Timing The Market

Plus: Nvidia vs. Apple for the crown of world's largest company

"A plan without action is not a plan. It’s a speech"

- T. Boone Pickens

“Debt means you had more fun than you were supposed to”

- Greg Fitzsimmons

Hey Readers,

Thanks for checking out StreetSmarts. I’m on vacation this week so there might be a few rum punch induced typos but I had fun with this one.

If there’s anything you think would be fun to dive into for next week please just let me know in the comments.

Best,

Ryan

Street Stories

Timing The Market

One of the great truisms of investing is ‘time in the market beats timing the market’. I was reminded of this the other day when I saw a Instagram Reel by Tony Robbins (yes, random).

In it, he said Warren Buffett impressed this upon him when saying that over the last 20 years if you were invested in the market you would have returned around +8.2%. But if you missed the 10 best trading days, you’d only have a return of +4.5%. Miss the top 20? +2% return. Miss the top 30 and you lose money.

I’ve heard variations of this over the years but I thought I’d test it myself. Pitter patter, let’s get at ‘er.

To start, yeah. Damnnn!

Over the last 40-years the S&P 500 has had an average annual return of +9.4%. If you missed just the 10 best of those 10,000ish trading days then your return gets cut to +7.2%. Miss the top 50 days (0.5% of trading days), and your return is +2.4% and you’d have been better putting your money into some lame money market fund.

Next, while +9.4% vs. +7.2% doesn’t sound like too much of a sacrifice, it turns out it is actually quite massive due to the magical powers of math - specifically, compounding.

If the S&P 500 didn’t have those 10 best days, it wouldn’t be sitting at 5,987 but a much uglier 2,674 - just 45% of the market’s actual return. Yeesh.

So I guess that answers that, eh? Time in the market beats time out of the market.

BUT WAIT!!!

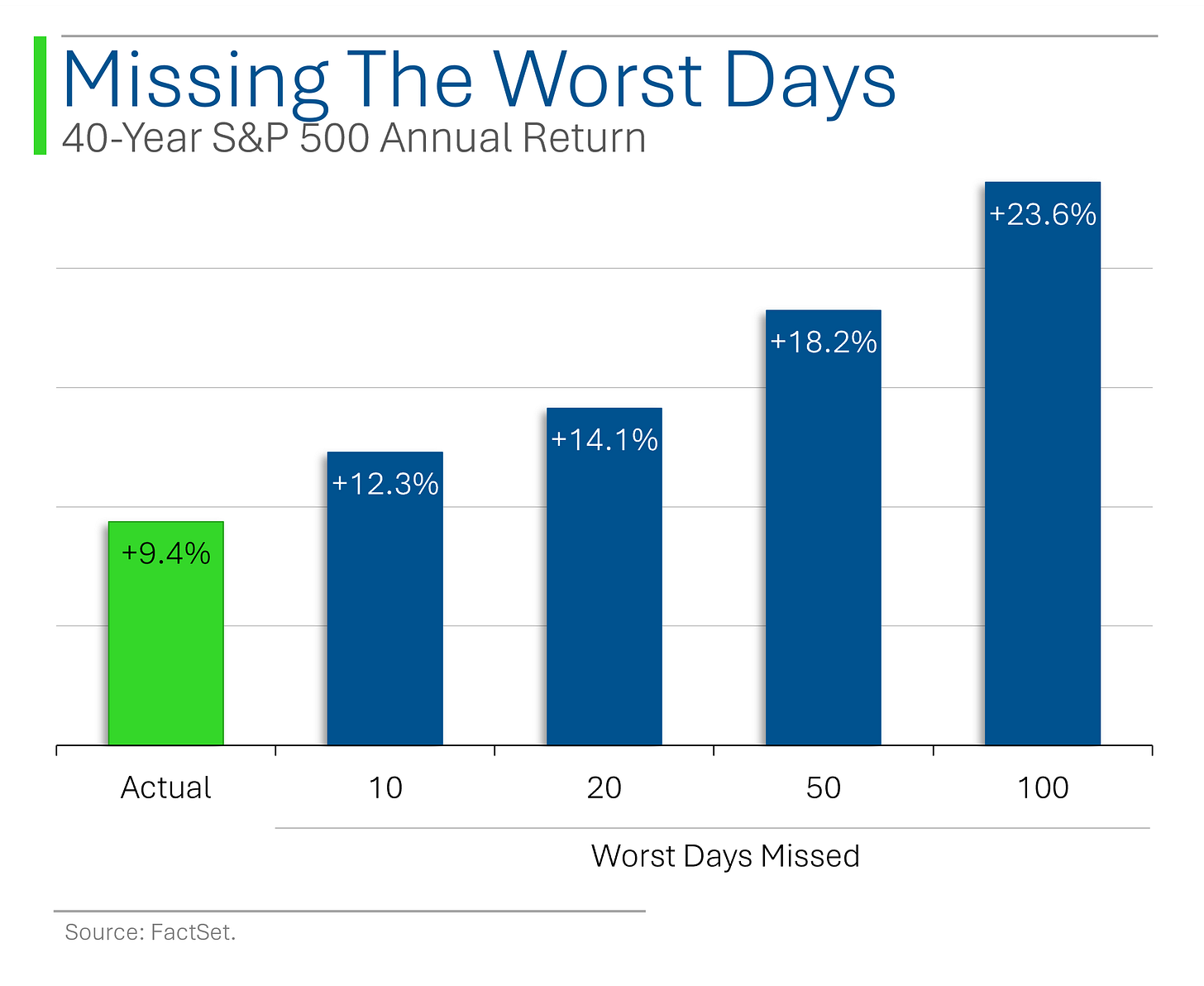

See, the market goes both ways. If you’re out of it you might miss the best days, but you also might miss the worst days. And that’s something that old adage carelessly ignores.

Missing the 10 worst days in the market takes that +9.4% annual return and makes it +12.3%. Lucky enough to miss those 100 worst days and you are making +23.6% per annum. Pretty nifty.

Here again, the magic of compounding gets pretty wild. Comical even.

If the market missed those 20 worst days over the last 40 years it would currently be sitting at 32,778.

If I could figure out how to miss those days I wouldn’t need to write a newsletter for a living. Ok, I’d still do it cuz it’s pretty fun.

What’s also interesting is that most of the really bad days are also around the time when the really good days happen. As you can see above, the ten worst trading days in the last 40 years come from four big market crises: Black Monday, The GFC, The Pandemic and The Asian Crisis.

The ten best days all came during three of those crises.

My point is that trying to ‘time the market’ to miss the worst days means you’ll also probably be out of the market for the best ones.

Can’t imagine too many people called March 12th 2020 (-9.5%) right and also March 13th 2020 (+9.3%).

To me, the real story is here about compounding. Just having your money sitting in the market will produce a good enough return for most people’s purposes. For example, $10k put in the market 40 years ago would be worth $314k by now. However, if you played it too safe, or let someone talk you into something gross, like bonds, your future wealth would have taken a massive hit.

If instead of getting the market’s 9% return, you found yourself stuck with only a 5% return, then that $314k would only be worth $70k. Oooof.

…oh, and in case curious, I couldn’t help myself and carried it to the next logical step: compare missing the same amount of best and worst days.

If you can pull it off, it does yield a superior return.

The Tony Robbins clip that ‘inspired’ this:

Apple vs. Nvidia

Last week Nvidia overtook Apple to become the world’s largest publicly traded company. While they’re both ‘tech companies’, they don’t really have much in common so I thought it would be interesting to dive into the numbers that make them tick.

As you can see above, Nvidia actually overtook Apple for about 20 minutes back in the summer.

We’ll see if they can make it stick this time.

And it’s pretty easy to tell how Nvidia got where it is today. Folks only focus on the big rallies we’ve seen in the shares over the last few years but Nvidia has returned over 100% per year since 2016.

Apple - at a measly +32% per year - seems quaint in comparison…

Nvidia’s is certainly one of the great financial 180s I’ve ever seen: It’s one thing for a no-name small-cap to suddenly find it’s rhythm, but to go from a $10 billion revenue company (2018) to a forecast $240 billion revenue company (est. 2027) that’s a bit more tricky.

Despite the massive share price appreciation, it’s really hard to argue that Nvidia is in some inflated bubble.

Sure, 36x P/E isn’t cheap but with Tesla at +90x and growing at barely 1/10th what Nvidia is, you can see why trying to build a short thesis might be dangerous.

One area that investors point to as proof of Nvidia’s market strength is its insane gross margins. Being a virtually monopoly has it’s perks but this is one place where I certainly have my concerns.

This isn’t exactly a niche market (it’s arguably the biggest one in history), and their biggest customers (Meta, Microsoft, Alphabet, Amazon) are also investing hundreds of billions to free themselves of Nvidia’s hegemony (or even to compete with them).

With such a prize on offer, I’d be shocked if 10 years from now a company that sells a physical product that is manufactured by a third party (TSMC mostly) is still enjoying software-esque margins.

Whatever the future brings, however, there’s no arguing that right now Nvidia is in the driver’s seat. While sales may still be well short of big brother Apple, Wall Street seems to grow more bullish on their prospects by the minute.

Whether they will be the biggest company in the world this time next year is anyone’s guess, but it has been one hell of a ride!

Joke Of The Day

An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.

Trivia

Today’s trivia is on the Medici.

The famous Medici banking dynasty originated from and for 300 years were de facto rulers of which Italian city?

A) Milan

B) Genoa

C) Florence

D) CapuaIn addition to effectively ruling [one of the above cities], the Medici produced two Queens’ of France, and how many Popes?

A) 1

B) 2

C) 3

D) 4Nicknamed ‘the Magnificent’, this Medici patriarch played a vital role in fostering the Renaissance, including patronages of Brunelleschi, Da Vinci, Donatello, Michelangelo:

A) Cosimo I de' Medici

B) Lorenzo de' Medici

C) Giovanni di Bicci de' Medici

D) Ferdinando II de' Medici

(Yup, that’s three of the four Ninja Turtles. Raphael (the fourth) was also commissioned by Giulio de' Medici, the future Pope Clement VII)

(answers at bottom)

Market Movers

Friday:

Gap (GAP) [+12.9%] Q3 sales and EPS beat expectations, raised guidance, with strong margins, SG&A leverage, and growth in Athleta and Gap brands.

Reddit (RDDT) [-7.2%] Bloomberg reports Advance looking to set up a credit facility using Reddit equity, amid focus on Tencent share sales after a strong earlier week.

Intuit (INTU) [-5.7%] Q1 results ahead, but softer Q2 guidance raised scrutiny despite strong Credit Karma performance.

Thursday:

Snowflake (SNOW) [+32.7%] Q3 results beat with growth in AI products, raised FY25 guidance, and announced acquisition of enterprise AI firm Datavolo.

Deere & Co. (DE) [+8.1%] Strong FQ4 results with upbeat margins despite weak FY25 guidance on lower volumes.

Kura Oncology (KURA) [-36.8%] Global license deal on ziftomenib cheered but raised questions on timing and M&A potential.

Baidu (BIDU) [-5.9%] Q3 results mixed as AI Cloud outperformed, but online marketing and shareholder returns disappointed.

Alphabet (GOOGL) [-4.7%] DOJ seeks Chrome divestiture and AI restrictions in final proposal.

Wednesday:

Lemonade (LMND) [+16%] Morgan Stanley upgrade boosted shares, citing better profitability outlook after a strong investor day.

Wix.com (WIX) [+14.3%] Solid Q3 results with strong guidance driven by AI-driven subscription growth and better conversion rates.

Target (TGT) [-21.4%] Weak Q3 across the board with challenges in margins, general merchandise, and uneven execution.

Roku (ROKU) [-6.7%] Competitor The Trade Desk launched its own smart TV OS, "Ventura."

Tuesday:

Super Micro Computer (SMCI) [+31.2%] Filed compliance plan with Nasdaq and appointed new auditor, boosting investor confidence.

Symbotic (SYM) [+27.7%] Q4 revenue beat, gross margin rebound, and strong growth outlook excited the market.

Valvoline (VVV) [-8.7%] Mixed Q4 with hurricane impact flagged, but analysts expect activity rebound in Q1.

Incyte (INCY) [-8.3%] Paused Phase 2 study on urticaria after preclinical toxicology findings.

Intuit (INTU) [-5.1%] Speculation around IRS mobile tax-filing app sparked concerns about competitive landscape.

Monday:

Trump Media & Technology Group (DJT) [+16.7%] Advanced talks to buy crypto firm Bakkt spiked shares.

Super Micro Computer (SMCI) [+15.9%] Plans to remain Nasdaq-listed boosted shares.

Robinhood Markets (HOOD) [+8.3%] Upgraded by Needham on Trump-related tailwinds and anticipated crypto listings.

Uber Technologies (UBER) [-5.4%] Trump transition team’s focus on self-driving vehicles sparked regulatory concerns.

Redfin (RDFN) [-4.4%] Goldman Sachs downgrade flagged housing market risks and commission pressures.

NVIDIA (NVDA) [-1.3%] Customer concerns emerged over overheating issues in new AI chips.

This Week In History

November 18, 1928 – Debut of Mickey Mouse in "Steamboat Willie": Walt Disney's "Steamboat Willie" premiered, introducing Mickey Mouse and revolutionizing animation with synchronized sound.

November 23, 1924 – Edwin Hubble's Discovery: Astronomer Edwin Hubble published findings showing that the Andromeda "nebula" is actually a separate galaxy, expanding our understanding of the universe.

November 24, 1963 – Lee Harvey Oswald Killed: Lee Harvey Oswald, accused assassin of President Kennedy, was shot and killed by Jack Ruby, sparking numerous conspiracy theories.

Market Update

Trivia Answers

C) The Medici came to power in Florence.

D) Medici family members produced 4 Popes.

B) Lorenzo de' Medici.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Thanks for the reminder of “time in the market vs timing the market” and that missing the bad days (luckily) also means missing the best days of the market (most likely)

On Nvidia, I am reminded of Intel’s huge gross margin once upon a time - wrong execution and a bad decision can wipe out these margins…