🔬The Stock Market During Rate Cuts

Plus: Trump's $DJT Lock-up Is Ending; Canadian Rail Strike F***s Everything Up; and Much More!

"An investment in knowledge pays the best interest."

- Benjamin Franklin

"Life isn’t about finding yourself. Life is about creating yourself."

- George Bernard Shaw

Sucky day for the big US markets, with the S&P 500 -0.9% and Nasdaq -1.7%. Mostly a large-cap problem as S&P Equal Weight outperformed by 50bps.

3 of 11 sectors closed higher, led by Real Estate (+0.6%). Tech was worst at -2.1%.

Notable companies:

Peloton Interactive (PTON) [+35.4%]: Q4 EBITDA beat expectations with revenue ahead on Connected Fitness strength, but analysts remain cautious due to growing churn and declining revenues despite positive cost reduction progress.

Zoom Video (ZM) [+13.0%]: Strong FQ2 earnings and revenue beat, with improved FCF, but some concerns linger due to modest growth despite positive AI and Contact Center Business developments.

Urban Outfitters (URBN) [-9.6%]: Q2 EPS beat with revenue in line and strong gross margins, but comps missed, weak Q3 gross margin guidance, and slowing brand trends due to macro challenges.

More below in ‘Market Movers’.

Street Stories

The Stock Market During Rate Cuts

The odds of at least one rate cut coming out of the Fed’s meeting on September 17/18th is currently sitting at 100%. Any potential doubts about this seem to have been crushed on Tuesday with the release of the minutes from July’s meeting which all but spelled it out.

So now that this is officially going to happen - is that a good thing? I mean, of course anyone looking to get a mortgage will be better off. Companies with new or variable debt will pay less interest. And lots of other stuff will end up being cheaper, like car loans. But what about the stock market?

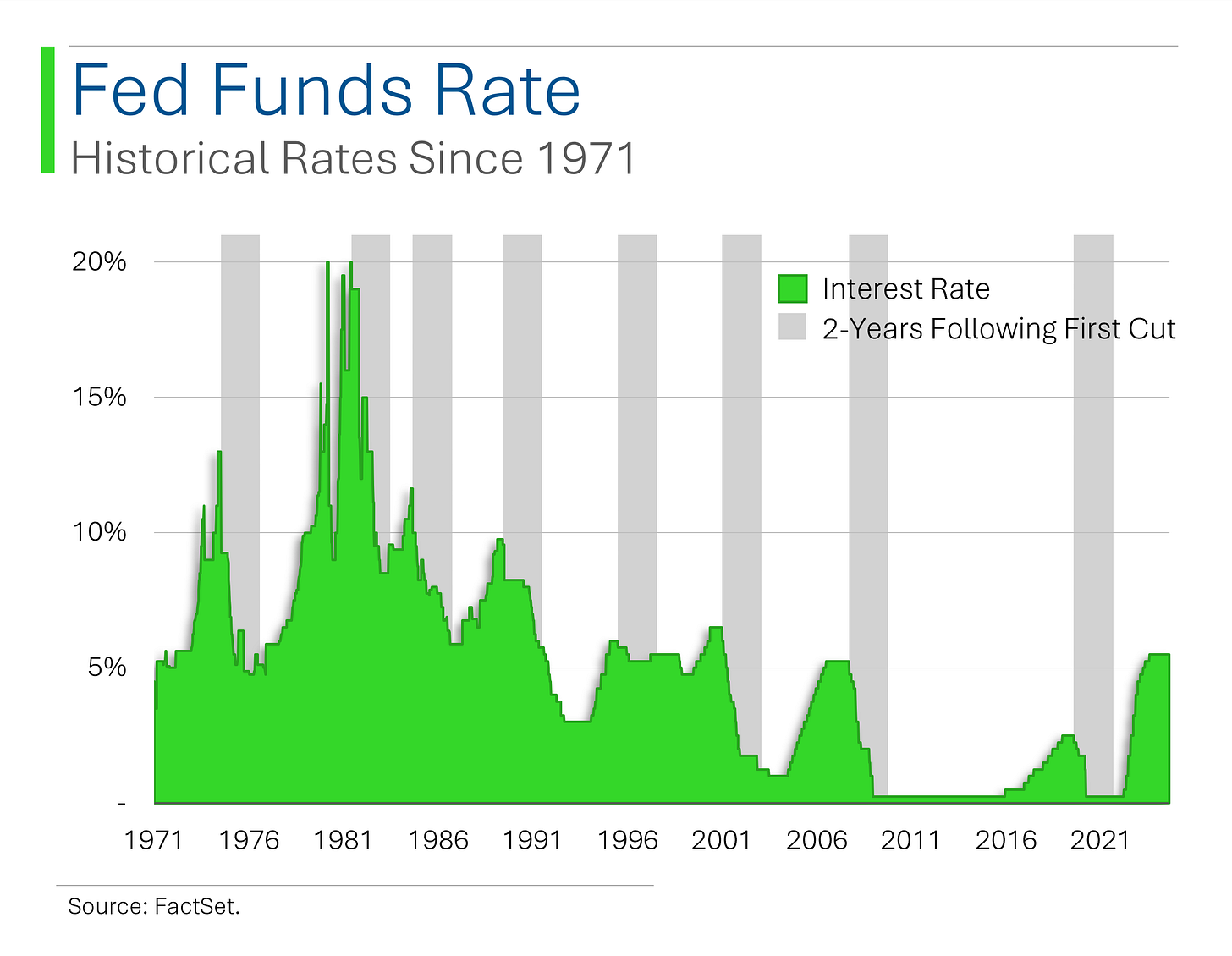

To check this out, I looked at historical periods of rate cutting. As you can see below, in the 70s/80s/90s there were a lot of head-fake rate cuts so I only included periods where rates were lower for at least two years.

Looking at things this way presents a bit of a mixed bag. For example, in 2001 and 2008, the world was in complete meltdown so few a basis-points here or there weren’t exactly life saving.

Other times, like 1996 or even the pandemic in 2020, rate cuts were able to help facilitate a soft landing and the market bounced back nicely.

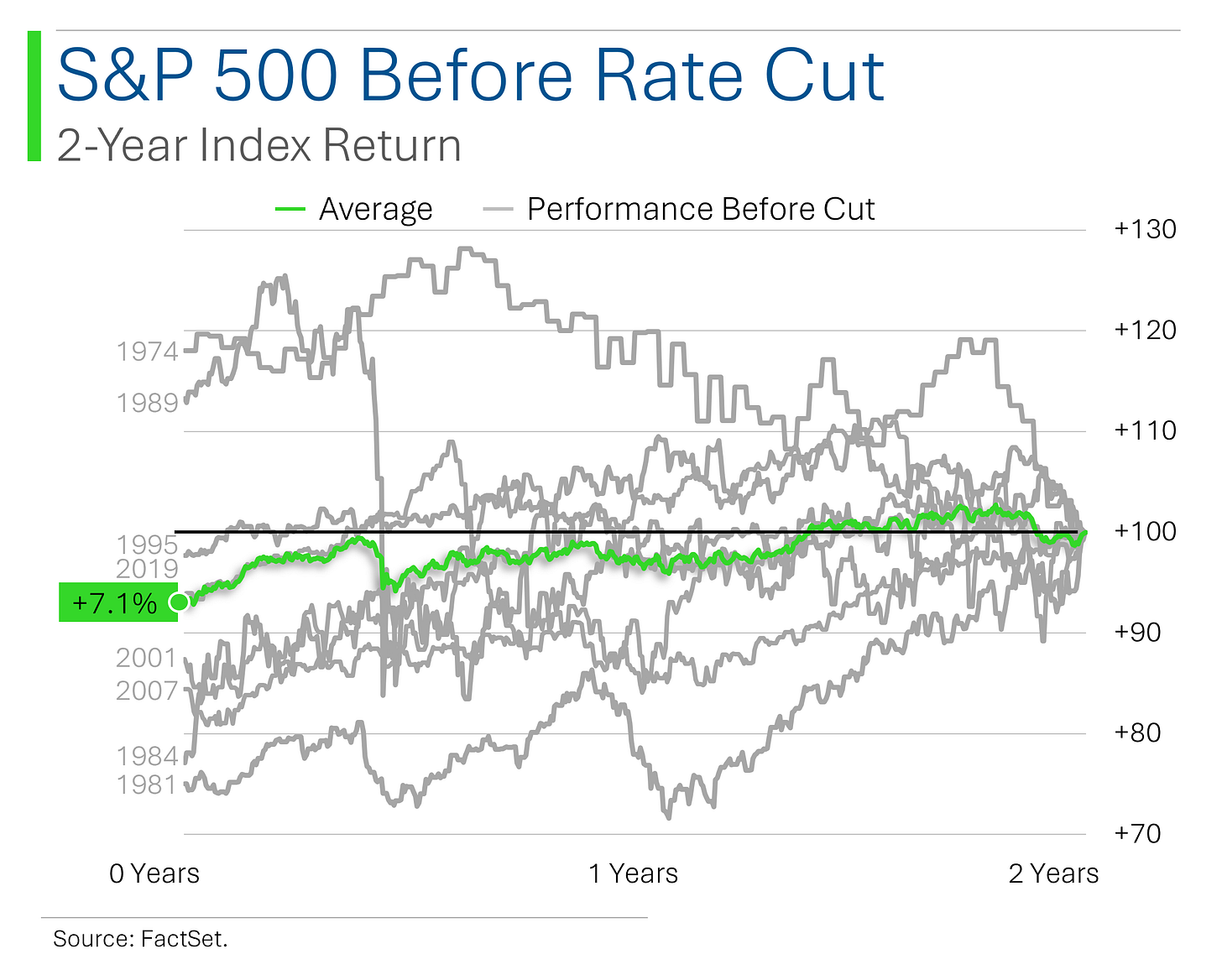

Looking at the eight proper rate-cutting periods we’ve been through since the early '70s, on a two-year basis the market has been positive five times (63%), but the result has averaged a pretty muted +4.3% (it’s +11.1% if you exclude the GFC in 2007).

Decent, but well below the S&P’s annual average at around 10% per year.

This also comes in well below the two-year average heading into a rate cut at +7.1%.

So while the start of rate cuts will undoubtedly have some positive impact in supporting a soft landing, I think it’s a bit too presumptuous to assume that the market will be business as usual. Especially when you consider we are only 1.7% away from the S&P 500’s all-time high…

Trump's $2.6 Billion Dilemma

Donald Trump is just weeks away from potentially cashing in on his $2.6 billion stake in Trump Media & Technology Group Corp., with the lockup period ending on September 20. Trump hasn’t revealed any plans to sell his 60% share, but doing so could help cover his over $500 million in legal bills.

However, dumping a significant portion of his holdings could tank the stock, which has already dropped nearly 72% from its peak to $22.24 per share.

With the potential to walk away with billions—or watch the value plummet—the question remains: will Trump cash out, or hold on?

Canada Derailed

Canada’s two major railroads have just locked out over 9,000 employees, setting the stage for a labour showdown that could derail $730 million in daily trade and wreak havoc on North American supply chains.

With no government intervention in sight, businesses are bracing for impact as negotiations stall. Is this where Trudeau makes his stand?

Only time will tell if he forces the parties involved into binding arbitration.

The Western Grain Elevator Association warns of $36 million in daily losses, while chemical producers fret over dwindling chlorine supplies. As both sides dig in, the question is: how long before Canada’s economy—and its rail-dependent industries—grind to a halt? (fought so hard no to say ‘de-railed’)

Joke Of The Day

My boss said “dress for the job you want, not for the job you have.”

So I went in as Batman.

Hot Headlines

CNBC / Paramount special committee extends Skydance ‘go shop’ period as it reviews Bronfman offer. It looks like Paramount isn’t ready to settle down just yet—they’ve extended their "go shop" period by 15 days, giving themselves more time to weigh a competing offer from Edgar Bronfman Jr…Apparently, shopping for a new owner is as complicated as it sounds.

CNBC / Peloton shares rise 35% as turnaround plan takes hold, losses shrink. Peloton beat on revenue by a slight margin…growing only 0.2% over last year and even moreso, they weakened their subscription forecast - but apparently this showed the market all it needed to see.

Reuters / Venezuela's top court ratifies Maduro election win as government tightens control. Venezuela’s Supreme Court just gave Maduro’s election win the thumbs-up, sealing the deal like a final round in a heavyweight title match. Meanwhile, the opposition’s out there saying this is less about governance and more about keeping the referee firmly in the ruling party’s corner…mind you, they did turn down an offer to hold a reelection.

CNBC / A gold bar is now worth $1 million. Gold has once again proved its ‘anti-fragility’ as Nassim Taleb coined. Furthermore, this just gave the gold bugs a couple more decades of lifeline.

CNBC / FDA approves updated Pfizer, Moderna Covid vaccines as virus surges; shots to be available within days. The new jabs are taking aim at the latest pesky strain, KP.2 - a chip off the old omicron block.

Trivia

Today’s trivia is on trade between Canada and the US - the one of the biggest in the world!

What is the largest category of Canadian exports to the United States?

A) Automobiles

B) Oil and Gas

C) Lumber

D) MachineryWhich sector represents the largest portion of U.S. exports to Canada?

A) Agricultural products

B) Electronics

C) Automotive

D) PharmaceuticalsApproximately what percentage of Canada's total exports are destined for the United States?

A) 50%

B) 60%

C) 70%

D) 75%Which of the following is the most significant agricultural product that Canada exports to the United States?

A) Wheat

B) Canola Oil

C) Beef

D) Maple Syrup

(answers at bottom)

Market Movers

Winners!

Peloton Interactive (PTON) [+35.4%]: Q4 EBITDA beat expectations with revenue ahead on Connected Fitness strength, but analysts remain cautious due to growing churn and declining revenues despite positive cost reduction progress.

Zoom Video (ZM) [+13.0%]: Strong FQ2 earnings and revenue beat, with improved FCF, but some concerns linger due to modest growth despite positive AI and Contact Center Business developments.

Crocs (CROX) [+1.0%]: Upgraded to buy from hold as the announcement of Sydney Sweeney as a global ambassador for HEYDUDE is expected to attract younger customers and boost brand visibility.

Losers!

Advance Auto Parts (AAP) [-17.5%]: Q2 earnings and operating margin missed while revenue was in line, margin pressures noted, FY guidance cut, and selling Worldpac for ~$1.5B to streamline focus and improve the balance sheet.

Snowflake (SNOW) [-14.7%]: FQ2 revenue and operating income beat but guidance for product revenue deceleration in the back half of the year raised concerns, despite positive signs in cloud optimization trends.

Urban Outfitters (URBN) [-9.6%]: Q2 EPS beat with revenue in line and strong gross margins, but comps missed, weak Q3 gross margin guidance, and slowing brand trends due to macro challenges.

Williams-Sonoma (WSM) [-9.2%]: Q2 earnings and margins beat expectations, but revenue fell slightly short; comps missed, leading to a cut in FY revenue guidance despite improving operating margin guidance.

Viking Holdings (VIK) [-8.9%]: Q2 adj EBITDA beat on pricing and cost management, though deceleration in 2025 bookings raised concerns despite steady demand.

BJ's Wholesale Club (BJ) [-6.8%]: Q2 EPS, EBITDA, and revenue beat, with comps ahead, but analysts cautious about near-term margin outlook despite positive merchandise margins and membership fee growth.

Wolfspeed (WOLF) [-5.1%]: FQ4 earnings and revenue missed expectations, with next-Q EPS guidance below consensus, although $200M FY25 capex reduction was announced.

Baidu (BIDU) [-4.4%]: Q2 EPADS and EBITDA beat expectations, but revenue missed; analysts noted better-than-feared online marketing revenue and strong AI Cloud trends, but investment spending remains a concern.

Market Update

Trivia Answers

B) Oil and Gas is the largest category of Canadian exports to the United States.

C) The Automotive sector represents the largest portion of U.S. exports to Canada.

D) Approximately 75% of Canada's total exports are destined for the United States.

B) Beef is the most significant agricultural product that Canada exports to the United States.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Can this Paramount situation take any more turns and re-evaluations? Man o man