🔬What The Hell Is 'Tech' Anyway?

"Successful investing requires a rare combination of just the right amount of arrogance and humility to imagine that you can see the future and the wherewithal to admit when you have made a mistake"

- Howard Marks

"I'm not a businessman - I'm a business, man"

- Jay-Z

Super short note today as US markets were closed and news flow was pretty dead.

Street Stories

What The Hell Is 'Tech' Anyway?

I’ve talked quite a bit about the ‘Magnificent 7’ and the lack of market breadth but most of that boils down to the Tech sector crushing it. Well, kinda…

See, 4 out of the 7 aren’t actually ‘Tech’ companies as defined by S&P.

If we look beyond what the market considers actual ‘Tech’ to find the best performing companies over the last year and a half, the results are pretty interesting: Interesting in that most of the return has come from companies that are, well, techy.

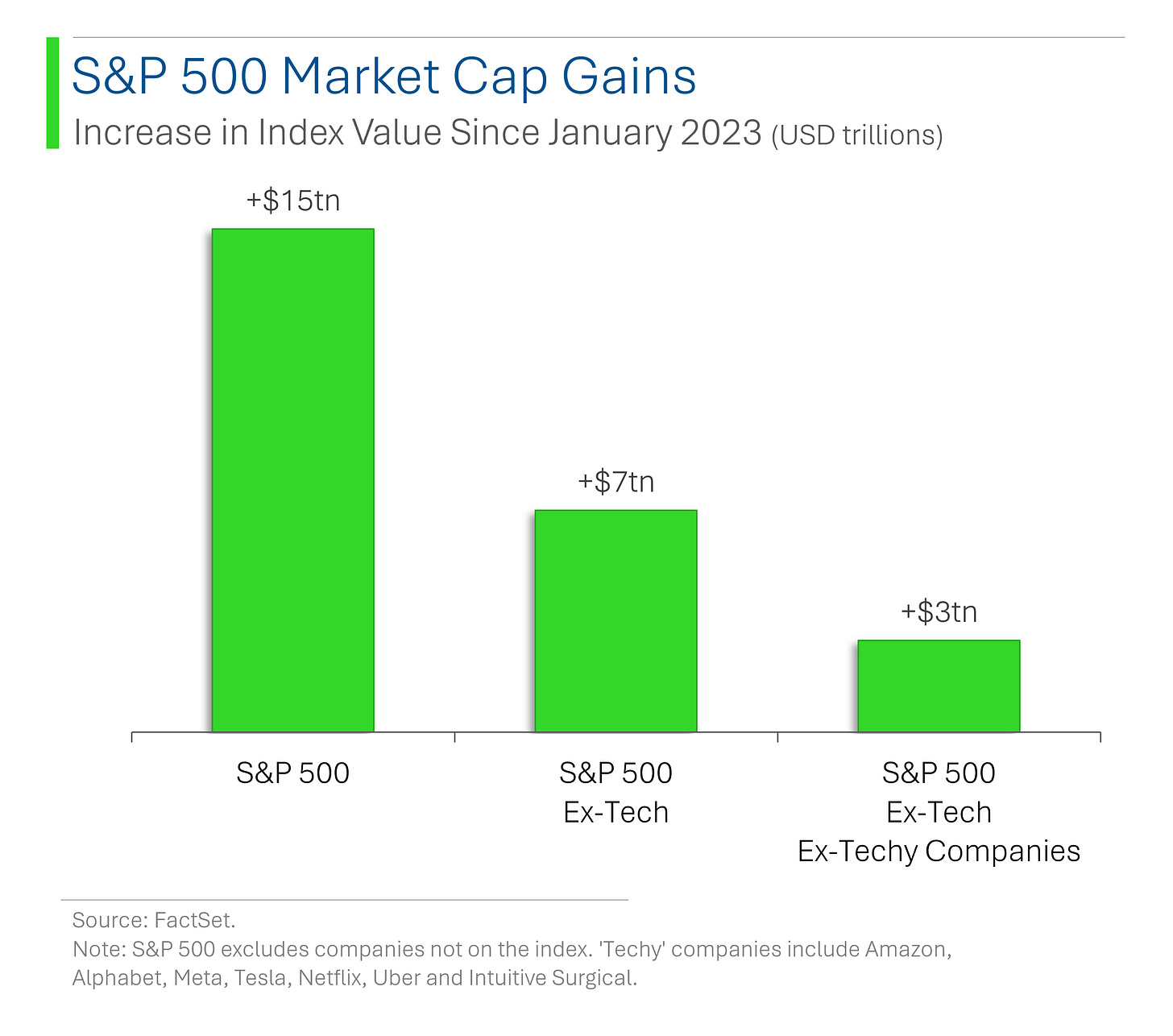

To lay that out in a less colorful way, since the start of 2023 the S&P 500 has added ~$15 trillion in market value1.

If we remove the 67 companies that make up the Tech Sector, then the return of this ‘S&P 430ish’ plummets to ~$7 trillion.

But if we also remove those techy companies highlighted above, the return of this ‘S&P 425ish’ is only ~$3 trillion. Like, one fifth. (ie: everything else kinda sucks.)

1. I had to remove a few companies that didn’t have trading data that far back.

The point I’m haphazardly working towards is that the definition of Tech is sorta weird. Just look at the Consumer Services sector as a ‘fer instance’: Around 79% of the market value of the companies in the sector can loosely be described as Tech companies.

I mean, if you ask me, making video games and running websites is a lot more techy than, say, Fair Isaac (a credit rating agency) or Dell (assembles and sells computers and equipment other companies make) which are both in the actual Tech sector.

Consumer Discretionary also has the same vibes.

Probably the weirdest one for me is Uber being in the Industrials sector. Like… it’s an app running logistics software. I guess, kinda, it competes with other industrials, like GM or Ford, but not any more than it competes with walking or public transit.

The take-away, however, probably isn’t that the good people at S&P Global are dummies. But rather that techy companies are so prolific now that the folks classifying companies don’t want to overcrowd the Tech sector.

Back in May I wrote a piece on the history of Tech (A Tale of The Tech Sector), and highlighted that when the S&P was originally broken into official sectors, Tech was the 6 largest out of 10. Right now it’s number 1 and ~126% larger than its next closest peer.

Lumping in all the sorta techy companies I’ve flagged would take this figure closer to 50%. Which is probably too big…

Joke Of The Day

China's stock market is down again. We should have seen it coming. The red flags were everywhere.

Trivia

Today’s trivia is on one of the great financial dynasties: the Rothchilds.

The Rothschild banking dynasty originated from which country?

A) France

B) Germany

C) United Kingdom

D) ItalyWhat unique method did the Rothschilds use in the 19th century to communicate rapidly across Europe?

A) Smoke signals

B) Carrier pigeons

C) Semaphore lines

D) TelegraphIn what year did Nathan Mayer Rothschild allegedly use advanced knowledge of Napoleon's defeat at Waterloo to make a fortune on the stock market?

A) 1805

B) 1815

C) 1825

D) 1835In which century did the Rothschild banking dynasty begin to rise to prominence?

A) 16th Century

B) 17th Century

C) 18th Century

D) 19th Century

(answers at bottom)

Trivia Answers

B) The dynasty started in Germany.

B) Carrier pigeons were used by the bank to transport news and financial information.

B) Napoleon’s defeat was in 1815.

C) The family came into international prominence in the 18th Century.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.