🔬TSMC Adds Fuel to Chip Sector Fire

Plus: Netflix reports good quarter/bad outlook; Home sales drop on high mortgage rates; 23andMe's CEO is trying to take the company private (now that it's basically free); and much more

"Wide diversification is only required when investors do not understand what they are doing."

- Warren Buffett

“I'm tired of hearing about money, money, money, money, money. I just want to play the game, drink Pepsi, wear Reebok.”

- Shaquille O'Neal

Modest down day for the big US markets and the sell-off continues S&P 500 -0.2% and Nasdaq -0.5%.

7 of 11 sectors closed in the red with Communication Services (+0.7%) and Utilities (+0.6%) the bestest. Tech (-0.9%) and Consumer Discretionary (-0.7%) the worstest.

Another busy day for semiconductor stocks as TSMC (-4.9%) reported it’s Q1 which failed to win hearts and minds, and taking the chip sector down with it (ex-Nvidia, which was up).

Israel launched an attack against Iran last night with mixed reports saying it was a drone strike and others that it was a missile attack.

Street Stories

TSMC Reports Q1

There was a lot of focus on TSMC’s Q1 yesterday following chip equipment maker ASML’s downbeat outlook for chip demand (bookings fell 61% from last quarter) on Wednesday. And it could have gone better.

The quarter itself was pretty stock, with modest beats on Revs and EPS:

EPS: NT$8.70 vs. Wall Street estimate of NT$8.31 [+4.7% BEAT]

Revenue: NT$592.6 billion vs. Wall Street estimate of NT$584.0 billion [+1.5% BEAT]

*NT$ is New Taiwanese Dollar.

What the Street didn’t like, nor the share price obviously, was the small nuance in their outlook which took their view on semiconductor market growth from ‘+10%’ to ‘10%’. Not sure that warrants a 4.9% drop in share price but the AI hype machine seems fickle at the moment.

From the earnings call:

“We lowered our forecast for the 2024 overall semiconductor market, excluding memory, to increase by approximately 10% year-over-year, while foundry industry growth is now forecast to be mid- to high-teens percent, both are coming off the steep inventory correction and/or base of 2023. Having said that, we continue to expect 2024 to be a healthy growth year for TSMC.”

Netflix Shows Strong Subscriber Growth

Netflix is down 4.8% in pre-market trading after reporting after close yesterday. The company posted a strong quarter with a modest beat of revs, and big beats on EPS and new subscriber additions.

The deets:

- EPS: $5.28 vs. Wall Street estimate of $4.52 [+16.9% BEAT]

- Revenue: $9.4 billion vs. Wall Street estimate of $9.3 billion [+1.4% BEAT]

- Global Streaming Paid Net Adds: 9.33 million vs. Est. 4.59 million [+103% BEAT]

However, just like TSMC, the company got dinged by investors over its guidance. Specifically, the company updated its full year 2024 revenue outlook from ‘healthy double digit revenue growth’ to 13-15%. Ok, not great, but sure. They also said they expect second-quarter revenues of $9.49 billion vs. the Street’s $9.52 billion estimate. Also not great, but ok.

Weirdly, though, they also said they will stop publishing quarterly subscriber and average revenue per subscriber data starting Q1 2025. Management says that with the evolving business model (tier pricing, ads) this info is less relevant but I think they’re just trying to hide it (or sick of the shares getting smoked when growth cools).

Can’t make everyone happy, but since the shares are up 258% from June 2022, you gotta produce.

Small aside, but given the strong subscriber growth was the big positive, I thought I would mention that back in 2022, Netflix’s stock collapsed from ~$680 down to a low in the $170s after posting flat subscriber growth. Back then it seemed like Netflix had reached market saturation but that clearly didn’t last.

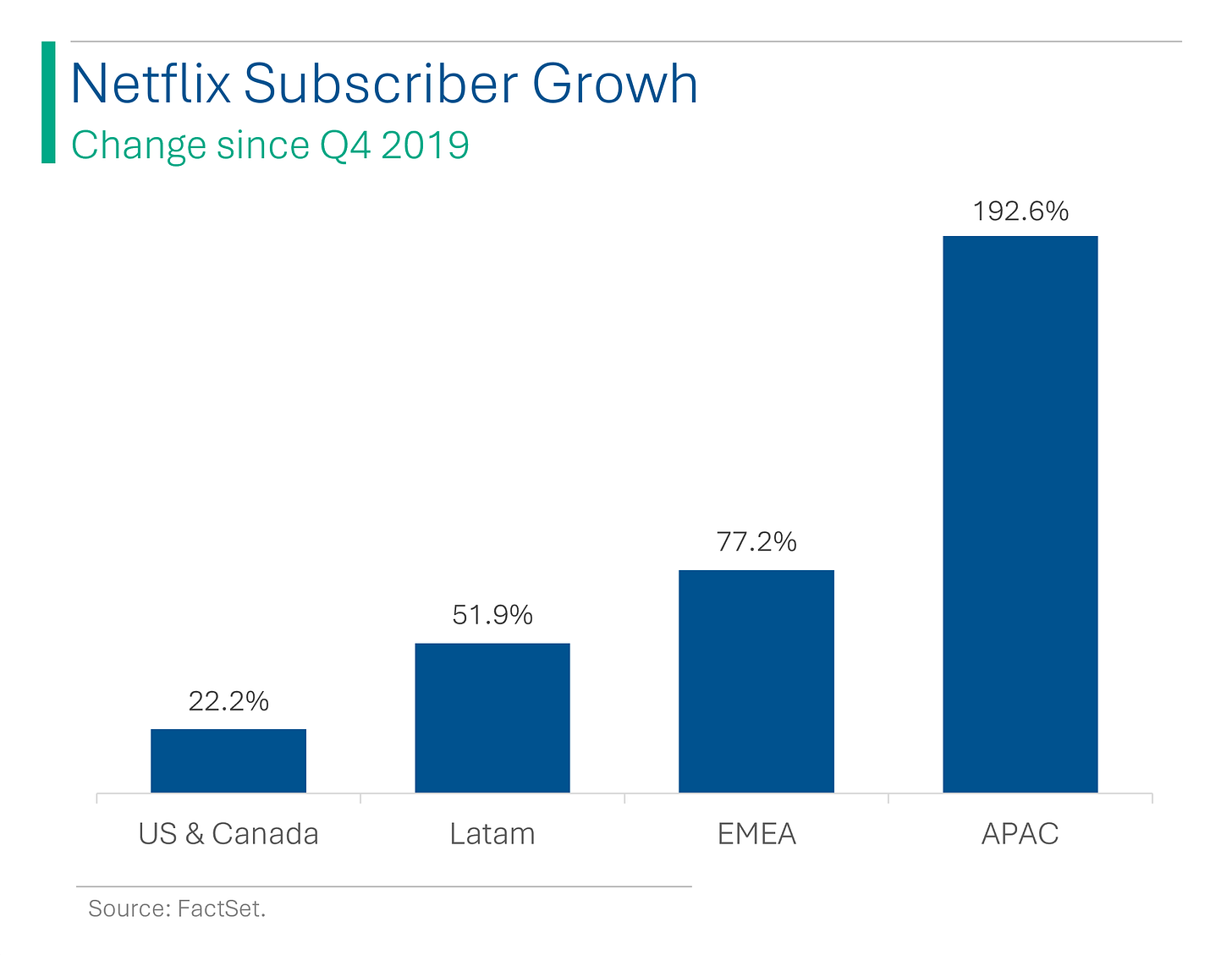

What is a bit of a point of contention for me is the fact that most of this growth has been from outside of the US, which is much less profitable. For example, average revenue per user (ARPU) in the US & Canada division was $17.30 last quarter. In APAC, this figure was only $7.35.

But given that Netflix is now in 82 million households in the US and Canada out of a total of 142 million (58%), there ain’t too much room left to grow.

Home Sales

Existing home sales for March came in at 4.19 million, slightly ahead of consensus for 4.16 million but down 4.3% from February. Mortgage rates ticking back up is considered the main culprit for the decline.

Additionally, the median price was up for the ninth-straight month on an annual basis despite the fact that inventories (ie: people trying to sell) have increased considerably; up +4.7% since February and +14.4% since last March. Guess those sellers don’t want to sell that badly...

23andMe Set To Go Private

CEO Anne Wojcicki plans to take 23andMe private after the company announced she is working with advisors and exploring financing options. She holds 49.99% of voting power so she can at least block anything else happening that she doesn’t want.

Following the announcement, 23andMe's stock price surged 40% to $0.50 per share from a record low of $0.36.

40%!? That’s a big pop…until you see the below.

Joke Of The Day

My IQ test results came back. They were negative.

Hot Headlines

Yahoo Finance / Trump Media stock jumps 26% for a second big day of gains as company goes to battle with short sellers. On Wednesday the company posted instructions for investors on how they can prevent their shares for being loaned out for a short-interest position. Short interest in the stock is ~13% versus a typical a 3-4% for the average company (according to Yahoo).

Nikkei Asia / Boeing aims to bring flying cars to Asia by 2030. The company is developing electric vertical take-off and landing (eVTOL) craft at subsidiary Wisk Aero. The aircraft will adopt autonomous technology, rare among eVTOL craft. With their recent safety track record I don’t think I’ll be signing up as an early adopter...

Yahoo Finance / IMF revises down Mideast growth outlook on war, trade disruptions. The agency said that the war in Gaza, attacks on Red Sea shipping and lower oil output add to existing challenges of high debt and borrowing costs.

The Verge / Meta announces new Llama 3 AI will be integrated into a number of the companies software and hardware offerings. In other news, Zuck changed the company’s motto from ‘move fast and break things’ to ‘move fast and create Skynet’.

Yahoo Finance / L'Oreal sales rise 9.4% as mass market makeup outshines luxury. The Maybelline and Lancome owner, which is the world’s biggest cosmetics maker, showed strong growth while luxury company LVMH reported slowing growth Tuesday. Concealer is the new Campbell’s soup.

Trivia

Today’s trivia is on the father of value investing, Benjamin Graham.

Benjamin Graham wrote a famous book on investing, which is this?

A) The Wealth of Nations

B) The Intelligent Investor

C) Security Analysis

D) Common Stocks and Uncommon ProfitsWhich future billionaire was a student of Benjamin Graham at Columbia University?

A) Bill Gates

B) Stan Druckenmiller

C) Warren Buffett

D) George SorosWhich of the following concepts is NOT associated with Benjamin Graham’s investment philosophy?

A) Margin of Safety

B) Efficient Market Hypothesis

C) Mr. Market

D) DiversificationGraham was a pioneer of a particular type of analysis for evaluating stocks. What is it called?

A) Fundamental analysis

B) Technical analysis

C) Sentiment analysis

D) Predictive analysis

(answers at bottom)

Market Movers

Winners!

Ally Financial (ALLY) [+6.7%] Beat Q1 EPS and net revenue expectations with a record 3.8M consumer auto applications, generating $9.8B in originations. Profits dropped 56% for the quarter, and NIM slightly missed year-over-year comparisons.

Duolingo (DUOL) [+5.3%] Will be added to the S&P MidCap 400, signaling recognition of its growth and market value.

Losers!

Las Vegas Sands (LVS) [-8.7%] Q1 adjusted EBITDA and revenue outperformed with Marina Bay Sands contributing significantly, although Macau was weaker due to capital investment disruptions and market share losses, causing investor hesitancy; long-term optimism remains among analysts.

Equifax (EFX) [-8.5%] Q1 earnings surpassed expectations but revenue was slightly low; USIS was a relative highlight despite a sharp decline in mortgage credit inquiries, with misses noted in Workforce Solutions and International sectors; Q2 guidance was below expectations, though FY guidance remained unchanged.

Snap-On (SNA) [-7.7%] Q1 earnings exceeded forecasts but revenue was below expectations; Tools segment underperformed with weaker US sales and the Commercial/Industrial sector was below consensus due to a decline in power tools and weak APAC operations; reaffirmed FY capex guidance.

Taiwan Semiconductor (TSM) [-4.9%] Q1 EPS and revenue beat estimates, with Q2 revenue guidance exceeding expectations despite expected pressure on margins from higher electricity costs; cut FY24 semiconductor industry growth forecast to 10% year-over-year, with a decline expected in the auto segment; analysts remain positive on leading edge but cautious on trailing edge trends.

Tesla (TSLA) [-3.6%] Downgraded to hold from buy at Deutsche Bank due to a strategic shift away from the Model 2, with previous valuation based on a next-generation vehicle priced at $25K; the focus on robotaxi and full driverless autonomy poses additional operational challenges.

Market Update

Trivia Answers

B) Graham wrote The Intelligent Investor.

C) Warren Buffett was a student and mentee of Graham’s.

B) The Efficient Market Hypothesis isn’t something Graham is known for. That was Eugene Fama in 1970.

A) Graham literally wrote the book on Fundamental analysis.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Any reason to think 23andMe would pay a premium to buy up all the shares?