🔬The Weight-Loss Juggernauts

Plus: US Q1 GDP is revised even lower after consumers got lazy; and much more!

"The best time to buy a stock is when the company is as unpopular as a dentist at a lollipop convention."

– Peter Lynch

“The difference between playing the stock market and the horses is that one of the horses must win."

– Joey Adams

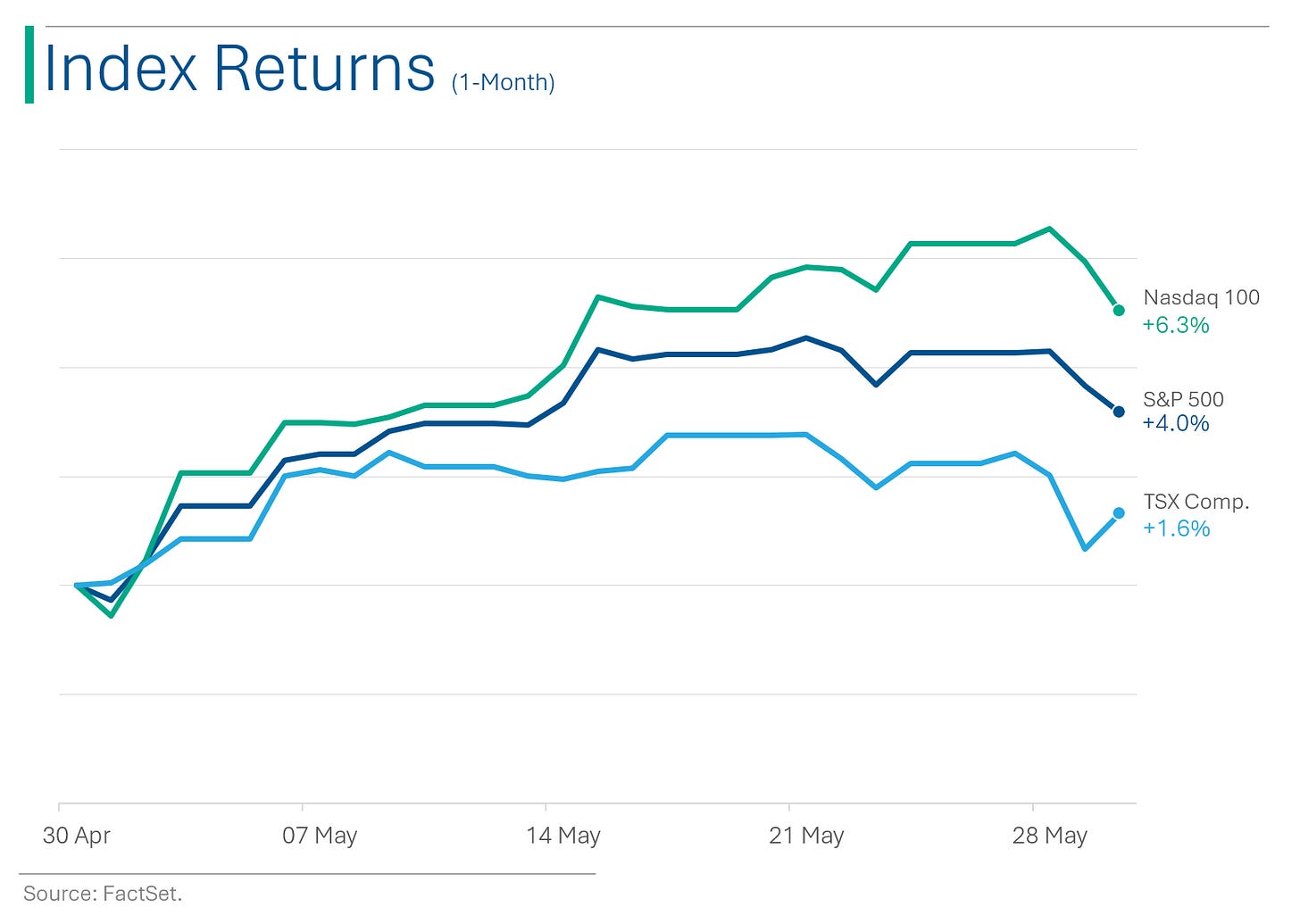

Another weak day for the big US markets with the S&P 500 -0.6% and Nasdaq -1.1%.

9 of 11 sectors closed higher but Nvidia pulled down enough to overshadow that. Real Estate (+1.5%) and Utilities (+1.4%) were up the most, Tech (-2.5%) and techy Communication Services (-1.1%) ruined the party for everyone.

The US is reportedly delaying chip sales to Middle East over security concerns, which is expected to have an impact on Nvidia and other chip makers’ sales.

US Pending Home Sales collapsed 7.7% in April to lowest levels in four years.

Notable companies:

HP, Inc. (HPQ) [+17.0%]: Fiscal Q2 results ahead; FY EPS guide tightened at midpoint; reiterated FY24 FCF guidance; better PC revenues and margins.

Foot Locker (FL) [+15.0%]: Big Q1 EPS beat due to disciplined expense management, favorable expense timing; cleaner inventory; reiterated FY guide; stock down nearly 30% YTD.

NVIDIA (NVDA) [-3.8%]: Bloomberg reported US delaying sales of AI-related chips to Middle East amid national security concerns.

Street Stories

The Weight-Loss Juggernauts

For decades Eli Lilly and Novo Nordisk have held an oligopoly on the Diabetes market. That brought them tens of billions in revenue, but their latest forays into weight-loss have made them the most valuable healthcare companies in the world.

In just the last four years, the companies went from a combined market cap of $299 billion to a staggering $1.4 trillion - a gain of over 355%.

When I started writing StreetSmarts last year, I did a bit of a deep-dive into the Ozempic frenzy (The Financial Skinny on Ozempic). Back then, Wall Street analysts were coming up with crazy estimates for the potential size of the global weigh-loss opportunity, with most eyeing a potential $100 billion market by the early 2030s.

Fast forward only a few months, and Ozempic isn’t in the news as frequently, but those same analysts have only grown more bullish on the space with many estimates now topping a $150 billion market opportunity (BMO: $150 billion by 2033; Leerink: $158 billion by 2032; etc.)

According to healthcare data provider IQVIA, global spending on obesity medications totaled $24 billion in 2023, with the vast majority heading to Lilly and Novo’s coffers.

IQVIA’s latest five-year outlook points to the weight-loss market reaching $131 billion in only four years, growing at an annual rate of +27%, from their previous estimate of +13%.

Wall Street’s love affair with weight-loss drugs is most evident in their progressive increase in estimates. For example, just two years ago, the Street’s consensus target for Ozempic sales in 2027 was just $10.2 billion. Now they are estimating sales will reach $23.8 billion.

How big is that? Well, in 2023 the highest selling pharmaceutical drugs in the world were (#1) Keytruda (various cancers including lung) at $25 billion and (#2) Humira (autoimmune disorders like Crohn’s and rheumatoid arthritis) at $14 billion.

Ozempic is now number three and will be in second place by year’s end.

As whole, the Street now sees Lilly hitting $62.5 billion in revenue by 2026, up massively from the $33.6 billion just three years ago. That’s some Nvidia-level growth.

And Novo is no slouch either, with the Street seeing it’s 2026 revs at $58.7 billion - up from a measly $30.4 billion in 2021.

In the same way that everyone and their mother is going after the Nvidia’s AI crown, the fattest (sorry) growth opportunity in pharma has attracted a slew of M&A and potential competitive threats coming from Amgen, Pfizer and even smaller players like Zealand, Viking Therapeutics and Innovent.

It’s definitely not going to be easy for Novo and Lilly to maintain their leadership but they have one hell of a head start - and billions to spend to stay there.

TLDR: Exercise is stupid. Take pills.

Q1 GDP Was Even Weaker Than First Read

With all the official data now posted, US Q1 GDP was revised down to an annualized rate of 1.3%, from the overzealous initial reading of 1.6%, primarily due to softer consumer spending on goods. Despite this, underlying domestic demand remains strong, with final sales to private domestic purchasers rising 2.8%.

A minor positive was that the Fed's preferred inflation metric, the Personal Consumption Expenditures price index, was revised down to a 3.3% annualized rate, slightly lower than initially projected at 3.4%.

Joke Of The Day

On a Miami to Chicago flight, there was a lively youngster who nearly drove everyone crazy. He was running up and down the aisle when the flight attendant started serving coffee. He ran smack into her, knocking a cup of coffee out of her hand and onto the floor.

As he stood by watching her clean up the mess, she glanced up at the boy and said, ‘”Look, why don’t you go and play outside?”

Hot Headlines

CNBC / Nelson Peltz sells entire Disney stake weeks after losing proxy battle. Finally an end to one of the highest profile proxy battles, after Peltz lost the shareholder vote to install allied board members. Don’t feel too bad for him, as his Trian fund walks away $1 billion thicker than before.

CEO Bob Iger can finally relax after a year in the trenches.

(I did a cool deep-dive on Disney in charts a few weeks back: link)

Cyber Daily / Hackers claim Ticketmaster/Live Nation data breach with more than 560m customers’ data compromised. Hacker group ShineyHunters is seeking a $500k ransom for the data.

CNBC / FAA says it won’t clear Boeing to increase 737 Max production for several months. Boeing has produced an average of 21 Max planes a month over the last three months, according to an estimate from Jefferies, well below the target rate of around 38 per month that it disclosed in mid-2023.

Still in the penalty box.

Reuters / Members discuss keeping voluntary oil cuts until year-end at OPEC+ meeting. Current cuts include 3.66 million barrels per day through to the end of 2024, and the 2.2 million barrel voluntary cuts by some members expiring at the end of June, which is likely to be extended. Thanks, jerks!

CNBC / Amazon to expand drone delivery service after clearing FAA hurdle. ‘Prime Air’ got the greenlight to fly out of sight of a ground spotter, materially increasing the delivery capabilities of the now decade-old initiative.

Bloomberg / US mortgage rates climb past 7% in first gain since early May. Trend of slowing mortgage rates comes to an end as levels continue to hover around 7%.

Trivia

Today’s trivia is on Ozempic maker Novo Nordisk.

Novo was created after the founder, whose wife suffered from diabetes, travelled to this country following their discovery of insulin, which eventually led to a licensing arrangement.

A. Canada

B. United States

C. England

D. GermanyNovo’s A Shares represent 28% of capital and 77% of voting rights, and are controlled entirely by whom?

A. Novartis

B. The Novo Nordisk Foundation charity

C. The family of founder August Krogh.

D. The Danish governmentNovo’s 2023 revenue was how much?

A. $20 billion

B. $34 billion

C. $51 billion

D. $88 billionIn what year did Novo Nordisk introduce the world's first prefilled insulin pen?

A) 1985

B) 1993

C) 1989

D) 2001

(answers at bottom)

Market Movers

Winners!

C3.ai, Inc. (AI) [+19.4%]: Q4 EPS and revenue beat; Q1 revenue and income guidance in line; FY24 revenue guidance ahead; revenue grew 20% y/y; gained market share; federal revenue up 100% y/y; strong margins.

Burlington Stores (BURL) [+17.6%]: Q1 earnings and revenue beat; comps ahead of consensus; slow February but accelerating March/April; expanding merchandise margin from lower markdowns, improved freight costs; raised FY EPS guidance.

HP, Inc. (HPQ) [+17.0%]: Fiscal Q2 results ahead; FY EPS guide tightened at midpoint; reiterated FY24 FCF guidance; better PC revenues and margins; y/y growth in Commercial PCs; positive on execution, cost control; soft consumer PC demand and Print margins.

Foot Locker (FL) [+15.0%]: Q1 comp decline and sales in line; big EPS beat due to disciplined expense management, favorable expense timing; cleaner inventory; reiterated FY guide; stock down nearly 30% YTD.

Red Robin Gourmet Burgers (RRGB) [+14.9%]: Q1 comp decline in line; revenue, RLM, EBITDA light; reaffirmed FY guidance; positive QTD comps; investments in food and labor boosted traffic; new loyalty program praised.

Best Buy Co. (BBY) [+13.4%]: Q1 EPS beat, revenue light due to larger-than-expected comp decline; reaffirmed FY25 EPS, revenue forecasts; trending toward midpoint of comps; positive on AI computer hardware releases.

Birkenstock (BIRK) [+11.7%]: Fiscal Q2 results and raised FY guide; strong wholesale sell-through; high demand, brand strength, regional upside, deleveraging progress.

Palantir Technologies (PLTR) [+3.8%]: Awarded $480M US Army contract.

Losers!

UiPath (PATH) [-34.0%]: Q1 results in line but Q2 guide below and lowered FY guidance; weaker macro environment led to higher deal scrutiny; concerns over CEO change and GMT strategy; multiple sell-side downgrades.

Nutanix (NTNX) [-23.1%]: FQ3 earnings, revenue, and margins better; large-customer wins but longer sales cycles and variability in new/expansion business; next-Q revenue guide below; slight raise to FY ACV billings and margin guidance.

Kohl's (KSS) [-22.9%]: Q1 EPS, comps, and revenue missed; lowered FY24 EPS, comps, and revenue growth guidance; positive trends in Women's business, strong growth in Sephora, but lower clearance sales and costs impacted performance.

Salesforce (CRM) [-19.7%]: Q1 revenue and cRPO missed; cRPO guide disappointed; macro uncertainty led to elongated deal cycles, deal compression, and budget scrutiny; positive on Data Cloud traction and Gen-AI opportunity.

Agilent Technologies (A) [-9.7%]: FQ2 earnings better but revenue light; weak Pharma demand, constrained instruments demand, big demand slump in China; Q2 guidance below the Street; cut FY guidance; announced $2B buyback.

NVIDIA (NVDA) [-3.8%]: Bloomberg reported US delaying sales of AI-related chips to Middle East amid national security concerns.

Market Update

Trivia Answers

A. Insulin was discovered in Canada.

B. The Novo Nordisk Foundation charity holds the A shares and voting control.

B. 2023 revs came in at $34 billion.

C) They created the world’s first insulin pen in 1989.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great work on the pharmas.

Wow. 355% in 4 years. Those are damn near Bitcoin numbers!!