🔬Wall Street Stats!

Plus: Chip maker TSMC keeps AI hopes alive; and much more!

"History may not repeat, but it does rhyme"

- Ken Fisher

"Investing without research is like playing stud poker and never looking at the cards"

- Peter Lynch

Strong day for the big US markets as the winning streak increased to 7 days, with the S&P 500 +1.0% and Nasdaq +1.2%.

All 11 sectors closed higher with Tech (+1.6%). Financials (+0.4%) and Staples (+0.5%) were the weakest but still had a good day of it.

Other than renewed AI enthusiasm it was a pretty quiet day in the markets ahead of today’s CPI inflation print.

Notable companies:

HubSpot (HUBS) [-12.1%]: Alphabet shelved potential bid for company, according to Bloomberg.

Taiwan Semiconductor (TSM) [+3.5%]: Reported Q2 revenue growth of 40% y/y, better than the ~35.5% consensus; AI a key tailwind.

MasterCard (MA) [-2.5%]: Downgraded to Hold from Buy at Bank of America; limited upside amid crowded investor positioning and regulatory overhangs.

More below in ‘Market Movers’.

Street Stories

Wall Street Stats

Today I thought it would be fun to bang through some of the interesting stats associated with the companies on the S&P 500.

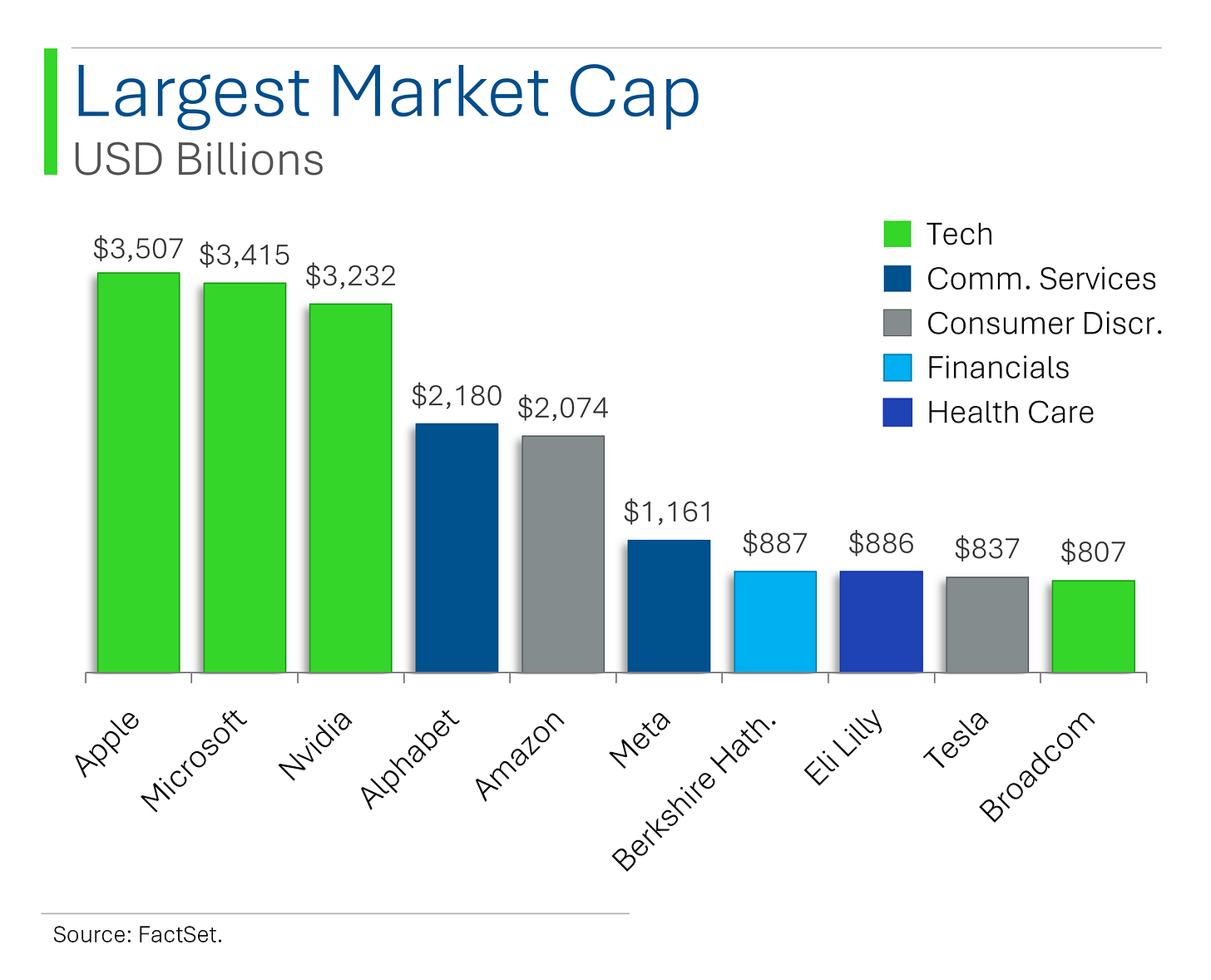

To start, I don’t think anyone would be too shocked by the list of companies with the largest market caps. The Top 10 is the Mag7 plus Berkshire Hathaway, Eli Lilly and Broadcom. Pretty much household names.

Worth noting that Tech, techy Communication Services and the techy piece of Consumer Discretionary occupy 8 of the 10 spots. Not an Industrial or Real Estate company in sight.

So yeah, not all sectors are created equal. For example, the biggest Tech company, Apple, is roughly 33x bigger than the biggest Real Estate company, Prologis.

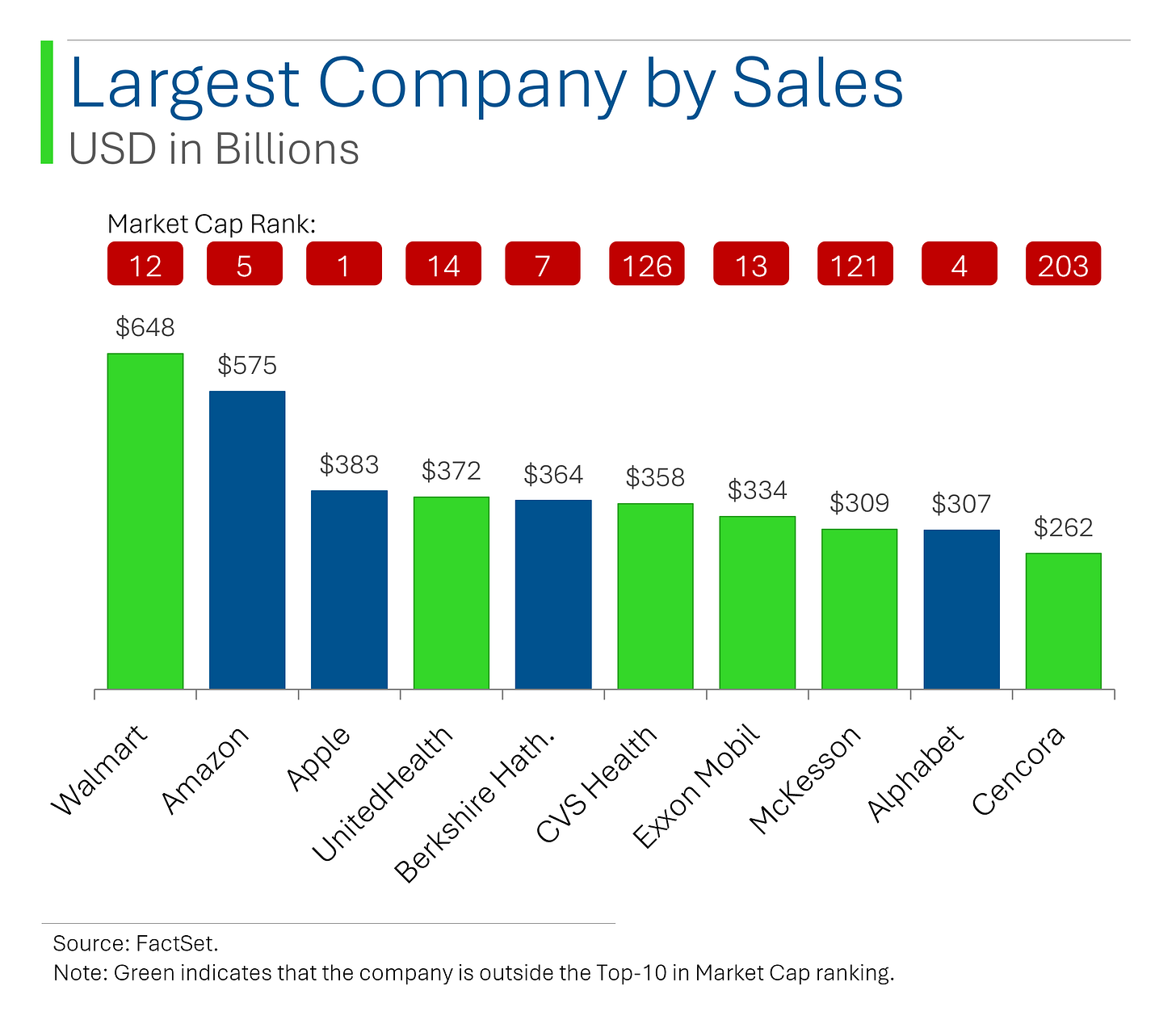

But market cap isn’t the only measure of size. For example, the company with the most sales in the world - Walmart with $648 billion last year - isn’t even in the top 10 ranking for market cap. The former largest company in the world is now only 12th.

The biggest mismatch here is Cencora (a drug distributor formerly known as AmerisourceBergen) with the 10th highest sales but the 203rd highest market cap.

On the valuation front, Tesla actually has the highest 12-Month Forward P/E at 91x - roughly 4.2 times the S&P 500 average of 21.5x.

Generally high P/Es indicate that the company is hot and investors are bidding up the price, typically in anticipation that the company will exhibit strong future growth to warrant the lofty valuation.

However… sometimes this can mean almost the opposite. For example, Boeing sits in the number two spot and I don’t think anyone considers them a hot stock at the moment. See even when ‘P’ drops, if the ‘E’ completely collapses to almost zero, your P/E ratio goes interplanetary.

TLDR: Really good (or hyped) companies have high P/Es. So do really terrible ones.

On the other end of the spectrum, it’s mostly dogs. While Tesla may trade 91x P/E, it’s less exciting peers Ford and GM trade significantly lower (7x and 5x respectively).

This is also the home of the airlines with Delta, American and United all in the bottom 10.

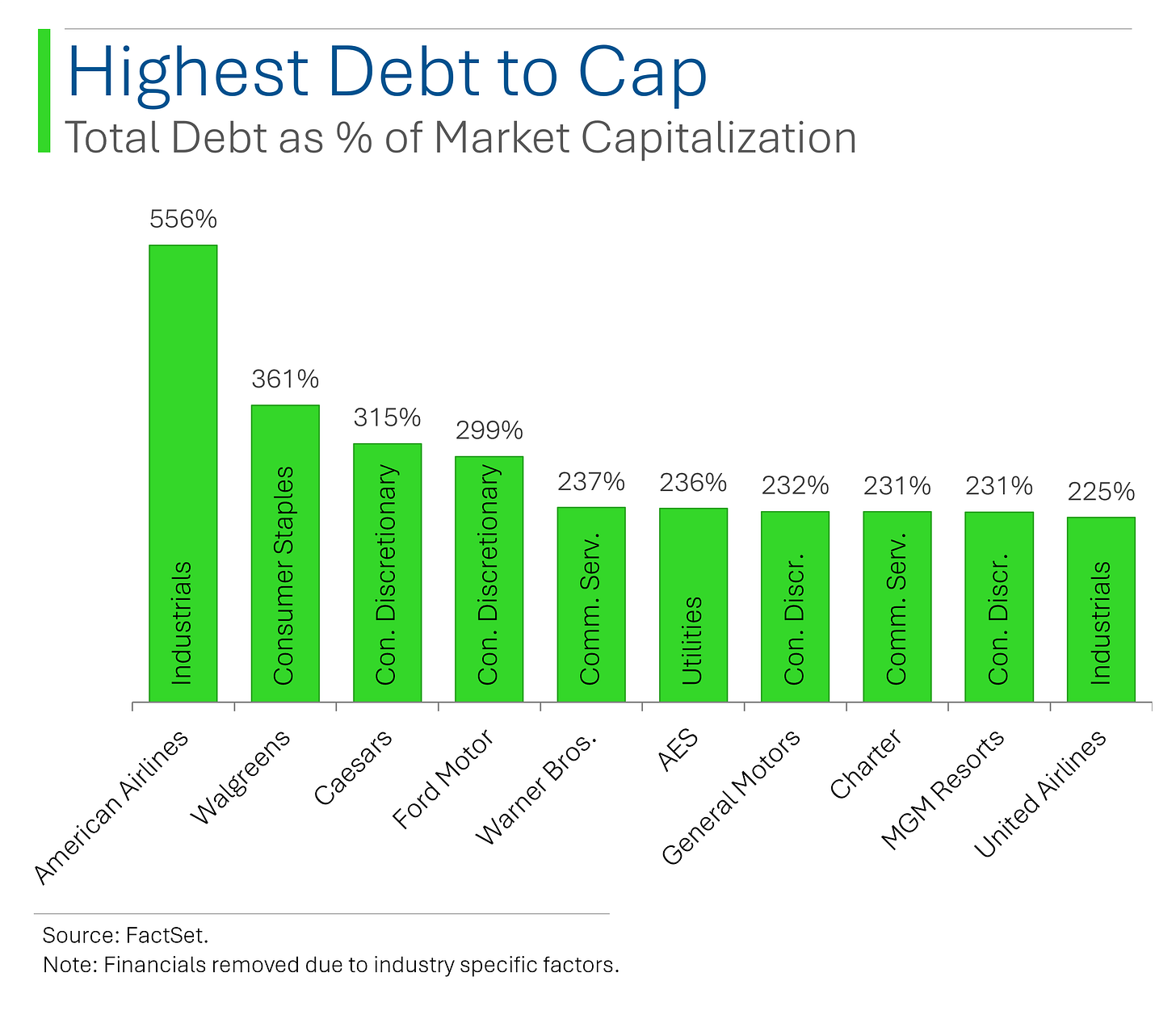

Now several of the companies above are there in part because of their massive debt loads - and the risks therein. As you can see, American Airlines, Delta Airlines, Ford, GM, Walgreen are also unhappily included in the Top 10 for highest debt as a percent of their market capitalization.

Looking at the highest total debt, this is interestingly occupied entirely by the likes of Communication Services, Consumer Discretionary and Tech companies.

Sector-wise, Utilities quite reasonably has the highest debt as a percent of market cap (tightly regulated industries can do that). While Tech has the lowest by a fair margin.

Indeed Microsoft and Apple are only on the list above just because of how massive they are.

So that’s my fun little update on the biggest, best and worst of Wall Street. If you have some other interesting stats in mind, please let me know in the comments and I’ll try to include them in an upcoming StreetSmarts. ✌️🤓

Chip Giant Joins Trillion Dolla Club

TSMC, the world’s largest contract chipmaker, reported strong second-quarter revenue growth of TWD$673.51 billion ($20.67 billion), beating market forecasts and adding additional fuel to the AI hype train that all is well in chip land.

The company, benefiting from clients like Apple and Nvidia, saw a 32% year-on-year increase in revenue, pushing its share price to a record high. TSMC's market capitalization reached $830 billion, with shares up 76% this year, and its ADRs briefly boosting the firm’s market value to $1 trillion.

Joke Of The Day

A man’s home is his castle…In a manor of speaking.

An armed man ran into a real estate agency and shouted…“Nobody move!”

Hot Headlines

Yahoo / Intuit is laying off 1,800 employees as AI leads to a strategic shift. The tax software company claims it won’t cut costs as it casually cuts 10% of its work force.

Bloomberg / As home delinquencies start to grow, distressed property buyers are on the hunt for ‘exceptional bargains’. Kinda was a big deal last time…

CNN / Democrats stunned by how rapidly things have unraveled for Biden in the last 24 hours. In the latest round of protests, 9 House Democrats and 1 Democratic senator have publicly called on the president to step aside. Good things the President doesn’t know what planet he’s on or he’d probably be upset.

Reuters / Bank of Israel waiting for digital Euro ahead of digital shekel launch. As of March, 134 countries representing 98% of the global economy were exploring digital versions of their currencies, which would eventually replace cash. Some countries, such as China, are in advanced stages of pilot programs, while the U.S. Federal Reserve is lagging.

Forbes / Costco is raising membership fees for first time in 7 Years. New prices take effect in September. Shares are up +2.6% in pre-market trading.

Yahoo / Apple targeting 10% growth in new iPhone shipments on the back of AI-enablement. The company is planning to ship at least 90 million iPhone 16 devices in the latter half of this year with AI services to fuel demand for its new lineup after a rocky 2023.

Trivia

Today’s trivia is on random stock market facts.

What is the oldest stock exchange in the world?|

A) London Stock Exchange

B) Amsterdam Stock Exchange

C) New York Stock Exchange

D) Tokyo Stock ExchangeWhich company became the first trillion-dollar company by market capitalization?

A) Microsoft

B) Apple

C) Amazon

D) Google

What is the longest trading suspension in the history of the NYSE?

A) 3 days

B) 1 week

C) 4 months

D) 1 year

What event is known as "Black Monday" in stock market history?

A) The Wall Street Crash of 1929

B) The stock market crash of October 19, 1987

C) The Dot-com bubble burst of 2000

D) The Financial Crisis of 2008

(answers at bottom)

Market Movers

Winners!

Lantheus Holdings (LNTH) [+36.7%]: Analysts positive on new CMS proposal, improved payment for diagnostic radiopharmaceuticals; OPPS rule proposal could help Pylarify's passthrough status.

STAAR Surgical (STAA) [+10.9%]: Trading higher after Street Insider reported company approached by ALC; Betaville report indicated interest and potential sale.

CarMax (KMX) [+6.5%]: Oppenheimer positive on leading auto retailers; moderating used car prices suggest improving consumer demand; specifically noted CarMax.

Illumina (ILMN) [+6.1%]: Announced acquisition of Fluent BioSciences; aims to develop end-to-end solutions for single-cell analysis; analysts positive on market expansion; upgraded at Citi.

Goodyear Tire & Rubber (GT) [+4.8%]: Bloomberg reported advanced talks to sell Off-the-Road tire business to Yokohama Rubber for at least $1B.

Carvana (CVNA) [+4.2%]: Upgraded to buy from hold at Citi; profitable secular growth story; potential growth using digital-first customer experience and under-used physical footprint.

Advanced Micro Devices (AMD) [+3.9%]: Announced deal to acquire Silo AI, Europe's largest private AI lab, for $665M in cash; deal expected to close in 2H.

Taiwan Semiconductor (TSM) [+3.5%]: Reported Jun Q revenue growth of 40% y/y, better than the ~35.5% consensus; AI a key tailwind.

Losers!

LegalZoom.com (LZ) [-25.4%]: Traded lower after CEO Wernikoss announced immediate resignation; lowered FY revenue and FCF guidance; multiple downgrades.

Kura Sushi USA (KRUS) [-16.1%]: Guided Q4 comps down MSD to HSD; ongoing macro pressures; significant softening in CA market.

10X Genomics (TXG) [-13.9%]: Downgraded to hold from buy at Deutsche Bank; pressures from increased competition (ILMN acquisition of Fluent); volume declines and pricing pressures could hurt margins.

HubSpot (HUBS) [-12.1%]: Alphabet shelved potential bid for company, according to Bloomberg.

Ziff Davis (ZD) [-10.3%]: Expects certain Q2 results to be below Street consensus.

Deckers Outdoor (DECK) [-4.9%]: Lower amid cautious analyst commentary suggesting some June deceleration in HOKA and UGG growth.

Intuit (INTU) [-2.6%]: Disclosed reorganization plan to focus on growth; will cut 10% of workforce.

MasterCard (MA) [-2.5%]: Downgraded to neutral from buy at Bank of America; limited upside amid crowded investor positioning and regulatory overhangs.

Market Update

Trivia Answers

B) Amsterdam Stock Exchange is the oldest in the world.

B) Apple became the first trillion dollar company back in August 2018.

C) The NYSE was closed for 4 months in 1914 at the start of WWI.

B) The stock market crash of October 19, 1987 is referred to as ‘Black Monday’. The 1929 one was ‘Black Tuesday’.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.