🔬Valuation vs. Growth

Plus: Robinhood in SEC hotseat over crypto; GameStonk's share price is imaginary; and another investment banker dies from being overworked.

“I skate to where the puck is going to be, not where it has been.”

- Wayne Gretzky

"Don’t invest in any idea you can’t illustrate with a crayon."

- Mohnish Pabrai

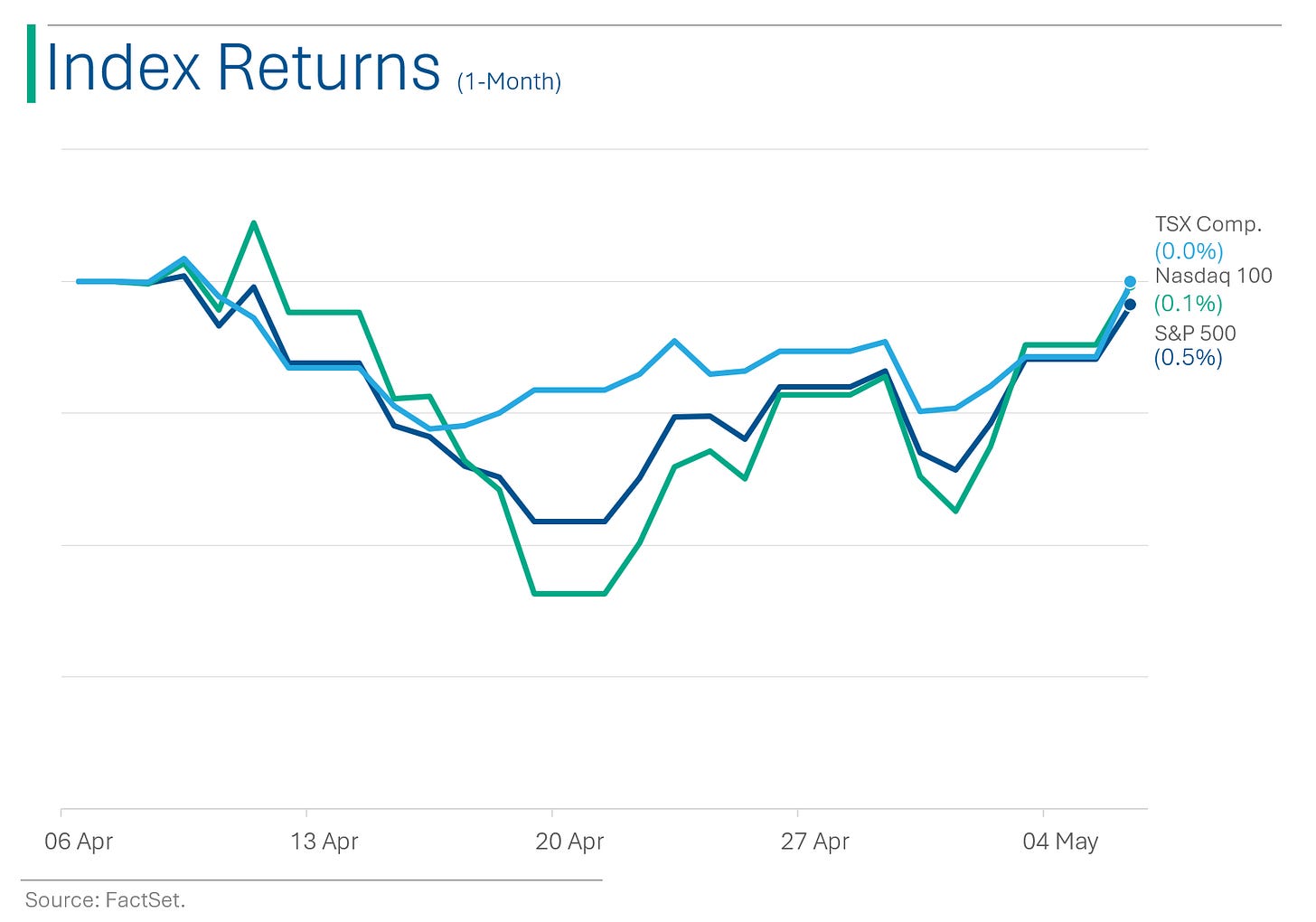

The big US markets were up for the third straight day with the S&P 500 +1.0% and Nasdaq +1.2%, as a lack of catalysts seems to bode well for a bored market.

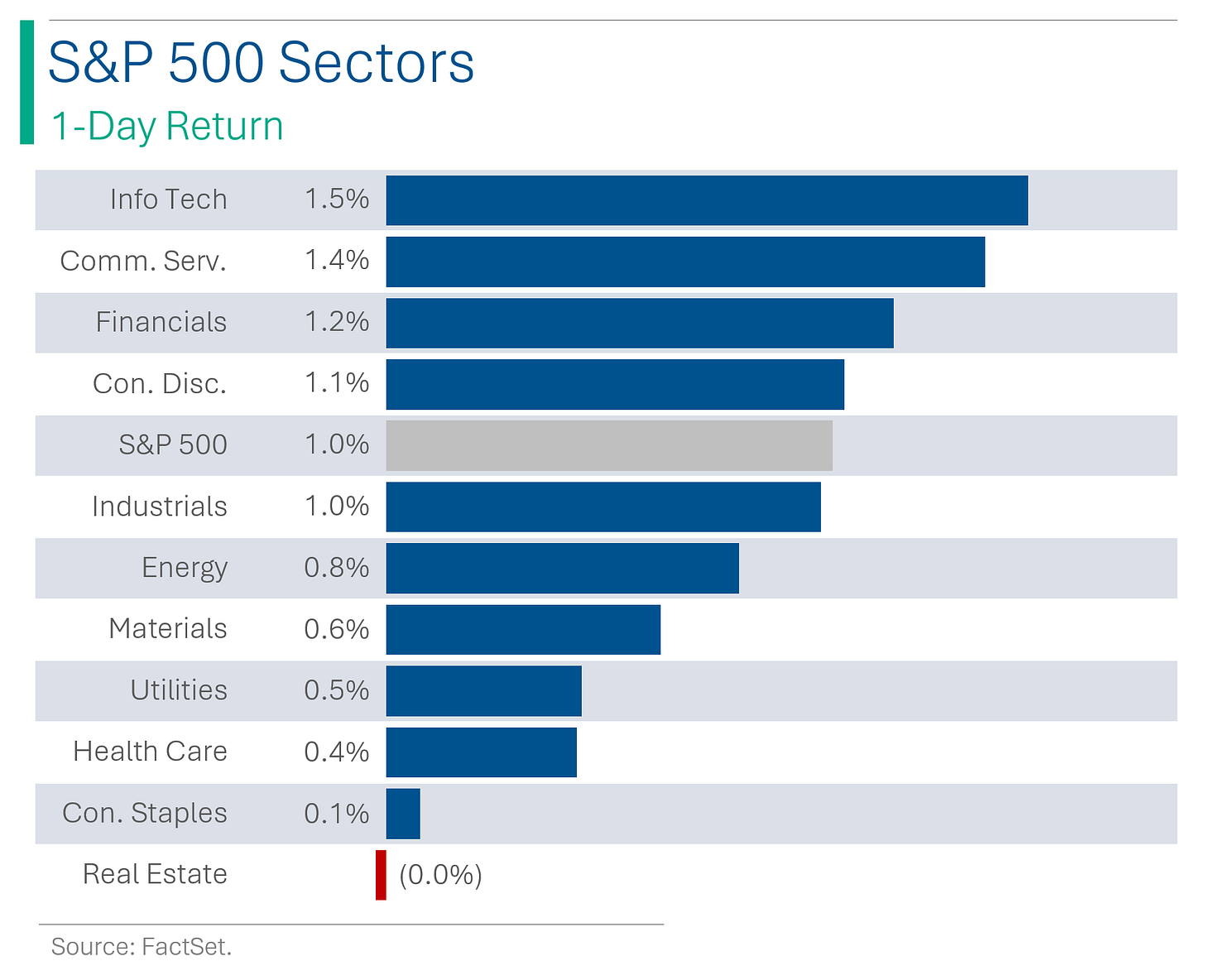

10 of 11 sectors closed higher, led by Tech (+1.5%) and techy Communication Services (+1.4%). Real Estate was the only loser (-0.0%).

Vistra Corp closed up 2.2% on news that it will be added to the S&P 500 on Wednesday, replacing Pioneer Natural Resources after it’s $60 billion takeover by Exxon. 🕊️

Palantir shares were on a bit of a rollercoaster after posting a decent Q1 print after close with in-line EPS and beats on Revenue and OpIncome. Shares closed yesterday up +8.1% in anticipation of strong earnings, only to trade down 10.0% in pre-market trading.😅

Street Stories

Valuation vs. Growth

An overly simplified but kinda neat way to look at the state of the market is along the spectrum of growth and valuation: Is the market cheap or expensive compared to where it’s been in the past? And is it growing faster or slower than it has in the past?

This led me to build the below, which a lack of creativity has left it with the working title of the ‘Metcalf Model’ after yours truly.

As you can see above, in May of 2020 the growth outlook for the S&P 500 was pretty terrible (negative) as the world ground to a halt, however, stocks rallied hard after the initial Covid blip.

In the ‘Everything Bubble’ during the pandemic, growth expectations continued to improve but valuations remained extremely elevated. As views about growth cooled heading into 2022, the stock market went into freefall, however, Wall Street’s estimates for earnings growth didn’t really budge, that’s why the drop was straight down.

Since February 2023, growth estimates have improved (+4% to +12% currently) but so have valuations (18.5x P/E to 20.2x P/E).

Going all the way back to 2000 is a bit of a mess but does shed a bit of insight on where the current levels of P/E and forecast EPS growth stack up. As it stands, the S&P 500 trades at a P/E more than +2 standard deviations above from its historical average but only +1.0% higher expected EPS growth.

Not exactly the discount of the millennium.

Robinhood Joins Crypto Fight With SEC

Robinhood Markets snagged a not-so-coveted ‘Wells notice’ from the SEC, hinting at looming enforcement over the crypto tokens it trades. Dan Gallagher, Robinhood's chief legal eagle, scoffed at the idea, which hinges on the definition of crypto currencies as securities - which Robinhood alleges they aren’t, and Coinbase is currently engaged in a legal battle with the SEC to prove.

I don’t know who’s going to win but if they call this turnip to testify again, consider shorting $HOOD.

Another Investment Banker Dies

As a former Investment Banker, I know we aren’t a group that gets a whole lot of sympathy. The pay is great, the exit opportunities incredible, so if you’ve ever heard any of us whine about long hours I don’t imagine you’ve offered much solace.

That said, it’s unacceptable that kids are literally getting worked to death, which has happened yet again. This time it was a former green beret and reported father of two, working as an Associate at Bank of America’s New York Office.

For anyone that remembers, there was a bit of a an outcry in the industry to fix hours for junior bankers and cap weekend work following the death of Moritz Erhardt in 2013. Moritz was a junior at Bank of America Merrill Lynch, who reportedly pulled 3 all-nighters before collapsing and being found dead by his roommates.

That hit home for me in many ways: Firstly, that this happened in London, where I was working at the time so there were friend-of-friends that made it quite real. And secondly, is that a year earlier I had pulled a similar stint of sleepless nights and ended up leaving Credit Suisse’s Canary Wharf office in an ambulance after developing severe enough pneumonia that I could barely move or remain conscious.

Anyway, it’s crazy to think that conditions are so bad as to turn a group of the some of the world’s most type-A, Darwinian overachievers into something akin to a union (a dirty word on Wall Street), but that’s where we are. The list of reported demands is almost comical, such as requesting a work limit of 100 hours in a week since most people probably didn’t know there were that many to begin with. Or if they did know that, they’d rightly assume that even sweatshops wouldn’t operate like that (they don’t).

RIP to the deceased. Hopefully this time some real change comes of things.

GameStop Rallies… for no reason

Yep, you heard that right.

The stock is up 50% since last week. It’s not expected to report Q1 until June. No news. Just meme-stocks gunna meme-stock. 🤘🫠

Joke Of The Day

What’s Irish and stays out all night? Patty O’Furniture.

Hot Headlines

Bloomberg / Nvidia is missing link in a strong season of AI earnings reports. The chipmaker at the center of the AI trade reports on May 22, with the stock up 20% since getting hammered in April, but is still down about 3% from a March peak.

Bloomberg / Citi sees Fed’s Balance-Sheet runoff extending into 2025. The central bank has been winding down its holdings since June 2022, through a process known as quantitative tightening. Last week it said it would slow the pace at which it lets Treasuries roll off every month, a move meant in part to ease potential strains on funding markets.

Reuters / Swiss National Bank exploring ways to tokenise financial assets. Chairman Thomas Jordan said central banks needed to decide how best to engage in the developments which advocates say will speed up and make payments cheaper. No word if they will try and digitize all their Nazi gold.🤦♂️

MarketWatch / Trump’s Truth Social dismisses accounting firm after SEC accused it of ‘massive fraud’. The company fired BF Borgers Friday, the same day the auditor agreed to pay a $14 million fine after admitting it had falsely claimed filings for hundreds of companies met accounting standards.

For those preferring a sports analogy, BF Borgers is like Pete Rose - all-time leader in hits. While Arthur Andersen (Enron, Wordcom) is like Barry Bonds, with a huge slugging percentage.

Reuters / Investors pull $9.9 billion from hedge funds in March. This is up from $780 million in February and the 22nd consecutive month where industry outflows totaled more than inflows. Those poor, poor fellows. I mean, not like real ‘poor’.

Trivia

Today’s trivia is on BlackRock, the world’s largest investment manager.

When was BlackRock founded?

A) 1980

B) 1985

C) 1988

D) 1991BlackRock started as a part of which financial institution before becoming independent?

A) Merrill Lynch

B) Goldman Sachs

C) Blackstone Group

D) J.P. MorganWhich is the flagship ETF of BlackRock?

A) Vanguard Total Stock Market ETF

B) iShares Core S&P 500 ETF

C) SPDR S&P 500 ETF Trust

D) Invesco NASDAQ 100 ETFAs of 2023, what were BlackRock’s total assets under management (AUM)

A) $800 billion

B) $2.42 trillion

C) $7.84 trillion

D) $10.01 trillion

(answers at bottom)

Market Movers

Winners!

Freshpet (FRPT) [+10.5%] Big Q1 revenue and EBITDA beat with volumes up 5.6pp sequentially, exceeding expectations. Strong club velocities and notable improvements in plant expenses, quality costs, and lower input costs highlighted. Media and logistics costs also reduced; FY EBITDA guidance raised while maintaining revenue outlook.

Bausch + Lomb (BLCO) [+6.2%] Upgraded to overweight by Morgan Stanley, citing faster than expected margin growth and potential for more organic sales from Miebo and other pipeline opportunities.

Micron Technology (MU) [+4.7%] Baird upgraded to outperform, pointing to a favorable valuation and positive trends in DRAM pricing and demand for high-bandwidth memory.

United States Steel (X) [+4.3%] EU approval received for Nippon Steel's acquisition. Morgan Stanley upgraded to overweight, highlighting the company's transformation and growth initiatives' value.

Paramount Global (PARA) [+3.1%] NY Times reported that negotiations have opened with a Sony and APO-led bidding group following a proposed $26B nonbinding bid and the end of an exclusive negotiation period with Skydance.

Losers!

Spirit Airlines (SAVE) [-9.7%] Q1 revenue and EPS matched expectations but Q2 guidance fell short due to a competitive environment with high capacity in many markets. Expressed confidence in strategic changes to foster continuous improvement in coming years.

Medical Properties Trust (MPW) [-7.6%] Faced challenges as major tenant Steward Health Care filed for Chapter 11. Arranged debtor-in-possession financing with MPW for $75M, with an additional $225M contingent on certain conditions.

Treehouse Foods (THS) [-7.2%] Q1 earnings and margins fell short, though revenue was higher. Experiences included downtime and a restart of the broth facility, lower volumes, rising labor costs, and an unfavorable category mix. Q2 EBITDA expected below expectations but reaffirmed full-year guidance; anticipates cost savings in H2.

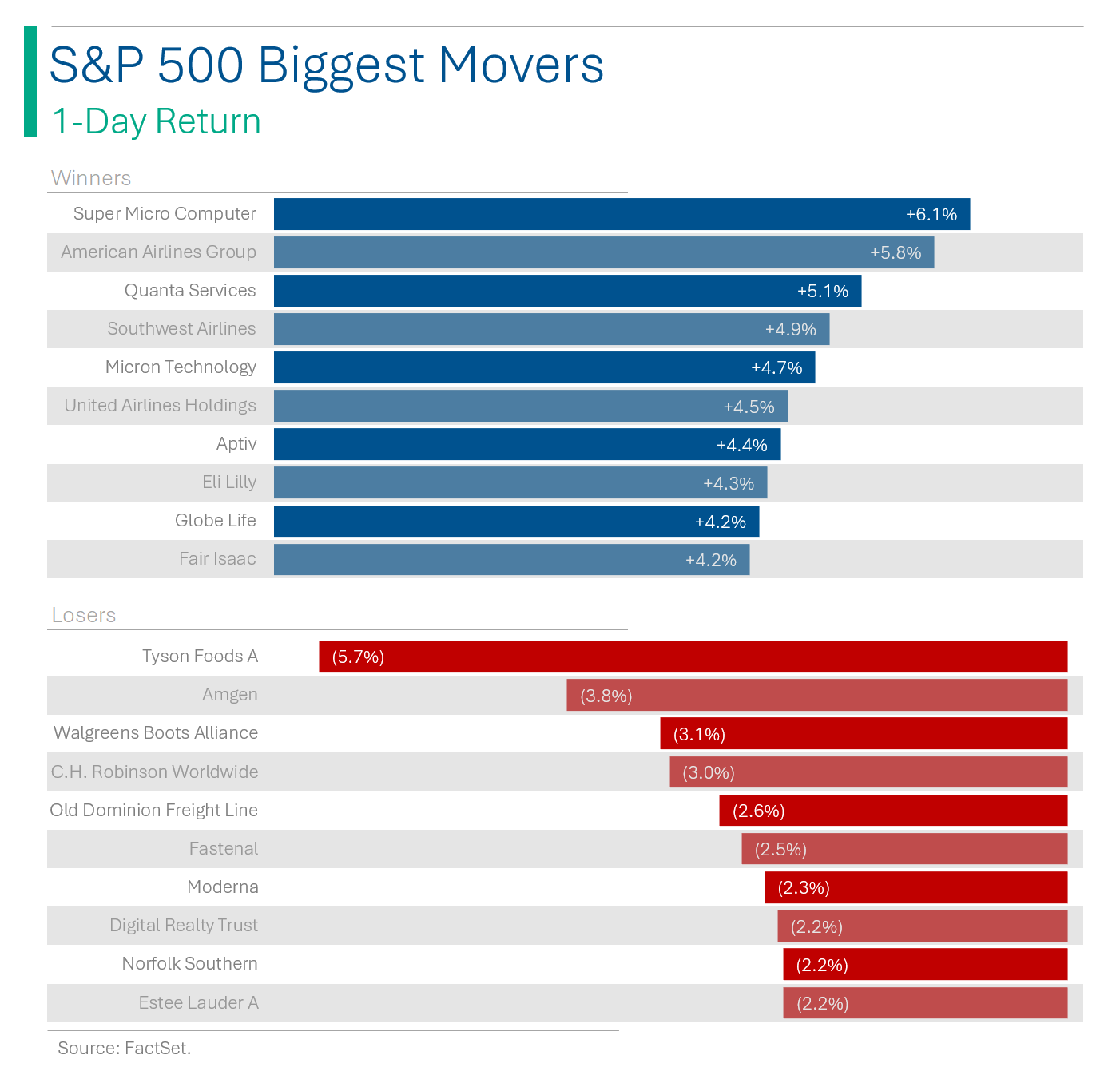

Tyson Foods (TSN) [-5.7%] Q2 EPS and operating income exceeded forecasts, though revenue was slightly under expectations. Reaffirmed FY24 revenue growth and raised the operating income range. Adjusted FY guidance for segments: decreased losses in beef and increased income in chicken, but noted weaker performance in pork and prepared foods. Highlighted consumer price sensitivity shifting from quick service restaurants to in-home due to prolonged inflation.

Market Update

Trivia Answers

C) BlackRock was founded in 1988.

C) BlackRock as originally a subsidiary of Blackstone Group.

B) The iShares Core S&P 500 ETF is their flagship ETF.

D) As of 2023 they had AUM of $10.01 trillion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great visuals of growth versus valuation - especially with the standard deviation rings 🙏🏻👍