🔬What Are the Biggest Sector Moves Ever?

Plus: High yield spreads are less high (good thing); Mortgage applications are down big (bad thing); Stripe is worth $65 billion (again); and much more.

"It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong"

- George Soros

"Economists have predicted nine out of the last five recessions"

- Paul Samuelson

Soft day for the big US markets with the S&P 500 -0.2% and Nasdaq -0.6%.

7 of 11 sectors closed higher, with Real Estate (+1.3%) and Financials (+0.4%) up the most. Communication Services (-0.9%) and Tech (-0.6%) were down the most.

Another hype day for Bitcoin, with futures up +5.4% and trading above $60k for the first time since November 2021.

Lots of earnings yesterday (see ‘Market Movers’ at bottom) including: eBay (+7.9%) and Beyond Meat (+30.7%) having strong days after positive Q4 results. Warby Parker (-15.0%) and Bumble (-14.8%) did the opposite, following weak reporting.

Street Stories

The Biggest Moves of All-Time (sorta)

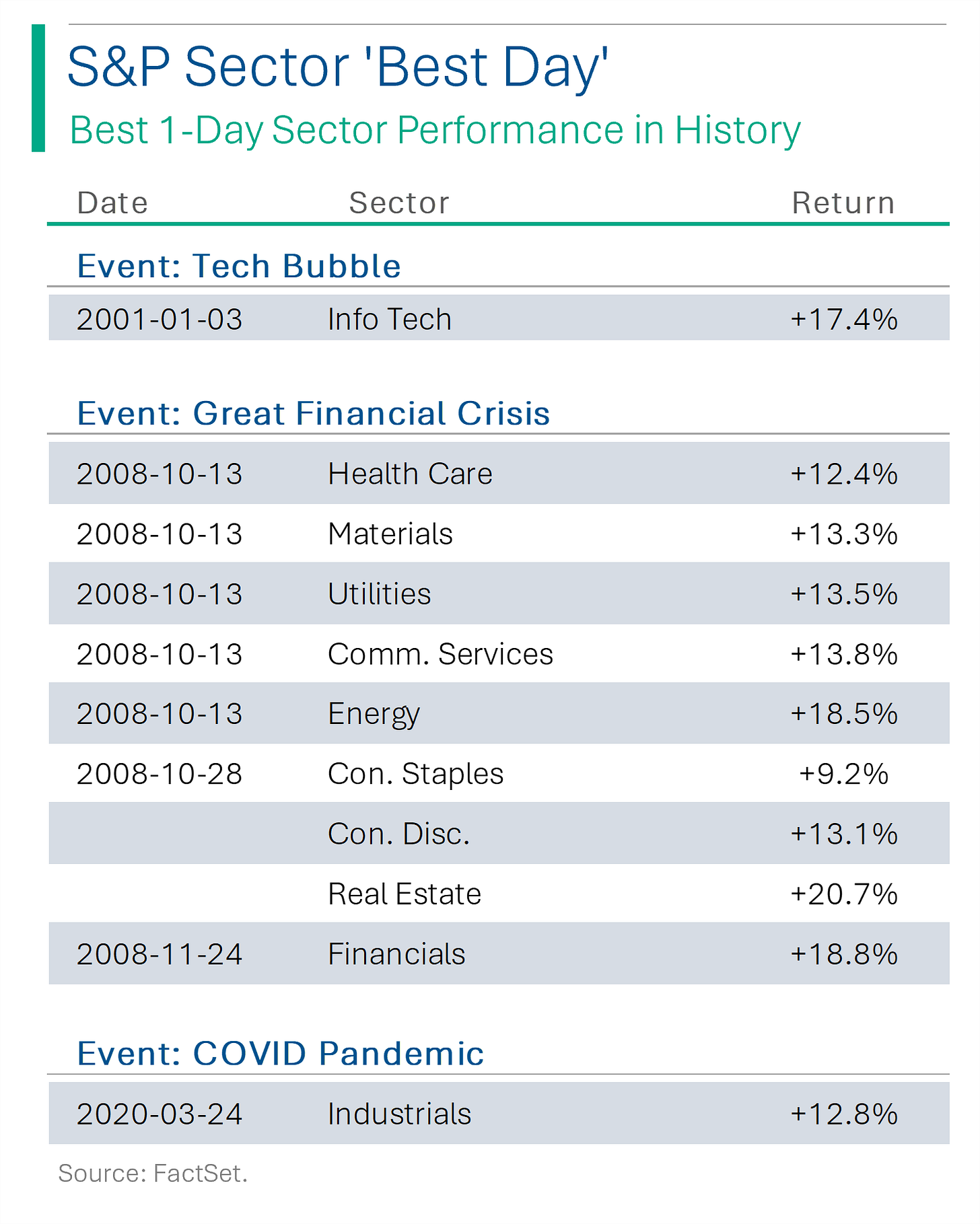

While the S&P 500 has been around since 1957, S&P Dow Jones Indices only launched the sector indices at the end of 1994. Over those 29 years, the markets have seen bubbles, panics and everything in between. After Nvidia reported reported last week, the Info Tech sector popped +4.3%. This got me thinking: What are the biggest one-day moves for each sector?

Turns out, the biggest one day moves were a lot bigger than I’d expected. To start, the biggest one day sector crash was from Energy at the onset of the pandemic, when it lost a massive 20.1% in one day. That makes sense as everything from shipping to travel to commuting basically ground to a halt overnight. Perhaps not unexpectedly, the biggest one day moves down have all come from either the Great Financial Crisis or the COVID Pandemic.

As for the biggest one day gains, well almost all of them are from the GFC too. That may sound a bit weird, but those were weird times when everyday seemed to vacillate between ‘everything’s fine’ to ‘this is the end’ narratives, so on days when it was the latter, the stock moves up were pretty huge.

Other than the GFC, the biggest industrials move came after the pandemic meltdown started to cool. And Tech’s came as the Tech Bubble was mid-meltdown. That +17.4% Tech day in January 2001 was just a little hope rally during a month where the index was down over 30%. Oof.

Looking at things just on an S&P 500 basis, you can see that the biggest moves (positive and negative) came primarily during the Tech Bubble, the GFC and the COVID pandemic. For example, the 3-year stretch from 2007 to 2009 saw a wild 36 days where the market dropped more than 3%. 12 of which were moves worse than -5%.

As a bit of an aside, when S&P created their sector indices in 1994 the initial values were 100 for each sector. As you can see below, some sectors have grown much faster than others. (Note that this doesn’t include dividends, which are the primary form of return for sectors like Utilities.) Still though, yeesh.

High Yield is Less Scared

The spreads in Bloomberg’s U.S. Corporate High Yield Bond Index have continued to tighten, and are now approaching the lows of the late pandemic (when everything was peachy). The tightening implies that investors see less risk in corporates with high levels of debt, and is an indication that the risk environment for corporates is continuing to improve. Yeehaw.

Explainer: The ‘spread’ here refers to the gap between the yield of a specific corporate bond in the index relative to their comparable length (‘maturity’) government treasury bond. For example, if a corporate bond with five years left until maturity has a yield of 6% and the comparable five year US treasury bond has a yield of 4%, the spread is 2%. This spread index is basically just the average of those yields. Thank you for coming to my TedTalk.

Stripe Does Tender Offer at $65bn

Fintech giant Stripe has secured a tender offer with investors to buy over $1 billion in shares from current and former employees at a $65 billion valuation, marking a 30% increase from its last valuation but still below its peak in 2021. This move, part of a commitment to provide liquidity to employees holding shares, has pushed the anticipated IPO to potentially next year, despite recent interest in acquiring shares in the company.

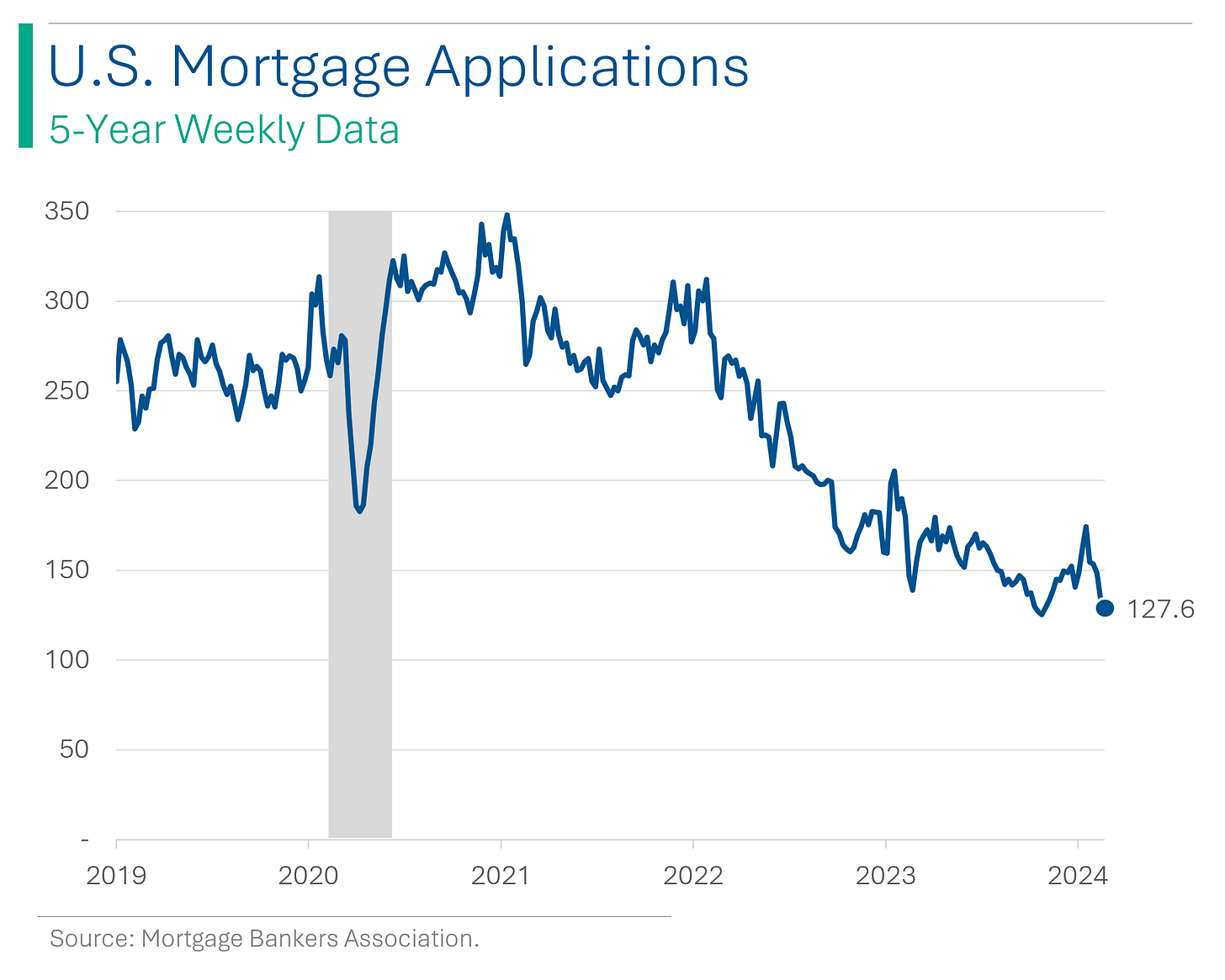

Mortgage Applications Suck

U.S. mortgage applications for home purchases have declined for a fifth consecutive week, hitting a near three-decade low, as persistent high mortgage rates above 7% dampen housing market momentum. Applications picked up sharply at the end of 2023 as Fed rate cuts expectations depressed interest rates. But as the Fed has continued to telegraph a cautious stance on cuts, due to robust economic indicators, this has led to increased home-financing costs, further slowing the market. Thanks J.Pow!

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

🤦♂️I got an email asking me to invest in Egyptian architecture. Sounds like a pyramid scheme.

Hot Headlines

Reuters | Wendy’s backs down on proposed ‘surge pricing’ proposal after public backlash. That was me. I was the backlash. ‘Backlash, Ryan Backlash’.

CNBC | FAA gives Boeing 90 days to come up with quality control plan after 737 Max accident. Wonder if the words ‘don’t make it rain aluminum over Oregon’ were used?

AP | Mitch McConnell will step down as the Senate Republican leader in November after a record run in the job. #termlimits

Reuters | Semiconductor equipment maker Applied Materials receives new subpoenas on shipments to China. The company is under U.S. criminal investigation for potentially evading export restrictions on China's top chipmaker SMIC. Those rascals!

Axios | Retirements spike again as stock market booms. The U.S. has about 2.7 million more retirees than predicted based on a model designed by an economists at the Federal Reserve Bank of St. Louis. This has a significant impact on labor markets and consumption.

Bloomberg | Bitcoin scales $60,000 as ETF demand puts record high in sight. The king of crypto is now past levels not seen since November 2021.

Trivia

This week’s trivia is on early corporations and investing. Today’s trivia is on early stock trading.

What is considered the world's first stock exchange by modern standards?

A) The London Stock Exchange

B) The Amsterdam Stock Exchange

C) The New York Stock Exchange

D) The Tokyo Stock Exchange

The Buttonwood Agreement, signed in 1792, led to the creation of which stock exchange?

A) The London Stock Exchange

B) The Tokyo Stock Exchange

C) The New York Stock Exchange

D) The Amsterdam Stock Exchange

What was one of the primary reasons for the establishment of early stock exchanges?

A) Entertainment

B) Funding voyages and trade expeditions

C) Gambling

D) Social gatherings

(answers at bottom)

Market Movers

Winners!

Beyond Meat (BYND) [+30.7%]: Q4 earnings missed, revenue beat. Announced massive cost-cutting program for margin expansion in 2024, plans to drop unprofitable products, and selectively raise US prices. 2024 guidance suggests flat to negative sales growth, mid-teens gross margin.

Polestar Automotive (PSNYW) [+25.8%]: Secured $950M through a three-year loan facility. Expects volume growth supporting 2025 targets and double-digit gross profit margin.

Flywire (FLYW) [+17.7%]: Q4 earnings, revenue beat; 38% y/y revenue growth. Q1 guidance slightly light, but FY24 guidance exceeds consensus. Payment volume up 32% y/y.

Axon Enterprise (AXON) [+13.8%]: Q4 EPS, revenue beat; strong AB4 shipments and cloud services. FY24 revenue guidance surpasses consensus. TASER 10 momentum strong, expects improved margins from automation.

Life Time Group (LTH) [+10.5%]: Q4 EBITDA, EPS, and revenue beat. FY24 EBITDA, revenue guidance above Street, expects FCF positive in Q2. Analysts note increased member visits, stronger comps.

ADT Inc (ADT) [+10%]: Q4 earnings beat, revenue slightly light. CSB segment shows strength, high customer retention. FY adjusted EPS guidance exceeds expectations.

Coupang (CPNG) [+7.9%]: Q4 earnings, revenue beat. Momentum in Developing Offerings and higher spending per customer in Product Commerce noted. Sequential margin improvement from efficiency investments and supply chain optimization.

eBay (EBAY) [+7.9%]: Q4 GMV, revenue, and EBITDA ahead. 2024 guidance improved. Focus categories outperforming, product improvements gaining traction, expecting positive GMV FXN growth in 2H, margins expanding, favorable capital return dynamics.

Losers!

Integral Ad Science Holding (IAS) [-41.5%]: Q4 EPS, EBITDA, revenue beat. Q1, FY revenue and EBITDA guidance below consensus. Concerns over volume discounts, competitive pricing. Raymond James downgraded to outperform. Meta brand safety opportunity details lacking.

Payoneer Global (PAYO) [-19.6%]: Q4 EBITDA, revenue beat; FY24 EBITDA, revenue guidance missed consensus. Volumes up 16% y/y. Transaction costs expected at 17.5% of 2024 revenue.

Boston Beer (SAM) [-15.7%]: Q4 below expectations, FY24 EPS guidance below. Depletions YTD down 2%. Pressure on Truly, CEO succession plan, and turnaround timing uncertain.

Warby Parker (WRBY) [-15%]: Q4 EBITDA below guidance and consensus. SG&A deleverage noted. Sales, GM better. 2024 revenue guidance matches, EBITDA below Street. Customer growth and insurance network expansion discussed.

Bumble (BMBL) [-14.8%]: Q4 revenue, EBITDA in line; Q1 guidance light, lowered 2024 revenue growth guidance. EBITDA margin expansion improved. US Bumble app softness, slower start to 2024, but positive margin commentary.

Urban Outfitters (URBN) [-12.8%]: Q4 sales slightly below, EPS missed. January slowdown blamed on weather. GM miss, UO underperformance noted, looking for improvement.

Cytokinetics (CYTK) [-9.8%]: Q4 EPS, revenue missed; FY24 revenue guidance below consensus. Plans FDA NDA filing for Afi' in 3Q24, MAA to EMA in 4Q24. Two years of cash runway noted.

Kontoor Brands (KTB) [-8.9%]: Q4 revenue missed, EPS impacted by charge. Challenging US wholesale environment. Better performance in digital wholesale, China, DTC. FY24 guidance below Street.

Topbuild (BLD) [-5.1%]: Q4 EPS, EBITDA beat; revenue missed. Installation volume decline, but specialty distribution beat on pricing. FY24 revenue, EBITDA guidance below Street.

TKO Group Holdings (TKO) [-3.9%]: Q4 revenue, earnings missed; profit impacted by high corporate costs, expected to moderate in Q1. FY24 revenue guidance below consensus. Optimism on NFLX deal.

Market Update

Trivia Answers

B) The Amsterdam Stock Exchange is considered the first modern stock exchange.

C) The Buttonwood Agreement created what became the New York Stock Exchange. It’s called that because prior to the agreement, traders and merchants would meet under a buttonwood tree near Wall Street to transact.

B) Funding voyages and trade expeditions was the initial reason for creating stock exchanges.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Just want to flex that I got all the trivia right and also that this newsletter will be the first recommendation I will suggest to readers of my own — very good stuff