Wall Street's Weight-Loss Hangover: Have Investors Binged Too Much on Obesity Stocks?

Plus: 2024 sectors in review, and much more!

“The individual investor should act consistently as an investor and not as a speculator”

- Benjamin Graham

“Why is patience a virtue? Why can’t ‘hurry the #$%@ up’ be a virtue?”

- Stephen Knight, Earthfall

Hey Readers!

Hope everyone is having a great start to 2025. I had fun writing today’s note and getting back into the swing of things after way too much holiday cheer. Hope you enjoy it!

Best,

-Ryan

Street Stories

Weight-Loss Hangover

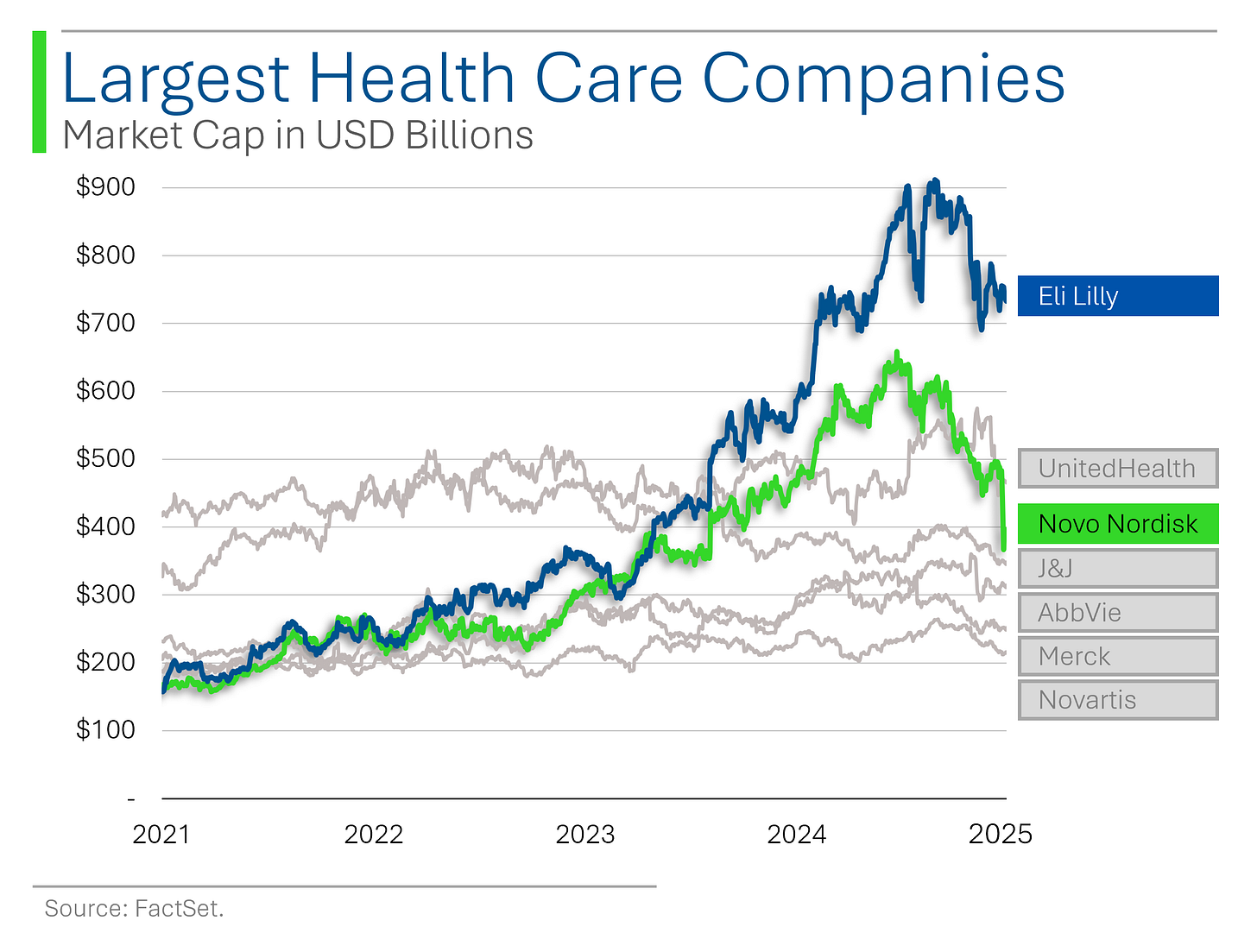

Novo Nordisk rode the Ozempic wave to staggering heights in 2023, with its shares surging 49% as the weight-loss drug became a global phenomenon. The Danish pharmaceutical giant leapfrogged competitors to become the world's second most valuable healthcare company, trailing only rival Eli Lilly.

But as 2024 wrapped, the company's momentum stalled. Has Wall Street's weight-loss euphoria finally tipped the scales?

The latest setback for Novo Nordisk hit as the company lost nearly $100 billion in market value after its experimental weight-loss drug combination, CagriSema, delivered underwhelming results in a Phase 3 trial in mid-December. CagriSema, a dual-drug therapy combining semaglutide (used in Ozempic and Wegovy) with cagrilintide, helped patients lose 22.7% of body weight on average after 68 weeks.

While significant, this fell short of the company’s and investors’ expectations of 25% weight loss and failed to exceed Eli Lilly’s Zepbound, which has demonstrated a similar 22.5% weight reduction.

The 3,400-person trial tested CagriSema against its components and placebo in non-diabetic patients, showing mild to moderate nausea as the main side effect. While matching Zepbound's effectiveness, analysts were underwhelmed, having expected the drug (with projected peak sales of $20 billion) to demonstrate superior results.

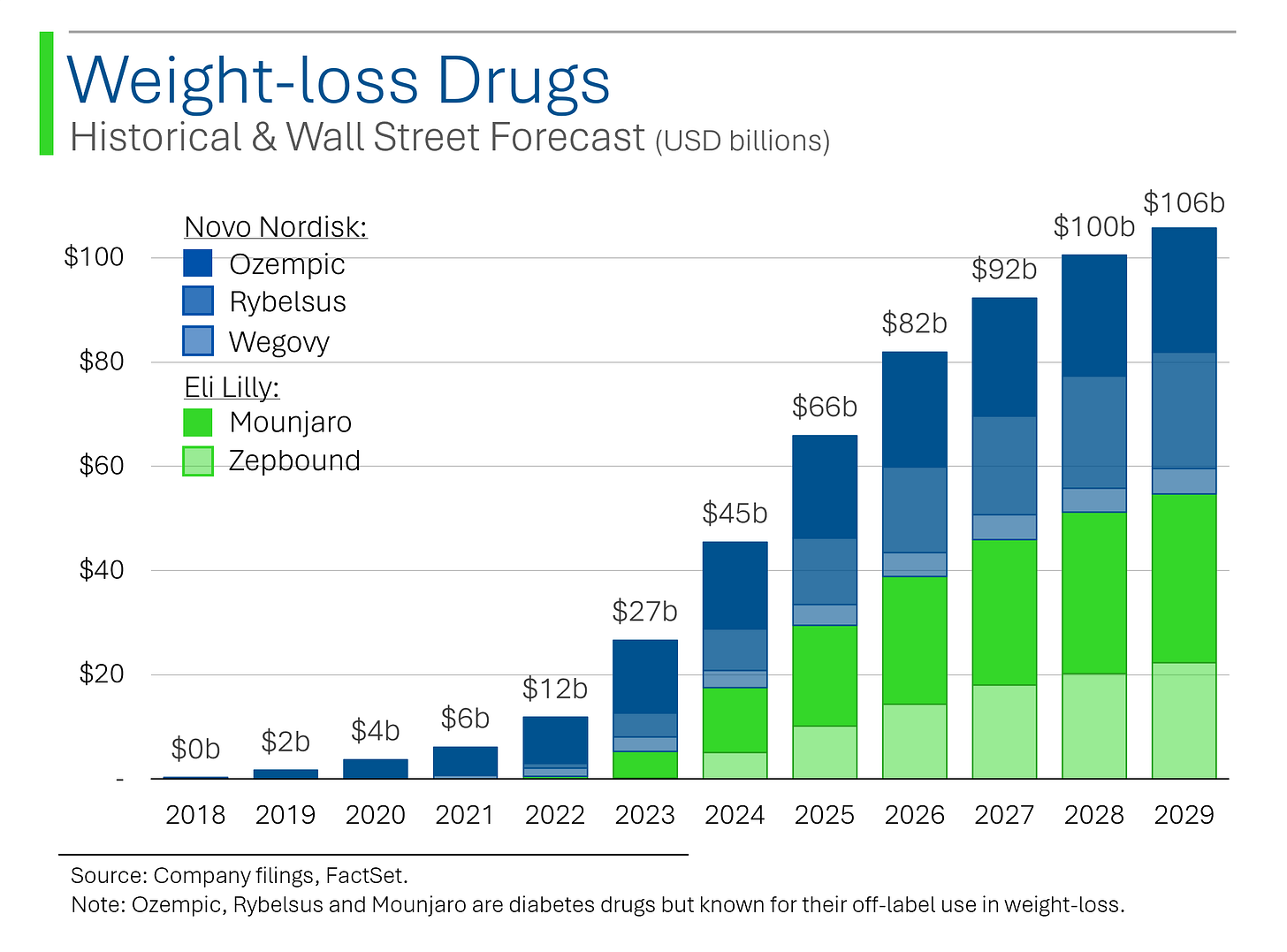

The news sent Novo shares tumbling over 20%. Analysts saw it as a crucial setback in the booming weight-loss drug market, projected to hit $100 billion annually. While Novo plans more trial results in 2025, competitors like Lilly continue advancing their obesity treatments.

Basically, Novo’s woes seem more like a ‘them’ problem than an industry one.

Estimates for the main weight-loss drugs continuously saw Wall Street upgrade their prospects over the last few years, but this trend seems to have subsided, with most estimates flatlined since mid-2024.

Moreover, Eli Lilly’s Mounjaro appears to have replaced Ozempic as the dominant compound in the weight-loss war.

This has meant that the Street’s outlook for Novo Nordisk has been contractionary, while Eli Lily’s has only grown stronger.

So while Novo may have kicked off the weight-loss frenzy, it seems that Lilly has levelled the playing field and are even expected to growth EPS faster in the coming years.

But before we go and get too bearish on Novo, it’s worth considering that it still is expected to have significant growth in the coming years - all while trading at a valuation roughly in-line with the broader S&P 500.

Novo Nordisk and Eli Lilly both remain positioned to capture substantial slices of a $100 billion pie – even if Lilly currently has the bigger fork. For investors willing to stomach some volatility, these pharmaceutical heavyweights might still provide healthy returns in the long run.

After all, in the weight loss market, it's not just about who loses – it's about who gains.

Mag7 Still Mega

From a ranking perspective, little changed at the top of list last year. The Mag7 started the year holding the top seven spots by market cap and finished the year that way.

Buffett’s Berkshire Hathaway replaced Tesla for most of the year but the EV maker had a dramatic comeback to clinch the final spot. Since their April low of $142, Tesla shares bounced back +185% over the course of the rest of the year.

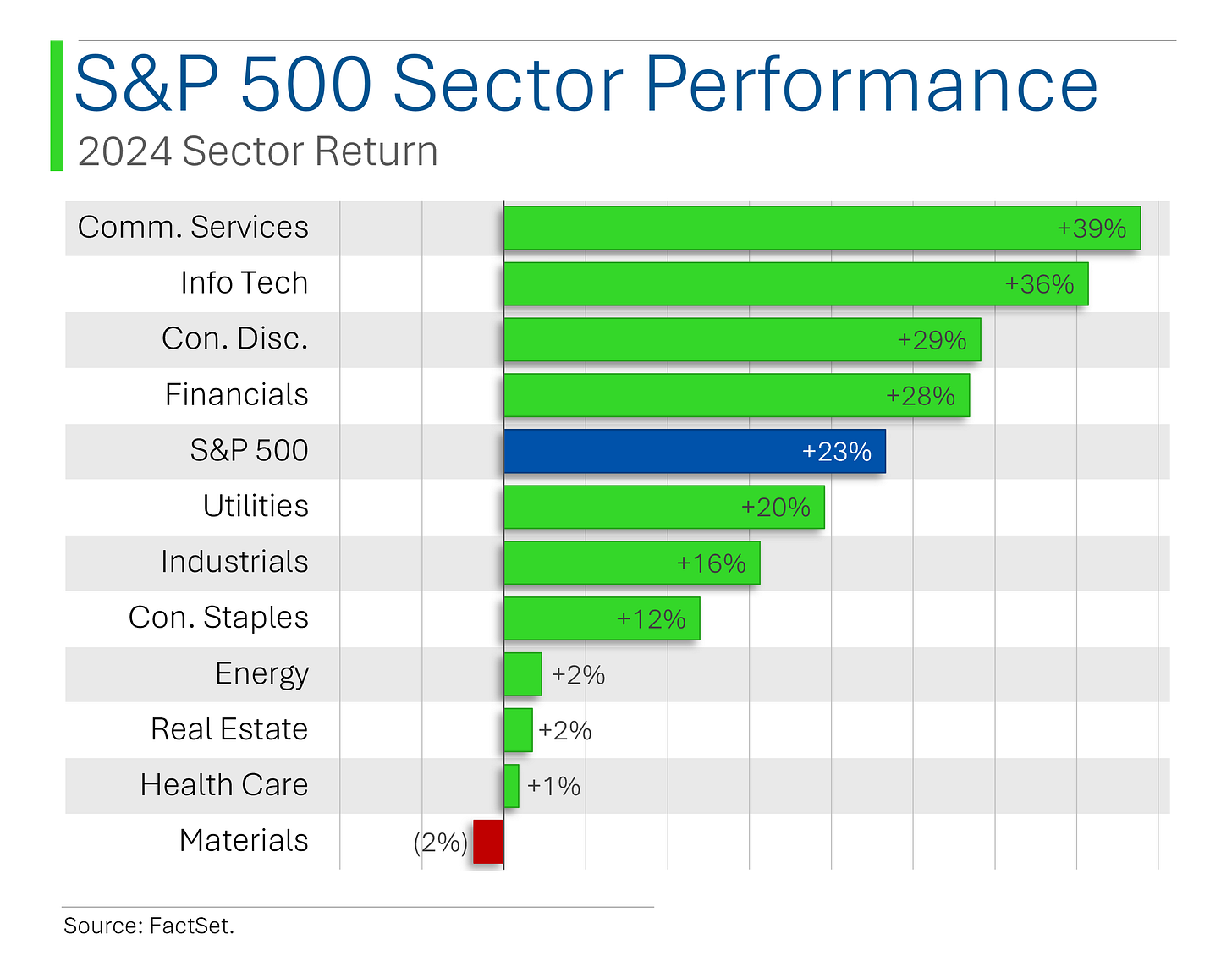

The S&P 500 finished the year up 23.3% - it’s second year in a row of +20% gains. But it’s worth noting that the Mag7 contributed 56% of that performance.

Yup, it’s still super top heavy.

2024 Performance Review

And while the biggest got bigger, there were also plenty of other big winners - and losers - in 2024.

Palantir was the best performing of all of them (+341%) but only part of the return contributed to the S&P 500 as they were only added in September. While Intel and Walgreens were at the bottom of the list - down 60% and 64% respectively.

Intel has already been replaced in the Dow Jones - up traded for Nvidia no less - but with a market cap of $87 billion, another year like 2024 and it may find itself off the S&P as well.

On the sector front, Tech, Consumer Discretionary and Communication Services had another incredible year, while Energy, Real Estate, Health Care and Materials had 2024 to forget.

And this is nothing new. In fact, Tech, Communication Services and Discretionary have averaged annual gains of 23.8%, 12.0% and 14.8% over the past ten years.

What do you think? Will Tech and friends continue to crush it in 2025? Let me know in the comments below. For what it’s worth, I think Industrials and Health Care could find their way to the top next year.

Joke Of The Day

Blessed are the young, for they shall inherit the national debt.

– Herbert Hoover

Macro Update

ISM Manufacturing [Friday]

The December ISM Manufacturing Index rose to 49.3, the highest since April 2024 and above the consensus of 48.4, signaling slower contraction compared to November's 48.4.

New orders expanded to 52.5, and production increased to 50.3, but employment fell to 45.3, and prices climbed to 52.5. Analysts saw mixed signals, with some concerns about Fed hawkishness due to rising prices despite optimism about 2025.

Jobless Claims [Thursday]

Initial jobless claims fell to 211K, below the consensus of 220K and the prior week's revised 220K. The four-week moving average also decreased to 223,250, while continuing claims dropped to 1,844K, below the 1,892K consensus.

Jobless claims showed regional variation, with increases in New Jersey, Kentucky, and Missouri, and decreases in New York, Florida, and West Virginia.

Home Price Index [Tuesday]

The U.S. National Home Price NSA Index reported a 3.6% annual return for October 2024, down from 3.9% in September, signaling a slight deceleration in price growth.

The 10-City Composite Index increased by 4.8% annually, compared to 5.2% the prior month, while the 20-City Composite rose by 4.2%, down from 4.6%.

New York led gains with a 7.3% annual increase, followed by Chicago at 6.2% and Las Vegas at 5.9%, while Tampa lagged with the lowest year-over-year growth at just 0.4%.

Trivia

Today’s trivia is on Ozempic maker Novo Nordisk.

What is the origin country of Novo Nordisk?

A. Denmark

B. Sweden

C. Norway

D. FinlandNovo was created after the founder, whose wife suffered from diabetes, travelled to this country following their discovery of insulin, which eventually led to a licensing arrangement.

A. Canada

B. United States

C. England

D. GermanyNovo’s A Shares represent 28% of capital and 77% of voting rights, and are controlled entirely by whom?

A. Novartis

B. The Novo Nordisk Foundation charity

C. The family of founder August Krogh.

D. The Danish governmentNovo’s 2023 revenue was how much?

A. $20 billion

B. $34 billion

C. $51 billion

D. $88 billionIn what year did Novo Nordisk introduce the world's first prefilled insulin pen?

A) 1985

B) 1993

C) 1989

D) 2001

(answers at bottom)

This Week In History

Introduction of the Euro Currency (January 1, 1999): The Euro was introduced as an accounting currency in 11 European countries, marking a significant step in European economic integration.

Emancipation Proclamation by President Abraham Lincoln (January 1, 1863): Lincoln issued the proclamation declaring all slaves in Confederate-held territory free, a pivotal moment in the American Civil War.

Establishment of the Soviet Union (December 30, 1922): The Union of Soviet Socialist Republics (USSR) was officially formed, uniting multiple Soviet republics under a centralized government, significantly impacting global politics for the rest of the 20th century.

Execution of Saddam Hussein (December 30, 2006): Former Iraqi President Saddam Hussein was executed after being convicted of crimes against humanity, marking a significant moment in Iraq's post-invasion history.

Market Update

Market Movers

Friday:

FNMA (Fannie Mae) [+29.8%]: Shares soared after the FHFA and Treasury announced a process to end its conservatorship.

RIVN (Rivian) [+24.5%]: Rivian beat Q4 delivery and production expectations, with full-year figures aligning with guidance.

SQ (Block, Inc.) [+6.2%]: Upgraded by Raymond James on renewed confidence in its 2025 growth story and Seller GPV growth potential.

CHWY (Chewy, Inc.) [+6.2%]: Wolfe Research upgraded Chewy on anticipated customer growth, pet health focus, and international expansion.

X (United States Steel) [-6.5%]: Shares dropped after President Biden blocked Nippon Steel's acquisition over national security concerns.

Thursday:

MODG (Topgolf Callaway Brands) [+14.5%]: Jefferies upgraded MODG on valuation optimism and excitement over the Topgolf spin-off.

LYFT (Lyft) [+5.8%]: Shares jumped on reports that AMZN might acquire Lyft in 2025.

UBER (Uber Technologies) [+4.7%]: Added to Goldman Sachs' US Conviction List, boosting investor confidence.

SOFI (SoFi Technologies) [-8.9%]: KBW downgraded SoFi on valuation concerns.

TSLA (Tesla) [-6.1%]: Missed Q4 delivery expectations, with deliveries down 1.1% year-over-year.

Monday:

BA (Boeing) [-2.3%]: South Korea announced an investigation into Boeing's 737-800 planes following a deadly crash.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

A. Novo Nordisk was founded in Denmark.

A. Insulin was discovered in Canada.

B. The Novo Nordisk Foundation charity holds the A shares and voting control.

B. 2023 revs came in at $34 billion.

C) They created the world’s first insulin pen in 1989.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.