🔬What the Hell Is Reporting Season Anyway?

Plus: Why does Disney continue to suck? And much more!

"The markets are like a large movie theater with a small door"

- Jeffrey Gundlach

“All of our dreams can come true if we have the courage to pursue them.”

- Walt Disney

Big day for the big US markets with the S&P 500 +2.3% and Nasdaq +2.9%. Even Small-Cap resumed to form, with the Russel 2000 +2.4%.

All 11 sectors closed higher as correlation seems to be the order of the day (Tuesday all sectors closed higher, Monday all sectors closed lower). Tech (+3.3%) still managed a big day tho.

Notable companies:

Palantir Technologies (PLTR) [+11.2%]: Announced plans to deploy its AI products on Microsoft's Azure for US government.

Duolingo (DUOL) [+10.9%]: Crushed Q2 earnings with revenues and bookings beat; FY25 outlook raised; daily active users and paid subscribers increased more than expected; high user retention and return rates.

Eli Lilly (LLY) [+9.4%]: Big Q2 revenue and EPS beat; raised FY sales guidance by 7% and EPS guidance by 19%; diabetes drug Mounjaro and weight-loss drug Zepbound standouts.

Bumble (BMBL) [-29.2%]: Sucky earnings with Q2 EBITDA and EPS beat but revenue missed; total users and net adds better than expected, but cut FY24 revenue growth and EBITDA margin growth guidance; expect greater payer churn. They just suck.

Street Stories

What the Hell Is Reporting Season Anyway?

We all hear about it - and occasionally see our stocks pop or implode on earnings news - but I don’t think the when and why are particularly common knowledge.

Lemme break it down for you.

To start, there’s no actual fixed period when companies have to report their earnings. Most companies have a December 31st fiscal year end but it can really be anytime they choose. December 31st lines up their fiscal year nicely with the calendar but lots of companies choose other times as well.

Typically they match up with the calendar quarters - such as Microsoft at June 30th or Apple at September 30th - but you do get weird ones. For example, a lot of retailers want the full impact of the Christmas shopping season baked into their numbers (and don’t want to get murdered by their accountants around New Years from pulling all-nighters) so they have a January year end (such as GameStop).

Nvidia also has a January year end and my guess is because they spent most of their life selling graphics cards to gamers and December was their biggest season.

Above you can see the breakdown of reporting so far in 2024. Reporting is a lot more spread out in the January to March period because most companies have a December fiscal year end. According the the Securities and Exchange Commission (SEC), companies have 60 days after their year end to report so companies have a pretty wide window to report their Q4 (annual report).

Quarterly reports require less audited information so the SEC only give them 35 days to report. Thus, with most companies finishing their Q1 on March 31 they have to have their financials made public by May 5th.

As a result, the reporting period for Annuals (Q4) lasts around 6-7 weeks, while Quarterlies are usually wrapped up in only 4 weeks.

Even within a very busy reporting season, some days are a lot s*****r busier than others. On the busiest day of 2024 - May 2nd - 65 companies in the S&P 500 reported.

That is in part due to the fact that reporting across the week isn’t uniform, with most companies choosing to report between Tuesday and Thursday. There’s a bunch of reasons for this, like not having to prepare for your call over the weekend (Monday) or not having your earnings call after hours on a Friday.

And I’m pretty sure I subconsciously built up a selling bias towards companies that made me listen to an earnings call at 6:30PM on a Friday. Clowns.

I’ve even heard it rumored that an old Wall Street trick for when you were having a terrible quarter was to report on a Friday in the hopes it would slip through the cracks.

Lastly, it’s worth noting that different industries tend to report at different times. For example, the big banks are usually the ones that lead off reporting season, while Tech tends to take it’s sweet time.

I hope some of that was informative - but more importantly, I’m glad this messy Q2 season is almost over!

Disney Can’t Catch A Break

The company reported a solid quarter Wednesday with in-line Revs ($23.2b vs. Wall Street estimates for $23.1b), a hefty beat on EPS ($1.39 vs. Street’s $1.20) and upped their earnings guidance from +30% from +25% for the year.

But, like, it wasn’t good enough.

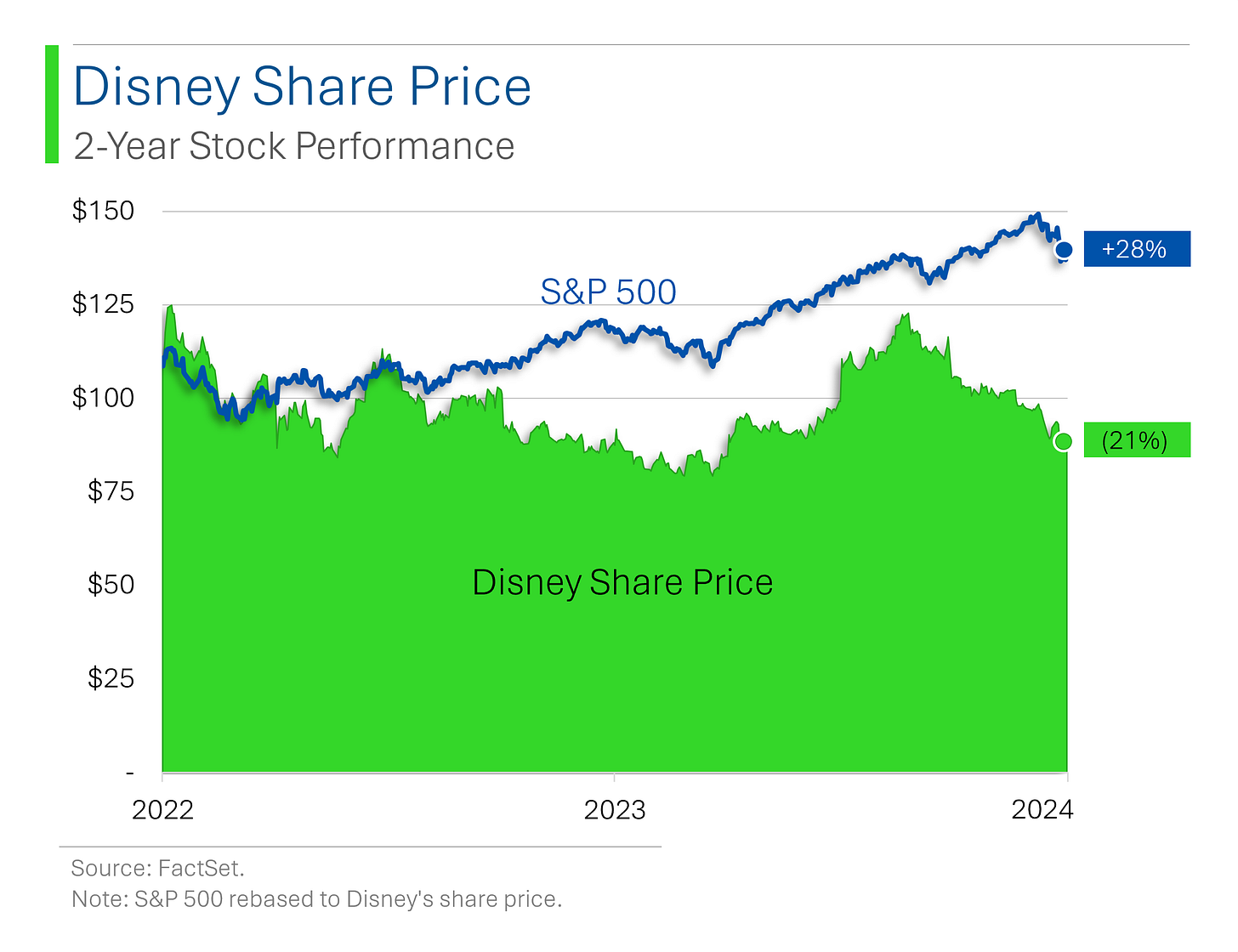

The report took shares for another -4.5% bath as hopes that the company has turned itself around after several terrible years gets pushed back further. Bringing the 2 year performance gap vs. the S&P 500 to 49%. Youch!

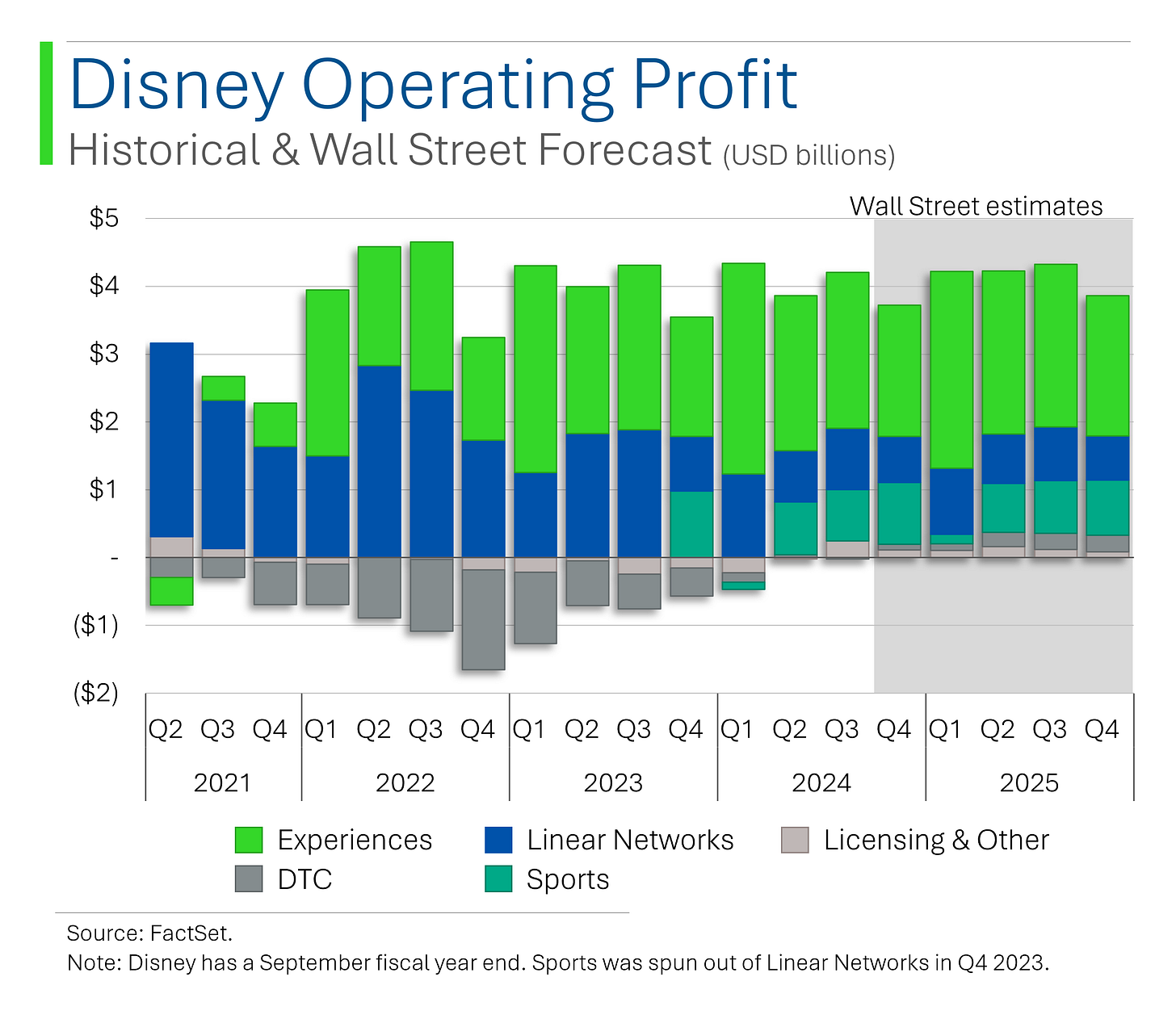

Revenues remained muted and the guidance didn’t imbue optimism that growth in Experiences (mostly theme parks) and DTC (Disney+, Hulu) would offset continued declines in Linear Networks (regular TV stuff) and Sports (ESPN).

The biggest negative is that they see their Parks business sinking by mid-single digits in revenue compared to 2023.

In a nutshell, the profitability of Linear Networks (above blue) and Sports (dark green) are expected to continue to suck, while the only bright spot has been their Parks business (most of the light green) - which now also appears to suck.

As analysts digest the numbers, I’d expect those nice light green bars on the right to shrink even more.

Joke Of The Day

Why is Google Chrome like a submarine? They tend to get a little slow if you open too many windows.

I got an e-mail saying “At Google Earth, we can even read maps backwards”, and I thought...“That’s just spam”

Hot Headlines

CNBC / Boeing’s new outsider CEO Ortberg takes the helm, this time from the factory floor. With the firm’s share price down 37% in 2024, Ortberg reportedly spent his first day inspecting Boeing’s 737 Max factory in Renton, Washington…Suffice to say, he definitely has a couple of tough years ahead of him.

CNBC / JPMorgan raises 2024 recession odds to 35%. The bank raised its figure from 25% in response to July’s disappointing unemployment report which saw 4.3% of the American labor force without work.

AXIOS / Trump offers new dates for presidential debates. With only 88 days until the election, Donald Trump has reached agreements with major networks to host three debates through the month of September. While VP Harris’ polling numbers have seen a recent jump, she is still yet to agree to two of the dates.

Yahoo Finance / Consumer insolvencies hit 4-year high in Canada as interest rates weigh on households. 386 Canadians filed for bankruptcy each day within Q2, eclipsing the level of insolvency seen just before the pandemic struck in the tail-end of 2019.

CNBC / Palantir jumps on Microsoft partnership to sell AI to U.S. defense, intel agencies. I think we’ve all seen this movie before.

Trivia

Today’s trivia is on Disney:

What was the first animated feature film produced by Disney?

A) CinderellaB) Sleeping Beauty

C) Snow White and the Seven Dwarfs

D) Pinocchio

How much did Disney pay to acquire Marvel Entertainment in 2009?

A) $2 billion

B) $4 billion

C) $6 billion

D) $8 billion

How many theme parks does Disney operate worldwide as of 2024?

A) 5

B) 8

C) 12

D) 14

Which Disney movie is the highest-grossing animated film of all time (as of 2024)?

A) Frozen

B) The Lion King (2019)

C) Toy Story 4

D) Frozen II

(answers at bottom)

Market Movers

Winners!

Viasat (VSAT) [+37.8%]: Q2 earnings and revenue beat expectations due to strong licensing and Defense Technology business; management slightly raised F25 guidance, lifting the low end while maintaining the high end.

Klaviyo (KVYO) [+33.3%]: Q2 earnings, revenue, and margins beat; billings and customer metrics ahead of consensus, with large-customer growth better than expected; solid retention on expansions from existing clients; raised FY guidance; upgraded at KeyBanc.

Under Armour (UA) [+18.3%]: Fiscal Q1 revenue better and EPS unexpectedly positive; North America (NA) and EMEA ahead, with GM 140 bp better; slightly raised FY NA revenue outlook and EPS guide; lower discounting in DTC, lower product costs, improved inventory positioning.

Zillow Group (ZG) [+18.2%]: Big Q2 EBITDA beat; Q3 Residential revenue outlook below while company reiterated FY guidance and announced leadership change; outperformance vs housing market, product innovations, improved connection and conversion rates.

SharkNinja (SN) [+16.8%]: Q2 EPS, EBITDA, and net sales all beat; raised FY24 EPS and EBITDA guidance, increased net sales growth midpoint to 23%; sales up across all product categories, especially in food preparation, beauty, and home environment segments.

YETI Holdings (YETI) [+16.7%]: Q2 EPS and adjusted revenue beat; FY24 EPS and revenue guidance raised; analysts noted recovering sentiment driven by better revenue data and potential for gross margin upside from continued freight benefits.

Krispy Kreme (DNUT) [+13.5%]: Q2 EPS in line while revenue beat; McDonald's partnership rollout on track, expanding to over 1,000 locations by end of 2024; positive updates on Walmart and Target development plans.

Palantir Technologies (PLTR) [+11.2%]: Announced plans to deploy its AI products on Microsoft's Azure for US government.

Duolingo (DUOL) [+10.9%]: Q2 earnings, revenues, and bookings beat; Q3 guidance in line to slightly ahead; FY25 outlook raised; daily active users and paid subscribers increased more than expected; high user retention and return rates.

Eli Lilly (LLY) [+9.4%]: Big Q2 revenue and EPS beat; raised FY sales guidance by 7% and EPS guidance by 19%; Mounjaro and Zepbound standouts; improving supply dynamics for incretin portfolio, higher realized prices for Mounjaro in US.

Penn Entertainment (PENN) [+8.5%]: Q2 earnings and revenue beat; outperformance driven by stable revenues in the retail business and margin benefits; consistent consumer trends and growth from ESPN Bet customers.

CyberArk Software (CYBR) [+8.3%]: Q2 ARR and margins ahead; raised FY guidance for both metrics and FCF; customer consolidation and expansion, 245 new logos; leverage to changing cybersecurity needs.

Vistra (VST) [+7%]: Q2 earnings beat with FY24 guidance reaffirmed; guidance trending toward upper end of range; solid results despite mild summer weather in Texas and lower wholesale prices across competitive markets.

TKO Group Holdings (TKO) [+6.7%]: Q2 EBITDA beat, revenue ahead with both WWE and UFC ahead of consensus; raised FY24 EBITDA and revenue guidance; revenue jump from media rights and sponsorships.

Datadog (DDOG) [+5.6%]: Q2 EPS, operating income, and revenue beat; billings and deferred revenue ahead; raised FY24 EPS, OI, and revenue guidance; guidance likely conservative; outperformance compared to peers.

Occidental Petroleum (OXY) [+4.3%]: Q2 EPS beat though revenue slightly missed; profit surge from higher oil production in Colorado and rise in crude prices; Q3 production expected to increase by 140,000 boepd.

HubSpot (HUBS) [+3.4%]: Q2 EPS, operating income, and revenue beat; billings ahead; raised FY24 EPS, revenue, and income guidance; upgraded to sector weight at KeyBanc; new pricing and packaging traction.

Pinterest (PINS) [+1.6%]: Partnering with TikTok and Pinterest to allow users to buy items from Amazon ads without leaving social media apps, according to The Information.

Losers!

Bumble (BMBL) [-29.2%]: Q2 EBITDA and EPS beat but revenue missed; total users and net adds better than expected, but ARPU light; cut FY24 revenue growth and EBITDA margin growth guidance; multiple downgrades due to lack of traction in April refresh and worsening app data trends; expect greater payer churn.

JFrog (FROG) [-27.5%]: Q2 EPS, revenue, operating income in line; billings and deferred revenue ahead; cut FY24 EPS, revenue, and operating income guidance; analysts flagged macro headwinds to cloud, including pushouts and slower migrations; Security and Curation contributions not expected until 2025.

Dutch Bros (BROS) [-19.9%]: Q2 comp growth and EBITDA ahead; flagged disappointment as company maintained +LSD comp growth guidance for 2H, implying softer performance; slight reduction in 2024 unit development guidance noted.

GoodRx Holdings (GDRX) [-18.6%]: Q2 revenue largely in line while EPS better; Q3 guidance light and FY24 revenue guided to low end due to headwinds from Rite Aid closures; however, raised FY EBITDA guide.

McKesson (MCK) [-11.3%]: Fiscal Q1 EPS beat by 10%, but seen as lower quality with investment tailwinds; revenue and EBIT light with three of four segments missing; weakness in Med-Surg and guidance reduction in US Pharma revenue noted.

Monster Beverage (MNST) [-10.9%]: Q2 earnings, revenue, and OM missed; slowdown in energy drink category noted due to tighter consumer spending and reduced convenience-store traffic; weak international performance and worsening US trends in July; still planning a ~5% US price hike in November.

Warner Bros. Discovery (WBD) [-8.9%]: Q2 earnings, FCF, and revenue missed; all segments missed consensus; $9.1B non-cash goodwill impairment charge from Networks segment highlighted; mixed analyst views with broad-based underperformance but optimism for Studios recovery in 2025.

Liberty Media Formula One (FWONK) [-5.1%]: Q2 AOIBDA and revenue missed consensus; disclosed DoJ antitrust investigation regarding Andretti Formula Racing's F1 application.

SolarEdge Technologies (SEDG) [-3.1%]: Q2 EPS missed with revenue in line; Q3 revenue guidance below consensus; analysts note lack of visibility into post-inventory drawdown sell-through.

Topgolf Callaway Brands (MODG) [-2%]: Q2 sales light but EBITDA beat with good expense management; Q3 guidance weak, and FY24 guidance lowered; consumer spending headwinds affecting Topgolf attendance; positive commentary on strategic review of Topgolf and SOTP dynamics.

Sonos (SONO) [-1.6%]: Fiscal Q3 revenue and EBITDA ahead with NA sales +5% y/y despite CE challenges; discussed entry into headphones; cut FY guidance, blaming new app rollout issues.

Market Update

Trivia Answers

C) Snow White and the Seven Dwarfs was Disney’s first animated film.

B) Disney paid $4 billion to acquire Marvel in 2009.

C) Disney has 12 theme parks around the globe.

D) Frozen II is the highest grossing animated film. Into theee unknooooooown! (sorry, I have 6yo daughter and have watched it 80x).

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.