🔬The Tech Wreck...in charts!

Plus: GDP comes in hot - but it's mostly filler; and much more!

"Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway."

- Warren Buffett

"It's money!! I remember it from when I was single."

- Billy Crystal (When Harry Met Sally)

Things continued to suck for the big US markets with the S&P 500 -0.5% and Nasdaq 0.9%. Small-cap was back to work after a weak Wednesday, with the Russell 2000 +1.3%.

4 of 11 sectors closed higher, with Energy (+1.5%) and Industrials (+0.8%) in the lead. Another sucky day for Tech (-1.1%) and techy Comm. Services (-1.9%).

Expect another wild day today with PCE inflation data and consumer sentiment pending today.

Initial Jobless Claims came in at 235K vs. estimates for 239K so pretty much a non-event.

Notable companies:

Viking Therapeutics (VKTX) [+28.3%]: Announced VK2735 weight-loss drug to advance into Phase 3 from Phase 1; Q2 EPS ahead of consensus.

Ford Motor (F) [-18.4%]: Q2 EBIT and EPS missed big; focus on warranty headwinds related to quality issues; maintained FY EBIT guidance but a raise was expected.

Alphabet (GOOGL) [-3.1%]: OpenAI launching search tool called SearchGPT; initially rolling out to a limited group of users on Thursday.

More below in ‘Market Movers’

Street Stories

The Tech Wreck

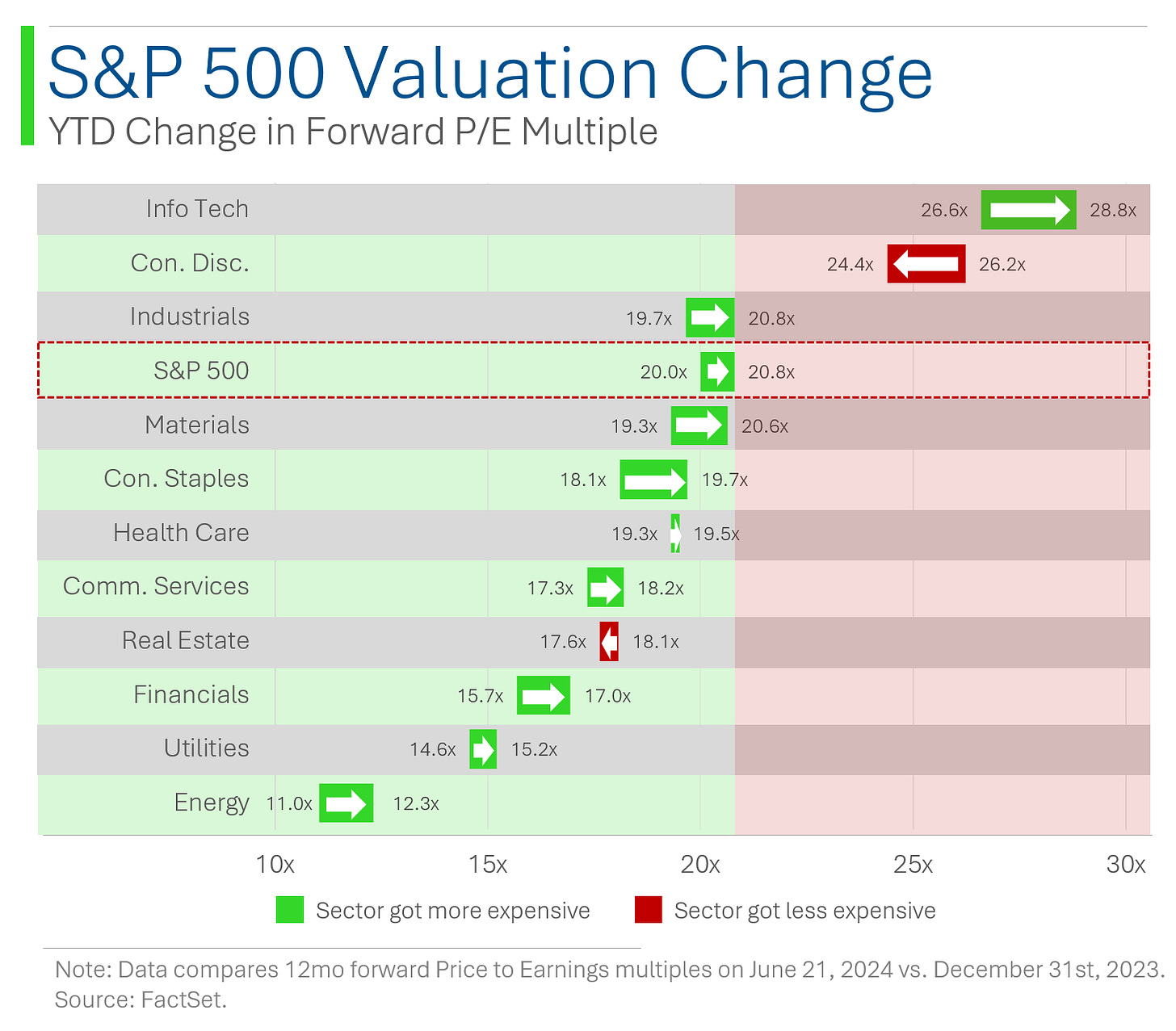

So far in 2024, only two sectors have actually seen a decline in their forward P/E multiples: Consumer Discretionary and Real Estate. The sector that got the most expensive this year is also the one lightyears ahead of everything else: Tech.

Sure, the companies in the sector have generally performed well and it certainly holds the biggest winners of the year (Nvidia, Supermicro, Meta, etc.) but there is no overlooking the fact that the sector is currently trading at it’s highest levels this millennium.

Let me give you a ‘for instance’: Tech has generally traded around levels comparable to the broader S&P 500 but currently sits at a 40% premium. And when you consider that it now has a ~40% weight in the S&P, it means the non-Tech bit is at an even greater discount.

Basically everything that isn’t Tech is free.

This spread - currently sitting at a P/E gap of 8.5x - is also the largest it’s ever been in history.

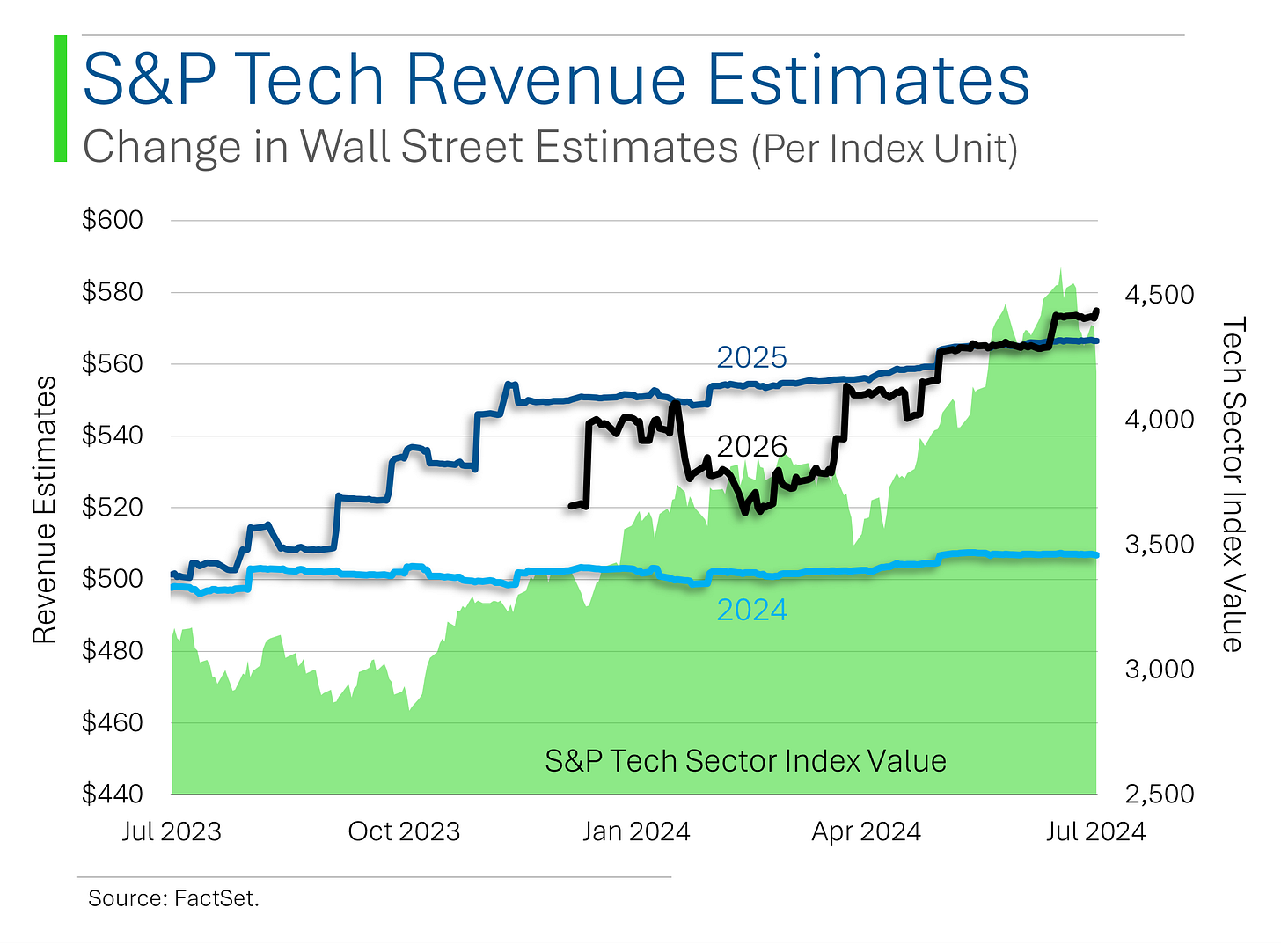

From that, one might assume that Tech is having a renaissance moment and that it’s banging out it’s highest growth ever.

To that, you would be mistaken.

Wall Street currently sees double digit revenue growth in 2025 and 2026 but that is far from anything transformational.

And it’s fair to say that Wall Street enthusiasm hasn’t exactly matched the massive increase in share prices. For example, over the last year aggregate 2024 revenue estimates for the sector are only up around 1%. 2025 estimates are up 13% but if you exclude Nvidia and one or two other big names from the equations it’s pretty much negligible.

Efficient Market Hypothesis nerds must be screaming at their monitors everyday.

In my very longwinded way, this is all to say that there is still a lot of air underneath a lot of these Tech valuations. Some of the big names have come down pretty heavily but there still could be a ways to go if valuations return to more historical levels.

The shift within Tech to more blue-chip, less sexy companies is also apparent. I mean, IBM has outperformed Nvidia by 25% in the last two weeks but hell hasn’t frozen over.

At Least GDP Didn’t Suck!

U.S. preliminary Q2 GDP posted a banger, coming in at +2.8% - well ahead of the 1.9% bogey the street was predicting. Higher consumption (+2.3% vs. estimates for +2.0%) helped but the beat was mostly driven by inventory building and government spending. So like ¯\_(ツ)_/¯

Joke Of The Day

The CEO of IKEA was elected Prime Minister in Sweden. He should have his cabinet together by the end of the weekend.

Hot Headlines

The Verge / OpenAI announces its search engine SearchGPT. Instead of just a plain list of links, the engine tries to makes sense of them and provide descriptions that try to better answer your query.

Reuters / Former President Trump to speak at upcoming Bitcoin 2024 conference. Trump and Republicans are trying to position themselves as ‘crypto friendly’ in an effort to attract defi enthusiasts. Marks a big pivot after Trump called Bitcoin a ‘scam’ in the past.

AP News / Talent mega union SAG-AFTRA announces strike for motion capture actors in video games. Moves comes after talks broke down over AI protections. Not sure if striking because you were worried about getting replaced by AI is gunna work out too well.

Bloomberg / Uber, Lyft, DoorDash prevail in California gig-worker ruling. The unanimous decision upholds California’s Proposition 22, which was the greatest overhang on these stocks as a poor verdict could have seen them paying millions of people who would now be classified as employees.

Barron’s / New fund by the hedgefund world’s biggest wiener, Bill Ackman, expected to close at a tenth of originally planned size. The proposed $25 billion closed-end fund is now expected to be in the $2.5 to $4.0 billion range according to letter to investors.

Trivia

Today’s trivia is on Silicon Valley.

Which company is known as the first successful startup in Silicon Valley?

a) Hewlett-Packard

b) Apple

c) Texas Instruments

d) Intel

Which company became the first trillion-dollar company?

a) Amazonb) Google

c) Microsoftd) Apple

Which company was originally called "BackRub"?

a) Facebook

b) Amazon

c) Google

d) Twitter

What year did Netflix start its streaming service?

a) 2005

b) 2007

c) 2009

d) 2011

(answers at bottom)

Market Movers

Winners!

Viking Therapeutics (VKTX) [+28.3%]: Announced VK2735 weight-loss drug to advance into Phase 3 from Phase 1; Q2 EPS ahead of consensus.

ServiceNow (NOW) [+13.4%]: Q2 results ahead; strength in cRPO (+22% y/y), better Q3 cRPO guidance (+22.5%), Now Assist momentum; some concerns about executive departures.

Pool Corp (POOL) [+10.0%]: Q2 EPS and revenue in line with preannouncement; reaffirmed FY24 EPS guidance; lower spending on discretionary products; stable demand in maintenance category; noted big short position in shares.

CBRE Group (CBRE) [+9.3%]: Core adjusted EPS and revenue beat; strength in Advisory and Global Workplace Solutions; raised FY core EPS guidance.

Masco (MAS) [+7.5%]: Q2 EPS slightly ahead of consensus with revenue in line; raised FY24 EPS guidance; gross and operating margins beat; expects operating margin expansion.

Nasdaq (NDAQ) [+7.2%]: Q2 earnings and revenue beat; solid progress on Adenza integration; positive on strong FinTech results.

Northrop Grumman (NOC) [+6.4%]: Q2 EPS and revenue beat; strength in Aeronautics; raised FY24 revenue guidance; positive on bookings and FCF despite cost concerns around Sentinel program.

Dover Corp (DOV) [+5.7%]: Q2 organic growth of +4.8% better than expected; raised FY guidance; positive on strong orders growth.

IBM (IBM) [+4.3%]: Q2 revenue ahead and EPS helped by better margin performance; strong software and AI-related bookings; consulting missed but not surprising.

Hasbro (HAS) [+3.5%]: Q2 revenue ahead and EBITDA beat with better GM performance; solid games and digital licensing performance; strong Wizards / Digital Gaming sales.

Keurig Dr Pepper (KDP) [+1.3%]: Q2 EPS and revenue in line; GM, OM ahead; net sales growth light; reaffirmed FY24 sales and EPS growth guidance.

Losers!

Edwards Lifesciences (EW) [-31.3%]: Q2 results below; TAVR revenue miss and lowered FY24 TAVR guidance; TAVR underperformance due to ramp in TMTT programs; multiple sell-side downgrades.

Ford Motor (F) [-18.4%]: Q2 EBIT and EPS missed big; focus on warranty headwinds related to quality issues; maintained FY EBIT guidance; analysts noted a raise was expected; positive on Pro segment.

West Pharmaceutical Services (WST) [-14.4%]: Q2 earnings, revenue, and margins missed; weak Proprietary Products segment; sales decline in generics; elevated customer destocking; cut FY EPS and revenue guidance; increased capex guide.

Teradyne (TER) [-13.4%]: Q2 results better; AI applications drove demand; growth in robotics business; 2024 as expected; Q3 sales and EPS guidance below.

LKQ Corp (LKQ) [-12.4%]: Q2 EPS, revenue, and FCF missed; lowered FY24 EPS and FCF guidance; lower repairable claims in North America and tough macroeconomic conditions in Europe; expects revenue headwinds to continue.

lululemon athletica (LULU) [-9.1%]: Downgraded to neutral from buy at Citi; credit card data points to further deceleration in Q2 versus Q1 in yoga and active apparel.

Align Technology (ALGN) [-7.7%]: Q2 earnings and margins better; revenue in line; Aligner revenues missed due to higher discounts, mix shift to lower ASP products; Q3 revenue guide below Street; lowered FY revenue-growth guidance; better GMs on some low-ASP products noted.

Warner Bros. Discovery (WBD) [-5.7%]: NBA to enter into long-term arrangement with Amazon after company’s latest proposal did not match Amazon's offer.

Honeywell International (HON) [-5.2%]: Q2 EPS and revenue beat; cut FY24 EPS guidance on weaker organic growth; segment margins negative; potential acquisitions to pressure earnings, margins noted.

Eli Lilly (LLY) [-4.5%]: GLP-1 makers including Lilly, Novo Nordisk weaker after Viking Therapeutics update on its weight loss drug advancing into Phase 3 development, adding competition in GLP-1 space.

New York Community Bancorp (NYCB) [-3.0%]: Q2 EPS, NII, and NIM missed; nonperforming loans and assets grew q/q; provision for credit losses $390M vs FS $197.2M.

Alphabet (GOOGL) [-3.1%]: OpenAI launching search tool called SearchGPT; initially rolling out to a limited group of users on Thursday.

Chipotle Mexican Grill (CMG) [-1.9%]: Q2 comp growth of +11.1% nearly 200 bp better than consensus; RLMs and EPS ahead; flagged brand marketing and return of Chicken Al Pastor; June comps at +6% and July similar; scrutiny on 2H margin guide.

Market Update

Trivia Answers

a) Hewlett-Packard is generally considered the first Silicon Valley start-up.

d) Apple was the first publicly traded company to reach a $1 trillion market cap.

c) Google - later renamed Alphabet - was first called ‘BackRub’ due to the search engine using backlinks to range pages.

b) Netflix started its streaming service in 2007.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.