🔬 War & P/Es: Defense Stocks Benefit from Global Tensions

“Your most unhappy customers are your greatest source of learning.”

- Bill Gates

"Would I rather be feared or loved? Easy. Both. I want people to be afraid of how much they love me."

- Michael Scott

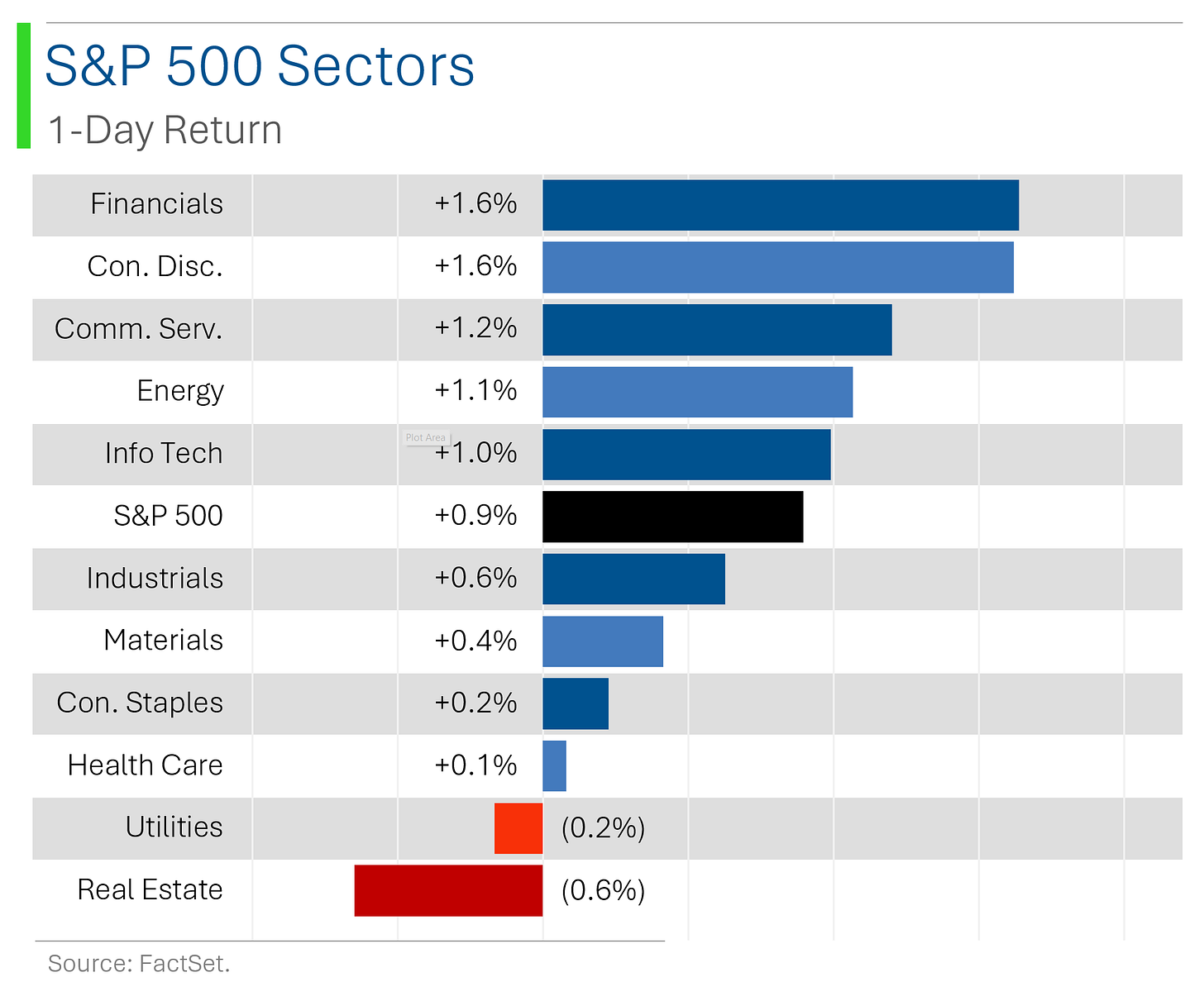

US stocks closed higher, led by big tech and a range of outperforming sectors: The S&P and Nasdaq logged their fourth straight weekly gain, with strength in airlines, autos, banks, and tech. Treasuries weakened as the yield curve flattened, while the dollar index gained and crude oil logged its best week since March 2023.

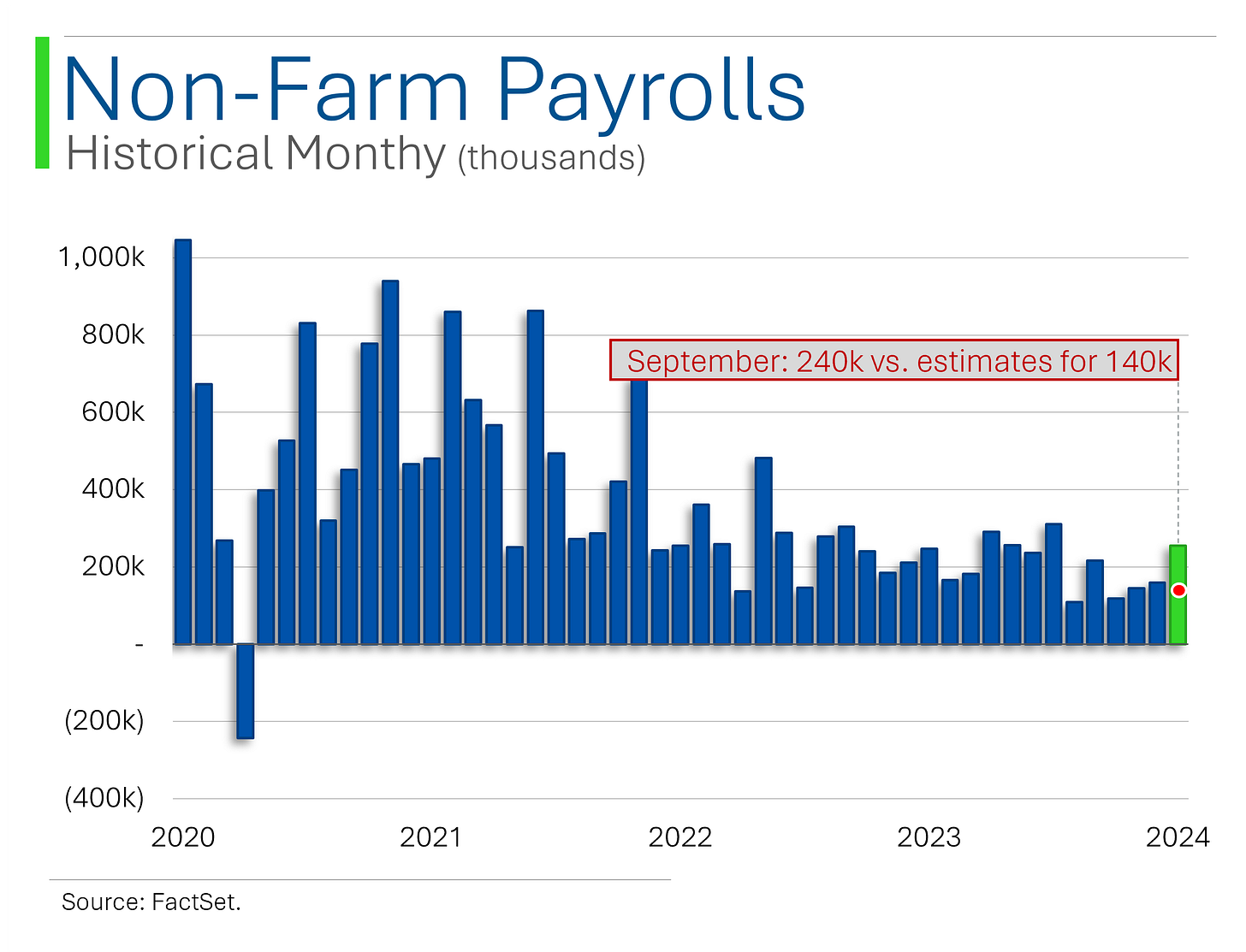

Nonfarm payrolls beat expectations, fueling rate-cut speculation: September payrolls came in at 254K, far exceeding the forecast of 140-150K, while unemployment dropped to 4.1%. The data shifted expectations towards a smaller 25bp rate cut in November, though upcoming economic data will be crucial.

Corporate updates and global tensions added to market dynamics: Rivian lowered its delivery guidance due to component shortages, while Coeur Mining announced a $1.7B acquisition of SilverCrest. Middle East tensions simmered with expectations of an Israeli response, and ExxonMobil pointed to an in-line Q3 earnings report.

Notable companies:

Spirit Airlines (SAVE) [-24.8%]: There are reports that Spirit is talking to bondholders about a possible bankruptcy filing, though it’s not expected to happen immediately, with restructuring also on the table.

Apogee Enterprises (APOG) [+22.7%]: Apogee crushed it in Q2 with strong earnings, better project mix, and higher prices, plus raised its guidance despite some sales hits from exiting low-margin products.

Abercrombie & Fitch (ANF) [+9.1%]: JPMorgan just added Abercrombie to its Positive Catalyst Watch, pointing out Hollister's growing momentum and better Q3 promotions.

More below in ‘Market Movers’.

Street Stories

War & P/Es

Today marks the one year anniversary of Hamas’ barbarous attack on Israel, which has since evolved into a complex regional conflict involving the US, Hezbollah, Yemen, Iran, etc.

As terrible as this conflict has become, it is only part of the increasingly tumultuous geopolitical landscape that includes fomenting East-West tensions (notably US vs. China) and the Russian ‘special military operation’ barbaric invasion of the Ukraine.

Hell, the Ukes reportedly killed North Koreans fighting on the front lines over the weekend. What movie are we living in?

Sadly, that joke about ‘buy defense stocks when the shooting starts’ isn’t particularly apocryphal: The S&P may be riding a generational bull market, but it has lagged the big names in the Defense sector.

President Calvin Coolidge famously said ‘the business of America is business!’ - and war is a surprisingly profit business.

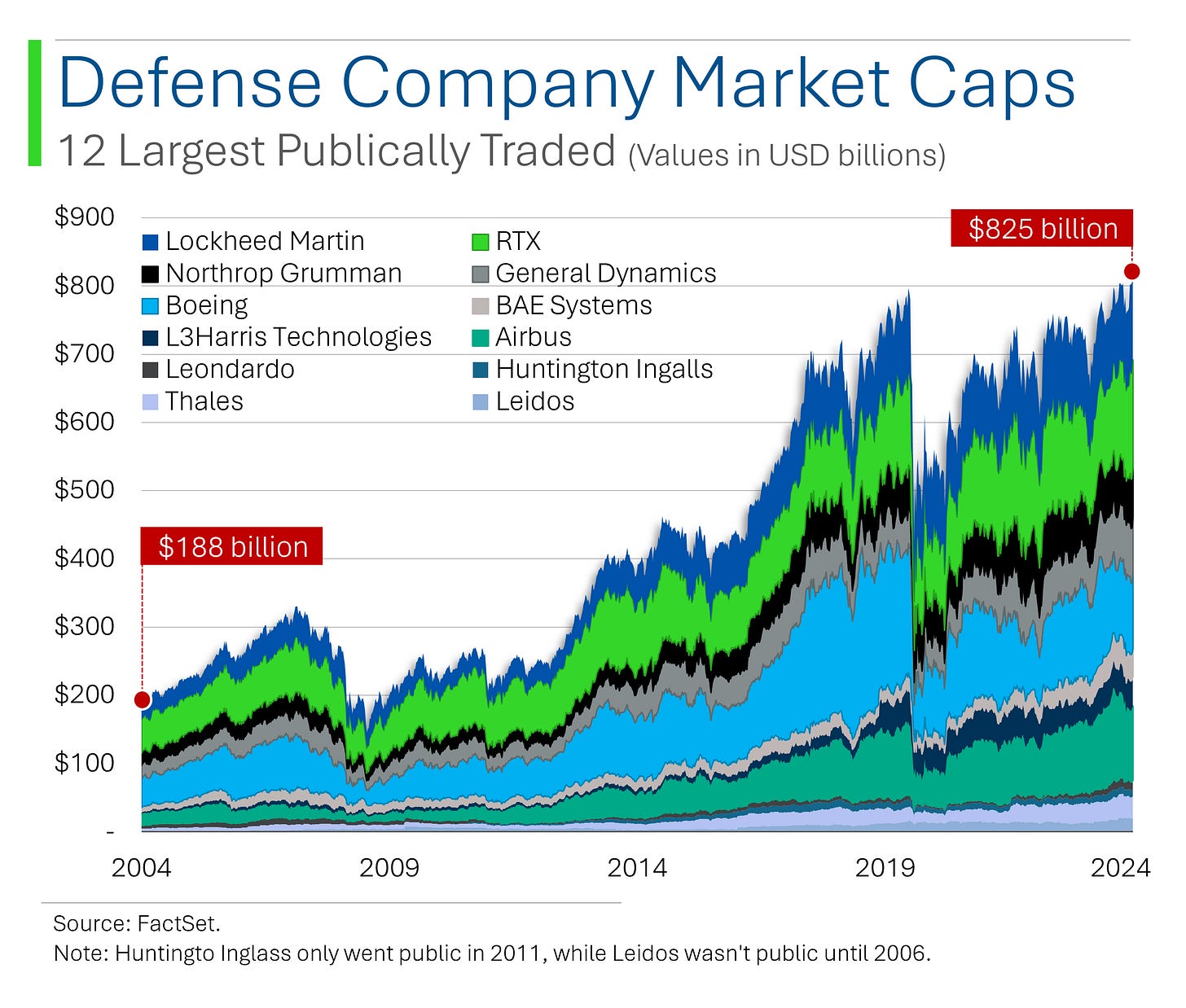

For context, of the 12 most valuable Defense companies in the world, only 3 of them have failed to outpace the S&P since shooting started in the Ukraine.

And obviously one of those was Boeing.

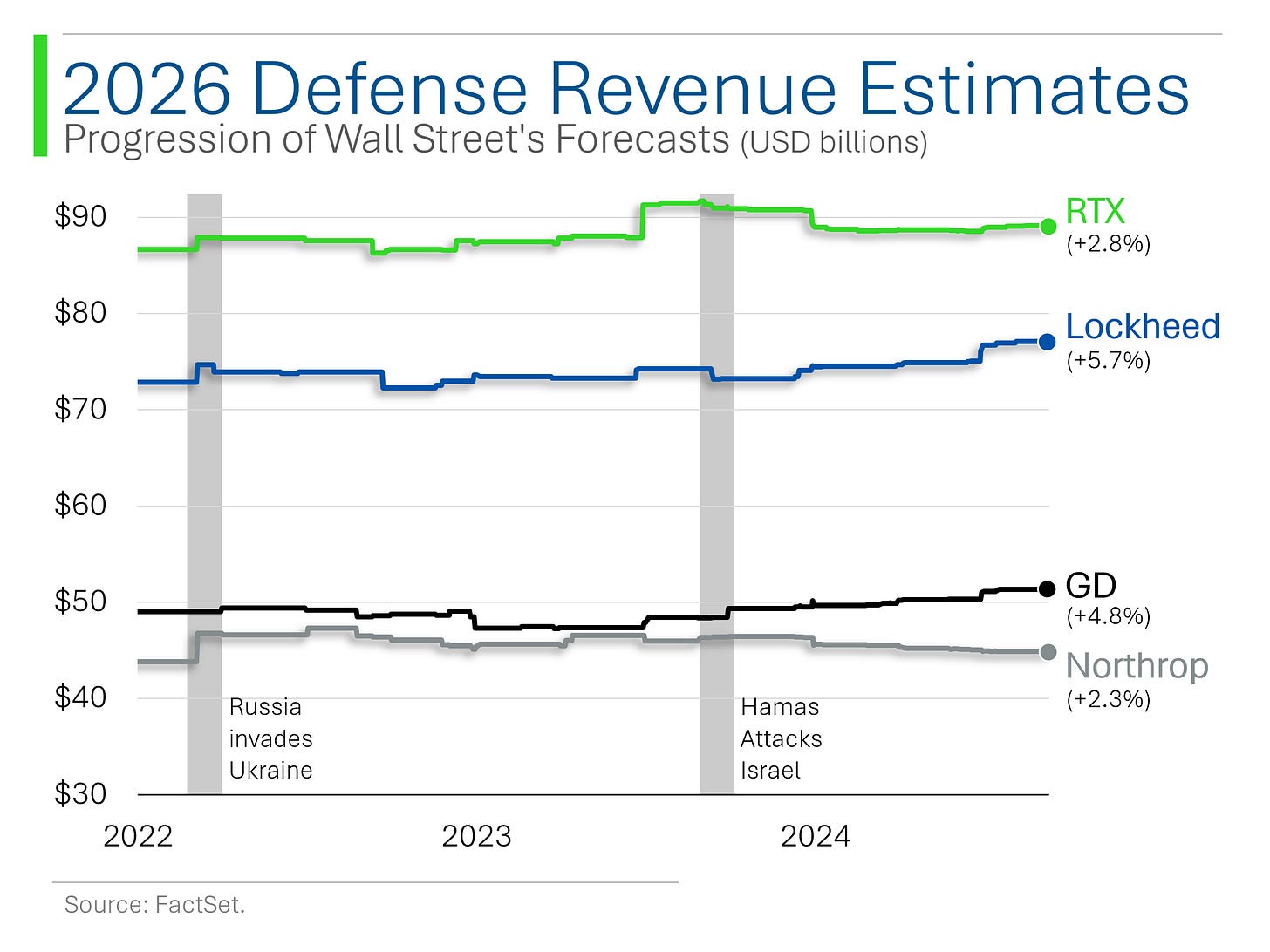

That’s in part based on Wall Street’s high growth estimates for the next few fiscal years, as nations across the globe are moving to bolster defense budgets and update dated equipment.

Again, Boeing is really the only weak link here.

That said, estimates for the next few years have only budged up a modestly due to the lag in procurement timelines. However, over the long-term the Defense space is expected to be one of the few beneficiaries of a world descending into ever greater strife.

In fact, the top dozen Defense companies now hold nearly $1 trillion in market cap - the highest amount it’s ever been.

And as an indication of that growing international divide, the world now has to accept that the US no longer has a monopoly of the tools of making war. Only emerging over the last few years, 30% of the Top 15 Defense companies are now based in China.

And a lot of their tech deploy a new kind of camouflage whereby they look identical to American equipment (witchcraft!) And you thought the knock-offs stopped at handbags and pharmaceuticals.

Non-Farm Payrolls

In a surprise for economists who are usually quite attached to their pessimistic forecasts, September's job numbers soared to 254k – nearly twice the 140k that was expected – while unemployment quietly improved to 4.1%.

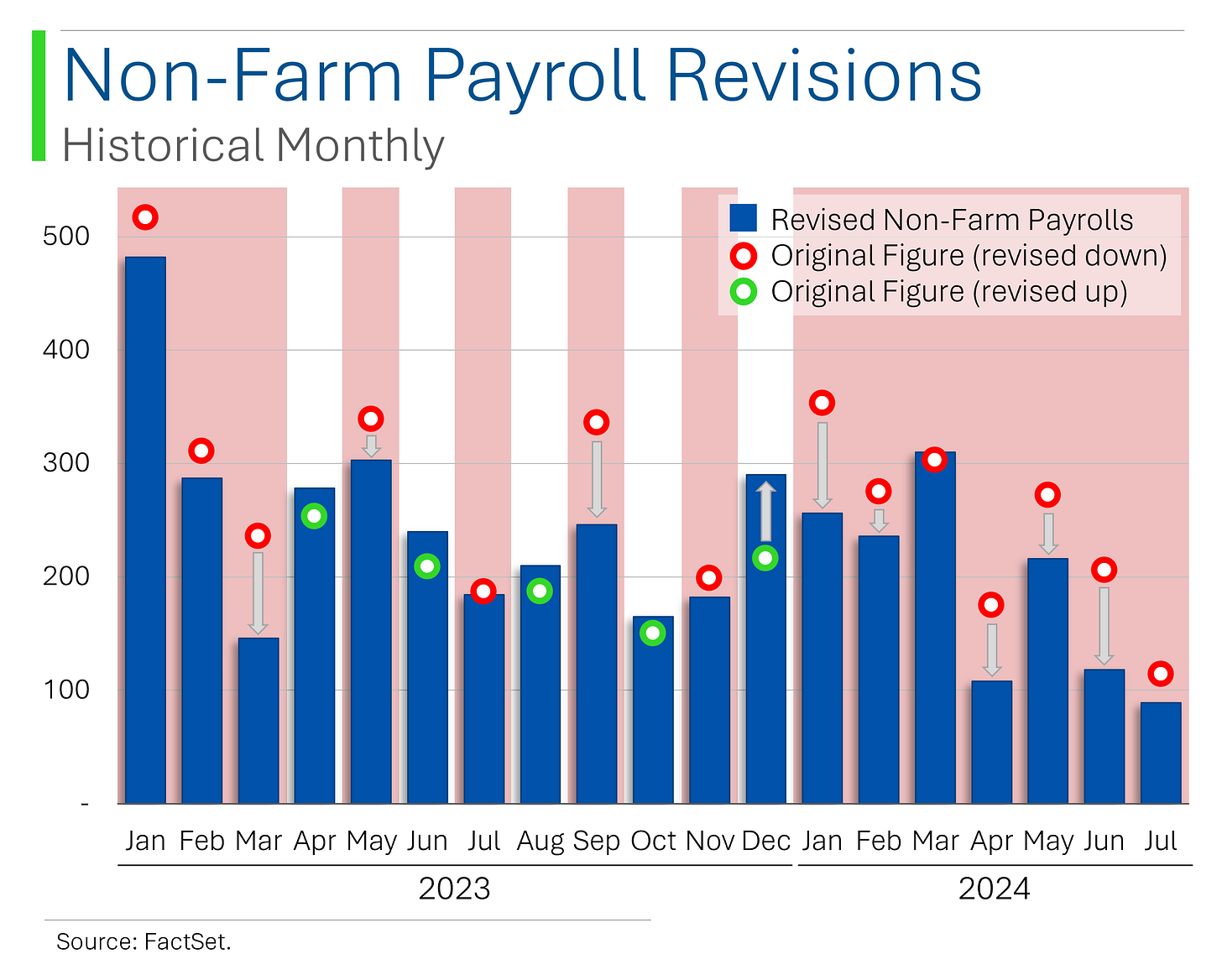

Previous months' numbers were also revised upward by 72k jobs, suggesting that perhaps the Bureau of Labor Statistics had been a touch too modest in their initial calculations (for once; see below).

However, October's economic script might need a rewrite, what with Hurricane Helene making an unwanted cameo in the Southeast, Boeing's workforce taking an extended coffee break, and dock workers briefly deciding to explore alternative career paths before returning to their posts.

However, one interesting thing is that the September’s ‘Seasonal Adjustment Factor’ was the highest on record. The Bureau of Labor Statistics toggles the data a bit to account for seasonal variations in order to make the data comparable on a month-by-month basis (teachers off in the summer, construction slowing down in the winter, etc.)

Could it be they are getting a bit too slap happy with this stuff - and the job market pick-up is only superficial?

I mean, it’s bad enough that the vast majority of Non-Farm prints end up getting revised significantly downward…

Joke Of The Day

I bought shoes from a drug dealer.

I don’t know what he laced them with, but I’ve been tripping all day.

Hot Headlines

Yahoo Finance / Netflix stock is on a tear. But its big challenge is making sure people keep watching. Despite adding 39 million subscribers in the past year, total engagement barely grew, rising just 1%. Engagement directly impacts Netflix's burgeoning ad-supported tier, and analysts worry that stalled engagement will limit growth. In fact, we did a piece on this recently and as you can see, Netflix was one of the only streamers that didn’t hike prices this year.

Yahoo Finance / Stellantis sues UAW in US federal court over strike threats. The automaker claims UAW’s vote for strike authorization violates their agreement, which includes $1.5 billion in planned investments, now delayed due to slowing demand for electric vehicles. Gotta love using the legal system to blame others.

Bloomberg / Oil ‘Tourists’ pile into market amid biggest rally in two years. Fueled by geopolitical tensions, such as Iran's attack on Israel, crude prices surged over $6 per barrel in the past week and funds are flowing in. Pigs get fat, hogs get slaughtered…but you’re also probably young enough to try again later.

Reuters / New Zealand Navy ship sinks off Samoa, all 75 onboard safe. Bruh.

CNBC / China-linked security breach targeted U.S. wiretap systems. The hackers, believed to be from the Chinese group Salt Typhoon, may have had access for months or longer, posing significant national security risks. U.S. officials are concerned the breach could be used to disrupt communications systems in the event of a U.S.-China conflict. China has denied previous accusations of government-sponsored hacking. I’m pretty sure that in Terminator 3, nations were blaming each other when in actuality, it was Skynet that was responsible for all the network outages on Judgement Day.

CNBC / U.S. ports start 100-day countdown clock to new strike, and automation is poised to be the dealbreaker. Logistics experts warn that automation could trigger another strike if unresolved by mid-January. Imagine wanting to save money by automating logistics with efficient machines that never get sick - why would a company even want to do that?

Trivia

Today's trivia is all about our industry’s favorite beverage - beer!

Which country consumes the most beer per capita annually?

A) Germany

B) Czech Republic

C) United States

D) IrelandWhat is the process called where yeast converts sugars into alcohol during beer production?

A) Distillation

B) Filtration

C) Fermentation

D) PasteurizationWhich famous brewery is the world’s oldest, still in operation today?

A) Guinness

B) Budweiser

C) Heineken

D) Weihenstephan AbbeyWhat country is credited with the invention of the first beer cans?

A) United States

B) Germany

C) United Kingdom

D) Belgium

(answers at bottom)

Market Movers

Winners!

Apogee Enterprises (APOG) [+22.7%]: Apogee crushed it in Q2 with strong earnings, better project mix, and higher prices, plus raised its guidance despite some sales hits from exiting low-margin products.

Barnes Group (B) [+13.0%]: Rumors are swirling that Apollo is close to buying the aerospace company for over $45 a share, according to Reuters.

Abercrombie & Fitch (ANF) [+9.1%]: JPMorgan just added Abercrombie to its Positive Catalyst Watch, pointing out Hollister's growing momentum and better Q3 promotions.

Albemarle (ALB) [+8.3%]: There's buzz that RIO might be looking to acquire a big player in the lithium space, and Albemarle is one of the potential targets.

Diamondback Energy (FANG) [+3.4%]: BMO upgraded Diamondback to outperform, saying the company is set to be a long-term winner with its efficient operations and deep inventory.

CVS Health (CVS) [+2.7%]: TD Cowen upgraded CVS to buy, highlighting some big changes coming to its 2025 Medicare Advantage plan.

Losers!

Spirit Airlines (SAVE) [-24.8%]: There are reports that Spirit is talking to bondholders about a possible bankruptcy filing, though it’s not expected to happen immediately, with restructuring also on the table.

Coeur Mining (CDE) [-9.5%]: Coeur is buying SilverCrest for $1.7 billion, a deal that includes a 22% premium, with the transaction set to close in late Q1 2025.

AZEK Co. (AZEK) [-5.0%]: Loop Capital downgraded AZEK to hold, noting a drop in demand for composite decking that’s now hitting mid- and high-end products too.

Rivian (RIVN) [-3.2%]: Rivian slashed its FY delivery guidance due to production disruptions caused by a shortage of shared components across its platforms.

Market Update

Trivia Answers

B) Czech Republic – The Czechs hold the title for the highest beer consumption per capita, averaging around 140 liters per person annually.

C) Fermentation – Fermentation is the process where yeast converts sugars into alcohol and carbon dioxide, creating beer.

B) Weihenstephan Abbey – Located in Bavaria, this brewery claims to have been producing beer since 1040.

A) United States – The first beer cans were introduced in 1935 by the Krueger Brewing Company.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.