🔬What Is The Tech Sector Hiding?

Plus: Producer inflation helps lift rate cut doomsday scenarios; EVs aren't great investments right now; and much more

"The stock market is designed to transfer money from the Active to the Patient"

- Warren Buffett

“Bad decisions make good stories”

- Ellis Vidler

Solid rebound day for the big US markets (S&P 500 +0.7%, Nasdaq +1.7%) following Wednesday’s nasty inflation report.

5 of 11 sectors closed higher, led by Tech (+2.4%) - great timing. Financials (-0.6%) and Healthcare (-0.5%) were worst.

Producer Price Index came in better than expected (+0.2% vs. Wall Street’s +0.3% consensus) which offset some of the inflationary concerns from Wednesday’s CPI print.

Insurer Globe Life tanked 53% following a short report by Fuzzy Panda Research… which apparently is a thing that exists.

Street Stories

What are you hiding, Tech?

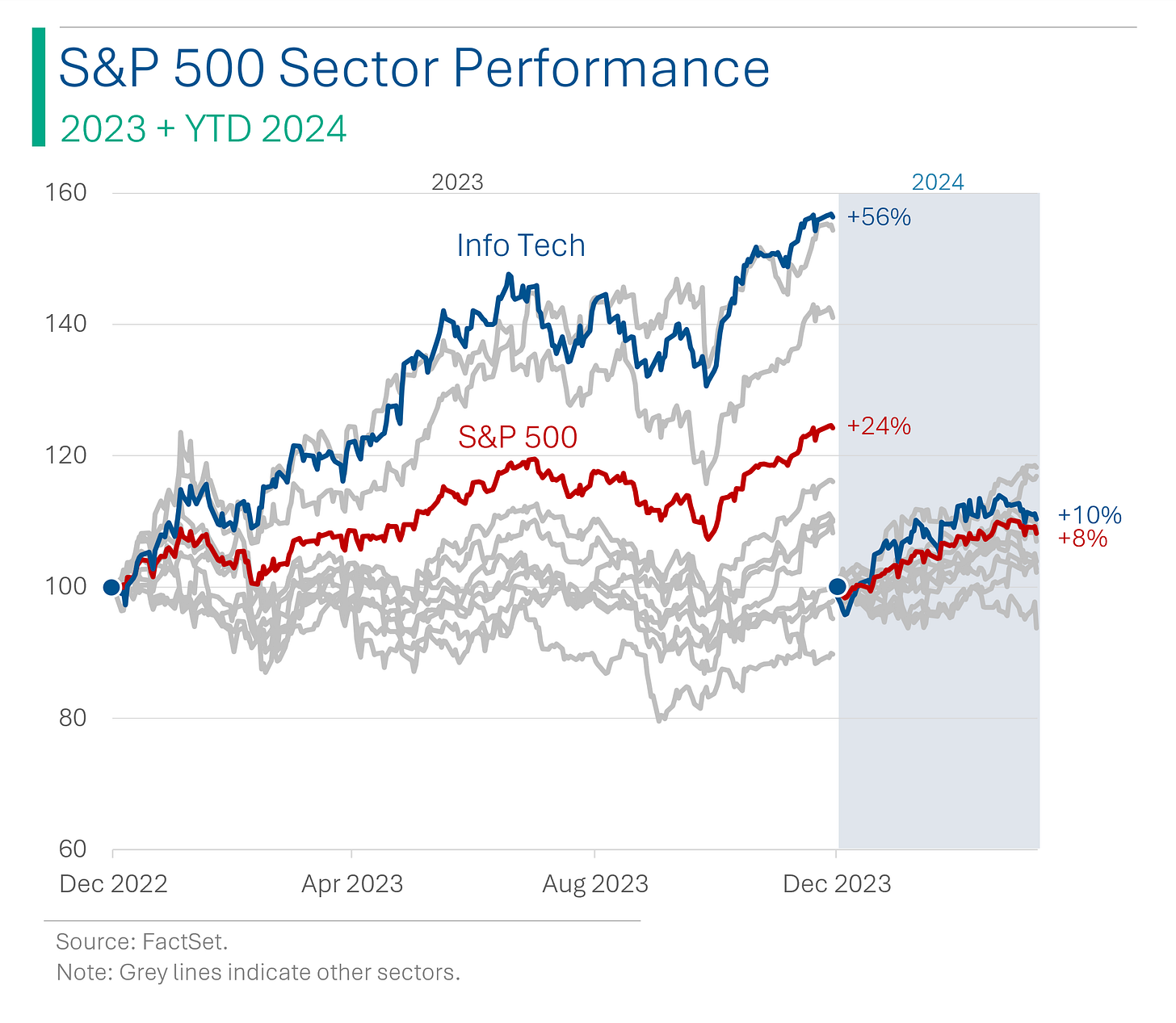

The S&P 500’s Information Technology sector had one of its best years ever in 2023; gaining an incredible 56%. What about 2024, though? Well, on paper that’s going pretty well too: the sector is up 10.4% and only trails techy Communication Services and Energy, which has been on a tear along with the oil price.

So all good, right? Well, it’s a bit more complicated than that.

See, while the sub-index has been doing well, on a company-by-company basis the situation isn’t as pretty. Of the 65 companies that make up the Tech sector, only 26 of them are beating the S&P 500 at the moment (40%).

And, weirdly, only one third of them are beating the Tech index itself.

So what’s going on? Well, in the same way that the Magnificent 7 pulled the whole of the index up last year, this time around it seems like only Nvidia, Microsoft and Apple really matter.

Let me give you a ‘for instance’:

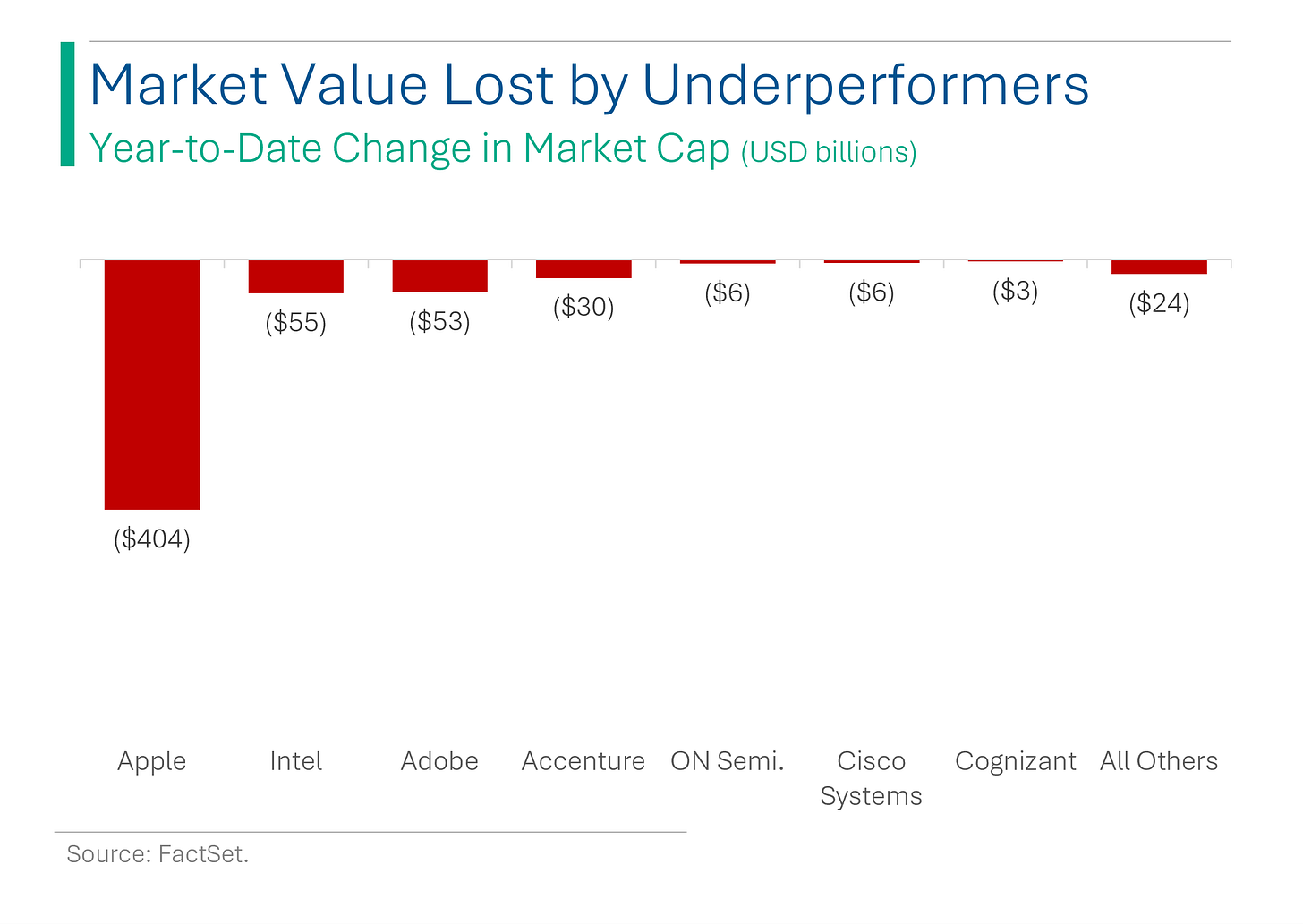

- 39 companies are up on the year, totaling $1.8 trillion in market value. Nvidia and Microsoft accounted for 72% of that.

- 26 companies are down on the year, totaling $580 billion in market value. Apple is 70% of that.

Updating our original chart to include what the Tech sector would look like without li’l ole Nvidia, drops the index into a virtual tie for second last place with Utilities. Tech isn’t living its best life in 2024.

EVs Get No Love

I’ve rattled on about Tesla quite a bit this year but there are, of course, other EV makers. And most of them are doing a lot worse then Tesla. For example, following an announcement from Ford yesterday that they will be slashing prices on their EV trucks by up to 7.5%, Rivian and Lucid both made fresh new all-time lows: down 94.4% and 95.5% from their peaks, respectively.🫠

PPI Adds Hope to July Rate Cut

The Producer Price Index (PPI) came in +0.2% vs. Wall Street’s estimate for +0.3%, which materially moved the Street’s odds of a rate cut in July (YoY figures were +2.1% vs. Street’s 2.2%). The move reversed a lot of the impact from Wednesday’s CPI inflation print, which came in higher than expected for the third straight month.

I’m glad and all, but that doesn’t seem like that big of a win…

Joke Of The Day

All I ask is a chance to prove money can’t buy happiness.

Early to bed, early to rise… makes people suspicious.

Hot Headlines

Tech Crunch / Walmart will deploy robotic forklifts in its distribution centers. The company announced the partnership with Fox Robotics after a 16 month pilot program at one of their distribution facilities.

Axios / Venture Capital investment in crypto increases as optimism returns to the sector. Like I always say, ‘nothing changes sentiment like price’.

Bloomberg / Apple Plans to overhaul entire Mac line with AI-focused M4 chips. The company, which released its first Macs with M3 chips five months ago, is already nearing production of the next generation M4 processor.

NY Times / Customers flock to Costco to buy gold bars. Wells Fargo estimates they may be selling up to $200 million worth each month. And yes, it’s apparently eligible for 2% cashback on select Costco credit cards. #freemoney.

Bloomberg / S&P data shows that the number of companies reporting repeat defaults is rising.

Fuzzy Panda / Globe Life shares plummet 50% after short-seller ‘Fuzzy Panda’ accuses company of insurance fraud. One of the funniest, and definitely the douchiest, short reports I’ve ever seen. F*** these guys. (YouTube, website)

Trivia

This week’s trivia is on stock indices, and today’s is on Japan’s Nikkei.

When was the Nikkei 225 Stock Average first published?

A) 1941

B) 1950

C) 1965

D) 1974

The Nikkei hit a peak of ~39k in December 1989. What year did it finally break that level for a new all-time high?

A) 1999

B) 2007

C) 2015

D) 2024What does the Nikkei 225 measure?

A) The performance of all stocks listed on the Tokyo Stock Exchange (the 225 is a legacy term)

B) The performance of Japan's top 225 technology companies

C) The performance of 225 leading companies listed on the Tokyo Stock Exchange

D) The performance of 225 Asian companiesWhat is unique about how the Nikkei 225 is calculated?

A) It's weighted by market cap

B) It's price-weighted

C) It's equally weighted

D) It's volume-weighted

(answers at bottom)

Market Movers

Winners!

Alpine Immune Sciences (ALPN) [+36.9%] To be bought by Vertex Pharmaceuticals for $65/share, deal valued at $4.9B, closing expected in Q2.

Paramount Global (PARA) [+7.3%] Ariel Investments challenges exclusive Skydance talks, urges consideration of APO's $26B offer, reports NY Times.

Atlassian (TEAM) [+4.8%] Barclays upgrades to overweight, highlighting strong enterprise migration momentum and potential for cloud growth and margin expansion.

Apple (AAPL) [+4.3%] Bloomberg reveals Mac overhaul with M4 chips focusing on AI; JP Morgan and BofA issue positive outlooks.

Losers!

Globe Life (GL) [-53.2%] Fuzzy Panda Research's short report accuses of insurance fraud and executive bribery; DOJ probes sales practices.

CarMax (KMX) [-9.2%] FQ4 disappoints with earnings, revenue, and GM; cites affordability issues; delays 2M+ unit sales goal to FY26-30 amid market uncertainty.

Fastenal (FAST) [-6.5%] Q1 EPS, revenue miss, net sales drop 7% y/y; sales up 1.9% y/y; gross margins meet expectations; reaffirms FY24 capex, blames weather for sales dip, notes slower fastener pricing.

Gen Digital (GEN) [-6%] Downgraded by Barclays to equal weight due to service mix shift and ARPU challenges expected through FY25.

Morgan Stanley (MS) [-5.3%] Under federal investigation for anti-money laundering client vetting, media report.

Market Update

Trivia Answers

B) The Nikkei 225 was founded in 1950.

D) The Nikkei didn’t hit a new high until 2024.

C) The Nikkei 225 tracks the performance of 225 leading companies listed on the Tokyo Stock Exchange.

B) The Nikkei 225 is price-weighted like the Dow Jones Industrial Average.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.