To Be, or Not To Be (a Bitcoin Hedgefund)

Plus: Sectors & Size: What's bad and what's worse.

"Only when the tide goes out do you discover who's been swimming naked.

- Warren Buffett

"You can't keep blaming yourself. Just blame yourself once and move on."

- Homer Simpson

Street Stories

Let’s pretend you’re a legacy brick-and-mortar retailer, and that most of the products you sell are available online for less. What do you do?

Tighten up your online presence? Check. Pivot towards new niches, like collectibles? Tried that too. Become a Bitcoin hedgefund? Whaaaaaa?!

Yep, GameStop is trying to pull a MicroStrategy and get into the crypto game. And reactions thus far have been… well, less than enthusiastic.

Shares of the beleaguered meme stock initially popped when the company released a presser claiming that its board approved the creation of a treasury fund to house the crypto it planned to buy.

However, when they announced a $1.3 billion convertible bond issuance two days later to start buying bitcoin in earnest, the market got cold feet - sending the shares down double digits.

Not exactly tiptoeing into this, eh?

For those a bit hazy on the rationale, they are basically trying to ‘pull a Microstrategy’ - the mediocre tech company led by crypto evangelist Michael Saylor that became a famous for issuing shares (or prefs or converts) to buy Bitcoin.

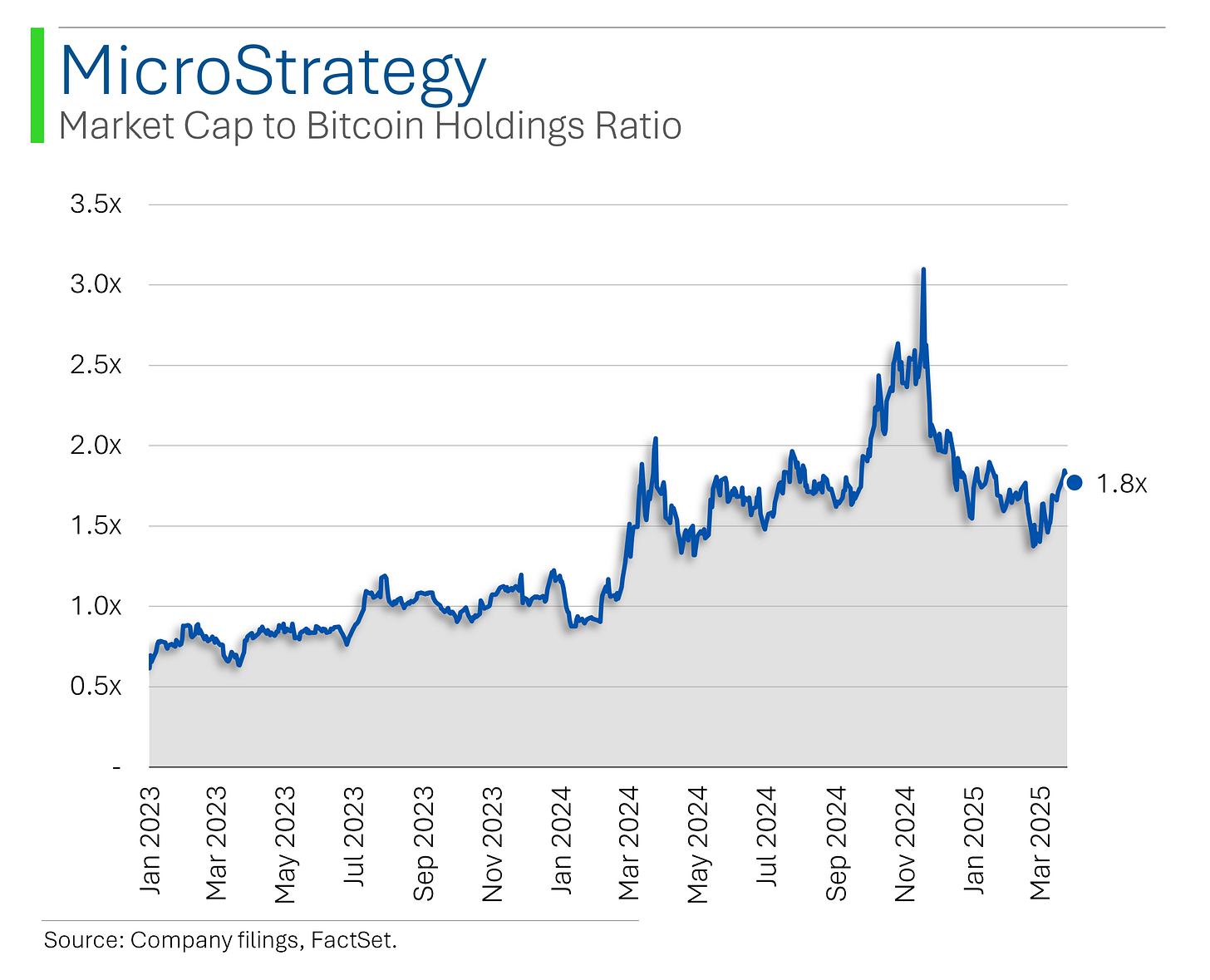

The secret sauce was that - for reasons that still remain mystifying - the company continues to trade at a massive premium to their Bitcoin holdings. In essence, they can issue shares; buy Bitcoin; and their stock goes up like some sort of perpetual money printer.

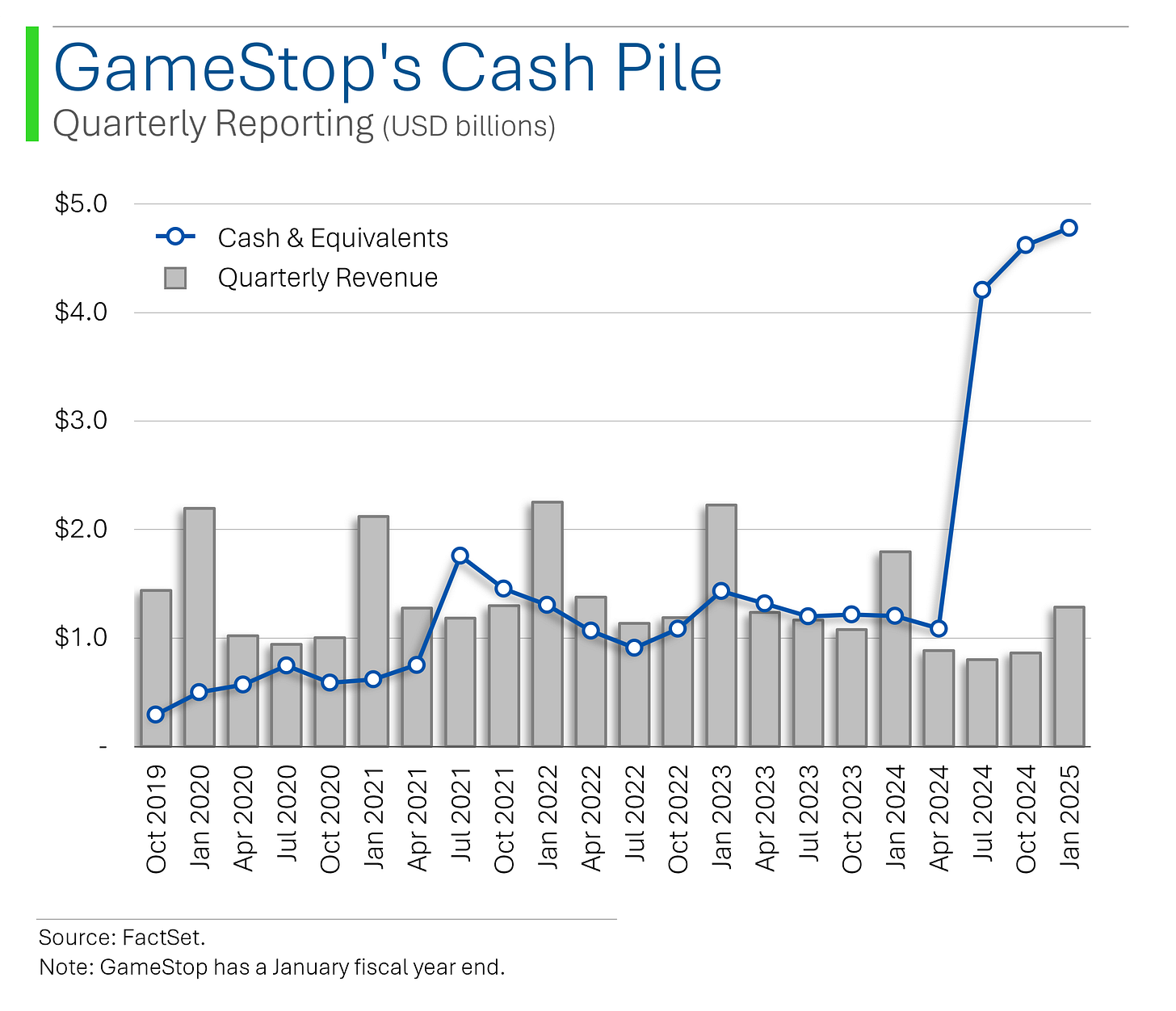

So, since GameStop has tried a whole whack of stuff but hasn’t yet been able to turn the business around (they closed 600 stores last year and Q4 revenue was down 28% year-over-year) they thought they’d give this a whirl.

They do have a bit of a problem though: They already trade at a ridiculous premium.

See, EPS for the fiscal year ending in January clocked in at $0.25 making the $22 share price something of a stiff P/E multiple.

However, the company has aggressively leveraged this premium valuation to issue shares and raise cash - dilution be damned!

So what happens if GameStop dumps all of its massive $4.8 billion cash pile into Bitcoin and we slap on a similar ‘Market Cap-to-Bitcoin Holdings Multiple’1 to MicroStrategy of 1.8x?

Well, that would imply that the share would go down 12.9%

1. I can’t believe I just typed that.

Anyway, this isn’t to say that this won’t work (I mean, assuming they can issue shares/converts at a premium, why wouldn’t it?). But if you want to be a ‘real’ business, there does need to be something beyond financial engineering.

If the only reason you are still in existence is a shareholder base willing to absorb dilution even after a dilution event in the belief that GameStop can regain its former glory, then turning yourself into a glorified Coinbase wallet is gambling (quite literally) with people’s hard earned capital.

And even the folks at r/wallstreetbets have their limits.

What’s Bad & What’s Worse

The market had another week to forget, with the S&P 500 down 1.5%.

Other than Energy - which has hung in there with solid oil prices kept up by Middle-East woes and a punchy OPEC vowing further supply cuts - things are playing out in fairly traditional fashion:

Defensive sectors, like Utilities, Health Care and Consumer Staples, are all in the green; aided by more reasonable valuations.

Cyclical sectors, like Industrials, Materials and Consumer Discretionary, have been getting beat up, as tariffs, trade wars and fears of a cooling economy have tempered some of the big winners in 2025.

The biggest pain has come from Tech, with the average company down 8.5% this year after the sector jumped +36% in 2024. Of the 69 Tech companies in the S&P, only 15 of them are up on the year.

Moreover, the bigger names in the S&P 500 have held in better than the smaller ones - which again is standard operating procedure.

Put into buckets (shown above), the biggest 100 companies have averaged positive returns this year (+0.6%), as have the next 100 biggest (+1.4%). The smallest 100 (bottom 20%), however, are down by an average of 6.5% so far this year.

And this trend is directionally consistent as we get into the world of Mid-Cap and Small-Cap stocks, with the S&P 400 (mid-cap) off 4.9% and the 600 (small-cap) even worse at -7.7% for the year.

So, while it may seem like unprecedented times, with defensives being defensive and small underperforming big, this is pretty much out of the textbook right now.

Joke Of The Day

Nothing is foolproof to a sufficiently talented fool.

Macro Update

Core PCE [Friday]

February core PCE rose 0.4% m/m (vs. 0.3% expected), bringing the annualized rate to 2.8% (vs. 2.7% consensus).

Headline PCE increased 0.3% m/m, matching expectations, with the annualized rate steady at 2.5%.

Personal spending rose 0.4% (vs. 0.3% expected), while income jumped 0.8% (vs. 0.4%), showing strong consumer momentum despite sticky inflation.

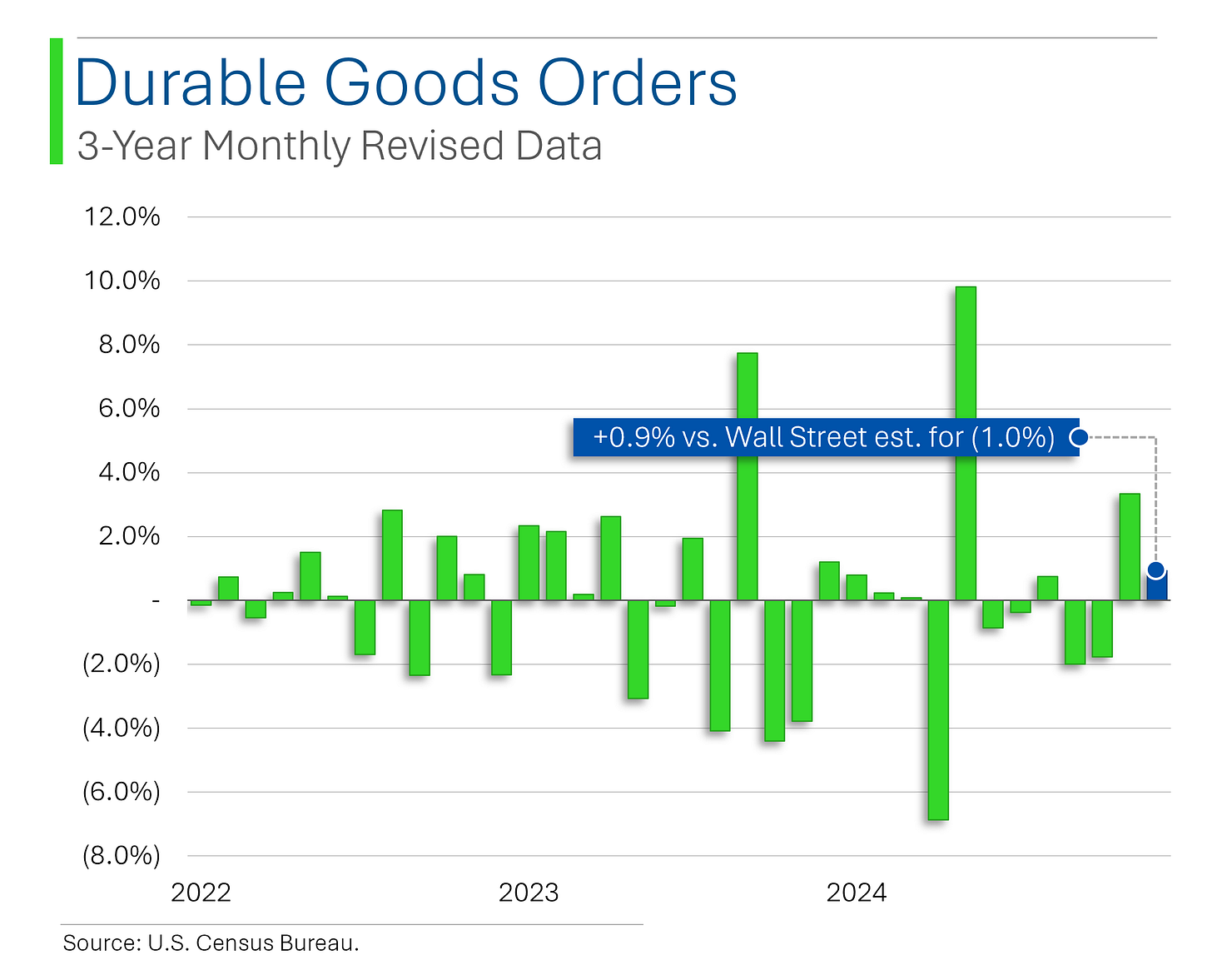

Durable Goods Orders [Wednesday]

Headline durable goods orders rose 0.9% m/m in February (vs. -1.0% expected), with January revised up to 3.3%.

Core capital goods shipments came in strong at +0.9%, suggesting resilient equipment demand.

Consumer Confidence [Tuesday]

March Consumer Confidence dropped to 92.9 (vs. 94.5 expected), its lowest since January 2021, with the Expectations Index hitting a 12-year low at 65.2.

Labor market perceptions held steady, but inflation and trade concerns weighed on sentiment.

New Home Sales [Tuesday]

February new home sales rose 1.8% to 676K (vs. 677.5K expected), continuing a modest upward trend.

PMIs [Monday]

March preliminary composite PMI came in at 53.5 (vs. 51.7 expected), with services rising to 54.3 (vs. 50.8) and manufacturing slipping to 49.8 (vs. 51.9).

Business activity was lifted by services, while manufacturing contracted amid slower new orders. Input costs surged at the fastest pace in nearly two years, especially in manufacturing.

Trivia

Today’s trivia is on Nike.

When was Nike, Inc. originally founded?

A) 1971

B) 1954

C) 1964

D) 1980What was Nike's original name?

A) Mountain Footwear

B) Blue Ribbon Sports

C) Victory Sports

D) Athlete's FootWhat was the initial payment for the creation of the Nike Swoosh logo?

A) $35,000

B) $35

C) $350

D) $3,500What were Nike’s sales in fiscal 2024?

A) $7.1 billion

B) $45.9 billion

C) $104.8 billion

D) $87.4 billion

(answers at bottom)

Market Update

Market Movers

Friday

Applovin (APP) [+4.1%] CEO Foroughi clapped back at the Muddy Waters short report, saying their ad models are improving and their data practices are no different from the big tech players.

Rocket Lab USA (RKLB) [+1.1%] Got a boost after joining the US Space Force Launch Program, opening the door to future national security contracts.

Wolfspeed (WOLF) [-51.9%] Cratered after reports it failed to reach a debt swap deal and could lose a key CHIPS Act grant, though it stuck to its Q3 outlook.

lululemon athletica (LULU) [-14.2%] Despite a solid Q4 beat, weak comps and a soft outlook spooked investors, especially with tariff pressure and cautious US shoppers in the mix.

Thursday

GameStop (GME) [-22.1%] Tanked after announcing a $1.3B convertible debt offering tied to buying Bitcoin.

Applovin (APP) [-20.1%] Slammed by a Muddy Waters short report claiming weak e-commerce conversions and questionable data collection practices.

Concentrix (CNXC) [+42.4%] Soared after crushing Q1 expectations and sounding upbeat on AI, market share, and cash flow.

General Motors (GM) [-7.4%] Slipped after Trump proposed a 25% tariff on all autos not made in the U.S.

Advanced Micro Devices (AMD) [-3.2%] Downgraded by Jefferies over lagging AI traction and rising pressure from Intel.

Wednesday

Grab Holdings (GRAB) [+5.3%] Rose on reports it’s eyeing a $2B loan to possibly acquire Indonesian rival GoTo.

Dollar Tree (DLTR) [+3.1%] Popped on a solid Q4 and news it’s selling Family Dollar for just over $1B, though tariffs remain a concern.

NVIDIA (NVDA) [-6%] Dropped after FT reported China’s energy rules could cost it $17B annually in chip sales.

Tuesday

Trump Media & Technology Group (DJT) [+8.9%] Gained after announcing a planned partnership with Crypto.com to launch ETFs under the Truth.Fi brand.

Mobileye Global (MBLY) [+8.7%] Jumped as Volkswagen picked it to help upgrade driver assistance tech in upcoming vehicles.

Carvana (CVNA) [+3.8%] Upgraded by Morgan Stanley, which called it a leader in auto retail with strong free cash flow and execution.

CrowdStrike (CRWD) [+3.3%] Got a boost from a BTIG upgrade, citing clearer skies after an earlier IT outage and potential reacceleration.

Lyft (LYFT) [+2.2%] Moved up after Engine Capital reportedly took a stake and is pushing for strategic changes.

United Parcel Service (UPS) [-5.1%] Weakened on a price target cut and softer Q1 outlook tied to tariff uncertainty and freight weakness.

Monday

Intuitive Machines (LUNR) [+30%] Surged despite weak Q4 results, as the company guided toward positive EBITDA by late 2025.

Fannie Mae (FNMA) [+11.1%] Jumped on reports that the Trump admin may push to privatize it and Freddie Mac via executive order.

Dutch Bros (BROS) [+7.7%] Got a lift from a Morgan Stanley upgrade, citing strong growth potential and room for margin expansion.

FedEx (FDX) [+5.2%] Upgraded by Jefferies, which sees earnings growth and cost cuts outweighing macro challenges.

Pinterest (PINS) [+5.1%] Rose after Guggenheim said its recent dip is a buying opportunity with user growth and monetization both looking strong.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

C) Nike was founded in 1964.

B) Nike’s original name was Blue Ribbon Sports.

B) Nike paid $35 for the famous ‘Swoosh’ design.

B) 2024 revenues were $45.9 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.