🔬The Walmart Way 2.0

"The secret of success is to do the common thing uncommonly well."

- John D. Rockefeller

"Do what you can, with what you have, where you are."

- Theodore Roosevelt

Another bla day for the big US markets with the S&P 500 and Nasdaq both +0.2%. Low action day as the market sits on its hands awaiting Nvidia’s Q2 after close tomorrow to see where sentiment sits.

6 of 11 sectors closed higher, led by Tech (+0.6%) and Financials (+0.5%) but nothing too extraordinary driving positioning.

Oil fell 2.4% after jumping 3.5% yesterday on Mid-East flare-up and Libyan production halt.

Notable companies:

Trip.com Group (TCOM) [+8.6%]: Q2 earnings significantly outperformed expectations, driven by a margin-friendly mix shift and strong cross-border travel demand.

Hain Celestial Group (HAIN) [+18.6%]: FQ4 earnings beat expectations with revenue in line and margins supported by productivity and pricing, with international margins as a standout.

Lumen Technologies (LUMN) [-14.5%]: Kerrisdale report claims AI hype is masking a declining business burdened with $19B in debt, with the firm shorting the stock.

Street Stories

The Walmart Way 2.0

There's been a lot of news flow out of Walmart these days and we thought it was about time we get up to date on what's going on with one of America’s most American companies. They’re partnering with fast-food giants, tweaking global strategies, and flexing some serious AI muscle.

That said, I wonder how employee satisfaction is doing…

First up: Walmart’s sizzling partnership with Burger King. Walmart+ members now get a 25% discount on digital BK orders and a free Whopper every three months. This deal is part of Walmart’s broader strategy to supercharge its membership program, which costs $98 per year or $12.95 per month.

Walmart+ has about 14% of Americans on the service and offers members benefits like free shipping with no order minimum, fuel discounts, and now, exclusive perks like discounted meals at Burger King.

Next, Walmart’s bold move in China - offloading its nearly 10% stake in JD.com to focus on its own operations, especially the growing Sam’s Club footprint. JD.com’s stock took a hit, but Walmart is reinvesting those funds where it counts, showing a commitment to strengthening core operations.

Moreover, Walmart’s Q2 numbers were impressive, with revenue hitting $167.8 billion, up 4.7% year-over-year, and adjusted EPS up 9.8%.

A big driver? Generative AI.

Walmart is leveraging AI to boost e-commerce, improving product search and inventory management for leaner operations and better margins.

Internationally, Walmart saw a strong quarter with $29.9 billion in revenue, up 8.3% year-over-year, driven by Flipkart's success in India's growing grocery market and its new quick commerce venture, Minutes.

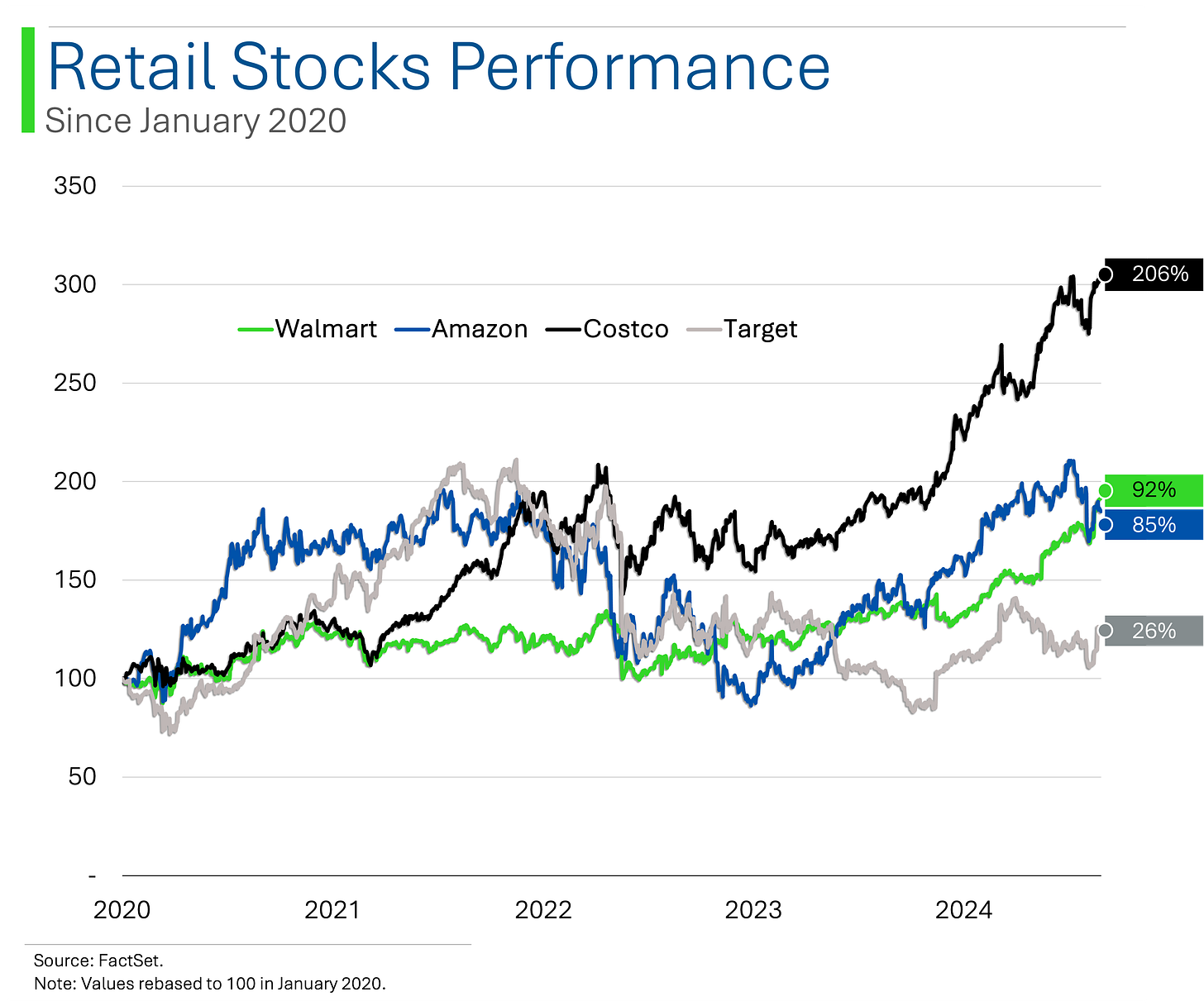

But what about the broader retail landscape?

Walmart’s latest quarter was a standout, but it doesn’t necessarily reflect overall consumer health. The company's success lies in its ability to maintain low prices and offer convenient services, and they’ve succeeded in attracting higher-income customers feeling the economic pinch, who are spending more on both essentials and discretionary items.

Sadly, the biggest driver for Walmart’s success of late has been scooping up financially stretched consumers now pushed down market towards the world’s largest discounter. Good for the stock but not exactly a harbinger of economic strength.

Intel Doesn’t Stand for ‘Intelligence’, Just So You Know…

Intel’s management is apparently in full defense mode in anticipation of pending activist investor activity, tapping Morgan Stanley and other advisors for support. This move comes as the chipmaker struggles to regain its footing, having lost nearly 60% of its value this year amidst fierce competition in the AI space.

CEO Pat Gelsinger is under pressure to turn things around, especially after Intel lost its crown as the largest U.S. chipmaker by revenue to Nvidia, whose AI business has surged.

Smart money seems to indicate that Pat won’t have a job by Christmas…

The company is also facing internal challenges, including the recent resignation of board member Lip-Bu Tan after just two years, further signaling instability.

Intel’s latest cost-cutting measures, including a 15% workforce reduction, reflect its ongoing efforts to navigate a turbulent market.

While no formal activist campaign has been launched, Intel’s proactive steps suggest it’s preparing for a fight to protect its strategic vision and leadership…Gotta love shareholder rights plans eh?

Joke Of The Day

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

Hot Headlines

Reuters / Nvidia results could spur record $300 billion swing in shares, options show. Traders are betting big on Nvidia’s upcoming earnings, with a potential $300 billion swing hanging in the balance. They're expecting a stock move of around 9.8%, which is more than a mild tremor—it’s practically an AI earthquake. .

Bloomberg / Canadian Credit Card Balances Highest Since 2007, Equifax Says. Canadians are swiping their credit cards like it’s 2007 again, with average balances hitting C$4,300—the highest since the good old days before the financial crisis. I thought when people spend, GDP goes up though?

CNBC / Hindenburg takes aim at AI server maker Super Micro with short position. Allegations of “accounting manipulation” and shady dealings have Super Micro’s stock on the ropes, down 3.5%. Is it just me, or do we all classify Hindenburg Research in the same league as Elliot Investment Management?

Yahoo Finance / Americans grew 'more pessimistic' about the job market in August while overall confidence rose. Eyes bigger than their stomach anyone?

CNBC / Home prices hit record high in June on S&P Case-Shiller Index. U.S. home prices reached a new peak in June, with New York leading the charge with a 9% annual rise while the nation was up 5.4% from last year overall.

Trivia

Today’s trivia is on legendary economists!

Milton Friedman, a key proponent of monetarism, challenged the prevailing Keynesian orthodoxy of his time. In which of his works did he present the idea that inflation is always and everywhere a monetary phenomenon?

A) A Monetary History of the United States

B) Capitalism and Freedom

C) The General Theory of Employment, Interest, and Money

D) The Wealth of Nations

John Maynard Keynes fundamentally altered economic policy with his theories during the 1930s. Which concept central to his theory suggests that insufficient aggregate demand can lead to prolonged periods of high unemployment?

A) Rational expectations

B) The paradox of thrift

C) Say’s law

D) The natural rate of unemployment

Adam Smith's "The Wealth of Nations" laid the foundation for modern economics. Which principle did Smith argue is the driving force behind individuals pursuing their own interests, which unintentionally benefits society as a whole?

A) The labor theory of value

B) The invisible hand

C) The law of diminishing returns

D) Comparative advantage

David Ricardo is renowned for his contributions to trade theory. Which principle did Ricardo's theory of comparative advantage demonstrate, fundamentally altering the way nations engage in international trade?

A) Absolute advantage

B) Opportunity cost

C) Protectionism

D) Terms of trade

Karl Marx critiqued the capitalist system with his theories on class struggle and economic exploitation. Which concept central to Marx's critique describes the increasing concentration of capital in fewer hands, leading to economic instability?

A) Surplus value

B) Commodity fetishism

C) The falling rate of profit

D) The iron law of wages

(answers at bottom)

Market Movers

Winners!

Hain Celestial Group (HAIN) [+18.6%]: FQ4 earnings beat expectations with revenue in line and margins supported by productivity and pricing, with international margins as a standout.

Trip.com Group (TCOM) [+8.6%]: Q2 earnings significantly outperformed expectations, driven by a margin-friendly mix shift and strong cross-border travel demand.

XPeng, Inc. (XPEV) [+6.7%]: Upgraded to buy from sell by Bocom.

Energizer Holdings (ENR) [+6.6%]: Upgraded to buy from hold at Truist, citing market stability and improved consumer outlook.

Insulet (PODD) [+6.6%]: Announced FDA clearance for Omnipod 5, the first automated insulin delivery system for both type 1 and type 2 diabetes, ahead of schedule.

Losers!

Lumen Technologies (LUMN) [-14.5%]: Kerrisdale report claims AI hype is masking a declining business burdened with $19B in debt, with the firm shorting the stock.

American Woodmark (AMWD) [-10.7%]: Fiscal Q1 revenue, EBITDA, and EPS missed expectations, with FY25 guidance lowered due to continued softness in the remodel market and a slowdown in new construction.

Hims & Hers Health (HIMS) [-7.5%]: Lilly announced it will sell Zepbound at a discount of at least 50% via its own DTC LillyDirect platform.

Paramount Global (PARA) [-7.2%]: Company confirmed Edgar Bronfman has withdrawn his acquisition proposal.

Cava Group (CAVA) [-6.1%]: CEO and insiders sold shares after a post-earnings rally, with Artal International selling 6M shares in a block trade.

Hershey (HSY) [-2.7%]: Downgraded to sell from neutral at Citi due to a challenging year ahead, with cocoa inflation likely offsetting 2025 mid-single-digit pricing plans.

Super Micro Computer (SMCI) [-2.6%]: Hindenburg Research published a short report alleging accounting red flags, undisclosed related-party transactions, and sanctions issues.

SiTime (SITM) [-1%]: Downgraded to underweight from neutral at Barclays, citing valuation concerns despite a positive outlook for recovery, with caution around gross margin pressure.

Market Update

Trivia Answers

A) Milton Friedman presented the idea that inflation is always and everywhere a monetary phenomenon in "A Monetary History of the United States."

B) The paradox of thrift is the Keynesian concept suggesting that insufficient aggregate demand can lead to prolonged periods of high unemployment.

B) Adam Smith argued that the "invisible hand" is the driving force behind individuals pursuing their own interests, which benefits society.

B) David Ricardo's theory of comparative advantage demonstrated the principle of opportunity cost.

C) Karl Marx's critique includes the concept of the falling rate of profit, which describes the increasing concentration of capital in fewer hands.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.