’ weakness (like Warner Brothers: -38%; Paramount: -32%; Charter: -27%) is more than eclipsed by the biggest companies’ strength (Alphabet: +26%; Netflix: +39%; Meta: +42%).

On the percentage front, things are pretty consistent …but I made the graph so you must look at it.

The only big exception here is Energy, which has a lot of companies doing great and a lot of companies doing terribly (no middle ground).

Looked at another way, putting the companies into buckets based on performance shows just how skewed the returns for the market are this year. Only 120 companies (24%) are actually up more than 15% this year - roughly the level of the S&P 500.

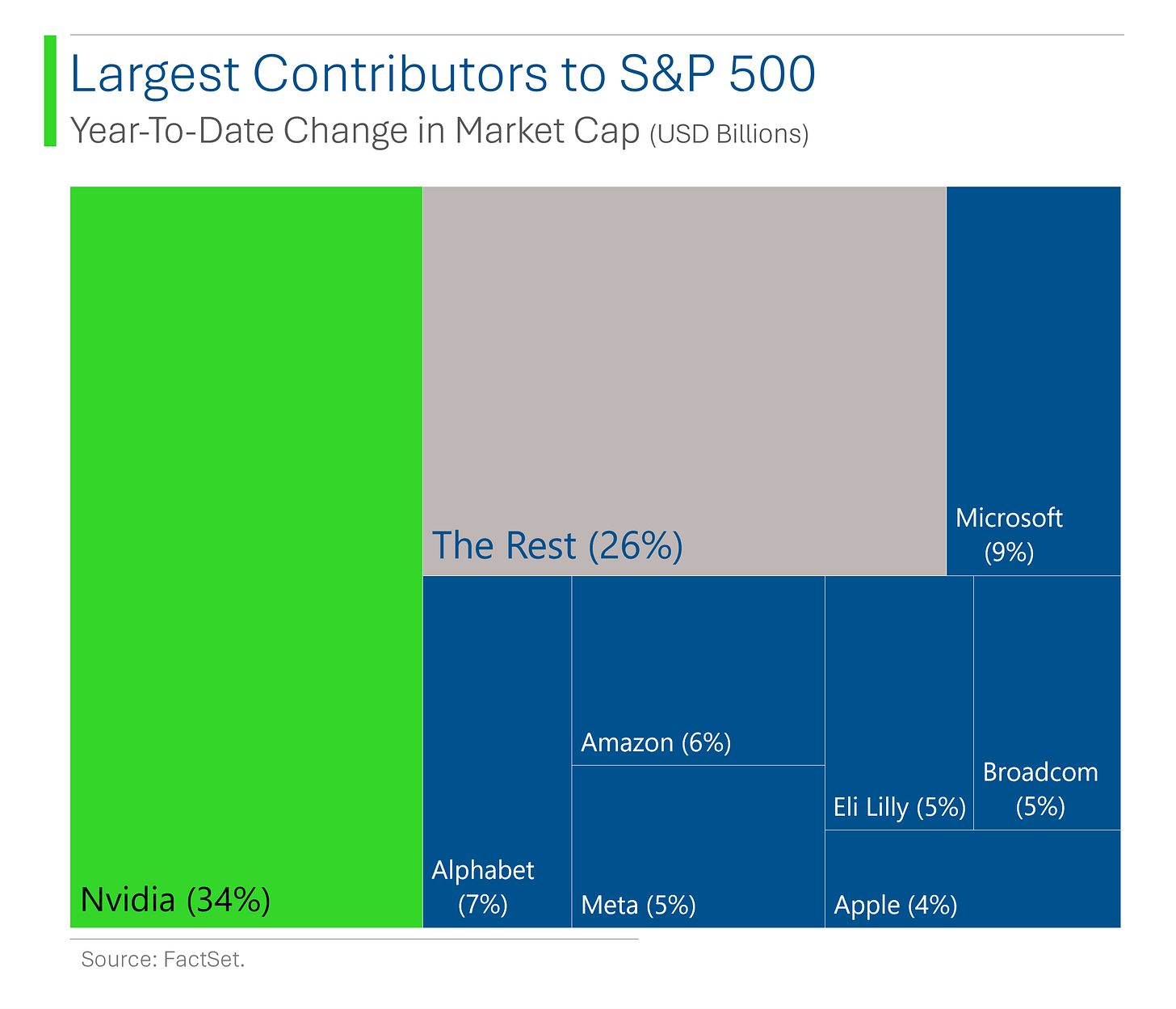

At the company level, I’ve talked enough about Nvidia but besides them, the index’s returns have still been rather top heavy. For example, the top 15 performers this year have contributed $5.1 trillion to the S&P 500 - or roughly 85% of the return. Meaning the other 485 companies have only contributed $0.9 trillion.

Do better.

On the downside, there aren’t too many megacap blow ups save for Tesla, Intel and Boeing, which have combined to lose $342 billion this year.

To wrap this up, the top 8 best performing companies this year contributed the vast majority of the market’s return.

Wanna know something crazy? Those top 8 performers also happen to be 8 of the top 9 largest companies in the US. The only one missing is Berkshire Hathaway: The number 7 largest company which contributed only +1.8% to the S&P this year.

TOP. F***ING. HEAVY.

Nvidia’s Bad Day

Ok, I mean it wasn’t a disaster.

After soaring last week to take over Microsoft’s mandate as the largest publicly traded company in the world (which it has now lost), it’s reasonable to expect some investors to take profit.

However, at this scale the company’s 3.5% loss yesterday represented a massive dollar amount. For example, yesterday wiped out the equivalent of Intel. On no news.

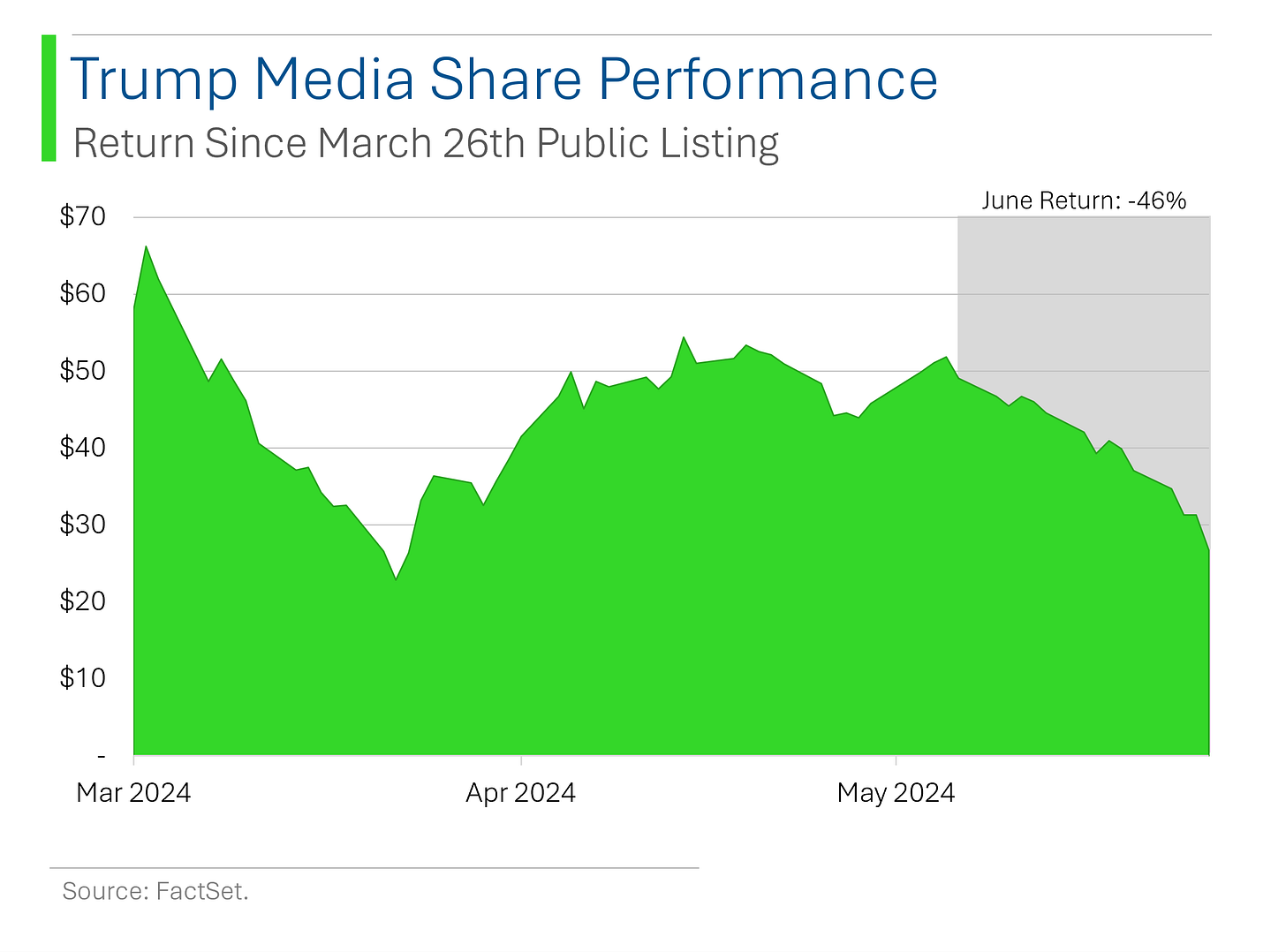

Trump Stock’s Stumble

Shares of Trump Media & Technology Group (DJT) have plummeted 46% this month, following Trump's guilty verdict on 34 felony counts, closing at $26.75 on Thursday.

The company warned investors about potential adverse effects due to disagreements over Trump’s obligation to prioritize posting on Truth Social, amid a volatile stock performance and a shrinking market cap of $5.5 billion.

Trump Media officials have claimed stock manipulation by naked short sellers for its woes. Suuuure. 🚮

Joke Of The Day

A woman hears from her doctor that she only has 6 months to live. The doctor advises her to marry an economist. The woman asks, “Will this make me live longer?” The doctor answers, “No. But it will seem longer”.

Hot Headlines

CNBC / Gilead's experimental HIV prevention medication was 100% effective in Phase 3 trial. For those not familiar with Gilead, they cured Hep-C and turned AIDs into a a non-fatal annoyance. Now the twice-yearly shot seems to eliminate the risk of catching HIV to begin with. Shares closed +8.5% on the news.

Yahoo Finance / Struggling rental car firm Hertz plans to raise $750 million through notes. The company has been struggling to due to weak demand for EVs weighing on earnings, and is slimming down the business including plans to sell 10,000 more EVs, taking its total planned sales to 30,000 this year.

Reuters / Nikola plans 1-for-30 reverse stock split to comply with Nasdaq listing rules. Shares currently trade at $0.33 and the firm took action since companies need to trade above $1 to maintain their listing. However, the fact that they did a 30:1 instead of a 10:1 signaled to the market that management has little confidence going forward - and shares tanked 32%. EV peer Fisker’s Tuesday bankruptcy probably didn’t help either.

Tech Crunch / Anthropic claims its latest AI model is best-in-class. The OpenAI rival claims its Claude 3.5 Sonnet is better than Chat-GPT on paper on most tests, and can analyze text and images.

Bloomberg / McDonald’s $5 value meal intensifies a fast food price war. All major food retailers, including Starbucks, have gotten in on the action to lure back inflation-weary diners.

The Onion / Man sleeping on sidewalk must not know about heat advisory. Ooof.

Trivia

Today’s trivia is on ‘first year economics’.

The 'Phillips Curve' suggests a short-term trade-off between:

A) Inflation and unemployment

B) Interest rates and exchange rates

C) Economic growth and inflation

D) Supply and demandThe 'Efficient Market Hypothesis' suggests that:

A) All markets are inherently efficient

B) Stock prices fully reflect all available information

C) Only financial markets can reach efficiency

D) Market efficiency is impossibleWhich of the following is an example of a 'public good'?

A) A branded smartphone

B) A private garden

C) National defense

D) A concert ticket

(answers at bottom)

Market Movers

Winners!

Penn Entertainment (PENN) [+9.9%]: Reuters reported Boyd Gaming (BYD) approached Penn about an acquisition.

Gilead Sciences (GILD) [+8.5%]: Phase 3 trial of Gilead's lenacapavir shows complete prevention of HIV in women.

Accenture (ACN) [+7.3%]: Fiscal Q3 revenue and EPS light, slightly lowered FY guidance, but Street positive on 26% new bookings growth and ~50% sequential acceleration in GenAI new bookings to $900M+.

WestRock (WRK) [+5%]: Smurfit WestRock shares from the merger agreement expected to start trading on NYSE and London Stock Exchange on Monday, 8-Jul.

Commercial Metals (CMC) [+3.8%]: Q3 EPS in line with revenue ahead of consensus; management noted a good start to spring and summer construction season and signs of increased infrastructure activity driving demand, expecting momentum to build, especially in North America.

TransUnion (TRU) [+2.9%]: Upgraded to buy from neutral at Bank of America, citing growth opportunities in emerging verticals and potential lending recovery in 2025 if mortgage sales return to pre-pandemic growth rate.

Losers!

Nikola (NKLA) [-31.5%]: Disclosed 1-for-30 reverse stock split to trade on split-adjusted basis beginning 25-Jun-24.

Jabil (JBL) [-11.4%]: Q3 EPS and revenue beat; FY24 EPS and revenue guidance reaffirmed; Q4 EPS and revenue guidance largely in line with mid-point expectations; Electronics Manufacturing revenue growth expected to be down 18% y/y; Diversified Manufacturing growth down 23% y/y.

Brookfield Business Partners (BBU) [-6.8%]: Owns CDK Global, which shut down its systems on Wednesday following cyber incidents, still down on Thursday.

GMS Inc (GMS) [-6.1%]: Fiscal Q4 EBITDA light; highlighted significant Steel price deflation; noted Steel has softened further into fiscal Q1; flagged near-term headwinds, especially in Wallboard and Steel margins; Wallboard volume growth recently turned positive for first time since fall 2022.

Vanda Pharmaceuticals (VNDA) [-5.8%]: Rejected unsolicited proposals from Cycle Group Holdings to acquire Vanda for $8.00 per share in cash and from Future Pak to acquire company for $8.50-9.00 per share in cash plus certain CVRs.

Jazz Pharmaceuticals (JAZZ) [-4.7%]: Top-line results from Phase 2b clinical trial evaluating efficacy and safety of suvecaltamide did not achieve statistical significance at 30mg versus placebo on the primary endpoint.

Winnebago Industries (WGO) [-3.6%]: Q3 EPS and revenue missed; management noted challenging outdoor industry market conditions and inconsistent retail patterns; revenues down 12.7% y/y; gross profit down 22% y/y.

Market Update

Trivia Answers

A) The 'Phillips Curve' deals with the short-term trade-off between Inflation and Unemployment.

B) That stock prices fully reflect all available information is the key tenet of the Efficient Market Hypothesis.

C) National defense is a public good.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.