🔬The S&P 500's Changed: 20 Year Composition Shift

Plus: Fiddy Beeps (the Fed cut); and much more!

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."

- Warren Buffett

“I like long walks, especially when they are taken by people who annoy me.”

- Fred Allen

Markets Overview: US equities closed mostly lower after volatile post-FOMC trading, with defensive sectors like utilities and staples underperforming, while small caps and sectors like machinery and regional banks outperformed. Treasuries weakened, the dollar rose slightly, and gold and Bitcoin posted modest gains.

Fed Policy Shift: The Fed made good on its loosening rhetoric with 50 bp rate cut, pushing rates to 4.75-5.00%, with one dissent in favor of a smaller cut. Despite signs of economic progress, concerns about inflation and unemployment remain, with Powell emphasizing the Fed’s commitment to staying ahead of inflation risks.

Corporate Updates: Notable news included a positive revenue beat from General Mills despite weak growth in its foodservice division, a potential $30B AI fund from BlackRock and Microsoft, and WillScot and McGrath canceling their merger due to regulatory hurdles. Elliott continues to push for leadership changes at Southwest Airlines.

Notable companies:

Intuitive Machines (LUNR) [+38.3%]: Won a NASA contract worth up to $4.82 billion to support their Near Space Network.

ResMed (RMD) [-5.1%]: Wolfe Research downgraded them, warning that Lilly's new sleep apnea treatment could disrupt their patient base.

Bausch + Lomb (BLCO) [+7.8%]: Private equity firms like Blackstone, Advent International, and TPG Capital are reportedly considering bidding on the company.

Street Stories

The S&P 500's Changed: 20 Year Composition Shift

20 years ago ‘Lean Back’ by Terror Squad topped the Billboard Hot 100, the cool kids had Motorola Razrs, and my hair was recovering from years of frosted tips. A lot has changed.

And the S&P 500 has changed a lot too.

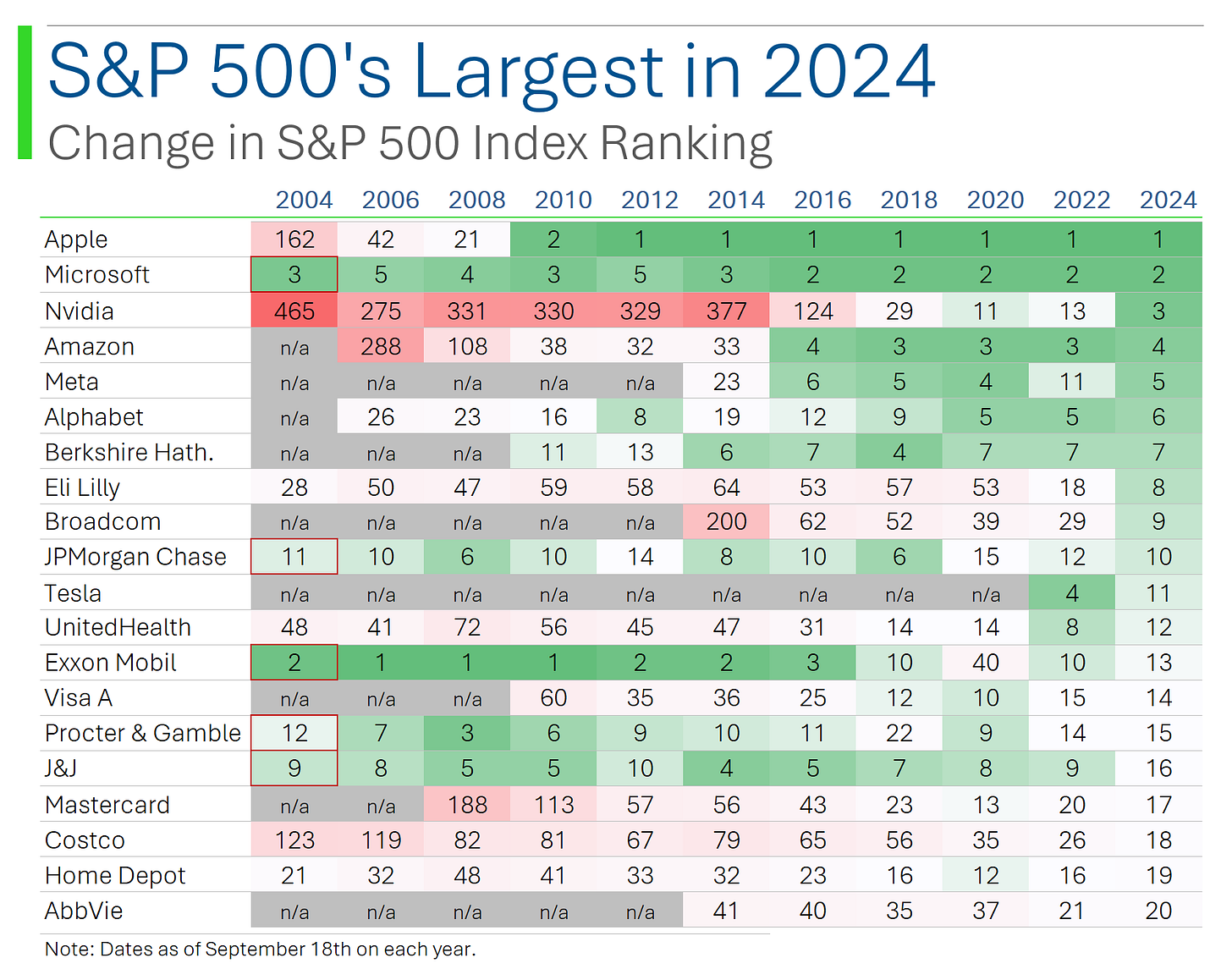

For starters, of the 20 largest companies in the index back in September 2004, only 5 are still in the Top 20 and only Microsoft is left in the Top 10. In fact the average company in the Top 20 in 2004 currently sits at 47th place. Yuck!

Hell, Dell has gone private; IPO’d again; and is actually joining the S&P 500 next week. Clearly a lot has changed.

Of the companies that currently reign over the S&P, 9 of them weren’t in the S&P 500 back in 2004 and 5 weren’t even publicly traded. I mean, Nvidia was a boring graphics card company only nerds knew about.

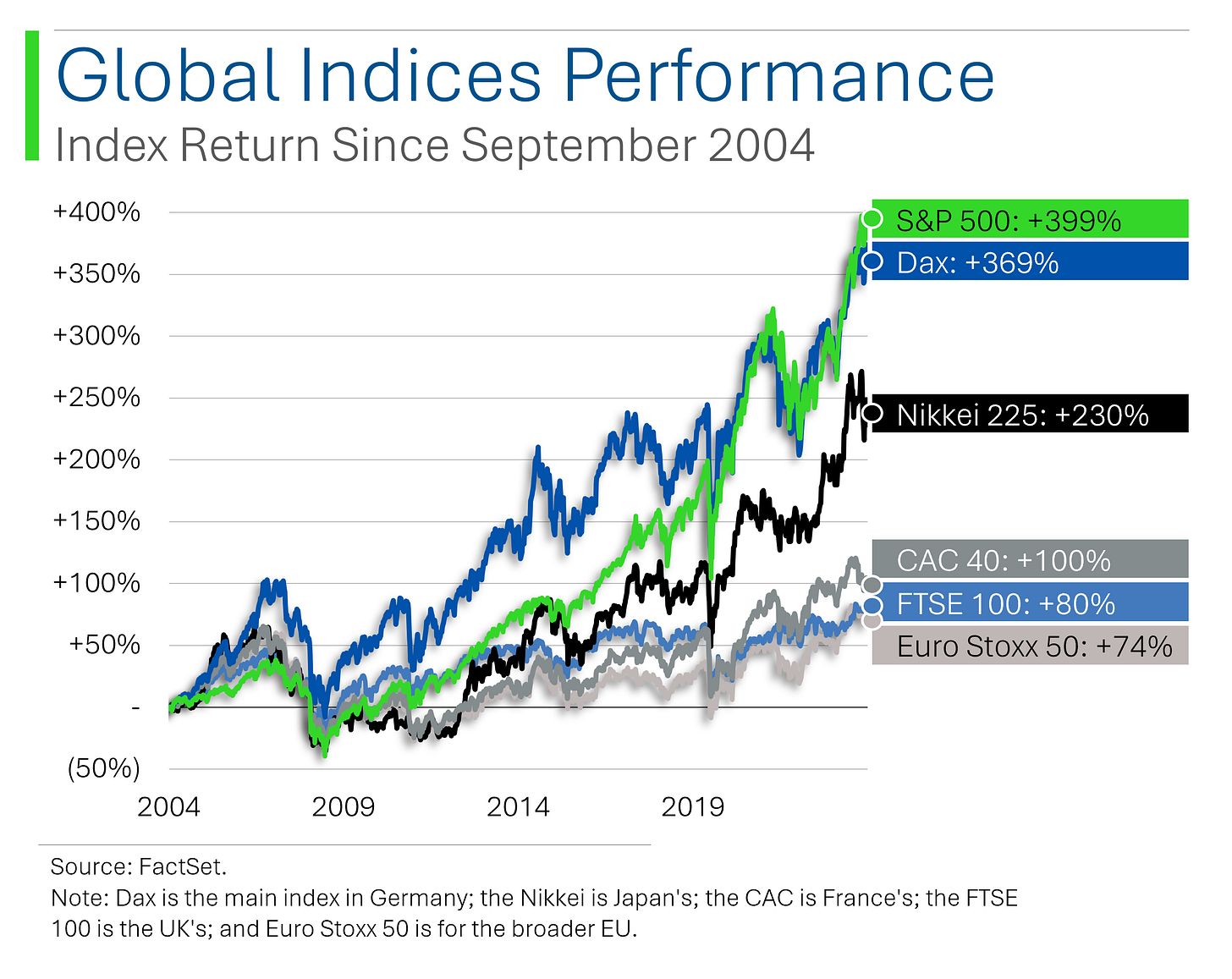

The ones that were trading have had an impressive ride though, with the average company +10,287% since 2004. The S&P 500 was only +399% since then. And what about the Top 20 back in 2004 (ex-Dell)? Well, they’ve only managed a paltry +201%. Embarrassing really…

Today’s Top 20 is much more distinguished than it’s awkward, low-Tech, highly cyclical younger self.

The growth of the S&P 500 has also been incredible. Only the German Dax has come close to matching it amongst the developed nations.

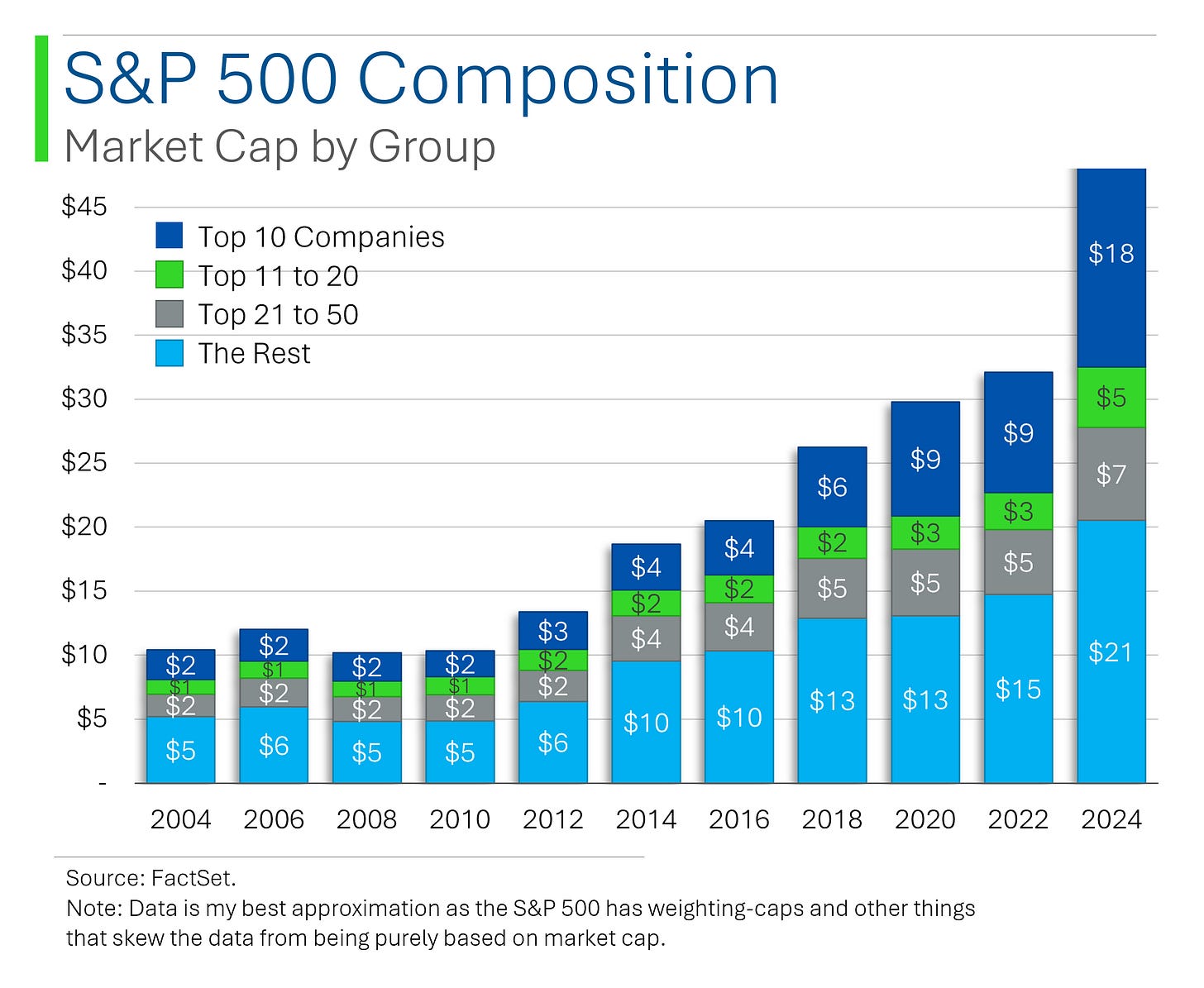

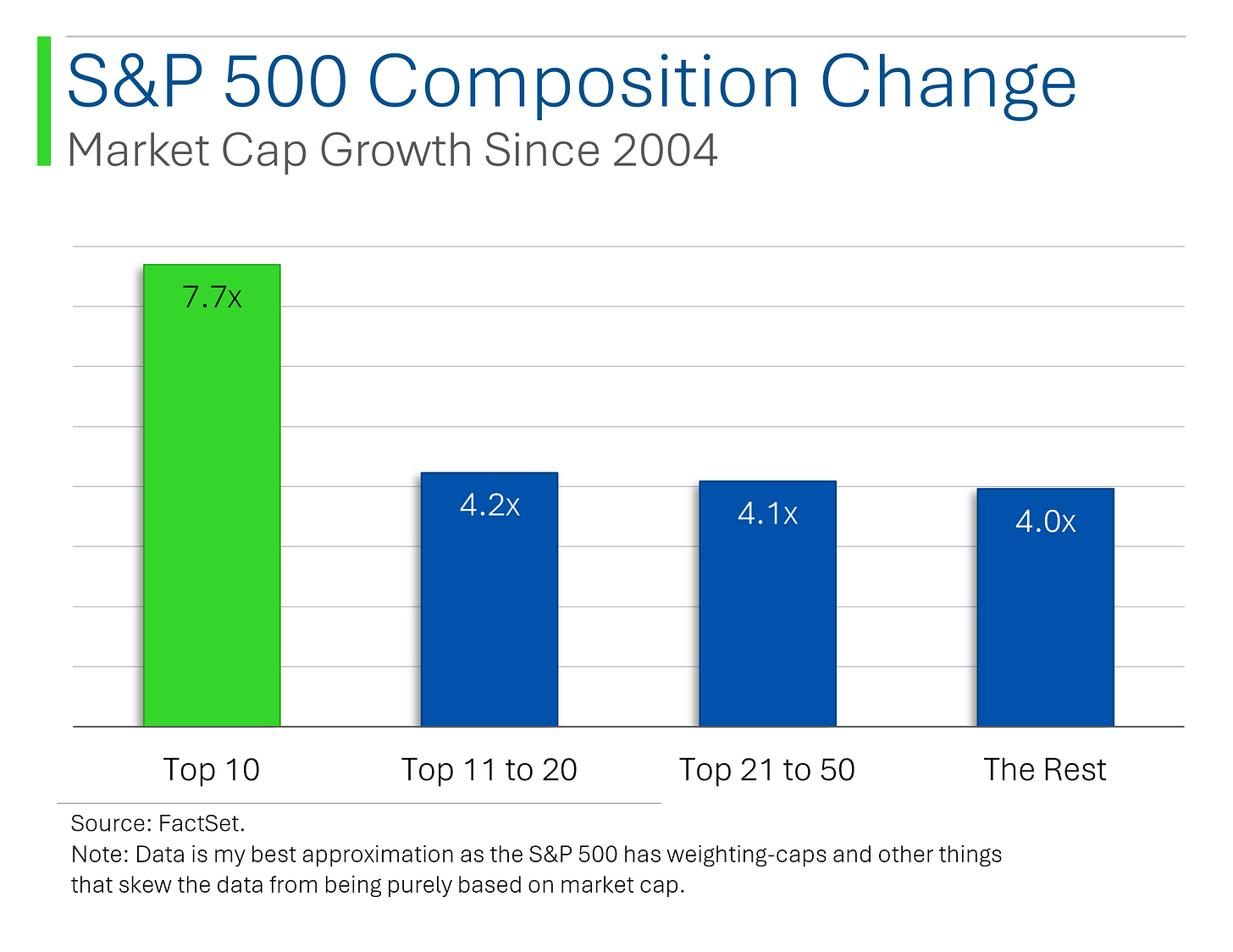

Market caps across the different buckets of the S&P has shown significant growth but the proportion of the index covered by the 10 largest companies has been gargantuan (so rarely get to use that in a sentence).

For example, since 2004 the cumulative market cap covered by the biggest 10 companies has increased by 7.7x (+770%) while the bottom 450 companies has only increased by 4.0x.

This has had effect of making the index rather top heavy. For example, the Top 10 companies current have the same market cap ($17.9 trillion) as the bottom 434 companies.

Back in 2004 the Top 10 only represented around 22% of the Index - now it’s ballooned to 35%.

I have to say I was surprised by the lack of staying power of the Top 10 from 2004, which is probably a good reminder that no company can remain a growth machine forever: Eventually they all enter that ‘mature growth’ phase, waiting to get passed by the next hot new growth stock.

Time waits for no man - or Delaware incorporated limited liability corporation.

(Ok, maybe Nvidia)

‘Fiddy Beeps’

Yesterday the Fed did their first interest rate cut since the pandemic, taking the top band of the Federal Funds Rate from 5.50% to 5.00%.

Now, this was Wall Street’s base-case, with the swaps market implying about a ~70% chance of a 50 basis point (or fiddy beeps if you’re cool) cut. Despite that, much of the media has latched onto the idea that this was big cut and well above historical precedent.

And they’d be wrong.

Sure, the ‘70s and ‘80s were the wild West of rate moves but in the three rate cutting cycles we’ve been in this millennium, two of them (2001, 2007) started with 50 basis point cuts.

In fact, if you consider the 2019 cuts - which started due to some languishing growth - as separate from the cut (singular) that occurred in March 2020 due to the pandemic, then three of the four cutting cycles (75%) since 2000 have started with fiddy beep cuts.

Not exactly ‘first edition Charizard’ rare.

Joke Of The Day

Why didn’t Han Solo enjoy his steak dinner? It was Chewie.

Hot Headlines

Reuters / Israel reported to have planted explosives in 5k Hezbollah pagers. These explosives are reported to have led to 20 deaths and over 450 injuries.

CNBC / Novartis not joining the ‘frenzy’ of weight loss drugs, CEO says. Novartis’ CEO Vas Narasimhan said that instead, they will focus on secondary effects of weight loss and areas where they see a competitive edge, such as cancer therapies, including a $20 billion opportunity in radioligand treatments…Surprisingly, their stock ended the day largely unchanged on this news.

CNBC / Google wins court challenge to the EU’s $1.7 billion antitrust fine over ad products. The EU General Court ruled that the Commission failed to fully consider all relevant factors regarding Google's contract clauses and while Google made changes in 2016, the court’s decision acknowledged errors in the initial ruling, annulling the fine. Hey, a win is a win, for now...

Bloomberg / Dalio sees ‘real issues’ in China, keeps small exposure. I couldn’t believe it either, but yes, Ray Dalio is speaking ill of China for once. He emphasized the need for economic restructuring, particularly in the struggling property sector while also reaffirming that he still sees China as a potentially attractive investment for any investor, provided they don’t ‘“overexpose” themselves. No word if he made the below in MS Paint.

Axios / Teamsters decline to endorse either Harris or Trump. This decision marks a shift from the union's past support for Democratic candidates. In fact, polling within the union shows that members actually prefer the Donald over Kamala Harris…despite the fact that the union was unable to secure commitments on key issues from either candidate.

Bloomberg / Amazon boosts warehouse worker pay by at least $1.50 an hour. This raises the average base wage to over $22 an hour for warehouse workers and is the result of a $2.2 billion investment in compensation on the part of Amazon. Also, and I found this kind of funny, but apparently they will start receiving Prime memberships as a benefit in 2025. #BetterLateThanNever…

Trivia

Today's trivia is on Bitcoin, the world's first cryptocurrency!

Which cryptographic breakthrough underpins Bitcoin’s security and decentralized nature, allowing for secure peer-to-peer transactions?

A) Merkle Trees

B) SHA-256

C) Elliptic Curve Cryptography

D) RSA EncryptionIn which year did the infamous Mt. Gox exchange hack occur, resulting in the loss of over 850k Bitcoins (about $53 billion at today’s price)?

A) 2012

B) 2014

C) 2016

D) 2018Bitcoin’s smallest divisible unit, often used for microtransactions, is named after its creator. What is this unit called?

A) MicroBTC

B) Nakamoto

C) Satoshi

D) FinneyWhat process secures Bitcoin’s decentralized network and involves solving complex mathematical problems to validate transactions?

A) Proof of Work

B) Proof of Stake

C) Delegated Proof of Stake

D) Byzantine Fault Tolerance

(answers at bottom)

Market Movers

Winners!

Intuitive Machines (LUNR) [+38.3%]: Won a NASA contract worth up to $4.82 billion to support their Near Space Network.

Bausch + Lomb (BLCO) [+7.8%]: Private equity firms like Blackstone, Advent International, and TPG Capital are reportedly considering bidding on the company.

VF Corp (VFC) [+3.9%]: Barclays upgraded them due to improvements in sales, inventory, and brand as part of their ongoing turnaround.

Victoria's Secret (VSCO) [+3.5%]: Barclays sees upside after upgrading them, noting the company's market share has stabilized at around 20%.

InterContinental Hotels Group (IHG) [+2.0%]: Goldman Sachs upgraded them, citing a stronger long-term growth outlook and secondary revenue streams.

Extra Space Storage (EXR) [+1.6%]: Jefferies upgraded them, expecting home sale volumes to improve as mortgage rates drop.

United States Steel (X) [+1.5%]: Nippon Steel got permission to refile its merger plans, keeping the deal alive but delaying any decision until after the election.

Losers!

ResMed (RMD) [-5.1%]: Wolfe Research downgraded them, warning that Lilly's new sleep apnea treatment could disrupt their patient base.

Medical Properties Trust (MPW) [-4.8%]: They're expecting a big Q3 impairment and amortization expense after settling with their major tenant Steward, who filed for Chapter 11.

McGrath RentCorp (MGRC) [-3.1%]: McGrath and WSC called off their merger, citing that regulatory clearance would be too much of a hassle.

T-Mobile US (TMUS) [-3.0%]: During their Capital Markets Day, T-Mobile announced plans to grow revenue, boost EBITDA, and return up to $50 billion in dividends and buybacks by 2027.

Incyte (INCY) [-1.9%]: Truist downgraded them, liking Opzelura’s launch but unsure if their pipeline can make up for losing Jakafi's exclusivity.

Market Update

Trivia Answers

B) SHA-256 – Bitcoin’s security is largely based on the cryptographic hash function SHA-256, which ensures the integrity and security of transactions.

B) 2014 – The Mt. Gox hack in 2014 led to the loss of over 850,000 Bitcoins, one of the largest Bitcoin losses in history.

C) Satoshi – Named after Bitcoin's creator, a “Satoshi” is the smallest unit of Bitcoin, equivalent to 0.00000001 BTC.

A) Proof of Work – Bitcoin’s network is secured through Proof of Work, a process where miners solve complex mathematical problems to validate transactions and add them to the blockchain.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

I had no idea the DAX had similar performance to the SPX over that period