🔬U.S. Steel To Be Bought By Japanese, The S&P Closes In On All-Time Highs, and Much More

"The markets are like a large movie theater with a small door"

- Jeffrey Gundlach

"When you innovate, you've got to be prepared for everyone telling you you're nuts"

- Larry Ellison

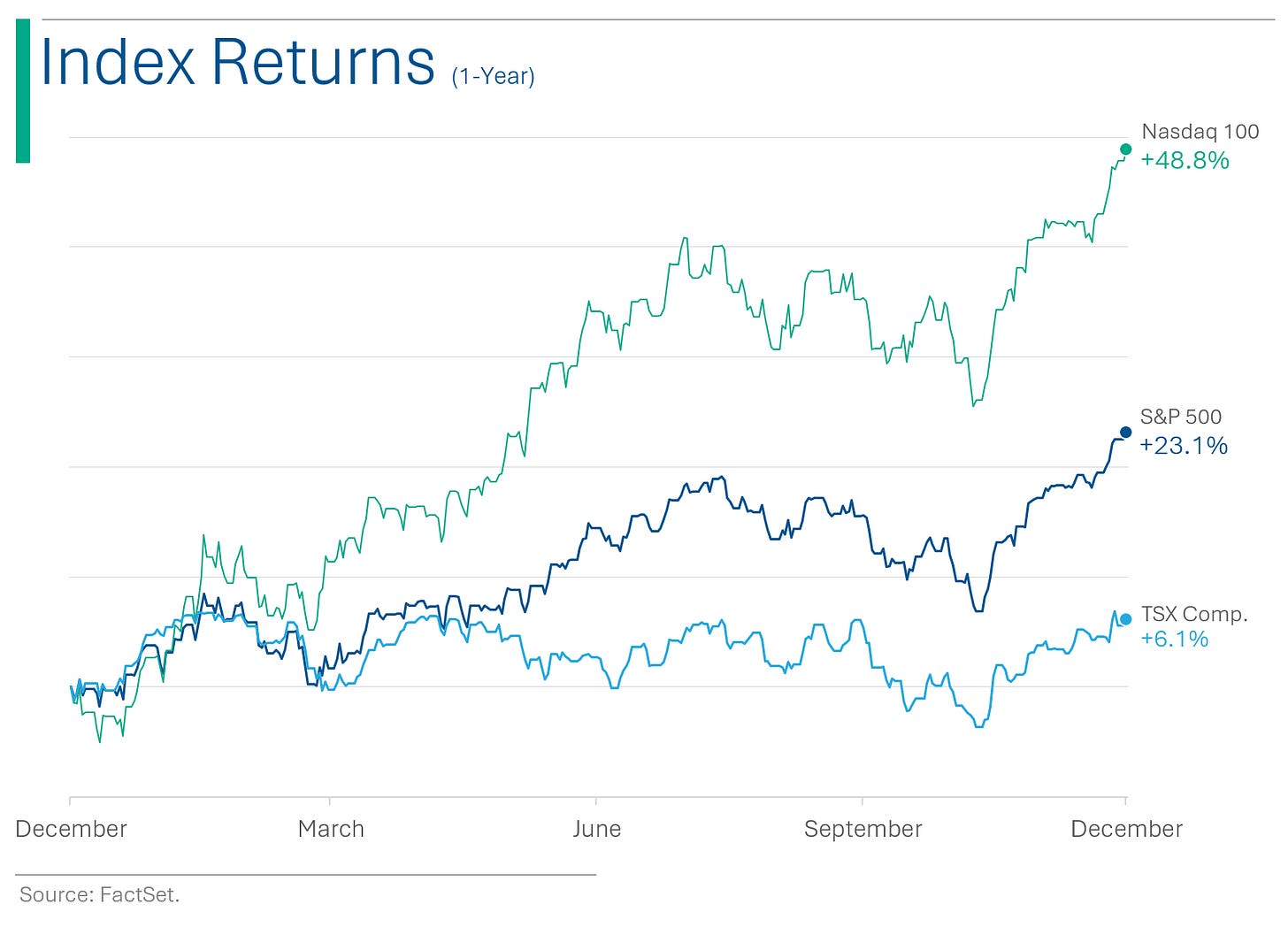

Decent up-day for the big US markets with the S&P 500 +0.45% and Nasdaq +0.61%. The S&P is now only 1.2% off its all-time high on January 3rd 2022.

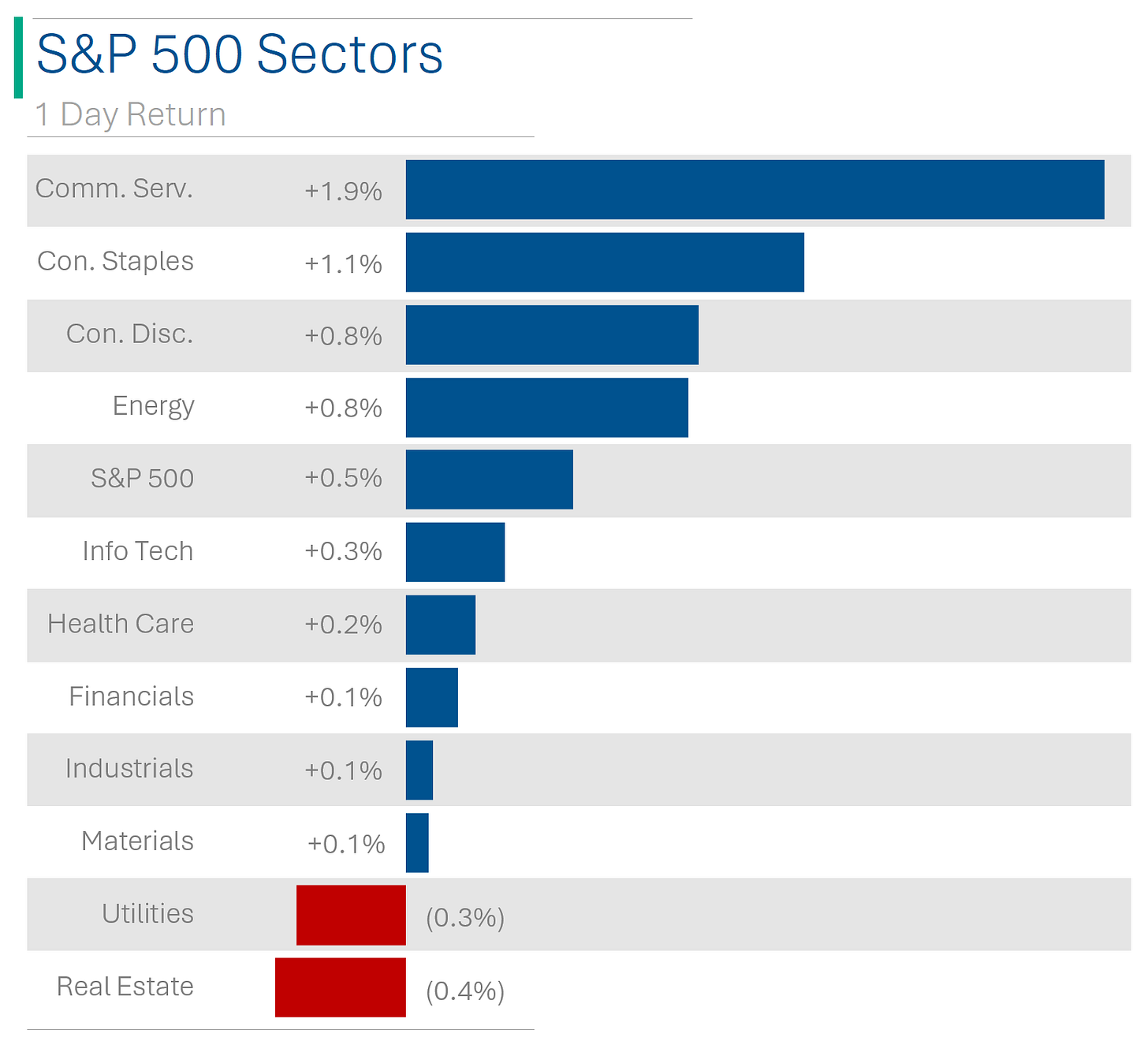

9 of 11 sectors closed in the green with Communication Services (+1.9%) crushing it. Real Estate (-0.4%) and Utilities (-0.3%) continued to sag.

WTI Crude was up 1.4% following more potential disruption to supply as more oil and shipping companies vow to cut usage of the Suez Canal following Hamas-supporting Houthi rebels recent attacks.

The market is now pricing an 80% chance of interest rate cuts by the US Fed as early as their March meeting. Currently 150bps of cuts are forecast between January 2024 and January 2025.

Adobe bins $20 billion takeover plan for Figma.

U.S. Steel to be acquired by Nippon Steel for $14.9 billion. If deal goes through, 100% chance Elon buys their ticker ($X)

Street Stories

STEEL & AMERICA - The mass production and use of steel has been a relatively powerful indicator of a nation’s growth and economic prosperity. Or at least it was historically. That’s why I think it’s worth mentioning the historic impact of yesterday’s news that Nippon Steel would be acquiring U.S. Steel in a $14.9 billion deal.

History Lesson: U.S. Steel was created in 1901 by J.P. Morgan (the guy, not the bank) following his merger of Andrew Carnegie’s Carnegie Steel with Federal Steel and National Steel. Clearly creative branding wasn’t yet a thing. The result was the world’s first billion dollar company, which controlled ~67% US steel production; a figure that would continue to grow in the coming decades through additional mergers. The company even remained intact when the anti-monopolists tried to break it up like Standard Oil.

Fast forward 100 years, however, and US Steel’s production is roughly the same that it was in the early 1900s. And what was once the world’s most valuable company, is now only the 23rd largest steel company.

While U.S. Steel has been left behind, the market for steel globally has remained strong - more than doubling over the last 20 years. Given that it’s not the easiest thing in the world to transport, it makes sense that production has moved to areas where the high rates of industrialization are taking place. China has of course been the leader in this area, and that’s part of the reason why currently 12 of the world’s 25 biggest producers are based there.

RYANAIR TAKING FLIGHT - The Financial Times did an interesting write-up on Ryanair CEO Michael O’Leary’s potential €100 million bonus. Outside of the US (and especially in the chronically unprofitable airline industry), mega bonuses like this are rare. Agreed to in his 2019 compensation plan, O’Leary gets the money if the airline’s share price hits €21 for 28 days, or it reports €2.2bn in annual profits after tax. And since the current share price is €18.66 he’s pretty darn close.

Anyway, good for him or whatever. But what really caught my attention is that he got this compensation package for building Ryanair into the second largest airline in the world: The same size as American Airlines and United combined. Not bad for a little Irish budget carrier.

FORMER NIKOLA CEO SENTENCED - Trevor Milton, founder of electric-truck company Nikola, was sentenced to a modest four-year vacation in prison for defrauding investors, demonstrating that rolling trucks downhill can indeed lead to a steep personal descent. Despite his claims of Nikola's groundbreaking technology, which turned out to be as real as a unicorn-powered spaceship, Milton must also pay a $1 million fine and forfeit a Utah property. The judge, not buying Milton's "optimistic" defense, ensured that Milton’s next big project involves crafting license plates rather than zero-emission trucks. [WSJ has more on this]

ISRAEL/HAMAS CONFLICT THREATENING SUEZ CANAL - Yesterday I wrote about how the world’s second biggest shipping company, Maersk, was redirecting ships away from the Suez region after Hamas-supporting Houthi rebels reported attacks on their vessels. Well, today the U.S. has launched Operation Prosperity Guardian, a multinational naval force including the U.K., Bahrain, France, Norway, and others, to protect merchant vessels in the Red Sea from further Houthi attacks. Major companies like BP and top boxship owners are diverting ships from the region, leading to increased oil prices and insurance rates.

A-ROD’s SPAC CLOSES SATELLITE DEAL - Alex Rodriguez, swapping baseballs for satellites, is merging his blank-check company Slam Corp. (so lame) with Lynk Global Inc., a firm set to revolutionize mobile connectivity with space. This $800 million deal promises to bring satellite service to everyone from farmers in the Dominican Republic to 5G enthusiasts, because apparently, regular cell towers are just too mainstream. And you thought all those SPACs were dead in the water.

Joke Of The Day

“A bank is a place that will lend you money if you can prove that you don’t need it.”

Hot Headlines

Yahoo | Goldman Sachs boosts 2024 S&P 500 target on increased confidence for Fed rate cuts in March. Sees the index hitting 5,100, a +7.6% move from here.

Bloomberg | Pentagon warns Ukraine military aid fund to run out Dec. 30. The Defense Department is spending its last $1.07 billion to buy new weapons and equipment that will replace those drawn down from stockpiles and sent to Ukraine

CNBC | Adobe and Figma call off $20 billion acquisition after regulatory scrutiny. Adobe still on the hook for the $1 billion break-fee for the cloud-based design tool company. Ouchy.

CNN | Goldman Sachs lowers its 2024 oil price forecast by 12% due to bumper US output. Targeting an average of $81 a barrel in 2024, down from its previous estimate of $92 a barrel.

Engadget | EU takes action against X over illegal content and disinformation.

Trivia

This week’s trivia is on ‘first year economics’.

The 'Laffer Curve' is a concept in:

A) Environmental economics

B) Taxation and revenue

C) International trade

D) Labor economicsIn behavioral economics, the 'Endowment Effect' refers to:

A) The increase in value of an asset over time

B) People’s tendency to value something more highly simply because they own it

C) The effect of inheritance on spending habits

D) The impact of gifts on economic behavior'The Tragedy of the Commons' refers to:

A) The overuse of a public resource leading to its depletion

B) The downfall of shared community spaces

C) A Shakespearean play about economics

D) The failure of communal farming systems

(answers at bottom)

Market Movers

Winners!

United States Steel (X) [+25.9%]: To be acquired by Japan's Nippon Steel in a $14.9B all-cash deal at $55.00 per share, a 40% premium. The deal is expected to close in Q2 or Q3 of 2024.

Cleveland-Cliffs (CLF) [+10.1%]: Some pop from peer US Steel's acquisition announcement, and also plans to reallocate capital for more aggressive share buybacks.

PGT Innovations (PGTI) [+9.6%]: Agreed to be acquired by window and door maker, Masonite, in a cash-and-stock deal valued at around $3B. The $41/sh offer is a ~14% premium, with Masonite anticipating ~$100M annual synergies post-deal.

NIO Inc (NIO) [+5.1%]: Secured a $2.2B investment from Abu Dhabi’s CYVN Holdings, gaining a ~20% stake in the company.

Losers!

Structure Therapeutics (GPCR) [-40.8%]: Announced its obesity drug's data results didn't meet investors' and the company's expectations, falling short of the efficacy seen in competitor weight-loss and diabetes drugs.

SunPower (SPWR) [-31.7%]: Filed its delayed Q3 10-Q, including a going concern notice questioning the company's ability to continue operations.

Masonite International (DOOR) [-16.6%]: Let’s just say the market didn’t like their PGT acquisition (above).

VF Corp (VFC) [-7.2%]: Disclosed a "cyber incident" on December 13 in an 8-K filing, which is expected to significantly impact business operations.

Market Update

Trivia Answers

B) The Laffer Curve relates to taxation and revenue.

B) The ‘Endowment Effect’ relates to people’s tendency to value something more highly simply because they own it.

A) The overuse of a public resource leading to its depletion is the main idea behind the ‘Tragedy of the Commons’.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.