🔬Timing The Market

Plus: Nvidia's no good, rotten, very bad week; and much more!

"Your margin is my opportunity."

- Jeff Bezos

"Would I rather be feared or loved? Easy. Both. I want people to be afraid of how much they love me."

- Michael Scott (The Office)

Third soft day in a row for the big U.S. markets, with the S&P 500 -0.3% and Nasdaq -1.1%.

9 of 11 sectors closed higher but when Tech (-2.1% and 32% of the index) has a bad day that’s usually enough to pull the market lower. Energy had a big day, closing +2.7% on a day when oil closed +1.1% higher.

Notable companies:

ResMed (RMD) [-11.4%]: Eli Lilly weight-loss drug Zepbound reduced severity of sleep apnea, and thus sales of their CPAP machines.

Alnylam Pharmaceuticals (ALNY) [+34.5%]: Reported topline results from HELIOS-B phase 3 study of vutrisiran; achieved statistical significance on primary and all secondary endpoints. So, like ‘good’.

IBM (IBM) [+1.5%]: Initiated buy at Goldman Sachs; cited strategic shift towards long-term growth, emphasizing focus on infrastructure software assets, especially AI. If Dell and HP can do it…nah

Street Stories

Timing The Market

One of the great truisms of investing is ‘time in the market beats timing the market’. I was reminded of this the other day when I saw a Instagram Reel by Tony Robbins (yes, random).

In it, he said Warren Buffett impressed this upon him when saying that over the last 20 years if you were invested in the market you would have returned around +8.2%. But if you missed the 10 best trading days, you’d only have a return of +4.5%. Miss the top 20? +2% return. Miss the top 30 and you lose money.

I’ve heard variations of this over the years but I thought I’d test it myself. Pitter patter, let’s get at ‘er.

To start, yeah. Damnnn!

Over the last 40-years the S&P 500 has had an average annual return of +9.3%. If you missed just the 10 best of those 10,000ish trading days then your return gets cut to +7.1%. Miss the top 50 days (0.5% of trading days), and your return is +2.3% and you’d have been better putting your money into some lame money market fund.

Next, while +9.3% vs. +7.1% doesn’t sound like too much of a sacrifice, it turns out it is actually quite massive due to the magical powers of math - specifically, compounding.

If the S&P 500 didn’t have those 10 best days, it wouldn’t be sitting at 5,465 but a much uglier 2,442 - just 45% of the market’s actual return. Yeesh.

So I guess that answers that, eh? Time in the market beats time out of the market.

BUT WAIT!!!

See, the market goes both ways. If you’re out of it you might miss the best days, but you also might miss the worst days. And that’s something that old adage carelessly ignores.

Missing the 10 worst days in the market takes that +9.3% annual return and makes it +12.2%. Lucky enough to miss those 100 worst days and you are making +23.5% per annum. Pretty nifty.

Here again, the magic of compounding gets pretty wild. Comical even.

If the market missed those 20 worst days over the last 40 years it would currently be sitting at 29,933.

If I could figure out how to miss those days I wouldn’t need to write a newsletter for a living. Ok, I’d still do it cuz it’s pretty fun.

To me, the real story is here about compounding. Just having your money sitting in the market will produce a good enough return for most people’s purposes. For example, $10k put in the market 40 years ago would be worth $314k by now. However, if you played it too safe, or let someone talk you into something gross, like bonds, your future wealth would have taken a massive hit.

If instead of getting the market’s 9% return, you found yourself stuck with only a 5% return, then that $314k would only be worth $70k. Oooof.

…oh, and in case curious, I couldn’t help myself and carried it to the next logical step: compare missing the same amount of best and worst days.

If you can pull it off, it does yield a superior return.

The Tony Robbins clip that ‘inspired’ this:

Nvidia’s Bad Week

Over the course of the last three trading days Nvidia has shed 12.9%. Which isn’t great.

What stands out, however, is the massive scale of this decline from the former largest company in the world (they’re now back in third).

If $430 billion dollars doesn’t really resonate with you, may I suggest a few alternative scales. Like, that that loss is equivalent to 1.1 Procter & Gambles - you know, the largest consumer products company in the world.

Or my favorite, 24 Expedias.

Joke Of The Day

I haven’t slept for ten days - because that would be too long.

Hot Headlines

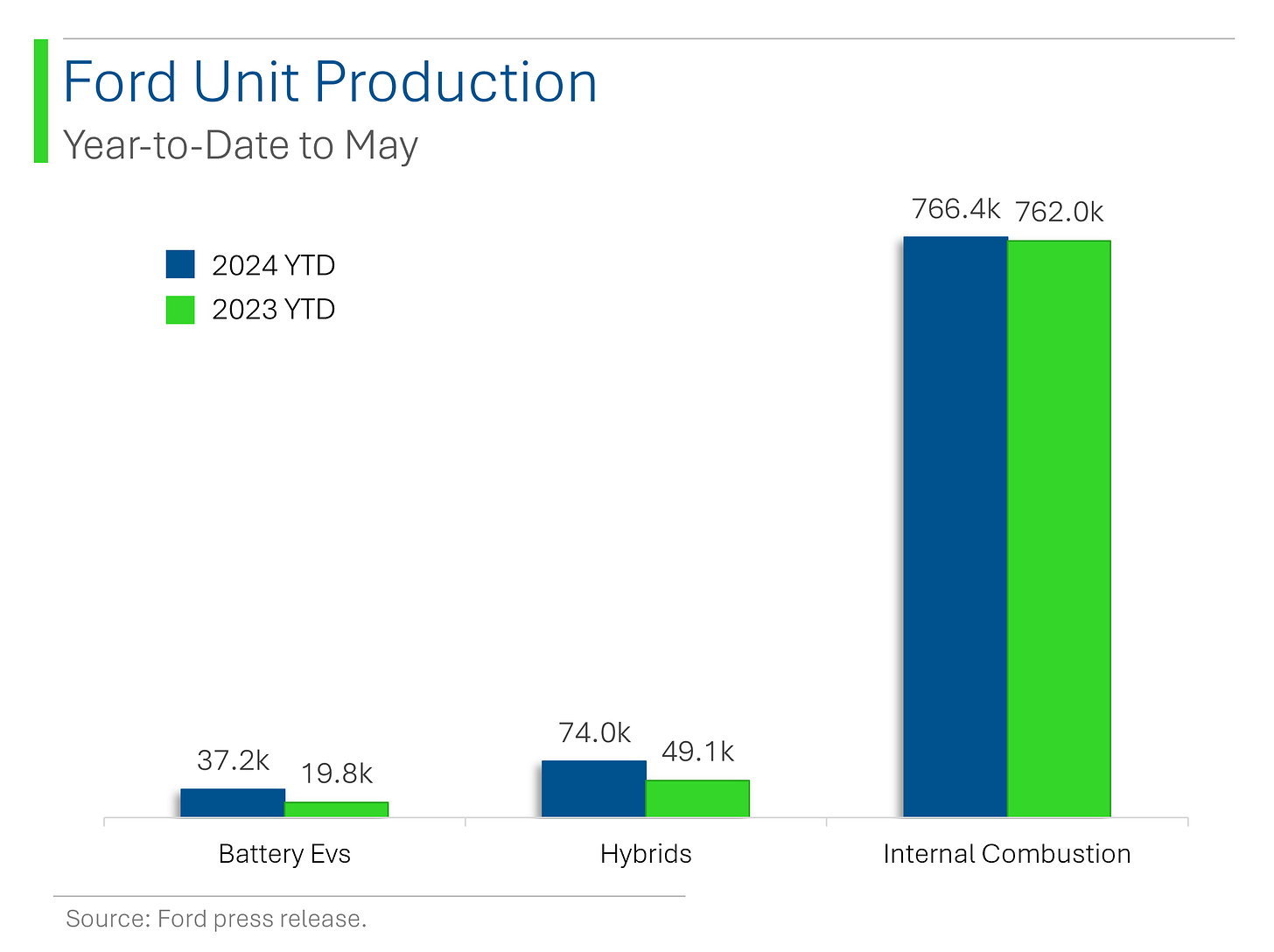

Argus / Ford suspends new EV models after further losses. "We will not launch a second-gen [EV] product unless it's profitable within the first year and we are going to get a return on that capital we're investing," chief financial officer John Lawler said.

CNBC / Paramount+ to increase prices for its streaming plans. Plans to sell the company failed so now management gotta look busy.

Bloomberg / Airbus cuts its annual aircraft delivery target from 800 jets to 770. Supply-chain issues impacting the plane maker of vital components, at a time when Boeing production is crippled. Not a great thing for airlines.

Reuters / Big US banks expected to be cautious on shareholder payouts after stress tests. Following his week's Federal Reserve health checks, Wall Street is expecting a weaker impetus for dividend growth and buybacks amid economic and regulatory uncertainties.

Bloomberg / Canada to curb China EV imports as Trudeau responds to Biden move. Only a few days after Europe. Why can’t we at least pretend we have sovereignty over our economic policy for a week or so?

CNBC / Fast fashion retailer Shein confidentially files for London IPO as U.S. listing stalls. Recall the U.S. IPO was canned over some minor peccadillos over their labor structure.

Gunna be first IPO prospectus listing ‘slave revolt’ as a Risk Factor. They very suck.

Trivia

Today’s trivia is on technological firsts.

The first mobile phone was made on April 3rd, 1973 by Martin Cooper, a researcher and executive for this company:

A) Verizon

B) Motorola

C) Bell South

D) Vodaphone

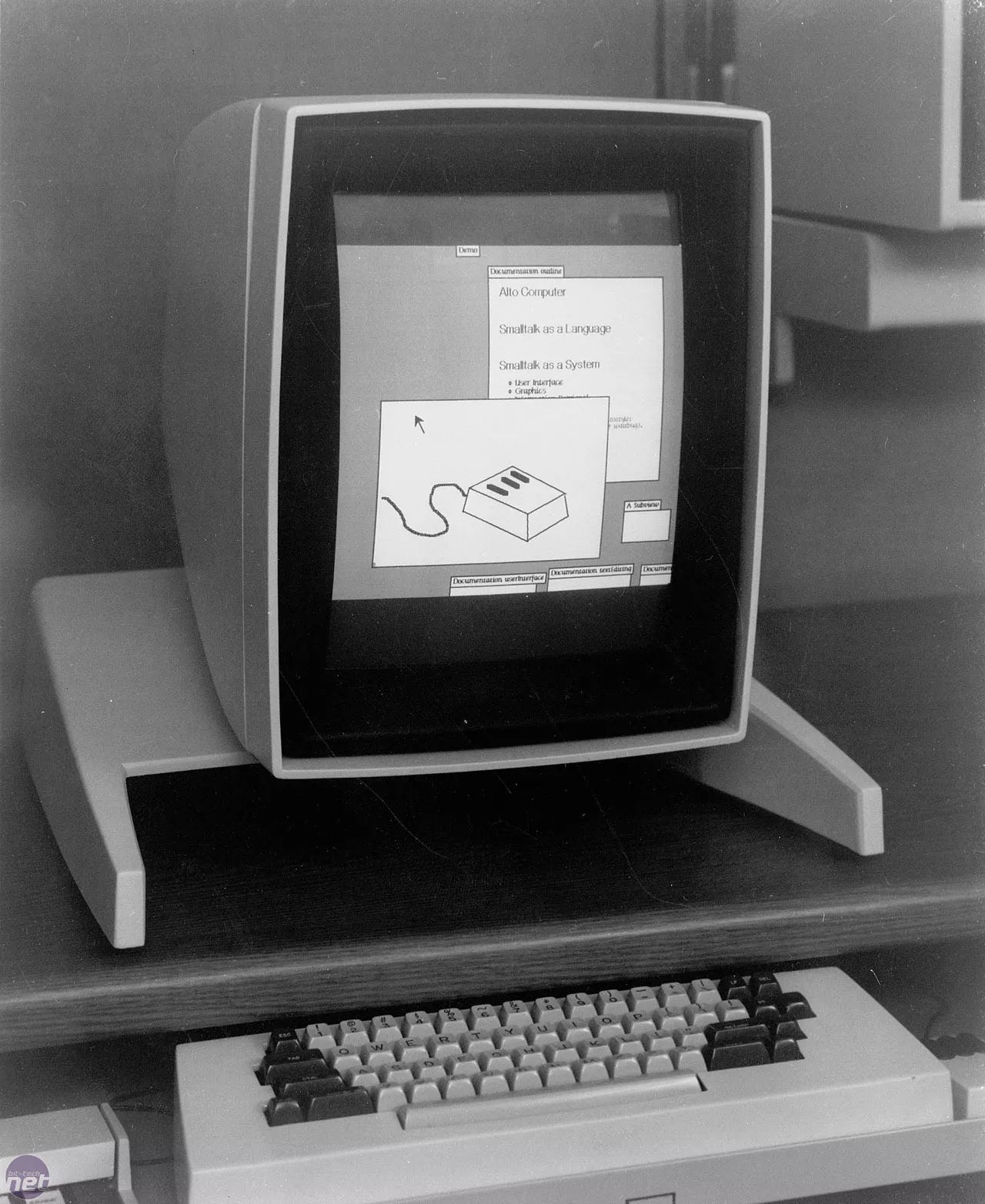

The Macintosh ‘Lisa’ was the first computer to be publicly sold with a graphical user interface (GUI) - Ie: being able to point and click at objects instead of typing into a command line. Which company did he get the idea from?

A) Xerox

B) General Electric

C) Bell Labs

D) Texas Instruments

In 1975, Eastman Kodak invented the first digital camera, using a movie camera lens, 16 batteries and a few bits from Motorola and Fairchild. What was the resolution of this camera? (For context, the latest iPhone is 48 megapixel.)

A) 5 megapixelB) 1 megapixel

C) 0.1 megapixel

D) 0.0001 megapixel

(answers at bottom)

Market Movers

Winners!

Alnylam Pharmaceuticals (ALNY) [+34.5%]: Reported topline results from HELIOS-B phase 3 study of vutrisiran; achieved statistical significance on primary and all secondary endpoints.

RXO, Inc. (RXO) [+23%]: To buy Coyote Logistics from UPS for $1.025B; reaffirmed Q2 Adjusted EBITDA $24-30M vs FactSet $26.4M.

Affirm Holdings (AFRM) [+12.8%]: Assumed buy at Goldman Sachs; cited expansive distribution network as vital for sustainable growth.

Cinemark Holdings (CNK) [+6.5%]: Upgraded to buy from neutral at Roth MKM; cited improvements in box office performance, debt reduction plans, and anticipated capital returns to shareholders.

Ryder System (R) [+3.3%]: Initiated overweight at Morgan Stanley; cited anticipated cycle inflection and benefits from transformation progress.

IBM (IBM) [+1.5%]: Initiated buy at Goldman Sachs; cited strategic shift towards long-term growth, emphasizing focus on infrastructure software assets, especially AI.term growth, emphasizing focus on infrastructure software assets, especially AI.

Losers!

Inspire Medical Systems (INSP) [-16.4%]: Eli Lilly weight-loss drug Zepbound reduced severity of sleep apnea.

ResMed (RMD) [-11.4%]: Eli Lilly weight-loss drug Zepbound reduced severity of sleep apnea.

Sonoco Products (SON) [-4.2%]: To acquire Eviosys for ~$3.9B; transaction expected by end of 2024.

Liberty Media Formula One (LSXMA) [-3.2%]: Downgraded to in line from outperform at Evercore ISI; cited closed relative value spread between Liberty SiriusXM and SIRI shares, expect share volatility as combination nears.

Market Update

Trivia Answers

Motorola. In a bit of competitive fun, Cooper made the call to Joel Engel, head of their main competitor AT&T-owned Bell Labs.

Xerox. The technology was developed for its PARC computer. Before the copier business declined due to competition, Xerox was considered one of the leading technology companies in the world.

C) The first digital camera was 0.1 megapixel which honestly sounds pretty good for the times.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Timing the market is bonus money.

Wow, missing the worst 100 days gives you Bitcoin-like returns! =]