🔬 The Small-Cap Rally is (Finally) a Thing

Plus: consumer sentiment holds steady; Icahn schemes his way onto ailing JetBlue board; Capital One hopes to join the big kids with Discover acquisition; and much more

"A plan without action is not a plan. It’s a speech"

- T. Boone Pickens

“Debt means you had more fun than you were supposed to”

- Greg Fitzsimmons

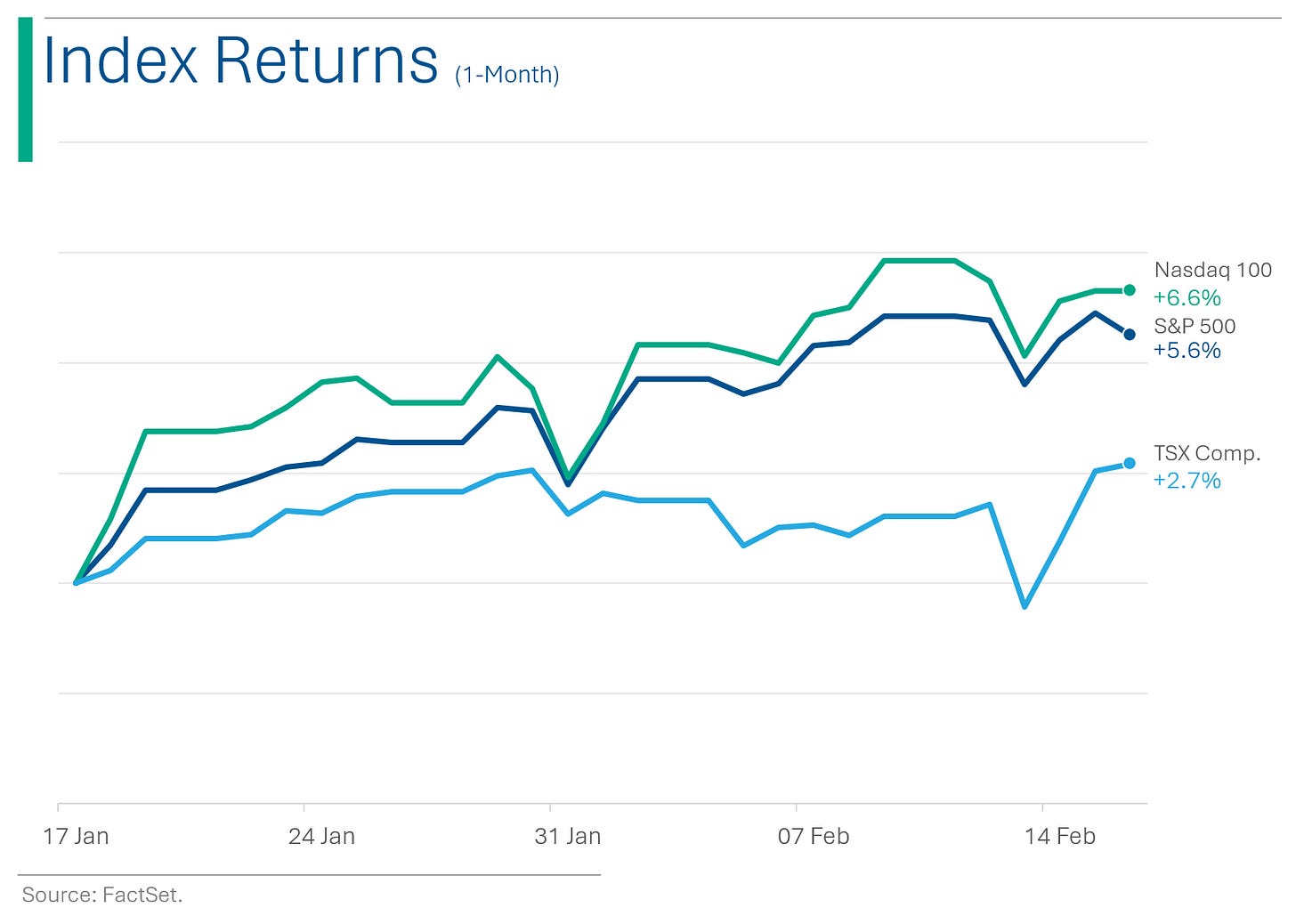

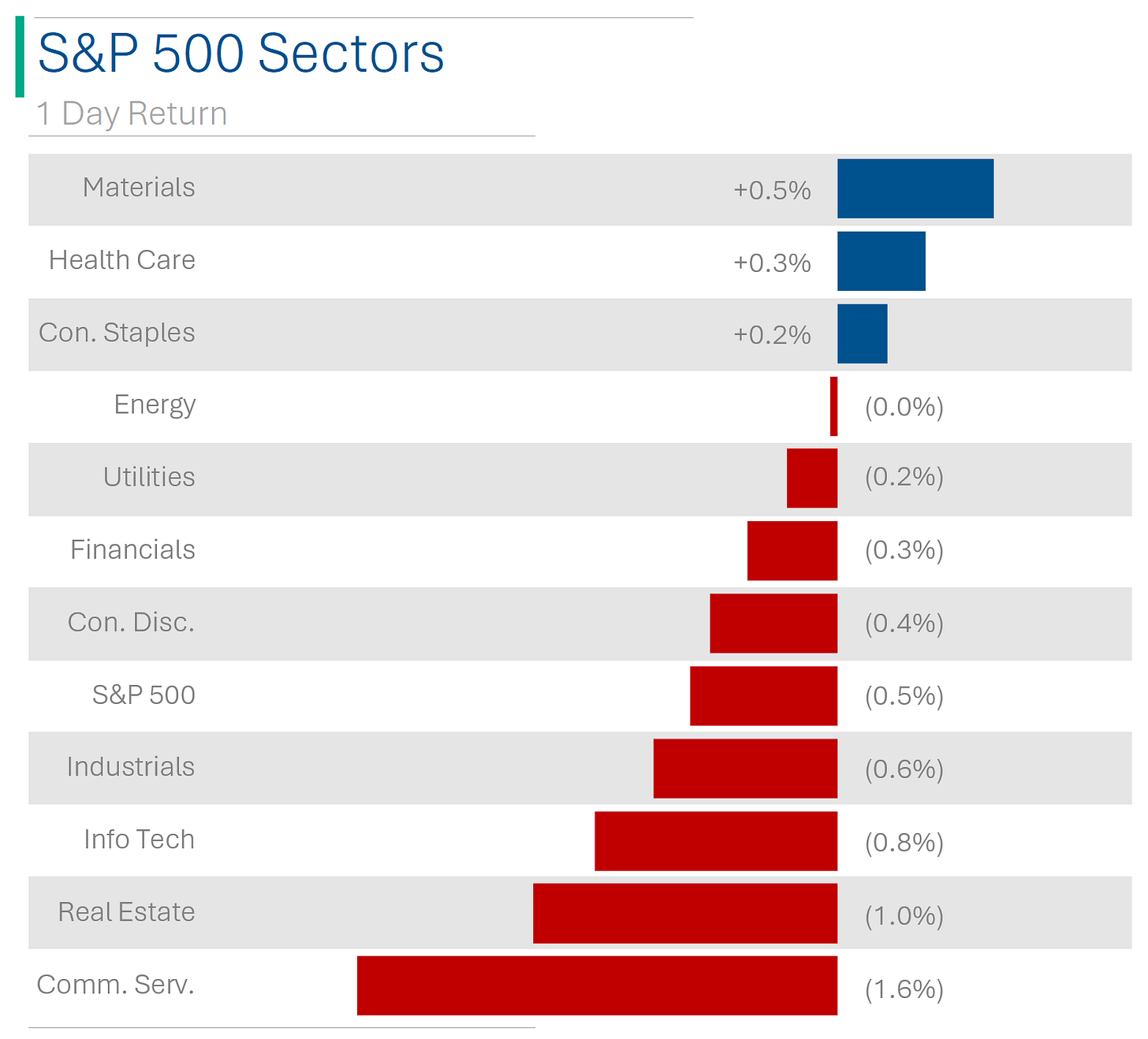

The big US markets ended Friday weaker with S&P 500 down 0.5% and Nasdaq down 0.82%. On the week, the S&P 500 was -0.4% and the Nasdaq -1.3%.

Only 3 of 11 sectors finished Friday positive, led by Materials (+0.5%). While techy Communication Services (-1.6%) and Real Estate (-1.0%) were the weakest.

January headline Producer Price Index (PPI) came in +0.3% m/m, above consensus for +0.1%, while Core PPI up +0.5%, well above 0.15% consensus. (inflation = bad)

Capital One launches a $35 billion offer for Discover in potential credit card shake-up. While sucky Q4 reporting from Roku (-24%) , DropBox (-23%), Yelp (-14%), and DoorDash (-8%) was the story of the day. (details in ‘Market Movers’ below)

Street Stories

Small-Caps Rally

A few months ago I did a bit of a deep-dive on Small-Caps, particularly the S&P 600, and was surprised by something: They were all old. The average age of a company in the small-cap index was 50*, whereas I had assumed there would be a much higher composition of punchy, young upstarts, raring for a chance to make it to the big leagues (the S&P 500). Instead, the answer was that they were mostly low growth journeymen, floating around the minor leagues to pay child support.

*In my original note I say that it was 40 - because I can’t count/sometimes I write this note after a few marg’s.

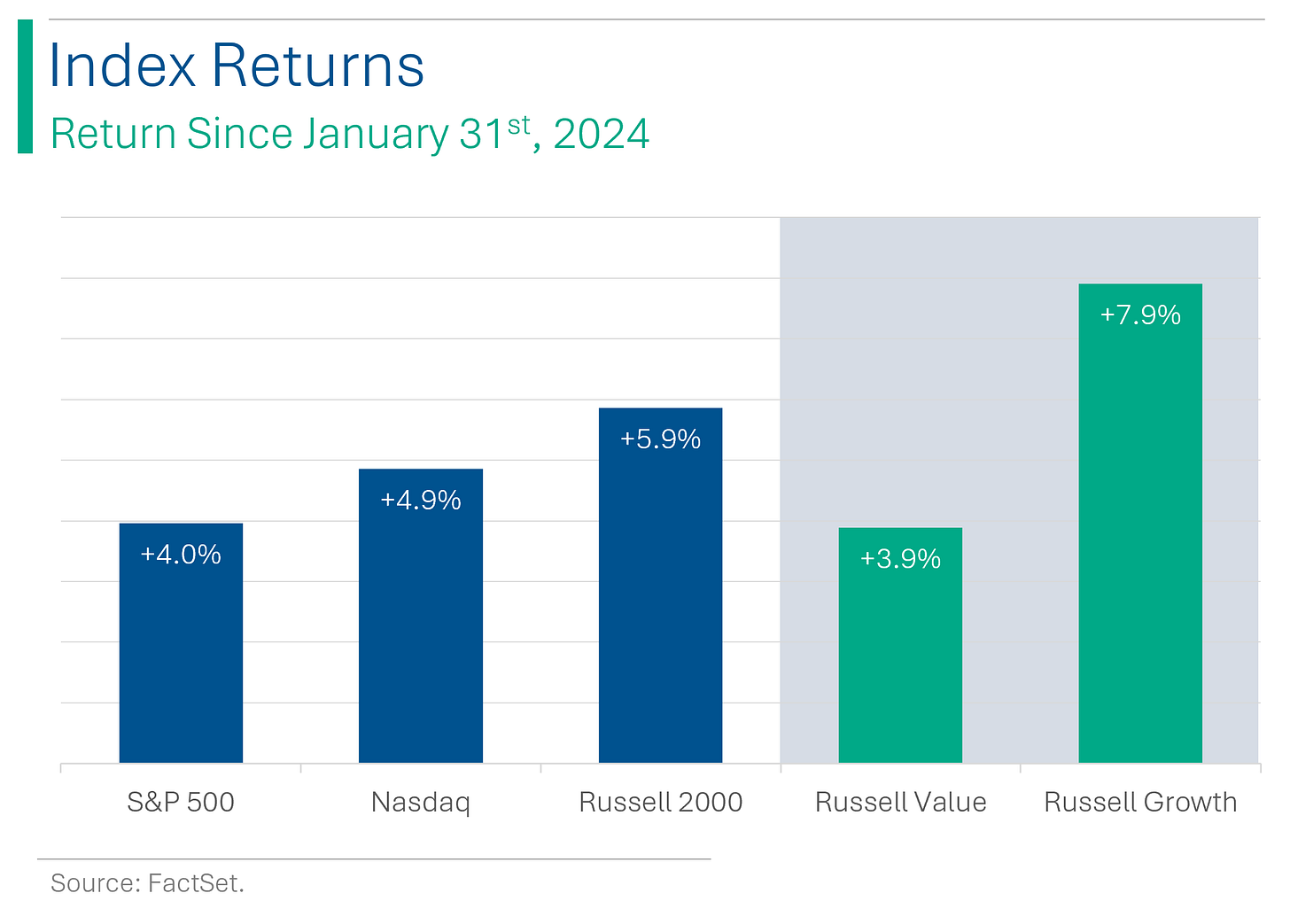

I bring this up, because we’ve actually started to see a bit of a rally form in Small-cap Land. Since January 31st, the Russell 2000 is up nearly 6% - almost 50% more than the S&P 500. What stood out to me, though, was that it was being pulled up by the ‘growthy’ side of the Russell…which I had previously doubted existed.

For those that have been following the more punchy side of the market, the Russell doing well was actually a bit of a story towards the end of last year, when it briefly went on steroids (before sorta being bla again).

So why the outperformance? Well, most of that can probably be chalked up to two factors: 1) Minor rotation away from companies that have outperformed; and 2) Less fear that smaller companies will get smacked by an economic downturn/high interest rates.

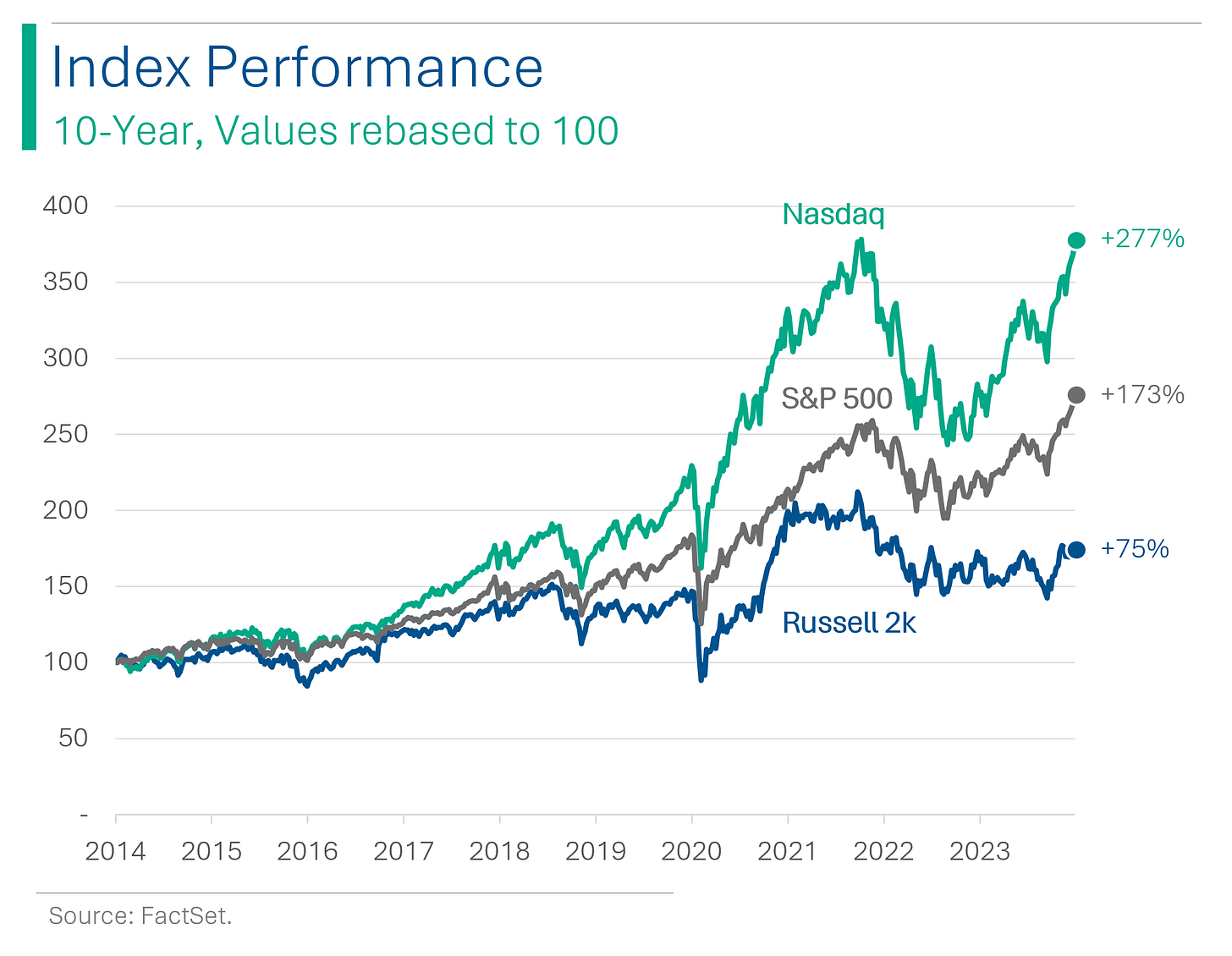

Firstly, since the start of 2023 the S&P 500 and Nasdaq are up 31% and 51% respectively. While some of the big stories (I’m looking at you, AI Hypetrain) still seem to be attracting a lot of love, some names might be getting long in the tooth and investors are looking around for better bargains. For context, the Russell is only up 17% since the start of 2023.

Secondly, the ‘Peak Fed’ narrative (the idea that the US is through with rate hikes and we can start looking forward to more relaxed interest rates) powered the big rally at the end of last year, in combination with the fact that the US economy has remained quite strong. As I’ve written about previously in ‘The Smaller They Are, The Harder They Fall’, Small-caps get hurt the most during periods of high interest rates or economic downturns (explainer below). As high interest rate and economic worries have cooled dramatically over the last few months, it makes sense that the greatest beneficiaries of this are the Small-caps (outside of AI, that is).

To conclude, this isn’t meant as a mea culpa, as I still see more long-term growth and higher returns in the S&P 500 and Nasdaq. While all the boilerplate script on mutual fund documents state, ‘past performance may not be indicative of future returns’; given the composition of quality, high growth companies that have grown beyond the Russell, I’d rather take my chances on them. Although the Russell 2000 Growth Index does look pretty enticing.

Explainer: Why Small-caps get hurt more during high interest rates and economic slowdowns. While not a definitive list, the below are some of the reasons:

Liquidity Risk - small companies aren’t as actively traded and have fewer shares, so an investor’s ability to enter or exit a position is often trickier than it is with large caps. For larger investors, exiting a small-cap position quickly can move the price dramatically as finding buyers is more difficult. So if you smell a downturn coming, it behooves you to move on the weaklings first.

Recession Risk - there is evidence that smaller companies are more at risk during economic downturns. An example might be that if you have a massive contract with Tesla that represents most of your sales and they don’t pay you; well, you might give them some leniency since you need the business. Meanwhile, if a small owner-operator can’t pay, you will send them into bankruptcy and have their car repossessed.

Inflation Risk - smaller companies tend to have less dominant market positions. On the buying front, they tend to be ‘price takers’ vs. ‘price setters’. On the selling front, they tend to have more difficulty passing on price increases to customers.

Credit Risk - typically, small companies have higher rates for raising capital - both debt (loans, bonds, etc.) and equity (shares) - due to their higher risk profiles (see 2 and 3).

The Optimist's Economy: Where Consumer Sentiment Learns to Fly

In February, the University of Michigan's preliminary consumer sentiment index showed a slight increase to 79.6 from January's 79, albeit a bit shy of Wall Street’s estimate for 80, marking a modest rise and reflecting ongoing consumer optimism about the economy and expectations of continued inflation slowdown and labor market strength. However, inflation expectations for the coming year edged up to 3.0% from 2.9%, amidst a 3.1% annual inflation rate in January, slightly higher than anticipated and indicating the Federal Reserve's challenges in achieving its 2% inflation target.

Icahn Gets JetBlue Board Seats

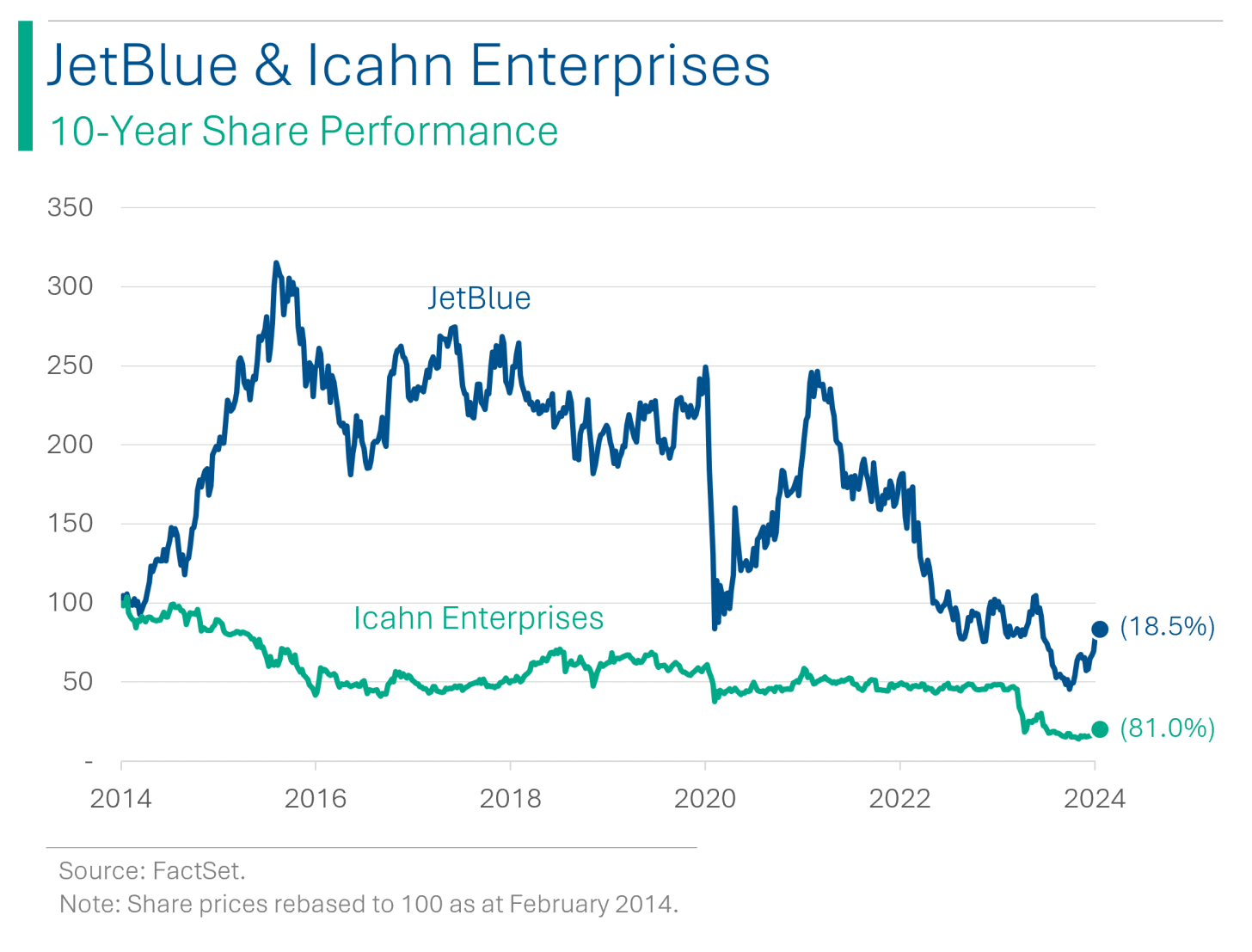

Last Monday I noted that activist/financial pariah Carl Icahn has added a 9.9% position in struggling regional carrier, JetBlue. Unlike his attack on Disney, where so far it’s looks unlikely that he will get the Board representation he’s been fighting CEO Bob Iger for, JetBlue apparently capitulated rather quickly. On Friday, the company announced that Icahn Enterprises representatives will be given two Board seats; specifically to Jesse Lynn, Icahn Enterprises’ General Counsel, and Steven Miller, a portfolio manager at Icahn Capital. Worth noting that neither of these individuals appear to have any experience in the aviation space, but Icahn hasn’t ever really been known for actually fixing anything. His stock price included.

Credit Where Credit's Due: Capital One To Acquire Discover

Capital One Financial is set to acquire Discover Financial Services in a landmark $35.3 billion all-stock transaction, offering Discover shareholders a 26% premium over its last closing price. The merger is expected to close between late 2024 and early 2025, resulting in a combined entity where Capital One and Discover shareholders will own 60% and 40% respectively. This strategic move aims to bolster Capital One's credit card and deposit offerings, and could potentially be the largest deal in financial services since Bank of America picked up Merrill Lynch during the Financial Crisis for $50 billion. Capital one is currently the fourth largest player in the U.S. credit card market by volume, while Discover is the sixth.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

My stockbroker and I are working on a retirement plan. Unfortunately, it’s his.

An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.

Hot Headlines

WSJ | In between court appearances and a presidential campaign, Donald Trump found the time to launch a new sneaker line. The $399 gilded high top is set to be the highest selling presidential shoes since Reagan’s ‘Trickle Down’ low tops.

Reuters | UK property prices show first annual rise since August. Data shows prices up +0.1% compared to last year, just as the UK economy enters technical recession.

Politico | EU to fine Apple €500M over music streaming. Rumored suit by the European Commision would be the first by the organization and follows similar ‘anti-steering’ pushback the company has faced following the Spotify complaint in 2019.

Bloomberg | Ukraine’s allies are gaming out a world in which the US retreats. European leaders met in Munich to discuss Russia strategy as stalled US aid package to Ukraine ignites concerns over expanded Russian aggression without Congressional support.

Reuters | China's travel spending during Lunar New Year holidays beats pre-COVID levels. Small positive from the worrisome Chinese economic situation as 47.3% increase from last year surpassed 2019 levels.

Trivia

This week’s trivia is on financial dynasties. Today’s is on the Medici.

The famous Medici banking dynasty originated from and for 300 years were de facto rulers of which Italian city?

A) Milan

B) Genoa

C) Florence

D) CapuaIn addition to effectively ruling [one of the above cities], the Medici produced two Queens’ of France, and how many Popes?

A) 1

B) 2

C) 3

D) 4Nicknamed ‘the Magnificent’, this Medici patriarch played a vital role in fostering the Renaissance, including patronages of Brunelleschi, Da Vinci, Donatello, Michelangelo:

A) Cosimo I de' Medici

B) Lorenzo de' Medici

C) Giovanni di Bicci de' Medici

D) Ferdinando II de' Medici(Yup, that’s three of the four Ninja Turtles. Raphael (the fourth) was also commissioned by Giulio de' Medici, the future Pope Clement VII)

(answers at bottom)

Market Movers

Winners!

Trade Desk (TTD) [+17.5%]: Q4 revenues and EBITDA beat, with EPS matching expectations. Q1 forecasts surpass expectations, driven by CTV growth. Announced a $700M share buyback and reduced concerns over Amazon Prime Video ads.

Shockwave Medical (SWAV) [+11.2%]: Surpassed Q4 earnings and revenue, driven by US peripheral business and improved international performance, despite slow China IVL adoption. FY24 revenue guidance meets consensus.

Coinbase (COIN) [+8.8%]: Beat Q4 adjusted EBITDA and revenue, with transaction revenue and trading volumes topping consensus. Upgraded by KBW, though some concern over transaction mix.

Sarepta Therapeutics (SRPT) [+7.8%]: FDA accepted the efficacy supplement for ELEVIDYS, filing it with the Biologics License Application.

Applied Materials (AMAT) [+6.4%]: Fiscal Q1 and Q2 outlook surpassed expectations, highlighting China DRAM strength and industry recovery. Expects to continue outperforming despite potential China market normalization.

Vulcan Materials (VMC) [+5.2%]: Q4 adjusted EBITDA beat, revenue as expected. Aggregates shipments and Asphalt Mix performed well. FY24 guidance encompasses consensus, with positive pricing environment and Aggregates segment profit improvement anticipated.

Losers!

Roku (ROKU) [-23.8%]: Despite better Q4 results and positive Q1 guidance, concerns include modest beat magnitude, weak platform revenue growth forecast, limited margin expansion, and 2024 marked as an investment year with uneven ad market recovery.

Dropbox (DBX) [-22.9%]: Q4 earnings and revenue slightly better, but FCF, paid users, and ARR fell short of expectations. FY24 outlook disappoints, leading to multiple downgrades amid ARR deceleration, weak net adds, mixed execution, and cautious customer spending.

Bloom Energy (BE) [-17.5%]: Missed Q4 EPS and revenue, with weaker FY24 revenue guidance, largely due to delayed Korea orders. EBITDA margins also fell short, with the CFO planning to leave. Analysts remain cautious due to near-term uncertainties despite long-term demand.

Yelp (YELP) [-14.4%]: Q4 revenue matched forecasts, EPS slightly missed, with Q1 and FY24 revenue projections below consensus. Macro pressures lead to weakness across categories, with expected revenue growth deceleration and margin contraction.

Opendoor Technologies (OPEN) [-10.5%]: Q4 earnings and revenue exceeded expectations; however, Q1 guidance falls short. Analysts express caution over the postponed breakeven sales volume target and increased advertising spend.

Carvana (CVNA) [-8.9%]: Downgraded due to valuation concerns and investor hesitancy, moving from market perform to underperform at Raymond James.

DoorDash (DASH) [-8.1%]: Q4 GOV and EBITDA outperformed expectations, but the upside was less than anticipated. Concerns include increased investments in new verticals and higher marketing costs in a competitive environment, though demand and market share gains are positives.

Block, Inc. (SQ) [-5.5%]: Under investigation following whistleblower allegations about insufficient customer identification policies in its Cash App, according to NBC reports.

Nike (NKE) [-2.4%]: Reports of CEO Donohoe announcing layoffs of about 2% of employees, starting today through May. Downgraded to perform from outperform at Oppenheimer due to inconsistent customer demand and innovation lulls.

Market Update

Trivia Answers

C) The Medici came to power in Florence.

D) Medici family members produced 4 Popes.

B) Lorenzo de' Medici.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.