🔬TSMC Is Important to Chips (Which Are Important), Chinese Stocks Suck, and Much More

"What the wise do in the beginning, fools do in the end"

- Warren Buffett

“If you can't make it good, at least make it look good”

- Bill Gates

The big US markets had a modest up day (S&P 500 +0.22%, Nasdaq +0.32%) following the strong rally Friday.

8 of 11 sectors closed in the win column, with Industrials (+0.7%) and Real Estate (+0.4%) at the head, and Consumer Discretionary and Utilities (both -0.5%) at the tail.

Oil was +2% while Bitcoin was down -2.9%, continuing the rough trend since their ETFs were approved two weeks ago (down 15.3% since then).

Spirit Airlines was up +19.2% after it said it filed an appeal with JetBlue to try and unblock their proposed merger. While food and agriculture giant Archer-Daniels-Midland was down 24.4% on alleged fraud (more below).

Street Stories

TSMC & Tech

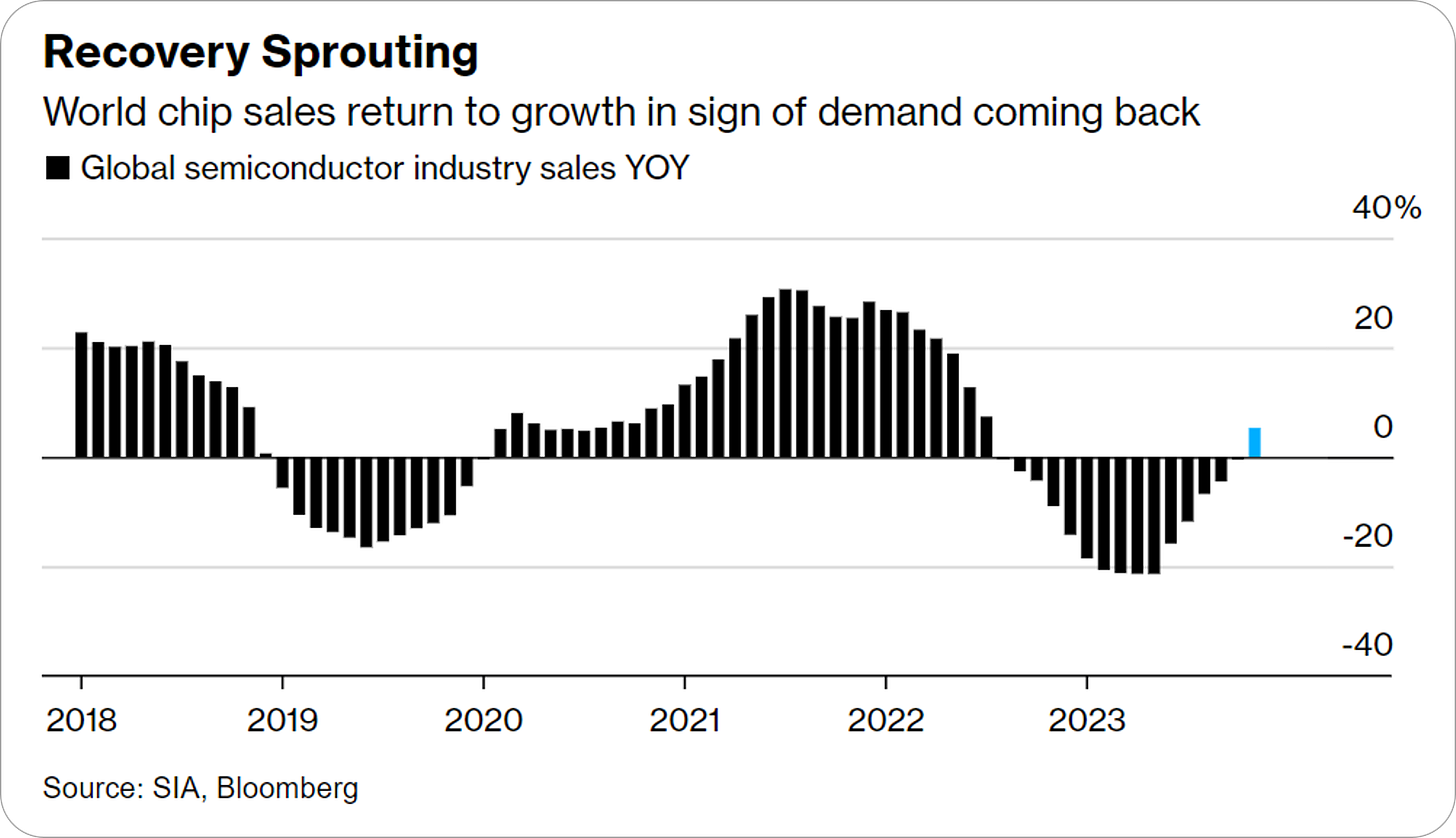

When semiconductor heavyweight Taiwan Semiconductor (TSMC) reported last Thursday, the stock popped +9.8%. Good for them, but the ripple effect across tech was even more pronounced. As a bit of background, chip sales growth started turning negative in the back half of 2022 as demand cooled amidst worries of a global slowdown and oversupply took hold. Most recently, however, the global market for chips has began to turn positive, and TSMC compounded the good news.

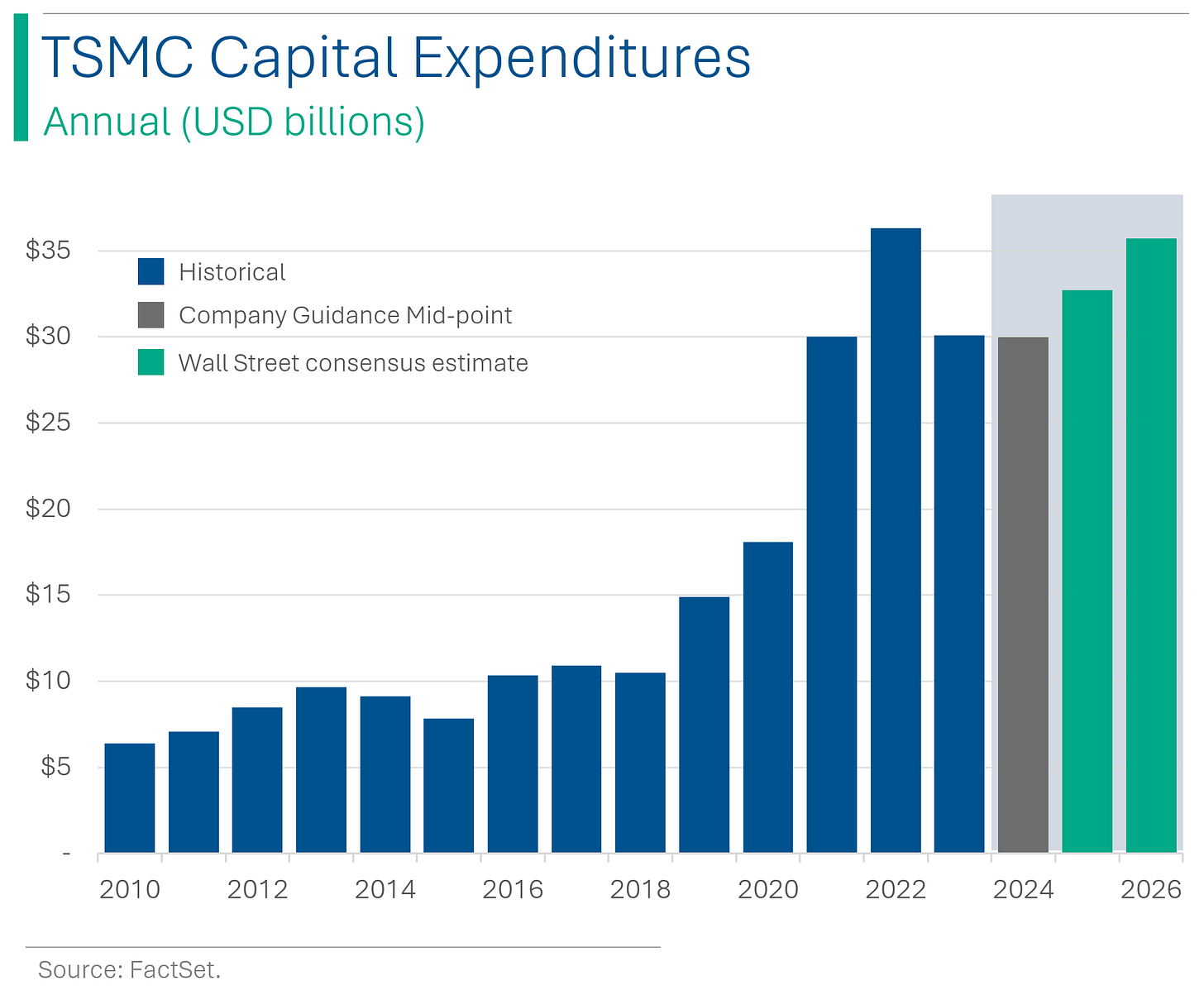

TSMC’s Q4 release highlighted not just their return to revenue growth, but also through their capital expenditure guidance (for new and upgraded manufacturing fabrication foundries) and earnings call, they indicated that the outlook for chips is strong. Guiding towards between $28 and $32 billion in capital expenditures this year (which is staggering) isn’t a decision come to lightly, and is the result of contract manufacturing arrangements (formalized or expected) to where the demand cycle is pointed. And it appears to be pointed up and to the right.

What is TSMC? For those unfamiliar, TSMC is the world’s largest microchip fabrication company in the world; an industry it effectively started when it was founded back in 1987. Following the recent AI boom, GPU company Nvidia was the stock market hero in 2023. But they don’t actually produce any chips. Those are made at TSMC under contract from Nvidia using their designs.

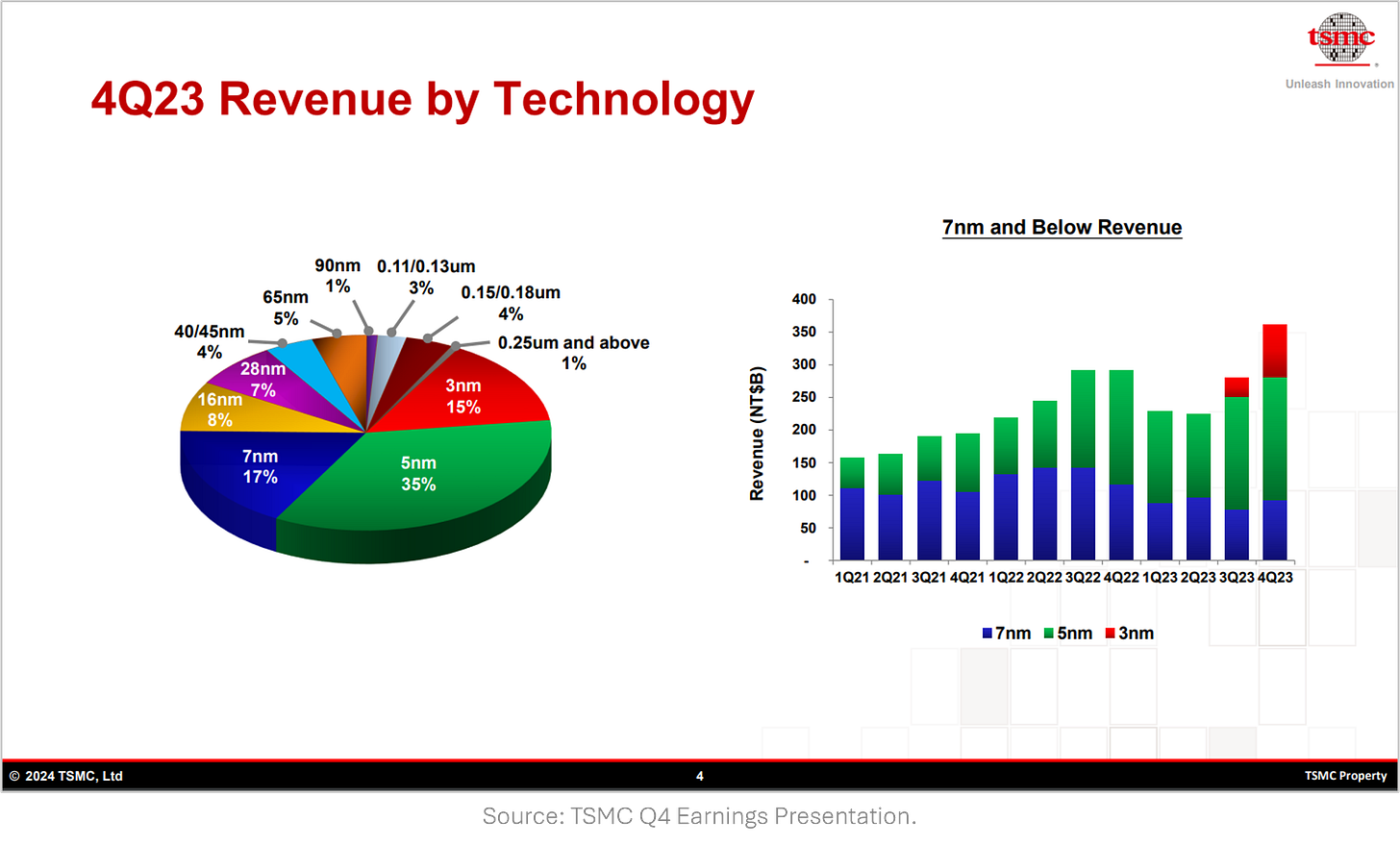

As of Q2 2023, TSMC had a 56% market share in third party manufacturing - the next biggest is Samsung at 12% - and closer to 90% share of the most advanced chips. For example, only TSMC, Samsung and Intel have the manufacturing capacity to produce 3 nanometer chips (ie: 3 billionth of a meter node), with 2 nanomater technology launching in 2024. Given that they effectively represent the future demand cycle for next-generation computing (AI for data centers is the big growth engine at the moment), they are an extremely important bellwether for the state of the hardware side of the tech world.

The market response to TSMC’s news has been jubilant, reinvigorating a sector that seems to have vacillated between hype and concern over the last month. Besides, who doesn’t love chips?

The Great Wall of Worry: China's Stock Slide Saga

Chinese stocks are plunging to their lowest since the pre-pandemic era, but foreign investors seem to be too busy adjusting their monocles to notice the 'bargains'. Beijing's lukewarm stimulus efforts are as inspiring as decaf coffee, leaving the economic recovery moving at the pace of a lazy Sunday stroll. Meanwhile, geopolitical drama and the U.S. election antics are making investors more nervous than a long-tailed cat in a room full of rocking chairs, leading to a grand exodus of foreign capital away from risky international bets, including China - a real vote of confidence, indeed.

Economic Rollercoaster: Up, Down, and Sideways in Market Land

In contrast to the strong recent economic data coming out of the US, The Conference Board's Leading Economic Index (LEI) in the U.S. decreased by 0.1% in December, reflecting a slower but ongoing economic downturn. In the last six months, the LEI shrank by 2.9%, showing a slight improvement from the previous period's 4.3% drop. Despite some positive indicators, challenges in manufacturing, high interest rates, and low consumer confidence continue. The trend hints at a looming recession, with expected negative GDP growth in Q2 and Q3 of 2024, though a recovery is anticipated later in the year. What do economists know anyways?

Accounting maleficence is a dish best served cool

Archer-Daniels-Midland Co. (ADM), the giant food and agricultural trading company, has placed its CFO Vikram Luthar on administrative leave and is facing an SEC investigation into its sketchy accounting practices, particularly in its nutrition reporting segment. The company's shares reportedly dropped the most in 50 years and erased about $8.8 billion in market value. ADM is revising its financial outlook and delaying its earnings report, amidst historical legal issues and ongoing challenges in its nutrition business, including a lawsuit over alleged price manipulation in ethanol trading. Imagine going to jail for illegally propping-up a nutritional ingredients business? At least do something cool*.

*MarketLab does not condone fraud. Especially uncool fraud.

Joke Of The Day

I have a joke about trickle-down economics, but most people won’t get it.

Hot Headlines

CNBC | Initial demand for Apple’s Vision Pro headset could wane, top analyst cautions. The virtual reality headsets sold out shortly after pre-orders opened up on Friday, and Morgan Stanley estimates they could sell between 300k and 400k this year. At $3,499 each, who exactly is gunna buy these?

CNBC | U.S. oil giant Exxon Mobil sues activist investors to prevent climate proposals from being displayed at annual shareholder meeting. Can’t you just, like, not display them?

Fortune | Nvidia CEO made trip to China in effort to navigate chip controls. Ie: illegally evade US sanctions. Classy.

Deadline | Sony walks away from $10bn merger with Zee Entertainment in India. Follows after two years struggling to get regulatory approval.

Kotaku | YouTube superstar MrBeast is closing in on historic $100m deal for first streaming TV show on Amazon Prime. Jimmy Donaldson aka MrBeast has 233 million subscribers. That’s like a million times more than me. 😅

If you’ve never heard of him, he’s this dude…

Trivia

This week’s trivia is on big steps in technology.

Which corporation was the first to produce a successful digital camera?

A. Canon

B. Kodak

C. Nikon

D. SonyWhich company was the first to develop a commercially viable hybrid electric vehicle?

A. Ford

B. Toyota

C. Honda

D. NissanWho created the first video game console?

A. Sony

B. Magnavox

C. Nintendo

D. Atari

(answers at bottom)

Market Movers

Winners!

Spirit Airlines (SAVE) [+19.2%]: Filed a joint appeal with JetBlue following a blocked merger on antitrust grounds.

NuStar Energy (NS) [+18.4%]: To be acquired by Sunoco in a $7.3B deal, representing a 24% premium, expected to close in Q2 of 2024.

SentinelOne (S) [+5.9%]: Upgraded to buy at BTIG, with increased market share expectations and new product tailwinds in cloud security and AI.

Archer Aviation (ACHR) [+4.7%]: Announced a NASA collaboration focusing on high-performance battery cells and safety testing for Advanced Air Mobility.

Losers!

Archer-Daniels-Midland (ADM) [-24.4%]: CFO Vikram Luthar on administrative leave amid Nutrition segment probe into accounting irregularities, and chopped adjusted EPS guidance to $6.90 versus $7.29 consensus.

Gilead Sciences (GILD) [-10.2%]: Phase 3 clinical trial EVOKE-01 for lung cancer study failed to meet primary endpoint.

EchoStar (SATS) [-5.3%]: Open letter from investment firm Buxton Hemsley to directors claims pre-merger financial misstatements at DISH Network. More fraud?

Market Update

Trivia Answers

B. Kodak invented the first digital camera in 1975 but failed to commercialize it as it would compete with its film business. Great example of the ‘innovator’s dilemma’.

B. Toyota. While not the first hybrid, the Prius was the first commercially success one.

B. Magnavox Odyssey was launched in 1972. Atari’s arcade version of Pong was released the same year but the console one wasn’t released until 1975.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.