The Yield Curve Does the Fed's Job, Grandma Sandals are Expensive (Birkenstock IPO), and Much More

StreetSmarts Morning Note

"There is a time to make money and a time to not lose money."

-David Tepper

"He who lives by the crystal ball will eat shattered glass."

-Ray Dalio

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Birkenstock Prices IPO $8.6 Billion Valuation

US Fed isn’t ‘Dovish’…just less ‘Hawkish’

S&P, Nasdaq & TSX Reverse Losses

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

Birkenstock Prices IPO $8.6 Billion Valuation

Birkenstock priced its IPO at $46, below the mid-point of the $44 to $49 range it was shopping around to potential investors, with trading under the ticker symbol BIRK expected to start soon.

The valuation implies a Price to Earnings of around 36x which is steep and a material premium to its peers (see above).

Analysts are optimistic about Birkenstock due to its longstanding history and established customer base but investors need to factor in the performance of recent IPOs, which has been dismal:

Instacart ($CART) is down 20% since its September 19th IPO

ARM Holdings ($ARM) is 12% since its September 14th IPO

The S&P 500 is only down around 3% over the same time period

Birkenstock has experienced notable revenue and profit growth, with net proceeds from the IPO expected to be around $1.5 billion.

Private equity firm L Catterton will remain the majority owner after the IPO, and the company has secured additional financial backing from prominent investors.

Take-Aways: I’m always very suspicious when a private equity firm (in this case L Catterton) only holds a company for a few short years before flipping it back onto the market (they bought Birkenstock in Q1 2021) while touting an outsized revenue growth rate. They often pull tricks, like adding SKUs or stuffing channels, to get a short term pop and pretend that its sustainable growth.

From the F1 registration filing, the company cited a 22% adjusted net profit CAGR from 2020 to 2022. That’s huge! But if you put your thinking cap on for a second, does a sleepy ole German sandal company seems like it can sustain tech company sized growth rates for long? I don’t know. Probably not. And at an 80% valuation premium to the market I’d probably want to know for sure.

Admittedly, skimming the F-1 filing taught me more than I ever wanted to know about sandals. Look! Three kinds of arch support!

The US Fed isn’t ‘Dovish’…just less ‘Hawkish’

Higher bond yields are aiding the Federal Reserve's efforts to combat inflation by increasing borrowing costs and slowing down the economy, reducing spending and upward pressure on prices.

Recent statements starting over the weekend by Federal Reserve officials indicate that the increase in bond yields may reduce the need for further action, such as raising the fed-funds rate, to cool down the economy and curb inflation.

The market has adjusted to these developments, with interest-rate futures indicating a lower likelihood of additional increases in the Fed-funds rate, which also gave a boost to stocks.

Take-Aways: The yield curve increasing for the longer duration government debt (‘the back end’) seems to really be resonating with the Fed. The yield curve is still heavily ‘inverted’ - meaning that interest rates for short-term government bonds is greater than the yields on longer ones, which runs counter to normal times (see ‘Term Structure of Interest Rates’).

Inverted yield curves have historically been a reliable recession indicator, as an inverted yield curve has preceded every U.S. recession since the 1950s. So an ‘un-verting’ could go a long way in alleviating those fears, and if that also helps to take the Fed’s foot off the gas pedal (no more rate hikes), that’s a good thing too.

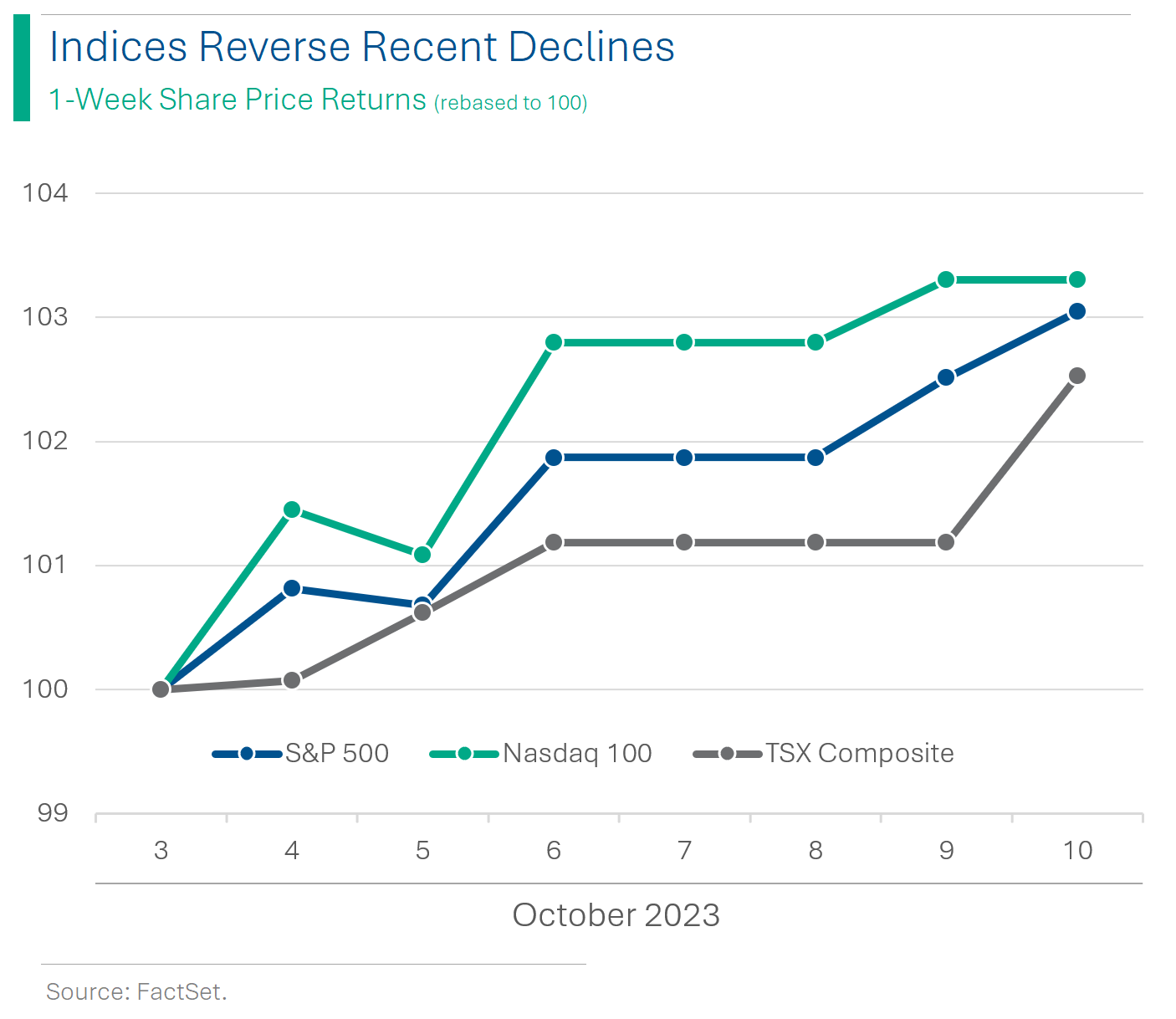

S&P, Nasdaq & TSX Reverse Losses

Despite a mixed bag of economic data points and a new war in the Middle East, the main North American indices are on something of a tear lately, with the S&P 500, Nasdaq 100 and TSX Composite up 3.0%, 3.3% and 2.5%, respectively. This follows a weak September when those same indices were down 4.9%, 5.1% and 3.7% respectively.

Take-Aways: Does this mean the Street is getting excited for earnings season? Q3 reporting officially kicks-off on Friday with some of the big banks reporting and this could an interesting one given the mixed signals we’ve seen economically. However… chatter on the street has been dominated by the Fed’s recent dovish rhetoric, so we’ll credit this pop in stocks to the decreased likelihood of future Fed hikes.

Joke Of The Day

Advisor jokes for my buddy Greg…

After I spoke to my financial adviser I slept like a baby… I woke up every hour and cried.

How many financial advisers does it take to change a light bulb? Just one. He hires a lightbulb installer to do it and then charges you 1% of your assets each year.

I’m not saying my financial adviser is bad at her job... but when I went into her office and asked her to check my balance, she tried to push me over.

Hot Headlines

(Reuters) GM, Canadian union reach tentative agreement, ending strike - the strike ended after 12 hours! Reportedly both sides said sorry and signed some papers.

(BNN Bloomberg) LVMH Sales Growth Slows as Global Luxury Demand Cools - this bellwether for luxury goods hints the post-pandemic boom is ending.

(Barron’s) Hamas-Linked Crypto Accounts Give Fuel To Industry’s Critics - the punchline is more regulation for crypto exchanges.

(BBC) Amazon staff in Coventry to strike on Black Friday in pay row - ‘row’ is British for ‘disagreement’.

(Reuters) AMD to acquire AI software startup in effort to catch Nvidia - a journey of a 100,000 miles begins with a first step (they’re so far behind).

(CNBC) Caroline Ellison took almost 30 seconds to recognize ex-boyfriend Sam Bankman-Fried as testimony begins - snitches get… impaired vision?

***Semi-related: I started reading the new Michael Lewis book on FTX and Sam Bankman-Fried, Going Infinite, and can’t put it down. Maybe check it out***

Trivia

What percent of US equity trading volume is done by algorithms?

60 - 73%

57 - 62%

+90%

<50%

What percent of foreign exchange (FOREX) trading volume is done by algorithms?

60 - 73%

57 - 62%

+90%

<50%

(answers at bottom)

Market Update

Trivia Answers

50 - 63%. While high-frequency trading (HFT) strategies and their ilk represent a massive side of the market, good ole people still do their bit. Including a significant and growing proportion of retail traders, which reached highs above 20% of trading volume in the go-go days of 2020.

+90%. Lots of good reasons why FOREX was tailor made for algorithmic trading, such as easier monitoring of market conditions and faster execution to capture smaller gains, all the way to ‘less likely to make a fat finger trade with all those damn decimals’.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and Subscribe!