'War Stocks' Rally, the Great Resignation is Over, and Much More

StreetSmarts Morning Note

“The best time to plant a tree was 20 years ago. The second-best time is now.”

-Chinese proverb

“If you think nobody cares if you’re alive, try missing a couple of car payments.”

-Earl Wilson

Table of Contents

A.M. Allocations: Summaries of important news and investing events

“War in the Middle East” Stocks

The New Strike Economy

The End of the Great Resignation

Is Gold Poised for a Rally?

Oil Industry Leaders Differ Massively Over ‘Peak Demand’

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

“War in the Middle East” Stocks

I think the above is self-explanatory…

The New Strike Economy

Tens of thousands of workers at Kaiser Permanente, the managed care consortium, have joined ongoing strikes. This elevates the total number of Americans on picket lines to at least 250,000 amid failed contract negotiations.

SAG-AFTRA members, representing 150,000 actors, are in the third month of a strike affecting Hollywood; over 25,000 United Automobile Workers are also picketing against Detroit's Big Three automakers.

Labor strikes are increasing in frequency, with UPS narrowly avoiding a walkout and the Writers Guild of America ending a 148-day strike after winning concessions from major Hollywood studios.

Take-Away: Although significant for the 21st century, current labor stoppages are smaller in scale compared to historical strikes, such as in 1970 when at least 2.4 million workers were on strike. That said, as inflation has regular folks continuing to feel less well off compared to where they were a few years ago, I don’t foresee this trend subsiding anytime soon.

The End of the Great Resignation

The rate of workers resigning returned to its pre-pandemic level in August, marking the end of the "great resignation" era characterized by a surge in workers quitting jobs for better opportunities.

Despite this change, the job market continues to be strong, with a significant number of jobs added in September and unemployment rates maintaining near record lows.

Take-Away: The Jobs Report showed the market is still strong for finding work…maybe just not strong enough to keep folks shopping around for a new gig.

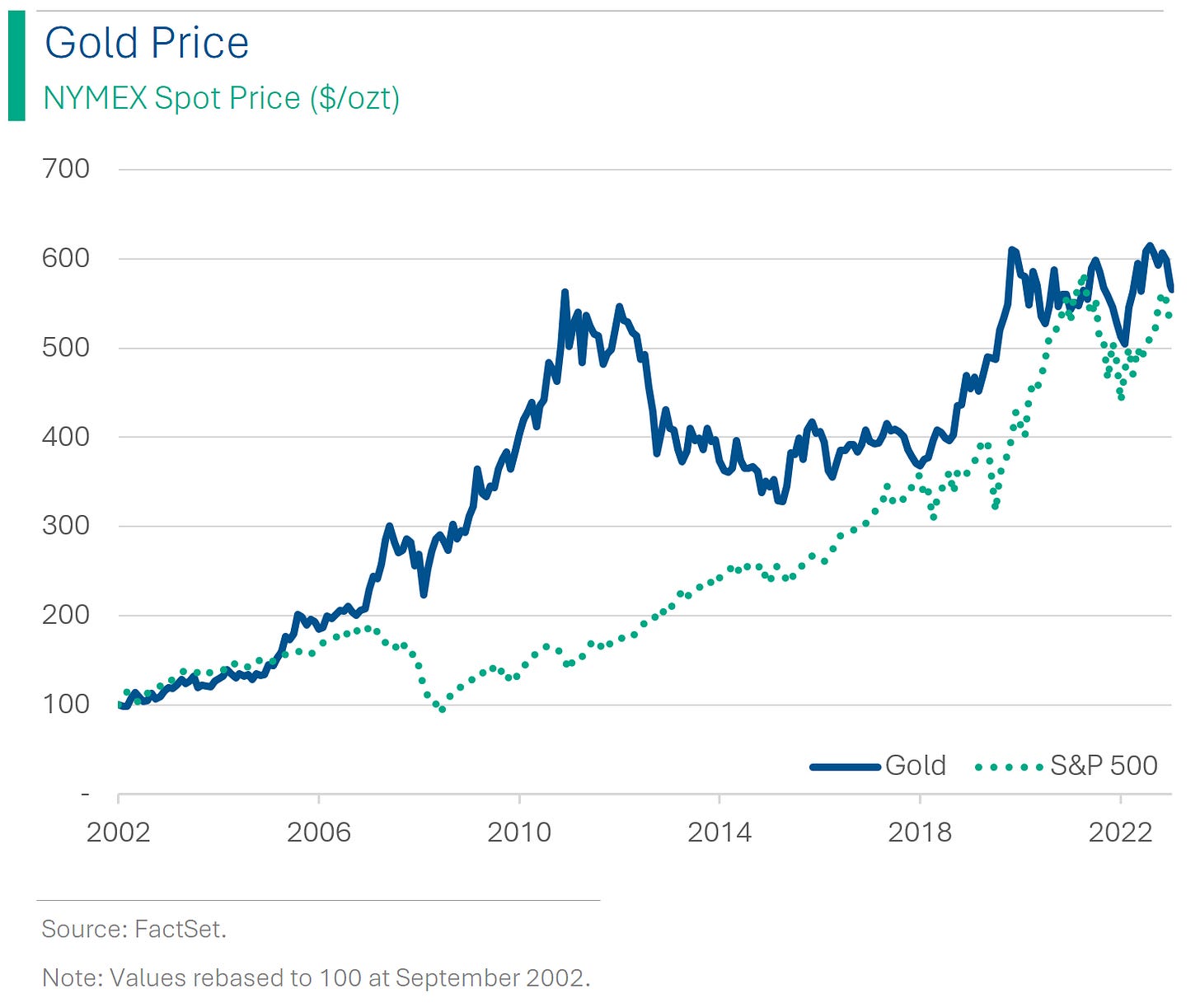

Is Gold Poised for a Rally?

Gold and the US Dollar are considered the world’s great ‘safe haven’ assets - things you buy when the rest of the world looks like it’s going to hell in a handbasket. But while USD has strengthened against other global currencies (the Dollar Index (DXY) is up over 13% in the last 3 years), gold is still hovering below its all-time high it touched back in July 2020.

Take-Aways: Considering the double-digit inflation we’ve seen since the last peak, plus rising recession fears for 2024, and now a war in the middle-east, it seems increasingly likely to me that we see gold markets dust-off the cobwebs and attract new investors looking to hedge amidst the murkier global economic outlook.

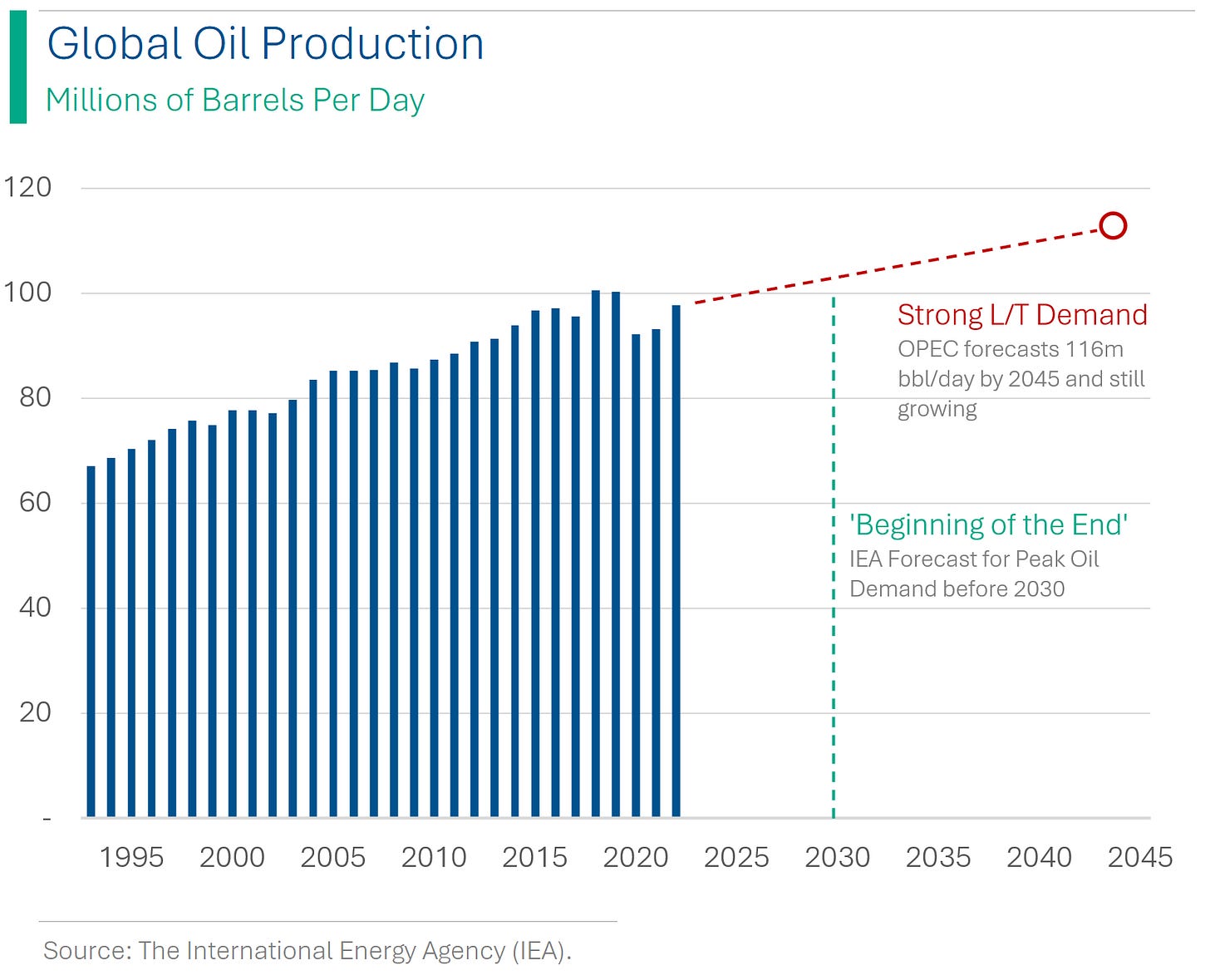

Oil Industry Leaders Differ Massively Over ‘Peak Demand’

OPEC increased its medium- and long-term global oil demand forecasts, predicting a rise to 116 million bpd by 2045 and calling for $14 trillion in investments to meet this demand, contrary to the IEA’s forecast of peak fossil fuel demand before 2030.

IEA Executive Director Fatih Birol described the imminent decline in fossil fuel consumption as a “historic turning point,” stressing the need for further reductions to limit global warming to 1.5 degrees Celsius above pre-industrial levels.

The opposing views have intensified the rift between OPEC and IEA, with OPEC labeling the IEA's forecast as “extremely risky” and “ideologically driven,” while the IEA emphasizes the necessity of reducing fossil fuel usage to combat climate change.

Take-Aways: Unless we have some unforeseen break-through in clean energy, the end results are likely to split these two uprights. It’s almost like the two agencies have differing objectives, huh?

Joke Of The Day

“The trick is to stop thinking of it as ‘your’ money.” – IRS auditor

Hot Headlines

(WSJ) Apple’s Easy Google Money May Get Harder to Keep

(CNBC) Cruise prices are way up as operators meet surging travel demand

(Reuters) Analysis: Expected rise in US earnings could be balm for stocks after rough stretch

(CNBC) UAW Mack Trucks union members to join striking Detroit autoworkers on picket lines after voting down tentative deal

(Bloomberg) Middle East Conflict Spurs Bullish Rush in Oil Options Market

(CNN) 11 US citizens dead in Israel conflict, Biden says

(NY Times) Militants attacking Israel are backed by Iran, but Tehran denies involvement.

Trivia

When was the New York Mercantile Exchange (NYMEX) founded?

1872

1931

1960

1977

Who acquired NYMEX in 2008?

Chicago Mercantile Exchange

New York Stock Exchange

Intercontinental Exchange (ICE)

Goldman Sachs

(answers at bottom)

Market Update

Trivia Answers

1872. NYMEX originated in 1872 as the Butter and Cheese Exchange of New York, established by Manhattan dairy merchants aiming to standardize and regulate the chaotic trading conditions of their industry. It expanded to include the egg trade, prompting a name change to the Butter, Cheese, and Egg Exchange, and later diversified to encompass dried fruits, canned goods, and poultry, becoming the NYMEX in 1882.

Chicago Mercantile Exchange. On March 17, 2008, Chicago based CME Group signed a definitive agreement to acquire NYMEX Holdings, Inc. for $11.2 billion in cash and stock and the takeover was completed in August 2008.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and Subscribe!