🔬What Happens After 2 Weeks of Sell-Offs?

Plus: Mag7 earnings; the Dow Jones gets more Techy; and much more!

"There are two classes of forecasters: those who don’t know, and those who don’t know they don’t know"

- John Kenneth Galbraith

"All this from a slice of gabagool?"

- Tony Soprano

Hope you had a great week and a happy Halloween! Here’s the love of my life trying to pre-emptively combat all the candy she knew she’d be eating.

I’m still tinkering with the structure a bit and this week I added a few new sections (‘Macro Update’ and ‘This Week In History’) but left out ‘Hot Headlines’. I’m still looking for suggestions about things to add/remove/‘do better’ so please let me know in the comments or by replying to this email.

Thanks to everyone who provided feedback last week!

Street Stories

The S&P & Double Down Weeks

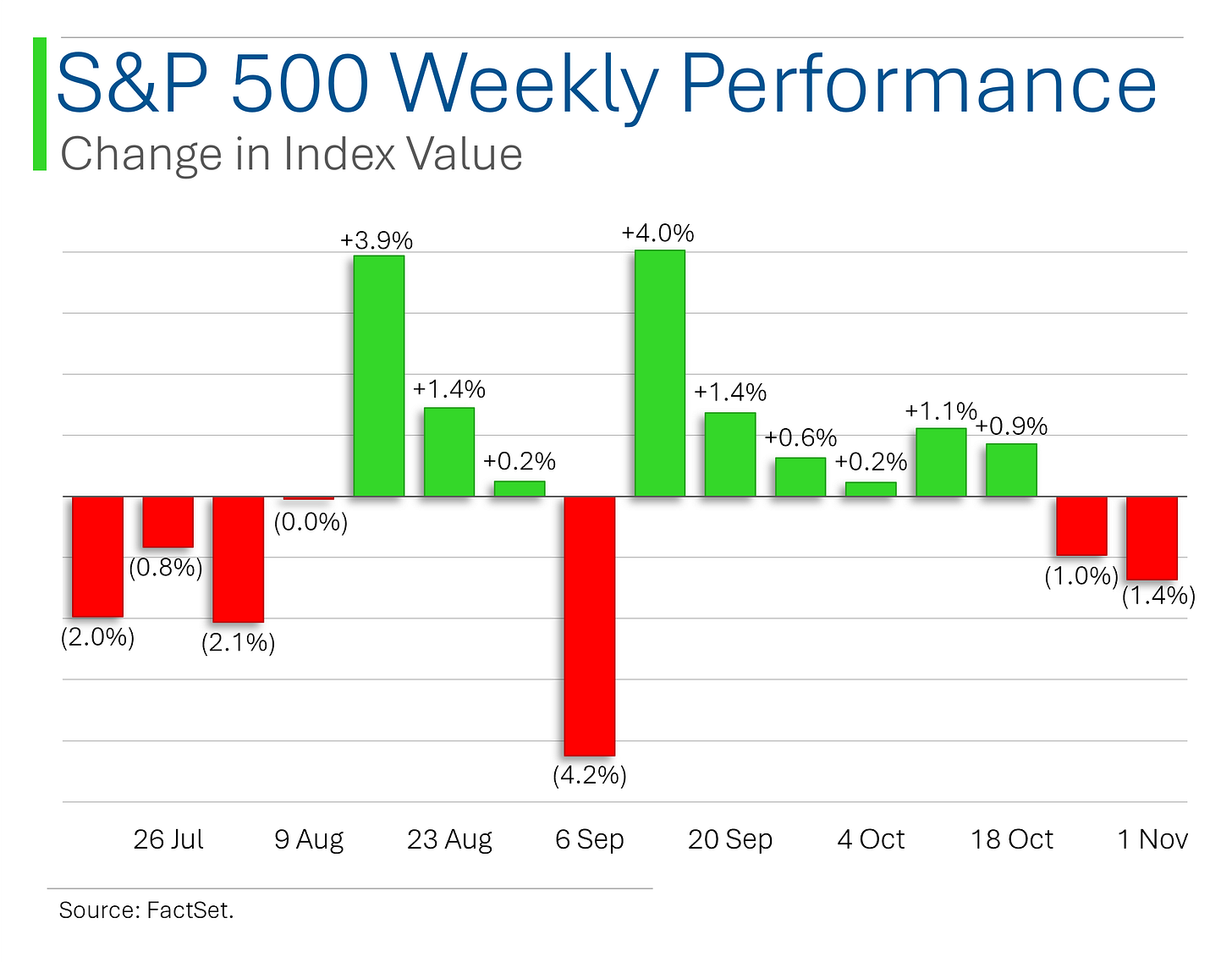

After six straight weeks for gains for the market, election jitters and mixed earnings sentiment sent the market into the red for the second straight week.

This got me wondering: Are we more likely to see another week in the red following two weekly declines?

To be clear, I’m one of those weirdos people that sees imaginary patterns in the mundane (shout out to Elliot Wave traders or Astro-Finance theorists!) but moreso thinking about investment sentiment capitulating or momentum shifts.

Turns out that the opposite has been true since 2000: After back-to-back weekly declines, the market has bounced back positive 57.7% of the time, which is higher than the 56.1% for any given week.

Also - weirdly - the average weekly return following multiple weekly declines is actually pretty impressive.

The sweet-spot definitely seems to be a trading strategy that goes big after four straight down weeks (positive 68% of the time, averaging +1.9%) - but that’s only happened 25x this millennia, so maybe not the most thrilling to implement.🤷♂️

Mag7 Reporting

Five of the seven reported this week with the stock market’s biggest bellwethers receiving decidedly mixed reactions1.

1. Tesla dropped their numbers Oct. 24th and Nvidia - with its wonky January fiscal year end - doesn’t report for three weeks, so they are excluded from the earnings graphs below.

Apparently there’s no pleasing some people as the results have actually been quite strong, with the average being a +1.2% beat on Revenue and a massive +14.5% beat on Earnings Per Share.

Amazon was the biggest winner this week, posting more strong growth out of its increasingly more AI-focused cloud business, Amazon Web Services. That said, AWS grew 19% to $27.4B - noticeably trailing Microsoft’s Azure's 33% and Google Cloud's 35% growth. Microsoft and Meta revealing the not-so-surprising news that AI is expensive, sending investors into a mild panic about increasing investment requirements.

Apple's AI-enhanced iPhone initially impressed, until China sales dropped and holiday forecasts came in lukewarm.

Wall Street's been riding the AI wave to record highs, but now everyone's getting a reality check about the actual cost of innovation. Turns out, teaching machines to think isn't exactly a budget operation.

The companies have continued to pile on the growth this year, with the average company in the club growing quarterly revenue by 28% year-over-year (12% if you exclude Nvidia).

While Earnings Per Share is up by an average of +44% in 2024 to the most recent quarter - or ‘only’ 26% if you exclude Nvidia.

However, the mixed response to reporting is disconcerting; not just to those holding their shares but also do to their impact on broader market sentiment.

Mag7 euphoria has dragged the market higher this year so it’s reasonable to assume that negativity towards this handful of companies could lead to deeper contagion.

The Dow Swaps Chip Makers

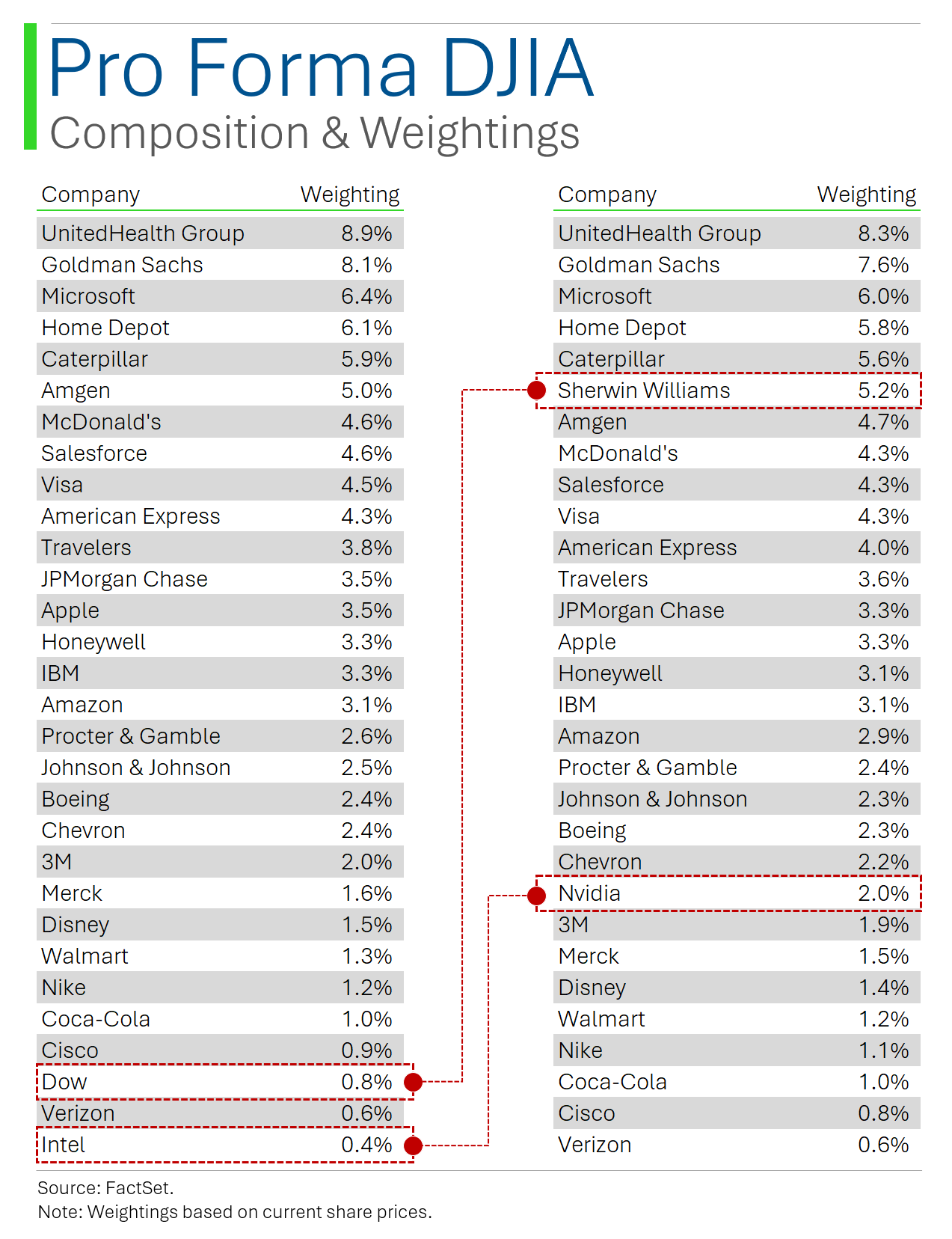

Nvidia will replace Intel in the Dow Jones Industrial Average on November 8th, reflecting the companies' contrasting fortunes as Intel struggles with strategic missteps while Nvidia thrives in the AI boom with a market cap over $3 trillion.

Sherwin-Williams will also replace Dow Inc., which had become smaller after spinning off into three companies in 2019.

These are the first changes to the index since February, when Amazon replaced Walgreens Boots Alliance.

Clearly the index is trying hard to be cooler with more Tech names but I still couldn’t care less about its value as a market indicator. I mean, what the hell is a ‘price weighted’ index anyway?

Joke Of The Day

When in doubt, mumble.

Macro Update

Q3 GDP: The economy grew at a better-than-expected 2.8% annualized rate (vs 2.6% consensus), moderately lower than Q2's 3.0%, with strength in consumer spending driving growth while being partially offset by declines in inventory investment and notably weaker residential fixed investment activity.

PCE Inflation: Core PCE increased 2.7% year-over-year through September following a 0.3% monthly gain, while headline PCE rose just 2.1% (lowest since February 2021) after August's 2.3% reading, potentially supporting the Fed's case for a 25bp rate cut next week as inflation continues its gradual move toward the 2% target.

ISM Manufacturing: October's reading fell to 46.5, missing expectations of 47.6 and declining from September's 47.2, with the crucial New Orders Index remaining in contraction territory at 47.1 despite showing marginal improvement from the previous month's 46.1, suggesting continued weakness in the manufacturing sector.

October Nonfarm Payrolls: Employment grew by a mere 12K (lowest since December 2020), dramatically below consensus of 110-120K, with previous months revised down by a significant 112K; the weak report was impacted by hurricane disruptions and strikes but nonetheless aligned with the broader narrative of labor market cooling, particularly given the substantial downward revisions.

ADP Report: Private sector hiring surged to 233K in October, more than double the expected 108K and up from September's revised 159K, marking the strongest hiring since July 2023 with broad-based gains across most sectors except manufacturing (-19K), and notably including a return to growth in small business hiring after two months of losses.

Trivia

Today’s trivia is on Charlie Munger.

Charlie Munger got his law degree from Harvard. What was interesting about the way he got his degree?

A) He failed most of his tests and only passed because he was likeable.

B) He never completed an undergraduate degree.

C) He is highly dyslexic and couldn’t read the text books.

D) He never went to class.Charlie coined a term that he uses to describe the phenomenon wherein different biases layer and interlock with one another that ultimately can distort people’s perception of events and things, such as the stock market. This was called what?

A) Layered Biases Effect

B) Lollapalooza Effect

C) Three Stooges Effect

D) Sticky PerceptionsWhat famous book is based on the writings and speeches given by Charlie Munger?

A) Munger on Munger

B) Tap Dancing To Work

C) Snowball

D) Poor Charlie’s AlmanackWhat did Munger say was a reliable way to take a fortune and make it small?

A) Day trading

B) Airlines

C) Real estate

D) Gold miningWhat did Munger say was "better than sex"?

A) Making money

B) Reading books

C) Compound interest

D) Watching stock prices rise

(answers at bottom)

Market Movers

Friday:

Atlassian (TEAM) [+19%] FQ1 earnings and revenue exceeded expectations with strong Cloud and Datacenter performance, leading to raised guidance and a $1.5B buyback.

Intel (INTC) [+7.8%] Surprised with a Q3 beat, with signs of improvement in PC and server demand despite some one-time charges.

Boeing (BA) [+3.5%] Reached a tentative deal with its machinists' union for wage increases, but ratification is still uncertain.

Wayfair (W) [-6.3%] Q3 earnings beat despite weaker customer metrics, with further cost discipline highlighted.

Apple (AAPL) [-1.2%] Strong iPhone sales lifted Q4 results, but guidance for December was underwhelming.

Thursday:

Peloton Interactive (PTON) [+27.8%] Strong Q1 earnings and guidance, plus CEO announcement, boosted investor confidence.

Roblox (RBLX) [+19.9%] Impressed with Q3 user metrics and raised FY guidance amid successful product features.

Carvana (CVNA) [+19.2%] Beat Q3 expectations and pointed to strong unit sales and potential margin improvements.

Etsy (ETSY) [+7.2%] Q3 beat with a new $1B buyback plan, though holiday guidance was cautious.

Booking Holdings (BKNG) [+4.8%] Q3 results impressed with strong Europe travel demand and improved booking trends.

Robinhood Markets (HOOD) [-16.7%] Disappointed with light revenue and high expenses, though Gold subscriptions hit a high.

eBay (EBAY) [-8.2%] Slight Q3 beat but weak guidance led to lowered expectations, despite a boost in buybacks.

Microsoft (MSFT) [-6.0%] Delivered strong Q1 and Azure growth but warned of a Q2 Azure slowdown.

Meta Platforms (META) [-4.1%] Beat Q3 and guided positively, but investors focused on upcoming capital expenditure hikes.

Wednesday:

Reddit (RDDT) [+42.0%] Major Q3 revenue and EBITDA beat with strong platform engagement and new advertising partnerships.

Snap (SNAP) [+15.7%] Q3 beat on user growth and ARPU, with strong Direct Response metrics.

Visa (V) [+2.9%] Impressed with Q4 growth metrics, highlighting stable consumer spending across segments.

Super Micro Computer (SMCI) [-32.7%] Audit firm resigned, causing concerns over financial reliability.

Advanced Micro Devices (AMD) [-10.6%] Delivered a solid Q3 but provided soft Q4 guidance on gaming and embedded weaknesses.

Tuesday:

VF Corp (VFC) [+27.0%] Beat Q2 expectations and resumed guidance, with focus on stabilizing Vans and cost control.

Crocs (CROX) [-19.2%] Beat Q3 but issued a cautious Q4 outlook, specifically revising HEYDUDE brand projections.

Monday:

Alaska Air Group (ALK) [+3.4%] Gained on a favorable analyst upgrade citing positive West Coast market trends.

Boeing (BA) [-2.8%] Announced a $19B capital raise following earlier funding plans and credit facility agreement.

This Week In History

Microsoft Stock Debuts (October 29, 1986) - Microsoft’s initial public offering helped shape the technology sector’s growth, creating billionaires and cementing tech as a major industry.

First Ever 'Black Tuesday' (October 29, 1929) - The Great Depression’s infamous stock market crash began with panic selling and major losses on Wall Street, a day now synonymous with financial disaster.

Standard Oil Founded (November 1, 1870) - John D. Rockefeller established Standard Oil, creating a monopoly in the oil industry and reshaping American business and antitrust laws. Shout out to the GOAT!

The Cuban Missile Crisis Ends (October 28, 1962) - Soviet leader Nikita Khrushchev agreed to remove nuclear missiles from Cuba, ending a standoff with the U.S. that nearly led to nuclear war.

First Hydrogen Bomb Test (November 1, 1952) - The U.S. detonated the first hydrogen bomb, significantly escalating the nuclear arms race during the Cold War.

Brexit Vote by UK Parliament (October 31, 2019) - The UK Parliament voted to approve a general election as a step toward Brexit, which marked a major political and economic shift for the UK and EU.

Market Update

Trivia Answers

B) While he’d been to two universities prior to Harvard, he had never completed an undergraduate degree.

B) Lollapalooza Effect.

D) Poor Charlie’s Almanack.

B) Airlines. Charlie wasn’t a fan…

C) Compound interest. Charlie was a fan…

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Always love how neat your graphs look, and they are original!

Like the macro update section! Something fun I always love to read is untold story /aspect of an investor or some scientist…