The US Fed Situation 101

Beginner Friendly Guide To Interest Rates, Inflation & The Impact On The Economy

The US Fed Situation 101

Economic Catch-22

The biggest news in the markets over the last week has been Federal Reserve Chairman Jerome Powell’s (from now on, JPow - as he likes to be called) comments coming out of the last Fed meeting last Thursday. At the meeting, the Fed kept rates unchanged (as expected) but the tone was perceived as ‘hawkish’ - bond nerd speak that he’s committed to raising rates to fight inflation; economy be damned! Below I’m going to outline some of the considerations weighing on future Fed decisions, discuss the potential impacts, and highlight some of the expectations from investors and Wall Street.

What’s the Fed’s Job?

First and foremost, the Federal Reserve has certain duties to uphold regarding the US economy. This is primarily referred to as the Fed’s ‘Dual Mandate’:

1) To keep price levels stable - this mostly comes in the form of raising interest rates to keep inflation below a target level of 2%; and

2) To maximize employment - you can ignore this one (at least during this crisis…)

What have they done?

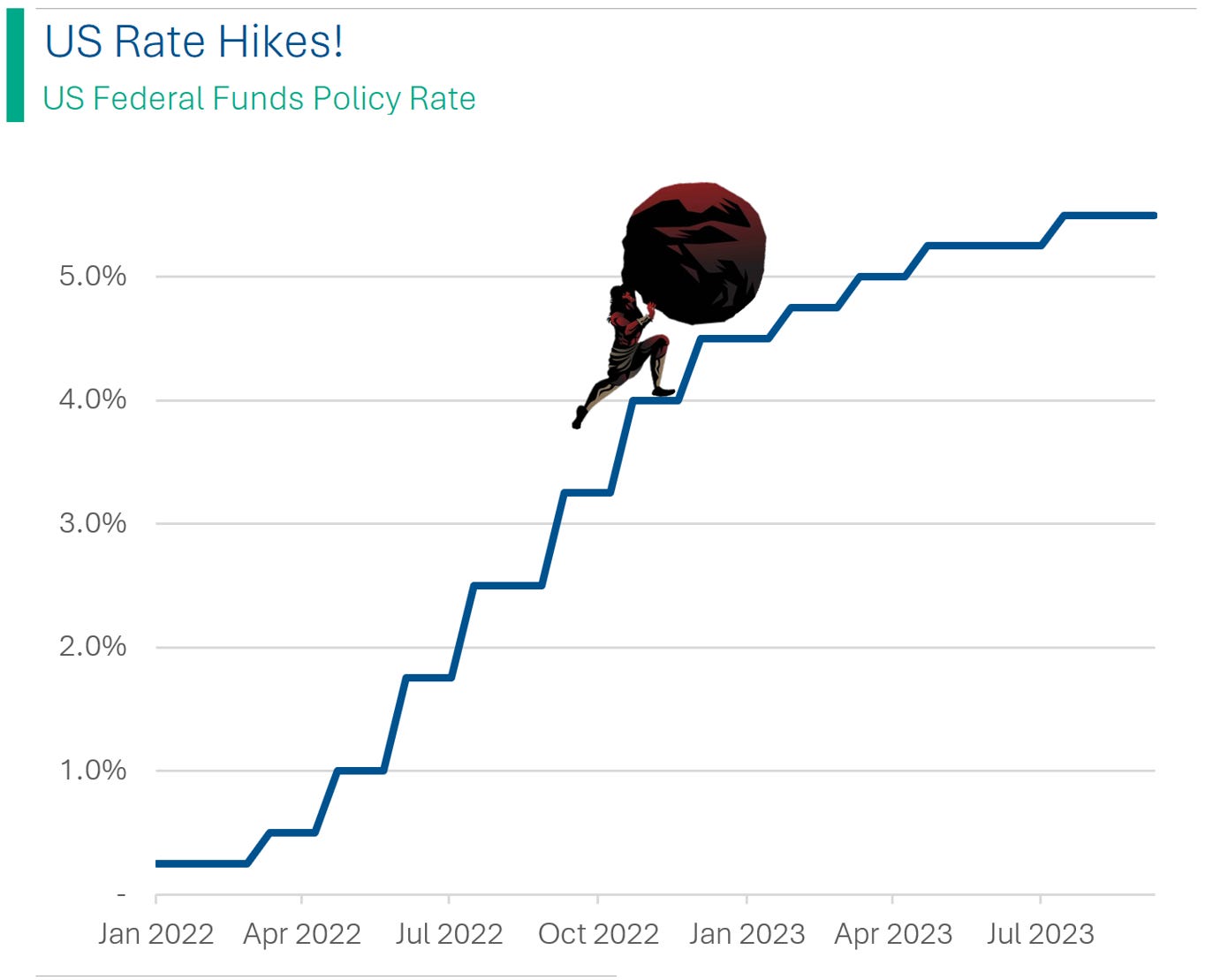

In light of the high inflation experienced since the pandemic - peaking at 9% in June 2022 - the Fed has raised rates aggressively to bring price levels down. This worked out reasonably well as inflation dropped substantially from its peak.

What’s the problem now?

While inflation has dropped significantly, it remains above the Fed’s 2% target level, currently sitting at 3.7%. What’s worse, is the figures for July and August actually showed a year-over-year increase.

Why is that so bad?

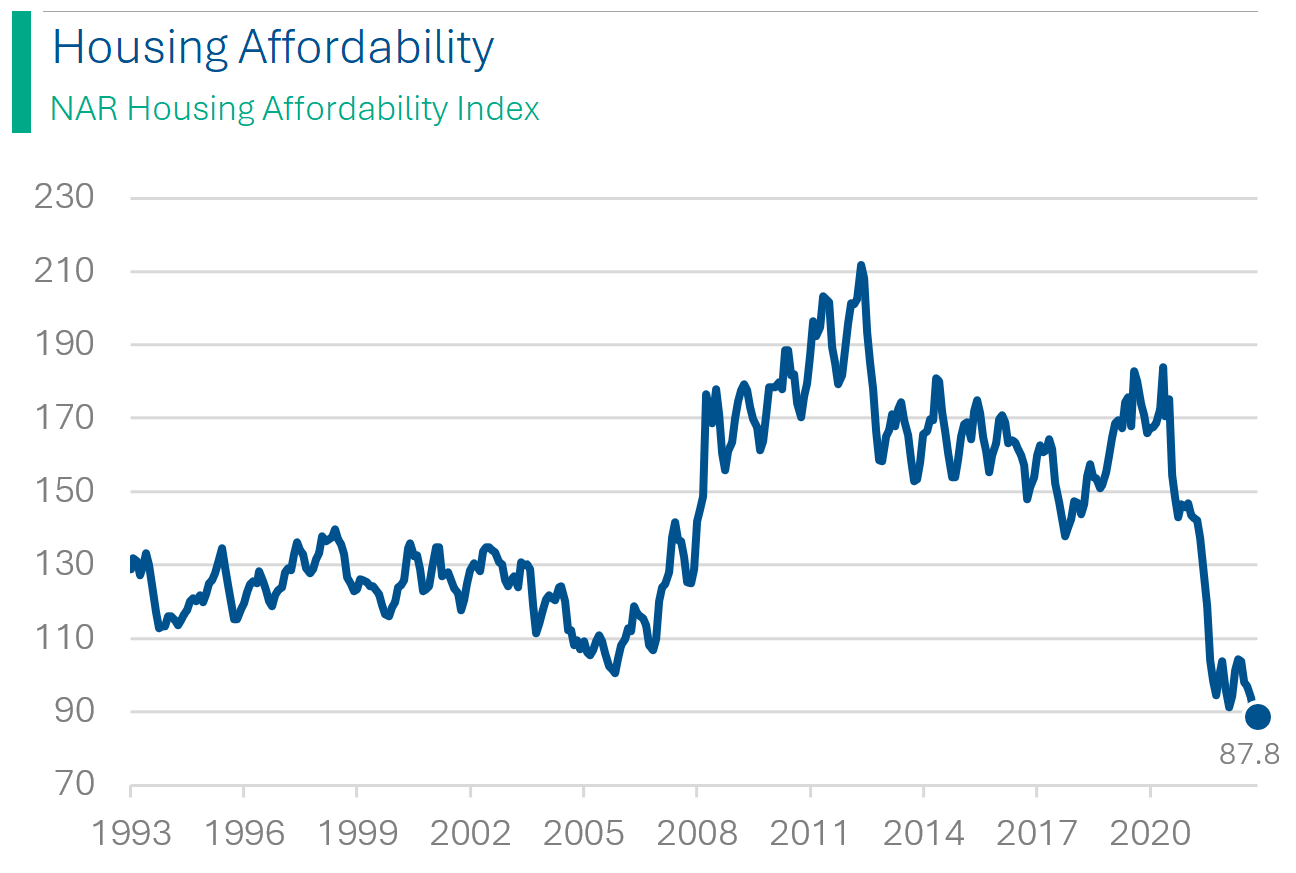

High interest rates have a negative impact on the broader economy. From businesses being charged more to borrow to expand their businesses, to regular people getting charged more for mortgages and car payments. Investors (and people looking to get a loan) were hoping that inflation would cool off more and that the Fed could begin to lower rates. Instead, it looks like they will take more action (raise rates higher) which will have an even greater negative impact on the economy.

So, how is the economy doing now?

By a lot of measures things look pretty good. And that’s part of why the Fed would even be considering raising rates: unemployment is still near record lows and economic growth, in the form of Gross Domestic Product, has actually been outperforming expectations. However, there are a lot of things behind the scenes that are building up. For example:

Housing affordability is at its lowest levels in over 30 years

Delinquencies on credit cards and personal loans are growing at a fast pace

Data shows that excess savings built up during the pandemic are now exhausted for the bottom 80% of Americans and credit card debt is building

44 million American’s have just started to resume payments on student loans with an average monthly payment of ~$500

The net result of all of that is that people will have less money to spend, which causes a recession, which leads to job losses, increases in personal debt, etc.

How has the Fed’s view changed?

The language during the press conference from JPow (also, Pow Dog) was increasingly hawkish and left on the table the potential for additional rate increases this year and next. He made statements about the Fed’s belief it can succeed lowering inflation without blowing up the economy (I’m paraphrasing here) and leading to significant job losses.

The Fed also provides the data from internal polling of is officials (when fully staffed this number is 19). These people are responsible for the famed ‘dot plot’ (seen above), which discloses the officials’ individual views on where they see rates shaking out in the future. Below, you can see the Dot Plot’s data aggregated into percent ranges. The key take away here is the that in the period since the June meeting (dotted line), Fed officials have increased their expectation of where interest rates will be over the next two years.

Additionally, the officials provide their personal projections for GDP growth (seen below), which have increased materially for 2023 and modestly for 2024.

Opinion/Take-Away: The way I interpret this is that the Fed sees GDP growth as strong (improved, actually) and as a result might be less hesitant to halt rate hikes if they believe the economy can endure them. The big question is ‘are they right?’ As mentioned above, there’s a lot of evidence that the US economy is deteriorating and they could end up making things much worse if they are wrong.

What does the Street think?

Expectations for interest rates in 2024 and 2025 have increased as expected (they expect interest rates to come down slower than previously). Lots of attention being paid to Personal Consumption Expenditures (PCE) which is going to be released on Friday. PCE is the Fed’s preferred gauge of inflation, over the more familiar Consumer Price Index (CPI). A high print for PCE on Friday could give the Fed extra impetus to raise rates.

Opinion: Personally, I think additional rate hikes are potentially quite dangerous. There is a lag between the time that you raise interest rates and that their impact trickles through the economy. So, the full force of +5% interest rates likely hasn’t really worked its way through the broader economy to cool inflation down to the Fed’s target 2% rate. And it’s not like the US has been on the back foot through all of this and needs to rush to play catch-up; it has the highest interest rates in the developed world!

From the other side, the person who’s seen their car payments go up $200 a month, or their mortgage payments go up by $500 doesn’t just go bankrupt tomorrow. They have to burn through savings and max out their HELOC and credit cards first. Just because we haven’t seen the economy fall apart yet doesn’t mean its immune to what’s happened, and what likely will continue to happen. High interest rates aren’t a knock-out punch, more like body shots.

Conclusion

It’s a tricky time to be a Fed Official, having to weigh the costs and benefits of tackling inflation versus overburdening the economy. This Fed, under JPow, have proven to be quite hawkish - or keen to aggressively attack rates - compared to their peers around the world.

Importantly, however, is that other than the initial sticker shock additional rate hikes may have on Wall Street and investors, the true impact of their actions won’t really be felt in the economy until down the road in 2024. By they, an increasing number of analyst are predicting a US recession. Their actions in the coming months may end up determining whether the expected cool down in the economy is a ‘soft-landing’ (an economic cool down that doesn’t trigger a recession) or a thud.

If you enjoyed this article, please give this post a like and consider signing-up for my free, daily newsletter where I dig into the big stories in the business world and financial markets. I’m just starting out so it really helps to get my work noticed!