UnitedHealth & The Numbers Behind The Health Insurers

Plus: How to get fired as a CEO

“Man looks in the abyss, there's nothing staring back at him. At that moment, man finds his character. And that is what keeps him out of the abyss.”

- Lou Mannheim (Wall Street)

“If you need a friend, get a dog.”

- Gordon Gekko (Wall Street)

Street Stories

Bad Health Insurers

This isn’t really the forum to weigh-in on the morality of murder (it’s bad) but last week’s murder of Brian Thompson, CEO of UnitedHealthcare - the insurance arm of $500 billion UnitedHealth - has obviously sparked renewed outrage at the state of US health insurance, and the healthcare system more broadly.

Since the events of December 4th, the leading players in the health insurance oligopoly have seen their shares drop by an average of 7.8%.

Unlikely the result of investors updating their models to account for increased outlays for bodyguards, this is primarily due the expectation of increased oversight and scrutiny in a sector as close to regulatory capture as the military industrial complex.

I’m a capitalist first and foremost, but there is a good argument to be made that a sector of health care that doesn’t develop medicines or operate hospitals probably shouldn’t be worth nearly a trillion dollars in an efficient market.

For context, in the rest of the developed world this isn’t even an industry.

Of nearly equal concern to the size of the industry, is just how fast it continues to grow.

Looking just at UnitedHealth specifically, their revenue topped $372 billion last year - up a whopping 295% since 2010 (ie: a wee bit faster than wages have grown), and isn’t expected to slow.

For additional context, only around 55% of this revenue and 51% of their Operating Profit falls under the UnitedHealthcare division - their insurance arm, while the rest is attributable to Optum, which has a host of health care services, such as billing and IT solutions, but is primarily known for being one of the world’s largest Pharmacy Benefit Managers.

For those unfamiliar, a Pharmacy Benefit Manager - or PBM - is a company that manages prescription drug benefits on behalf of health insurers, employers, and government programs. PBMs serve as intermediaries between insurers, pharmacies, and drug manufacturers, with the alleged goal of controlling costs and improving drug accessibility.

Obviously a business that makes a profit by acting as an intermediary between pharmaceutical companies and patients can be a murky area (in most of the developed world there is usually only one PBM, and it’s the Federal Government).

What makes this even more murky is that historically these were independent companies until a round of consolidating M&A pushed them into the hands of the big insurers. As of 2023, the three largest PBMs - CVS Health's Caremark, Cigna's Express Scripts, and UnitedHealth Group's OptumRx - collectively manage approximately 79% of U.S. prescription drug claims.

As for those wondering about the insurers, they’ve experienced an equally massive consolidation that has effectively left America with an oligopoly running its health care system.

UnitedHealth hasn’t shied away from M&A, and has been one of the more aggressive acquirors across the various subindustries.

All of this of course has likely played a major role in the massive increase in health care costs experienced by the average American, which are up by an inflation adjusted 268% since 1980.

Since consolidation hasn’t had the impact that it promised to regulators - the expansion of coverage and a reduction in the cost of care - at some point Americans won’t be able to afford to ignore it any longer.

How CEOs Get Fired

There are lots of ways a CEO can get fired.

Norfolk Southern’s CEO Alan Shaw (inappropriate relationship with a subordinate) and Olympus’ CEO Stefan Kaufmann (buying drugs) found this out a few weeks back.

But then there’s the more traditional way, which the former team captains of Intel and Stellantis (the old Fiat Chrysler) experienced earlier this month: A tanking share price and evaporating sales.

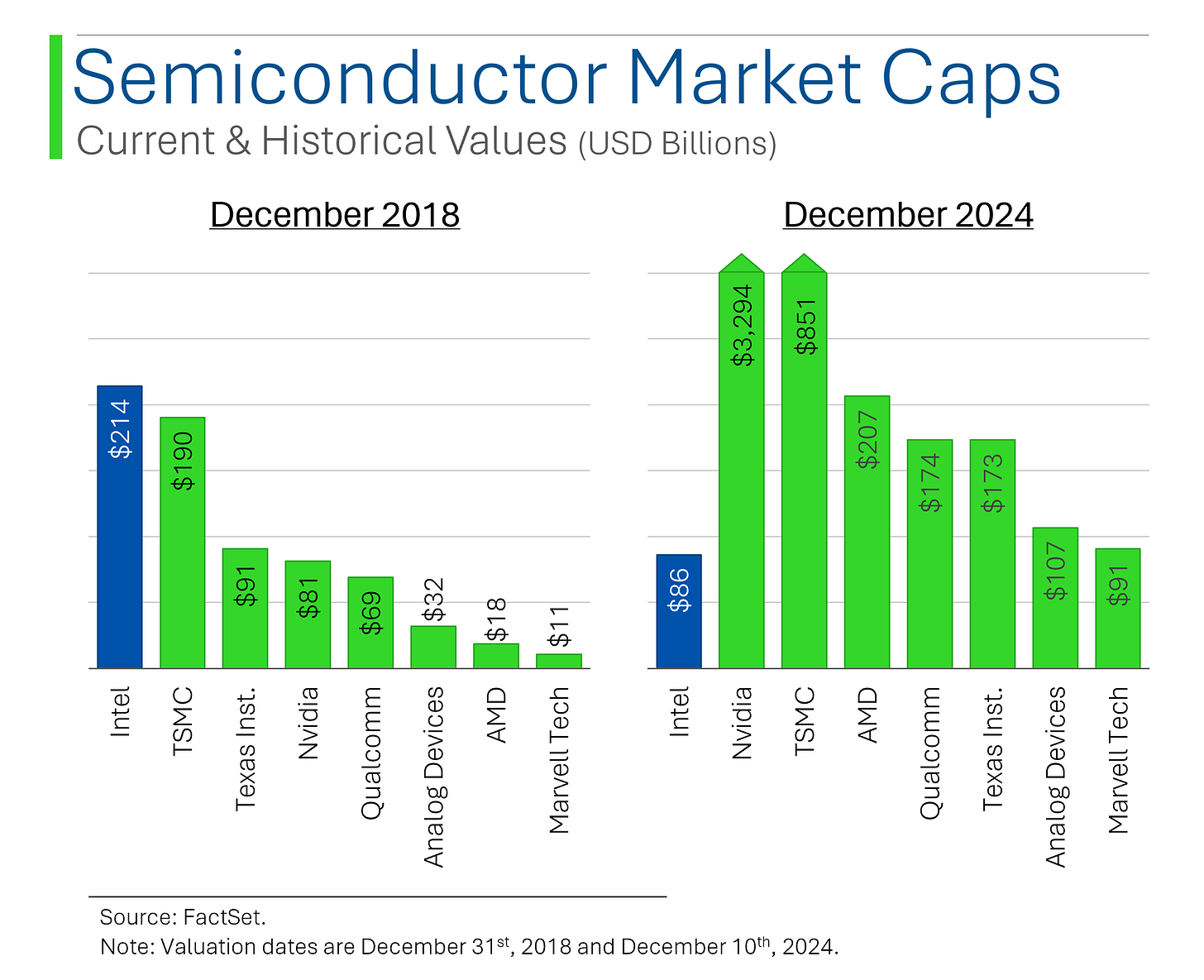

For Intel CEO Pat Gelsinger the ride lasted less than four years at the helm.

During which he oversaw a halving of Intel’s share price during a time when its peers have been rocket ships.

Tapped to return the arthritic former chip hegemon to past glory, Pat’s plan was for leadership in the GPU space and competition with TSMC in the outsourced manufacturing ‘Fab’ space.

While some impressive progress was made - Intel’s latest Arch outperforms Nvidia’s RTX GPU by most metrics - the transition’s been too slow, too expensive and lacking in consumer enthusiasm.

I mean, there’s no point in owning a Fab if no one wants you to build their chips. 🤦♂️

As Intel’s Board grew increasingly disappointed with the progress, Pat Gelsinger graciously fell on his sword, such that Intel may be reinvigorated by new blood and a new vision.

Class act.

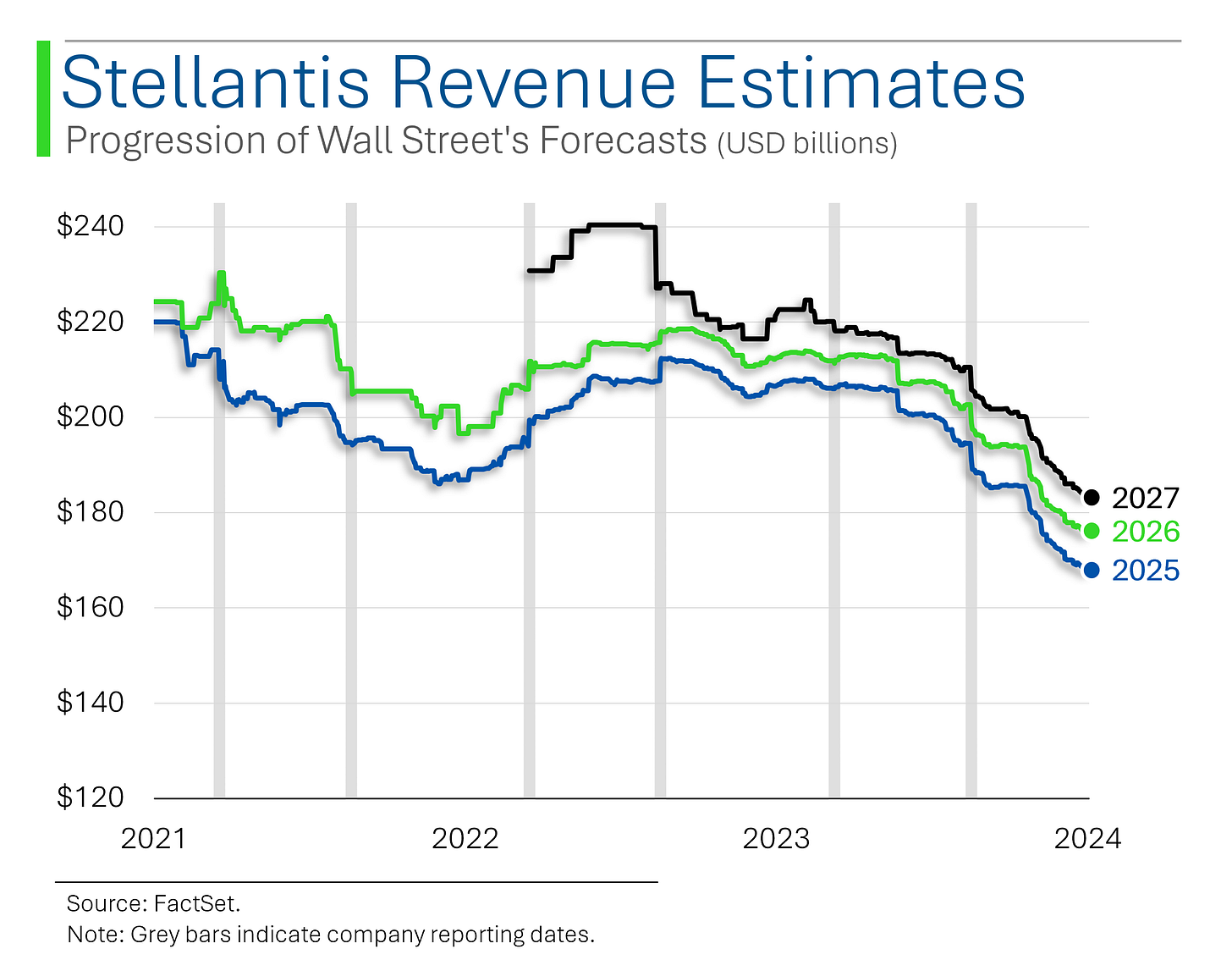

As for Carlos Tavares at Stellantis, his reign started well enough, with Frankenstein automaker (they own like 14 brands from Maserati to Dodge) matching the S&P 500 for most of his tenure.

But two months out from a profit warning and with sales forecasts collapsing, he had to have known that it was time to lean on that expense account because his days were numbered.

And while the S&P 500 may have been on a tear the last few years, there’s no shortage of companies out there that have drastically underperformed - and whose CEOs have to be wondering when their time will come.

At least they can take solace that when their time comes, they couldn’t possibly have screwed up as bad as this guy - destroying his whole company in the process.

[Link to the famous Ratner speech]

Joke Of The Day

The adjective for metal is metallic, but not so for iron, which is ironic.

Macro Update

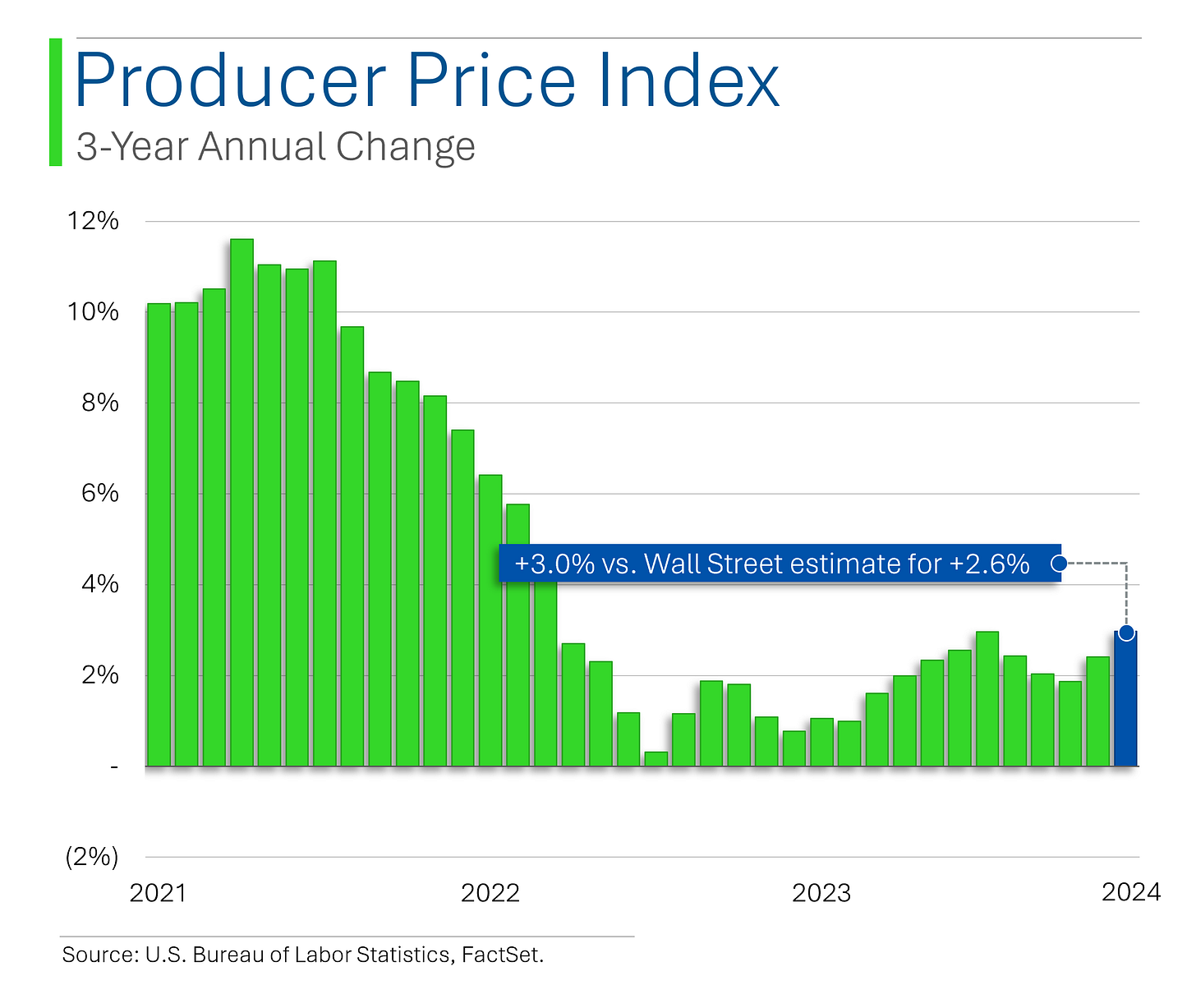

Producer Price Index (Thursday)

November headline PPI rose 0.4% m/m, above the 0.3% consensus, with October's reading revised up to 0.3% from 0.2%.

Annualized PPI came in at 3.0% (vs 2.6% consensus), the highest since February 2023, while core PPI rose 3.4% (vs 3.2% expected).

Initial jobless claims increased to 242K (vs 220K expected), while continuing claims were slightly below forecasts at 1.886M.

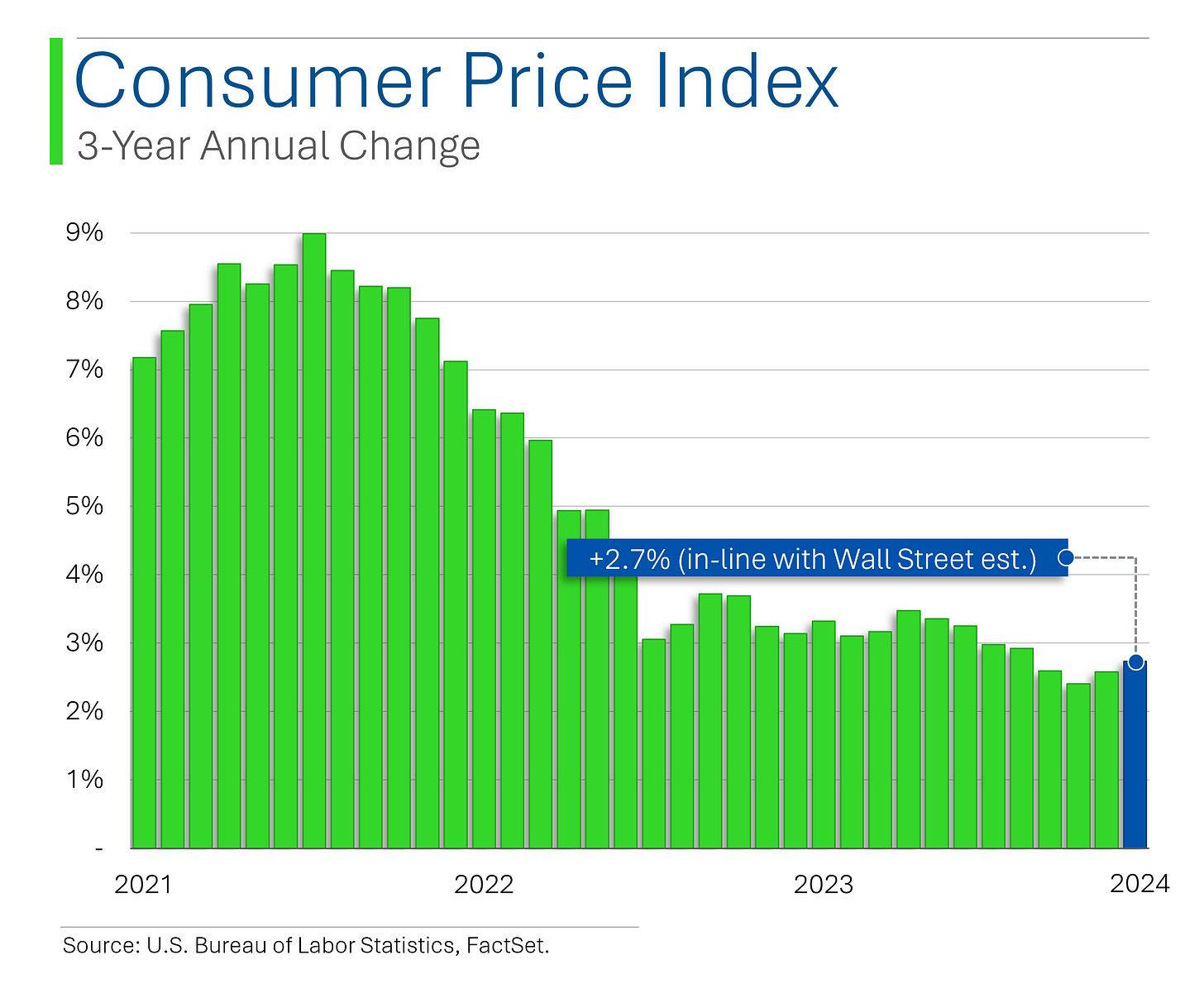

CPI Inflation (Wednesday)

November core CPI increased 0.3% m/m, matching expectations and marking the fourth consecutive month at that level. Annualized core inflation came in at 3.3%, in line with forecasts and the prior reading.

Headline CPI rose 0.3% m/m, with annualized headline inflation at 2.7%, also meeting expectations.

Shelter inflation moderated slightly, with rent and owners’ equivalent rent rising just 0.2% m/m. Food prices accelerated (+0.4%), used vehicle prices climbed (+2.0%), and airfares eased (+0.4%) after October’s sharp increase.

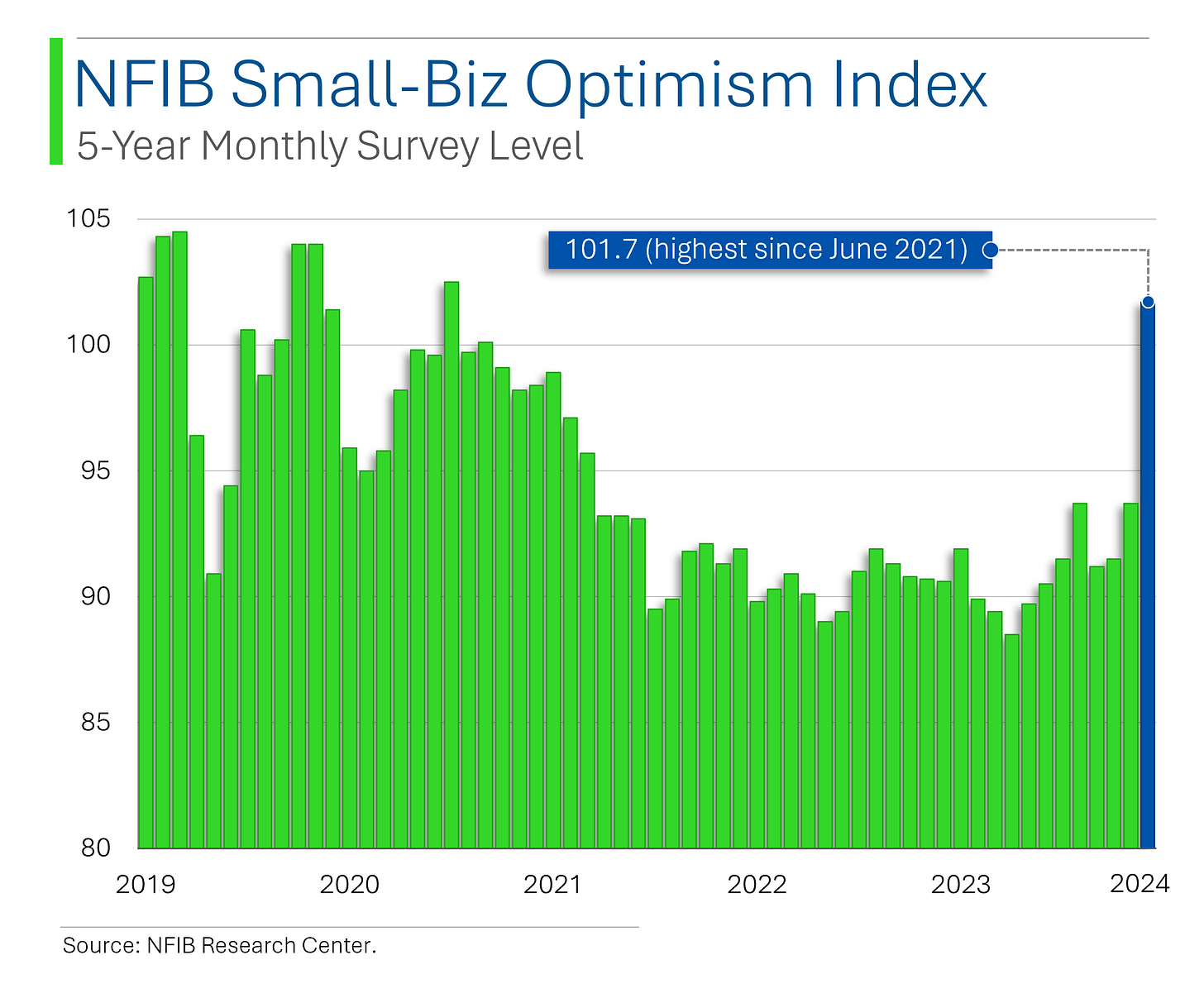

NFIB Small-Business Optimism Index (Tuesday)

NFIB small business optimism index jumped 8 points to 101.7, the highest since June 2021, snapping a 34-month streak of record-high uncertainty. Nine of the ten index components improved, driven by expectations for favorable tax and regulation policies.

The boost aligns with market optimism tied to the GOP’s election win and reduced policy uncertainty.

Trivia

Today’s trivia is on the US healthcare system.

Which U.S. president signed Medicare into law in 1965?

A. Richard Nixon

B. Lyndon B. Johnson

C. John F. Kennedy

D. Gerald FordWhat is the estimated total annual U.S. health care spending in 2024?

A. $1 trillion

B. $2.5 trillion

C. $4.3 trillion

D. $6 trillionWhat percent of the U.S. GDP does health care spending account for?

A. 10%

B. 15%

C. 18%

D. 25%What percentage of Americans receive health insurance through their employer?

A. 31%

B. 42%

C. 49%

D. 68%How many Americans are currently enrolled in Medicare?

A. 40 million

B. 65 million

C. 75 million

D. 85 million

(answers at bottom)

Market Update

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B. Lyndon B. Johnson signed Medicare into action in 1965.

C. $4.3 trillion is what America will spend on health care in 2024.

C. Health care accounts for 18% of US GDP.

C. 49% of Americans get health insurance through their employer.

B. 65 million Americans are enrolled in Medicare.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

When evaluating the profit of United health group, you need to separate the profits of UnitedHealthcare, and Optum. Optum is where all of you United health group’s Profit is. UnitedhealthCare subject to the ACA medical loss ratio requirements. Their profit is limited. So by overpaying for prescriptions from OptumRx, or for medical services from Optum, or by overpaying doctors that they own through Optum, they increase UHG’s profits overall, manipulating and bypassing the ACA medical loss ratio requirements.